Baby Foods and Infant Formula Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434788 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Baby Foods and Infant Formula Market Size

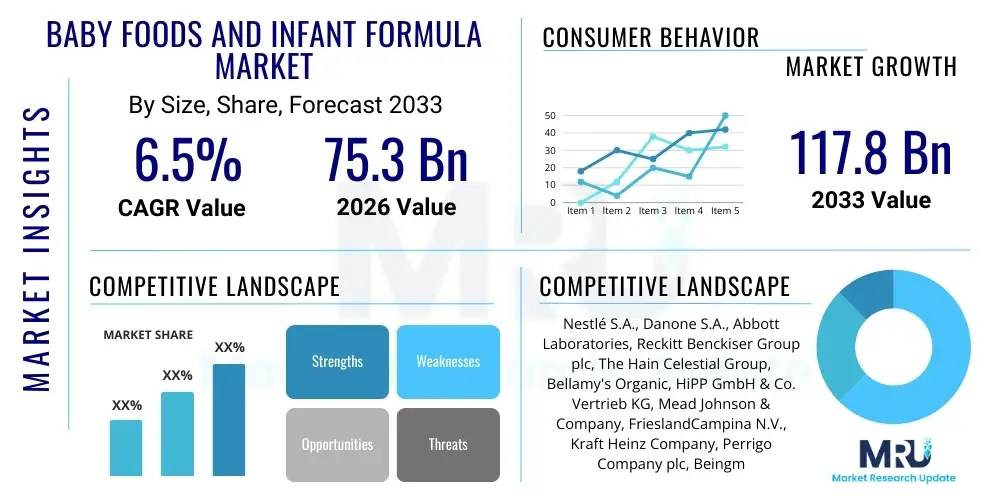

The Baby Foods and Infant Formula Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 75.3 Billion in 2026 and is projected to reach USD 117.8 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by increasing awareness regarding infant nutrition, rising disposable incomes in emerging economies, and the sustained introduction of innovative, specialized formula and organic baby food products designed to cater to specific dietary needs and parental preferences for clean labeling and premium ingredients.

Baby Foods and Infant Formula Market introduction

The Baby Foods and Infant Formula Market encompasses all commercially available food products and nutritional supplements designed for infants and toddlers up to 36 months of age, excluding standard table foods. This broad category includes infant formula (milk-based, soy-based, and specialized formulas), prepared baby food (purees, meals, snacks), and dried baby food (cereals). These products are critical for supplementing or replacing breast milk, ensuring adequate nutritional intake during the crucial stages of early development, and simplifying the feeding process for modern parents who often require convenient, safe, and regulated options. The driving factors include urbanization, the increasing participation of women in the workforce, regulatory standards emphasizing product safety, and ongoing scientific advancements in nutritional science leading to fortified and specialized products, such as those addressing allergies or digestive sensitivities.

Product descriptions vary widely, ranging from powdered infant formula, which requires mixing with water, to ready-to-eat pouches of fruit and vegetable purees. Major applications revolve around ensuring optimal growth, cognitive development, and supporting the immune system of infants when breastfeeding is not feasible or needs supplementation. Key benefits include guaranteed nutritional content, adherence to strict safety standards, convenience, and providing essential micronutrients like DHA, ARA, and iron. Furthermore, the market is continually evolving with new entrants focusing on plant-based ingredients and sustainable sourcing practices, appealing to environmentally conscious consumers.

Market growth is significantly bolstered by the increasing prevalence of e-commerce platforms, which offer greater accessibility and product diversity, particularly specialized and premium international brands. Demographic shifts, especially the rising birth rates in regions like Asia Pacific and Africa, coupled with heightened governmental focus on infant health programs, further cement the market's robust future. These dynamics necessitate continuous innovation in packaging to ensure extended shelf life and maintain nutritional integrity, reinforcing the market's foundational role in public health and consumer convenience.

Baby Foods and Infant Formula Market Executive Summary

The global Baby Foods and Infant Formula Market is characterized by intense competition, driven by leading multinational corporations focusing heavily on research and development to introduce highly differentiated, scientifically backed products. Current business trends indicate a significant pivot towards premiumization, where consumers are increasingly willing to pay higher prices for products labeled organic, non-GMO, or those incorporating functional ingredients like probiotics and prebiotics. E-commerce penetration is defining the current sales landscape, offering targeted marketing opportunities and expanding reach into previously underserved rural and suburban areas. Strategic mergers and acquisitions remain prevalent, allowing key players to quickly absorb innovative startups and enter specialized niche segments, such as goat milk formula or specific dietary supplements.

Regional trends highlight the Asia Pacific (APAC) region as the dominant market, propelled by high birth rates, rapidly growing middle-class populations, and significant consumer trust in established global brands. North America and Europe, while mature, are focusing heavily on regulatory compliance, sustainability, and sophisticated specialized nutrition products targeting specific developmental stages or addressing common infant intolerances. Emerging economies in Latin America and the Middle East & Africa (MEA) represent high-growth potential, driven by improving healthcare infrastructure and increasing adoption of commercial formula and baby food as convenient and reliable alternatives to traditional feeding practices, though price sensitivity remains a key factor in these regions.

Segment trends confirm the growing dominance of the Infant Formula segment due to its essential nature, especially specialized formulas addressing lactose intolerance or premature birth. Within baby foods, the Prepared Baby Food segment, particularly products packaged in convenient pouches, is witnessing the fastest growth, appealing directly to the need for on-the-go feeding solutions. Organic ingredient adoption is transitioning from a niche requirement to a mainstream expectation across all segments. Distribution channels are shifting, with traditional supermarkets maintaining volume share, but online retail channels rapidly gaining value share due to their ability to offer subscription services, greater variety, and competitive pricing, fundamentally altering the consumer purchase journey for recurring purchases like infant formula.

AI Impact Analysis on Baby Foods and Infant Formula Market

User queries regarding AI in the Baby Foods and Infant Formula Market primarily center on three areas: enhancing supply chain transparency and safety, personalizing infant nutrition recommendations, and optimizing manufacturing efficiency. Users are concerned about how AI can trace ingredients from farm to shelf to mitigate contamination risks, given the vulnerability of the consumer base. There is strong interest in AI-driven diagnostic tools that could personalize formula composition based on an infant's microbiome data, genetics, or specific metabolic needs, moving beyond standardized offerings. Furthermore, manufacturers are keenly interested in how predictive maintenance and robotics, informed by AI, can reduce downtime and minimize human error in sensitive, high-volume production environments, thereby ensuring consistent quality and regulatory compliance.

The application of Artificial Intelligence is revolutionizing quality control and safety standards within this highly regulated industry. AI-powered image recognition and machine vision systems are being deployed on production lines to detect even the slightest anomalies in packaging, sealing, or product consistency at speeds impossible for human inspection. This proactive approach significantly reduces recall risks, which are exceptionally damaging in the infant food sector. Moreover, AI models are now integral to predictive inventory management, forecasting regional demand shifts based on birth rates, seasonal factors, and social media sentiment, ensuring that adequate stock of crucial products, especially specialized formulas, is maintained without excessive waste.

In the realm of consumer interaction, AI is driving sophisticated engagement strategies. Chatbots and virtual nutrition assistants, trained on vast datasets of pediatric and nutritional information, are providing immediate, 24/7 support to parents regarding feeding schedules, product selection, and mild health concerns related to nutrition. This improves customer satisfaction and provides manufacturers with invaluable real-time data on consumer pain points and product perceptions. Ultimately, AI’s influence stretches from precision farming techniques used to source organic ingredients to complex algorithms ensuring the stability and safety of the final packaged product, cementing its role as a key enabler of safety and personalization.

- AI-powered predictive modeling for demand forecasting and inventory optimization.

- Enhanced supply chain traceability using blockchain integrated with AI verification systems.

- Deployment of machine vision for high-speed, accurate quality control and defect detection during packaging.

- Personalized nutritional recommendations via virtual assistants analyzing infant developmental data.

- Optimization of ingredient mixing and processing parameters to maximize nutritional stability and minimize waste.

- Automated regulatory compliance checks against global infant food standards.

DRO & Impact Forces Of Baby Foods and Infant Formula Market

The market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the global increase in the working female population, heightening the need for convenient, ready-to-feed solutions, and the persistent growth of the middle class in developing nations, leading to increased purchasing power for premium infant nutrition. Concurrently, regulatory bodies worldwide are consistently raising the bar for nutritional and safety standards, which, while increasing operational costs (a restraint), simultaneously builds immense consumer trust, acting as a crucial underlying driver for branded, regulated products. The primary restraint is the global promotion of exclusive breastfeeding by public health organizations, which naturally limits the addressable market for formula, alongside intense price competition in emerging markets where local brands offer more cost-effective alternatives. Opportunities lie primarily in the expansion of organic, plant-based, and specialized therapeutic diets, driven by higher incidence of allergies and evolving lifestyle choices.

Impact forces within the market are predominantly characterized by high buyer power and significant regulatory pressure. Buyer power is substantial because parents are highly informed consumers, often making purchasing decisions based on perceived quality, brand reputation, and peer recommendations rather than price alone, especially in developed economies. However, switching costs are relatively low if trust is compromised, leading manufacturers to invest heavily in brand loyalty and quality assurance programs. Regulatory frameworks, such as those imposed by the FDA, EFSA, and WHO guidelines, act as a major barrier to entry for new players, forcing existing firms to maintain stringent quality controls and invest continually in clinical studies to substantiate health claims, stabilizing the competitive environment around established, reputable brands.

Technological change serves as a moderate impact force, mainly accelerating innovation in ingredients (e.g., human milk oligosaccharides - HMOs) and enhancing supply chain resilience. The shift towards e-commerce, facilitated by digital logistics, fundamentally alters distribution, placing pressure on traditional retail channels to adapt or lose market share. Furthermore, social and cultural factors, particularly the influence of digital media and parenting influencers, exert a growing impact, rapidly disseminating information (both accurate and inaccurate) about nutrition, driving instant trends and demanding rapid product response from manufacturers, which creates both volatility and opportunity for marketing success.

Segmentation Analysis

The Baby Foods and Infant Formula Market is segmented based on the product type, ingredients, distribution channel, and category, reflecting the diverse nutritional requirements and purchasing habits of global consumers. The detailed analysis of these segments is crucial for understanding specific growth pockets and tailoring product development strategies. The product type segmentation captures the primary forms in which nutrition is delivered, ranging from highly convenient, ready-to-feed liquids to traditional, cost-effective dried powders and prepared foods designed for transitional feeding stages. Ingredient segmentation highlights the growing consumer preference for natural and ethically sourced products, driving the premiumization trend across all geographic areas.

Further segmentation by category distinguishes between standard formulations, which cater to the majority of healthy infants, and specialized/therapeutic formulations, which address specific medical or dietary needs, such as reflux, prematurity, or documented allergies to standard cow's milk protein. This specialized segment, while smaller in volume, offers significantly higher margins and requires substantial R&D investment. Distribution channel analysis confirms the enduring strength of organized retail (supermarkets and hypermarkets) as the primary purchasing point, but emphasizes the disruptive, high-growth nature of online sales and pharmacy channels, particularly for specialized or emergency formula purchases.

Understanding these segments allows market participants to optimize their product portfolios and distribution networks. For instance, manufacturers targeting the burgeoning organic segment must ensure transparent sourcing and certification, while those focusing on the high-volume infant formula segment need to prioritize supply chain robustness and competitive pricing. The future growth trajectory is heavily dependent on the performance of the e-commerce channel coupled with successful navigation of increasingly complex global regulatory landscapes concerning nutritional content and marketing ethics, especially for formula products.

- Product Type:

- Dried Baby Food (Cereals, Snacks)

- Prepared Baby Food (Purees, Meals in Jars or Pouches)

- Ready-to-Feed Infant Formula

- Powdered Infant Formula

- Ingredient:

- Organic

- Conventional (Non-Organic)

- Distribution Channel:

- Supermarkets and Hypermarkets

- Pharmacies and Drug Stores

- E-commerce (Online Retail)

- Other Retail Channels (Convenience Stores, Direct Sales)

- Category:

- Standard Formula

- Specialized Formula (Hydrolyzed, Anti-Reflux, Hypoallergenic)

- Follow-On Formula

- Growing-Up Milk

Value Chain Analysis For Baby Foods and Infant Formula Market

The value chain for the Baby Foods and Infant Formula Market is highly complex, beginning with the upstream supply of raw materials, primarily dairy components (milk powder, whey protein), essential vitamins, minerals, and organic fruits and vegetables. Upstream analysis highlights the critical need for secure, high-quality sourcing, particularly for organic and specialized ingredients. Manufacturers often engage in long-term contracts or vertical integration to ensure control over raw material purity and stability, given the severe consequences of contamination or quality fluctuation in this consumer segment. Rigorous testing and certification at the source are prerequisites for maintaining brand reputation and regulatory compliance. The cost of raw materials, especially dairy commodities, remains a significant determinant of final product pricing and profitability.

The core manufacturing stage involves complex processing, blending, sterilization, and packaging under extremely stringent hygienic standards (GMP, HACCP). This midstream segment is characterized by high capital expenditure in advanced processing machinery and quality control technologies, including AI-driven inspection systems. Following manufacturing, the distribution channel is crucial. Products are distributed through sophisticated logistics networks (both direct and indirect), utilizing cold chain management where necessary for certain prepared foods and ready-to-feed formulas. The indirect channel, involving large retailers, wholesale distributors, and specialized pharmacies, dominates physical sales, requiring careful management of inventory freshness and retail shelf placement.

Downstream analysis focuses on reaching the end-consumer (parents/caregivers). The shift towards e-commerce represents a significant evolution in distribution, offering direct-to-consumer models, subscription services, and enhanced personalization capabilities, thereby bypassing some traditional intermediary costs. Direct distribution often provides higher margins and better control over the customer experience. However, the indirect channel through hypermarkets and pharmacies remains essential for impulse purchases and providing immediate access. Successful players must maintain robust physical presence while aggressively expanding their digital footprint, ensuring that marketing messaging adheres strictly to local regulatory guidelines, particularly regarding the promotion of infant formula as regulated by WHO codes.

Baby Foods and Infant Formula Market Potential Customers

The primary end-users and buyers in the Baby Foods and Infant Formula Market are parents and primary caregivers of infants and toddlers aged 0 to 36 months. Within this broad group, segmentation is crucial based on demographic, economic, and behavioral factors. High-potential customer groups include working mothers who prioritize convenience and are willing to pay a premium for ready-to-feed and organic options that save preparation time while ensuring high nutritional standards. Another vital segment comprises parents of infants with specific medical conditions (e.g., lactose intolerance, severe allergies, or prematurity), who rely on specialized therapeutic formulas often recommended or prescribed by pediatricians and requiring consistent availability.

Geographically, customers in developed markets like North America and Western Europe demonstrate a high demand for premium, certified organic, clean-label, and non-GMO products, driven by health consciousness and higher disposable incomes. Conversely, customers in fast-growing emerging economies, particularly in APAC and Latin America, represent massive volume potential, characterized by increasing brand loyalty as incomes rise, but often exhibiting greater price sensitivity towards standard formula and fortified cereals. This group seeks reliable, affordable nutrition that meets international standards.

A rapidly expanding customer demographic includes digitally native parents who heavily utilize online platforms for research, comparison, and purchasing, often influenced by pediatric advice, social media endorsements, and detailed product reviews. This segment requires seamless omni-channel experiences, demanding real-time information on sourcing, ingredients, and sustainability practices. The secondary customer base includes healthcare institutions, hospitals, and government welfare programs that purchase infant formula in bulk for distribution or in-patient care, often selecting products based on clinical efficacy, cost-effectiveness, and established reputation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 75.3 Billion |

| Market Forecast in 2033 | USD 117.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., Danone S.A., Abbott Laboratories, Reckitt Benckiser Group plc, The Hain Celestial Group, Bellamy's Organic, HiPP GmbH & Co. Vertrieb KG, Mead Johnson & Company, FrieslandCampina N.V., Kraft Heinz Company, Perrigo Company plc, Beingmate Co., Ltd., Yili Group, Synutra International Inc., Arla Foods, Ausnutria Dairy Corporation Ltd., Kewpie Corporation, Hero Group, NurturMe, Little Freddie |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Baby Foods and Infant Formula Market Key Technology Landscape

Technological innovation in the Baby Foods and Infant Formula market is centered on enhancing product safety, optimizing nutritional content, and improving manufacturing efficiency and sustainability. One critical technological advancement is the application of Human Milk Oligosaccharides (HMOs) synthesis, which allows manufacturers to incorporate complex carbohydrates structurally identical to those found naturally in breast milk. This biotechnology requires advanced fermentation and purification processes to produce these ingredients at commercial scale and ensure their stability in formula powder, addressing consumer demand for products closer to nature. Furthermore, advanced retort and aseptic processing techniques are crucial for the prepared baby food segment, enabling extended shelf life for purees and meals without compromising flavor, texture, or requiring excessive preservatives, directly appealing to the "clean label" trend.

In the manufacturing sphere, sophisticated drying technologies, such as customized spray drying processes, are essential for producing high-quality infant formula powder with precise particle size distribution and minimal nutrient degradation from heat exposure. Continuous processing systems are increasingly replacing traditional batch processing to reduce product variability, minimize energy consumption, and ensure instantaneous quality assessment. The integration of Industry 4.0 principles, particularly the use of IoT sensors embedded throughout the production line, facilitates real-time monitoring of temperature, pressure, and humidity, which are vital parameters for maintaining the integrity of sensitive nutritional ingredients like vitamins and fatty acids (DHA/ARA).

Beyond production, packaging technology plays a pivotal role in ensuring product integrity and convenience. Advancements include the development of multilayer barrier materials that prevent oxygen and light degradation, crucial for preserving delicate fats and vitamins over long storage periods. For prepared foods, lightweight, durable, and environmentally friendly packaging, such as recyclable pouches with easy-open caps, are driven by consumer convenience and sustainability mandates. Moreover, digital technologies like QR codes and blockchain are being utilized to provide enhanced product transparency, allowing consumers to scan and trace ingredients back to their origin, directly addressing the paramount concern of product safety and authenticity in this market.

Key Technologies Used in the Baby Foods and Infant Formula Market:

- Biotechnology for Ingredient Synthesis: Large-scale fermentation and synthesis of Human Milk Oligosaccharides (HMOs) and other prebiotics.

- Aseptic and High-Pressure Processing (HPP): Used for prepared baby foods to extend shelf life without relying on high heat or chemical preservatives.

- Advanced Spray Drying: Optimized processes for powdered formula to ensure nutrient stability, uniform particle size, and enhanced solubility.

- Nutritional Microencapsulation: Techniques to protect sensitive ingredients (e.g., omega-3 fatty acids, probiotics) from degradation during processing and storage.

- Industry 4.0 and IoT Integration: Real-time monitoring, predictive maintenance, and autonomous quality control using interconnected sensor networks in manufacturing.

- Blockchain Traceability: Digital systems to ensure ingredient authenticity and transparency throughout the supply chain from raw material to retail shelf.

- Sustainable and Barrier Packaging: Development of innovative, recyclable, oxygen-impermeable packaging materials (e.g., bio-based plastics, advanced foils) to maximize product freshness.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Baby Foods and Infant Formula Market, largely due to its high population density, rising birth rates in countries like India and Indonesia, and the rapid expansion of the middle class in China. Economic growth has significantly increased consumer purchasing power, leading to a strong demand for premium and foreign brands, particularly in the infant formula sector where consumer trust is paramount following past safety concerns related to local products. Regulatory harmonization, though complex across diverse national markets, is driving local players to improve standards. The convenience factor is highly valued in urban centers, boosting the sales of prepared baby food pouches and snacks.

- North America: North America is a highly mature and innovation-driven market characterized by stringent regulatory oversight (FDA) and a strong preference for organic, non-GMO, and specialized formulas. Market growth is not volume-driven but value-driven, focused on high-margin products addressing niche needs, such as plant-based formulas (oat or almond milk bases) and products enriched with human milk components like HMOs. E-commerce penetration is extremely high, with subscription models widely adopted for routine formula purchases. The market sees constant introduction of new functional ingredients marketed towards cognitive and digestive health.

- Europe: Europe is defined by very high food safety standards (EFSA) and strong environmental consciousness, making it a leader in organic and sustainably sourced baby food. Germany, France, and the UK are key markets. The trend here is towards transparent sourcing, minimal processing, and clean-label products with very short ingredient lists. The market is witnessing robust growth in the Prepared Baby Food segment, particularly products packaged in glass jars or compostable materials, reflecting strong consumer aversion to plastics and processed ingredients.

- Latin America (LATAM): LATAM presents significant growth potential, driven by urbanization and improved accessibility to modern retail formats. While price sensitivity is higher compared to North America, there is an increasing demand for internationally recognized brands perceived as safer and more reliable. Governments and NGOs play a role in distribution and education. Key market focuses include fortified cereals and basic powdered formula, with Brazil and Mexico leading the regional demand, supported by rising healthcare expenditure and awareness regarding infant nutrition.

- Middle East and Africa (MEA): This region is characterized by high diversity. The Middle Eastern markets, particularly the GCC countries, show strong demand for premium imported infant formula due to high disposable incomes and a preference for Western brands. Africa, while offering high volume potential due to high birth rates, is often constrained by supply chain challenges and lower purchasing power. The growth in Africa is concentrated in urban areas, focusing on accessible fortified cereals and affordable basic formula, often supported by government and international aid programs to address malnutrition.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Baby Foods and Infant Formula Market. Strategic activities covered include product launches, capacity expansions, mergers and acquisitions, and competitive positioning analysis.- Nestlé S.A.

- Danone S.A.

- Abbott Laboratories

- Reckitt Benckiser Group plc

- The Hain Celestial Group

- Bellamy's Organic (acquired by Mengniu Dairy)

- HiPP GmbH & Co. Vertrieb KG

- Mead Johnson & Company (now part of Reckitt Benckiser)

- FrieslandCampina N.V.

- Kraft Heinz Company

- Perrigo Company plc

- Beingmate Co., Ltd.

- Yili Group

- Synutra International Inc.

- Arla Foods

- Ausnutria Dairy Corporation Ltd.

- Kewpie Corporation

- Hero Group

- NurturMe

- Little Freddie

Frequently Asked Questions

Analyze common user questions about the Baby Foods and Infant Formula market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for specialized infant formula?

The increasing prevalence of infant food sensitivities, allergies (like cow's milk protein allergy), and specific dietary needs (e.g., prematurity) drives the demand for specialized formulas, which offer hypoallergenic or therapeutic nutritional profiles to support healthy development where standard formulas are unsuitable.

How significant is the role of e-commerce in the distribution of baby products?

E-commerce is highly significant, acting as the fastest-growing distribution channel. It offers parents unparalleled convenience, subscription models for routine purchases, greater access to niche and international brands (especially organic), and competitive pricing, particularly in developed and rapidly urbanizing markets.

What major regulatory challenge faces infant formula manufacturers globally?

Manufacturers face the complex challenge of navigating varying global regulatory standards concerning nutritional composition, ingredient approval (such as HMOs), and, critically, strict guidelines on marketing and advertising formula products, often governed by the WHO International Code of Marketing of Breast-milk Substitutes.

Which ingredient trend is currently defining the premium segment of the baby food market?

The ingredient trend defining the premium segment is the integration of Human Milk Oligosaccharides (HMOs) in formula and the strong consumer preference for certified organic, non-GMO, and plant-based ingredients in prepared baby foods, reflecting a focus on products perceived as cleaner and more natural.

Which geographical region holds the highest growth potential for the Baby Foods and Infant Formula Market?

The Asia Pacific (APAC) region holds the highest growth potential, primarily driven by large, growing populations, increasing disposable incomes, high birth rates, and the continuous shift of consumers towards trusted, premium commercial nutrition options in countries like China, India, and Southeast Asian nations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager