Axial Piston Hydraulic Motors and Pumps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431815 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Axial Piston Hydraulic Motors and Pumps Market Size

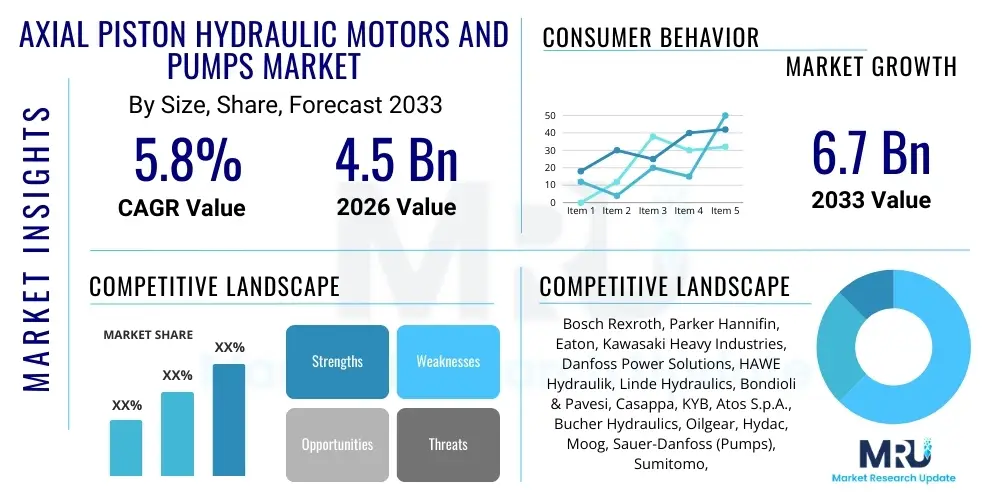

The Axial Piston Hydraulic Motors and Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for energy-efficient and high-power density fluid control solutions across critical industries, including heavy construction, agriculture, and material handling. Axial piston units offer superior performance characteristics, particularly in high-pressure systems, making them indispensable for modern machinery requiring precise control and variable displacement capabilities, distinguishing their market trajectory from traditional gear or vane pump technologies.

Axial Piston Hydraulic Motors and Pumps Market introduction

The Axial Piston Hydraulic Motors and Pumps Market encompasses the manufacturing, distribution, and utilization of sophisticated fluid power components designed to convert mechanical energy into hydraulic energy (pumps) or hydraulic energy back into mechanical rotation (motors). These units are characterized by pistons arranged parallel to the axis of rotation within a cylinder block, utilizing either a swashplate or bent-axis design to achieve displacement variation. The inherent design allows for operation at significantly higher pressures and rotational speeds compared to other hydraulic pump and motor types, offering exceptional volumetric efficiency and reliability crucial for demanding industrial applications.

Axial piston units are predominantly utilized in applications requiring variable displacement and stringent efficiency standards. Major applications span mobile machinery such as excavators, cranes, agricultural tractors, and mining equipment, where power-to-weight ratio and control precision are paramount. In the industrial sector, these components are critical for power generation equipment, metal forming presses, marine propulsion systems, and aerospace actuators. The robust construction and capacity for continuous duty cycles under extreme loads solidify their position as the preferred choice for heavy-duty operational environments worldwide.

Key benefits driving market adoption include their high efficiency, which minimizes heat generation and operational costs; their compact design, facilitating integration into space-constrained systems; and their ability to function effectively at high pressures, enhancing the overall power density of the hydraulic system. Furthermore, the increasing focus on energy conservation and adherence to stringent environmental regulations are bolstering the demand for variable displacement pumps, which dynamically adjust flow based on load requirements, thereby reducing wasted energy. These factors, combined with ongoing advancements in material science for improved component longevity and noise reduction, firmly anchor the market's positive growth trajectory.

Axial Piston Hydraulic Motors and Pumps Market Executive Summary

The Axial Piston Hydraulic Motors and Pumps market is experiencing robust growth driven by significant technological integration and shifting regional investment patterns. Business trends emphasize the development of smart hydraulic systems, integrating IoT sensors and real-time monitoring capabilities into axial piston units to facilitate predictive maintenance and optimized performance management. Key manufacturers are focusing on miniaturization, higher pressure ratings (above 420 bar), and developing components suitable for electrification in mobile equipment, ensuring seamless integration with battery and hybrid power sources, thus future-proofing the technology against evolving environmental standards and operational requirements across diverse sectors.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive infrastructure projects, burgeoning manufacturing capabilities, and rapid industrialization, particularly in China and India. Europe maintains a strong foothold, characterized by high-value applications in precision engineering, aerospace, and renewable energy sectors, where stringent quality and efficiency standards necessitate the deployment of premium axial piston units. North America's market growth is propelled by the resurgence in oil and gas exploration, coupled with substantial investments in heavy construction and sophisticated agricultural machinery, driving demand for high-performance mobile hydraulics designed for extreme operational reliability.

Segment trends reveal that the Swashplate design continues to dominate the market due to its simplicity and cost-effectiveness in high-volume applications, while the Bent-axis design shows faster growth in highly specialized applications demanding maximum volumetric efficiency and high starting torque. Furthermore, the Mobile Hydraulics segment is expanding rapidly, supported by the increasing mechanization of agriculture and the global replacement cycle for construction equipment, demanding lighter, quieter, and more efficient hydraulic power packs. The shift towards closed-circuit systems in hydrostatic transmissions for advanced vehicles is also accelerating segment revenues, providing superior control and regeneration capabilities compared to traditional open-circuit installations.

AI Impact Analysis on Axial Piston Hydraulic Motors and Pumps Market

User inquiries regarding AI's influence primarily center on how artificial intelligence and machine learning (ML) can enhance the operational lifespan, maintenance scheduling, and energy optimization of complex hydraulic systems. Common concerns include the complexity of retrofitting existing machinery, the security implications of transmitting high-frequency sensor data, and the potential for AI to autonomously adjust pump displacement based on real-time load feedback, moving beyond simple pressure compensation controls. Users are keenly interested in predictive failure analysis—determining the precise moment component wear necessitates replacement—and leveraging ML algorithms to fine-tune system parameters (such as minimum pressure hold or ramp-up rates) to maximize efficiency and minimize cavitation and noise, ultimately aiming for zero unplanned downtime across fleets of heavy machinery.

- Enhanced Predictive Maintenance: AI algorithms analyze vibration, temperature, pressure, and fluid contamination data to forecast component failure with high accuracy.

- Optimized Energy Consumption: Machine learning models dynamically adjust the displacement of variable piston pumps to match exact power requirements, reducing energy waste by up to 15-20%.

- Automated Diagnostics and Troubleshooting: AI-driven systems provide real-time root cause analysis for performance anomalies, significantly speeding up repair and minimizing technician input.

- Simulation and Design Optimization: AI tools accelerate the design phase by simulating thousands of operational scenarios, optimizing piston geometry and valve plate timing for superior efficiency and reduced noise levels.

- Smart Fleet Management: Integration of axial piston unit performance data into broader fleet management platforms, enabling centralized monitoring and lifecycle management using AI.

DRO & Impact Forces Of Axial Piston Hydraulic Motors and Pumps Market

The market is significantly propelled by robust Drivers, anchored primarily in the global need for high power density and energy efficiency in heavy machinery, particularly within the construction and agricultural sectors where demand for advanced automation is escalating. However, it faces substantial Restraints, most notably the high initial investment cost associated with precision-machined axial piston units and the skilled maintenance personnel required to service these complex components. Vast Opportunities exist in the electrification of mobile equipment and the increasing implementation of Industry 4.0 standards, which demand smart, sensor-equipped hydraulic solutions. These internal dynamics are shaped by external Impact Forces, including fluctuating raw material costs (steel, specialized alloys) and rigorous governmental regulations regarding noise emissions and environmental contamination, compelling manufacturers to innovate materials and operational fluid compatibility.

A primary Driver is the ongoing shift from fixed displacement to variable displacement pumps, driven by global mandates for reducing carbon footprint and improving overall machine efficiency. Axial piston pumps, especially in closed-loop systems, offer unmatched control over flow rate and pressure, directly translating to fuel savings in mobile applications and reduced energy bills in industrial settings. Furthermore, continuous product evolution, including the incorporation of lightweight, durable materials and noise-dampening technologies, is expanding their applicability into sensitive environments like marine and urban construction, fueling adoption across specialized high-margin sectors globally.

Conversely, a critical Restraint is the competitive pressure from advanced electro-mechanical actuation systems, particularly in light-duty industrial automation, which are perceived as simpler to integrate and maintain, despite the lower power density. Moreover, the steep learning curve and capital outlay required for manufacturers to maintain the necessary precision machining capabilities act as a barrier to entry, concentrating the market among a few established global players. Despite these challenges, the massive Opportunity presented by emerging markets in Southeast Asia and Africa, coupled with the necessity for specialized, high-pressure hydraulic transmission in emerging sectors such as large-scale wind turbine pitch control systems and deep-sea robotics, provides significant avenues for sustained expansion throughout the forecast period, encouraging targeted investment in localized manufacturing and distribution infrastructure.

Segmentation Analysis

The Axial Piston Hydraulic Motors and Pumps market is extensively segmented based on design structure, circuit type, product type, application type, and regional geography, allowing for precise market targeting and competitive analysis. Segmentation by design structure distinguishes between Swashplate and Bent-axis configurations, reflecting different efficiency, cost, and pressure handling capabilities required by diverse end-users. Circuit type segregation into Open Circuit and Closed Circuit is fundamental, determining whether the unit is used primarily for fixed industrial power supply (open) or high-precision hydrostatic transmission (closed) typically found in mobile machinery. This granular segmentation approach highlights the specialization inherent in the fluid power sector, where component selection is critically dependent on the specific operational envelope of the final application.

- By Design Structure:

- Swashplate Design

- Bent-axis Design

- By Circuit Type:

- Open Circuit

- Closed Circuit

- By Product Type:

- Axial Piston Pumps (Fixed Displacement, Variable Displacement)

- Axial Piston Motors (Fixed Displacement, Variable Displacement)

- By Application:

- Mobile Hydraulics (Construction Equipment, Agricultural Machinery, Material Handling, Mining, Marine)

- Industrial Hydraulics (Machine Tools, Presses, Energy Generation, Chemical Processing, Oil & Gas)

- By End-Use Industry:

- Construction and Earthmoving

- Agriculture and Forestry

- Automotive and Transportation

- Manufacturing and Metal Processing

- Aerospace and Defense

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Axial Piston Hydraulic Motors and Pumps Market

The value chain for axial piston hydraulic units is characterized by intensive upstream activities dominated by specialized material suppliers and precision machining firms, followed by complex assembly and stringent quality assurance processes carried out by Original Equipment Manufacturers (OEMs). Upstream analysis reveals reliance on high-grade steels, specialized aluminum alloys, and synthetic seals necessary to withstand extreme pressures and thermal loads. Suppliers of these raw materials, along with providers of high-precision components like valve plates, cylinder blocks, and piston shoes, play a crucial role, as the performance and durability of the final product are directly tied to the metallurgical consistency and dimensional accuracy achieved at this stage. Any volatility in global commodity markets, particularly for specialized alloys, directly impacts the production costs and lead times for major hydraulic manufacturers.

Midstream activities involve core manufacturing, including CNC machining, heat treatment, surface finishing (e.g., ceramic coating for low friction), and the final assembly and testing of the pumps and motors. Major manufacturers such as Bosch Rexroth and Parker Hannifin heavily invest in proprietary assembly techniques and testing facilities to ensure products meet international standards (ISO, SAE) for efficiency and longevity. The complexity of manufacturing variable displacement units, which incorporate sophisticated electro-hydraulic controls and pressure compensators, requires significant technical expertise and vertical integration of control software and hardware components, creating a substantial barrier to entry for new market participants.

Downstream distribution channels are bifurcated into direct sales to large Original Equipment Manufacturers (OEMs) who integrate the units into heavy machinery, and indirect channels relying on specialized distributors and service partners who cater to Maintenance, Repair, and Overhaul (MRO) needs and smaller system integrators. The indirect channel is vital for providing localized technical support, spare parts inventory, and rapid repair services, which are critical for minimizing machinery downtime across diverse geographical regions. Manufacturers must maintain robust relationships with these service partners to ensure brand loyalty and comprehensive post-sale support, especially for high-value components like axial piston pumps and motors. The push toward digitalization is increasingly seeing OEMs utilize e-commerce and digital platforms for parts ordering and technical documentation dissemination.

Axial Piston Hydraulic Motors and Pumps Market Potential Customers

The primary potential customers for axial piston hydraulic motors and pumps are heavy machinery manufacturers across the mobile and industrial sectors, seeking components that offer high efficiency, resilience, and precise control under challenging operating conditions. Within the Mobile Hydraulics segment, key buyers include global leaders in construction equipment (e.g., excavators, loaders, bulldozers), major agricultural machinery producers (e.g., high-power tractors, combine harvesters), and specialized mining equipment providers (e.g., face shovels, large haul trucks). These customers prioritize components that can deliver maximum power density within a constrained footprint, tolerate high levels of contamination, and offer excellent performance across varied terrains and temperature extremes globally, making the variable displacement capabilities of axial piston units indispensable for their advanced hydrostatic transmission systems.

In the Industrial Hydraulics sector, potential customers encompass manufacturers of heavy-duty metal forming presses, large-scale injection molding machines, marine equipment (especially winch and steering systems), and aerospace testing rigs. These applications require continuous high-pressure flow, exceptional control stability, and superior component lifespan, often operating in controlled, yet demanding, environments. Industrial customers are particularly sensitive to operational noise levels and energy consumption, leading them to favor variable displacement pumps integrated with sophisticated electronic controls that allow for extremely accurate flow and pressure control, minimizing wasted hydraulic power during non-peak load cycles and ensuring process repeatability.

Beyond traditional industrial and mobile users, emerging customer segments include manufacturers focusing on renewable energy infrastructure, such as pitch and yaw control systems for large offshore wind turbines, and developers of specialized machinery for deep-sea and subsea exploration, where extreme reliability and resistance to corrosive environments are mandatory. Furthermore, the burgeoning market for specialized municipal service vehicles (e.g., refuse trucks, street sweepers) and sophisticated material handling equipment (e.g., heavy-duty forklifts, automated guided vehicles - AGVs) represents a growing customer base, as these applications increasingly adopt closed-circuit hydrostatic drive systems for enhanced maneuverability and efficiency, driving continued demand for specialized, smaller-scale axial piston units optimized for urban operation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Rexroth, Parker Hannifin, Eaton, Kawasaki Heavy Industries, Danfoss Power Solutions, HAWE Hydraulik, Linde Hydraulics, Bondioli & Pavesi, Casappa, KYB, Atos S.p.A., Bucher Hydraulics, Oilgear, Hydac, Moog, Sauer-Danfoss (Pumps), Sumitomo, Yuken Kogyo, M+S Hydraulic, Zhejiang Hongqi |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Axial Piston Hydraulic Motors and Pumps Market Key Technology Landscape

The technological landscape of the Axial Piston Hydraulic Motors and Pumps market is rapidly advancing, focusing primarily on enhancing efficiency, reducing noise, and enabling smarter system control through sophisticated electronics. A critical development involves the continuous optimization of the internal design, particularly the materials used for the piston shoes, swashplate, and cylinder block, often utilizing ceramic coatings and specialized low-friction alloys to reduce internal leakage and parasitic losses, which directly boosts volumetric and overall efficiency. Furthermore, advanced manufacturing techniques, such as high-precision grinding and honing, are essential for maintaining the minute tolerances required for high-pressure operation, allowing modern units to safely operate continuously at pressures exceeding 450 bar, a significant increase over previous generations.

A major area of innovation is the integration of electronic displacement control (EDC) and sophisticated proportional valving directly into the pump housing. This technological shift allows for real-time adjustments of flow and pressure based on CAN bus inputs from the machine’s central control unit (ECU), enabling highly accurate load sensing and immediate response to variable demands. These smart hydraulics not only improve system efficiency but also enhance safety and controllability, particularly in complex mobile applications like crane operations or precision farming. The seamless electronic interface facilitates easier diagnostics and predictive maintenance scheduling by logging operational parameters and warning signs internally.

Additionally, noise reduction technologies are paramount, driven by increasingly strict environmental and occupational health regulations. Manufacturers are implementing innovative casing designs, internal damping features, and specialized port plates to minimize fluid pulsation and structural vibration. The introduction of hybrid and electro-hydraulic pump systems represents the future, combining the power density of axial piston units with the precise control and energy regeneration capabilities of electric motors and drives. This allows for 'power on demand' operation, where the hydraulic unit only runs when required, significantly reducing idle energy consumption and facilitating the transition to fully electric heavy machinery.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily driven by China, India, and Southeast Asian nations. Massive government investment in infrastructure development, rapid urbanization, and exponential growth in the manufacturing sector necessitate substantial volumes of heavy construction and industrial machinery, which rely heavily on axial piston technology. Localized production and competitive pricing structures are key factors propelling market dominance in this region.

- Europe: Europe holds a strong market position, characterized by high-value, technology-intensive applications, particularly in Germany, Italy, and Scandinavia. The European market focuses heavily on innovation related to efficiency (EU Stage V emissions standards), noise reduction, and smart system integration (Industry 4.0). Demand is strong in precision machine tools, high-speed rail, and advanced agricultural robotics.

- North America: The North American market is driven by robust spending in the construction, mining, and oil & gas sectors. The demand here centers on rugged, high-durability axial piston units capable of operating reliably in extreme temperatures and remote locations. The market is also seeing strong adoption of hybrid hydraulic systems in mobile equipment to meet increasingly stringent fuel efficiency requirements imposed by regulatory bodies.

- Latin America (LATAM): Growth in LATAM is closely linked to commodity cycles, particularly in agriculture (Brazil, Argentina) and mining (Chile, Peru). The region is a vital end-market for high-capacity hydraulic pumps and motors used in large-scale extraction and processing equipment. Market development often focuses on reliability and cost-effectiveness of replacement parts and servicing infrastructure.

- Middle East and Africa (MEA): This region exhibits steady growth fueled by massive infrastructure projects in the GCC countries and the necessity for robust heavy equipment in resource extraction across Africa. The demand profile is focused on durability, resistance to high ambient temperatures, and reliable after-market service provision, given the challenging operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Axial Piston Hydraulic Motors and Pumps Market.- Bosch Rexroth AG

- Parker Hannifin Corporation

- Eaton Corporation plc

- Kawasaki Heavy Industries, Ltd.

- Danfoss Power Solutions

- HAWE Hydraulik SE

- Linde Hydraulics GmbH & Co. KG

- Bondioli & Pavesi S.p.A.

- Casappa S.p.A.

- KYB Corporation

- Atos S.p.A.

- Bucher Hydraulics GmbH

- Oilgear Company

- Hydac International GmbH

- Moog Inc.

- Sauer-Danfoss (Pumps Division)

- Sumitomo Heavy Industries, Ltd.

- Yuken Kogyo Co., Ltd.

- M+S Hydraulic PLC

- Zhejiang Hongqi Machinery Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Axial Piston Hydraulic Motors and Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of axial piston pumps over gear pumps?

Axial piston pumps offer superior efficiency, particularly volumetric efficiency, and are designed for continuous operation at significantly higher pressures (often exceeding 400 bar). Crucially, they facilitate variable displacement control, allowing the output flow to be dynamically adjusted based on the system load, which is essential for energy savings and precision control in heavy machinery.

How is the adoption of electrification influencing the demand for axial piston units?

Electrification is increasing demand for specialized axial piston units designed for electro-hydraulic actuation (EHA) systems. These units are integrated with electric motors and high-speed drives to create 'power on demand' systems, improving energy efficiency, reducing noise, and offering more precise control compared to traditional diesel-driven fixed-speed pumps, vital for next-generation mobile equipment.

Which design structure, Swashplate or Bent-axis, offers higher volumetric efficiency?

The Bent-axis design generally offers higher volumetric efficiency and better power density due to reduced side loads on the pistons and lower frictional losses. However, Swashplate designs often dominate due to their more compact physical size and lower manufacturing complexity, making them a more cost-effective choice for general-purpose variable displacement applications.

What are the key application areas driving market growth in the Asia Pacific region?

The APAC market growth is primarily driven by massive infrastructure and construction projects, extensive investment in agricultural mechanization, and the rapid expansion of industrial manufacturing capabilities. These sectors necessitate robust, high-power-density mobile and industrial hydraulic systems where axial piston technology excels.

What role does predictive maintenance technology play in the axial piston market?

Predictive maintenance, supported by integrated sensors and AI analysis, is critical for maximizing component lifespan and minimizing expensive unplanned downtime. It allows operators to precisely monitor parameters like fluid contamination, vibration, and temperature to forecast potential failure in the pump or motor, ensuring timely, condition-based servicing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager