B2B Travel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436414 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

B2B Travel Market Size

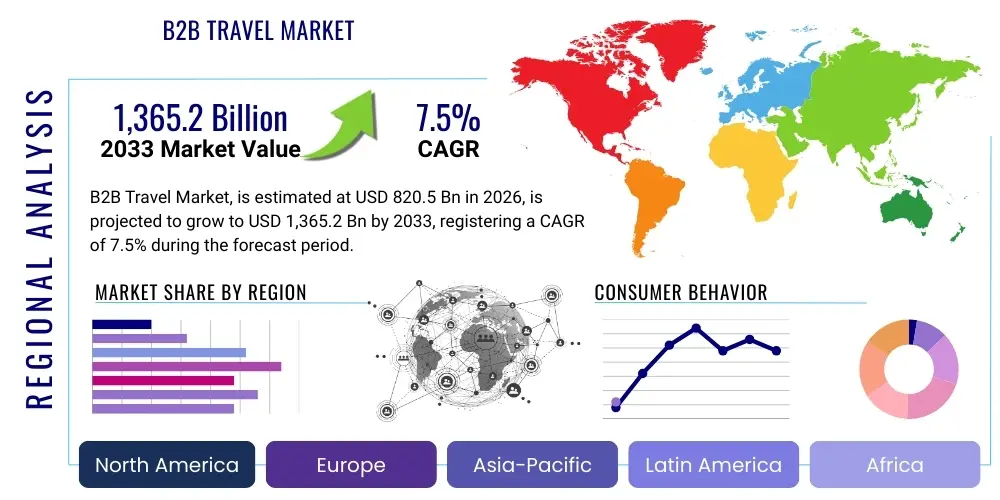

The B2B Travel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $820.5 Billion in 2026 and is projected to reach $1,365.2 Billion by the end of the forecast period in 2033.

B2B Travel Market introduction

The B2B travel market encompasses all transactional activities related to corporate travel, meetings, incentives, conferences, and exhibitions (MICE), where services are procured by businesses for their employees, clients, or partners. This sector involves complex ecosystems, including travel management companies (TMCs), corporate booking tools, expense management platforms, and specialized vendors catering specifically to business needs such as group bookings, risk management, and regulatory compliance. Unlike leisure travel, B2B travel prioritizes efficiency, cost control, policy adherence, and traveler safety, making technological integration a crucial element for seamless operations.

Product descriptions within this market range from sophisticated self-service online booking tools (OBTs) integrated with enterprise resource planning (ERP) systems, to comprehensive duty of care solutions that utilize real-time data for traveler tracking and incident response. Major applications span corporate air and ground transportation, hotel accommodations, visa processing, and specialized event planning logistics. The market is highly diversified, serving multinational corporations, small and medium-sized enterprises (SMEs), government agencies, and educational institutions, each requiring tailored services focused on optimizing travel spend and maximizing return on investment (ROI).

The market benefits significantly from enhanced data analytics capabilities, allowing businesses to gain deep insights into spending patterns, supplier negotiations, and policy compliance, ultimately driving substantial cost savings. Key driving factors include increasing globalization and international business expansion, the necessity for face-to-face meetings in establishing robust business relationships, and the ongoing digital transformation within travel procurement processes. Furthermore, the rising demand for personalized, yet policy-compliant, traveler experiences is compelling suppliers to invest heavily in advanced mobile and artificial intelligence technologies to maintain competitiveness and market relevance.

B2B Travel Market Executive Summary

The B2B Travel Market is undergoing a rapid evolution characterized by a strong convergence of business process automation and personalized traveler experience platforms. Current business trends indicate a significant shift towards integrated travel and expense (T&E) management solutions that offer end-to-end visibility and control, addressing longstanding issues related to leakage and non-compliance. Post-pandemic recovery has prioritized duty of care, leading to increased adoption of advanced risk management software and robust communication tools, positioning traveler safety as a core strategic objective alongside cost efficiency. Furthermore, sustainability is becoming a non-negotiable factor in corporate travel policies, driving demand for reporting and offsetting solutions that track and minimize carbon footprints associated with business trips.

Regionally, North America and Europe maintain dominance, characterized by early adoption of sophisticated T&E technologies and a high volume of multinational corporate activity. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid economic expansion, increasing foreign direct investment, and a growing domestic business travel segment, particularly in emerging economies such as India and Southeast Asia. Latin America and the Middle East and Africa (MEA) are also exhibiting robust growth, driven by investments in infrastructure and the establishment of regional business hubs, although these regions often require more localized booking content and payment solutions due to fragmentation.

In terms of segmentation, the Managed Travel segment remains the cornerstone of the market, driven by large enterprises seeking comprehensive TMC partnerships. Crucially, the Technology Platform segment, particularly focusing on Software as a Service (SaaS) OBTs and Expense Management Systems, is experiencing explosive growth, displacing traditional manual processes. The dominance of mobile applications for booking, itinerary management, and expense capture highlights a key trend: the necessity for flexibility and accessibility for the modern business traveler. Specialized services like consulting, data analytics, and group travel management are also seeing elevated demand as corporations seek to maximize efficiency across all aspects of their travel portfolios.

AI Impact Analysis on B2B Travel Market

User inquiries regarding the integration of Artificial Intelligence (AI) in B2B travel primarily revolve around three core themes: operational efficiency, personalized booking experiences, and predictive risk management. Users frequently question how AI can automate complex tasks such as dynamic policy checking, supplier negotiation through predictive pricing models, and automated expense reconciliation, seeking tangible reductions in administrative overhead. Another critical area of concern is personalization; businesses want to know if AI can recommend flights and accommodations based not just on price, but also on the traveler’s past preferences, loyalty programs, and schedule constraints, improving traveler satisfaction while maintaining policy adherence. Finally, there is high interest in AI's role in duty of care, specifically its capacity to utilize real-time data to forecast geopolitical or logistical disruptions and proactively alert both the traveler and the management team, thereby ensuring swift and effective response mechanisms.

AI's influence is fundamentally reshaping the internal infrastructure of B2B travel management. By deploying machine learning algorithms, travel platforms can analyze historical booking data, current market dynamics, and corporate spending policies simultaneously, leading to highly optimized booking decisions that deliver the best value for money within seconds. This automation significantly reduces the reliance on human agents for routine transactions, allowing TMCs to reallocate expert staff towards complex itinerary planning, crisis management, and strategic consulting services. The continuous refinement of AI models ensures that policy parameters are enforced dynamically, adapting immediately to negotiated corporate rates or changing regulatory environments, which is crucial for compliance in multinational operations.

Furthermore, AI is instrumental in transforming the expense management workflow, moving beyond simple optical character recognition (OCR) of receipts. Modern AI-driven systems automatically categorize expenses, detect potential fraud or out-of-policy spending patterns, and integrate seamlessly with corporate finance systems, accelerating reimbursement cycles and improving financial transparency. The integration of Natural Language Processing (NLP) into virtual assistants and chatbots provides immediate, 24/7 support for travelers, handling common inquiries, modifications, and cancellations efficiently. This holistic application of AI ensures the B2B travel ecosystem is not just faster and cheaper, but also inherently smarter, more reliable, and better equipped to handle dynamic global business requirements.

- Enhanced dynamic pricing and inventory management through predictive analytics.

- Automated compliance checking against corporate travel policies and regulatory frameworks.

- Personalized itinerary generation based on traveler history, loyalty status, and policy constraints.

- Real-time risk assessment and proactive duty of care notifications using machine learning.

- Deployment of AI-powered chatbots and virtual assistants for 24/7 traveler support and booking modifications.

- Streamlining of expense reporting and auditing processes through intelligent receipt scanning and categorization.

- Optimized supplier negotiations driven by algorithms analyzing aggregated purchasing power and market rates.

DRO & Impact Forces Of B2B Travel Market

The B2B Travel Market is primarily driven by the imperative of global business connectivity and the tangible benefits derived from in-person collaboration, while simultaneously facing significant restraints related to economic volatility and the ongoing complexity of regulatory environments. Opportunities abound in leveraging advanced technologies like AI and blockchain to revolutionize payment security and data management, offering market players distinct competitive advantages. These forces collectively dictate the pace and direction of market growth, making adaptability and technological investment crucial for stakeholders.

Key drivers include the global expansion of multinational corporations requiring frequent international travel, the proven correlation between face-to-face interactions and successful deal closure, and the continuous innovation in corporate travel management software that promises enhanced efficiency and cost control. However, the market is constrained by factors such as fluctuating geopolitical stability, which necessitates restrictive travel advisories, persistent concerns over corporate data security and traveler privacy, and the high initial implementation costs associated with integrating complex, global T&E platforms, particularly for smaller enterprises.

Significant opportunities lie in serving the growing demand for specialized Bleisure travel options (blending business and leisure), catering to the specific needs of SMEs through scalable SaaS solutions, and developing comprehensive sustainability reporting tools that align with corporate Environmental, Social, and Governance (ESG) mandates. The major impact force currently shaping the market is the shift toward a hybrid work model; while routine internal meetings may remain virtual, high-value sales, client engagement, and strategic leadership meetings are accelerating the demand for purposeful, efficient, and well-managed business trips, fundamentally redefining the concept of necessary corporate travel.

Segmentation Analysis

The B2B Travel Market is broadly segmented based on travel type (managed versus unmanaged), service offering (transportation, accommodation, technology), enterprise size, and industry verticals. This granular segmentation allows market participants to tailor their solutions precisely to the varying complexities and budgetary constraints of different business entities. The fastest-growing segments are those related to software and platforms, reflecting the market’s ongoing digitization, while large enterprises continue to drive volume in managed services due to their extensive compliance and duty of care requirements across multiple geographies.

- By Travel Type:

- Managed Business Travel (Utilizing TMCs and OBTs)

- Unmanaged Business Travel (Ad-hoc bookings without centralized oversight)

- MICE (Meetings, Incentives, Conventions, and Exhibitions)

- By Enterprise Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Service Offering:

- Transportation (Air, Rail, Road)

- Accommodation (Hotels, Short-term rentals)

- Technology Platforms (OBTs, Expense Management, Data Analytics)

- Consulting and Advisory Services

- Risk Management and Duty of Care

- By Industry Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- IT and Telecom

- Healthcare and Pharmaceuticals

- Manufacturing and Automotive

- Retail and Consumer Goods

- Government and Defense

Value Chain Analysis For B2B Travel Market

The value chain of the B2B travel market is intricate, starting with upstream suppliers and extending through intermediaries to the final business consumer. The upstream segment involves core providers such as airlines, hotel chains, ground transportation companies, and global distribution systems (GDSs) like Sabre, Amadeus, and Travelport. These entities generate the primary inventory and pricing data necessary for travel procurement. Efficiency at this stage is crucial, particularly in establishing favorable corporate negotiated rates and ensuring real-time inventory synchronization across various platforms.

The midstream comprises the technology and service providers essential for aggregating and managing travel. This includes Travel Management Companies (TMCs) such as American Express Global Business Travel and Carlson Wagonlit Travel, Online Booking Tools (OBTs), expense management software vendors like SAP Concur, and specialized risk management platforms. These intermediaries play a critical role in enforcing corporate policies, providing duty of care services, integrating disparate booking channels, and delivering comprehensive reporting to corporate clients, effectively bridging the inventory source with the organizational buyer.

Distribution channels are multifaceted, utilizing both direct and indirect methods. Direct distribution involves corporations booking directly with suppliers using negotiated contracts, often for highly customized or recurring travel needs. Indirect distribution, which dominates the managed travel segment, relies on TMCs and specialized technology platforms (like aggregators and meta-search engines tailored for corporate users) to offer centralized procurement, compliance checks, and consolidated invoicing. The shift towards API-based integration and New Distribution Capability (NDC) is profoundly impacting this chain, allowing intermediaries to access richer content and offer more personalized solutions directly to the corporate client, streamlining the traditionally complex process and moving value capture closer to the technology providers.

B2B Travel Market Potential Customers

Potential customers, or end-users/buyers, in the B2B travel market are diverse, spanning the entire spectrum of global enterprise sizes and industry requirements. The primary consumer is the corporation itself, acting through procurement departments, finance teams, and human resources, which dictate travel policies and budgets. Large multinational corporations (MNCs) constitute the segment with the highest spending volume, requiring complex, globally consistent, and fully managed travel programs that prioritize integration with enterprise resource planning (ERP) systems and sophisticated duty of care capabilities.

The second major customer group includes Small and Medium-sized Enterprises (SMEs). While individually smaller spenders, their collective volume is immense. SMEs increasingly seek user-friendly, scalable, and affordable Software as a Service (SaaS) OBTs that can automate basic booking and expense tasks without the need for a full-scale, bespoke TMC solution. These buyers prioritize ease of use, mobile functionality, and rapid implementation, often utilizing integrated platforms that bundle booking and expense management to achieve efficiency with minimal internal travel management staff.

Furthermore, specialized sectors such as the pharmaceutical industry, legal firms, and consulting services represent high-value niches. These sectors often require highly complex itineraries, specialized compliance reporting (e.g., meeting regulatory disclosure requirements for healthcare interactions), and premium service levels. The buyers in these industries look for providers who can offer deep industry expertise, robust data security, and specialized logistical support for events such as large-scale product launches or global clinical trial coordination, making the ability to handle highly specific, sensitive travel needs a crucial differentiator.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $820.5 Billion |

| Market Forecast in 2033 | $1,365.2 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | American Express Global Business Travel, CWT, BCD Travel, Expedia Group (Egencia), SAP Concur, Sabre, Amadeus, Travelport, TripActions (Navan), FCM Travel Solutions, TravelPerk, Corporate Travel Management (CTM), MakeMyTrip, Clarity Travel, TripActions (Navan), Kayak for Business, Booking.com for Business, Airbnb for Business, Trainline Partner Solutions, GetThere. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

B2B Travel Market Key Technology Landscape

The technological landscape underpinning the B2B travel market is defined by a shift from legacy systems towards interconnected, cloud-based platforms designed for scalability and integration. Central to this evolution are Online Booking Tools (OBTs) which have transformed from simple search interfaces into sophisticated management hubs, capable of integrating directly with multiple Global Distribution Systems (GDSs), supplier direct feeds, and New Distribution Capability (NDC) streams. This integration ensures access to comprehensive, personalized inventory and competitive pricing, addressing the long-standing corporate requirement for price optimization and policy compliance at the point of sale. The widespread adoption of Software as a Service (SaaS) models further lowers the barrier to entry for SMEs and facilitates rapid updates and feature deployment across large enterprise networks.

Expense management technology forms the other critical pillar of the B2B travel stack. Systems utilizing Artificial Intelligence (AI) and Machine Learning (ML) are standardizing expense reports by automatically capturing receipts via mobile apps, categorizing spend, and validating compliance against corporate policies in real-time. The integration of virtual payment solutions and corporate cards directly into these platforms minimizes manual data entry and provides finance teams with immediate spend visibility. Furthermore, blockchain technology is being explored for securing traveler identity data, streamlining cross-border payments, and ensuring immutable record-keeping, enhancing both security and audit trails in compliance-heavy industries.

A crucial technological development is the implementation of advanced data analytics and predictive modeling. Travel management companies and corporate platforms leverage big data tools to analyze booking patterns, identify potential cost savings through predictive negotiations, and forecast future travel demands. These systems are also fundamental for Duty of Care, utilizing GPS data, integrated external risk feeds, and machine learning algorithms to locate travelers and communicate urgent safety information during crises. The convergence of mobile technology, AI-driven automation, and secure cloud infrastructure ensures that the modern B2B travel ecosystem is dynamic, resilient, and highly focused on delivering measurable business value and enhanced traveler well-being.

Regional Highlights

The B2B Travel Market exhibits substantial regional variation influenced by economic development, corporate culture, and technological adoption rates. North America, encompassing the United States and Canada, remains the largest market share holder globally, characterized by high corporate spending, early adoption of comprehensive T&E technology suites (like SAP Concur and Navan), and a strong presence of major Travel Management Companies (TMCs). The region’s focus is heavily centered on seamless integration, data-driven cost optimization, and robust implementation of duty of care protocols to manage extensive domestic and international travel volumes.

Europe, driven by powerful economies such as Germany, the UK, and France, represents the second-largest market. This region is distinguished by complex regulatory frameworks, highly developed rail infrastructure, and a significant push towards sustainable travel options. European businesses are increasingly demanding integrated reporting tools that track Scope 3 emissions associated with travel, necessitating platform upgrades that incorporate environmental metrics. The market structure here is slightly more fragmented, involving strong regional TMCs alongside global players, and a heightened focus on GDPR compliance for traveler data.

Asia Pacific (APAC) stands out as the fastest-growing region, fueled by booming economies in China, India, and Southeast Asia. The growth is driven by increasing intra-regional business activity and the influx of foreign direct investment. The B2B travel landscape in APAC is characterized by a strong emphasis on localized content (e.g., regional airlines and payment methods), mobile-first booking solutions, and the demand for platforms that can handle multiple languages and currencies seamlessly. While managed travel is growing, unmanaged and hybrid models are still prevalent, offering vast opportunities for technology providers specializing in aggregation and localization.

- North America: Market leader; high technology adoption, driven by large multinational headquarters and advanced duty of care systems. Focus on integrated T&E solutions.

- Europe: Second largest market; emphasis on sustainable travel, rail usage, and complex regulatory compliance (GDPR). Rapid growth in decentralized, localized booking platforms.

- Asia Pacific (APAC): Highest CAGR; growth driven by emerging economies (India, China), rapid infrastructure development, and demand for mobile-centric, localized inventory.

- Latin America: Developing market with increasing corporate investment; challenges include fragmented supply chains and reliance on cash/local payment methods, driving demand for localized payment integration.

- Middle East and Africa (MEA): Growth centered around major hubs (UAE, Saudi Arabia); driven by MICE and investment in tourism infrastructure, requiring specialized luxury and high-security travel management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the B2B Travel Market.- American Express Global Business Travel (Amex GBT)

- CWT (Carlson Wagonlit Travel)

- BCD Travel

- Expedia Group (Egencia)

- SAP Concur

- Sabre Corporation

- Amadeus IT Group

- Travelport

- Navan (formerly TripActions)

- FCM Travel Solutions

- Corporate Travel Management (CTM)

- TravelPerk

- Priceline Partner Solutions

- MakeMyTrip Limited

- Clarity Travel

- Serko Ltd.

- GetThere (Sabre)

- Flight Centre Travel Group

- Booking Holdings (Booking.com for Business)

- Travel Leaders Group

Frequently Asked Questions

Analyze common user questions about the B2B Travel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary challenges facing the B2B Travel Market in the next five years?

The primary challenges include managing the complexity of hybrid work models, ensuring robust cybersecurity and data privacy compliance across global operations, and meeting stringent corporate demands for travel sustainability and carbon footprint reporting. Furthermore, rising inflation and persistent economic volatility exert continuous pressure on corporate travel budgets, necessitating highly effective cost control and policy enforcement through technology.

How is New Distribution Capability (NDC) affecting B2B travel procurement?

NDC, driven by airline mandates, is fundamentally shifting B2B procurement by allowing direct access to richer, personalized airline content, including ancillary services and dynamic pricing not always available through traditional Global Distribution Systems (GDSs). This requires Travel Management Companies (TMCs) and Online Booking Tools (OBTs) to rapidly adopt new technological standards and integrate multiple distribution channels to ensure corporate travelers have access to the best available fares and tailored offers.

What is the role of centralized payment solutions in managing corporate travel spend?

Centralized payment solutions, such as lodge cards and virtual credit cards integrated within expense management platforms, are essential for improving financial control and visibility. They reduce reliance on traveler-funded expenses, simplify reconciliation, minimize fraud risk, and provide finance departments with real-time data on expenditures, thereby enhancing policy compliance and reducing the administrative burden associated with expense reporting.

What defines the emerging Bleisure travel segment within the B2B market?

Bleisure travel refers to trips where employees combine a business trip with personal leisure time, often extending their stay or bringing family members. This segment demands flexibility and personalized booking options within corporate policy. Travel platforms must cater to this by seamlessly allowing travelers to add personal itinerary components, which drives traveler satisfaction and retention while maintaining corporate visibility and compliance for the official business portion of the trip.

Which technology is most critical for ensuring B2B traveler safety and duty of care?

Real-time risk management and tracking technology are most critical for duty of care. This encompasses integrated geo-location tracking, automated alert systems triggered by external events (geopolitical or health crises), and AI-powered platforms that can quickly identify and communicate with travelers affected by disruptions. These systems must be seamlessly integrated into corporate security and human resources protocols to ensure timely intervention and compliance with safety mandates globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager