Azadirachtin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434728 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Azadirachtin Market Size

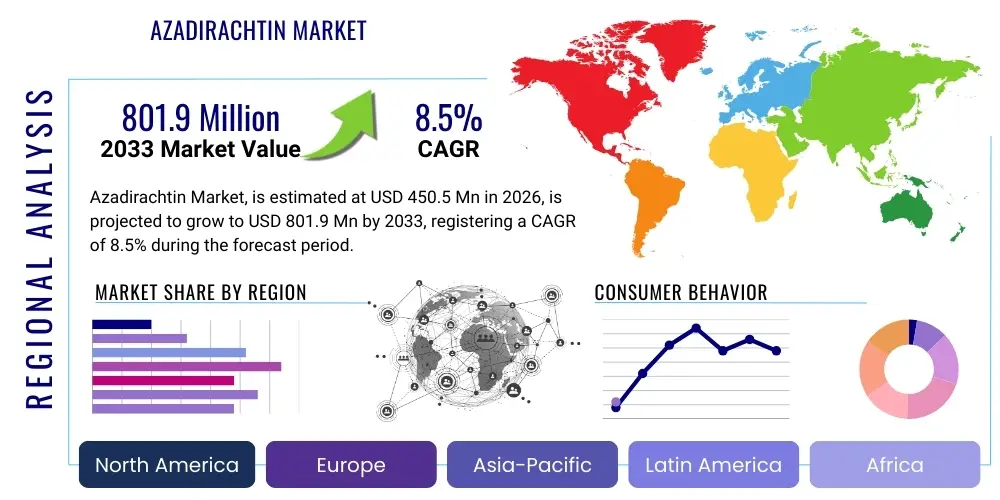

The Azadirachtin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 801.9 Million by the end of the forecast period in 2033.

Azadirachtin Market introduction

Azadirachtin is a highly potent, naturally occurring tetranortriterpenoid derived primarily from the seeds of the Neem tree (Azadirachta indica). This compound is recognized globally as the principal active ingredient responsible for the insecticidal, anti-feedant, and insect growth regulating properties of neem oil extracts. Azadirachtin functions by disrupting the hormonal system of insects, specifically interfering with the molting process, resulting in larval death, reduced feeding, and sterility in adult stages. Its complex chemical structure makes it highly effective against a broad spectrum of pests, including aphids, whiteflies, thrips, and various chewing insects, positioning it as a cornerstone material in the burgeoning biological pest control industry. The growing global apprehension regarding the environmental and human health risks associated with synthetic chemical pesticides is significantly bolstering the adoption of Azadirachtin-based formulations, particularly in high-value crop cultivation and organic farming systems.

The major application sectors for Azadirachtin are predominantly centered within agriculture, encompassing crop protection for fruits, vegetables, cereals, and ornamentals. Beyond traditional farming, its applications are extending into public health pest control (e.g., mosquito and fly larvae management), veterinary applications (for treating ectoparasites), and stored grain protection, offering an eco-friendly alternative to synthetic chemicals. Key benefits driving its market expansion include its low mammalian toxicity, rapid biodegradability, and the relatively low risk of pests developing resistance compared to single-mode-of-action synthetic insecticides. Furthermore, Azadirachtin products often comply seamlessly with stringent Maximum Residue Limits (MRLs) set by regulatory bodies in key importing regions like North America and the European Union, making them attractive for export-oriented agricultural producers seeking sustainable solutions.

Several critical factors are driving the accelerated growth of the Azadirachtin market. Primarily, the stringent regulatory environment in developed economies, coupled with consumer demand for organically grown produce, necessitates the shift toward bio-pesticides. Secondly, continuous investment in R&D has led to the development of stabilized, highly concentrated, and water-soluble formulations, improving efficacy and shelf life, thereby overcoming historical limitations associated with natural extracts. Thirdly, advancements in sustainable extraction technologies, such as supercritical fluid extraction, are enhancing the purity and yield of Azadirachtin, making its production more cost-competitive against generic chemical alternatives. This confluence of regulatory push, consumer preference, and technological innovation cements Azadirachtin’s crucial role in modern sustainable agricultural practices globally.

Azadirachtin Market Executive Summary

The Azadirachtin market is experiencing robust growth fueled by irreversible trends favoring biological crop protection and sustainable agriculture practices worldwide. Business trends indicate a strong focus on strategic mergers and acquisitions among large agrochemical corporations seeking to integrate bio-pesticide portfolios, thereby capitalizing on the premium segment of the market. Investment is heavily directed towards improving supply chain efficiency for neem seed sourcing and refining microencapsulation technologies to enhance product stability under varying environmental conditions. Segmentation trends highlight the Liquid Formulation segment dominating the market due to ease of application and higher bioavailability, while the Fruits & Vegetables application segment registers the fastest growth due to high per-acre value and consumer sensitivity toward chemical residues in fresh produce. The integration of advanced diagnostics and precision agriculture technologies is allowing for targeted application of Azadirachtin, maximizing efficacy and minimizing input waste, further solidifying its economic viability for large commercial farms.

Regional trends illustrate Asia Pacific (APAC) maintaining its dominance in terms of production capacity, largely due to India being the primary source of raw materials (Neem), coupled with low processing costs. However, North America and Europe are pivotal in terms of market value and regulatory adoption, driven by strong government incentives for organic farming and high consumer awareness regarding residue-free food. Specifically, the European Union's Farm to Fork strategy, which aims to drastically reduce chemical pesticide use, serves as a significant regulatory accelerator for Azadirachtin adoption. Latin America is also emerging as a high-growth region, particularly Brazil and Argentina, where major agricultural exports necessitate compliance with international biosafety standards. This geographic divergence sees APAC focusing on large-scale raw material supply and initial processing, while North America and Europe lead in finished product formulation, technological refinement, and high-value consumption.

The competitive landscape is characterized by the presence of a few major established global players and numerous regional specialty bio-pesticide manufacturers. Key companies are strategically expanding their global distribution networks and focusing on obtaining rapid registration approval across diverse regulatory jurisdictions to gain a competitive edge. The shift towards integrated pest management (IPM) programs is fundamentally transforming the consumption pattern, promoting Azadirachtin as a foundational tool in resistance management strategies. Overall, the market trajectory is highly positive, underpinned by regulatory support, consumer health consciousness, and continuous technological enhancements that are successfully addressing historical challenges related to product consistency and shelf life, positioning Azadirachtin as a crucial component for future global food security.

AI Impact Analysis on Azadirachtin Market

User inquiries regarding AI's influence on the Azadirachtin market primarily revolve around three critical themes: optimizing production efficiency, enhancing application precision, and accelerating R&D for novel formulations. Users frequently ask if AI can predict peak pest infestation periods to maximize the efficacy of natural products like Azadirachtin, which often require earlier intervention than synthetic chemicals. Furthermore, there is significant interest in how machine learning algorithms can analyze complex environmental data (soil, weather, crop stress) to tailor optimal Azadirachtin dosages, thereby reducing waste and cost. Concerns also focus on the adoption rate of such complex technologies by smaller, traditional farmers who are major consumers of neem-based products. The consensus expectation is that AI integration will primarily democratize sophisticated pest management, moving Azadirachtin from generalized application to highly localized, data-driven treatment protocols, vastly improving its performance parity with synthetic alternatives and standardizing quality control across various manufacturing batches.

- AI-driven Predictive Modeling: Utilization of machine learning to predict pest pressure intensity and timing, optimizing Azadirachtin application schedules for maximum efficacy and minimizing environmental exposure.

- Precision Agriculture Integration: Deployment of algorithms to analyze drone imagery and sensor data, enabling variable-rate application (VRA) of Azadirachtin only where needed, enhancing cost-effectiveness.

- Supply Chain Optimization: AI tools improving the forecasting of global demand for neem seeds and optimizing logistics pathways, ensuring stable raw material sourcing and reducing price volatility.

- Quality Control and Formulation Stability: Machine learning models analyzing spectroscopic data during extraction and formulation to ensure consistent Azadirachtin purity levels and predict long-term product stability under various storage conditions.

- Accelerated R&D: AI simulation tools assisting in the rapid screening of potential synergistic compounds that can be combined with Azadirachtin to broaden its spectrum of activity or enhance photostability.

DRO & Impact Forces Of Azadirachtin Market

The Azadirachtin market dynamics are shaped by a potent combination of drivers promoting sustainable practices, significant restraints pertaining to production consistency, overwhelming opportunities in niche markets, and critical impact forces influencing pricing and regulatory environments. The primary driver is the accelerating global transition towards organic farming and integrated pest management (IPM) methodologies, fueled by stricter governmental regulations on chemical pesticides, especially in regions like the EU and the US. Coupled with this is the escalating problem of widespread insect resistance development to conventional insecticides, positioning Azadirachtin, with its multi-site mode of action (anti-feedant and growth regulator), as an indispensable tool for resistance management strategies. Restraints primarily involve the inherent instability of the Azadirachtin molecule, which is susceptible to degradation by UV light and high temperatures, demanding complex and costly stabilizing formulation technologies. Furthermore, the reliance on a single natural source (Neem seeds) introduces vulnerability to seasonal harvests, geopolitical supply chain risks, and fluctuations in raw material quality, posing challenges to consistent, large-scale industrial supply.

Opportunities for market expansion are vast, particularly in emerging markets where agricultural intensification is occurring, alongside increasing awareness of sustainable input usage. Significant opportunity lies in developing Azadirachtin formulations specifically for non-agricultural applications, such as professional pest management (PPM) for structures, turf management, and household public health products targeting mosquito vectors resistant to conventional chemical treatments. Technological breakthroughs, specifically in nanotechnology and microencapsulation, offer immense potential to overcome the product instability restraint, substantially improving both shelf life and field longevity, thus expanding the geographical applicability of the product. Moreover, obtaining specialized bio-pesticide exemptions and fast-track registration from regulatory bodies, recognizing its environmental safety profile, provides a strategic opportunity for quicker market entry compared to synthetic competitors.

The critical impact forces affecting the market are divided into two main categories: regulatory mandates and raw material pricing pressure. Regulatory policy, particularly in developed economies, acts as a powerful external force, either accelerating adoption through subsidy programs for bio-controls or restricting competitors through banning certain synthetic active ingredients. Changes in the regulatory definitions of 'organic' or 'natural' can significantly impact market accessibility and labelling claims. Concurrently, the impact force related to raw material pricing is high. Since neem seed supply is subject to climatic variability and fragmented collection efforts, any major drought or adverse weather event can dramatically increase input costs for manufacturers. This pricing instability compels continuous optimization of extraction efficiency and drives backward integration strategies among key players to secure reliable neem supply, ultimately influencing the final price competitiveness of Azadirachtin against commodity chemical pesticides.

Segmentation Analysis

The Azadirachtin market is comprehensively segmented based on its formulation type, application area, the specific crop type it targets, and its fundamental mode of action. Understanding these segments provides critical insights into consumption patterns and key growth vectors. Formulation analysis confirms that Liquid Concentrate remains the most adopted form, valued for ease of mixing and application through existing farm spray equipment, especially in large-scale agriculture. However, granular and powder forms are gaining traction in specific applications such as soil drenching and turf management. The Application segment reveals agriculture as the dominant consumer, yet specialized sectors like public health and animal health are registering accelerated growth due to demand for safer alternatives to control vectors and ectoparasites. Crop type segmentation highlights the concentration of high-value Azadirachtin use on fruits, vegetables, and specialty crops where strict residue limits dictate the necessity of bio-pesticides.

- By Formulation

- Liquid (Emulsifiable Concentrates, Soluble Concentrates)

- Powder (Wettable Powders, Dusts)

- Granules

- By Application

- Agriculture (Crop Protection)

- Health & Veterinary (Ectoparasite control, livestock care)

- Public Health (Mosquito and vector control)

- Stored Product Protection

- By Crop Type

- Fruits and Vegetables

- Grains and Cereals

- Oilseeds and Pulses

- Turf and Ornamentals

- Plantation Crops

- By Mode of Action

- Insecticide

- Insect Growth Regulator (IGR)

- Anti-feedant

- Nematicide

Value Chain Analysis For Azadirachtin Market

The Azadirachtin value chain is critically dependent on the integrity of its upstream activities, centered on the collection and primary processing of raw neem material. Upstream analysis involves the harvesting and procurement of neem seeds, which is often managed by a fragmented network of local collectors in major neem-growing regions like India and parts of Africa. Key upstream challenges include standardizing the quality of collected seeds, which dictates the final Azadirachtin yield, and implementing effective storage techniques to prevent seed degradation before processing. Major manufacturers often engage in contract farming or established collector networks to secure consistent, high-quality feedstock, utilizing primary extraction methods (like solvent or cold pressing) to produce crude neem oil and defatted neem cake, the immediate precursors to high-purity Azadirachtin. This initial stage significantly impacts the final product cost and consistency.

The midstream phase focuses on the complex and proprietary process of refining the crude extract to high-purity Azadirachtin, often involving chromatographic separation and stabilization technologies, followed by the formulation into finished products (e.g., ECs, WPs). Downstream activities involve distribution channels, reaching the ultimate end-users. Distribution is characterized by both direct and indirect routes. Direct distribution involves large bio-pesticide companies selling directly to major commercial farming cooperatives or large growers, often supported by technical advisory services to ensure correct product application. Indirect distribution, which accounts for a substantial portion of sales, relies heavily on a tiered network including national distributors, regional wholesalers, specialized agrochemical retailers, and organic farm input suppliers, providing extensive coverage to small and medium-sized farms.

The choice between direct and indirect distribution channels is strategic, dictated by the target market's maturity and geographical dispersion. In highly regulated markets like North America and Europe, specialized indirect distributors often handle the product, providing localized technical support essential for bio-pesticides. For the commodity agricultural sector, indirect channels dominate due to established infrastructure. The efficiency of the entire value chain hinges on technological advancements in microencapsulation, which improve product stability and logistics, and digital integration that links raw material collectors with finished product marketers. This optimization reduces lead times and mitigates the seasonality risk associated with neem harvesting, thereby ensuring a smoother flow from source to farm.

Azadirachtin Market Potential Customers

The primary consumers and potential customers for Azadirachtin products are diverse, encompassing traditional agriculturalists, high-tech indoor farmers, public health agencies, and veterinary service providers. In the agricultural sector, the largest buyer segment includes producers of high-value crops—specifically greenhouse growers and open-field producers of organic fruits and vegetables (such as berries, tomatoes, peppers, and leafy greens)—who require solutions compliant with stringent residue-free standards for export markets. These professional growers utilize Azadirachtin as a fundamental component of their IPM protocols to manage pest populations before they reach economic damage thresholds, prioritizing product safety and environmental stewardship over immediate cost savings.

A rapidly expanding segment of potential customers includes large-scale conventional farmers who are strategically adopting Azadirachtin as a sophisticated resistance management tool. These growers utilize bio-pesticides in rotation with synthetic chemicals to extend the useful life of conventional active ingredients, particularly in highly regulated crops like cotton and certain row crops. Furthermore, state and municipal public health departments represent significant institutional buyers, utilizing Azadirachtin-based larvicides for targeted vector control programs (e.g., dengue, Zika, malaria) due to its high efficacy against mosquito larvae and favorable non-target organism safety profile in aquatic environments. Lastly, pet and livestock owners, alongside veterinary clinics, constitute a specialized customer base focused on natural alternatives for controlling fleas, ticks, and mites.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 801.9 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Certis USA LLC, T. Stanes & Company Limited, Neem India Products Private Limited, Amvac Chemical Corporation, Oorja Development Solutions Limited, Fortune Biotech, Parijat Industries Private Limited, E.I.D. Parry (India) Limited, Gharda Chemicals Limited, Bioplus Life Sciences, P J Margo Pvt. Ltd., Tolerant Organic, Green Earth Agro, UPL Limited, Arysta LifeScience, FMC Corporation, Syngenta AG, Adama Agricultural Solutions, West Coast Neem, Source BioScience |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Azadirachtin Market Key Technology Landscape

The technological landscape of the Azadirachtin market is characterized by intense efforts aimed at overcoming the primary limitations associated with natural product stability, efficacy, and consistency. A pivotal area of innovation is extraction technology. While traditional solvent extraction remains common, supercritical fluid extraction (SFE) is gaining prominence. SFE, particularly using CO2, allows for the extraction of highly purified Azadirachtin with minimal solvent residues and degradation, resulting in a more potent and safer final product that meets stringent regulatory standards. Furthermore, continuous flow processing and automated chromatographic separation are increasingly utilized to scale up production while maintaining batch-to-batch consistency, a crucial factor for gaining trust among commercial farmers accustomed to standardized synthetic chemical performance. These advanced purification methods address historical market concerns regarding product variability inherent in plant-derived extracts.

The most transformative technologies are currently focused on formulation science, specifically addressing the molecule's photolability and short residual activity in the field. Microencapsulation and nano-formulation techniques are paramount, involving encasing the Azadirachtin molecules within protective polymeric shells (e.g., starch, chitosan, or synthetic polymers). Microencapsulation technology shields the active ingredient from immediate UV degradation, significantly extending its field persistence from a few hours to several days, thereby enhancing biological efficacy and reducing the need for repeated applications. This breakthrough not only improves performance but also enhances ease of handling and shelf stability, making the product more viable for international distribution and storage in varied climatic conditions. Advanced wetting agents and stabilizers are also continually being optimized to ensure high quality Emulsifiable Concentrates (ECs) that remain homogenous and effective when diluted with various water types.

Beyond physical formulation, the application technology landscape is rapidly evolving with the integration of digital agriculture tools. Drone and satellite imagery combined with advanced geographic information systems (GIS) are enabling precise spot treatments, moving away from broadcast spraying. Sensor-based technologies on farm equipment detect early signs of infestation, allowing for timely, localized application of Azadirachtin, which is essential given its primary function as an anti-feedant/IGR requiring ingestion by early-stage pests. Biotechnology is also contributing through research into developing transgenic microorganisms or plant cell culture systems that could potentially produce Azadirachtin sustainably without reliance on harvested neem seeds. Although still nascent, success in this area could revolutionize the supply chain, ensuring unparalleled quality control and insulating the market from agricultural supply fluctuations, marking the next major technological leap for the industry.

Regional Highlights

The Azadirachtin market exhibits distinct dynamics across key geographical regions, reflecting variations in regulatory environments, agricultural practices, and raw material availability. The Asia Pacific (APAC) region, driven primarily by India, is the undisputed leader in raw material sourcing and primary processing, benefiting from endemic neem cultivation and lower operational costs. While APAC serves as the global production hub, it is also a significant consumption market, characterized by government subsidies promoting bio-pesticides, particularly in markets like China and Southeast Asia, where pesticide residue control is becoming increasingly strict for export crops.

- North America: High-Value Consumption Market. Characterized by strict EPA regulations and high demand for organic produce. US and Canada are major importers of finished, high-purity formulations. Adoption is strong in specialty crops (cannabis, fruits, ornamentals) and professional turf management.

- Europe: Regulatory Accelerator. Driven by the EU's ambitious 'Farm to Fork' strategy, which mandates significant reductions in chemical pesticide use. This creates an immediate regulatory pull for proven bio-pesticides like Azadirachtin. Focus on high-quality, residue-free food production across key agricultural countries like Spain, Italy, and France.

- Asia Pacific (APAC): Production and Growth Hub. Dominant region for raw material sourcing (Neem seeds, mainly India) and primary extraction. Rapid market growth is observed due to agricultural intensification, supportive government policies, and increasing domestic consumer awareness regarding food safety, making it critical for global supply and future demand.

- Latin America (LATAM): Emerging Growth Center. Significant expansion in major agricultural economies such as Brazil, Argentina, and Mexico. Use is growing rapidly in large-scale export crops (soybeans, coffee, fruits) where international standards compliance is mandatory. Regional focus is on maximizing efficacy in tropical and subtropical climates.

- Middle East and Africa (MEA): Niche Market Expansion. Driven by need for efficient pest control in arid climates and increasing investment in food security initiatives. Focus on public health applications (vector control) and high-value greenhouse agriculture projects in the Gulf Cooperation Council (GCC) states.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Azadirachtin Market.- Certis USA LLC

- T. Stanes & Company Limited

- Neem India Products Private Limited

- Amvac Chemical Corporation

- Oorja Development Solutions Limited

- Fortune Biotech

- Parijat Industries Private Limited

- E.I.D. Parry (India) Limited

- Gharda Chemicals Limited

- Bioplus Life Sciences

- P J Margo Pvt. Ltd.

- Tolerant Organic

- Green Earth Agro

- UPL Limited

- Arysta LifeScience (now part of UPL)

- FMC Corporation

- Syngenta AG (focusing on bio-controls)

- Adama Agricultural Solutions

- West Coast Neem

- Source BioScience

Frequently Asked Questions

Analyze common user questions about the Azadirachtin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mode of action of Azadirachtin and why is it effective for resistance management?

Azadirachtin acts as a potent insect growth regulator (IGR) and anti-feedant. Its unique multi-site mechanism disrupts hormonal balance (molting) and suppresses feeding behavior, making it highly effective for resistance management as pests are less likely to evolve resistance simultaneously to these multiple, complex physiological targets.

How does the regulatory environment, particularly in the European Union, affect the demand for Azadirachtin?

The EU’s stringent regulations, including the 'Farm to Fork' strategy and tightened Maximum Residue Limits (MRLs) on synthetic pesticides, create a strong regulatory pull factor. This pressure forces growers, particularly those exporting to Europe, to adopt residue-free bio-pesticides like Azadirachtin, significantly boosting demand across high-value crop sectors.

What major technological advancement is addressing the instability issue of Azadirachtin?

Microencapsulation and nano-formulation technologies are the major advancements. These processes encapsulate the active molecule within a protective polymer shell, shielding it from degradation by UV light and high temperatures, substantially extending its shelf life and residual efficacy in the field.

Which region dominates the production and consumption of raw Azadirachtin material?

Asia Pacific, specifically India, dominates the global production of raw Azadirachtin material due to the high density of neem tree cultivation, availability of large-scale extraction facilities, and established raw material collection networks. North America and Europe lead in consumption value of finished, high-purity formulations.

Is Azadirachtin safe for beneficial insects, pollinators, and non-target organisms?

Azadirachtin is generally considered much safer for beneficial insects and pollinators compared to broad-spectrum synthetic pesticides. When used appropriately, it exhibits low toxicity to adult non-targets and primarily affects pests through ingestion, making it a preferred option in integrated pest management programs focused on preserving ecological balance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager