B2B Floor Cleaning Robots Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432460 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

B2B Floor Cleaning Robots Market Size

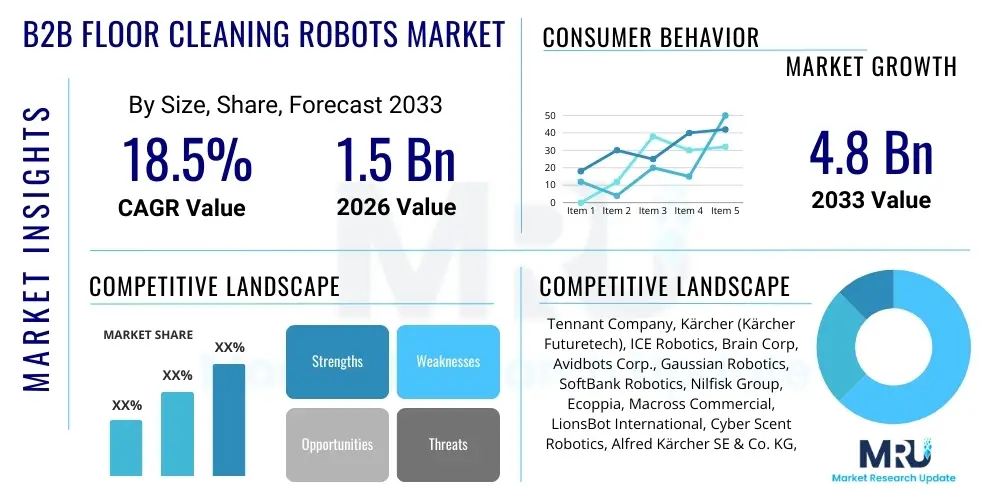

The B2B Floor Cleaning Robots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 4.8 Billion by the end of the forecast period in 2033.

B2B Floor Cleaning Robots Market introduction

The B2B Floor Cleaning Robots Market encompasses autonomous devices designed specifically for commercial and industrial floor maintenance tasks, addressing critical needs across various sectors such as retail, healthcare, hospitality, manufacturing, and logistics. These robotic systems, often utilizing advanced Simultaneous Localization and Mapping (SLAM) technology, LiDAR, and vision sensors, automate repetitive and labor-intensive cleaning processes, thereby enhancing efficiency, consistency, and hygiene standards in large commercial spaces. The primary product descriptions include robotic scrubbers, sweepers, vacuums, and specialized disinfection robots, tailored to handle diverse floor types and operational environments, ranging from polished hospital corridors to abrasive warehouse floors.

Major applications of these systems span general area cleaning in shopping malls and airports, sterile cleaning in hospital operating theatres, and routine maintenance in corporate offices and educational institutions. The fundamental benefits driving market adoption are substantial reductions in operational costs associated with manual labor, improved cleaning quality consistency 24/7, and enhanced worker safety by minimizing human exposure to hazardous cleaning chemicals or large machinery. Furthermore, these robots provide detailed reporting and data analytics on cleaning performance and coverage, which is increasingly vital for compliance and facility management optimization.

Driving factors for the rapid expansion of this market include the persistent global shortage of manual labor willing to undertake rigorous cleaning tasks, coupled with rising labor costs across developed economies, making automation a critical economic imperative. Additionally, the heightened focus on facility hygiene and sanitation standards, particularly post-pandemic, has catalyzed the deployment of autonomous solutions capable of delivering verifiable and consistent cleaning results. Technological advancements in battery life, sensor accuracy, AI-driven navigation, and fleet management systems are continually lowering the total cost of ownership (TCO) and increasing the return on investment (ROI) for adopting these sophisticated B2B cleaning solutions, solidifying their role as indispensable tools in modern facility management.

B2B Floor Cleaning Robots Market Executive Summary

The B2B Floor Cleaning Robots Market is experiencing robust acceleration, fueled by the compelling economic case for automation in commercial environments facing acute labor shortages and escalating wage pressures. Current business trends indicate a strong shift towards Robot-as-a-Service (RaaS) models, allowing businesses to adopt high-capital equipment without significant upfront investment, thereby broadening market access for Small and Medium Enterprises (SMEs). Furthermore, strategic mergers and acquisitions among traditional cleaning equipment manufacturers and specialized robotics firms are consolidating the market landscape, leading to more comprehensive product portfolios that integrate cleaning hardware with sophisticated software analytics for enhanced fleet management and operational reporting. Innovation is centered on improving operational uptime, maximizing energy efficiency, and achieving superior deep cleaning capabilities through hybrid robot designs that can perform multiple cleaning tasks simultaneously, ensuring minimal disruption to business operations.

Regionally, North America and Europe currently dominate the market, primarily due to high labor costs, early technological adoption curves, and stringent regulatory standards regarding workplace safety and cleanliness in sectors like healthcare and food processing. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, propelled by rapid urbanization, massive infrastructural development (e.g., airports, metro systems, large retail complexes), and increasing adoption in manufacturing hubs where consistency and precision cleaning are paramount for quality control. Government initiatives supporting smart city infrastructure and industrial automation in countries like China, Japan, and South Korea are instrumental in driving this regional expansion, often focusing on localized manufacturing and supply chain resilience for robotic components.

Segment trends reveal that the robotic scrubber segment holds the largest market share, essential for maintaining large, hard floor surfaces prevalent in retail and logistics, while the autonomous vacuum segment is witnessing rapid adoption in corporate and hospitality settings due to its quiet operation and versatility. Technology-wise, the integration of 3D vision systems and advanced AI for obstacle avoidance and dynamic path planning is becoming standard, moving beyond simple programmed routes to achieve true adaptive navigation in complex, crowded environments. The healthcare end-user segment is experiencing exceptional growth, driven not just by general cleaning needs but by the increasing demand for UV-C or chemical-based autonomous disinfection robots that provide measurable pathogen reduction, thus expanding the robot's utility beyond mere aesthetic maintenance into critical hygiene management.

AI Impact Analysis on B2B Floor Cleaning Robots Market

Common user inquiries regarding AI’s influence on the B2B Floor Cleaning Robots Market frequently center on performance metrics, operational efficiency, and the ability of robots to handle real-world unpredictability. Users often ask: "How does AI improve cleaning coverage and path planning in dynamic environments?", "Can AI-driven robots integrate seamlessly with existing smart building management systems (BMS)?", and "What is the role of machine learning in predictive maintenance and reducing robot downtime?". Analysis of these concerns reveals a strong user expectation for robots that are not merely automated but truly autonomous, capable of making intelligent, real-time decisions. Key themes include the need for superior navigation robustness (handling spontaneous obstacles or changes in facility layout), the desire for actionable data insights (optimizing cleaning schedules based on traffic patterns), and the necessity of proactive diagnostics to maximize uptime and TCO.

The core expectation is that AI will transform robots from simple programmed machines into self-optimizing members of the cleaning workforce. Facility managers demand systems that use machine learning to identify high-traffic zones over time, automatically adjust cleaning intensity (e.g., using more water or stronger scrubbing pads) based on perceived dirtiness, and dynamically re-route around temporary hazards or human activity. Furthermore, there is significant interest in how deep learning algorithms can process data from diverse sensor arrays (LiDAR, cameras, ultrasonic) to minimize collisions and reduce the need for human intervention, which is currently a significant constraint on true autonomy.

Ultimately, the impact of AI is viewed through the lens of maximizing ROI and reliability. Users are less concerned with the underlying algorithms and more focused on practical outcomes: a robot that cleans faster, misses fewer spots, requires less supervision, and signals maintenance needs before critical failure occurs. This drive for operational excellence is cementing AI—particularly simultaneous localization and mapping (SLAM), deep learning for object recognition, and predictive analytics—as the single most critical differentiator in the highly competitive B2B cleaning robotics ecosystem, transforming capital expenditure into verifiable productivity gains.

- Enhanced Simultaneous Localization and Mapping (SLAM) for superior, accurate navigation in complex and dynamic commercial environments.

- Predictive Maintenance implemented via machine learning to analyze usage patterns and sensor data, significantly reducing unplanned robot downtime.

- AI-driven optimization of cleaning routes based on real-time occupancy data and historical dirt accumulation patterns (heatmaps).

- Improved object recognition and classification using deep learning, enabling sophisticated obstacle avoidance and safe interaction with humans and property.

- Autonomous anomaly detection, allowing robots to identify spills, vandalism, or misplaced items and flag them for facility management intervention.

- Seamless integration with Building Management Systems (BMS) and IoT platforms for centralized scheduling and resource management.

DRO & Impact Forces Of B2B Floor Cleaning Robots Market

The market dynamics of B2B Floor Cleaning Robots are shaped by a potent combination of macroeconomic drivers and technical constraints, while opportunities arise from emerging technologies and service models. The central driver is the pervasive and increasing shortage of affordable labor for janitorial services worldwide, pushing operational costs to unsustainable levels for large facilities, thereby making the high initial investment in robotics economically viable over the long term. This is powerfully complemented by stringent regulatory requirements and heightened public expectations for verifiable hygiene levels, particularly in sensitive sectors like healthcare and food service. Technological progress, specifically in battery chemistry (extended run times) and navigation reliability (SLAM accuracy), further reduces the friction associated with adoption. Collectively, these forces create a substantial market pull, compelling facility operators to embrace autonomous solutions to maintain competitive operational costs and cleanliness standards simultaneously.

However, the market faces significant restraints that slow universal adoption. The primary hurdle is the high initial capital expenditure (CapEx) required to purchase and deploy large robotic fleets, posing a financial barrier for smaller enterprises or those with tight operational budgets, although RaaS models are mitigating this issue. Technical constraints include the difficulty robots still face in handling highly complex, non-standard environments—such as staircases, elevators without direct integration, or heavily cluttered spaces—necessitating human supervision for completion tasks. Furthermore, cybersecurity concerns related to data collected by these networked devices (floor plans, schedules, occupancy data) represent a growing constraint, requiring robust security protocols and compliance which adds to system complexity and cost.

The most compelling opportunities lie in the expansion of Robot-as-a-Service (RaaS) models, which transform CapEx into predictable Operational Expenditure (OpEx), significantly lowering the entry barrier and accelerating SME adoption. Specialized applications represent another major opportunity, including autonomous floor stripping, waxing, and autonomous chemical dispensing specifically tailored for pathogen reduction, moving beyond simple vacuuming or scrubbing. The increasing sophistication of fleet management software, enabling remote diagnostics, predictive maintenance, and multi-robot coordination, will be crucial. These technological advancements offer a pathway for vendors to provide complete, integrated facility management solutions rather than just selling hardware, positioning them to capture higher-margin service revenue streams and ensuring market resilience through recurring service contracts.

Segmentation Analysis

The B2B Floor Cleaning Robots Market is highly segmented across several critical dimensions, reflecting the diverse cleaning needs and technological requirements of commercial environments. Key segmentation variables include the type of product (robotic scrubbers, sweepers, vacuums), the type of technology employed (LiDAR, Vision-based, Ultrasonic), the cleaning capability (dry, wet, disinfection), and the primary end-use industry (Healthcare, Retail, Hospitality, Manufacturing, etc.). Understanding these segments is crucial as different industries prioritize different robotic attributes; for example, healthcare facilities prioritize high-grade disinfection and verifiable coverage, while logistics warehouses prioritize speed and endurance on large, unobstructed floor areas. This complexity drives manufacturers to develop highly specialized models rather than generalized solutions, leading to market fragmentation and specialized value propositions designed for distinct operational challenges. The growth in the disinfection segment, driven by new public health concerns, represents a strategic shift in capabilities.

The differentiation in segmentation is not merely product-based but deeply rooted in technological choice and integration. Scrubbers, the largest segment, rely heavily on robust fluid management and contact force control, often utilizing LiDAR/SLAM for navigating large retail aisles or airport concourses. In contrast, autonomous vacuums deployed in corporate settings prioritize low noise emission and vision-based systems for discrete operation in carpeted offices. The service delivery model, segmented into outright purchase versus RaaS, also heavily influences market penetration. RaaS is particularly dominant among new adopters and smaller businesses, providing flexibility and guaranteed uptime, while large corporations with mature maintenance departments often prefer outright purchase to maintain direct control over assets and integration with existing IT infrastructure. The ongoing evolution of sensors and AI capabilities continuously blurs the lines between segments, enabling future multi-functional platforms.

- By Product Type:

- Robotic Scrubbers

- Robotic Sweepers

- Robotic Vacuums

- Multi-functional/Hybrid Robots

- Disinfection Robots (UV-C, Chemical Spray)

- By Technology:

- LiDAR (Light Detection and Ranging)

- Vision-Based (VSLAM, Camera/AI)

- Ultrasonic/Infrared Sensors

- By Cleaning Type:

- Wet Cleaning

- Dry Cleaning

- Disinfection and Sanitization

- By End-Use Industry:

- Retail and E-commerce

- Healthcare and Pharmaceutical

- Hospitality (Hotels, Casinos)

- Education and Government

- Manufacturing and Logistics (Warehousing)

- Corporate Offices and Commercial Buildings

- By Sales Channel/Model:

- Outright Purchase

- Robot-as-a-Service (RaaS)

Value Chain Analysis For B2B Floor Cleaning Robots Market

The value chain for the B2B Floor Cleaning Robots Market is complex, involving specialized technological components, sophisticated manufacturing, and strategic distribution networks designed to deliver high-touch service and maintenance. The upstream segment is dominated by critical technology suppliers, including providers of advanced sensors (LiDAR, high-resolution cameras, 3D vision systems), specialized AI and SLAM software developers, battery manufacturers (particularly high-capacity Lithium-ion packs), and sophisticated motor and motion control system producers. The ability to source reliable, cost-effective, and cutting-edge components directly dictates the final performance and pricing of the robotic system. Key OEMs (Original Equipment Manufacturers) integrate these components, focusing heavily on robust mechanical design, waterproofing, and industrial durability suitable for continuous commercial operation, alongside the development of proprietary fleet management software that is vital for competitive advantage.

The downstream activities involve distribution and extensive post-sales support. Distribution channels are typically segmented into direct sales, especially for large institutional clients (e.g., major airport authorities or national hospital networks), and indirect sales through highly specialized industrial equipment distributors and facility management service providers (FMSPs). These distributors often bundle the robots with consumables, training, and routine maintenance contracts, adding significant value. A crucial and rapidly growing part of the downstream value chain is the provision of RaaS (Robot-as-a-Service), managed either directly by the OEM or through certified partners. This model requires sophisticated remote monitoring and rapid response technical teams, shifting the economic burden and technological complexity from the end-user to the service provider, thus accelerating market adoption.

The success of the entire value chain hinges on effective, reliable service delivery. Due to the high-tech nature and constant operational requirements of B2B cleaning robots, the indirect distribution channel, particularly those partners capable of offering local technical support and preventive maintenance, remains extremely important. Direct channels are leveraged for securing high-volume, enterprise-level contracts where customized software integration and data security requirements are paramount. Effective coordination across the value chain, from component standardization upstream to guaranteed uptime downstream, is essential for maintaining brand reputation and achieving sustained profitability in this highly specialized industrial market.

B2B Floor Cleaning Robots Market Potential Customers

The primary customers and end-users of B2B Floor Cleaning Robots are enterprises across numerous commercial and institutional sectors characterized by expansive floor areas, high foot traffic, and stringent hygiene requirements, coupled with intense pressure to minimize operational labor costs. Key buyers include facility management departments of large retail chains, which require 24/7 cleaning of thousands of square meters of space, and logistics/e-commerce fulfillment centers, where cleaning dust and debris is vital for maintaining automation equipment integrity. The healthcare sector, encompassing hospitals, clinics, and long-term care facilities, represents a premium customer segment, driven by the critical need for verifiable sanitation and the increasing adoption of disinfection robots to combat healthcare-associated infections (HAIs).

Another major cohort of potential customers resides within the travel and leisure sector, including large international airports, train stations, convention centers, and high-end hotel chains. In these environments, the robot's ability to maintain a consistently high aesthetic standard while operating discreetly during peak hours is highly valued. Furthermore, the education sector (universities and large school districts) and corporate campuses (large tech parks and financial headquarters) are significant adopters, seeking to standardize maintenance quality across multiple buildings while managing constrained public or corporate cleaning budgets. The shift towards autonomous systems in these spaces is not just a cost-saving measure, but a strategic investment in employee and patron well-being, supported by data demonstrating cleaning coverage and adherence to schedules.

The buying decision process for these customers is typically centralized within facility management, procurement, or operations departments, focusing heavily on total cost of ownership (TCO), demonstrated reliability and uptime metrics, and the ease of integration with existing building infrastructure. Increasingly, the software component—specifically fleet management capabilities, reporting dashboards, and API integration capabilities—is a decisive factor, often outweighing minor differences in hardware specifications. Customers seek long-term partnerships with vendors who can provide ongoing software updates, flexible RaaS financing, and regionalized, rapid technical support to ensure minimal disruption to continuous business operations, positioning potential customers as demanding sophisticated, turnkey automation solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tennant Company, Kärcher (Kärcher Futuretech), ICE Robotics, Brain Corp, Avidbots Corp., Gaussian Robotics, SoftBank Robotics, Nilfisk Group, Ecoppia, Macross Commercial, LionsBot International, Cyber Scent Robotics, Alfred Kärcher SE & Co. KG, Intellibot Robotics (Taski), Whiz by SoftBank, Exyn Technologies, MESA Robotics, Hako Group, Diversey, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

B2B Floor Cleaning Robots Market Key Technology Landscape

The technological landscape of the B2B Floor Cleaning Robots Market is defined by the synergistic integration of advanced sensing, artificial intelligence, and robust electromechanical design, aimed at achieving high levels of reliability and autonomy in complex commercial environments. Central to this advancement is the refinement of Simultaneous Localization and Mapping (SLAM) technology, which allows robots to build a map of their surroundings while simultaneously tracking their location within it. Modern SLAM implementation leverages sensor fusion, combining input from LiDAR (superior for long-range, accurate mapping), 3D cameras (essential for fine object detection and classification), and ultrasonic sensors (critical for close-range anti-collision). The shift from 2D LiDAR to 3D sensing is a key trend, providing rich environmental data that allows robots to identify overhead obstacles, navigate sloped surfaces, and better differentiate between temporary human presence and permanent fixtures, dramatically reducing operational interruptions and increasing safety standards required by facility managers.

Furthermore, the market relies heavily on sophisticated fleet management and connectivity solutions, primarily based on IoT infrastructure. These systems enable facility managers to centrally monitor, schedule, and update entire fleets of robots across multiple locations via cloud platforms, ensuring standardized performance and data collection. Telemetry data, including operational hours, cleaning metrics (water usage, coverage rate), and system diagnostics, is streamed in real-time. This connectivity supports the critical function of predictive maintenance, where machine learning algorithms analyze operational data to forecast component failure (e.g., brush wear, motor heat spikes) before it occurs, drastically minimizing unplanned robot downtime—a major value proposition for commercial users focused on maximizing asset utilization. Secure, low-latency network connectivity (often utilizing 4G/5G technology for remote sites) is mandatory for maintaining continuous operational integrity.

Power management and cleaning effectiveness technologies are also central to the landscape. Battery technology, mainly high-density, fast-charging Lithium Iron Phosphate (LiFePO4) or advanced Lithium-ion chemistries, has significantly extended robot run times, enabling all-day operation with minimal breaks. In terms of cleaning mechanism, innovation focuses on adaptive cleaning intensity: robots now utilize advanced actuators and control systems that automatically adjust brush pressure, water flow, and chemical concentration based on the sensor-detected type and severity of soiling. Additionally, the increasing integration of autonomous docking and automatic waste disposal/refilling systems is critical, moving the robot closer to truly lights-out, unsupervised operation, reducing the human labor required for maintenance and enabling continuous cycling, which is the ultimate goal for high-efficiency facility management.

Regional Highlights

- North America: Market Leader Driven by Labor Economics and Early Adoption

North America currently holds the largest share of the B2B Floor Cleaning Robots Market, a dominance rooted in the region’s high prevailing labor costs and a pervasive shortage of janitorial staff, making the investment in automation highly economical. The region’s market is characterized by early and aggressive adoption across diverse sectors, particularly retail, large corporate campuses, and warehousing/logistics operations driven by the massive expansion of e-commerce giants. Facility managers in the U.S. and Canada are often early adopters of high-end robotics incorporating the latest AI and connectivity features, prioritizing seamless integration with existing smart building infrastructure and demanding detailed ROI metrics based on labor displacement.

The market environment is highly competitive, featuring both established global cleaning equipment manufacturers and innovative, VC-backed robotics startups. Regulatory frameworks, particularly concerning workplace safety and increasing sustainability mandates, also favor autonomous solutions that use precise dosing of water and chemicals. The U.S. healthcare sector is a particularly strong growth driver, implementing autonomous scrubbers and UV-C disinfection robots rapidly to meet increasingly stringent cleaning verification standards. This proactive approach to automation, coupled with substantial capital availability for technology investment, ensures North America’s continued leadership in terms of both deployment volume and technological demand, focusing heavily on RaaS models to accelerate SME penetration.

- Europe: Focus on Hygiene Standards and Regulatory Compliance

Europe represents a mature and technologically sophisticated market, where adoption is strongly influenced by strict public health regulations, high occupational safety standards, and sustainability goals. Key drivers in Europe include the high cost of manual labor, similar to North America, but also a cultural emphasis on quality and environmental stewardship. Countries like Germany, the Nordics, and the UK are rapid adopters, with a preference for robots designed for energy efficiency, minimal noise output (critical for daytime cleaning), and verifiable use of ecological cleaning agents.

The market dynamics are characterized by strong penetration in airports, railway stations, and the manufacturing sector, especially automotive production facilities where clean floors are essential for preventing quality control defects. European consumers demand robust data privacy and security compliance, which requires robotic platforms to adhere strictly to GDPR, impacting how sensor data (including potential video feeds) is managed and stored. While adoption is robust, fragmentation across different European countries in terms of language support, service infrastructure, and specific regulatory nuances presents a unique challenge, necessitating localized service models and multilingual user interfaces for effective market scale.

- Asia Pacific (APAC): Fastest Growth Driven by Infrastructure and Urbanization

The Asia Pacific region is forecast to be the fastest-growing market globally, propelled by unparalleled rates of urbanization, massive governmental investment in modern infrastructure (e.g., new smart cities, extensive metro systems, and mega-airports), and the rapid expansion of the manufacturing and logistics sectors. While labor costs in some emerging economies are lower than in the West, the sheer scale of cleaning operations required in APAC's new facilities necessitates automation for efficiency and consistency, especially in high-traffic hubs like China, India, Japan, and South Korea.

Japan and South Korea lead in adopting highly advanced, high-tech robotics, often driven by domestic technological capabilities and facing some of the world's most acute aging workforces, making automation a demographic necessity. China dominates in terms of sheer market potential and localized manufacturing capacity, often fostering a highly competitive domestic robotics industry focused on rapid scale and cost-effectiveness. The key challenge in APAC remains navigating the diverse regulatory landscapes and infrastructural maturity levels across the region, requiring vendors to develop adaptable solutions suitable for both cutting-edge smart buildings and older industrial complexes. However, the sheer volume of new commercial space coming online ensures explosive demand for autonomous cleaning solutions.

- Latin America and MEA: Emerging Markets with High Potential

Latin America and the Middle East & Africa (MEA) represent emerging markets characterized by significant investments in hospitality, tourism infrastructure, and large commercial developments (e.g., GCC national projects). Adoption in these regions is driven by a desire for world-class facility aesthetics and, increasingly in MEA, a reliance on expatriate labor, making automated solutions attractive for long-term operational stability and cost predictability. The growth trajectory is steep but starting from a lower base compared to North America and Europe.

In MEA, the luxury retail and hospitality sectors in the UAE, Saudi Arabia, and Qatar are primary adopters, seeking premium, reliable cleaning services to match their high service standards. In Latin America, economic volatility and currency fluctuations can make high CapEx purchases challenging, favoring flexible RaaS models. However, increasing standardization of facility management practices in major economies like Brazil and Mexico is paving the way for wider acceptance, focusing initially on large-scale logistics and airport facilities where continuous operation provides a clear and immediate ROI justification.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the B2B Floor Cleaning Robots Market.- Tennant Company

- Kärcher (Kärcher Futuretech)

- ICE Robotics

- Brain Corp

- Avidbots Corp.

- Gaussian Robotics

- SoftBank Robotics

- Nilfisk Group

- Ecoppia

- Macross Commercial

- LionsBot International

- Cyber Scent Robotics

- Alfred Kärcher SE & Co. KG

- Intellibot Robotics (Taski)

- Whiz by SoftBank

- Exyn Technologies

- MESA Robotics

- Hako Group

- Diversey, Inc.

- D Robotics

Frequently Asked Questions

Analyze common user questions about the B2B Floor Cleaning Robots market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high adoption rate of B2B cleaning robots?

The central driver is the persistent and increasing global shortage of affordable manual labor for janitorial services, coupled with rising operational costs, making automation essential for maintaining economic viability and consistent facility cleanliness standards across large commercial and industrial sites.

How do B2B cleaning robots ensure safety and navigation in environments with high human traffic?

Modern B2B robots utilize sophisticated sensor fusion, combining LiDAR, 3D vision systems, and AI-driven deep learning algorithms to achieve highly accurate Simultaneous Localization and Mapping (SLAM). This allows for dynamic path planning, real-time obstacle avoidance, and safe interaction with people and temporary clutter, adhering strictly to commercial safety protocols.

What is the significance of the Robot-as-a-Service (RaaS) model in this market?

The RaaS model is critical as it transforms the high upfront capital expenditure (CapEx) associated with purchasing robotics into a predictable operating expense (OpEx). This significantly lowers the financial barrier to entry, accelerates adoption among SMEs, and guarantees uptime through vendor-provided maintenance and software updates.

Which end-use industry is witnessing the fastest growth in robot deployment?

The healthcare and logistics sectors are experiencing the fastest growth. Healthcare demand is driven by the need for verifiable, automated disinfection and hygiene compliance, while logistics and e-commerce facilities use robots to maintain vast warehouse floors essential for automated material handling systems.

What role does AI play in optimizing the performance of B2B floor cleaning robots?

AI, through machine learning, optimizes cleaning performance by generating usage heatmaps, dynamically adjusting cleaning intensity based on perceived dirtiness, and enabling predictive maintenance by analyzing component health data, thereby maximizing robot uptime and overall cleaning efficacy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager