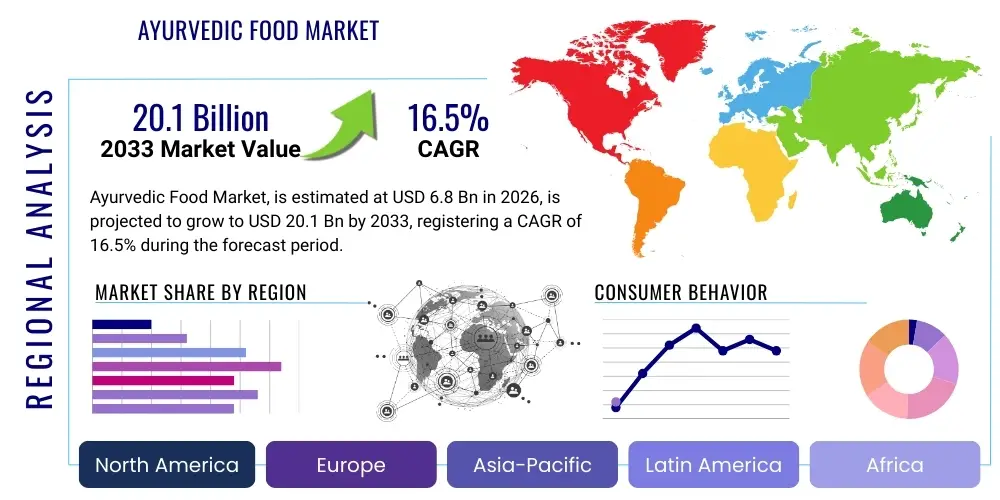

Ayurvedic Food Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435606 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Ayurvedic Food Market Size

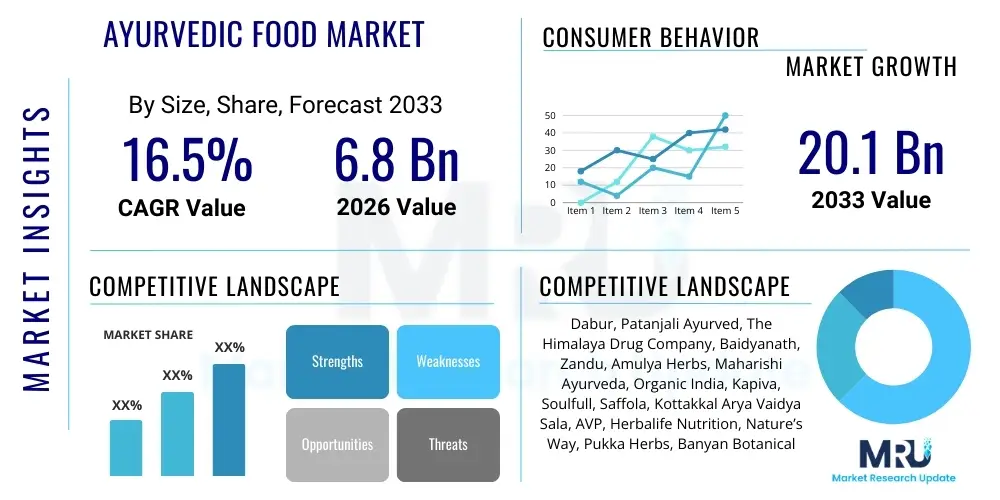

The Ayurvedic Food Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 6.8 Billion in 2026 and is projected to reach USD 20.1 Billion by the end of the forecast period in 2033.

Ayurvedic Food Market introduction

The Ayurvedic Food Market encompasses products manufactured and consumed based on the principles of Ayurveda, an ancient Indian system of medicine focused on achieving balance between the body, mind, and spirit through diet and lifestyle. These products are generally characterized by natural, herbal, and functional ingredients designed to promote holistic health, improve digestion, and prevent disease. The market includes a wide array of offerings, such as functional snacks, herbal teas, specialized dietary supplements, and foods fortified with specific Ayurvedic herbs like Ashwagandha, Turmeric, and Brahmi.

Major applications of Ayurvedic food products span across preventative healthcare, digestive wellness, immunity boosting, and stress management. Consumers increasingly incorporate these foods into their daily routines as a proactive measure against lifestyle diseases, moving away from reactive medical interventions. Key benefits derived from these foods include enhanced metabolism, detoxification, reduced inflammation, and improved energy levels, positioning them as superior alternatives to conventional processed foods lacking functional benefits. The emphasis on natural sourcing and minimal processing further enhances their appeal in the modern clean-label movement, aligning perfectly with global demands for transparency and ingredient integrity.

Driving factors for this robust market growth include heightened consumer awareness regarding the health benefits of traditional medicine, increasing disposable incomes in emerging economies, and proactive government support for natural and indigenous healthcare systems, particularly in Asian countries. Furthermore, effective marketing strategies leveraging digital platforms and the growing trend of personalized nutrition, where Ayurvedic principles naturally excel, contribute significantly to market expansion. The COVID-19 pandemic acted as a major catalyst, significantly accelerating consumer interest in immunity-boosting and naturally sourced products, aligning perfectly with the philosophy of using food as preventative medicine.

Ayurvedic Food Market Executive Summary

The Ayurvedic Food Market demonstrates strong momentum, driven by fundamental shifts in global consumer preferences toward preventative and holistic health solutions. Key business trends indicate significant investment in research and development to validate traditional formulations using modern scientific standards, ensuring both efficacy and safety. There is a discernible trend toward premiumization, where niche, organic, and ethically sourced Ayurvedic products command higher prices, appealing to affluent, health-conscious demographics. Furthermore, strategic partnerships between established pharmaceutical companies and traditional Ayurvedic practitioners are emerging to streamline supply chains and enhance global distribution capabilities, minimizing supply volatility and improving consumer access to high-quality products.

Regionally, Asia Pacific, particularly India, remains the bedrock of the market due to deep cultural integration and a mature consumer base that views Ayurveda as essential to daily life. However, North America and Europe are exhibiting the fastest growth rates, catalyzed by rising skepticism toward synthetic ingredients and a surging interest in plant-based and ancient wellness practices. European consumers are particularly focused on traceability and certified organic claims, pushing manufacturers to adapt their sourcing and labeling practices rigorously. The introduction of local processing and manufacturing units in Western markets is a critical regional trend aimed at mitigating complex import regulations, reducing logistical costs, and customizing products for local palates and regulatory requirements.

Segment trends reveal that the functional beverages and specialized supplements segments are leading the innovation curve, incorporating novel delivery systems and more palatable formats, such as effervescent tablets and ready-to-drink herbal infusions. This focus on convenience and improved taste is key to mass-market acceptance. The distribution landscape is undergoing a digital transformation, with online retail emerging as the dominant growth channel, offering direct-to-consumer access, personalized recommendations, and detailed educational content regarding product benefits and usage. The traditional segment of spices and seasonings, while stable, is also seeing innovation through pre-mixed, functional spice blends tailored for specific health conditions (e.g., Kapha, Pitta, Vata doshas), reflecting the market's move toward tailored wellness solutions supported by modern scientific packaging and preparation.

AI Impact Analysis on Ayurvedic Food Market

Users frequently inquire about AI's role in validating traditional Ayurvedic formulations, optimizing the complex herbal supply chain, and customizing dietary recommendations based on individual body types (Prakriti). Key concerns revolve around ensuring AI algorithms accurately interpret ancient texts and traditional knowledge without dilution, and how AI-driven predictive analytics can manage the volatility and seasonality of medicinal herb sourcing. Expectations center on AI significantly improving personalized nutrition plans, streamlining quality control, and accelerating new product development by identifying efficacious ingredient combinations that adhere to Ayurvedic principles while meeting modern regulatory standards for safety and efficacy.

The application of Artificial Intelligence (AI) in the Ayurvedic food sector marks a transformative shift, particularly concerning personalized wellness and supply chain integrity. AI is crucial in managing the vast complexity inherent in Ayurvedic ingredient lists, often involving dozens of herbs and specific preparation methods. Machine learning algorithms are being employed to cross-reference traditional knowledge systems (classical Ayurvedic texts) with modern biochemical data, helping researchers scientifically validate the efficacy and mechanism of action for various food products and herbal blends. This scientific validation is paramount for expanding market penetration in stringent regulatory environments like North America and Europe, which demand evidence-based substantiation for health claims before consumer acceptance can be achieved.

Furthermore, AI-driven predictive analytics are vital for optimizing the procurement and processing of raw materials. Since many Ayurvedic herbs are wild-harvested or require specific climate conditions, AI models predict harvest yields, potential supply disruptions due to weather or disease, and monitor real-time quality parameters using sensor data. This capability ensures sustainable sourcing, minimizes wastage, and guarantees the consistency of the final food product, thereby addressing critical consumer demands for quality and purity. AI also powers highly personalized recommendation engines used by online retailers and wellness consultants, allowing them to match specific Ayurvedic food products and dietary regimens (based on sophisticated Dosha assessment algorithms) directly to individual consumer needs, moving beyond generalized health advice and offering truly tailored dietary solutions.

- AI-Powered Dosha Assessment: Utilizing machine learning models trained on millions of data points for highly accurate, non-invasive assessment of individual Prakriti (body constitution) to recommend personalized Ayurvedic food diets and lifestyle adjustments.

- Supply Chain Optimization: Implementing predictive analytics and IoT sensors to forecast demand for specific herbs, optimize inventory management, and ensure the immutable traceability of ingredients from farm/wild habitat to final consumer product using blockchain integration.

- Scientific Validation and R&D: Using AI algorithms to analyze vast phytochemical databases, screen for potential toxicity, and validate the synergistic effects of complex herbal combinations mentioned in ancient texts, significantly accelerating the process of bringing scientifically credible products to market.

- Quality Control Automation: Deployment of computer vision and sensor technology coupled with deep learning to automatically detect contaminants, adulteration, or inconsistencies in raw herbal materials and finished food products with unprecedented speed and precision, ensuring regulatory compliance.

- Enhanced Customer Engagement: Developing AI chatbots and virtual assistants that provide instant, 24/7, culturally relevant, and context-aware advice on integrating specific Ayurvedic foods into daily life, addressing complex user queries related to traditional usage and modern application.

DRO & Impact Forces Of Ayurvedic Food Market

The Ayurvedic Food Market is robustly driven by increasing global acceptance of holistic medicine, strong consumer preference for natural immunity boosters, and favorable governmental policies promoting traditional healthcare systems, particularly in Asia. These drivers are tempered by significant restraints, primarily concerning stringent global regulations on herbal health claims, issues related to ingredient standardization and quality control across diverse sourcing environments, and the challenge of scaling traditional, often labor-intensive, preparation methods without compromising efficacy. Opportunities lie in expanding into the mainstream functional food segment, leveraging personalized nutrition technologies such as AI and genomics, and penetrating non-traditional Western markets through strategic educational marketing and rigorous scientific validation. The primary impact forces include the rising tide of chronic lifestyle diseases, which necessitates preventative dietary measures, and the pervasive influence of digital media in disseminating ancient wellness wisdom globally, rapidly increasing consumer exposure and awareness.

Drivers for market growth are profoundly linked to demographic and societal shifts across the globe. The aging population is increasingly seeking natural, side-effect-minimal remedies to manage age-related conditions and maintain vitality, while younger generations are prioritizing preventative wellness and demanding 'clean label' products devoid of synthetic additives or artificial processing. Furthermore, the successful integration of Ayurvedic principles into mainstream media and wellness culture, championed by influential figures and integrative medical professionals, has significantly reduced previous market skepticism. The economic driver includes the favorable cost structure of Ayurvedic raw materials relative to synthetic supplements, allowing competitive pricing for certain mass-market products, particularly in Asia Pacific, while supporting a premium pricing model for certified organic and ethically sourced specialized items targeting affluent Western consumers. The consistent messaging that Ayurvedic foods treat the root cause, rather than just the symptoms, resonates deeply with long-term health seekers focused on sustainability of well-being.

Restraints pose a considerable challenge, particularly concerning intellectual property and standardization across varied geographical supply regions. The lack of standardized cultivation, harvesting, and processing protocols across different regions can lead to high variability in the chemical composition and therapeutic efficacy of the final food product, hindering the consistent quality assurance required for mass market acceptance and export. Moreover, navigating the diverse regulatory frameworks in Western countries—which often classify Ayurvedic foods differently (as foods, supplements, or traditional medicines)—creates significant, costly market entry barriers that require specialist legal and scientific compliance teams. The occasional presence of heavy metals or contaminants in poorly sourced herbs, although infrequent among reputable brands due to rigorous testing, still poses a critical reputational risk that requires coordinated industry efforts to mitigate through mandated third-party testing, rigorous certification, and robust supply chain transparency protocols.

Opportunities for expansion are abundant, centered around product innovation and geographical diversification aimed at maximizing convenience and palatability. Creating hybrid products that seamlessly blend potent Ayurvedic herbs into familiar Western formats, such as fortified plant-based milk alternatives, energy bars, functional coffees, and specialized seasoning blends, opens vast new consumer bases previously resistant to traditional forms. Furthermore, capitalizing on the rising trend of sustainable and ethical sourcing provides a distinct competitive advantage, as Ayurvedic practices inherently align with ecological stewardship and community support. The growing acceptance of telehealth and remote wellness consultations allows Ayurvedic practitioners to reach global audiences, fueling targeted demand for specific corresponding dietary products recommended during these consultations. The digital platform serves as the ultimate facilitator, enabling rich educational marketing that demystifies traditional concepts for modern consumers seeking actionable wellness solutions.

Segmentation Analysis

The Ayurvedic Food Market is segmented based on product type, form, distribution channel, and application, allowing for a detailed analysis of consumption patterns, innovation trajectories, and high-growth pockets across different global demographics. The segmentation reflects the diverse ways consumers incorporate Ayurvedic principles into their diets, ranging from essential, daily functional foods (like spices) to targeted therapeutic supplements (like specialized herbal jams). Analyzing these segments helps stakeholders understand which product categories are achieving rapid mainstream adoption and which distribution channels are most effective for reaching specific consumer demographics, particularly differentiating between established, tradition-bound Asian consumers and emerging, technology-driven Western buyers.

The segmentation by product type is critical, highlighting the shift from traditional raw herbs towards ready-to-consume functional foods and beverages designed for modern convenience. Functional foods, which include Ayurvedic cereals, high-protein snack bars, and ready-to-eat meals fortified with traditional ingredients, are particularly appealing to urban populations seeking health benefits without extensive preparation time. The liquid segment, driven by demand for herbal juices, immunity shots, and specialized Kashayams (decoctions), is growing rapidly due to perceived higher bioavailability, immediate absorption, and ease of consumption. This segment’s growth is directly linked to the widespread consumer demand for quick, measurable health benefits, especially in preventative health contexts.

Further granularity in segmentation reveals consumer motivations. The application segment, divided into immunity boosting, digestion enhancement, stress relief, and general wellness/anti-aging, clearly shows that immunity and digestive health are currently the primary purchasing drivers, a trend heavily amplified post-pandemic as consumers prioritize resilience. Understanding the interplay between form and distribution (e.g., highly technical solid supplements being sold heavily through specialized online pharmacy channels, while ready-to-drink beverages and functional snacks dominate physical supermarket shelves) is essential for effective inventory management and optimized marketing strategies. This multi-dimensional segmentation confirms that the market is rapidly evolving from a niche therapeutic category into a highly accessible, global functional food sector.

- By Product Type:

- Herbal Drinks and Functional Beverages (e.g., herbal teas, immunity shots, functional juices)

- Spices and Seasonings (e.g., Turmeric blends, functional masalas)

- Ayurvedic Functional Foods (e.g., Snacks, Fortified Cereals, Energy Bars, Roti/Bread mixes)

- Ayurvedic Supplements (e.g., Chyawanprash, Prash, Grithams, standardized capsules/tablets)

- Oils and Ghee (e.g., medicated ghee, specialized massage oils used in diet)

- By Form:

- Solid (e.g., Tablets, Capsules, Powders, Food Items like bars and cereals)

- Liquid (e.g., Juices, Syrups, Decoctions, Ready-to-Drink Teas)

- Semi-Solid (e.g., Jams, Pastes, Lehyams, Grithams)

- By Distribution Channel:

- Online Retail and E-commerce Platforms (Direct-to-Consumer and Marketplaces)

- Supermarkets and Hypermarkets (Mass retail accessibility)

- Pharmacies and Drug Stores (Focus on medicinal supplements)

- Direct Sales and Specialized Ayurvedic Clinics (High trust, personalized recommendations)

- By Application:

- Immunity Boosting and Preventative Health (Largest segment post-COVID)

- Digestive Health and Metabolism (Addressing issues like Agni/gut health)

- Stress Management and Cognitive Function (Adaptogenic herbs like Ashwagandha)

- General Wellness and Anti-aging (Long-term vitality and energy)

Value Chain Analysis For Ayurvedic Food Market

The Ayurvedic food value chain is exceptionally complex, starting with the cultivation and sourcing of medicinal herbs (upstream analysis), which requires specialized, often organic, agricultural practices, ethical wild foraging, and adherence to specific seasonal harvesting windows. The criticality of this stage lies in maintaining the potency (phytochemical profile) of the raw materials, which is highly sensitive to environmental and handling conditions. The midstream involves advanced extraction, purification, and careful formulation, often adhering to ancient, labor-intensive preparation methods (like specific Bhasmas or decoctions) which are paramount for preserving the intended synergistic efficacy of bioactives as prescribed in classical texts. Any deviation at this stage directly compromises the final product’s authenticity and therapeutic value.

Upstream operations are dominated by small-scale farmers, tribal communities, and specialized collectors, particularly in biodiversity-rich regions like India, Sri Lanka, and Nepal. Key challenges at this stage include ensuring sustainable and regenerative harvesting practices to protect endangered species, preventing contamination or adulteration, and achieving consistent quality control despite varying climate and soil conditions. Significant investment is increasingly directed towards implementing Good Agricultural Practices (GAPs) and obtaining stringent organic and fair-trade certifications to meet exacting international standards. The raw material processing phase involves critical steps like solvent extraction, drying, and powdering, which modern technology now enhances using precise temperature and pressure controls to ensure standardized potency, moving away from subjective traditional methods without compromising the underlying principles of the formulation.

The distribution channel (downstream analysis) is characterized by a strong dichotomy: traditional routes (direct) and rapidly growing indirect mass-market channels. Direct channels include proprietary Ayurvedic clinics, company-owned exclusive stores, and specialized practitioners who provide personalized, high-touch recommendations, ensuring high levels of customer loyalty and detailed product education necessary for adherence. Indirect channels, which are experiencing the fastest growth globally, primarily consist of large supermarket chains, third-party pharmacies, and, most critically, large e-commerce marketplaces and dedicated online wellness platforms. E-commerce platforms facilitate rapid global reach, allowing smaller specialty brands to bypass traditional retail gatekeepers, provided they can manage complex international shipping logistics and diverse regulatory compliance hurdles. The success of the downstream market relies heavily on compelling digital content and strong AEO strategies that effectively educate consumers about the nuanced science and traditional benefits of Ayurvedic food preparations.

Ayurvedic Food Market Potential Customers

Potential customers for the Ayurvedic Food Market are broadly categorized into three highly engaged segments: Holistic Health Seekers, Preventative Wellness Consumers, and Consumers managing specific Chronic Conditions. Holistic Health Seekers, who often reside in Asia Pacific or adhere strictly to lifestyle diets, already embrace Ayurvedic philosophies and seek products for long-term physiological and psychological balance (Dosha balancing), prioritizing authenticity and adherence to classical preparation methods. Preventative Wellness Consumers, dominating Western markets (North America, Europe), are typically highly active, educated consumers aged 25–45, seeking natural alternatives to boost immunity, enhance physical performance, and manage stress proactively, viewing Ayurvedic foods primarily as convenient, functional supplements rather than traditional medicine.

A key emerging demographic includes affluent, urban individuals (35-60 years old) globally who possess high disposable incomes and are willing to pay a substantial premium for certified organic, ethically sourced, and scientifically validated Ayurvedic food products. This group is strongly driven by concerns over synthetic ingredients, traceability, and environmental impact, and they demand absolute transparency regarding ingredient origin and processing methods. Furthermore, the market targets parents who are keen on incorporating natural, immunity-boosting, and preservative-free foods into their children’s diets, specifically seeking products like fortified infant foods or specialized herbal preparations such as children's Chyawanprash. These buyers prioritize safety certifications, clinical endorsement, and strong recommendations from pediatric wellness experts and trusted online communities.

The final significant segment comprises individuals dealing with chronic lifestyle diseases such as diabetes, severe digestive disorders (IBS, leaky gut), or chronic inflammatory conditions. These customers are actively looking for complementary, natural dietary solutions that minimize adverse side effects associated with conventional treatments and support overall systemic well-being, often driven by referrals from integrative medicine practitioners. Their purchasing decisions are heavily influenced by scientific clinical efficacy data, robust peer-reviewed testimonials, and the ease of product incorporation into existing, restrictive diet plans. Successful targeting requires educational outreach emphasizing Ayurvedic concepts like 'Agni' (digestive fire) and detoxification, framing the food product as an essential, scientifically sound tool for restoring and maintaining metabolic harmony and long-term health resilience.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.8 Billion |

| Market Forecast in 2033 | USD 20.1 Billion |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dabur, Patanjali Ayurved, The Himalaya Drug Company, Baidyanath, Zandu, Amulya Herbs, Maharishi Ayurveda, Organic India, Kapiva, Soulfull, Saffola, Kottakkal Arya Vaidya Sala, AVP, Herbalife Nutrition, Nature’s Way, Pukka Herbs, Banyan Botanicals, New Chapter, Planet Ayurveda, Good Earth Tea. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ayurvedic Food Market Key Technology Landscape

The technological evolution within the Ayurvedic food market is primarily focused on four core areas: ensuring stringent quality control and ingredient verification, enhancing the bioavailability and absorption rate of active compounds, modernizing preparation processes for scalability, and optimizing consumer personalization. Advanced analytical chemistry techniques, including High-Performance Liquid Chromatography (HPLC), High-Performance Thin-Layer Chromatography (HPTLC), and sophisticated Mass Spectrometry, are now standard requirements for chemical fingerprinting herbal ingredients, verifying absolute purity, and quantitatively measuring specific active compounds (e.g., piperine in black pepper, withanolides in Ashwagandha). These analytical technologies directly address the critical restraint of standardization, validating efficacy and ensuring safety for global export markets.

Furthermore, cutting-edge delivery technologies such as nanotechnology, micro-encapsulation, and liposomal encapsulation are rapidly emerging to dramatically improve the cellular delivery and absorption (bioavailability) of traditionally poorly soluble Ayurvedic extracts. By encapsulating compounds like curcumin or specific herbal resins in nano-sized lipid carriers, manufacturers can significantly enhance their therapeutic efficacy, allowing for lower, more effective dosages and improving stability. This innovative application of advanced food science and drug delivery science to traditional food items represents a major technological leap, appealing strongly to scientifically minded Western consumers who prioritize measurable and proven results over purely anecdotal or traditional claims. This technology is vital for premium product positioning and justification.

On the processing and manufacturing front, leading manufacturers are adopting highly automated, closed-system extraction and concentration units that minimize potential human error, ensure rigorous sanitation, and guarantee scalable production while precisely mimicking the slow, heat-controlled, multi-step processes prescribed in ancient texts. Robotics and advanced sensor systems coupled with AI are integrated into manufacturing lines to ensure high throughput and consistency while maintaining stringent hygiene standards. Additionally, blockchain technology is actively being piloted and deployed to create immutable digital ledgers of the entire supply chain, providing end-to-end transparency for every batch of herb used, certifying its organic status, geographical origin, and precise processing conditions—a direct and robust response to rising consumer and regulator demands for ethical sourcing, traceability, and verifiable authenticity in wellness products.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest market both in terms of consumption and production, serving as the foundational hub for Ayurvedic practice globally. Growth is robustly driven by deeply ingrained cultural acceptance of Ayurveda, particularly in key source countries like India, Nepal, and Sri Lanka. India alone commands the dominant market share, fueled by strong domestic consumer demand, proactive government initiatives like the Ministry of AYUSH promotion, and the presence of numerous established market leaders (e.g., Dabur, Patanjali). The APAC market is characterized by high, stable consumption of traditional supplements (Chyawanprash) and raw herbs, transitioning rapidly toward packaged, convenient Ayurvedic functional foods and beverages among the younger, highly urbanized demographic seeking convenience. Increasing disposable incomes and higher consumer spending on preventative wellness across secondary markets like China, Malaysia, and Japan are core growth accelerators, integrating Ayurvedic principles through wellness tourism and cross-cultural food trends.

- North America: North America is classified as the fastest-growing region globally, albeit starting from a relatively smaller penetration base. Growth is intensely propelled by exceptionally high levels of health consciousness, significant consumer expenditure on premium dietary supplements, and a widespread cultural interest in plant-based, ancient medicinal systems, often viewed as alternatives to conventional pharmaceutical routes. The market demand centers on convenient, highly specialized, and scientifically backed products, such as certified organic herbal extracts, ready-to-drink functional shots (containing adaptogens like Ashwagandha), and functional meal replacements. Strict regulatory clarity (or lack thereof) regarding herbal claims under the FDA remains the primary challenge, forcing brands to position products primarily as dietary supplements or functional foods rather than making overt medicinal claims. Education, transparency, and scientific validation are critical for sustained expansion, compelling brands to invest heavily in clinical studies and third-party quality certifications to support health claims and boost consumer confidence in product efficacy.

- Europe: The European market is uniquely characterized by high consumer demand for stringent organic certification, ethical sourcing practices, and complete supply chain transparency. Countries like Germany, the UK, and France show significant market penetration, primarily focused on herbal teas, digestive health aids, and stress-relief supplements (e.g., turmeric lattes, Kapha-balancing blends). Regulatory hurdles, particularly the complex EU Novel Food Regulation, restrict the legal entry of many traditional Ayurvedic preparations unless they can conclusively demonstrate a documented history of consumption within the EU prior to May 1997 or undergo extremely costly and time-consuming novel food authorization. Consequently, European market growth is driven by niche, premium products sold through specialized health food stores, dedicated ethical retailers, and online platforms, targeting affluent, environmentally conscious consumers seeking sustainable and rigorously tested traditional wellness products.

- Latin America (LATAM): The LATAM region presents nascent but high-potential opportunities, with regional economic powerhouses like Brazil and Mexico showing the earliest and most enthusiastic adoption of Ayurvedic concepts. The market growth here is influenced by increasing public interest in natural health alternatives and the presence of strong indigenous medicine systems that share philosophical common ground with Ayurveda. Market penetration remains low compared to developed Western markets, but increasing urbanization, expanding middle classes, and growing exposure to global wellness trends through digital media are driving foundational growth in awareness and willingness to experiment. Key areas of focus are immunity boosting, digestive regularity, and general wellness products, distributed primarily through modernized pharmacy chains and online retail, benefiting from lower market saturation and a high volume of digital engagement.

- Middle East and Africa (MEA): The MEA region's growth is largely concentrated within the affluent Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia) due to high import capacities, significant disposable income, and a large, health-aware expatriate population that brings global wellness trends. These markets show strong demand for premium, imported supplements and packaged health foods. In the African continent, the market is highly fragmented, with penetration primarily occurring through specialized health food stores and targeting high-income demographics seeking sophisticated preventative health solutions. Halal certification, compliance with strict import standards, and deep cultural alignment are crucial strategic and marketing considerations in the Middle East, heavily influencing product formulation, labeling, and retail presentation to ensure consumer trust and acceptance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ayurvedic Food Market.- Dabur India Ltd.

- Patanjali Ayurved Ltd.

- The Himalaya Drug Company

- Baidyanath (Shree Baidyanath Ayurved Bhawan Pvt. Ltd.)

- Zandu Pharmaceutical Works Ltd.

- Amulya Herbs

- Maharishi Ayurveda Products Pvt. Ltd.

- Organic India Pvt. Ltd.

- Kapiva (Ayu Health Products)

- Soulfull (Tata Consumer Products)

- Saffola (Marico Limited)

- Kottakkal Arya Vaidya Sala

- AVP (Arya Vaidya Pharmacy)

- Herbalife Nutrition Ltd.

- Nature’s Way Products, LLC

- Pukka Herbs (Unilever)

- Banyan Botanicals

- New Chapter, Inc. (Procter & Gamble)

- Planet Ayurveda

- Good Earth Tea

Frequently Asked Questions

Analyze common user questions about the Ayurvedic Food market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Ayurvedic Food Market between 2026 and 2033?

The Ayurvedic Food Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% during the forecast period from 2026 to 2033, reflecting accelerating global adoption of traditional wellness principles and functional foods.

Which factors are primarily driving the growth of the Ayurvedic Food Market?

Primary drivers include the increasing consumer preference for natural and holistic preventative healthcare, strong governmental support for traditional medicine systems, and heightened awareness regarding the role of diet in immunity and chronic disease management globally.

How does standardization affect the market entry of Ayurvedic foods in Western countries?

Lack of standardization in cultivation, preparation, and quality control of herbs creates significant regulatory barriers in Western countries (like the EU and North America), necessitating substantial investment in scientific validation, third-party testing, and stringent quality assurance protocols to ensure mass market acceptance.

How is AI transforming the personalization of Ayurvedic food recommendations?

AI is used to analyze individual health data and traditional Prakriti (Dosha) assessments using machine learning models to generate highly customized dietary plans and product recommendations, ensuring consumers receive targeted Ayurvedic food solutions based on their unique physiological profile.

Which segment holds the highest growth potential in the Ayurvedic Food Market?

The Ayurvedic Functional Foods and Herbal Drinks segment is expected to show the highest growth potential, driven by convenience, innovation in taste, high bioavailability, and seamless integration into modern, fast-paced lifestyles, particularly appealing to younger consumers and urban populations globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager