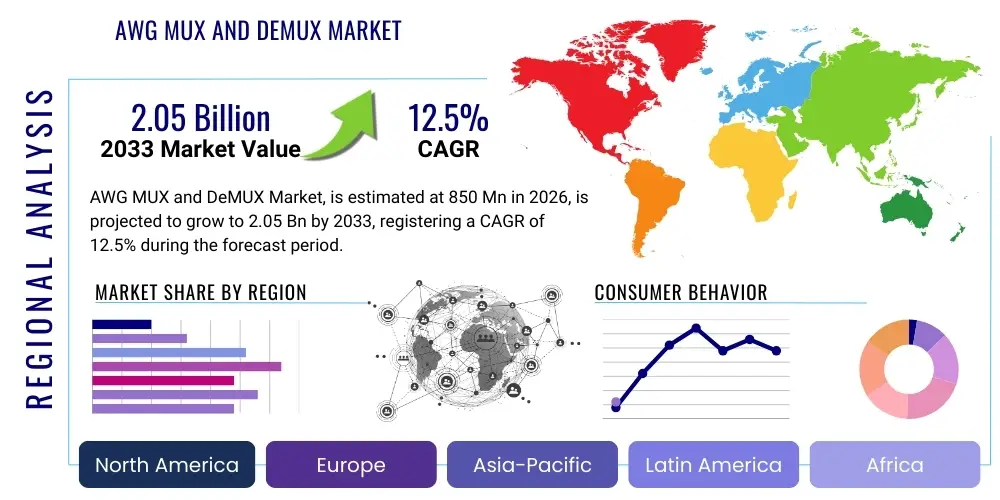

AWG MUX and DeMUX Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439793 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

AWG MUX and DeMUX Market Size

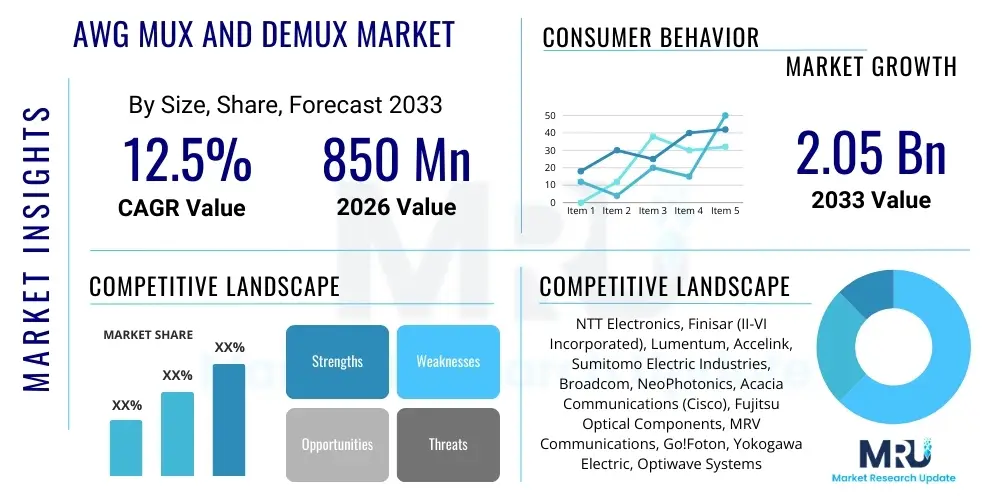

The AWG MUX and DeMUX Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 2.05 Billion by the end of the forecast period in 2033.

AWG MUX and DeMUX Market introduction

The Arrayed Waveguide Grating (AWG) Multiplexer and Demultiplexer market is a critical segment within the broader optical communication industry, essential for enabling high-bandwidth data transmission over fiber optic networks. AWG MUX and DeMUX components are passive optical devices that multiplex (combine) multiple optical signals of different wavelengths onto a single optical fiber or demultiplex (separate) them back into individual channels at the receiving end. This capability is fundamental to Wavelength Division Multiplexing (WDM) and Dense Wavelength Division Multiplexing (DWDM) systems, which dramatically increase the data carrying capacity of optical fibers by utilizing various wavelengths, akin to multiple lanes on a highway.

The core product involves precise optical waveguides fabricated on a planar lightwave circuit (PLC) chip, typically made from silica-on-silicon. These waveguides are designed to create a specific path length difference for different wavelengths, causing them to interfere constructively or destructively at different output ports. This allows for highly accurate and stable separation or combination of optical channels. Major applications span across diverse sectors, predominantly in telecommunications networks, where AWGs are deployed in long-haul, metro, and access networks to manage burgeoning data traffic. They are also indispensable in modern data centers for high-speed interconnections, FTTx (Fiber-to-the-x) deployments for last-mile connectivity, and increasingly in specialized areas like optical sensing and quantum communication.

The primary benefits of AWG MUX and DeMUX devices include their high channel count capability, enabling many optical signals to be simultaneously transmitted; low insertion loss, which minimizes signal degradation; excellent channel isolation, preventing crosstalk between channels; and a compact form factor, making them suitable for integration into various network architectures. Driving factors for this market's robust growth are largely attributed to the insatiable global demand for high-speed internet, the pervasive rollout of 5G networks, the continuous expansion of cloud computing infrastructure, and the proliferation of IoT devices, all of which necessitate greater bandwidth and more efficient optical networking solutions. These factors collectively underscore the pivotal role AWG technology plays in the evolution of modern digital communication.

AWG MUX and DeMUX Market Executive Summary

The AWG MUX and DeMUX market is experiencing dynamic growth, propelled by the relentless demand for higher bandwidth and greater network efficiency across global telecommunications and data communication landscapes. Business trends indicate a focus on integration, with manufacturers exploring advanced packaging solutions to incorporate AWGs with other optical components, such as variable optical attenuators (VOAs) and photodiodes, into compact, multi-functional modules. This trend aims to reduce overall system complexity, cost, and footprint, appealing to network operators striving for leaner and more scalable infrastructure. Furthermore, there's a discernible move towards higher channel counts and narrower channel spacing to maximize spectral efficiency within existing fiber infrastructure, pushing the boundaries of AWG performance.

Regional trends highlight Asia Pacific (APAC) as the leading market, driven by extensive FTTx deployments, aggressive 5G infrastructure build-outs in countries like China and India, and a rapidly expanding data center ecosystem. North America and Europe also present significant growth opportunities, characterized by substantial investments in upgrading existing fiber networks, the proliferation of hyper-scale data centers, and the adoption of advanced optical technologies to support burgeoning cloud services and enterprise applications. Latin America, the Middle East, and Africa, while smaller in market share, are emerging with increasing investments in digital infrastructure, signaling future growth potential as internet penetration and digital transformation initiatives gain momentum.

Segmentation trends reveal a strong inclination towards Athermal AWGs due to their inherent temperature stability, which simplifies network design and reduces operational costs associated with thermal management. Higher channel count AWGs (e.g., 40/48-channel, 96-channel, and beyond) are gaining traction, especially in DWDM systems for metro and long-haul networks, reflecting the urgent need for increased capacity. The application segment continues to be dominated by telecommunications and data centers, both of which are undergoing massive upgrades to accommodate escalating data traffic. The market is also seeing increasing demand for specialized AWGs in emerging applications such as optical sensing for industrial monitoring and advanced research and development in quantum computing, broadening the addressable market beyond traditional communication uses.

AI Impact Analysis on AWG MUX and DeMUX Market

User inquiries concerning AI's influence on the AWG MUX and DeMUX market primarily revolve around how artificial intelligence can optimize network performance, predict equipment failures, and enable more intelligent resource allocation within optical networks. Key themes include the potential for AI-driven network management systems to dynamically adjust wavelength assignments and power levels, thereby maximizing the efficiency of AWG-enabled DWDM systems. Users are also keen to understand how AI can facilitate predictive maintenance for optical components, including AWGs, reducing downtime and operational costs. Expectations often center on AI enhancing the adaptability and self-healing capabilities of optical networks, making them more resilient to traffic fluctuations and service demands. There is also significant interest in AI's role in the design and manufacturing processes, potentially leading to more efficient and cost-effective production of AWG devices.

- AI-driven network optimization: Enables dynamic routing and wavelength assignment to maximize AWG utilization and spectral efficiency in WDM networks.

- Predictive maintenance: AI algorithms can analyze performance data from AWGs to anticipate potential failures, reducing network downtime and maintenance costs.

- Enhanced fault detection and isolation: AI can quickly identify anomalies in optical signals passing through AWGs, pinpointing issues with greater accuracy.

- Intelligent resource allocation: AI can optimize the allocation of network resources, including wavelength channels managed by AWGs, based on real-time traffic patterns and demand.

- Automated network configuration: AI can automate the configuration and reconfiguration of optical paths involving AWGs, improving operational agility and reducing human error.

- Improved energy efficiency: AI can manage power consumption within optical network elements, including AWG-based modules, by dynamically adjusting signal levels.

- Design and manufacturing optimization: AI can be used in the R&D phase to simulate and optimize AWG designs, and in manufacturing to enhance yield and quality control.

- Support for cognitive optical networks: AWGs become programmable elements within AI-driven cognitive networks, allowing for greater flexibility and adaptability.

DRO & Impact Forces Of AWG MUX and DeMUX Market

The AWG MUX and DeMUX market is fundamentally shaped by a complex interplay of drivers, restraints, opportunities, and competitive forces that dictate its growth trajectory and strategic landscape. A primary driver is the exponentially growing global demand for high-speed internet and data services, fueled by the widespread adoption of cloud computing, video streaming, online gaming, and enterprise digitalization. This necessitates continuous upgrades and expansion of optical network infrastructure, where AWGs are indispensable for efficiently managing increasing data traffic volumes. The aggressive global rollout of 5G networks, requiring massive fiber densification and high-capacity backhaul, further amplifies the demand for AWG technology. Additionally, the proliferation of hyperscale data centers and the burgeoning Internet of Things (IoT) ecosystem are creating unprecedented traffic loads, compelling network operators and cloud service providers to invest heavily in advanced WDM solutions powered by AWGs.

Despite the strong growth drivers, several restraints pose challenges to market expansion. The high initial investment required for deploying and upgrading fiber optic networks, especially those incorporating sophisticated AWG-based DWDM systems, can be a significant barrier for smaller operators or emerging economies. The technological complexity associated with designing, manufacturing, and integrating high-performance AWGs, particularly those with very high channel counts or specialized functionalities, demands significant R&D expenditure and specialized expertise. Furthermore, the market faces competition from alternative optical technologies, such as tunable filters or certain silicon photonics solutions, which, while not direct substitutes in all applications, can offer competitive alternatives for specific use cases, potentially impacting AWG market share in niche segments. Supply chain disruptions, exacerbated by global events, can also affect the availability and cost of raw materials and components, leading to production delays and increased prices.

Opportunities within the AWG MUX and DeMUX market are emerging from several fronts. The continuous development of new applications, such as quantum communication networks and advanced optical sensing systems for environmental monitoring, medical diagnostics, and industrial automation, is creating novel demand for specialized AWG devices. The ongoing trend towards network virtualization and software-defined networking (SDN) and network function virtualization (NFV) presents an opportunity for AWG integration into more programmable and flexible optical architectures. Furthermore, the expansion into developing regions, where internet penetration is rapidly increasing and digital infrastructure is being built out from the ground up, offers substantial long-term growth prospects. The impact forces within the market, including the bargaining power of buyers (large telecom operators and data center giants demanding cost-effective and high-performance solutions) and suppliers (specialized component manufacturers), the threat of new entrants (given the high R&D and capital requirements), and the competitive rivalry among established players, all contribute to a dynamic market environment. The threat of substitutes, while present, is mitigated by the highly specialized and integrated nature of AWG technology within modern optical networks.

Segmentation Analysis

The AWG MUX and DeMUX market is segmented across various parameters, allowing for a detailed understanding of its dynamics and growth drivers within specific niches. These segmentations are crucial for market players to tailor their product offerings, strategic investments, and go-to-market approaches. The market can be broadly categorized by the inherent operational characteristics of the device, its capacity, the specific use case it addresses, and the type of entity that ultimately deploys the technology.

- By Type

- Athermal AWG (AAWG): These devices are designed to operate stably across a wide range of temperatures without requiring external temperature control, simplifying deployment and reducing operational costs.

- Thermal AWG (TAWG): These AWGs require active temperature stabilization through heating elements to maintain optimal performance, typically used in applications where precise wavelength control is paramount.

- By Channel Count

- 4-channel

- 8-channel

- 16-channel

- 32-channel

- 40/48-channel

- 96-channel

- 100-channel and above

- By Application

- Telecommunications: Long-haul, metro, and access networks for voice, video, and data transmission.

- Data Centers: Inter-datacenter and intra-datacenter connectivity for high-speed data transfer.

- FTTx (Fiber-to-the-x): Last-mile fiber optic deployments for broadband access.

- Optical Sensing: Applications in industrial monitoring, environmental sensing, and medical diagnostics using wavelength-specific responses.

- Research & Development: For advanced photonics research, quantum computing experiments, and new optical communication technologies.

- Others: Includes specific industrial or government applications.

- By End-User

- Telecom Operators: Major carriers and service providers investing in network infrastructure.

- Cloud Service Providers: Companies like Amazon, Microsoft, Google building and operating large-scale data centers.

- Enterprises: Businesses with private optical networks or demanding high-speed connectivity needs.

- Government Agencies: For secure communication networks and various public sector applications.

- Research Institutions: Universities and labs engaged in optical communication and photonics research.

- Industrial Sector: For specialized optical monitoring and control systems.

Value Chain Analysis For AWG MUX and DeMUX Market

The value chain for the AWG MUX and DeMUX market is a multi-layered ecosystem, starting from fundamental raw materials and culminating in end-user applications, encompassing various stages of design, manufacturing, integration, and distribution. Upstream analysis reveals the critical role of suppliers of highly specialized raw materials such as high-purity silica, silicon wafers, and various glass compositions essential for fabricating planar lightwave circuits (PLCs). These materials require stringent quality control and precision engineering. Component manufacturers then transform these raw materials into passive optical components, including the wafers themselves, along with optical fibers, connectors, and protective packaging materials, which are all integral to the final AWG device. The intellectual property and specialized fabrication techniques at this stage are key competitive differentiators.

Further down the value chain, the fabricated AWG chips are integrated into modules and sub-systems, often combined with other optical components like photodiodes, laser diodes, or variable optical attenuators, to form complete transceiver or transponder units. This integration phase is highly technical, requiring expertise in optical alignment, packaging, and testing. These integrated modules are then supplied to network equipment providers (NEPs) and system integrators. Downstream analysis focuses on how these AWG-enabled products reach their final users. NEPs incorporate AWG modules into larger communication systems such as DWDM optical line terminals (OLTs), optical distribution frames (ODFs), or data center interconnects (DCIs). System integrators then deploy these complete systems within the infrastructure of telecom operators, cloud service providers, and large enterprises.

The distribution channel plays a crucial role in bridging the gap between manufacturers and end-users. Direct sales channels are often utilized for large-volume contracts with major telecom operators and cloud giants, where customized solutions and direct technical support are paramount. Indirect distribution involves working with a network of specialized distributors and value-added resellers (VARs) who cater to a broader range of smaller enterprises, regional service providers, or niche applications. These indirect channels provide geographical reach, localized support, and integration expertise. Both direct and indirect channels are critical for market penetration and customer relationship management, with the choice often depending on the size of the customer, the complexity of the solution, and the geographical scope of operations. Effective logistics and after-sales support are also integral components of this value chain, ensuring product reliability and customer satisfaction throughout the product lifecycle.

AWG MUX and DeMUX Market Potential Customers

The potential customers for AWG MUX and DeMUX products are diverse, spanning multiple industries that rely heavily on high-speed, high-capacity optical communication infrastructure. At the forefront are telecommunications companies, including national carriers, regional service providers, and internet service providers (ISPs), which are continually upgrading their long-haul, metro, and access networks to meet the surging demand for broadband internet, mobile connectivity (especially with 5G deployments), and various enterprise services. These operators are critical buyers as AWGs form the backbone of their WDM/DWDM systems, enabling them to transmit vast amounts of data efficiently over existing fiber optic cables, thereby optimizing capital expenditure and operational costs.

Another significant customer segment comprises cloud service providers and hyperscale data center operators. Companies like Amazon Web Services (AWS), Google Cloud, Microsoft Azure, and other large data center conglomerates are continuously expanding their infrastructure globally. AWGs are essential for their data center interconnects (DCIs) and within the data centers themselves, facilitating high-bandwidth communication between servers and storage units, and connecting multiple data centers over optical networks. The need for ultra-low latency and massive throughput in these environments makes AWG technology indispensable for their operations. As data consumption and cloud adoption continue to grow, these entities represent a consistently expanding customer base.

Beyond the major communication infrastructure providers, the market also serves a range of other end-users. This includes large enterprises that deploy private optical networks for secure and high-speed internal communication, particularly those in finance, media, and manufacturing sectors. Government agencies, including defense and public safety organizations, also procure AWG technology for their secure communication networks and critical infrastructure. Furthermore, research institutions and universities often utilize AWGs for advanced photonics research, experimental optical communication setups, and the development of new optical sensing applications. Lastly, niche industrial sectors are increasingly exploring AWG-based solutions for precise optical sensing, monitoring, and control systems, expanding the product's applicability beyond traditional telecommunications into areas like environmental sensing, structural health monitoring, and advanced industrial automation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 2.05 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NTT Electronics, Finisar (II-VI Incorporated), Lumentum, Accelink, Sumitomo Electric Industries, Broadcom, NeoPhotonics, Acacia Communications (Cisco), Fujitsu Optical Components, MRV Communications, Go!Foton, Yokogawa Electric, Optiwave Systems, Santec, OE Solutions, Shenzhen D-Link Technology, Fiberhome, Huawei, ZTE, Furukawa Electric |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

AWG MUX and DeMUX Market Key Technology Landscape

The AWG MUX and DeMUX market is underpinned by a sophisticated array of key technologies that collectively enable their high performance and versatility in optical networks. Central to AWG fabrication is Planar Lightwave Circuit (PLC) technology, a manufacturing process that creates optical waveguides on a planar substrate, typically silica-on-silicon. This technology allows for the precise patterning of optical paths with micrometer accuracy, which is essential for defining the arrayed waveguides that form the core of the MUX/DeMUX functionality. The silica-on-silicon platform offers excellent optical properties, including low loss and high refractive index contrast, enabling compact device footprints and reliable performance. Advancements in PLC technology continuously drive the development of AWGs with higher channel counts, narrower channel spacing, and improved spectral characteristics.

Another critical technological aspect involves various packaging techniques that protect the delicate optical chip and ensure its long-term reliability and environmental stability. Hermetic packaging, which creates a sealed environment, is often used for high-reliability applications to prevent moisture ingress and temperature fluctuations from affecting performance. Non-hermetic packaging offers a more cost-effective solution for less stringent environments. Furthermore, athermalization techniques are crucial for maintaining the AWG's spectral stability across varying operating temperatures. Athermal AWGs (AAWGs) incorporate temperature-compensating materials or designs that negate the thermal expansion effects on the refractive index, thus eliminating the need for active temperature control and reducing power consumption and operational complexity in network deployments. This technology significantly contributes to the appeal of AWGs for widespread network applications.

Beyond the core fabrication and packaging, the technological landscape also includes the integration of AWGs with other active and passive optical components to create more complex, multi-functional modules. This involves combining AWGs with variable optical attenuators (VOAs) for power balancing, photodiodes for monitoring, or even laser diodes for compact transceiver solutions. The development of advanced optical coating technologies and fiber attachment techniques further enhances the performance and reliability of AWG modules by minimizing insertion loss and maximizing return loss. Furthermore, the ongoing research into new material platforms, such as silicon photonics, offers potential for future integration with electronic circuits on a single chip, promising even greater functionality, smaller form factors, and reduced costs, although silicon photonics currently faces challenges in achieving the low loss and polarization independence characteristic of silica-based AWGs for certain applications. These combined technological efforts are vital for the continued evolution and competitiveness of AWG MUX and DeMUX devices in the rapidly advancing optical communication industry.

Regional Highlights

- North America: This region is a significant market driven by substantial investments in hyperscale data centers, rapid adoption of cloud computing, and ongoing upgrades of existing telecom infrastructure. The demand for high-bandwidth connectivity from major technology companies and the pervasive rollout of 5G networks are key factors. Countries like the United States and Canada are at the forefront of deploying advanced optical communication technologies, contributing to robust market growth.

- Europe: The European market is characterized by widespread 5G network deployments, extensive fiber optic infrastructure expansions, and initiatives for digital transformation across various industries. Investments in metro and long-haul networks, coupled with a focus on sustainable and energy-efficient optical solutions, drive the adoption of AWG technology. Germany, the UK, France, and the Nordic countries are prominent contributors to regional market growth.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for AWG MUX and DeMUX, primarily fueled by massive FTTx deployments in countries like China and India, aggressive 5G infrastructure build-outs, and a rapidly expanding ecosystem of data centers. Governments in the region are actively promoting digital connectivity, leading to significant investments in new fiber optic networks and upgrades to existing ones, making it a pivotal region for manufacturers.

- Latin America: This region is an emerging market with increasing investments in digital infrastructure and growing internet penetration. Countries such as Brazil and Mexico are experiencing expanding data traffic, leading to the gradual upgrade of their optical networks. While smaller in market share compared to other regions, Latin America presents long-term growth opportunities as connectivity initiatives gain momentum.

- Middle East and Africa (MEA): The MEA market is witnessing steady growth due to governmental initiatives aimed at economic diversification and digital transformation. Increased internet penetration, particularly in the Middle East, and growing investments in telecommunications infrastructure across both regions are driving the demand for advanced optical components like AWGs. The development of smart cities and burgeoning data centers further contributes to market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the AWG MUX and DeMUX Market.- NTT Electronics

- Finisar (II-VI Incorporated)

- Lumentum

- Accelink

- Sumitomo Electric Industries

- Broadcom

- NeoPhotonics

- Acacia Communications (Cisco)

- Fujitsu Optical Components

- MRV Communications

- Go!Foton

- Yokogawa Electric

- Optiwave Systems

- Santec

- OE Solutions

- Shenzhen D-Link Technology

- Fiberhome

- Huawei

- ZTE

- Furukawa Electric

Frequently Asked Questions

Analyze common user questions about the AWG MUX and DeMUX market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an AWG MUX and DeMUX, and how does it function?

An AWG (Arrayed Waveguide Grating) MUX (Multiplexer) and DeMUX (Demultiplexer) is a passive optical device used in Wavelength Division Multiplexing (WDM) systems. It combines multiple optical signals of different wavelengths onto a single fiber (MUX) or separates them back into individual channels (DeMUX) by utilizing an array of waveguides that create precise path length differences, enabling wavelength-specific interference.

What are the primary applications of AWG MUX and DeMUX in modern networks?

The primary applications include telecommunication networks (long-haul, metro, and access for high-capacity data transmission), data centers (for high-speed interconnections and data center interconnects), FTTx deployments (fiber-to-the-home/building), and increasingly in specialized areas like optical sensing and advanced research for quantum communication systems.

What are the key advantages of using AWG technology in optical communication?

Key advantages of AWG technology include its ability to handle a high number of optical channels, very low insertion loss (minimal signal degradation), excellent channel isolation (reduced crosstalk), compact form factor, and inherent reliability. Athermal AWGs (AAWGs) further offer temperature stability without external control, simplifying network design and reducing operational costs.

What factors are driving the growth of the AWG MUX and DeMUX market?

The market's growth is primarily driven by the escalating global demand for high-speed internet, the widespread rollout of 5G networks, the continuous expansion of cloud computing infrastructure, and the proliferation of IoT devices. These trends necessitate greater bandwidth and more efficient use of fiber optic networks, making AWG technology crucial.

How does AI impact the future development and deployment of AWG MUX and DeMUX?

AI is expected to significantly impact AWG deployment through network optimization, enabling dynamic wavelength assignment and routing. It will also facilitate predictive maintenance for AWGs, enhance fault detection, and allow for intelligent resource allocation within optical networks, ultimately leading to more autonomous, efficient, and resilient communication systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager