Axle Counting System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435283 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Axle Counting System Market Size

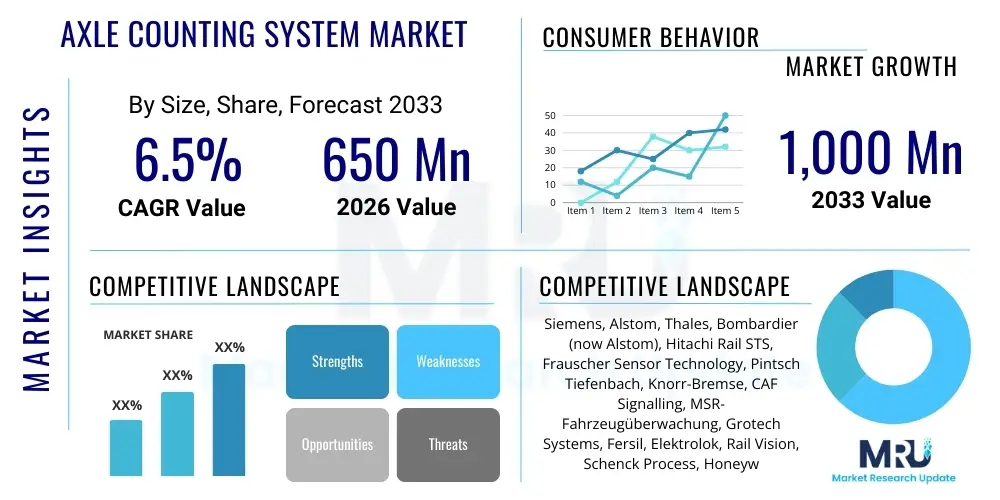

The Axle Counting System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,000 Million by the end of the forecast period in 2033.

Axle Counting System Market introduction

Axle Counting Systems (ACS) are critical safety components primarily used in railway signaling to detect the presence and direction of trains and ensure block section clearance, thereby preventing collisions and optimizing traffic flow. The product utilizes sensors placed on the rails to count the axles entering and exiting a defined track section, verifying track occupancy status with high reliability. Major applications span mainline railway networks, urban metro and light rail systems, and increasingly, specialized industrial sidings and road traffic management for weigh-in-motion enforcement.

The core benefits of adopting ACS include enhanced track vacancy detection compared to traditional track circuits, reduced maintenance complexity, and immunity to certain environmental factors like rust and varying rail conditions. These systems are instrumental in modernizing signaling infrastructure, supporting higher train densities, and integrating with advanced train control systems such as European Train Control System (ETCS) and Communications-Based Train Control (CBTC). The widespread global push for railway network expansion and digital transformation drives the fundamental demand for sophisticated axle counting technology.

Driving factors for this market center on stringent government regulations mandating high safety standards in rail transport, substantial investments in high-speed rail projects across Asia Pacific and Europe, and the inherent resilience of ACS technology in extreme weather conditions compared to older track occupation methods. Furthermore, the development of digital axle counters offering increased diagnostics and data integration capabilities is pushing forward market adoption, allowing operators to achieve predictive maintenance and operational efficiency gains.

Axle Counting System Market Executive Summary

The Axle Counting System Market exhibits robust growth driven by significant global railway modernization programs and the strategic shift toward digital signaling technologies. Business trends indicate a strong focus on interoperability, with major players investing heavily in sophisticated software algorithms and integrated diagnostic tools that enhance system reliability and ease of maintenance. Key regional trends show Asia Pacific leading market expansion due to massive infrastructure projects in China and India, while Europe remains a strong market for technological innovation and replacement cycles. North America is characterized by gradual modernization focused on improving freight rail efficiency and safety, particularly through advanced communication protocols.

Segment trends highlight the dominance of the Digital Axle Counters segment, which provides superior accuracy, remote monitoring capabilities, and integration with advanced traffic management systems, overshadowing legacy analog counterparts. The railway signaling application segment, especially mainline rail networks, maintains the largest market share, serving as the backbone for operational safety. Component-wise, the demand for highly resilient Wheel Sensors and sophisticated Evaluation Units is escalating, as these are critical determinants of system accuracy and uptime. The market structure remains moderately consolidated, with fierce competition among global engineering conglomerates and specialized sensor manufacturers focusing on system customization and lifetime service contracts.

Overall, the market trajectory is strongly upward, underpinned by essential safety requirements and the necessity of upgrading aging rail infrastructure worldwide. The future growth will be shaped by the successful deployment of high-speed rail corridors and the adoption of IoT and AI integration within ACS for predictive maintenance. Strategic partnerships between signaling providers and telecommunications firms will be vital in developing highly connected and data-rich axle counting solutions suitable for the demands of next-generation railway traffic management.

AI Impact Analysis on Axle Counting System Market

Users frequently inquire about how Artificial Intelligence (AI) can move axle counting systems beyond simple binary detection (occupied/unoccupied) toward proactive, diagnostic tools. Common questions revolve around the use of machine learning for anomaly detection, predicting sensor failure, and improving the overall diagnostic capabilities of existing systems. Users seek to understand if AI can effectively process the large volumes of raw sensor data generated by wheel detectors to identify subtle deviations indicative of mechanical issues, track degradation, or impending system faults before they cause operational disruptions. The primary expectation is that AI integration will substantially reduce unscheduled maintenance costs and maximize system availability.

The integration of AI is transforming Axle Counting Systems from basic safety tools into intelligent condition monitoring platforms. By applying machine learning algorithms to historical and real-time data collected from wheel sensors and evaluation units, systems can learn normal operational patterns and instantly flag deviations. This capability extends beyond simply counting axles; it allows for detailed analysis of wheel profiles, train speed anomalies, and vibration patterns, which are critical inputs for predictive maintenance strategies. This shift minimizes reliance on time-based maintenance schedules, leading to significant cost savings and reduced downtime for railway operators globally.

Furthermore, AI-powered analytics are enhancing cybersecurity defenses within ACS networks, which are increasingly vulnerable due to greater connectivity. AI models can detect unusual access patterns or data manipulation attempts, ensuring the integrity of critical safety data. The ability of AI to fuse data from multiple sources—such as axle counters, track circuits, and meteorological sensors—provides a holistic view of the track section, enabling smarter, adaptive signaling decisions that optimize traffic flow, especially during complex operational scenarios or severe weather events.

- AI enhances predictive maintenance by analyzing sensor data to forecast potential component failure (e.g., wheel detectors or evaluation units).

- Machine Learning algorithms enable improved anomaly detection, identifying subtle variations in wheel signatures that indicate train defects (e.g., flat wheels).

- AI supports the development of sophisticated diagnostic tools that reduce troubleshooting time and system downtime.

- Integration with IoT platforms allows AI to process multi-source data (e.g., vibration, temperature, count data) for holistic track condition assessment.

- AI-driven optimization models can fine-tune axle counting thresholds and parameters in real-time, adapting to varying track conditions and minimizing false reports.

DRO & Impact Forces Of Axle Counting System Market

The Axle Counting System Market is primarily driven by stringent global railway safety standards and intensive governmental investments in modernizing aging rail infrastructure, particularly in emerging economies where network expansion is rapid. However, the high initial capital expenditure required for system installation and integration with legacy signaling frameworks acts as a significant restraint, especially for smaller or regional operators. Opportunities lie in the increasing digitalization of railway operations, offering specialized systems for high-speed rail and urban metro expansion, and the potential for leveraging advanced sensors and communication technologies (such as 5G) to enhance data transmission and diagnostics capabilities.

Key impact forces shaping this market include technological advancements, particularly the shift from analog to digital and hybrid axle counters, which offer superior performance and lower lifecycle costs. Regulatory mandates, such as those imposed by the European Union requiring standardized safety technology, compel operators to upgrade their systems, ensuring sustained demand. Economic cycles, while influencing large-scale infrastructure spending, have a lesser impact on safety-critical components like ACS, as these upgrades are typically prioritized regardless of short-term economic fluctuations. Competitive rivalry remains high, forcing manufacturers to continuously innovate in sensor resilience, integration flexibility, and maintenance-free operational guarantees.

The accelerating adoption of Automatic Train Operation (ATO) and Communication-Based Train Control (CBTC) necessitates extremely reliable and accurate track vacancy detection, inherently favoring axle counting systems over traditional track circuits in dense traffic environments. This technological pull, combined with the structural requirement for high rail network throughput, reinforces the market's resilience against economic slowdowns. Addressing the restraint of complex system certification and interoperability challenges across different signaling environments remains crucial for unlocking broader market potential.

Segmentation Analysis

The Axle Counting System Market is systematically segmented based on Technology, Component, and Application, providing a granular view of market dynamics and adoption trends. The Technology segmentation differentiates between legacy Analog Systems and the increasingly dominant Digital Systems, which incorporate microprocessors and advanced communication protocols. Component segmentation focuses on the hardware elements essential for detection and processing, while Application segmentation highlights the primary end-use sectors, predominantly the highly regulated and rapidly growing railway industry. This multi-dimensional segmentation is crucial for understanding specific growth pockets and technological preferences across diverse geographical markets and operational requirements.

The shift towards digital architectures is the most significant trend across all segments. Digital Axle Counters offer inherent advantages in diagnostics, remote monitoring, and integration flexibility, making them the preferred choice for new installations and major modernization projects globally. Furthermore, the specialized requirements of high-speed rail demand robust components capable of operating accurately at very high velocities, driving innovation in sensor design and data processing capabilities. The increasing complexity of signaling environments, coupled with the need for enhanced cyber resilience, further reinforces the necessity for advanced digital and network-integrated solutions within the key segments.

Geographical segmentation reveals that while established markets like Western Europe and North America focus heavily on renewal and high-level integration, high-growth markets in the Asia Pacific region are characterized by mass deployment for entirely new railway lines, driving volume demand, particularly in the mainline application segment. Understanding the interplay between component lifecycle and technology refresh cycles within these segments is essential for strategic market positioning and product development focused on modularity and upgradeability.

- By Technology:

- Digital Axle Counters (Leading segment due to advanced diagnostics and integration capabilities)

- Analog Axle Counters (Phasing out but still present in older networks)

- Hybrid Axle Counters

- By Component:

- Wheel Sensors / Rail Detectors (Including inductive, magnetic, and eddy current sensors)

- Evaluation Units / Processors (Processing units that calculate occupancy and movement)

- Reset Boxes / Key Boxes (Used for manual resetting of track sections)

- Communication & Diagnostic Systems (Integration hardware and software)

- By Application:

- Railway Signaling (Mainline, Metro/Urban Rail, Light Rail)

- Industrial Automation (Mines, Ports, Heavy Industries)

- Road Traffic Monitoring (Weigh-in-Motion, Vehicle Classification)

Value Chain Analysis For Axle Counting System Market

The value chain for the Axle Counting System market begins with upstream analysis involving specialized sensor component manufacturing, often requiring high precision engineering and specific material science expertise for railway-grade durability. This stage includes suppliers of specialized electronic components, robust enclosures, and magnetic materials. Raw material quality is paramount, as the wheel sensors must withstand extreme temperature variations, heavy vibrations, and constant exposure to environmental elements without compromising detection accuracy. Strategic relationships with raw material providers and component manufacturers dictate production cost and system reliability.

The midstream involves system integration and assembly, where the specialized sensors, evaluation units, and communication modules are combined, often requiring extensive software development for proprietary algorithms and diagnostic interfaces. Major market players typically handle this complex system integration in-house to maintain intellectual property and ensure seamless integration with broader signaling frameworks (e.g., interlocking systems). Direct distribution channels are prevalent, especially for large railway operators or national railway authorities (NRAs), where projects involve long-term contracting, bespoke engineering, and stringent regulatory certification processes managed directly between the manufacturer and the end-user.

Downstream activities center on installation, commissioning, rigorous testing, and long-term maintenance services. Due to the safety-critical nature of ACS, comprehensive post-sales support and scheduled calibration are vital revenue streams. While direct sales and service models dominate high-value projects, indirect distribution via specialized railway engineering consultancies or local system integrators is used to reach regional or smaller industrial automation customers. Effective management of the supply chain, ensuring compliance with global railway safety standards (e.g., CENELEC standards), and providing lifetime operational support are critical differentiators in this market.

Axle Counting System Market Potential Customers

The primary customers for Axle Counting Systems are governmental and private entities responsible for managing railway infrastructure and operations. These include national railway authorities (NRAs), private freight operators, and metropolitan transit agencies. NRAs, such as Deutsche Bahn (Germany), Network Rail (UK), and Indian Railways, represent the largest customer base due to their extensive network size and continuous need for safety upgrades and capacity expansion. These entities prioritize systems that offer high availability, robust performance under adverse conditions, and long operational lifecycles.

Beyond traditional rail applications, potential customers include entities involved in high-speed rail construction and urban mass transit development, such as metro and light rail organizations globally, particularly those implementing CBTC signaling systems. Furthermore, non-rail industrial sectors also constitute a significant customer segment. This includes major mining operations, port authorities, and heavy industrial facilities that utilize internal rail networks or require specialized vehicle classification and weigh-in-motion solutions for regulatory compliance and operational efficiency within their restricted premises.

The purchasing decision among these potential customers is heavily influenced by total cost of ownership (TCO), demonstrated reliability statistics, and the system's compliance with specific national safety standards. System integrators and signaling contractors act as important intermediaries, often specifying and procuring ACS on behalf of the end-user as part of a larger signaling modernization package. Therefore, targeting specialized consulting firms and engineering procurement construction (EPC) contractors is also a crucial element of the market strategy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,000 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens, Alstom, Thales, Bombardier (now Alstom), Hitachi Rail STS, Frauscher Sensor Technology, Pintsch Tiefenbach, Knorr-Bremse, CAF Signalling, MSR-Fahrzeugüberwachung, Grotech Systems, Fersil, Elektrolok, Rail Vision, Schenck Process, Honeywell International, Cisco Systems, GE Transportation (Wabtec), Nokia, Mitsubishi Electric. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Axle Counting System Market Key Technology Landscape

The technological landscape of the Axle Counting System market is rapidly evolving, moving away from simple magnetic detection towards highly sophisticated digital signal processing and network integration. The foundation of the system relies on specialized wheel sensors, predominantly utilizing inductive coil technology to detect the metallic wheel flange passing over the rail. The current trend involves enhancing these sensors to be non-intrusive, requiring less maintenance, and capable of operating reliably across diverse rail profiles and environmental extremes, including heavy snow or intense heat. Innovation is focused on creating sensors with greater immunity to electromagnetic interference (EMI) and improved signal-to-noise ratio to ensure data integrity.

A major technological advancement involves the shift towards highly integrated Digital Axle Counters (DACs). DACs incorporate microprocessors and field-programmable gate arrays (FPGAs) directly into the evaluation units, allowing for sophisticated algorithms to filter noise, compensate for temperature changes, and perform self-diagnostics. These digital units support standardized communication protocols such as Ethernet/IP, enabling seamless integration with centralized traffic management systems (TMS) and interlocking devices. Furthermore, the adoption of fiber optic communication links is improving data transmission speed and resilience over long distances within railway corridors, crucial for high-speed applications.

The future technology landscape is dominated by the integration of IoT and cloud-based analytics. Modern ACS are being deployed with wireless connectivity modules to transmit diagnostic data regarding sensor performance, battery health, and communication status in real-time. This continuous data feed supports advanced predictive maintenance models, often powered by AI, that can schedule intervention before a safety-critical failure occurs. Furthermore, there is growing interest in developing redundant, fail-safe architectures based on SIL 4 safety integrity levels, utilizing specialized hardware and software methodologies to meet the highest safety requirements of modern railway signaling.

Regional Highlights

The regional dynamics of the Axle Counting System market are characterized by varying rates of infrastructure investment and technological maturity across continents. Asia Pacific (APAC) stands out as the fastest-growing region, driven by extensive government investment in high-speed rail networks, expansion of urban metro systems in countries like China, India, and Southeast Asian nations, and the imperative to modernize older, high-traffic corridors. The sheer volume of new construction projects necessitates mass deployment of reliable safety equipment, making APAC a primary focus for global ACS providers.

Europe represents a technologically mature market focusing on standardization, renewal, and integration with the European Rail Traffic Management System (ERTMS). Countries in Western Europe, particularly Germany, France, and the UK, are undergoing significant replacement cycles, prioritizing digital, highly integrated axle counters that comply with stringent CENELEC safety standards. The strong regulatory environment and focus on interoperability drive demand for specialized, high-specification products that support higher levels of automation and traffic density.

North America is primarily characterized by the dominance of freight rail and a slower, phased approach to signaling modernization compared to passenger-focused European networks. Investment here is focused on optimizing operational efficiency and enhancing safety along vast, remote corridors, leading to demand for robust, low-maintenance axle counting systems capable of remote diagnostics and long-range communication. Latin America and the Middle East & Africa (MEA) are emerging markets, with growth concentrated around specific metropolitan metro projects and resource-related rail transport expansion, relying heavily on imports and expertise from established European and Asian vendors.

- Asia Pacific (APAC): Leading market growth driven by extensive greenfield high-speed rail projects and modernization in high-density urban areas; strong governmental support for rail infrastructure expansion in China and India.

- Europe: High adoption rate of Digital Axle Counters; market driven by replacement cycles, ERTMS compliance, and strict adherence to CENELEC safety standards; focus on interoperability and advanced diagnostics.

- North America: Steady market growth dominated by freight rail safety upgrades; demand for robust, low-maintenance systems suitable for long-distance, heavy-haul applications; increasing adoption of Positive Train Control (PTC) which integrates with ACS data.

- Middle East & Africa (MEA): Emerging demand fueled by large-scale metropolitan transit projects (e.g., GCC rail network plans) and expansion of mining and port infrastructure; high reliance on imported technology and turnkey solutions.

- Latin America: Gradual modernization in key economic centers (Brazil, Mexico); market growth tied to infrastructure spending and local government initiatives to improve urban connectivity and commuter safety.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Axle Counting System Market.- Siemens

- Alstom

- Thales

- Hitachi Rail STS

- Frauscher Sensor Technology

- Pintsch Tiefenbach

- Knorr-Bremse

- CAF Signalling

- MSR-Fahrzeugüberwachung

- Grotech Systems

- Fersil

- Elektrolok

- Rail Vision

- Schenck Process

- Honeywell International

- Cisco Systems

- Wabtec Corporation (formerly GE Transportation)

- Mitsubishi Electric

- Nokia (for specialized communication infrastructure)

- TÜV Rheinland (as a certification and compliance service provider often linked to ACS deployment)

Frequently Asked Questions

Analyze common user questions about the Axle Counting System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Axle Counting Systems over traditional track circuits?

Axle Counting Systems (ACS) offer superior reliability in adverse environmental conditions such as wet ballast, rust, or contaminated rail surfaces, which can interfere with traditional track circuits. ACS also typically require less trackside wiring and maintenance, leading to lower life cycle costs and easier installation in difficult terrain or tunnels.

How is digitalization impacting the performance and maintenance of ACS?

Digitalization allows modern ACS to incorporate advanced diagnostics and remote monitoring capabilities. Digital Axle Counters (DACs) provide real-time data on system health, enabling predictive maintenance, reducing the need for manual inspection, and significantly improving overall system availability and troubleshooting efficiency.

Which application segment holds the largest market share for Axle Counting Systems?

The Railway Signaling application segment, specifically mainline and high-speed rail networks, holds the largest market share. ACS are safety-critical components essential for maintaining block integrity and controlling traffic flow, making them fundamental to large-scale railway operations globally.

What key safety standard must Axle Counting Systems comply with in Europe?

In Europe, Axle Counting Systems must comply with the CENELEC standards, particularly EN 50126, EN 50128, and EN 50129, to achieve Safety Integrity Level 4 (SIL 4). This certification ensures the highest level of safety and reliability required for railway signaling components.

How does the integration of AI improve the longevity of wheel sensors?

AI improves sensor longevity by analyzing performance data to identify subtle degradation or operational stress patterns. This allows maintenance teams to perform targeted, proactive servicing or calibration rather than adhering to rigid, potentially premature replacement schedules, maximizing the operational lifespan of the expensive components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager