Axle Counter Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431372 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Axle Counter Systems Market Size

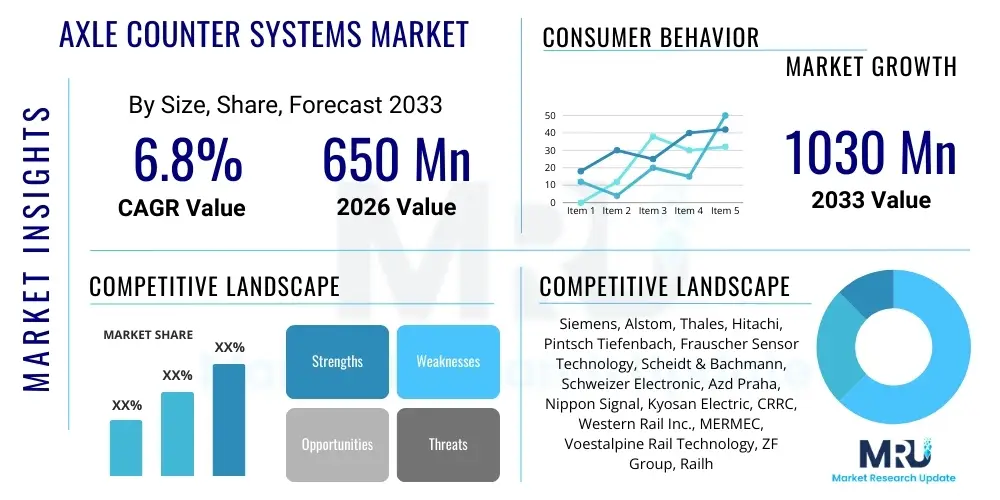

The Axle Counter Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1030 Million by the end of the forecast period in 2033.

Axle Counter Systems Market introduction

The Axle Counter Systems (ACS) Market encompasses the design, manufacture, installation, and maintenance of critical railway signaling infrastructure used primarily for train detection, track clearance verification, and safe train separation. Axle counters function by using magnetic wheel sensors installed along the rail track to count the number of axles entering and exiting a defined track section. This count is processed by an evaluation unit, ensuring that the number of axles leaving a section matches the number that entered, thereby confirming track occupancy or clearance. This technology provides a robust and reliable alternative or complement to traditional track circuits, particularly advantageous in difficult environmental conditions, such as areas prone to corrosion, poor drainage, or electrified tracks where track circuits face technical limitations.

Major applications of axle counter systems span across mainline railway signaling, high-speed rail corridors, metropolitan transit systems (metros and light rail), and industrial railway networks, including ports and mining operations. The inherent fail-safe design, adherence to strict Safety Integrity Levels (SIL 4), and flexibility in installation over long distances without intermediate power feeding have significantly contributed to their widespread adoption globally. Key benefits driving the market growth include reduced maintenance costs compared to track circuits, improved track utilization efficiency, and enhanced safety through highly accurate and reliable train detection, which is crucial for modern automated traffic management systems.

Driving factors propelling the expansion of the ACS market include massive global investment in railway infrastructure modernization, especially in emerging economies like India and China, and the implementation of advanced signaling technologies such as European Rail Traffic Management System (ERTMS) Level 2 and Level 3, which heavily rely on axle counting for precise train location determination and movement authority granting. Furthermore, the integration of new technologies, such as wireless communication between sensors and evaluation units and enhanced diagnostic capabilities, is making ACS a preferred technology for asset management and predictive maintenance strategies in the rail sector.

Axle Counter Systems Market Executive Summary

The global Axle Counter Systems market exhibits steady expansion, driven primarily by the replacement cycle of aging track circuit infrastructure in established markets and the construction of new rail networks in developing regions. Business trends indicate a strong focus on modular and highly scalable systems capable of supporting complex junction configurations and high-density traffic operations. The competitive landscape is characterized by a few major global players dominating system integration and complex project execution, while regional specialists focus on niche applications or sensor component manufacturing. A critical ongoing trend involves the migration toward digitalized signaling infrastructure, which necessitates high-precision, real-time data provided reliably by modern axle counters, fueling demand for wireless and IP-based communication protocols within these systems.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, propelled by extensive high-speed rail development in China and large-scale railway modernization projects in India, often mandated by government initiatives to improve rail safety and capacity. Europe remains a core market, characterized by stringent safety regulations and the widespread rollout of ERTMS, generating sustained demand for sophisticated, SIL 4-certified axle counter technology. North America shows steady growth, driven by freight rail operators seeking to enhance efficiency and reduce maintenance downtime associated with traditional track circuits, particularly in challenging environments where environmental compensation capabilities are crucial.

Segment trends reveal that the Component segment, specifically the Wheel Sensor/Detector unit, continues to hold a significant market share due to its requirement for periodic replacement and continuous technological refinement to improve durability and accuracy in varying climatic conditions. Application-wise, mainline railway signaling remains the dominant segment, though the fastest growth is observed in the Mass Transit Systems segment, fueled by rapid urbanization globally and the subsequent expansion of metro and subway networks that require continuous, high-reliability track occupancy detection systems tailored for short headways and high frequency of operations. Segmentation by type shows increasing interest and gradual adoption of wireless axle counter systems, offering reduced civil works costs and faster installation times, although wired systems maintain dominance due to historical installation base and perceived immunity to interference in dense signal areas.

AI Impact Analysis on Axle Counter Systems Market

User inquiries regarding the impact of Artificial Intelligence (AI) on Axle Counter Systems predominantly revolve around leveraging AI for predictive maintenance, anomaly detection, and enhancing the overall safety and efficiency of rail operations. Key themes include how AI can process the vast amount of sensor data generated by ACS (axle count, time of passage, sensor health status) to predict component failure before it occurs, moving away from scheduled maintenance protocols. Users are also concerned about the integration challenges between legacy ACS infrastructure and modern AI platforms, the potential for reduced human intervention in maintenance tasks, and the necessity for robust cybersecurity measures when connecting these critical safety systems to centralized AI analytical engines. Expectations center on AI enhancing system reliability, minimizing false-positive occupancy alarms, and providing deeper insights into traffic patterns and infrastructure degradation.

The integration of machine learning algorithms allows for sophisticated analysis of vibration patterns, sensor health indicators, and environmental data captured by ACS. Traditional axle counters are purely counting devices; however, modern networked systems provide real-time diagnostic data that, when analyzed by AI, can identify subtle deviations indicative of impending failure in the wheel sensor, evaluation unit, or connecting cables. This shift enables condition-based monitoring, dramatically reducing unnecessary track closures for preventative checks and optimizing resource allocation for maintenance teams. Furthermore, AI can improve the accuracy of the wheel-counting process itself by filtering out noise or compensating for environmental variables (e.g., heavy dust or ice buildup) that might otherwise lead to counting errors or system resets, thus enhancing the overall Safety Integrity Level (SIL) performance.

AI's influence extends beyond mere maintenance; it is integral to the next generation of railway traffic management. By combining ACS data with data from interlocking systems, CCTV, and scheduling software, AI can provide real-time optimization of train movements, improving network capacity and throughput. For instance, AI algorithms can learn typical axle signatures and detect anomalies related to wheel health (such as flat spots or overheated bearings) as trains pass over the sensor, offering a secondary safety layer for rolling stock condition monitoring. This advanced analytical capability is positioning ACS not just as a safety device, but as a crucial data source within the broader Digital Railway ecosystem, ensuring the market evolves toward smarter, autonomous operations.

- AI enables predictive maintenance by analyzing sensor diagnostics data (temperature, voltage, vibration) to forecast component failure.

- Machine learning enhances track occupancy reliability by distinguishing between legitimate axle counts and environmental noise/interference.

- AI algorithms improve operational efficiency by integrating ACS data with traffic management systems for real-time routing optimization.

- Cybersecurity posture is strengthened through AI-driven anomaly detection protecting networked axle counters from external threats.

- AI facilitates automated reporting and compliance checks, reducing manual intervention in safety verification processes.

DRO & Impact Forces Of Axle Counter Systems Market

The Axle Counter Systems market is strongly influenced by critical regulatory mandates concerning railway safety and operational efficiency, serving as significant drivers. Restraints include the high initial capital expenditure associated with system installation and the complexity of integrating new digital ACS technology with diverse, often legacy, signaling infrastructure globally. Opportunities lie predominantly in capitalizing on the massive infrastructure modernization waves in emerging markets, coupled with the potential integration of advanced IoT and 5G communication technologies into wireless axle counter solutions. These forces, ranging from governmental safety standards (drivers) to technological limitations and financial constraints (restraints), collectively shape the investment decisions and technological roadmap of key market players, dictating the pace and direction of market growth.

Drivers: Significant drivers include the global push for enhanced railway safety and the strict adherence to high Safety Integrity Levels (SIL 4) required for train detection systems. Governments worldwide are prioritizing railway safety investments following accidents, leading to mandates for replacing older, less reliable track circuits with modern ACS. The adoption of advanced communication-based signaling systems, such as Positive Train Control (PTC) in North America and ERTMS in Europe, fundamentally relies on precise and continuous track occupancy data provided by axle counters, thereby mandating their deployment. Furthermore, the inherent advantages of ACS, such as immunity to rail shunt resistance issues (especially on rusty or dirty tracks), make them highly favored over traditional methods, particularly in long-distance, high-speed, and electrified rail lines.

Restraints: The primary restraint is the significant upfront investment required for both the purchase and installation of axle counter systems, including complex calibration and system configuration for varying track geometry. This high barrier to entry can slow down adoption, especially in financially constrained railway operators or networks. Another significant restraint is the operational challenge of ensuring zero-crossing integrity—the precise determination of track clearance after a system failure, which often requires manual intervention (a physical reset) and thus introduces potential human error and operational delay. Furthermore, resistance to change within railway authorities, which have decades of experience with established track circuit technology, occasionally acts as a psychological barrier to rapid transition.

Opportunities: Key opportunities are emerging from the growing demand for wireless and battery-powered axle counter systems, significantly lowering civil works costs and installation time, making deployment viable in remote or difficult-to-access areas. The convergence of ACS data with IoT platforms and cloud-based analytics presents substantial opportunity for developing value-added services focused on predictive maintenance, real-time diagnostics, and enhanced security monitoring. Moreover, the accelerating development of autonomous metro systems and fully automated freight operations necessitates the absolute reliability offered by advanced ACS, creating specialized, high-value opportunities in the urban and industrial rail sectors.

Segmentation Analysis

The Axle Counter Systems market is meticulously segmented based on key functional components, communication technology, and end-user application, providing a granular view of demand dynamics across the global rail industry. Segmentation by Component—Wheel Sensor, Evaluation Unit, Reset Box, and Power Supply Unit—allows market participants to focus on specialized areas of manufacturing and supply chain management, particularly for the wheel sensor which is highly sensitive and subject to wear and tear. The Type segmentation distinguishes between established Wired Axle Counters and emerging Wireless Axle Counters, reflecting the industry's gradual shift towards reducing trackside cabling and installation complexity.

Application analysis provides insight into where the highest capital investments are being directed. Mainline Railway Signaling constitutes the largest segment, requiring rugged, long-distance monitoring solutions suitable for high speeds and varying environmental conditions. Conversely, Mass Transit Systems (Metro/Subway) demand extremely high-resolution, short-section counting capabilities to maintain minimal headways between trains, reflecting a different set of technical requirements and safety protocols. Industrial Rail applications, though smaller, offer specific requirements related to heavy haul and non-standard gauge tracks.

Understanding these segments is crucial for strategic planning. For instance, manufacturers focusing on the European market must prioritize compliance with ERTMS specifications (Level 2/3), driving demand for sophisticated Evaluation Units capable of interfacing seamlessly with standardized interfaces like the Eurobalise and Radio Block Centre (RBC). Conversely, suppliers targeting emerging APAC markets often prioritize robust, cost-effective wired solutions for large-scale, greenfield mainline infrastructure projects, emphasizing durability and ease of local maintenance.

- Type:

- Wired Axle Counters

- Wireless Axle Counters

- Component:

- Wheel Sensor/Detector

- Evaluation Unit (Processor)

- Reset Box and Interfaces

- Power Supply Unit

- Application:

- Mainline Railway Signaling

- Mass Transit Systems (Metro/Subway, Light Rail)

- Industrial Rail and Depots

- Technology:

- DC/AC Track Circuits Replacement

- Communication-Based Train Control (CBTC) Systems

- ERTMS Level 2 and Level 3 Integration

Value Chain Analysis For Axle Counter Systems Market

The value chain for the Axle Counter Systems market is segmented into raw material sourcing, component manufacturing, system integration, installation and commissioning, and post-sales services/maintenance. Upstream activities involve the sourcing of specialized materials, including high-grade magnetic materials (ferrite cores), specialized polymers for sensor housing (ensuring resistance to temperature extremes and UV exposure), and complex microprocessors for the evaluation units. Raw material suppliers must adhere to strict quality controls, as the reliability of the final product hinges on the resilience of the primary magnetic sensors. Component manufacturing, often outsourced or handled by specialized rail technology subsidiaries, focuses on producing the highly sensitive wheel detectors and the fault-tolerant evaluation units certified to SIL 4 standards.

Midstream activities are dominated by system integration, where major global players (like Siemens, Alstom, and Thales) combine their proprietary software and hardware components (including axle counters, interlocking systems, and traffic management software) to deliver comprehensive signaling solutions. This stage involves meticulous testing and compliance verification to meet national railway standards and international safety regulations (e.g., CENELEC EN 50126, EN 50128, EN 50129). Downstream activities focus heavily on installation, commissioning, and validation on the rail network, often carried out in partnership with local contractors possessing specialized railway signaling expertise and certifications. Direct distribution is common for large-scale infrastructure projects where contracts are awarded directly to the system integrators, while indirect distribution channels often handle spare parts, maintenance kits, and regional support services through authorized distributors and service partners.

The transition toward digitalization introduces new complexities into the value chain, particularly in the downstream segment, where maintenance shifts from reactive repair to predictive diagnostics. This requires sophisticated software updates, remote monitoring capabilities, and specialized training for maintenance personnel, creating a significant revenue stream through long-term service agreements (LTAs). Furthermore, the integration of wireless ACS necessitates collaboration with telecom infrastructure providers, adding a new dimension to the value chain, focusing on secure communication protocols and battery longevity, which are critical performance indicators for modern deployment.

Axle Counter Systems Market Potential Customers

The primary customers and end-users of Axle Counter Systems are organizations responsible for the ownership, operation, and maintenance of rail infrastructure, where system reliability and safety are paramount. These include national railway operators (e.g., Deutsche Bahn, Indian Railways, SNCF, Network Rail), which utilize ACS extensively across vast mainline networks for high-speed and conventional traffic management. These national entities are often the largest volume buyers, driven by government funding for safety improvements and capacity expansion. Their procurement decisions emphasize proven reliability, high SIL certification, and long-term serviceability across diverse geographic and climatic conditions.

A rapidly growing customer base comprises Metropolitan Transit Authorities and private operators of Mass Transit Systems, including subway, metro, and light rail networks in major global cities. These operators require extremely precise, high-frequency detection systems suitable for short block sections and quick response times characteristic of Communication-Based Train Control (CBTC) environments. Their purchasing criteria often prioritize small form factors, integration capability with advanced automation software, and resilience against electromagnetic interference common in urban underground settings, necessitating specialized axle counter variants optimized for mass transit demands.

Secondary, yet significant, customer segments include industrial and specialty rail operators, such as those in mining, ports, and heavy-haul sectors. These customers require robust, heavy-duty axle counters capable of withstanding extreme environmental conditions and the heavy axle loads associated with bulk cargo movement. Additionally, infrastructure engineering and construction firms, acting as EPC contractors for new rail projects, are indirect but crucial customers, purchasing ACS as part of a larger turnkey signaling package. Overall, the market is characterized by long sales cycles due to high safety requirements and public sector procurement complexity, demanding strong client relationships and deep technical expertise from suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1030 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens, Alstom, Thales, Hitachi, Pintsch Tiefenbach, Frauscher Sensor Technology, Scheidt & Bachmann, Schweizer Electronic, Azd Praha, Nippon Signal, Kyosan Electric, CRRC, Western Rail Inc., MERMEC, Voestalpine Rail Technology, ZF Group, Railhead Corp, Dellner, Kapsch TrafficCom, Bombarider (now Alstom). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Axle Counter Systems Market Key Technology Landscape

The Axle Counter Systems market relies on highly specialized and certified technologies centered around accurate, continuous, and fault-tolerant train detection. The core technology involves the use of electromagnetic induction sensors, primarily operating on the principle of detecting changes in a magnetic field caused by the passage of a ferromagnetic wheel flange. Modern systems utilize advanced dual- or multiple-sensor arrangements (e.g., two independent coils per detection point) to provide redundancy and directional sensing, ensuring that the system can accurately determine the speed and direction of travel, which is essential for maintaining the integrity of the counting process and confirming track clearance. These sensors are integrated with specialized high-speed microprocessors within the Evaluation Unit, which runs complex algorithms to filter out noise, compensate for temperature variations, and adhere strictly to Safety Integrity Level (SIL 4) requirements, representing the highest safety standard in railway applications.

A crucial technological advancement involves the shift towards digital, IP-based communication networks replacing traditional serial communication links between the wheel sensors and the central interlocking system. This digitalization facilitates real-time diagnostics, remote condition monitoring, and integration into centralized Traffic Management Systems (TMS). Modern ACS often incorporate integrated health monitoring capabilities, utilizing IoT sensors to track internal temperature, power supply fluctuations, and communication errors. This allows for proactive maintenance intervention, significantly improving system uptime. Furthermore, the development of wireless axle counter technologies utilizing low-power, wide-area network (LPWAN) or proprietary secure radio protocols is gaining traction, particularly in areas where trenching and cabling are prohibitively expensive or geographically challenging, such as tunnels or remote rural lines.

The future technology landscape is heavily invested in further miniaturization, enhanced immunity to electromagnetic interference (EMI), and better energy efficiency, especially for battery-powered wireless deployments. Advanced signal processing techniques, often leveraging embedded AI/ML capabilities, are being implemented to improve the system's ability to differentiate between legitimate axle passages and spurious events (such as loose equipment or small objects on the track), reducing the occurrence of false occupancy indications and unnecessary track resets. The seamless integration of ACS data into standardized interfaces like the European Train Control System (ETCS) and proprietary interfaces for Communication-Based Train Control (CBTC) systems remains a key technological focus for major industry players.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to massive infrastructure projects, particularly high-speed rail development in China and extensive mainline network modernization in India, often replacing outdated track circuits with modern ACS. Countries like Japan and South Korea maintain high standards for safety and technological adoption, generating steady demand for advanced, high-reliability systems.

- Europe: Europe represents a mature market characterized by replacement demand and mandated upgrades driven by the widespread rollout of the European Rail Traffic Management System (ERTMS). Germany, the UK, and France are key drivers, focusing on digital signaling solutions and integrating ACS with standardized EU infrastructure components, ensuring sustained demand for SIL 4-certified and ERTMS-compliant systems.

- North America: Market growth in North America is stable, primarily driven by investments from Class I freight rail operators seeking highly reliable detection systems immune to the shunt resistance issues common with heavy, aging freight rolling stock. The implementation of Positive Train Control (PTC) systems also mandates precise train location data, bolstering the adoption of sophisticated axle counter technology across the US and Canada.

- Latin America (LATAM): Growth in LATAM is localized and project-specific, focused mainly on urban mass transit expansion in major cities like São Paulo and Mexico City, alongside targeted upgrades to key mineral and agricultural freight corridors, requiring robust systems capable of operating reliably in often challenging environmental and fiscal conditions.

- Middle East and Africa (MEA): This region shows significant potential due to the construction of new rail networks, especially in the Gulf Cooperation Council (GCC) countries (e.g., Saudi Arabia, UAE) for passenger and freight corridors, demanding high-technology systems suitable for extreme desert climates and requiring systems with enhanced environmental compensation features.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Axle Counter Systems Market.- Siemens

- Alstom

- Thales

- Hitachi

- Pintsch Tiefenbach

- Frauscher Sensor Technology

- Scheidt & Bachmann

- Schweizer Electronic

- Azd Praha

- Nippon Signal

- Kyosan Electric

- CRRC

- Western Rail Inc.

- MERMEC

- Voestalpine Rail Technology

- ZF Group

- Railhead Corp

- Dellner

- Kapsch TrafficCom

- Bombardier (now Alstom)

Frequently Asked Questions

Analyze common user questions about the Axle Counter Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Axle Counter System (ACS) in railway operations?

The primary function of an ACS is to accurately detect the occupancy status of defined track sections by counting the number of train axles entering and exiting that section. This fail-safe counting mechanism ensures secure separation between trains and verifies track clearance, achieving high Safety Integrity Levels (SIL 4).

How do Axle Counter Systems compare to traditional Track Circuits?

ACS are generally superior to track circuits as they are immune to rail shunt resistance issues (caused by rust, dirt, or heavy rain) and do not require insulated joints, resulting in lower maintenance costs and better reliability, especially on electrified or high-speed lines and in tunnels.

What is the significance of Safety Integrity Level (SIL) 4 in the Axle Counter Systems Market?

SIL 4 is the highest standard for safety-critical railway systems, signifying the extremely low probability of a dangerous system failure. Axle counters must be certified to SIL 4 to be adopted in mainline signaling applications, ensuring maximum operational safety and regulatory compliance.

Which technological trend is most significantly influencing the future of ACS adoption?

The most significant trend is the shift toward wireless communication capabilities and the integration of IoT/AI for remote diagnostics and predictive maintenance. Wireless ACS reduces installation costs dramatically while AI enhances system reliability and reduces manual intervention for system resets and repairs.

Which geographical region leads in the adoption and investment in Axle Counter Systems?

The Asia Pacific (APAC) region currently leads in new investments and high-volume adoption, driven primarily by massive government-led railway infrastructure modernization and expansion programs in economies such as China and India, particularly in high-speed and metro rail development.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager