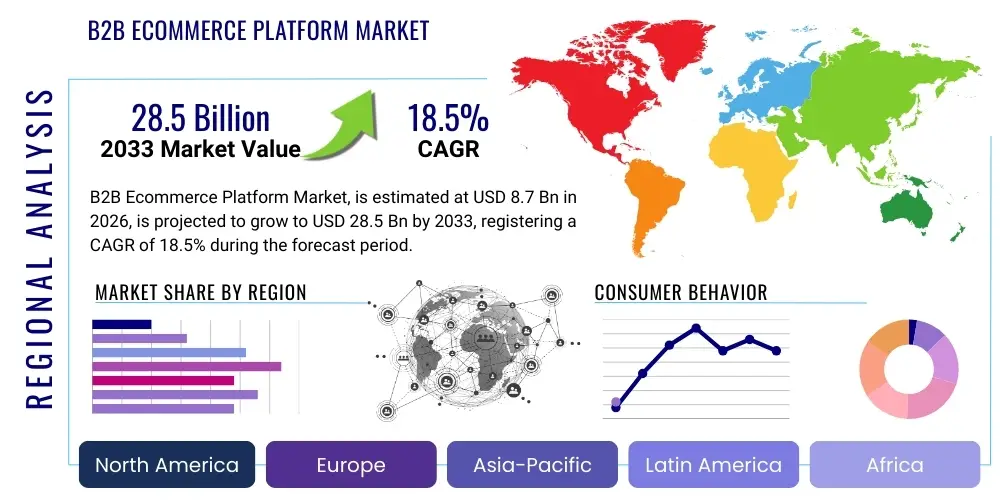

B2B Ecommerce Platform Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436338 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

B2B Ecommerce Platform Market Size

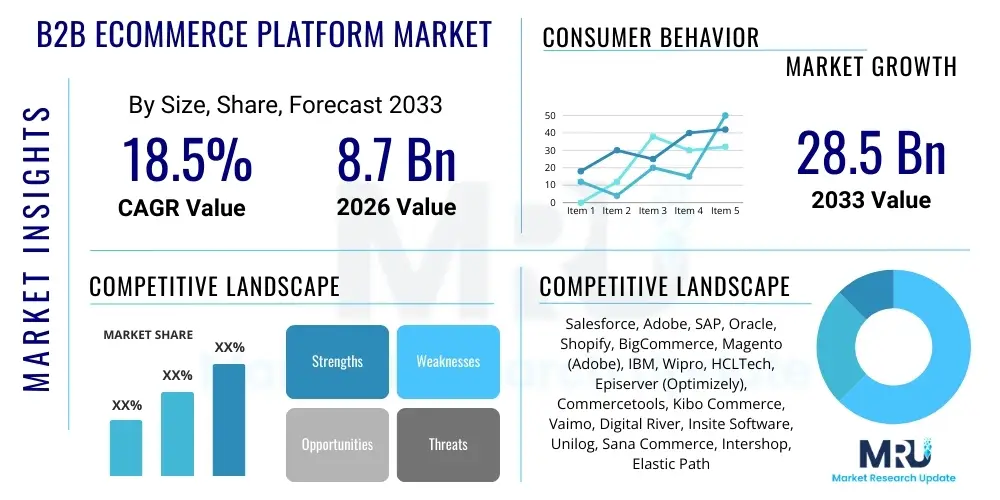

The B2B Ecommerce Platform Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 8.7 billion in 2026 and is projected to reach USD 28.5 billion by the end of the forecast period in 2033.

B2B Ecommerce Platform Market introduction

The B2B Ecommerce Platform Market encompasses software solutions designed to facilitate online transactions between businesses. These platforms offer robust functionalities tailored to complex B2B needs, including volume-based pricing, customized catalogs, account management features, integration with ERP and CRM systems, and workflow automation. Unlike traditional B2C models, B2B platforms must support intricate procurement processes, often involving multiple decision-makers, large order volumes, and tailored payment terms, positioning them as essential infrastructure for modern supply chains and digital commerce strategies. The core value proposition of these platforms lies in enhancing operational efficiency, expanding market reach, and providing superior digital experiences that mimic or exceed traditional sales channels.

Product descriptions within this market span various deployment models, primarily Software as a Service (SaaS), Platform as a Service (PaaS), and on-premise solutions, with SaaS models dominating due to their scalability, lower upfront costs, and faster deployment cycles. Major applications include enabling manufacturers to sell directly to distributors (D2D) or end-users (D2C), supporting wholesale distribution networks, and facilitating complex managed marketplaces. These platforms are crucial for businesses seeking to modernize their sales processes, moving away from manual orders and paper-based transactions towards streamlined, digital interactions that are available 24/7. The capability to handle complex pricing structures, including tiered discounts, negotiated contracts, and localized taxes, is a defining feature of these advanced B2B commerce systems.

Key benefits derived from implementing these platforms include significant cost reduction associated with order processing, improved accuracy in fulfillment, and accelerated time-to-market for new products and services. Driving factors fueling market expansion involve the rapid pace of digital transformation across industrial sectors, the increasing demand for seamless, personalized purchasing experiences mirroring B2C standards, and the imperative for businesses to diversify their sales channels. Furthermore, the global trend towards integrated digital ecosystems, requiring platforms that connect effortlessly with enterprise resource planning (ERP), supply chain management (SCM), and warehouse management systems (WMS), continuously elevates the technological sophistication demanded in the B2B ecommerce space, ensuring sustained market growth.

B2B Ecommerce Platform Market Executive Summary

The B2B Ecommerce Platform Market is characterized by accelerating digitalization and a fundamental shift in buyer expectations, driving businesses globally to invest heavily in robust online sales infrastructure. Key business trends indicate a strong movement towards headless commerce architectures and microservices, allowing enterprises greater flexibility in front-end presentation while maintaining powerful back-end functionalities. There is a pronounced focus on achieving true omnichannel synchronization, ensuring that sales interactions—whether online, through a mobile app, or via traditional sales reps—are consistent and integrated, thereby optimizing the customer journey and enhancing overall account value. Furthermore, the integration of advanced analytical tools and artificial intelligence is transforming platforms from simple transaction facilitators into sophisticated revenue optimization engines, capable of predictive pricing and personalized recommendations, crucial for maintaining competitive edge.

Regional trends reveal that North America and Europe remain the largest markets, driven by high technology adoption rates, established digital infrastructure, and large multinational corporations with complex procurement needs. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by the rapid expansion of Small and Medium-sized Enterprises (SMEs) embracing digital sales models, especially in high-growth economies such as China and India. The regional emphasis in APAC often centers on mobile optimization and marketplace integration, reflecting local commerce habits. Regulatory environments, particularly in Europe, necessitate platform compliance with cross-border taxation and data privacy standards (such as GDPR), influencing the architectural design and feature sets offered by vendors operating within these jurisdictions, ensuring localized platform relevance.

Segmentation trends highlight the dominance of the SaaS deployment model due to its accessibility and operational agility, making it particularly attractive to mid-market businesses and SMEs looking to scale quickly without significant capital expenditure. Vertically, the Manufacturing and Wholesale Distribution segments are the primary adopters, leveraging platforms to manage extensive product catalogs, complex inventory, and intricate logistics networks. From a technological perspective, platforms emphasizing API-first strategies are seeing increased adoption, as businesses prioritize composable commerce stacks that can be customized and integrated rapidly. This modular approach allows enterprises to select best-of-breed solutions for specific functions, rather than relying solely on monolithic suites, marking a definitive evolution in B2B platform architecture toward specialized functionalities and interoperability.

AI Impact Analysis on B2B Ecommerce Platform Market

User queries regarding the impact of Artificial Intelligence (AI) on the B2B Ecommerce Platform Market consistently revolve around automation capabilities, enhancing personalization at scale, optimizing complex pricing strategies, and ensuring data security in automated environments. Users are particularly interested in how AI can move B2B commerce beyond reactive order processing into proactive relationship management and predictive sales. Key themes include the implementation of intelligent search functions, the use of machine learning for demand forecasting, and the application of generative AI for content creation and personalized sales messaging. Concerns often focus on the required investment in data infrastructure to feed AI models accurately and the ethical implications of automated pricing and customer interaction.

AI is fundamentally reshaping the B2B buying journey by providing enhanced tools that mimic the personalized attention of a dedicated sales representative, but available instantly and at scale. This technological shift addresses the B2B mandate for efficiency by automating repetitive tasks, such as generating custom quotes, verifying account credit, and routing complex inquiries to the correct department. Furthermore, AI algorithms are critical for analyzing vast datasets related to customer behavior, procurement patterns, and macroeconomic indicators, allowing platforms to dynamically adjust inventory levels, optimize logistics costs, and deliver hyper-relevant product suggestions to procurement managers, thereby driving higher conversion rates and increasing lifetime customer value. This integration transforms the platform from a transactional tool into a strategic competitive asset.

The future trajectory of B2B platforms is inextricably linked to AI capabilities, especially in predictive maintenance and complex system configuration. For industries dealing with highly technical products, AI can guide buyers through intricate configuration processes, minimizing errors and ensuring compatibility, which traditionally required intensive sales engineering support. Expectation management centers on the shift from simply offering products to providing sophisticated, predictive solutions that anticipate the buyer's needs before they materialize. This advanced level of service, driven by machine learning, is vital for large enterprise customers and is becoming a distinguishing factor among top-tier B2B platform providers, cementing AI as a core technological differentiator in the market.

- AI-driven personalized product recommendations based on historical procurement data and user role.

- Intelligent pricing optimization engines capable of dynamic adjustment based on inventory, demand elasticity, and competitor activity.

- Automation of complex quoting and configuration (CPQ) processes, reducing sales cycle duration.

- Deployment of advanced chatbots and virtual assistants for 24/7 technical support and order tracking inquiries.

- Predictive demand forecasting and inventory management, minimizing stockouts and optimizing warehousing costs.

- Enhanced fraud detection and security protocols utilizing machine learning algorithms to identify anomalous transaction patterns.

DRO & Impact Forces Of B2B Ecommerce Platform Market

The B2B Ecommerce Platform Market is powerfully influenced by a confluence of driving factors, structural restraints, and emerging opportunities, collectively shaping its development trajectory. The primary driver is the accelerating pressure on businesses to undergo digital transformation, moving away from outdated legacy systems to integrated digital platforms that support modern omnichannel selling. Restraints largely center on the significant initial capital investment required for enterprise-level platform implementation, the complexity of integrating these new systems with decades-old Enterprise Resource Planning (ERP) and supply chain systems, and the persistent shortage of specialized IT talent required to manage and customize these sophisticated platforms. However, substantial opportunities exist in the expansion of niche vertical marketplaces and the utilization of emerging technologies like headless commerce and blockchain to create highly resilient and flexible sales ecosystems, promising improved transparency and operational efficiency across the supply chain.

Driving forces are strongly anchored in changing B2B buyer demographics, as younger, digitally native professionals demand B2C-like purchasing experiences—characterized by ease of use, transparency, and personalization. This shift compels suppliers to rapidly upgrade their digital storefronts. Additionally, globalization and the need for businesses to easily access international markets without establishing physical sales offices are accelerating platform adoption, as ecommerce provides a scalable route to cross-border sales. The cost-saving potential derived from automating manual sales tasks, such as order entry, invoicing, and customer service, further reinforces the economic rationale for widespread platform deployment, making the investment highly defensible in an increasingly competitive global landscape.

Key impact forces include technological disruption from microservices architecture, which is fundamentally altering how platforms are built and deployed, fostering innovation and reducing vendor lock-in. Regulatory scrutiny, particularly concerning data privacy and international trade compliance, acts as a significant external force, requiring platforms to be inherently compliant and flexible across different jurisdictions. Moreover, the competitive landscape is intensely impacting platform development, pushing vendors to specialize their offerings, providing industry-specific solutions that cater to the unique operational demands of sectors such as life sciences, heavy manufacturing, or agricultural supply chains, ensuring that platform evolution remains responsive to real-world industrial needs and challenges.

Segmentation Analysis

The B2B Ecommerce Platform Market is comprehensively segmented based on various criteria, including deployment model, platform type, industry vertical, and enterprise size, each reflecting distinct operational needs and technological preferences. The core segmentation by deployment model divides the market into SaaS (Software as a Service), PaaS (Platform as a Service), and On-premise solutions. SaaS remains the dominant segment, favored by its subscription-based structure, ease of updates, and reduced infrastructure management overhead, appealing heavily to mid-market firms seeking rapid deployment and scalability. The segmentation by industry vertical is crucial, as platforms must offer specialized functionalities; for instance, manufacturing requires complex Bill of Materials (BOM) handling, while wholesale distribution demands advanced inventory management and multi-warehouse fulfillment capabilities, driving vendors toward highly tailored product offerings.

Platform type segmentation distinguishes between commercial off-the-shelf (COTS) solutions, often utilized by companies with standard requirements, and custom-built or open-source platforms, preferred by large enterprises needing deep integration and unique customization for highly proprietary workflows. Enterprise size segmentation, classifying users into Large Enterprises and SMEs, influences the choice of platform architecture and pricing strategy; Large Enterprises often adopt comprehensive, highly integrated platforms requiring significant customization, while SMEs gravitate towards cost-effective, out-of-the-box SaaS solutions that minimize internal IT resource allocation. This layered segmentation allows vendors to precisely target their product development and marketing efforts, ensuring that the feature set and support model align directly with the operational scale and technical maturity of the prospective business client.

- By Deployment Model:

- Software as a Service (SaaS)

- Platform as a Service (PaaS)

- On-premise

- By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Industry Vertical:

- Manufacturing

- Wholesale Distribution

- Retail and Consumer Goods

- Automotive

- IT & Telecom

- Healthcare & Life Sciences

- Others (e.g., Construction, Energy)

- By Platform Type:

- Off-the-shelf Platforms

- Custom Platforms/Open Source

Value Chain Analysis For B2B Ecommerce Platform Market

The value chain for the B2B Ecommerce Platform Market begins with Upstream Analysis, primarily involving core technology providers, including infrastructure vendors (cloud hosting services like AWS, Azure, Google Cloud), software component developers (payment gateways, security providers, logistics API developers), and data analytics tool creators. These foundational elements enable platform vendors to build scalable, secure, and feature-rich commerce solutions. The quality and availability of these underlying technologies, particularly robust cloud infrastructure for global deployment and advanced APIs for seamless integration, are critical determinants of a platform’s final performance and reliability, establishing the initial cost structure and innovation potential for the entire ecosystem.

Midstream activities focus on the core platform development and implementation. This stage involves the key platform vendors who develop and maintain the core software offerings (e.g., Salesforce Commerce Cloud, Adobe Commerce, Shopify Plus). Implementation partners, system integrators, and specialized consulting firms play a vital role here, customizing, integrating, and deploying the platforms to meet the unique operational requirements of diverse B2B clients. The complexity of B2B processes necessitates extensive customization—integrating with proprietary ERP systems or specialized warehouse management software—making service provision and expert consultation a high-value component of the midstream segment, directly influencing the total cost of ownership (TCO) for the end-user.

Downstream analysis centers on the distribution channels and the end-users. Distribution channels include direct sales by platform providers (for large enterprise contracts) and indirect channels utilizing channel partners, resellers, and managed service providers (MSPs), particularly important for reaching SMEs and specialized geographical markets. End-users (B2B buyers and sellers) receive the final product, utilizing the platform for transactions, supply chain management, and customer relationship management. The success of the downstream phase is measured by user adoption, transaction volume, and the platform’s ability to generate quantifiable ROI for the business by increasing efficiency and expanding market reach. Feedback from these end-users continuously fuels platform enhancements and innovation throughout the value chain.

B2B Ecommerce Platform Market Potential Customers

Potential customers for B2B Ecommerce Platforms span all entities involved in the wholesale exchange of goods and services, ranging from multinational manufacturers to small, specialized distributors seeking digital sales channels. The primary end-users, or buyers of the product, are Chief Information Officers (CIOs), Chief Digital Officers (CDOs), and E-commerce Managers within B2B organizations who are responsible for revenue generation, operational efficiency, and technological modernization. These decision-makers prioritize platforms that offer scalability, robust security features, deep integration capabilities with existing enterprise software stacks (SAP, Oracle, etc.), and industry-specific features crucial for handling complex product catalogs and pricing models common in their sectors.

The Manufacturing sector represents a massive pool of potential customers, particularly those looking to implement Direct-to-Customer (D2C) or Direct-to-Distributor strategies to gain greater control over their sales channels and customer data. Industrial equipment manufacturers, component suppliers, and automotive parts distributors require platforms capable of handling highly technical product configurations and long-term service contracts. Another significant customer base includes Wholesale Distributors, who leverage B2B platforms to streamline order management, reduce reliance on manual sales processes, and provide self-service ordering portals for their retail partners or sub-distributors, dramatically reducing administrative overhead and order error rates.

Furthermore, technology and professional services firms that require platforms for subscription management, complex service quoting, and client portal management also form a growing segment of potential customers. The increasing adoption of online marketplaces within the B2B space means that platforms offering multi-vendor capabilities are highly attractive to firms aspiring to build their own curated ecosystems for industry-specific procurement. Ultimately, any B2B entity recognizing the need for 24/7 self-service capabilities, enhanced transparency in pricing and inventory, and improved integration across the digital supply chain is a prime candidate for investment in advanced B2B ecommerce platform technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.7 billion |

| Market Forecast in 2033 | USD 28.5 billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Salesforce, Adobe, SAP, Oracle, Shopify, BigCommerce, Magento (Adobe), IBM, Wipro, HCLTech, Episerver (Optimizely), Commercetools, Kibo Commerce, Vaimo, Digital River, Insite Software, Unilog, Sana Commerce, Intershop, Elastic Path |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

B2B Ecommerce Platform Market Key Technology Landscape

The technology landscape of the B2B Ecommerce Platform Market is rapidly evolving, driven by the need for unprecedented flexibility, integration capabilities, and superior performance under high-load conditions. The most prominent technological shift is the widespread adoption of Headless Commerce architecture. This approach decouples the front-end presentation layer (the "head") from the back-end commerce engine (the "body"). This separation allows B2B organizations to utilize modern frameworks (like React or Vue.js) to build highly customized, fast-loading user interfaces (UIs) that can serve content across multiple touchpoints—websites, mobile apps, IoT devices, and digital kiosks—all managed by a single commerce API layer. This composable architecture facilitates faster innovation cycles and enables a true omnichannel experience, which is critical for meeting the increasingly sophisticated demands of modern B2B buyers who expect seamless transitions between different sales channels.

Another crucial technological development is the implementation of Microservices Architecture. Traditional monolithic B2B platforms struggled with complexity and slow updates; microservices break down the core platform into smaller, independent, and loosely coupled services (e.g., pricing service, inventory service, checkout service). Each service can be developed, deployed, and scaled independently, offering resilience and speed. When coupled with an API-First approach, microservices enable businesses to create a "best-of-breed" commerce stack, selecting specialized vendors for functions like advanced search (using technologies such as ElasticSearch) or sophisticated order management, rather than relying solely on a single platform vendor for all capabilities. This architectural evolution maximizes agility and minimizes system downtime during maintenance or updates, a non-negotiable requirement for high-volume B2B operations.

Furthermore, the integration of advanced data technologies and emerging concepts is defining competitive advantage. Progressive Web Apps (PWAs) are increasingly utilized to deliver app-like experiences on mobile browsers, crucial for sales representatives and field technicians who need reliable offline catalog and ordering capabilities. Blockchain technology is also gaining traction, particularly for supply chain transparency, secure payment processing, and verifying the provenance of goods, addressing critical B2B concerns regarding compliance and counterfeit products. Finally, the application of robust Cloud Computing infrastructure, predominantly through hyperscalers, ensures the necessary scale, reliability, and global reach for platforms handling massive transaction volumes and geographically dispersed user bases, forming the backbone of modern, elastic B2B commerce infrastructure.

Regional Highlights

- North America: North America holds the largest market share in the B2B Ecommerce Platform market, primarily due to the presence of numerous large enterprises, high early adoption rates of cloud technologies, and a mature digital infrastructure. The region is characterized by high levels of investment in sophisticated, integrated solutions that support complex enterprise architectures, particularly in the manufacturing and wholesale distribution sectors. Furthermore, North American businesses prioritize technological innovation such as Headless Commerce and AI-driven personalization, seeking competitive advantage through highly optimized customer experiences and automated sales workflows.

- Europe: Europe represents a significant and rapidly growing market, driven by the need for digital modernization across established industrial economies (Germany, UK, France) and the increasing focus on cross-border trade within the EU single market. European platform requirements are often stringent regarding compliance with regulatory standards, including GDPR for data privacy and localized VAT/taxation frameworks, necessitating flexible and legally compliant platform architecture. The trend here leans heavily towards SaaS models that facilitate rapid expansion into neighboring countries while maintaining local regulatory adherence and diverse language support.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR during the forecast period, fueled by rapid urbanization, massive growth in the SME sector, and increasing internet penetration, especially in emerging economies like India and Southeast Asia. Market dynamics in APAC are distinct, often emphasizing mobile-first commerce strategies, integration with regional payment methods, and strong participation in B2B marketplaces. The rapid digitalization of supply chains, particularly in China and South Korea, is compelling local and international vendors to offer scalable, highly localized platform solutions to capture the enormous untapped market potential across the region.

- Latin America (LATAM): The LATAM market is experiencing robust growth as local businesses seek to overcome traditional logistical challenges and high transactional costs associated with manual processes. Adoption is concentrated in countries like Brazil and Mexico. Key drivers include the desire for greater payment flexibility and streamlined inventory management. Platform vendors must address unique regional challenges, such such as fluctuating currency exchange rates and varying degrees of logistical infrastructure maturity, requiring localized feature sets and strong integration with regional banking systems.

- Middle East and Africa (MEA): The MEA market is still nascent but shows considerable potential, particularly driven by large-scale infrastructure projects and government-led digital economy initiatives in the GCC countries (UAE, Saudi Arabia). Investment in B2B platforms is critical for diversifying economies away from oil dependency and creating resilient non-oil supply chains. Platform adoption often focuses on logistics optimization and enabling regional trade hubs, with security and enterprise-grade reliability being primary concerns for major government and private sector clients.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the B2B Ecommerce Platform Market.- Salesforce

- Adobe

- SAP

- Oracle

- Shopify

- BigCommerce

- Magento (Adobe)

- IBM

- Wipro

- HCLTech

- Episerver (Optimizely)

- Commercetools

- Kibo Commerce

- Vaimo

- Digital River

- Insite Software

- Unilog

- Sana Commerce

- Intershop

- Elastic Path

- VTEX

Frequently Asked Questions

Analyze common user questions about the B2B Ecommerce Platform market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between B2B and B2C ecommerce platforms?

B2B platforms are designed for complex transactions involving negotiated pricing, volume discounts, account-specific catalogs, integrated procurement workflows, and diverse payment terms, often requiring deep integration with ERP and SCM systems, which are not necessary for standardized B2C transactions.

Which deployment model is dominating the B2B Ecommerce Platform Market?

The Software as a Service (SaaS) deployment model is currently dominating the market due to its cost-effectiveness, rapid deployment speed, automatic updates, and high scalability, making it the preferred choice for both SMEs and large enterprises seeking operational agility.

How is AI impacting B2B platform functionality?

AI is primarily used to enhance operational efficiency and personalization through predictive analytics for demand forecasting, dynamic pricing optimization, automating complex quoting processes (CPQ), and providing sophisticated, intelligent product recommendations tailored to specific buyer history and account needs.

What is Headless Commerce and why is it important for B2B?

Headless Commerce is an architectural approach that separates the customer-facing presentation layer from the back-end commerce engine using APIs. It is crucial for B2B because it allows organizations to deliver consistent, customized experiences across multiple touchpoints—web, mobile, IoT—without being constrained by monolithic platform limitations.

Which regions are driving the highest growth in B2B platform adoption?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by massive digital transformation efforts, significant growth of the SME sector, and increasing demand for mobile-optimized commerce solutions across high-growth economies.

What are the main restraints affecting market growth?

Key restraints include the substantial initial capital investment required for comprehensive enterprise-level implementations, the complexity and time needed to integrate new platforms with existing legacy ERP systems, and the persistent global shortage of specialized IT talent proficient in modern B2B platform technologies.

What role do microservices play in modern B2B platforms?

Microservices break down large platform applications into smaller, independently manageable services. This architecture enhances platform resilience, speeds up deployment and iteration cycles, and allows businesses to create flexible, best-of-breed commerce stacks by integrating specialized services from multiple vendors via APIs.

Who are the primary potential customers for B2B Ecommerce Platforms?

The primary potential customers are B2B organizations, particularly within the Manufacturing, Wholesale Distribution, and Industrial Equipment sectors, seeking to modernize their sales channels, automate procurement processes, and provide self-service functionalities to their institutional buyers and partners.

How does the B2B market address cross-border trade complexities?

B2B platforms address cross-border complexities by offering built-in capabilities for multi-currency handling, localized language support, automated calculation of regional taxes (like VAT and GST), compliance checks for international trade regulations, and integration with global logistics providers.

Is there an increasing trend toward vertical-specific B2B platforms?

Yes, there is a strong trend toward vertical specialization. Vendors are increasingly developing platforms tailored to the unique operational demands of specific industries, such as life sciences (requiring regulatory compliance features) or automotive (demanding complex parts catalog management and VIN integration).

What impact does digital transformation have on platform adoption?

Digital transformation acts as the primary driver for platform adoption, as businesses recognize that moving core sales and procurement functions online is essential for survival, efficiency gains, and meeting the digital-first expectations set by modern business buyers who prefer self-service options.

How do B2B platforms facilitate omnichannel experience?

Platforms facilitate an omnichannel experience by ensuring that pricing, inventory, customer history, and order status data are synchronized and accessible across all sales channels—whether a web portal, a mobile application, a field sales representative's tablet, or a physical store/warehouse counter—providing a unified buying journey.

What is the significance of API-First strategy in B2B commerce?

An API-First strategy means the platform's core functionalities are exposed entirely through robust APIs. This is significant as it maximizes interoperability, allowing businesses to easily integrate the commerce engine with any third-party software (CMS, ERP, PIM) and customize the front-end user experience without core system modification.

Do SMEs use B2B ecommerce platforms?

Yes, SMEs are increasingly adopting B2B ecommerce platforms, often favoring scalable, subscription-based SaaS solutions. These platforms enable SMEs to compete effectively with larger players by automating processes, expanding their geographic reach, and providing professional, self-service ordering portals without major upfront capital expenditure.

What security concerns are most relevant to B2B platforms?

The most relevant security concerns include protecting sensitive customer data, securing complex payment transactions (often large volume), ensuring compliance with international data residency laws (like GDPR), and safeguarding against sophisticated phishing and account takeover attacks targeting high-value corporate accounts.

How does the value chain analysis help in understanding the market?

Value chain analysis helps identify the key stages, from core technology provision (upstream) to platform implementation and distribution (midstream), and finally, end-user adoption (downstream). It highlights where value is created, where costs are incurred, and the dependencies between technology providers and system integrators.

What role does blockchain play in the B2B platform ecosystem?

Blockchain is utilized to enhance supply chain transparency and traceability, providing immutable records of product origins and transactions. It also aids in secure digital contracting, smart contracts execution, and establishing trust among multiple trading partners without requiring a central authority.

What are the typical growth drivers in the APAC region?

Growth drivers in APAC include rising internet and mobile penetration rates, increasing government support for digitalization of trade, the booming expansion of the SME segment, and a strong cultural preference for mobile commerce, all accelerating the demand for scalable B2B digital solutions.

How do B2B platforms handle complex pricing structures?

B2B platforms handle complex pricing by supporting sophisticated rule engines that allow for tiered pricing based on volume, account-specific negotiated contracts, user role-based pricing display, localized tax calculations, and dynamic adjustments based on inventory levels or supplier costs.

What are the opportunities associated with B2B marketplaces?

Opportunities lie in the ability for businesses to launch their own curated, multi-vendor marketplaces, expanding their product offerings beyond their own inventory and establishing themselves as industry hubs. This creates new revenue streams, increases customer engagement, and drives network effects within specialized vertical markets.

Is there a difference in platform adoption between North America and Europe?

While both markets are mature, North America often leads in early adoption of highly innovative and custom solutions (like Headless Commerce), whereas Europe places a higher emphasis on platform compliance with complex, multi-jurisdictional regulatory frameworks and supporting diverse language requirements for seamless cross-border commerce.

What considerations are important when selecting a B2B platform vendor?

Key considerations include the platform's ability to integrate deeply with existing ERP/CRM systems, its scalability to handle projected growth, native support for complex B2B features (like CPQ and account hierarchies), vendor support capabilities, and the flexibility of its architectural approach (e.g., microservices or monolithic).

How does the B2B buyer expectation influence platform development?

B2B buyer expectations, increasingly modeled after seamless B2C experiences, drive platform developers to prioritize user-friendly interfaces, advanced search functionality, personalized dashboards, transparent inventory visibility, and high mobile responsiveness to ensure a frictionless, professional procurement process.

What is a key impact force shaping competitive dynamics?

The adoption of composable and API-First architecture is a key impact force. It lowers the barriers to entry for specialized software vendors and increases competitive pressure on traditional monolithic vendors, forcing the entire industry to prioritize flexibility and interoperability over proprietary, all-in-one solutions.

How do B2B platforms improve operational efficiency?

Operational efficiency is improved by automating manual processes such as order entry, quote generation, invoice processing, and inventory lookups. This reduces administrative overhead, minimizes human errors in ordering and fulfillment, and allows sales teams to focus on strategic relationship building rather than routine transactions.

What is the role of system integrators in the market?

System integrators are crucial for the successful implementation and customization of complex B2B platforms. They bridge the gap between off-the-shelf software and a company’s proprietary business processes, handling complex integrations with legacy systems (ERP, WMS) and ensuring the platform meets highly specific operational needs.

How does the market define Large Enterprises versus SMEs?

Large Enterprises are typically defined by annual revenue exceeding 1 billion USD and/or employee counts exceeding 1,000, requiring highly robust, customized, and globally scalable platforms. SMEs encompass businesses below these thresholds, often prioritizing rapid, cost-effective SaaS implementations.

What emerging technology helps with supply chain logistics in B2B?

Emerging technologies like IoT sensors integrated with the B2B platform provide real-time tracking and logistics visibility. Combined with AI, this enables predictive logistics management, optimizing shipping routes, proactively alerting customers to delivery delays, and improving overall supply chain reliability.

How are B2B sales teams adapting to the rise of platforms?

B2B sales teams are shifting from being transactional order-takers to strategic consultants. Platforms handle routine orders, allowing sales reps to focus on complex negotiations, strategic account planning, custom solution configuration, and relationship management, leveraging platform data to inform their strategies.

What differentiates PaaS from SaaS in B2B ecommerce?

SaaS offers a fully managed, subscription-based solution requiring minimal client IT involvement, ideal for standardized needs. PaaS provides the underlying cloud infrastructure and development tools, giving the client greater control and customization ability over the application code and deployment environment, suitable for highly specialized enterprise needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager