Azelaic Acid Suspension Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436507 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Azelaic Acid Suspension Market Size

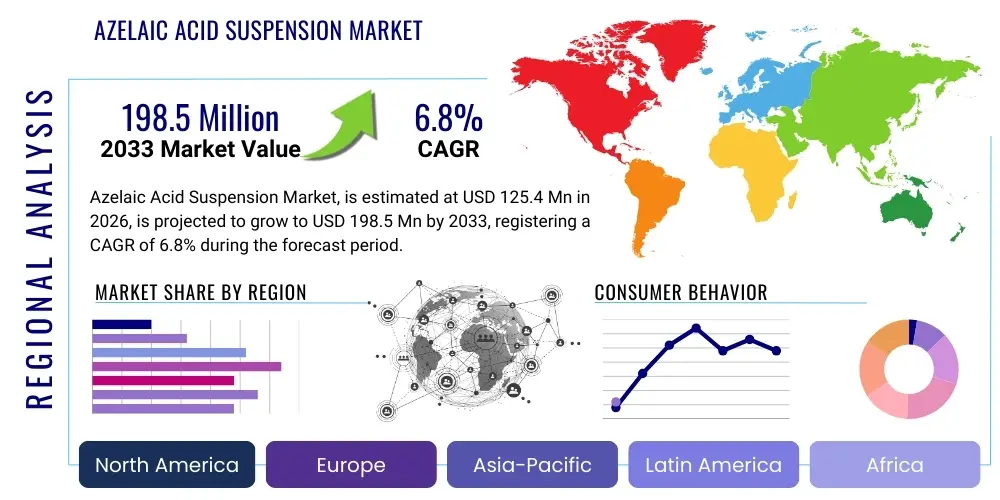

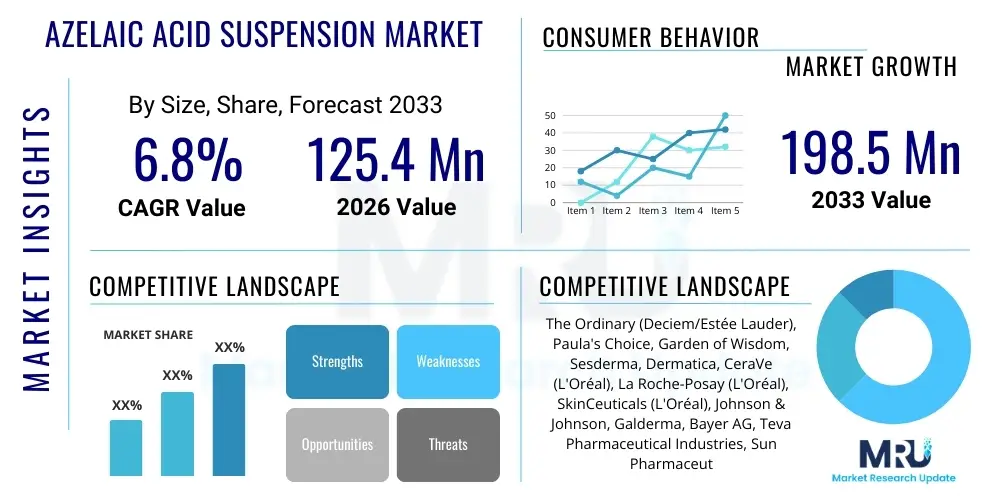

The Azelaic Acid Suspension Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $125.4 Million in 2026 and is projected to reach $198.5 Million by the end of the forecast period in 2033.

Azelaic Acid Suspension Market introduction

The Azelaic Acid Suspension Market encompasses topical formulations containing azelaic acid, primarily utilized for the treatment of mild to moderate acne, rosacea, and post-inflammatory hyperpigmentation (PIH). Azelaic acid, a naturally occurring dicarboxylic acid, offers unique multi-functional properties, including antibacterial, anti-inflammatory, and keratolytic effects, making its suspension form highly desirable for sensitive or compromised skin barriers. Suspensions, characterized by fine solid particles dispersed in a liquid medium, provide stability and optimized delivery of the active ingredient, ensuring efficacy while minimizing potential irritation commonly associated with highly acidic topical treatments.

Major applications driving market expansion include its widespread adoption as a prescription and over-the-counter (OTC) treatment for facial dermatoses. Specifically, its role in reducing papules and pustules associated with acne vulgaris and alleviating the erythema (redness) linked to rosacea differentiates it from conventional retinoids or benzoyl peroxide treatments, which often carry higher profiles of irritation. The increasing consumer preference for gentle yet effective skincare solutions, coupled with rising awareness regarding the long-term management of chronic skin conditions, fuels demand across various demographic groups.

Driving factors center on growing prevalence rates of chronic inflammatory skin conditions globally, particularly in industrialized nations where lifestyle factors and environmental pollutants contribute to increased skin sensitivity and reactivity. Furthermore, advancements in cosmetic dermatology and the formulation science—specifically, enhancing the palatability and texture of suspensions—have improved patient compliance. The ease of incorporation into daily skincare routines and the robust clinical data supporting its efficacy contribute significantly to its market momentum, pushing pharmaceutical and cosmeceutical companies toward developing more stable and bioavailable azelaic acid suspension products.

Azelaic Acid Suspension Market Executive Summary

The Azelaic Acid Suspension Market is undergoing significant evolution driven by shifting consumer trends toward ingredient transparency and functional dermatology. Business trends indicate a strong move toward DTC (Direct-to-Consumer) models and personalized skincare subscriptions, leveraging azelaic acid suspensions as cornerstone treatments recommended by AI-powered diagnostic platforms. Key market players are focusing on patenting novel micronization and encapsulation technologies to improve product stability, reduce particle size for better penetration, and minimize the grainy texture traditionally associated with suspension formulas, thereby enhancing user experience and competitive positioning.

Regionally, North America and Europe currently dominate the market due to high healthcare expenditure, established regulatory pathways for prescription and OTC dermatological products, and high consumer awareness regarding ingredient efficacy. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by the burgeoning middle class, rapid urbanization, increasing pollution-related dermatological issues, and a cultural emphasis on clear, even skin tone, where azelaic acid excels in treating hyperpigmentation. Regulatory harmonization across ASEAN and East Asian countries is further simplifying market entry for international brands.

Segment trends reveal a rapid expansion in the OTC/Cosmeceutical segment compared to the traditional Prescription segment. While prescription-strength suspensions (typically 15% to 20%) remain vital for severe conditions, lower-concentration, easily accessible OTC products (10% or less) are capturing the mass market for maintenance therapy and mild symptom management. Furthermore, the formulation type segment sees increased R&D investment in combination suspensions, integrating ingredients like niacinamide or ceramides to buffer potential irritation and provide comprehensive skin barrier support, thus broadening the target consumer base beyond strictly clinical applications.

AI Impact Analysis on Azelaic Acid Suspension Market

User queries regarding AI's influence in the Azelaic Acid Suspension Market primarily revolve around personalized treatment recommendations, AI-driven diagnostics for conditions like rosacea and acne, and the optimization of clinical trials and R&D formulation. Consumers and practitioners frequently ask how AI systems can distinguish between different subtypes of rosacea (erythematotelangiectatic versus papulopustular) to better target azelaic acid suspension usage, and whether machine learning (ML) models can predict patient responsiveness based on genetic markers or previous treatment history. A key concern centers on the ethical use of patient data for tailoring prescription or OTC product recommendations, balancing efficacy with privacy.

The consensus theme emerging from this analysis is that AI significantly enhances the precision and accessibility of Azelaic Acid suspension products. Diagnostic imaging combined with ML algorithms allows for highly accurate, early detection and severity scoring of dermatological conditions, leading to optimized dosing and application guidance for suspensions. In manufacturing, AI is being deployed for quality control and process optimization, ensuring consistent particle size distribution in suspension formulations, which directly correlates to product stability and bioactivity. This technological integration is shifting the market toward highly data-driven product development and consumer interaction.

- AI-powered diagnostic tools enhance the precision of acne and rosacea severity assessment.

- Machine learning models predict patient suitability and response rates to azelaic acid suspension therapy.

- Generative AI assists in optimizing suspension formulation stability and rheology profiles in R&D.

- Personalized digital dermatology platforms recommend specific suspension concentrations and usage frequencies.

- Automation in manufacturing utilizes computer vision for quality control of particle size and dispersion uniformity.

DRO & Impact Forces Of Azelaic Acid Suspension Market

The market dynamics for Azelaic Acid Suspension are shaped by a strong combination of clinical efficacy, consumer preference shifts, and regulatory environments. Drivers include the proven multi-functional benefits of the acid, increasing incidence of common skin conditions like acne and rosacea, and the strong consumer demand for multi-tasking, scientifically validated skincare ingredients. Restraints often involve the formulation challenges inherent in suspensions, such as maintaining stability, addressing gritty texture, and navigating potential skin irritation at higher concentrations. Opportunities arise primarily through product innovation, particularly the development of novel delivery systems (like liposomes or nanospheres) that can mitigate traditional formulation drawbacks and expand therapeutic applications beyond facial dermatoses.

Key drivers center on the global rise in self-care and the widespread availability of telehealth services facilitating remote diagnosis and prescription renewals. Azelaic acid’s established safety profile during pregnancy and its suitability for long-term use distinguish it favorably against competing pharmaceutical options. Furthermore, aggressive marketing campaigns by established cosmeceutical brands highlighting its benefits for post-inflammatory erythema (red marks) and hyperpigmentation (dark spots) position it uniquely within the aesthetic dermatology sector, widening its appeal beyond strict medical necessity and driving volume growth in the OTC space.

However, the market faces significant restraints, including intense price competition, particularly in generic markets, and the regulatory complexities surrounding transitioning high-concentration products from prescription-only status to OTC availability in various global jurisdictions. The impact forces are generally high and positive; the increasing consumer education via social media and dermatology influencers is generating pull demand, while technological advancements in formulation science (opportunity) are simultaneously pushing supply innovation. These forces collectively suggest sustained, robust market expansion despite the competitive and technical restraints.

Segmentation Analysis

The Azelaic Acid Suspension Market is meticulously segmented based on product concentration, application, distribution channel, and end-user. Understanding these segments is crucial for strategic positioning, as consumer needs vary significantly across therapeutic requirements (prescription versus cosmetic) and purchasing pathways. The concentration segment is particularly critical, dividing the market between clinical-grade (15% to 20%) and consumer-grade (typically 5% to 10%) products, directly impacting pricing strategies and regulatory oversight. The ongoing trend towards personalized medicine is blurring the lines between these segments, with customized compounding pharmacies offering intermediate concentrations tailored to specific patient needs.

Application segmentation highlights the dual utility of azelaic acid—treating acne vulgaris and managing rosacea symptoms constitute the two primary medical applications, with the management of PIH and melasma emerging as rapidly growing aesthetic applications. The robust performance in treating inflammatory lesions and improving skin texture ensures broad clinical utility. Moreover, the formulation segment, encompassing suspensions versus gels or foams, remains relevant, though suspensions are highly favored in the mass market for their cost-effectiveness and generally non-drying formulation base, despite potential textural limitations compared to micro-gel alternatives.

Distribution analysis shows a steady channel shift. While hospital pharmacies and dedicated dermatology clinics remain indispensable for dispensing high-concentration prescription suspensions, the exponential growth is visible in e-commerce platforms and specialized beauty retailers, which dominate the distribution of lower-strength OTC and cosmeceutical suspensions. This shift is primarily attributed to convenience, competitive pricing, and the ability of online platforms to host extensive product reviews and educational content, which is essential for driving purchases of topical dermatological treatments.

- By Concentration:

- Low Concentration (5% - 10%)

- Medium Concentration (11% - 15%)

- High Concentration (16% - 20%)

- By Application:

- Acne Treatment (Acne Vulgaris)

- Rosacea Management (Erythema and Papulopustular Rosacea)

- Hyperpigmentation and Melasma Treatment

- Other Dermatoses (e.g., Folliculitis)

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies and Drug Stores (OTC)

- E-commerce and Online Retailers

- Dermatology Clinics and Specialty Stores

- By End-User:

- Dermatology Clinics

- Hospitals

- Home Care and Consumer Use

Value Chain Analysis For Azelaic Acid Suspension Market

The value chain for the Azelaic Acid Suspension Market begins with the sourcing and synthesis of raw azelaic acid, primarily derived from vegetable oils, followed by the rigorous upstream analysis focused on purification and micronization processes to achieve the desired particle size crucial for suspension stability and efficacy. Key upstream suppliers specialize in pharmaceutical-grade raw materials and advanced excipients (such as suspending agents, thickeners, and preservatives) essential for creating a stable, cosmetically elegant formulation base. Quality control at this stage is paramount, as impurity profiles and particle consistency directly impact the final product's clinical performance and shelf life.

The midstream stage involves pharmaceutical manufacturing and formulation, where Active Pharmaceutical Ingredient (API) suspension processes are optimized. This phase requires specialized equipment for high-shear mixing and homogenization to ensure uniform dispersion and prevent settling or aggregation—common challenges in suspension technology. Direct distribution involves manufacturers supplying large institutional buyers, hospital networks, or leveraging their own proprietary online retail channels. Indirect distribution, however, dominates the consumer segment, utilizing third-party logistics (3PL) providers to move products through wholesalers, large pharmacy chains (CVS, Walgreens), and dominant e-commerce platforms (Amazon, Alibaba).

Downstream analysis focuses heavily on marketing, brand positioning, and consumer education, particularly as many lower-strength suspensions are now sold OTC. The efficiency of the distribution channel is increasingly measured by cold chain capabilities (though less critical for azelaic acid than biologics), speed to market, and strategic placement within dermatology aisles and online search results. Direct channels offer manufacturers greater control over pricing and customer feedback loops, whereas indirect channels provide unparalleled market penetration and reach, especially in highly fragmented regional markets like APAC and Latin America, where local pharmacy networks are crucial gatekeepers.

Azelaic Acid Suspension Market Potential Customers

The primary end-users and buyers of Azelaic Acid Suspension products are highly segmented, reflecting the duality of the product's use—from critical medical treatment to routine cosmetic maintenance. The clinical segment includes dermatologists, hospital procurement managers, and specialized compounding pharmacies, who require high-purity, prescription-strength formulations for treating moderate-to-severe acne and difficult-to-manage inflammatory rosacea. These professional users prioritize clinical evidence, regulatory approvals (e.g., FDA, EMA), and efficacy data regarding lesion reduction and erythema control. Their purchasing decisions are often quantity-driven and based on long-term institutional contracts.

The largest and fastest-growing customer base resides within the individual consumer segment, particularly those managing mild skin concerns or seeking products for pigmentation correction and overall texture improvement. This group, heavily influenced by online reviews, social media trends, and dermatologist endorsements, primarily purchases lower-concentration OTC suspensions through e-commerce or retail drug stores. Key demographics include women aged 20-45 managing hormonal acne or PIH, and individuals with sensitive skin who seek alternatives to harsher retinoids or AHAs, valuing the soothing, anti-inflammatory properties of the suspension format.

Another increasingly important customer segment includes aesthetic clinics and med-spas, which utilize azelaic acid suspensions as part of pre- and post-procedure protocols, complementing chemical peels or laser treatments to manage inflammation and prevent subsequent hyperpigmentation. These buyers look for professional-grade packaging, bulk discounts, and formulations that integrate seamlessly with other in-office treatments. Targeting these varied customers requires differentiated product positioning, emphasizing clinical outcomes for medical buyers and focusing on gentle efficacy and cosmetic appeal for the mass consumer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $125.4 Million |

| Market Forecast in 2033 | $198.5 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Ordinary (Deciem/Estée Lauder), Paula's Choice, Garden of Wisdom, Sesderma, Dermatica, CeraVe (L'Oréal), La Roche-Posay (L'Oréal), SkinCeuticals (L'Oréal), Johnson & Johnson, Galderma, Bayer AG, Teva Pharmaceutical Industries, Sun Pharmaceutical Industries Ltd., Viatris Inc., Taro Pharmaceutical Industries, Revlon, Beiersdorf, Shiseido, Unilever, Mylan N.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Azelaic Acid Suspension Market Key Technology Landscape

The technological evolution within the Azelaic Acid Suspension Market is primarily focused on overcoming inherent formulation difficulties associated with azelaic acid's low solubility and high melting point, which often result in a gritty texture and reduced skin absorption. Key innovation centers on particle size reduction, utilizing advanced micronization and proprietary milling techniques. Achieving uniform particles in the sub-10-micron range significantly improves suspension stability, prevents sedimentation over time, and crucially enhances the cosmetic elegance of the product, leading to better patient adherence, especially in long-term treatment protocols for chronic conditions.

A significant area of technological advancement involves specialized drug delivery systems, notably microencapsulation and the incorporation of liposomal technology. Microencapsulation involves enveloping azelaic acid particles within polymer matrices or lipid carriers. This strategy achieves several objectives: controlled and sustained release of the active ingredient, minimization of potential immediate irritation upon application, and protection of the ingredient from degradation, thereby extending the suspension's shelf life. These sophisticated delivery systems allow formulators to integrate azelaic acid into lighter, more aesthetically pleasing vehicle bases, competing effectively with gel and cream formats.

Furthermore, formulation chemistry is leveraging advanced rheology modifiers and stabilizing polymers to create non-tacky, quick-absorbing suspension bases that retain the integrity of the dispersed azelaic acid particles without requiring excessive shaking or complex storage conditions. The integration of patented transdermal enhancers, which temporarily and safely increase skin permeability, is also a critical technology, allowing therapeutic concentrations to reach the target dermal layers more effectively. This focus on bioavailablity and user experience through novel technology is defining the competitive edge for premium and prescription-grade suspension offerings in the global market.

Regional Highlights

- North America (NA): North America holds a dominant position in the Azelaic Acid Suspension Market, characterized by high consumer awareness, robust healthcare infrastructure, and favorable reimbursement policies for prescription dermatological treatments. The region benefits from the strong presence of major pharmaceutical companies and leading cosmeceutical brands that heavily invest in R&D and digital marketing targeting conditions like acne and rosacea, which have high incidence rates among the population. The market is highly saturated but technologically advanced, with a rapid uptake of prescription-strength (15% and 20%) suspensions, particularly in the US. The prevalence of Direct-to-Consumer (DTC) telehealth services and subscription boxes offering custom formulations further cements NA's leadership, emphasizing ease of access and personalized treatment plans for consumers.

- Europe: Europe represents a mature and highly competitive market, driven by stringent quality standards set by the European Medicines Agency (EMA) and a strong historical emphasis on cosmetic ingredients and dermatological efficacy, particularly in countries like Germany, France, and the UK. The market shows a balanced mix of prescription and OTC sales, with a notable preference for natural or naturally derived ingredients, aligning well with azelaic acid's origin. Regulatory approval for lower-strength azelaic acid products for general cosmetic use has broadened the consumer base significantly. Strategic collaborations between pharmaceutical manufacturers and local European pharmacy chains are crucial for maintaining distribution dominance, alongside aggressive digital strategies targeting younger, highly informed consumers interested in minimizing hyperpigmentation and post-acne marks.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period due to rapidly improving economic conditions, expanding middle class disposable income, and increasing awareness of advanced skincare solutions. The cultural emphasis on clear, bright, and even skin tone in countries like China, South Korea, and Japan drives extraordinary demand for azelaic acid suspensions used specifically for hyperpigmentation, melasma, and fading acne scars. While regulatory environments can be complex and fragmented across the region, the rising adoption of Western dermatological treatments, coupled with significant local manufacturing capacity, positions APAC as a high-potential growth engine. Localization of formulations to suit regional climate and skin sensitivity profiles is a key success factor.

- Latin America (LATAM): The LATAM market is experiencing steady growth, primarily driven by rising urbanization and increasing access to dermatological care, particularly in Brazil, Mexico, and Argentina. The demand here is dual-natured: prescription usage is critical in managing infectious dermatoses and acne severity, while OTC sales are capitalizing on the general wellness and beauty trends emphasizing corrective skincare ingredients. Challenges include economic volatility and price sensitivity, which favor locally manufactured or generic suspension products. Strategic market entry involves partnering with local distributors who possess established relationships with large retail pharmacy networks, offering accessible and affordable suspension formats.

- Middle East and Africa (MEA): Growth in the MEA region is gradual but accelerating, driven by high prevalence of chronic skin conditions, especially hyperpigmentation disorders exacerbated by high UV exposure and genetic predispositions. Key growth markets such as the UAE and Saudi Arabia benefit from high per capita spending on aesthetic procedures and cosmetic dermatology. Regulatory hurdles, particularly regarding import duties and certification standards, present market access challenges. However, the region offers significant untapped potential, particularly for high-end, premium-priced prescription azelaic acid suspensions marketed through specialized clinics and licensed medical institutions. Focus on stability testing for high-temperature environments is crucial for product suitability in the MEA region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Azelaic Acid Suspension Market.- The Ordinary (Deciem/Estée Lauder)

- Paula's Choice

- Garden of Wisdom

- Sesderma

- Dermatica

- CeraVe (L'Oréal)

- La Roche-Posay (L'Oréal)

- SkinCeuticals (L'Oréal)

- Johnson & Johnson

- Galderma

- Bayer AG

- Teva Pharmaceutical Industries

- Sun Pharmaceutical Industries Ltd.

- Viatris Inc.

- Taro Pharmaceutical Industries

- Revlon

- Beiersdorf

- Shiseido

- Unilever

- Mylan N.V.

Frequently Asked Questions

Analyze common user questions about the Azelaic Acid Suspension market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Azelaic Acid Suspension Market?

The Azelaic Acid Suspension Market is projected to experience a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period from 2026 to 2033. This growth is driven by the increasing demand for effective treatments for rosacea and acne, coupled with advancements in formulation technology that enhance product stability and user compliance.

Which geographical region is expected to lead the Azelaic Acid Suspension Market?

North America is anticipated to maintain its leadership in the Azelaic Acid Suspension Market due to high healthcare spending, strong consumer awareness of advanced dermatological ingredients, and the established presence of key market players specializing in both prescription and over-the-counter (OTC) formulations. The region excels in incorporating azelaic acid into personalized telemedicine treatment plans.

What is the primary technological challenge in manufacturing Azelaic Acid Suspensions?

The primary technological challenge centers on overcoming azelaic acid’s low solubility, which necessitates rigorous particle size reduction techniques, such as micronization. Effective technology is needed to ensure the active ingredient remains uniformly dispersed, preventing sedimentation, minimizing product grittiness, and ensuring optimal bioavailability and cosmetic elegance.

How do Azelaic Acid Suspensions primarily differ from gel or cream formulations in the market?

Azelaic Acid Suspensions differ by utilizing a finely dispersed solid particle phase within a liquid medium, which often allows for higher concentration stability and a generally less irritating application than some alcohol-based gels. While suspensions can sometimes have a thicker texture, they are often preferred for sensitive skin due to their typically lower potential for drying compared to certain gel or foam bases.

What are the main applications driving demand in the OTC segment?

The main applications driving demand in the OTC (Over-the-Counter) segment are the management of mild acne vulgaris and, crucially, the treatment of post-inflammatory hyperpigmentation (PIH) and general skin redness associated with rosacea. Consumers seek low-concentration suspensions (5%-10%) for consistent, gentle skin maintenance and overall improvement in skin tone uniformity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager