B2B E-Commerce for Tyre Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436163 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

B2B E-Commerce for Tyre Market Size

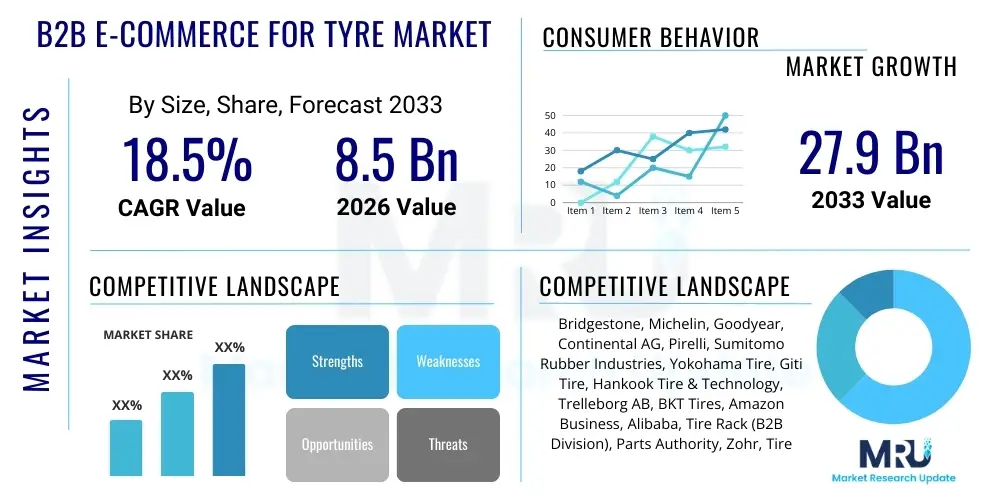

The B2B E-Commerce for Tyre Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $27.9 Billion by the end of the forecast period in 2033.

B2B E-Commerce for Tyre Market introduction

The B2B E-Commerce for Tyre Market encompasses all digital platforms and online channels utilized for the wholesale transaction of tires between manufacturers, distributors, retailers, fleet operators, and maintenance service providers. This ecosystem provides a streamlined, efficient, and transparent mechanism for bulk procurement, inventory management, and fulfillment of tire products, ranging from passenger car radials to heavy-duty off-road tires. The digital transformation within the automotive aftermarket, spurred by the need for reduced operational complexity and improved supply chain visibility, serves as the core catalyst for this market's expansion. Manufacturers are increasingly prioritizing investment in proprietary e-commerce portals and integrating with third-party marketplaces to secure direct access to their professional buyer base, bypassing traditional multi-layered distribution networks.

The primary product traded within this market includes a comprehensive range of tires categorized by application: Passenger Vehicle Tires, Commercial Vehicle Tires (trucks and buses), Off-the-Road (OTR) Tires (construction and mining), and Specialty Tires (agricultural and industrial). Major applications involve replenishment purchasing by independent garages and repair shops, large volume procurement by national fleet management companies, and inventory stocking by regional distributors. The shift to B2B e-commerce platforms allows buyers to access real-time inventory levels, dynamic pricing based on volume and relationship tiers, and sophisticated tracking features. Furthermore, these platforms often integrate tools for compatibility checks and recommendation engines tailored to specific vehicle models and operational requirements, significantly enhancing the precision and speed of transactions.

Key benefits driving the adoption of B2B e-commerce in the tire sector include enhanced efficiency, 24/7 accessibility, and the capacity for complex order handling that is difficult to manage through traditional sales channels. The market is propelled by factors such as the increasing digitization of business processes across the automotive supply chain, the growing preference for self-service procurement among professional buyers, and the necessity for manufacturers to establish resilient and scalable distribution models. Moreover, the inherent transparency offered by digital platforms helps mitigate issues related to counterfeit products and ensures compliance with regional regulatory standards regarding product specifications and certifications, contributing to greater buyer confidence in large-scale online purchases.

B2B E-Commerce for Tyre Market Executive Summary

The B2B E-Commerce for Tyre Market is characterized by a rapid technological transition, moving from traditional distributor-centric models to sophisticated, API-driven e-commerce ecosystems. Current business trends emphasize personalization, integrating sophisticated logistics management tools, and leveraging data analytics to predict demand fluctuations and optimize pricing strategies. Key market players are investing heavily in establishing seamless omni-channel experiences, ensuring that online ordering integrates flawlessly with offline fulfillment and technical support services. A significant trend involves the emergence of vertical-specific marketplaces that specialize exclusively in tire and related automotive components, offering tailored services like bulk purchasing contracts and specialized fitting scheduling tools, thus catering directly to the needs of large fleet operators and national dealership chains.

Regionally, the market dynamics are highly heterogeneous. North America and Europe currently represent the largest share due to well-established digital infrastructure, high rates of B2B digital adoption, and the presence of major global tire manufacturers who are pioneers in e-commerce integration. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by the explosive expansion of commercial vehicle fleets in countries like China and India, coupled with increasing internet penetration and government initiatives promoting supply chain digitization. This regional expansion is largely driven by the necessity to bypass fragmented traditional distribution networks, making e-commerce a crucial tool for scaling operations in complex logistical environments.

Segment trends indicate a strong shift towards commercial vehicle tires (truck and bus radials) as fleet operators seek to minimize vehicle downtime through efficient, just-in-time procurement via dedicated online portals. Platform Type segmentation shows that proprietary manufacturer platforms, offering exclusive access to product information and inventory, maintain dominance, but third-party vertical marketplaces are rapidly gaining traction due to their ability to aggregate offerings from multiple brands. Furthermore, the increasing adoption of specialized OTR tires for mining and construction via e-commerce is notable, driven by the high cost of these assets and the demand for highly reliable supply chains that can deliver to remote operational sites with guaranteed consistency and documentation.

AI Impact Analysis on B2B E-Commerce for Tyre Market

Common user questions regarding AI's impact on the B2B Tyre E-Commerce market frequently center on how AI can optimize supply chain logistics for bulky products, improve predictive maintenance recommendations, and enhance the complexity of personalized pricing models. Users are keenly interested in the potential for AI-driven demand forecasting to reduce safety stock levels and minimize obsolescence, a critical issue given the shelf-life constraints and high inventory costs associated with tires. Concerns also revolve around the implementation cost of AI systems, data privacy in cross-border B2B transactions, and the need for explainable AI (XAI) to justify complex sourcing or pricing decisions to professional buyers. Overall, users expect AI to transition B2B platforms from transactional interfaces into proactive, analytical partners that maximize operational uptime for end-users like trucking fleets and construction companies.

- Demand Forecasting and Inventory Optimization: AI algorithms analyze historical sales data, weather patterns, regional fleet growth, and macroeconomic indicators to predict future tire demand with greater accuracy, minimizing stockouts and reducing warehouse costs.

- Personalized Pricing and Recommendation Engines: AI dynamically adjusts pricing based on buyer history, volume commitments, market conditions, and relationship tiers, offering personalized catalog views and recommending compatible tires based on vehicle telematics data.

- Chatbots and Customer Service Automation: AI-powered conversational interfaces handle routine B2B inquiries (e.g., stock checks, order status, basic technical specifications), providing 24/7 service efficiency and freeing sales personnel for strategic account management.

- Supply Chain Route Optimization: Machine learning optimizes delivery routes for heavy and high-volume tire orders, factoring in fuel consumption, transit time, and real-time road conditions, crucial for B2B logistics efficiency.

- Fraud Detection and Security: AI monitors transaction patterns and buyer behavior to identify and mitigate potential security risks or fraudulent activities common in high-value B2B procurement, enhancing platform trust.

DRO & Impact Forces Of B2B E-Commerce for Tyre Market

The dynamics of the B2B E-Commerce for Tyre Market are shaped by a strong interplay between digitalization pressures (Drivers), logistical hurdles and legacy system inertia (Restraints), and the potential for leveraging new technologies (Opportunities). The primary driver is the pervasive need for efficiency gains and cost reduction across the automotive supply chain. Restraints often manifest as the difficulty in integrating new e-commerce platforms with existing, complex Enterprise Resource Planning (ERP) systems used by major distributors, alongside the inherent challenges of shipping large, heavy, and geographically dispersed inventories. Opportunities are abundant in adopting advanced technologies like blockchain for transparency in the supply chain and incorporating predictive maintenance services directly into e-commerce offerings. These forces collectively dictate the speed of digital transformation and the required investment level for market participants.

Segmentation Analysis

The B2B E-Commerce for Tyre Market is systematically segmented based on Product Type, Platform Type, Business Model, and End User to provide a detailed view of market penetration and growth trajectories across various buyer landscapes. Product segmentation highlights the dominance of Passenger Car and Commercial Vehicle tires, which account for the majority of transactional volume due to routine replacement cycles and large fleet requirements. Platform Type segmentation differentiates between proprietary systems—controlled directly by major manufacturers—and consolidated third-party marketplaces, which offer variety and competitive pricing transparency. Analyzing these segments is crucial for stakeholders to tailor their digital strategies, identify niche markets such as OTR tires, and understand the preference of different buyer types, such as independent repair shops versus large industrial customers.

- Product Type:

- Passenger Vehicle Tires

- Commercial Vehicle Tires (Truck & Bus)

- Off-the-Road (OTR) Tires

- Specialty/Industrial Tires

- Platform Type:

- Proprietary (Manufacturer-owned) Platforms

- Third-Party Marketplaces (Vertical & Horizontal)

- Aggregator Platforms

- Business Model:

- Manufacturer to Distributor (M2D)

- Manufacturer/Distributor to Retailer/Service Shop (M/D2R)

- Direct to Fleet Operator (D2F)

- End User:

- Independent Garages and Repair Shops

- Automotive Dealerships

- Fleet Management Companies

- Industrial and Construction Companies

- Government/Public Sector Fleets

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For B2B E-Commerce for Tyre Market

The value chain for the B2B E-Commerce for Tyre Market begins with upstream activities involving raw material sourcing (natural rubber, synthetic rubber, chemicals) and tire manufacturing. The shift to digital channels introduces efficiency early in the chain, allowing manufacturers to forecast production based on real-time B2B platform demand data rather than relying solely on lagging distributor forecasts. Upstream digitalization enables better management of commodity price volatility and quality control traceability. Manufacturers often utilize their B2B platforms not only for sales but also for managing dealer relationships, launching products, and distributing technical updates and certifications, transforming the platform into a core operational tool that spans manufacturing and marketing functions.

The midstream segment is defined by the e-commerce platform itself, which acts as the digital distribution channel, replacing or augmenting traditional warehousing and sales agent functions. Direct distribution via e-commerce allows manufacturers to capture higher margins and exercise greater control over brand messaging and pricing. The distribution channel is often hybrid; while the transaction and order processing are digital (indirect), the physical fulfillment leverages established third-party logistics (3PL) providers or proprietary fulfillment centers (direct). Efficiency in this segment hinges on API integration with logistics providers to ensure accurate, real-time tracking of large tire shipments, which is a key competitive differentiator for digital platforms.

Downstream analysis focuses on the end-user interaction: the purchasing process by retailers, service shops, and fleet operators. These buyers increasingly rely on digital tools for inventory integration and automated reordering. The direct channel includes manufacturer-to-fleet sales via dedicated portals, offering specialized contract pricing and technical support. The indirect channel involves purchasing through third-party marketplaces or distributors who operate their own digital storefronts. The value chain concludes with post-sales support, including warranty registration, technical documentation, and return management—all of which are now primarily handled through the B2B e-commerce interface, significantly improving service response times and documentation accuracy for professional buyers.

B2B E-Commerce for Tyre Market Potential Customers

The primary purchasers utilizing B2B e-commerce platforms for tires are those organizations requiring consistent, high-volume procurement subject to strict budgetary and operational constraints. This predominantly includes independent garages and automotive repair shops that depend on swift, reliable access to diverse tire brands and sizes for their service bays. Their key purchasing criteria center on competitive pricing, immediate availability validation, and rapid last-mile delivery. The platform must offer robust search and compatibility tools, as these businesses often service a wide range of vehicle types, demanding accuracy in their procurement process.

Another critical customer segment consists of large-scale fleet management companies, responsible for maintaining corporate or government vehicle fleets (trucks, buses, specialized vehicles). These buyers operate under stringent Service Level Agreements (SLAs) and require automated, contractual purchasing capabilities. For fleet operators, the e-commerce platform must integrate advanced features such as bulk order discounting, integration with telematics data for predictive replacement scheduling, and detailed reporting functionalities to track expenditure across thousands of vehicles, prioritizing operational uptime above all else.

Finally, industrial and construction companies constitute a rapidly growing customer base, particularly for specialized OTR tires used in mining, port operations, and heavy infrastructure projects. These customers prioritize product durability specifications, certifications, and reliable delivery to often remote sites. The B2B platform serves as the central hub for managing high-value, infrequently purchased assets, demanding comprehensive technical documentation, specialized logistical handling (e.g., oversized freight), and robust credit management tools tailored to large capital expenditures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $27.9 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bridgestone, Michelin, Goodyear, Continental AG, Pirelli, Sumitomo Rubber Industries, Yokohama Tire, Giti Tire, Hankook Tire & Technology, Trelleborg AB, BKT Tires, Amazon Business, Alibaba, Tire Rack (B2B Division), Parts Authority, Zohr, Tire Company Solutions, American Tire Distributors, Pneus Online, Simple Tire |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

B2B E-Commerce for Tyre Market Key Technology Landscape

The technological landscape supporting the B2B E-Commerce for Tyre market is rapidly evolving, driven by the need for enhanced efficiency in managing large, complex transactions. Core technology centers around robust E-commerce Platform Architecture, often utilizing microservices and headless commerce solutions. This architecture separates the front-end presentation layer (the user interface) from the back-end commerce logic (pricing, inventory, fulfillment), allowing for extreme flexibility in deploying custom user experiences for different B2B buyer types (e.g., fleet managers vs. small garages) without disrupting core operational systems. Furthermore, the integration of sophisticated Product Information Management (PIM) systems is crucial to manage the vast number of SKUs, technical specifications, fitment data, and compliance documentation associated with diverse tire products across multiple global markets.

Crucial to B2B success is the application of advanced Integration Technologies, primarily relying on Application Programming Interfaces (APIs). APIs facilitate seamless real-time data exchange between the e-commerce platform and legacy systems such as Enterprise Resource Planning (ERP), Warehouse Management Systems (WMS), and third-party logistics providers (3PLs). This integration ensures accurate inventory counts, automated order processing, and precise tracking of shipments, which is non-negotiable for professional buyers relying on just-in-time inventory. Without robust API connectivity, the benefits of digital sales are nullified by fulfillment bottlenecks and inventory inaccuracies, underscoring the necessity of secure and high-speed integration layers.

Emerging technologies like Artificial Intelligence (AI) and Machine Learning (ML) are redefining operational efficiencies. AI is employed in advanced demand sensing, predicting regional requirements based on seasonal changes, economic forecasts, and even linked to connected vehicle data when available. Blockchain technology is also gaining relevance, particularly in supply chain visibility and anti-counterfeiting measures. Given the high-value nature and safety implications of tires, using blockchain ledgering to track a tire's journey from raw material sourcing through manufacturing to the final B2B delivery ensures provenance and verifies quality assurance claims, building indispensable trust in the digital wholesale environment. Finally, mobile commerce (M-commerce) solutions optimized for procurement managers on the go are becoming standard, enabling purchasing and tracking via dedicated mobile applications.

Regional Highlights

North America: This region represents a mature and highly competitive market, characterized by sophisticated B2B buyers and high adoption rates of manufacturer-proprietary e-commerce platforms. The market is primarily driven by large automotive aftermarket chains, national fleet operators, and major industrial sectors (mining, agriculture). Digital strategies here focus heavily on logistical efficiency, utilizing advanced AI for route optimization and integration with third-party marketplaces like Amazon Business. Key market differentiators in North America include offering comprehensive financing solutions within the platform and leveraging deep data analytics to provide personalized, localized stocking recommendations to independent retailers, ensuring they hold inventory relevant to specific regional vehicle demands.

Europe: The European B2B E-Commerce for Tyre market is fragmented but rapidly consolidating, driven by stringent EU regulations on tire quality (e.g., rolling resistance, wet grip) and the need for seamless cross-border logistics. Manufacturers are establishing centralized European digital hubs to manage distribution across diverse national markets, each with unique tax and language requirements. The emphasis here is on multi-lingual platform capabilities, compliance documentation management (e-commerce platforms must host all necessary technical certificates), and supporting a blend of direct-to-retailer and manufacturer-to-distributor models, catering to both centralized purchasing groups and independent national businesses. Germany and the UK lead in terms of digital transaction volume and technological integration.

Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by the massive expansion of vehicle production and commercial fleets, particularly in China, India, and Southeast Asia. The adoption of B2B e-commerce is essential here due to the highly fragmented nature of traditional distribution networks, where digital platforms offer a vital leapfrog capability. Growth is propelled by mobile-first purchasing experiences, localized payment gateways, and the emergence of massive regional vertical marketplaces aggregating supplies. Challenges include establishing reliable last-mile logistics in densely populated or remote areas and overcoming initial buyer hesitancy regarding digital payment security for bulk purchases.

Latin America (LATAM): This region is characterized by high economic volatility and fluctuating currency values, which necessitates e-commerce platforms with dynamic, real-time pricing calculation capabilities. The B2B tire market in LATAM is gradually transitioning to digital, with adoption being highest in industrialized economies like Brazil and Mexico. The market requires high investment in cybersecurity measures to mitigate transaction risks and platforms capable of handling complex import duties and customs documentation directly within the purchasing workflow. Key demand drivers are focused on commercial vehicle tires supporting commodity exports and rapidly urbanizing infrastructure.

Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) countries, driven by significant infrastructure projects and high per capita vehicle ownership. Specialized tires for extreme heat conditions and heavy-duty vehicles (construction, oil & gas) are primary segments. E-commerce platforms serving this region must prioritize reliable fulfillment and advanced tracking for high-value shipments, often coordinating deliveries to complex industrial sites. African markets are seeing initial entry points through mobile-based B2B solutions focusing on localized distribution and supply chain transparency.

- China: Dominates APAC growth, driven by extensive commercial fleet expansion and aggressive manufacturer investment in proprietary digital ecosystems, utilizing integration with localized digital payment infrastructures.

- United States: Market leader in transaction value, characterized by sophisticated platform integration with national supply chains and heavy reliance on AI-driven inventory and pricing optimization for high-volume dealers and fleets.

- Germany: European digital core, focused on premium tire segments, demanding stringent data security standards, and seamless integration between manufacturing ERPs and B2B ordering portals.

- India: Rapid adoption fueled by infrastructure growth and the need to streamline highly disorganized traditional distribution, favoring mobile-optimized marketplaces and aggregator models.

- Brazil: Largest LATAM market, driven by the need for robust platforms capable of managing complex tax structures and logistics for agricultural and heavy-duty vehicle tires.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the B2B E-Commerce for Tyre Market.- Bridgestone Corporation

- Michelin Group

- Goodyear Tire & Rubber Company

- Continental AG

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries, Ltd.

- Yokohama Tire Corporation

- Hankook Tire & Technology Co., Ltd.

- Giti Tire Pte. Ltd.

- Trelleborg AB

- BKT (Balkrishna Industries Ltd.)

- American Tire Distributors (ATD)

- Simple Tire

- Tire Rack (B2B Division)

- Alibaba Group (through B2B platforms)

- Amazon Business

- Parts Authority

- Tire Company Solutions

- Pneus Online

- Zohr

Frequently Asked Questions

Analyze common user questions about the B2B E-Commerce for Tyre market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate for the B2B E-Commerce for Tyre Market?

The B2B E-Commerce for Tyre Market is projected to grow at an estimated Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033, driven primarily by supply chain digitization and the necessity for efficient fleet management procurement.

Which product segment holds the largest share in B2B Tyre E-Commerce?

Commercial Vehicle Tires (Truck & Bus) and Passenger Vehicle Tires collectively hold the largest market share, as these segments require high-volume, repetitive purchases by fleet operators, dealerships, and independent repair shops, which benefit significantly from digital procurement efficiency.

How is AI transforming B2B purchasing within the tire sector?

AI is transforming B2B purchasing by enabling predictive demand forecasting, optimizing complex logistics and delivery routes for bulky items, and creating hyper-personalized pricing models based on the purchasing history and operational needs of professional buyers.

What are the primary restraints affecting the B2B E-Commerce for Tyre Market growth?

Key restraints include the high initial investment required for integrating e-commerce platforms with complex legacy ERP and WMS systems, overcoming cybersecurity concerns for high-value transactions, and managing the inherent logistical complexity of shipping heavy and irregularly sized tire inventories.

Which geographical region is expected to show the highest CAGR?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate, attributed to rapid industrialization, massive expansion of commercial vehicle fleets in countries like China and India, and the necessity to bypass fragmented traditional distribution networks through digital channels.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager