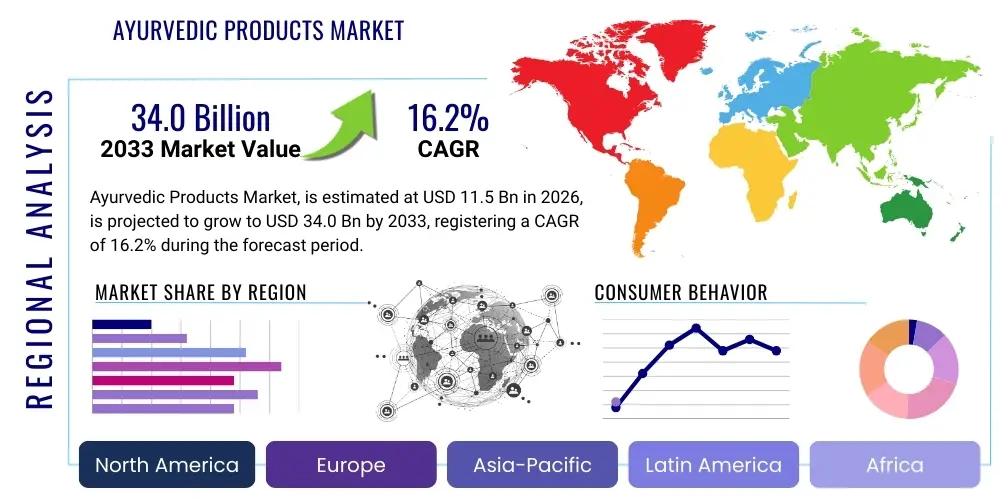

Ayurvedic Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437680 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Ayurvedic Products Market Size

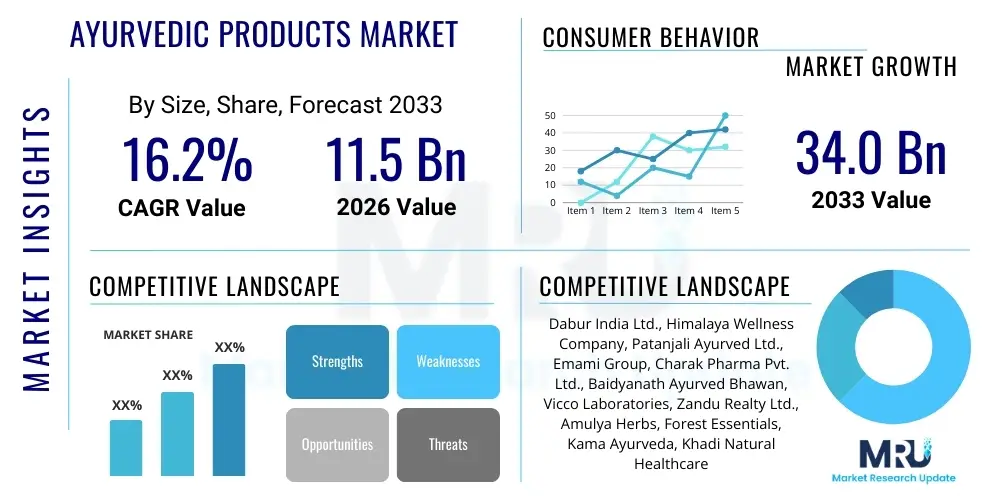

The Ayurvedic Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.2% between 2026 and 2033. The market is estimated at USD 11.5 billion in 2026 and is projected to reach USD 34.0 billion by the end of the forecast period in 2033.

Ayurvedic Products Market introduction

The Ayurvedic Products Market encompasses traditional holistic healthcare solutions derived from natural ingredients, primarily herbs, minerals, and metals, following principles established thousands of years ago in India. These products range from herbal formulations and classical medicines to personal care items and dietary supplements aimed at promoting comprehensive well-being rather than merely treating symptomatic illness. The core philosophical framework of Ayurveda, focusing on balancing the body’s doshas (Vata, Pitta, Kapha), resonates strongly with the modern global shift toward preventative health and natural alternatives. Market growth is structurally supported by rising consumer awareness regarding the potential side effects associated with synthetic pharmaceuticals and a deep-seated trust in traditional medicinal systems across developing economies. This market’s expansion is characterized by the modernization of traditional processes, including advanced standardization of formulations and rigorous quality control measures to meet international regulatory standards.

Major applications of Ayurvedic products span therapeutics (addressing chronic conditions like diabetes and arthritis), prophylactic care (enhancing immunity and detoxification), and cosmetic wellness (skincare, haircare, and oral hygiene). Therapeutic applications remain a cornerstone, leveraging the perceived efficacy of polyherbal compounds. However, the fastest-growing segment is personal care, driven by consumers actively seeking 'clean label' products free from harsh chemicals. The primary benefits driving adoption include the use of natural, renewable resources, minimal reported side effects when consumed correctly, and a holistic approach that integrates lifestyle and diet recommendations alongside medicinal intake. The high perceived safety profile, coupled with heritage value, provides a strong competitive advantage against conventional alternatives in specific consumer segments.

Key driving factors accelerating market penetration globally include favorable government initiatives in countries like India (through the Ministry of AYUSH), promoting research, export, and mainstreaming of Ayurveda. Furthermore, technological advancements in extraction, purification, and clinical validation are enhancing product credibility and bioavailability. The globalization of wellness culture, particularly the acceptance of yoga and meditation, has naturally introduced related Ayurvedic practices and products to Western markets. Supply chain maturity, coupled with increasing investments in sustainable sourcing and organic cultivation of medicinal herbs, ensures the consistent availability of raw materials, which is crucial for scaling production capacity to meet burgeoning international demand.

Ayurvedic Products Market Executive Summary

The global Ayurvedic Products Market is undergoing a rapid transformation, moving from localized, fragmented supply chains to organized, globally regulated trade driven by significant cross-border investments and strategic collaborations. Current business trends indicate a strong focus on clinical substantiation and product standardization, essential for overcoming regulatory hurdles in high-value markets such as North America and Europe. Companies are increasingly adopting digital platforms, leveraging e-commerce and direct-to-consumer models to bypass traditional retail bottlenecks and educate consumers directly about product authenticity and usage protocols. Innovation is concentrated in advanced delivery systems, such as encapsulated herbal extracts and nano-formulations, improving efficacy and patient compliance. Mergers and acquisitions are frequent among major cosmetic and pharmaceutical conglomerates seeking to integrate natural wellness brands into their portfolios, capitalizing on the high-growth trajectory of the holistic health sector.

Regional trends highlight Asia Pacific (APAC), particularly India, as the dominant force, serving as both the largest consumer base and the primary production hub, supported by vast biodiversity and governmental backing. However, North America and Europe are emerging as the fastest-growing regions, driven by high disposable incomes, increasing prevalence of lifestyle diseases, and a strong preference for natural health solutions among the millennial and Gen Z populations. In these Western markets, Ayurvedic products are successfully positioned within the premium wellness category, often marketed alongside supplements and organic food items. Regulatory harmonization remains a complex regional challenge; while some countries recognize Ayurvedic formulations as traditional medicines, others classify them strictly as dietary supplements, impacting market entry and claims validation strategies.

Segment trends reveal that the Personal Care category holds the largest market share, fueled by mass adoption of Ayurvedic principles in daily hygiene products like toothpaste, soaps, and hair oils, valued for their natural composition. However, the Healthcare/Medical segment, comprising classical formulations and proprietary medicines, is expected to exhibit the highest CAGR due to increasing research activity focusing on chronic disease management and immunity boosting, especially post-pandemic. Distribution channel analysis indicates that while traditional pharmacies and specialty Ayurvedic stores remain vital, the Online segment is experiencing exponential growth, necessitated by geographical reach, convenience, and the ability to verify product certifications and consumer reviews, strongly supporting younger, digitally native buyers.

AI Impact Analysis on Ayurvedic Products Market

Common user questions regarding AI's impact on the Ayurvedic Products Market primarily revolve around how technology can enhance the credibility, personalization, and efficiency of traditional systems. Users frequently inquire about AI's role in verifying the authenticity and efficacy of complex herbal formulations, optimizing traditional processes like quality control and raw material sourcing, and developing highly customized treatment plans. Key concerns include maintaining the philosophical integrity of Ayurveda while utilizing advanced algorithms and ensuring data privacy when sharing personal health metrics for personalized recommendations. The overall expectation is that AI will bridge the gap between ancient knowledge and modern scientific rigor, accelerating drug discovery, simplifying complex diagnosis based on Prakriti analysis, and ultimately validating Ayurvedic science on a global scale through empirical data management.

- AI-driven clinical validation: Utilizing machine learning models to analyze multi-omics data (genomics, metabolomics) and clinical trial results to statistically substantiate the efficacy and safety of traditional polyherbal compounds, thereby facilitating regulatory approvals.

- Personalized Ayurvedic recommendations: Developing algorithms that analyze a patient’s unique physiological profile (Prakriti), lifestyle factors, and disease symptoms to recommend precise herbal formulations, diet plans, and lifestyle adjustments, enhancing the concept of personalized medicine.

- Raw material supply chain optimization: Implementing predictive analytics and IoT sensors for monitoring agricultural conditions, predicting crop yields of medicinal plants, and ensuring traceability and quality assurance from farm to final product, mitigating adulteration risks.

- Accelerated drug discovery and formulation: Using AI to rapidly screen vast databases of Ayurvedic texts and chemical libraries to identify synergistic combinations of herbs (Rasayana) for specific therapeutic targets, dramatically reducing the time and cost associated with research and development.

- Enhanced quality control and standardization: Employing image processing and spectroscopic analysis (e.g., HPLC fingerprinting) combined with AI to detect contaminants, verify species identity, and ensure batch-to-batch consistency of active ingredients, addressing major industry challenges related to standardization.

DRO & Impact Forces Of Ayurvedic Products Market

The dynamics of the Ayurvedic Products Market are heavily influenced by a confluence of driving factors, restrictive barriers, and substantial growth opportunities, which collectively shape the market’s trajectory and competitive intensity. Primary drivers include the increasing global shift toward preventative and natural healthcare methodologies, particularly emphasized after global health crises, accelerating consumer preference for products with perceived lower side effects and long-term wellness benefits. Restraints mainly center on the lack of globally standardized regulatory frameworks and the challenge of scientifically substantiating the efficacy of complex traditional formulations using modern clinical trial methodologies, which hinders broader acceptance in highly regulated Western markets. Opportunities lie significantly in product innovation focused on convenient forms (e.g., ready-to-use extracts, specialized supplements) and expansion into untapped emerging economies in Africa and Latin America, coupled with leveraging digital health platforms for personalized product delivery and consumer education.

Impact forces acting upon this market include the high bargaining power of consumers, driven by the increasing availability of information and the necessity for certified, transparent sourcing; consumers are increasingly discerning, favoring brands with strong ethical and sustainability credentials. The threat of new entrants is moderate, as while the entry barrier for small-scale local production is low, scaling operations and establishing trust requires significant investment in infrastructure, clinical research, and navigating stringent international regulatory pathways. The competitive rivalry is intense, especially in high-volume segments like personal care, where local traditional players compete directly with multinational corporations entering the space through portfolio diversification or strategic acquisitions, necessitating constant innovation in product positioning and marketing.

Furthermore, the bargaining power of suppliers, particularly for rare or ethically sourced medicinal herbs, is increasing due to global warming, deforestation, and concerns over sustainable harvesting practices. This supply constraint potentially affects manufacturing costs and product stability. Substitutes, primarily synthetic supplements and over-the-counter pharmaceuticals, pose a moderate threat, especially in markets where immediate symptomatic relief is prioritized over holistic, long-term care. The future growth trajectory depends heavily on the market’s ability to standardize quality (ensuring heavy metal safety and potency), secure intellectual property rights for traditional knowledge, and successfully integrate Ayurvedic principles into mainstream medical insurance and reimbursement structures globally.

Segmentation Analysis

The Ayurvedic Products Market is primarily segmented based on Product Type, Form, and Distribution Channel, reflecting diverse consumer behaviors and application areas. The segmentation analysis reveals shifting dynamics, with an increasing focus on personal care and dietary supplements as entry points for new consumers, especially those in Western demographics unfamiliar with classical medicines. Geographic segmentation remains crucial, as the acceptance, regulation, and accessibility of Ayurvedic products vary drastically between regions, necessitating customized marketing and compliance strategies tailored to local health systems and consumer preferences. The ongoing modernization and repackaging of traditional remedies into accessible formats, such as capsules and ready-to-drink formulations, further diversifies the market offerings and helps capture younger consumer segments seeking convenience.

Analysis by Product Type shows a clear distinction between internal consumption products (healthcare and supplements) and external applications (personal care). While healthcare products (classical formulations and proprietary medicines for treating specific ailments) represent the historical core, the personal care category (including skin, hair, and oral care products) is expected to dominate market volume due to high frequency of purchase and broader consumer appeal across all age groups and geographies. Dietary supplements, positioned for preventative health, immunity boosting, and specific nutrient requirements (e.g., adaptogens like Ashwagandha), show the highest growth rate, reflecting the global preventative health paradigm shift and self-care movement.

The market structure is continually evolving, driven by the rapid penetration of e-commerce. Distribution channel segmentation now heavily favors online retail for its global reach and ability to provide detailed product information and certifications, crucial for trust-building in the traditional medicine segment. Conversely, physical stores, including specialized Ayurvedic clinics and modern retail chains, remain essential for offering personalized consultation and ensuring the availability of prescription-based or high-value classical medicines. This hybrid distribution model caters to both informed and new buyers, supporting sustained market accessibility and growth.

- Product Type:

- Healthcare Products (Classical Medicines, Proprietary Medicines)

- Personal Care Products (Skin Care, Hair Care, Oral Care, Cosmetics)

- Dietary Supplements/Nutraceuticals (Herbal Supplements, Mineral Supplements)

- Form:

- Solid (Tablets, Capsules, Powders)

- Liquid (Oils, Juices, Syrups)

- Semi-Solid (Creams, Pastes, Jams/Lehyas)

- Distribution Channel:

- Offline Channels (Pharmacies, Specialty Stores, Supermarkets/Hypermarkets)

- Online Channels (E-commerce Platforms, Company Websites)

- Application:

- Therapeutic

- Prophylactic

Value Chain Analysis For Ayurvedic Products Market

The value chain for Ayurvedic products is complex, beginning with the critical upstream activities of sourcing and cultivating medicinal herbs, which are highly dependent on geographical location, climate, and ethical harvesting practices. Upstream analysis involves sustainable agriculture, wild collection management, and standardization of raw material quality, often complicated by the seasonality and biodiversity required for polyherbal formulations. Key challenges at this stage include ensuring the authenticity of botanical species, maintaining potency through controlled drying and storage, and adhering to Good Agricultural and Collection Practices (GACP). Successful upstream integration is vital for mitigating supply risks and ensuring the final product meets purity and safety standards, particularly concerning heavy metal contamination and pesticide residues, which are major regulatory concerns globally.

The midstream phase focuses on manufacturing, processing, and formulation development, transforming raw herbs into finished products. This phase requires sophisticated processing technologies for extraction, distillation, and purification, moving toward Good Manufacturing Practices (GMP) compliance. Investment in R&D is crucial here for standardization, ensuring active constituent markers are consistent across batches, which enhances credibility. Downstream analysis involves logistics, branding, and distribution channels. Effective downstream strategy necessitates tailored marketing campaigns that bridge traditional wisdom with modern scientific language, appealing to both traditionalists and new consumers seeking scientifically validated natural alternatives. Packaging and labeling must comply with diverse regional requirements regarding ingredients, dosage, and health claims.

Distribution channels are categorized into direct and indirect methods. Direct channels typically involve company-owned clinics or online portals, allowing for better control over product narrative and personalized customer consultation, which is crucial for complex traditional medicines. Indirect channels, including pharmacies, mass retailers, and third-party e-commerce giants, provide high-volume market penetration. The trend is moving towards omnichannel distribution, where physical presence validates the product, while online platforms drive education and convenience. Successfully managing the value chain requires stringent quality control at every stage, establishing transparent traceability systems, and fostering long-term, ethical partnerships with farmers and wild collectors to ensure resource sustainability and community welfare.

Ayurvedic Products Market Potential Customers

The potential customer base for the Ayurvedic Products Market is remarkably broad, spanning demographics focused on preventative wellness, patients seeking chronic disease management, and consumers prioritizing natural ingredients in personal care. Primary customers are individuals aged 35 to 65 residing in developed economies who exhibit high health literacy, disposable income, and a willingness to invest in holistic, long-term health maintenance. This segment is characterized by disillusionment with conventional healthcare models for chronic conditions and a strong preference for remedies rooted in natural science. They seek products that offer evidence-based results while aligning with clean label and ethical sourcing standards. Educational content explaining the underlying principles of Ayurveda is a crucial component of marketing to this informed consumer segment.

A rapidly growing segment of end-users includes millennials and Gen Z consumers globally, who are driving the demand for Ayurvedic personal care items and adaptogenic supplements. These younger buyers are motivated by ethical consumption, sustainability, and transparency regarding product ingredients. They primarily access products through digital channels and value convenience (e.g., gummies, flavored shots, highly aesthetic packaging). For this group, Ayurvedic concepts are often intertwined with modern wellness trends like biohacking and mental well-being, utilizing herbs like Brahmi and Ashwagandha to manage stress and cognitive function, making them key buyers of dietary supplements and functional foods.

In the therapeutic segment, buyers include patients suffering from non-communicable diseases (NCDs) such as obesity, metabolic disorders, and musculoskeletal issues, particularly in regions where Ayurvedic treatments are integrated or recognized by the national healthcare system (e.g., India and specific Asian countries). Furthermore, licensed Ayurvedic practitioners, naturopaths, and integrative medicine specialists act as critical intermediate customers, recommending and prescribing complex formulations to their patient base. Their continued endorsement and integration into mainstream medical practices are essential for sustaining the credibility and growth of the high-value therapeutic product categories, requiring manufacturers to invest heavily in practitioner education and clinical data sharing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 34.0 Billion |

| Growth Rate | 16.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dabur India Ltd., Himalaya Wellness Company, Patanjali Ayurved Ltd., Emami Group, Charak Pharma Pvt. Ltd., Baidyanath Ayurved Bhawan, Vicco Laboratories, Zandu Realty Ltd., Amulya Herbs, Forest Essentials, Kama Ayurveda, Khadi Natural Healthcare, Biotique, Jiva Ayurveda, Shree Baidyanath Ayurved Bhawan Pvt. Ltd., Kerala Ayurveda Ltd., AVP Group, Maharishi Ayurveda Products Private Limited, P&G (via acquisitions), Unilever (via acquisitions). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ayurvedic Products Market Key Technology Landscape

The technological landscape in the Ayurvedic Products Market is rapidly evolving, driven by the need for quality assurance, standardization, and enhanced bioavailability, moving away from empirical methods toward data-driven science. Modern manufacturing relies heavily on advanced extraction technologies such as Supercritical Fluid Extraction (SFE) and Ultrasonic-Assisted Extraction (UAE), which allow for the precise separation of active compounds while preserving thermo-sensitive phytochemicals, thereby maximizing efficacy and minimizing degradation compared to traditional methods. Furthermore, chromatographic techniques, specifically High-Performance Liquid Chromatography (HPLC) and Gas Chromatography-Mass Spectrometry (GC-MS), are now standard tools used for fingerprinting herbal extracts, ensuring batch-to-batch consistency, and precisely quantifying marker compounds to comply with international pharmacopeial standards.

Bioavailability enhancement technologies represent a significant area of focus, essential for overcoming the challenges associated with the poor solubility and absorption rates of many natural active ingredients. Manufacturers are increasingly utilizing liposomal encapsulation, nano-emulsion systems, and phytosome technology to increase the systemic absorption of herbal compounds, translating into higher therapeutic effects at lower dosages and improving patient compliance. Additionally, advanced drying technologies, such as freeze-drying (lyophilization), are being employed to maintain the integrity and stability of complex herbal matrices during processing and storage, thereby extending product shelf life and ensuring consistent potency over time, addressing key concerns about stability in various climate zones.

Digital technologies, particularly blockchain and Artificial Intelligence, are transforming the supply chain and consumer engagement aspects. Blockchain implementation offers verifiable, immutable records of the herb sourcing journey, addressing consumer demand for transparency and combating the issue of counterfeit products in both domestic and international markets. AI and machine learning algorithms are being integrated to analyze massive datasets related to traditional texts, clinical trials, and personalized patient profiles (Prakriti analysis), facilitating targeted product development, optimizing formulation stability testing, and predicting potential herb-drug interactions, thus providing a foundation for future personalized Ayurvedic medicine and bolstering the credibility of traditional formulations in the scientific community.

Regional Highlights

The Ayurvedic Products Market exhibits significant regional variation in maturity, consumer acceptance, and regulatory environment. Asia Pacific (APAC) stands as the dominant region, primarily fueled by India, Nepal, and Sri Lanka, which possess rich biodiversity, a deep cultural history with Ayurveda, and robust domestic consumption. India, in particular, acts as a global manufacturing and knowledge hub, supported by the Ministry of AYUSH, which actively promotes standardization, research, and global outreach. The increasing disposable income in countries like China and Southeast Asian nations is also driving demand, as consumers increasingly seek out traditional and holistic health remedies for lifestyle diseases. The presence of established domestic players and a highly competitive local market structure ensure high product availability and continued innovation across the region.

North America and Europe represent the fastest-growing markets, albeit from a lower base. Growth in these regions is primarily spurred by the high uptake of Ayurvedic dietary supplements and personal care products, driven by health-conscious consumers and the widespread popularity of wellness trends. However, the regulatory environment is stricter; products are often classified as 'dietary supplements' rather than 'medicines,' requiring rigorous labeling and substantiation of health claims. Successful market penetration necessitates investment in clinical trials acceptable to Western regulatory bodies (e.g., FDA, EFSA) to validate efficacy and safety, particularly concerning heavy metal content and quality standards. Marketing strategies often position products emphasizing stress management, anti-aging, and immunity support, appealing to specific Western consumer needs.

Latin America and the Middle East & Africa (MEA) are emerging regions offering substantial long-term growth opportunities. In MEA, interest is growing due to increasing health expenditure and a rising preference for natural products, often introduced via diaspora populations or international trade partnerships. However, these regions face challenges related to product awareness, distribution infrastructure limitations, and economic volatility. Strategic partnerships focused on localizing formulations and securing import clearances are crucial for accessing these nascent markets. Overall, the global market is characterized by APAC driving volume, while North America and Europe define premiumization and set quality standards for international trade.

- Asia Pacific (APAC): Dominant market share due to cultural heritage, high domestic consumption (India), strong government support (Ministry of AYUSH), and extensive manufacturing capabilities. Focus is on classical medicines and personal care.

- North America: Highest CAGR, driven by demand for dietary supplements (adaptogens like Ashwagandha, Turmeric) and premium personal care; regulatory focus is on supplement classification and rigorous safety testing.

- Europe: Strong growth in organic and natural certifications; high demand for functional foods and personal care items; strict compliance required with EU Novel Food regulations for certain herbal ingredients.

- Latin America (LATAM): Emerging market potential driven by increasing health consciousness and interest in natural alternatives; market entry requires localization and navigating fragmented distribution networks.

- Middle East & Africa (MEA): Growth driven by expanding wellness tourism and rising consumer income; reliance on imports necessitates certified, high-quality products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ayurvedic Products Market.- Dabur India Ltd.

- Himalaya Wellness Company

- Patanjali Ayurved Ltd.

- Emami Group

- Charak Pharma Pvt. Ltd.

- Baidyanath Ayurved Bhawan

- Vicco Laboratories

- Zandu Realty Ltd.

- Amulya Herbs

- Forest Essentials

- Kama Ayurveda

- Khadi Natural Healthcare

- Biotique

- Jiva Ayurveda

- Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

- Kerala Ayurveda Ltd.

- AVP Group (Arya Vaidya Pharmacy)

- Maharishi Ayurveda Products Private Limited

- P&G (Procter & Gamble)

- Unilever

- Marico Ltd.

- The Ayurvedic Company (TAC)

- Samyang Foods Co., Ltd. (via subsidiary)

- Organic India Pvt. Ltd.

- Arogya Ayurvedic Products

Frequently Asked Questions

Analyze common user questions about the Ayurvedic Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Ayurvedic Products Market?

The Ayurvedic Products Market is projected to exhibit a high Compound Annual Growth Rate (CAGR) of 16.2% during the forecast period from 2026 to 2033, driven by increasing consumer preference for natural healthcare and holistic wellness solutions globally.

Which segment holds the largest share in the Ayurvedic Products Market?

The Personal Care Products segment, encompassing skincare, haircare, and oral care, currently holds the largest market share due to its high frequency of purchase, broad consumer appeal, and successful integration into mainstream retail channels worldwide.

What are the primary regulatory challenges facing the international expansion of Ayurvedic products?

The primary challenges include the lack of globally harmonized regulatory definitions, the requirement for robust scientific evidence (clinical trials) to validate traditional claims in Western jurisdictions, and stringent quality control standards concerning heavy metal safety and ingredient standardization.

How is technology, specifically AI, influencing the Ayurvedic industry?

AI is accelerating the Ayurvedic industry by enabling advanced clinical validation of formulations, optimizing raw material supply chain traceability via blockchain, and facilitating the development of personalized product recommendations based on individual physiological profiles (Prakriti analysis).

Which geographical region is expected to experience the fastest growth in Ayurvedic products?

North America and Europe are anticipated to exhibit the fastest growth rate, fueled by rising health awareness, high consumer disposable incomes, and the strong adoption of Ayurvedic dietary supplements and premium wellness products among younger populations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager