Baby Diaper Pails Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434358 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Baby Diaper Pails Market Size

The Baby Diaper Pails Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 900 Million by the end of the forecast period in 2033.

Baby Diaper Pails Market introduction

The Baby Diaper Pails Market encompasses specialized waste containment systems designed to hygienically store soiled diapers, mitigating odor and bacterial spread in household environments. These products are essential components of modern baby care infrastructure, serving as a dedicated solution for managing the high volume of waste generated by infants. Product descriptions typically highlight features such as superior odor control mechanisms—including carbon filters, scented liners, or sealed locking systems—and ease of operation, often incorporating hands-free designs.

Major applications of diaper pails are primarily residential, utilized by parents and caregivers globally to maintain a clean and sanitary nursery environment. The core benefits include superior odor containment compared to standard trash bins, enhanced hygiene through segregated waste disposal, and convenience features like single-handed operation or capacity indicators. The market is increasingly segmenting based on technological advancements, focusing on systems that minimize exposure to waste during disposal.

Driving factors for this market include the sustained global birth rate, rising parental awareness regarding nursery hygiene and sanitation, and continuous innovation by manufacturers introducing advanced sealing and odor-neutralizing technologies. Furthermore, urbanization and smaller living spaces necessitate compact and effective waste management solutions, positioning high-quality diaper pails as essential items in the newborn essentials checklist, thereby supporting consistent market expansion.

Baby Diaper Pails Market Executive Summary

The Baby Diaper Pails Market is experiencing robust growth driven primarily by shifting consumer preferences towards specialized, hygienic, and convenient baby care products. Key business trends indicate a strong focus on sustainability, with companies introducing biodegradable liners and pails made from recycled materials to appeal to environmentally conscious millennials and Generation Z parents. Competition is intensifying, pushing manufacturers to invest heavily in patented odor-control technologies, leading to a premiumization of innovative disposal systems over traditional manual pails.

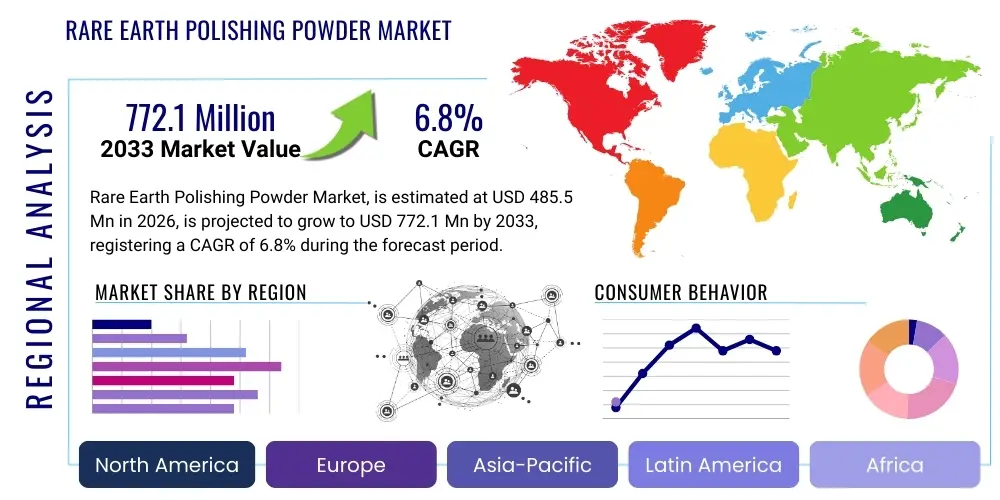

Regional trends show North America and Europe maintaining dominance due to high disposable incomes, strong awareness of hygiene standards, and established retail infrastructure for baby products. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by rapid urbanization, increasing middle-class populations, and rising penetration of organized retail and e-commerce platforms across countries like China and India. This growth is accelerating the adoption of premium diaper pail solutions previously exclusive to Western markets.

In terms of segmentation, the Diaper Disposal Systems segment (those utilizing proprietary sealed cassettes or continuous liners) holds the largest market share due to superior odor control and convenience. The online retail segment is expected to witness the highest growth rate, fueled by the accessibility and comparative pricing advantages offered by e-commerce giants. Furthermore, consumers are increasingly favoring foot-pedal operated or sensor-operated mechanisms over traditional manual pails, reflecting a growing demand for hands-free and more hygienic operation during diaper changes.

AI Impact Analysis on Baby Diaper Pails Market

User queries regarding AI’s influence in the Baby Diaper Pails Market commonly revolve around the integration of smart features, predictive inventory management of liners, and automated odor monitoring. Key themes include the feasibility of connected devices (IoT integration), concerns about data privacy related to usage patterns, and expectations for sophisticated operational efficiencies. Consumers are seeking clarity on whether AI can genuinely enhance the core functions—odor control and hygiene—or if it represents merely a superfluous luxury addition to an otherwise mechanical product. The primary expectation is for AI to provide seamless, low-maintenance operation and proactive warnings, such as automatically reordering liners when stock is low or detecting unusual odors that might indicate a system failure or an underlying health issue.

While the physical diaper pail remains a low-tech necessity, AI and IoT integration are beginning to redefine the ancillary services and user experience. Smart diaper pails, though niche, can connect to nursery monitoring apps, providing data on usage frequency, which can aid parents in tracking feeding and elimination schedules. Predictive maintenance algorithms could optimize the replacement cycle for filters and proprietary liner cassettes, ensuring peak performance. This integration moves the diaper pail from a static waste container into a connected, data-generating device within the broader smart nursery ecosystem, offering convenience and integration benefits.

However, mass adoption of AI-enabled pails is tempered by cost considerations and the necessity of such technology. Manufacturers must demonstrate a clear, tangible value proposition beyond simple novelty. Future AI advancements could focus on passive monitoring—for example, utilizing sensors to analyze discarded materials for temperature or moisture anomalies, providing subtle, non-invasive health insights. This evolution positions the diaper pail not just as a waste manager but potentially as a minor data node in the infant's wellness monitoring system.

- Integration with Smart Nursery Ecosystems: Linking pail usage data to baby tracking apps for pattern analysis.

- Predictive Replenishment: AI algorithms automatically order replacement liners or carbon filters based on historical usage rate.

- Sensor-Based Odor Management: Utilizing advanced sensors and AI to dynamically adjust ventilation or deploy neutralizing agents only when specific odors are detected.

- Voice Command Integration: Enabling hands-free opening and locking through smart home assistants.

- Automated Self-Sealing and Cutting: AI-optimized mechanisms for efficient sealing of soiled portions within continuous liner systems.

DRO & Impact Forces Of Baby Diaper Pails Market

The dynamics of the Baby Diaper Pails Market are shaped significantly by the interplay of key drivers (D), restraints (R), and opportunities (O), which collectively define the impact forces influencing market trajectories. A primary driver is the increasing global emphasis on health and hygiene, particularly among first-time parents who prioritize germ containment and odor mitigation in the nursery environment. This is complemented by the sustained marketing efforts of leading brands that position specialized diaper disposal systems as essential items, effectively elevating consumer expectations beyond standard trash receptacle functionality. Continuous product innovation, focusing on user convenience—such as one-hand operation and proprietary sealing technology—further fuels consumer adoption.

Conversely, significant restraints hinder growth, notably the recurring high cost associated with proprietary refill cassettes and liners required by many leading systems. This lock-in effect often deters budget-conscious consumers who may opt for cheaper, non-proprietary alternatives or standard waste bins. Furthermore, environmental concerns surrounding the plastic waste generated by non-biodegradable liners pose a public relations challenge and regulatory hurdle for the industry, pushing consumers towards eco-friendly alternatives which may not always offer the same level of odor control. The market also faces competition from general-purpose, high-quality household trash cans that incorporate effective sealing mechanisms at a lower initial cost.

The market is rich with opportunities, particularly in expanding into developing economies where middle-class disposable income is rising, enabling the purchase of specialized baby care products. Technological advances in sustainable materials present a crucial avenue for innovation, focusing on developing fully biodegradable or compostable liner systems that do not compromise on barrier properties. Moreover, leveraging e-commerce and direct-to-consumer models offers manufacturers a scalable way to reach global consumers and manage the recurring revenue stream generated by refill sales, optimizing logistics and inventory management across diverse geographical regions. These forces collectively dictate the market’s competitive landscape and future direction.

Segmentation Analysis

The Baby Diaper Pails Market segmentation provides a detailed structural analysis based on product type, operational mechanism, capacity, and distribution channel, enabling manufacturers and retailers to target specific consumer needs and purchasing behaviors effectively. The segmentation reflects a market maturity where consumers differentiate between basic disposal units and complex, odor-eliminating systems. Understanding these segments is crucial for strategic pricing, product development, and market entry strategies, especially concerning the balance between initial purchase price and the long-term cost of proprietary refills.

Key segmentation reveals a divide between high-end disposal systems that use continuous liners and sophisticated sealing technology, and more economical, traditional pails that rely on carbon filters or simple airtight seals. The fastest-growing segment often aligns with those products offering superior AEO performance—specifically, minimizing the required effort and maximizing hygiene perception for the end user. Distribution channels play a vital role, with online platforms democratizing access to specialized models and offering subscription services for refills, while physical retail maintains importance for immediate purchases and product demonstration.

Furthermore, segmentation by operational mechanism—manual, foot-pedal, or sensor-operated—highlights consumer preference for hygiene and convenience. Sensor-operated pails, although premium-priced, are gaining traction due to the hands-free advantage, minimizing contact with the unit during disposal. This detailed segmentation analysis is instrumental in identifying untapped geographical niches and developing products tailored to the varying levels of affluence and hygiene awareness present across global consumer bases.

- By Type: Traditional Diaper Pails, Diaper Disposal Systems (Cassette/Continuous Liner).

- By Mechanism: Foot Pedal Operated, Sensor Operated (Automatic), Manual Twist/Seal.

- By Capacity: Low Capacity (Up to 30 Diapers), Medium Capacity (30-60 Diapers), High Capacity (60+ Diapers).

- By Distribution Channel: Online Retail (E-commerce), Hypermarkets/Supermarkets, Specialty Baby Stores, Pharmacies and Drug Stores.

Value Chain Analysis For Baby Diaper Pails Market

The value chain for the Baby Diaper Pails Market begins with upstream activities involving the sourcing and processing of raw materials, primarily plastics (Polypropylene, ABS) and specialized components like odor-absorbing materials (activated carbon, proprietary scent additives) and liner films. Key upstream suppliers include petrochemical companies and specialized component manufacturers. Quality control at this stage is crucial, as the durability of the pail structure and the effectiveness of the liner material directly impact the perceived value and longevity of the final product. Manufacturers often face challenges related to volatile petrochemical pricing and sourcing sustainable material alternatives, which requires consistent supplier relationship management.

The midstream process involves manufacturing, assembly, and quality assurance, where design innovations are implemented, particularly regarding the patented sealing and twisting mechanisms characteristic of high-end disposal systems. This stage often involves sophisticated molding techniques and automated assembly lines to ensure airtight seals and reliable operational mechanics. Manufacturers typically operate large-scale facilities to benefit from economies of scale, especially those producing proprietary cassette refills, which represent a high-margin, recurring revenue stream integral to the business model.

Downstream activities focus on distribution, which is bifurcated into direct and indirect channels. Indirect channels dominate and include large-scale Hypermarkets/Supermarkets (offering breadth of choice), Specialty Baby Stores (providing expert consultation), and Pharmacies. Direct channels, primarily e-commerce and manufacturer websites, are increasingly important for managing the subscription services for refills, ensuring product availability, and leveraging digital marketing to reach new parents directly. Effective inventory management and robust logistics are vital downstream to ensure that both the initial pail units and the high-frequency refill cassettes are readily available to consumers globally.

Baby Diaper Pails Market Potential Customers

The primary potential customers and end-users of baby diaper pails are parents and guardians of infants and toddlers, particularly those with newborns up to the age of approximately three years, who utilize disposable diapers regularly. This segment places a high priority on hygiene, convenience, and effective odor control within their living spaces. Early adopters tend to be affluent, first-time parents residing in urban or suburban environments with relatively smaller living quarters where efficient waste management is a necessity, and they are generally willing to pay a premium for specialized solutions that offer superior sanitation performance and design aesthetics that complement the nursery decor.

A secondary, yet rapidly expanding, segment includes daycare centers, preschools, and institutional childcare facilities. These large-scale users require industrial-grade pails with very high capacity and robust, easy-to-clean designs to handle a significantly greater volume of waste while maintaining strict health and safety standards mandated by regulatory bodies. For this institutional segment, durability, capacity, and minimal maintenance are often prioritized over aesthetic features or sensor technology, though reliable mechanical function is paramount for high-frequency usage.

Additionally, grandparents or secondary caregivers who regularly host young children constitute another viable customer base, often purchasing simpler or lower-cost models for occasional use. The market for potential customers is directly correlated with global birth rates and disposable income levels, emphasizing the importance of targeted marketing strategies that highlight the specific benefits—odor elimination for residential users and capacity/durability for institutional buyers—relevant to each distinct end-user group's needs and purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 900 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Munchkin Inc., Playtex Products LLC (Diaper Genie), Angelcare, Dekor, Ubbi, Tommee Tippee, Safety 1st, Prince Lionheart, Korbell, Skip Hop, Chicco, Foppapedretti, Dreambaby, OKBaby, Beaba |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Baby Diaper Pails Market Key Technology Landscape

The technology landscape of the Baby Diaper Pails Market is dominated by innovations focused on two core functions: superior odor control and enhanced hygiene/convenience. In odor control, the shift has been from simple airtight seals to multi-layered proprietary systems. Key technologies include continuous liner systems that individually seal or twist each soiled diaper (as popularized by Diaper Genie and similar brands), multi-layer film technology in the liners themselves containing odor barriers, and advanced use of neutralizing agents like baking soda cartridges or activated carbon filters integrated into the lid structure. These technologies aim to prevent airborne pathogens and foul smells from escaping the container, ensuring the nursery remains fresh.

In terms of convenience and hygiene, manufacturers are heavily investing in hands-free operation mechanisms. The evolution from basic manual lids to foot-pedal systems is now progressing towards sophisticated sensor-operated (automatic) pails that require zero physical contact, thus maximizing sanitation during disposal. Furthermore, material science plays a role, with some pails utilizing specific plastics or even stainless steel (like Ubbi) which are non-porous and less likely to absorb and retain lingering odors over time, offering a long-term hygiene advantage over traditional plastic containers.

The emerging technological frontier involves the integration of IoT (Internet of Things) functionality, as noted in the AI analysis. This includes embedded sensors for inventory management of refills, connectivity to smartphone applications for usage tracking, and integration with smart home ecosystems. While still nascent, this connected technology landscape promises to elevate the diaper pail into a proactive component of the smart nursery, providing data-driven insights and automated maintenance, although the widespread consumer acceptance of these high-tech features remains dependent on their affordability and tangible contribution to the disposal process efficiency.

Regional Highlights

Geographical analysis reveals significant variance in the adoption rates, product preferences, and market maturity across global regions. North America currently holds the largest market share, characterized by high consumer awareness, strong branding, and a willingness to invest in premium baby care products, including proprietary diaper disposal systems. The market here is highly competitive, dominated by major players offering sophisticated, high-capacity pails with robust odor-control features. The established retail and e-commerce infrastructure facilitates easy access to both the initial units and the recurring, proprietary refills, cementing the dominance of cassette-based systems.

Europe represents a mature market with high penetration, focusing strongly on product safety standards, material sustainability, and aesthetically pleasing designs. Western European countries, particularly Germany, the UK, and France, exhibit strong demand for environmentally friendly solutions, including pails designed for biodegradable liners or those made from recycled content. While convenience remains a priority, European consumers often show a higher sensitivity to the long-term cost of proprietary systems compared to North American counterparts, leading to a balanced market between continuous liner systems and highly effective traditional pails utilizing standard bags coupled with advanced sealing mechanisms.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, driven by rapid economic development, increasing disposable income in urban centers, and the expanding influence of Western consumption patterns. Countries like China and India are experiencing a boom in demand for specialized baby products as the emerging middle class prioritizes modern, hygienic solutions. This region presents a critical opportunity for market entry, particularly for manufacturers who can offer products tailored to smaller living spaces and leverage the rapidly growing mobile commerce platforms for distribution and refill subscriptions, focusing initially on urban affluent segments before expanding into broader markets.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but offer long-term potential. Growth in these regions is primarily spurred by improvements in retail infrastructure and increasing health consciousness. In MEA, cultural factors and lower disposable incomes mean traditional methods remain prevalent, but targeted marketing towards high-income segments in Gulf Cooperation Council (GCC) countries is beginning to drive adoption of premium, convenient diaper disposal systems. Growth remains highly dependent on economic stability and the ability of manufacturers to establish cost-effective distribution networks for both pails and refills.

- North America: Market leader, high adoption of premium, cassette-based disposal systems, driven by strong branding and high disposable income.

- Europe: Mature market emphasizing sustainability, safety standards, and balanced preference between proprietary and standard bag systems.

- Asia Pacific (APAC): Fastest-growing region, fueled by urbanization, rising middle class, and explosive growth in e-commerce penetration.

- Latin America (LATAM): Emerging market potential, primarily focused on convenience and basic hygiene, constrained by economic variability.

- Middle East & Africa (MEA): Growth concentrated in affluent urban centers, slowly transitioning from traditional methods to specialized solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Baby Diaper Pails Market.- Munchkin Inc.

- Playtex Products LLC (Diaper Genie)

- Angelcare

- Dekor

- Ubbi

- Tommee Tippee

- Safety 1st

- Prince Lionheart

- Korbell

- Skip Hop

- Chicco

- Foppapedretti

- Dreambaby

- OKBaby

- Beaba

- Vickea

- Arm & Hammer (Church & Dwight Co., Inc.)

- Creative Baby Inc.

- Pampers (P&G) - Note: Related products like disposal bags

- Honeysuckle

Frequently Asked Questions

Analyze common user questions about the Baby Diaper Pails market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Baby Diaper Pails Market?

The Baby Diaper Pails Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% during the forecast period from 2026 to 2033, driven by hygiene awareness and product innovation.

Which type of diaper pail technology dominates the market?

Diaper Disposal Systems utilizing proprietary continuous liners or cassettes hold a significant market share due to their superior individual sealing mechanisms, which offer the highest level of proven odor containment.

What are the main restraints impacting market expansion?

The primary restraint is the high recurring cost associated with mandatory proprietary refill cassettes and liners required by many popular disposal systems, deterring price-sensitive consumers.

How is e-commerce affecting the distribution of diaper pails?

Online retail is a critical and fast-growing distribution channel, enabling manufacturers to offer subscription models for refills, reach global customers directly, and leverage competitive pricing strategies effectively.

Which geographic region is expected to experience the fastest market growth?

The Asia Pacific (APAC) region is forecasted to exhibit the fastest growth, propelled by rising disposable incomes, rapid urbanization, and increasing consumer adoption of specialized baby hygiene products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager