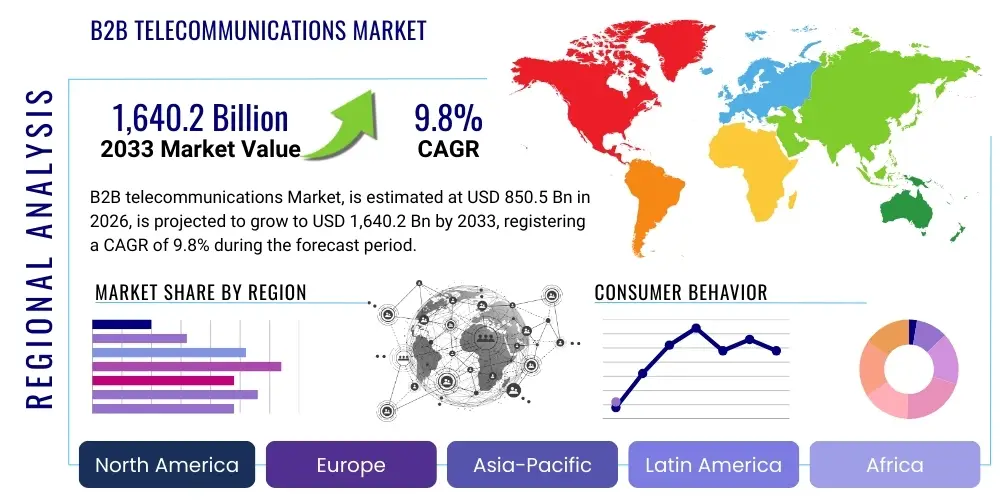

B2B telecommunications Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438439 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

B2B telecommunications Market Size

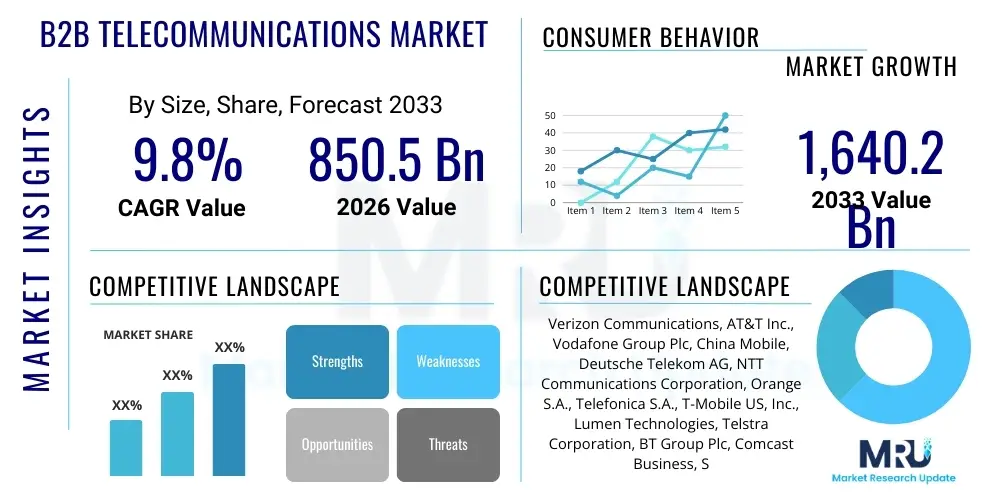

The B2B telecommunications Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 850.5 Billion in 2026 and is projected to reach USD 1,640.2 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the escalating demand for digital transformation initiatives across all major industries, requiring high-bandwidth, low-latency connectivity, and sophisticated managed services. Enterprises are shifting from traditional hardware-centric models to software-defined networking (SDN) and cloud-based communication platforms, creating robust revenue streams for telecommunication providers capable of offering integrated solutions.

Market growth is highly concentrated in the adoption of advanced network technologies such as 5G and Fiber-to-the-Enterprise (FTTE), which enable next-generation applications like industrial IoT, smart manufacturing, and remote operations. Furthermore, the pervasive trend of remote work and hybrid business models necessitates resilient and scalable unified communications as a service (UCaaS) solutions. Telcos are capitalizing on these demands by positioning themselves as crucial digital infrastructure partners, moving beyond mere connectivity provision to offering full-stack cybersecurity and cloud orchestration services.

B2B telecommunications Market introduction

The B2B telecommunications market encompasses the provision of connectivity, communication, and networking solutions specifically designed for enterprise use, including small, medium, and large businesses across various sectors. This market offers a diverse product portfolio, ranging from foundational services like fixed-line voice and high-speed data transmission to highly sophisticated managed services such as Software-Defined Wide Area Networks (SD-WAN), private 5G networks, cloud computing access, and robust cybersecurity packages. The primary objective of these services is to enhance operational efficiency, ensure data security, facilitate seamless collaboration, and support complex digital architectures necessary for modern business operations.

Major applications of B2B telecommunications span vertical sectors including financial services, healthcare, manufacturing, and retail. For instance, in manufacturing, 5G-enabled private networks support low-latency automation and real-time monitoring of industrial IoT (IIoT) sensors, while financial institutions rely heavily on secured, dedicated lines for high-frequency trading and transactional data transfer. Key benefits derived by businesses include improved scalability, reduced capital expenditure through OpEx-based consumption models (e.g., SaaS), enhanced business continuity through redundant network architectures, and a significant acceleration in digital transformation timelines.

Driving factors propelling this market include the global surge in cloud computing adoption, which mandates reliable high-speed dedicated connections, and the exponential growth of data traffic necessitating greater bandwidth capacity. The widespread deployment of 5G infrastructure, offering unprecedented speeds and extremely low latency, is opening new avenues for complex B2B applications, particularly in edge computing environments. Additionally, the increasing complexity of regulatory requirements and the rising threat landscape force businesses to seek integrated, secure managed communication services, further stimulating market expansion and service diversification among telco providers.

B2B telecommunications Market Executive Summary

The B2B telecommunications market is currently undergoing a structural transformation characterized by the convergence of connectivity and IT services, driven by enterprises prioritizing digital agility. Business trends indicate a significant shift away from traditional fixed-line revenues towards high-margin, flexible managed services, specifically centered around cloud communications (UCaaS, CPaaS) and advanced networking solutions like SD-WAN and Secure Access Service Edge (SASE). Strategic mergers and acquisitions are frequent as incumbent telecommunication giants seek to acquire specialized cloud and cybersecurity capabilities to offer end-to-end digital solutions. Furthermore, the rising adoption of consumption-based pricing models is enhancing customer stickiness and providing predictable recurring revenues for service providers, fundamentally reshaping competitive dynamics.

Regionally, North America and Europe maintain dominance due to early adoption of advanced technologies like 5G and established cloud infrastructure, driving demand for complex managed IoT and network virtualization services. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, fueled by aggressive government investments in digital infrastructure, rapid industrialization, and massive penetration of mobile data services across emerging economies. Latin America and MEA are seeing substantial investment in fiber optics and satellite connectivity to address connectivity gaps, primarily focusing on serving the expanding SME segment with affordable and reliable basic and unified communication solutions.

In terms of segmentation, the data services segment remains the largest revenue contributor, but the managed services segment, encompassing network management, security, and cloud solutions, is projected to exhibit the highest Compound Annual Growth Rate (CAGR). Enterprise size analysis highlights that while large enterprises are the primary consumers of bespoke private networks and extensive managed security portfolios, the Small and Medium Enterprise (SME) segment represents a high-growth opportunity, largely driven by the adoption of cost-effective, readily deployable UCaaS and bundled fixed-mobile services. Technology trends are predominantly centered on the deployment of 5G infrastructure and leveraging fiber optic networks for ubiquitous gigabit connectivity, alongside the integration of AI for optimizing network performance and resilience.

AI Impact Analysis on B2B telecommunications Market

User queries regarding AI's impact on B2B telecommunications largely focus on operational efficiency, security enhancements, and customer experience improvements. Common themes revolve around how AI can automate complex network management tasks (AIOps), whether AI-driven security can effectively mitigate sophisticated cyber threats targeted at enterprise networks, and the potential for generative AI to revolutionize B2B customer support and service provisioning. Concerns frequently highlight data privacy implications, the skills gap required to manage AI-driven systems, and the initial investment cost associated with deploying sophisticated AI infrastructure within existing telecom networks. Users are primarily expecting AI to deliver proactive service assurance and enable personalized, predictive offerings rather than just reactive fixes.

The core of AI integration in B2B telecom lies in transforming network operations from reactive troubleshooting to predictive maintenance. By analyzing massive streams of network data—including traffic patterns, device health, and service quality metrics—AI algorithms can forecast potential outages or degradation issues, allowing providers to intervene before service interruption impacts the B2B client. This transition significantly enhances Service Level Agreement (SLA) compliance and improves overall network reliability, which is paramount for mission-critical enterprise applications. Furthermore, AI and Machine Learning (ML) are vital in enhancing the efficacy of B2B cybersecurity services by detecting anomalies and zero-day threats in real time across complex enterprise network perimeters, offering a superior level of protection compared to traditional rule-based systems.

- AI enables AIOps for autonomous network management, reducing human intervention and operational costs.

- Predictive maintenance driven by ML minimizes enterprise downtime and improves SLA adherence.

- AI enhances fraud detection and bolsters cybersecurity services offered to B2B clients.

- Generative AI optimizes customer relationship management (CRM) and technical support processes, offering faster issue resolution.

- Machine learning algorithms optimize network resource allocation and traffic routing, particularly critical for 5G slicing in industrial applications.

- AI facilitates personalized service packaging and dynamic pricing based on client usage patterns and specific industry needs.

DRO & Impact Forces Of B2B telecommunications Market

The dynamics of the B2B telecommunications market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and strategic direction. A primary driver is the accelerating pace of global digital transformation, necessitating robust, secure, and scalable connectivity solutions to support cloud migration, distributed workforces, and industrial automation (Industry 4.0). The widespread commercial deployment of 5G networks offers unprecedented performance attributes—high throughput and ultra-low latency—that unlock new, high-value B2B use cases, particularly in manufacturing, logistics, and smart cities. Concurrently, the increasing maturity and acceptance of hybrid cloud architectures require telcos to provide reliable interconnection services, solidifying their role as essential partners in the enterprise IT ecosystem.

However, significant restraints temper this growth trajectory. Cybersecurity remains a major concern, as enterprises rely on telcos to safeguard critical data and operations, making service providers liable for sophisticated threats like DDoS attacks and data breaches. Regulatory complexity, particularly regarding data sovereignty and net neutrality rules across different jurisdictions, imposes substantial compliance costs and limits multinational service standardization. Furthermore, the intense capital expenditure required for 5G infrastructure deployment (e.g., fiber backbone upgrades and small cell installation) and the competitive pressure from Over-the-Top (OTT) communication providers and hyperscalers (offering integrated cloud and connectivity services) compress profit margins on traditional connectivity offerings, demanding constant innovation and service differentiation.

Opportunities for expansion are largely concentrated in emerging technologies and niche market segments. The rise of edge computing, which mandates decentralized network intelligence close to the data source, presents a lucrative chance for telcos to host and manage edge infrastructure, creating new revenue streams beyond mere transport. The growing interest in dedicated private 5G networks allows telcos to serve campus environments (factories, ports, mining sites) with tailored, high-security connectivity solutions, bypassing reliance on public network spectrum. The collective impact forces show that technological adoption (5G/SDN) and evolving enterprise demands (cloud migration) are high-impact and accelerating factors, while capital intensity and regulatory scrutiny are persistent, moderate-to-high resistive forces that require strategic mitigation efforts by market participants to ensure sustainable, profitable expansion.

Segmentation Analysis

The B2B telecommunications market is segmented based on Service Type, Enterprise Size, and Technology, reflecting the diverse needs and consumption patterns of modern businesses. Understanding these segments is crucial for telcos to tailor their offerings, optimize pricing strategies, and target specific vertical markets effectively. The primary focus of segmentation lies in differentiating commodity services (voice, basic data) from high-value managed solutions that integrate networking, security, and cloud access, driving the highest margins and long-term customer relationships. As enterprises increasingly demand customized, flexible, and fully managed solutions, the market is seeing rapid growth in segment offerings that move beyond standardized bandwidth provisioning.

- By Service Type:

- Data Services (Fixed Line, Mobile Data, Dedicated Internet Access)

- Voice Services (VoIP, Fixed Voice)

- Managed Services (Managed Networking, Managed Security, Managed IoT, Cloud Connect Services)

- Unified Communications and Collaboration (UCaaS, CPaaS)

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Technology:

- Fixed Line (Fiber Optics, DSL, Cable)

- Mobile (3G, 4G/LTE, 5G)

- Satellite Communication

- Software-Defined Networking (SDN) and Network Functions Virtualization (NFV)

- By Industry Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- IT and Telecom

- Manufacturing

- Healthcare

- Retail

- Government and Public Sector

Value Chain Analysis For B2B telecommunications Market

The value chain of the B2B telecommunications market is complex, beginning with upstream infrastructure provision and extending through service delivery and end-user support. Upstream activities involve significant capital investment in core infrastructure, including laying global fiber optic cables, launching communication satellites, deploying 5G base stations, and establishing data centers. Key players in this stage include equipment vendors (e.g., Ericsson, Nokia, Huawei) and infrastructure builders. The strategic importance of the upstream segment lies in controlling network capacity and technological capability; providers with extensive infrastructure ownership often possess a significant cost advantage and greater control over service quality parameters like latency and reliability.

Midstream activities focus on network operation, management, and service orchestration. This involves virtualizing network functions (NFV) and managing dynamic network resource allocation using SDN technologies to create tailored enterprise services, such as dedicated network slices for specific industrial applications. Distribution channels play a critical role; direct sales forces manage relationships with large enterprises, offering bespoke contractual agreements and highly customized solutions, particularly for multi-site global clients. Indirect channels, including value-added resellers (VARs), system integrators, and channel partners, are crucial for reaching the fragmented Small and Medium Enterprise (SME) market, often bundling telco services with broader IT solutions or software packages.

Downstream activities center on service delivery, maintenance, and ongoing customer relationship management. This stage involves providing comprehensive technical support, ensuring rigorous adherence to SLAs, and continually upgrading software and security protocols. Successful downstream operations require advanced AI-driven tools (AIOps) for rapid fault identification and resolution, ensuring high customer satisfaction and low churn. The transition towards managed services necessitates that telcos evolve from passive infrastructure providers to proactive consultants and integrators, deeply embedded in the client's IT strategy, thereby creating a higher barrier to entry for competitors and securing long-term service contracts.

B2B telecommunications Market Potential Customers

Potential customers, or end-users and buyers of B2B telecommunication products, are enterprises ranging from micro-businesses to multinational corporations, spanning virtually every economic sector. The demand profile of these customers is highly differentiated based on size, industry vertical, and specific operational needs. Large enterprises typically require global coverage, dedicated private networks, high-availability data centers, and complex, integrated security and UCaaS solutions, often procured via long-term, multi-million dollar managed service agreements focusing on maximum uptime and customization. These clients prioritize resilience and global scalability to support their dispersed operations.

Conversely, Small and Medium Enterprises (SMEs) represent a massive, dynamic customer base primarily focused on affordability, ease of deployment, and simplicity. SMEs predominantly consume bundled packages of basic connectivity, standard VoIP, and cloud collaboration tools (UCaaS). Their buying decisions are often influenced by channel partners or packaged solutions that offer immediate operational utility with minimal internal IT investment. The shift to cloud computing means that SMEs now rely heavily on reliable, fixed-line broadband or dedicated internet access (DIA) to effectively utilize SaaS applications for core business functions.

Specific industry verticals also define unique customer requirements. For example, the healthcare sector demands ultra-secure, HIPAA-compliant communication platforms for telemedicine and patient data transfer, prioritizing data encryption and regulatory compliance. The manufacturing sector (especially those involved in Industry 4.0) constitutes a burgeoning customer segment seeking private 5G networks to enable real-time automation and robot control, where the primary buying criterion is ultra-low latency and localized network reliability rather than pure bandwidth capacity. Telecommunication providers must align their product development and sales strategies to meet these distinct demands effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Billion |

| Market Forecast in 2033 | USD 1,640.2 Billion |

| Growth Rate | CAGR 9.8 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Verizon Communications, AT&T Inc., Vodafone Group Plc, China Mobile, Deutsche Telekom AG, NTT Communications Corporation, Orange S.A., Telefonica S.A., T-Mobile US, Inc., Lumen Technologies, Telstra Corporation, BT Group Plc, Comcast Business, Singapore Telecommunications (Singtel), Rogers Communications, Reliance Jio Infocomm Ltd., KDDI Corporation, SoftBank Group Corp., SK Telecom, Swisscom AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

B2B telecommunications Market Key Technology Landscape

The technological evolution in the B2B telecommunications sector is characterized by a fundamental shift from hardware-defined physical infrastructure to flexible, software-centric architectures. Key technologies driving this change include Software-Defined Networking (SDN) and Network Functions Virtualization (NFV). SDN decouples the control plane from the data plane, enabling dynamic, centralized network management and rapid deployment of customized services (like SD-WAN), which is essential for multinational enterprises seeking unified policy enforcement across distributed locations. NFV virtualizes network functions (e.g., firewalls, load balancers) that traditionally ran on proprietary hardware, allowing them to run on standard servers, thereby reducing CapEx, accelerating innovation cycles, and improving operational scalability and agility.

The widespread deployment of 5G technology is perhaps the most critical technological catalyst for the B2B market. 5G’s enhanced mobile broadband (eMBB), massive machine-type communication (mMTC), and ultra-reliable low-latency communication (URLLC) capabilities are specifically designed to meet complex enterprise requirements. This enables sophisticated applications such as real-time remote surgery (healthcare), massive sensor deployments (smart cities), and precision robotics control (manufacturing). The ability of 5G to support network slicing is particularly vital, allowing telcos to create dedicated, isolated, and quality-assured virtual networks tailored for specific industry critical applications under defined SLAs.

Further innovation is concentrated in cloud communication platforms and edge computing. Unified Communications as a Service (UCaaS) and Communication Platform as a Service (CPaaS) are leveraging cloud infrastructure to provide integrated voice, video, messaging, and collaboration tools, supporting the hybrid work environment and streamlining business processes. Edge computing moves processing power closer to the data source, drastically reducing latency—a requirement for autonomous vehicles and real-time industrial IoT. Telcos are strategically deploying Mobile Edge Computing (MEC) infrastructure at their cell tower sites and central offices, positioning themselves as indispensable facilitators of high-performance, distributed enterprise applications, moving up the value chain from pure connectivity to infrastructure management.

Regional Highlights

The global B2B telecommunications market exhibits distinct regional dynamics driven by varying levels of digital maturity, infrastructure readiness, and regulatory environments. North America, including the United States and Canada, remains a dominant market, characterized by early and aggressive adoption of 5G, extensive fiber deployment, and a highly competitive landscape focused on advanced managed services like SASE and robust cybersecurity offerings. Large enterprises in this region are actively moving to highly complex SD-WAN and hybrid cloud solutions, driving high Average Revenue Per User (ARPU) for service providers. The region benefits from strong presence of large technology innovators and a highly digitized industrial base.

Asia Pacific (APAC) represents the fastest-growing region, fueled by massive government investments in digital infrastructure, particularly in China, India, Japan, and South Korea. Rapid urbanization and industrial expansion are accelerating the demand for fixed and mobile broadband services across the SME sector. APAC carriers are aggressively rolling out 5G, particularly leveraging it for smart city initiatives and industrial automation projects. While pricing sensitivity remains a factor in emerging markets like India and Southeast Asia, the sheer volume of new digital users and businesses provides immense scaling opportunities, especially in the mobile connectivity and basic UCaaS segments.

Europe holds a strong position, marked by high fiber penetration and a significant focus on regulatory compliance, particularly GDPR, which necessitates secure communication solutions. Key growth drivers include the adoption of IoT across utilities and manufacturing (Industry 4.0) and strong demand for multinational connectivity solutions due to the integrated nature of the European Union economy. Market players here focus heavily on providing sophisticated cross-border managed services and integrated cloud security portfolios. Latin America and MEA are experiencing growth led by national fiber rollouts and increased mobile data consumption, with opportunities centered on connecting underserved regions and capitalizing on oil and gas industry demands for reliable communication and monitoring.

- North America: Market leader in managed services, 5G deployment, and sophisticated cybersecurity integration. High ARPU driven by large enterprise demand for SD-WAN and cloud connectivity.

- Asia Pacific (APAC): Fastest growth rate, driven by expansive 5G rollout, digitalization of SMEs, and government infrastructure spending in populous nations like China and India.

- Europe: Strong focus on high-quality fixed broadband, cross-border services, IoT implementation (Industry 4.0), and rigorous data privacy compliance (GDPR-compliant UC solutions).

- Latin America (LATAM): Growth fueled by national fiberoptic deployment projects, increasing mobile data penetration, and rising adoption of cloud services by mid-sized businesses.

- Middle East and Africa (MEA): Key investments focused on resilient satellite and fiber infrastructure, driven by demanding sectors such as oil & gas, finance, and major smart city projects (e.g., Saudi Arabia, UAE).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the B2B telecommunications Market.- Verizon Communications

- AT&T Inc.

- Vodafone Group Plc

- China Mobile

- Deutsche Telekom AG

- NTT Communications Corporation

- Orange S.A.

- Telefonica S.A.

- T-Mobile US, Inc.

- Lumen Technologies

- Telstra Corporation

- BT Group Plc

- Comcast Business

- Singapore Telecommunications (Singtel)

- Rogers Communications

- Reliance Jio Infocomm Ltd.

- KDDI Corporation

- SoftBank Group Corp.

- SK Telecom

- Swisscom AG

Frequently Asked Questions

Analyze common user questions about the B2B telecommunications market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards Managed Services in B2B telecommunications?

The shift is primarily driven by enterprises seeking to reduce complexity, manage IT costs effectively (OpEx model), and gain access to specialized skills for advanced technologies like SD-WAN, SASE, and cloud integration. Managed Services allow businesses to outsource network management, security, and maintenance, ensuring compliance and maximizing uptime without heavy capital investment or in-house expertise.

How is 5G technology specifically transforming B2B enterprise connectivity?

5G transforms B2B connectivity by providing Ultra-Reliable Low-Latency Communication (URLLC), crucial for Industry 4.0 applications like industrial IoT, robotic automation, and remote machine control. It also enables high-capacity connectivity (eMBB) and network slicing, allowing carriers to offer dedicated, performance-guaranteed virtual networks tailored for mission-critical enterprise use cases.

What role does SD-WAN play in the current B2B telecom landscape?

SD-WAN (Software-Defined Wide Area Network) is critical for modern B2B operations, enabling enterprises with multiple locations to manage their traffic centrally, prioritize cloud application performance, and utilize hybrid connectivity (MPLS, broadband, 5G) securely and efficiently. It significantly lowers network operational costs while enhancing application performance and network agility.

Which segment of the B2B telecommunications market is expected to exhibit the highest growth rate?

The Managed Services and Unified Communications as a Service (UCaaS) segments are expected to show the highest Compound Annual Growth Rate (CAGR). This growth is attributed to the widespread global adoption of hybrid work models, the continuous need for advanced cybersecurity protection, and the enterprise requirement for integrated, cloud-based collaboration tools accessible from anywhere.

What are the main challenges facing B2B telecom providers in emerging markets?

The primary challenges in emerging markets include the intense capital requirement for deploying fiber and 5G infrastructure in vast geographical areas, high price sensitivity among the SME customer base, and the necessity to navigate complex, often rapidly changing regulatory environments while simultaneously combating competition from local internet service providers (ISPs) and satellite broadband solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager