AWG Chip Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434256 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

AWG Chip Market Size

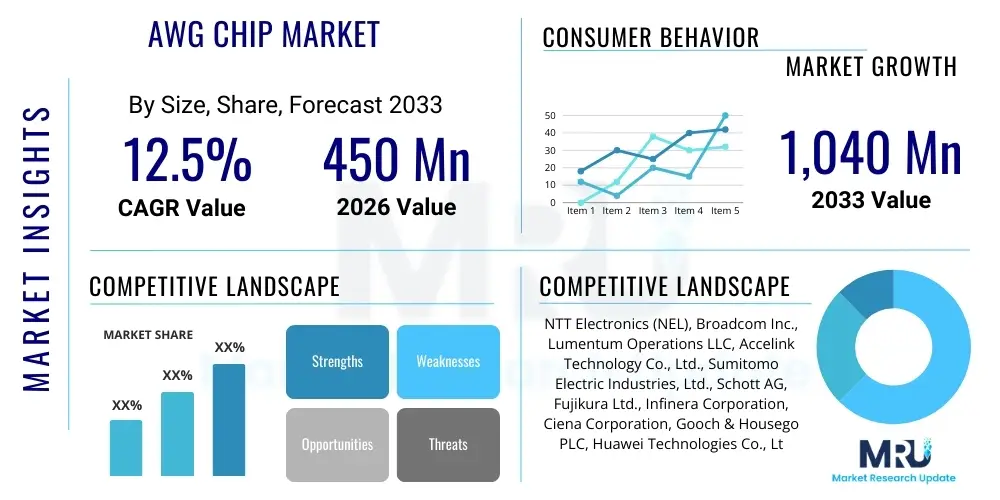

The AWG Chip Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 1,040 Million by the end of the forecast period in 2033.

AWG Chip Market introduction

The Arrayed Waveguide Grating (AWG) Chip Market encompasses passive planar lightwave circuit (PLC) components essential for optical signal processing, specifically enabling Wavelength Division Multiplexing (WDM) and Dense Wavelength Division Multiplexing (DWDM) in high-capacity optical networks. These chips function as multiplexers and demultiplexers, combining or separating multiple optical signals carried on different wavelengths onto a single optical fiber, thereby maximizing the efficiency and data throughput of existing fiber infrastructure. The core product description centers around the silicon-on-insulator (SOI) platform or other material systems like silica/glass, which define the high-precision arrayed waveguides responsible for the diffraction and focusing of light based on wavelength.

Major applications of AWG chips span across several critical infrastructure sectors. Telecommunications remains the foundational user, utilizing AWGs in metropolitan area networks (MANs), long-haul terrestrial systems, and submarine cable landing stations to manage vast quantities of data traffic. Furthermore, the rapid expansion of hyperscale data centers, driven by cloud computing and the burgeoning demand for streaming services and artificial intelligence, has accelerated the adoption of compact, low-power AWG chips for inter-rack and intra-data center connectivity. Beyond traditional communication, AWGs are increasingly finding utility in emerging fields such as Fiber-To-The-Home (FTTH) networks, advanced optical sensing systems, and LiDAR applications for autonomous vehicles, where precise wavelength control is paramount.

The primary benefit of AWG chips lies in their ability to offer high channel counts, low insertion loss, excellent wavelength stability, and high reliability in a compact, passively operated footprint. Key driving factors propelling market growth include the relentless global demand for higher bandwidth, necessitated by 5G network rollouts and the proliferation of IoT devices; the transition from 100G to 400G and 800G optical networking standards in data centers; and significant technological advancements in photonic integration, allowing for the co-packaging of AWGs with active components (e.g., lasers and detectors) for cost and space optimization.

AWG Chip Market Executive Summary

The AWG Chip Market is characterized by robust growth, primarily driven by major business trends focusing on high-speed data transmission and network densification across global telecommunications and data center infrastructure. Key business trends include the shift toward ultra-high-density DWDM systems requiring higher channel uniformity and tighter channel spacing, favoring specialized athermal AWG designs. Furthermore, the push towards integrated photonics necessitates collaborative partnerships between traditional optical component manufacturers and advanced semiconductor foundries specializing in Silicon Photonics (SiPh), leading to streamlined production processes and reduced component footprints. The sustained capital expenditure by technology giants (Google, Amazon, Meta, Microsoft) in constructing hyperscale data centers acts as a definitive market accelerant, requiring millions of AWG units for scalable connectivity solutions.

Regional trends indicate that the Asia Pacific (APAC) region, spearheaded by China, Japan, and South Korea, dominates consumption and manufacturing capacity, primarily due to expansive governmental investments in national fiber optic backbones (FTTH initiatives) and the rapid deployment of 5G infrastructure. North America and Europe, while mature, remain crucial markets focused on technological advancement and the adoption of cutting-edge coherent optical systems. These Western markets prioritize performance metrics such as polarization dependence and temperature insensitivity, driving demand for premium, customized athermal AWG solutions essential for maintaining network stability in dynamic operational environments. Latam and MEA are emerging regions, experiencing accelerated demand as digital transformation initiatives gain momentum, particularly in establishing foundational data centers and upgrading metro networks.

Segmentation trends reveal significant traction within the DWDM segment due to its superior efficiency in maximizing fiber capacity, contrasting with the slower, yet stable, CWDM segment utilized mainly in short-reach applications. The material segmentation highlights the increasing dominance of Silicon Photonics (SiPh)-based AWGs, lauded for their compatibility with standard CMOS manufacturing processes, enabling large-scale, cost-effective production, and superior integration density compared to traditional silica-on-silicon devices. Furthermore, the application segment for data centers is witnessing the fastest growth, surpassing the traditional telecom segment in terms of volume consumption, reinforcing the AWG chip's pivot from solely a telecom component to a fundamental building block of modern cloud infrastructure.

AI Impact Analysis on AWG Chip Market

Common user questions regarding AI's impact on the AWG Chip Market frequently center on whether AI-driven network management systems will increase the performance demands placed on passive optical components, how machine learning algorithms can optimize the manufacturing yield and design parameters of complex photonic circuits, and, crucially, how the insatiable data consumption associated with training and deploying large language models (LLMs) and deep learning frameworks will translate into immediate requirements for higher density and speed in AWG-enabled optical transport. Users are concerned about the ability of existing AWG technology to handle the unprecedented and non-uniform traffic patterns generated by AI workloads, which often involve massive east-west communication within data centers. The key theme is that AI fundamentally accelerates the bandwidth ceiling, demanding AWGs that are not only faster but also more robust, easier to monitor, and capable of integrating into automated, software-defined networking (SDN) environments. This pressure pushes manufacturers towards advanced athermal designs and tighter integration.

- AI adoption drives exponential data growth in data centers, necessitating the immediate upgrade of existing optical links from 400G to 800G and 1.6T, directly increasing the volume demand for high-channel-count DWDM AWG chips.

- AI algorithms are increasingly used in optimizing the design and fabrication of AWG components, leveraging machine learning to predict and correct mask variations, improving manufacturing yield, and reducing insertion loss variability across channels.

- The rise of CPO (Co-Packaged Optics) driven by AI processing units requires ultra-compact, thermally stable AWG chips suitable for tight integration alongside ASICs, significantly influencing product packaging and thermal management requirements.

- AI-powered network automation and orchestration systems rely on highly precise and stable passive components; AWGs with superior wavelength accuracy are favored to prevent crosstalk and enable real-time dynamic reconfigurability of optical paths.

- Advanced optical sensing applications, particularly in autonomous systems (LiDAR), utilize specialized, often bespoke AWG chips for spectral analysis and multiplexing, with AI serving as the primary driver for complexity and precision requirements in these sensing systems.

- The demand for low latency in AI-inference networks mandates passive, high-performance optical components like AWGs, as they minimize the signal processing delays inherent in active components, ensuring rapid data transfer between computational nodes.

DRO & Impact Forces Of AWG Chip Market

The market for AWG chips is fundamentally shaped by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that dictate market evolution and strategic investment. The primary driver remains the continuous and exponential surge in global data traffic, catalyzed by ubiquitous internet access, 5G network expansion, and the proliferation of cloud services and AI infrastructure, all demanding vastly increased bandwidth capacity that only WDM systems can efficiently deliver. Furthermore, technological progress in silicon photonics (SiPh) integration has significantly lowered the cost per channel, miniaturizing AWG size while enhancing scalability and manufacturability, thereby making them an economically viable choice for mass deployment in metropolitan and access networks. These drivers create an upward pressure on both volume and technological sophistication, rewarding innovation in athermal and high-channel-count designs. The transition from bulky, discrete optical modules to integrated, pluggable transceivers (like QSFP-DD and OSFP) heavily relies on miniaturized AWG chips, securing their role as an indispensable passive component.

Conversely, significant restraints hinder growth and pose challenges to market participants. High initial capital expenditure required for setting up advanced photonic fabrication facilities, particularly for mastering complex processes like deep UV lithography and high-precision etching necessary for SiPh AWGs, creates barriers to entry. Moreover, the inherent sensitivity of traditional silica-based AWGs to temperature fluctuations necessitates complex packaging and thermal compensation mechanisms (e.g., athermal packaging or active cooling), adding to the overall cost and complexity of deployment, particularly in uncontrolled environments. Another restraint is the increasing competition from alternative demultiplexing technologies, such as thin-film filters (TFFs) for lower channel counts and emerging technologies like tunable filters and specialized ring resonators, which, while facing scalability issues, constantly push the performance envelope and potentially substitute AWGs in specific short-reach applications.

Opportunities for expansion are abundant, particularly in niche and high-growth sectors. The proliferation of Coherent Optical Technology in metro and edge networks, moving beyond long-haul applications, presents a large addressable market for coherent-specific AWGs that must meet stringent requirements for phase and polarization sensitivity. The burgeoning market for integrated photonics devices, spanning from advanced LiDAR systems used in self-driving cars to sophisticated optical medical imaging devices (OCT), offers diversification avenues beyond traditional telecom applications, leveraging the precision wavelength filtering capabilities of AWG structures. Furthermore, the development of software-defined networking (SDN) protocols demands highly flexible and reconfigurable optical layers, opening up the opportunity for integration of AWGs with Micro-Electro-Mechanical Systems (MEMS) or other switching elements to create Reconfigurable Optical Add/Drop Multiplexers (ROADMs) with enhanced capabilities, ensuring the continued centrality of AWG technology in future intelligent optical networks.

- Drivers:

- Exponential growth of global data traffic, fueled by 5G, IoT, and cloud computing.

- Widespread deployment of hyperscale data centers requiring high-density WDM systems.

- Technological advancements in Silicon Photonics (SiPh) leading to miniaturization and cost reduction.

- Government initiatives promoting Fiber-to-the-Home (FTTH) and next-generation access networks globally.

- Restraints:

- High initial investment costs for advanced photonic integration manufacturing infrastructure.

- Temperature sensitivity of traditional AWGs requiring expensive athermal packaging or active compensation.

- Competition from alternative optical demultiplexing components in specific low-channel-count applications.

- Opportunity:

- Emerging markets in optical sensing, LiDAR, and biomedical imaging utilizing precise wavelength management.

- Integration of AWGs into Co-Packaged Optics (CPO) solutions for next-generation AI and network processors.

- Development of flexible ROADMs incorporating AWG technology for reconfigurable network architectures.

- Impact Forces:

- Bandwidth Demand: High (Constantly driving technological innovation towards denser channel spacing).

- Cost Pressure: Medium-High (SiPh offers cost reduction, but high-end athermal demands increase unit price).

- Regulatory Support: Medium (National broadband plans indirectly bolster AWG deployment).

Segmentation Analysis

The AWG Chip Market is comprehensively segmented based on its crucial attributes, including Channel Spacing, Material Type, Application, and Design Type, allowing for targeted analysis of market dynamics and technology preferences across various end-user sectors. This segmentation highlights the technological divergence between the high-performance, high-cost segment (e.g., high-channel-count DWDM athermal AWGs) and the volume-driven, cost-sensitive segment (e.g., standard CWDM or coarse DWDM used in access networks). Understanding these segments is vital for manufacturers to align their R&D efforts with specific market needs, such as focusing on low polarization-dependent loss (PDL) for coherent systems or prioritizing CMOS compatibility for data center deployment.

By Channel Spacing, the market clearly delineates between Dense Wavelength Division Multiplexing (DWDM) AWGs, which utilize narrow channel separations (typically 100 GHz or 50 GHz, moving towards 25 GHz), and Coarse Wavelength Division Multiplexing (CWDM) AWGs, which employ wider channel separations (e.g., 20 nm or 13 nm). The DWDM segment dominates in value due to its complexity and mandatory deployment in high-throughput backbone and metro networks, while the CWDM segment holds a significant volume share, largely owing to its simpler, lower-cost structure suitable for short-haul or access networks, particularly FTTx deployments where channel count requirements are less stringent. The increasing demand for higher spectral efficiency means that the DWDM segment, especially the tightly spaced versions, will exhibit the highest growth trajectory throughout the forecast period.

Furthermore, the material segmentation is undergoing a rapid transition. Historically, the market was dominated by Silica-on-Silicon (SiO2/Si) AWGs, valued for their low propagation loss and robust thermal stability. However, Silicon Photonics (SiPh) AWGs, fabricated using standard CMOS processes, are rapidly gaining ground due to their superior integration density, extremely compact footprint, and inherent ability to be co-packaged with active electronics (e.g., modulators, detectors). While SiPh AWGs present greater challenges regarding coupling loss and thermal management, their cost efficiency and scalability in volume manufacturing position them as the future cornerstone technology, particularly in the hyperscale data center segment where space and power consumption are critical metrics. The application segment reflects this shift, with Data Centers now emerging as the most dynamic end-user category, outpacing traditional Long-Haul Telecommunications and Metro Networks.

- By Channel Spacing:

- Coarse Wavelength Division Multiplexing (CWDM) AWGs

- Dense Wavelength Division Multiplexing (DWDM) AWGs (100 GHz, 50 GHz, 25 GHz, etc.)

- By Material Type:

- Silica-on-Silicon (SiO2/Si)

- Silicon Photonics (SiPh) / Indium Phosphide (InP)

- Polymer/Glass (Niche Applications)

- By Design Type:

- Athermal AWG (ATAWG)

- Thermal AWG (TAWG)

- By Application:

- Telecommunications (Long-Haul, Metro, Access)

- Data Centers (Interconnects, Intra-Data Center)

- Optical Sensing and Monitoring (LiDAR, Instrumentation)

- Fiber-to-the-Home (FTTH/FTTx)

Value Chain Analysis For AWG Chip Market

The value chain of the AWG Chip Market begins with upstream activities focused heavily on specialized raw material supply and intricate photonic chip fabrication. Upstream analysis involves suppliers of high-purity semiconductor substrates, primarily silicon-on-insulator (SOI) wafers for SiPh AWGs, or specialized doped silica materials for PLC fabrication. Foundries specializing in photolithography and plasma etching techniques are crucial here, as the performance of the AWG chip is directly contingent upon the precision of the waveguide geometries, often requiring nanometer-level control. Key upstream challenges include maintaining material consistency and achieving high yield in complex, high-channel-count array fabrication, which differentiates expert foundries from general semiconductor manufacturers. Technological barriers to entry are significantly high at this initial fabrication stage due to the capital investment required for dedicated cleanroom facilities and advanced processing equipment.

Midstream activities encompass the core AWG chip manufacturing, packaging, and integration process. This involves wafer processing, dicing, anti-reflection coating application, and, most critically, the passive or athermal packaging of the bare chip into a robust module that ensures thermal stability and fiber coupling efficiency. Packaging is a highly sophisticated step, often accounting for a significant portion of the total cost, as it involves precise pigtailing (connecting optical fibers to the chip's input/output facets) and the integration of thermal stabilization elements, especially for thermal AWGs. Manufacturers in the midstream must maintain strict quality control standards for insertion loss, cross-talk, and polarization-dependent loss (PDL), as these parameters are non-negotiable for high-speed optical networking equipment. The rise of integrated photonics is merging the chip fabrication and packaging stages, favoring vertically integrated companies or those with strong partnerships with foundry services.

Downstream analysis focuses on the distribution channels and end-user integration. Distribution is typically handled directly by component manufacturers to major OEM network equipment providers (NEPs) like Cisco, Nokia, and Huawei, who incorporate the AWG modules into their optical transport platforms (e.g., ROADMs, transponders). Alternatively, specialized component distributors supply smaller system integrators or instrumentation companies. The end-users, primarily telecommunication operators (e.g., AT&T, Vodafone, China Mobile) and hyperscale cloud providers (e.g., Google, AWS), drive the final demand and specifications. Direct and indirect sales channels coexist, with direct sales dominating the volume-heavy, long-term contracts with top-tier NEPs and cloud providers, while indirect sales through specialized technical distributors facilitate market access for smaller players and regional telecom operators. The proximity to high-volume data center hubs influences distribution logistics significantly.

AWG Chip Market Potential Customers

The primary consumers and end-users of Arrayed Waveguide Grating (AWG) chips are highly specialized entities operating within the global digital infrastructure ecosystem, distinguished by their constant need for high-speed, high-capacity, and spectrally efficient optical networking solutions. The largest segment of potential customers includes Tier 1 and Tier 2 telecommunication operators (Telcos), encompassing major national and international carriers responsible for constructing and maintaining long-haul, submarine, and metropolitan area networks. These customers utilize AWG chips in their optical transport systems to manage enormous volumes of aggregated voice, video, and data traffic, necessitating high-channel-count, stable DWDM AWGs, often supplied within fully packaged ROADM line cards or dense mux/demux modules. Their buying decisions are driven by reliability, guaranteed lifetime performance, and adherence to stringent industry standards.

A rapidly accelerating segment of potential customers comprises hyperscale cloud service providers (CSPs) and large enterprise data center operators. Companies like Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and Meta demand massive volumes of compact, cost-effective AWG chips for internal spine-and-leaf architecture interconnects, particularly favoring Silicon Photonics-based DWDM AWGs that can be integrated directly into pluggable transceivers (like QSFP-DD or OSFP). For these customers, the driving factors are volume scalability, low power consumption, minimal physical footprint, and the ability to rapidly deploy standardized components to keep pace with continuous internal bandwidth expansion fueled by AI and machine learning workloads. Their procurement often involves large, direct procurement contracts with component suppliers, bypassing traditional network equipment manufacturers (NEPs) to gain cost advantages and control over supply chains.

Beyond the core communication sector, potential customers also exist in specialized domains such as industrial automation, scientific instrumentation, and transportation. Manufacturers of advanced optical sensing systems, including coherent and frequency-modulated continuous wave (FMCW) LiDAR used in autonomous vehicles and industrial inspection, rely on precision AWGs for simultaneous wavelength scanning and spectral analysis. Additionally, companies developing sophisticated laboratory and medical diagnostic equipment, such as Optical Coherence Tomography (OCT) systems, utilize the high-resolution wavelength filtering capabilities of AWGs to enhance spectral imaging performance. These niche applications require custom-designed, often higher-cost AWGs tailored for specific wavelength ranges and environmental conditions, representing a high-value, albeit lower-volume, customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1,040 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NTT Electronics (NEL), Broadcom Inc., Lumentum Operations LLC, Accelink Technology Co., Ltd., Sumitomo Electric Industries, Ltd., Schott AG, Fujikura Ltd., Infinera Corporation, Ciena Corporation, Gooch & Housego PLC, Huawei Technologies Co., Ltd., MACOM Technology Solutions Inc., AOI (Applied Optoelectronics, Inc.), Accu-Tech Corporation, NeoPhotonics (now part of Lumentum), Oclaro (now part of Lumentum), MRSI Systems, Lightwave Microsystems, Santec Corporation, Fiberhome Telecommunication Technologies Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AWG Chip Market Key Technology Landscape

The AWG chip market is defined by continuous evolution in materials science and photonic integration techniques aimed at improving spectral performance, reducing physical size, and minimizing cost. Currently, the technology landscape is bifurcated between mature Planar Lightwave Circuit (PLC) technology, primarily utilizing silica-on-silicon platforms, and the rapidly ascending Silicon Photonics (SiPh) technology. Silica-based AWGs offer superior intrinsic performance, particularly concerning polarization dependence and low propagation loss, making them the standard choice for high-end long-haul DWDM systems where thermal stability is managed through athermal packaging techniques. These devices are robust but generally larger and more difficult to integrate with active electronic components, limiting their scalability for ultra-high-density applications.

Silicon Photonics represents the paradigm shift in the technology landscape. SiPh AWGs leverage the high refractive index contrast between silicon waveguides and silicon dioxide cladding, allowing for dramatically smaller devices—often 10 to 100 times smaller than their silica counterparts—critical for co-packaged optics and high-density transceivers. The primary challenge remains the thermal instability of silicon, which requires active temperature control or complex passive stabilization methods within the chip design itself. Despite this, the economic advantage derived from using CMOS-compatible mass production techniques makes SiPh the dominant platform for high-volume markets, especially data center interconnects where performance tolerances are sometimes relaxed in favor of density and cost efficiency. Innovation focuses heavily on reducing on-chip insertion losses and mitigating crosstalk through advanced waveguide geometry optimization.

Beyond material science, key technological advancements include the sophisticated engineering of Athermal AWG (ATAWG) designs, which use specialized polymer coatings or trench structures with materials exhibiting negative thermo-optic coefficients to passively compensate for the temperature-induced shift in the silicon or silica refractive index, eliminating the need for power-consuming active cooling. Furthermore, research is advancing into hybrid integration techniques, such as bonding Indium Phosphide (InP) materials (used for active functions like lasers and detectors) onto SiPh AWG platforms, creating fully integrated transceivers on a single chip. This integration trend, encapsulated by the move towards Co-Packaged Optics (CPO) and higher-order modulation formats like coherent 400G and 800G, dictates that future AWG chips must possess unparalleled spectral precision and environmental resilience while fitting into increasingly smaller footprints.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for the AWG Chip Market, dominating both manufacturing supply and end-user demand. This leadership is fueled by massive government-led initiatives in China, India, and Southeast Asia focused on expanding broadband access (FTTx deployments) and building robust national 5G networks. China, in particular, drives high-volume demand through its major telecom carriers (China Mobile, China Telecom) and extensive network equipment manufacturing base. The region exhibits high demand for cost-effective, high-volume CWDM and standard DWDM components, though the rapidly expanding hyperscale data center footprint in regional hubs like Singapore, Tokyo, and Sydney is simultaneously escalating the need for premium, SiPh-based AWGs for intra-data center connectivity.

- North America: North America represents a technologically mature and innovation-driven market, characterized by early adoption of the highest speed optical technologies (400G and 800G coherent systems) and substantial investment in hyperscale cloud infrastructure. Demand here focuses on high-performance, low-loss athermal DWDM AWGs, critical for ensuring reliability in long-haul and complex metro networks. The region’s key market players, including major cloud service providers, often drive direct technological specification requirements, pushing manufacturers towards advanced SiPh integration and CPO-compatible solutions. High capital expenditure in data center expansion remains the primary driver, ensuring steady demand for cutting-edge components.

- Europe: The European market displays steady growth, primarily focused on upgrading legacy infrastructure to support increased bandwidth required by business digitalization and regulatory mandates for universal broadband access. Demand is concentrated in Western European nations (Germany, UK, France), favoring robust, reliable, and standards-compliant AWG solutions for metropolitan area networks and regional interconnects. While slightly slower in volume deployment compared to APAC, Europe demonstrates strong interest in sustainable and energy-efficient components, favoring athermal AWGs and efficient SiPh designs to minimize operational power consumption in compliance with emerging environmental standards and regulations.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging growth territories. LATAM is seeing accelerated fiber deployment and data center construction in economic hubs like Brazil and Mexico, creating foundational demand for standard CWDM and DWDM AWGs used in building metro networks. MEA, particularly the GCC countries and South Africa, is investing heavily in digital transformation, driven by smart city projects and regional connectivity hubs. These regions offer high potential for future growth, although market penetration is currently hampered by uneven infrastructure development and reliance on imported technology, resulting in demand volatility influenced by large, sporadic infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AWG Chip Market.- NTT Electronics (NEL)

- Broadcom Inc.

- Lumentum Operations LLC

- Accelink Technology Co., Ltd.

- Sumitomo Electric Industries, Ltd.

- Schott AG

- Fujikura Ltd.

- Infinera Corporation

- Ciena Corporation

- Gooch & Housego PLC

- Huawei Technologies Co., Ltd.

- MACOM Technology Solutions Inc.

- AOI (Applied Optoelectronics, Inc.)

- Accu-Tech Corporation

- NeoPhotonics (now part of Lumentum)

- Oclaro (now part of Lumentum)

- MRSI Systems

- Lightwave Microsystems

- Santec Corporation

- Fiberhome Telecommunication Technologies Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the AWG Chip market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between CWDM AWG and DWDM AWG chips?

CWDM (Coarse WDM) AWG chips operate with wider channel spacing (typically 20 nm or 13 nm) and lower channel counts, making them cost-effective and suitable for short-reach, lower-density metropolitan and access networks. DWDM (Dense WDM) AWG chips utilize much tighter channel spacing (50 GHz or 100 GHz), enabling a significantly higher number of channels (up to 96 or 120) for high-capacity, long-haul, and hyperscale data center backbone networks where spectral efficiency is paramount.

How does Silicon Photonics (SiPh) technology impact the future design of AWG chips?

SiPh enables the fabrication of ultra-compact AWG chips using standard CMOS processes, drastically reducing the physical footprint and manufacturing cost per unit volume compared to traditional silica-on-sil-icon PLC technology. This integration allows AWGs to be seamlessly co-packaged with active components, facilitating the shift towards Co-Packaged Optics (CPO) solutions essential for 800G and 1.6T transceivers within next-generation data centers.

What is an Athermal AWG (ATAWG) and why is it crucial for network stability?

An Athermal AWG is designed with built-in passive temperature compensation mechanisms (often trench structures or specialized materials with negative thermo-optic coefficients) that prevent the AWG's central wavelength from shifting with ambient temperature changes. This thermal stability is crucial because wavelength drift can lead to signal loss and crosstalk, making ATAWGs essential for reliable performance in uncontrolled environmental deployments, such as outdoor cabinets or remote central offices.

Which end-user segment is driving the highest volume growth for AWG chips?

The Hyperscale Data Center segment is currently driving the highest volume growth for AWG chips. The exponential increase in cloud computing, streaming, and AI workloads necessitates continuous expansion of intra-data center bandwidth, rapidly consuming high volumes of compact, integrated DWDM AWGs for spine, leaf, and long-reach interconnects, often surpassing the volume demand from traditional long-haul telecom carriers.

What are the primary performance metrics used to evaluate the quality of an AWG chip?

Key performance metrics include Insertion Loss (IL), which measures the optical signal power reduction across the device; Channel Uniformity, ensuring minimal variation in IL across all output channels; Crosstalk (or Isolation), measuring the leakage of signal between adjacent channels; and Polarization Dependent Loss (PDL), quantifying the performance variation caused by the polarization state of the input light. Low values in IL, Crosstalk, and PDL signify a high-quality component.

The report provides deep insights into the technical and market dynamics of the AWG Chip sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager