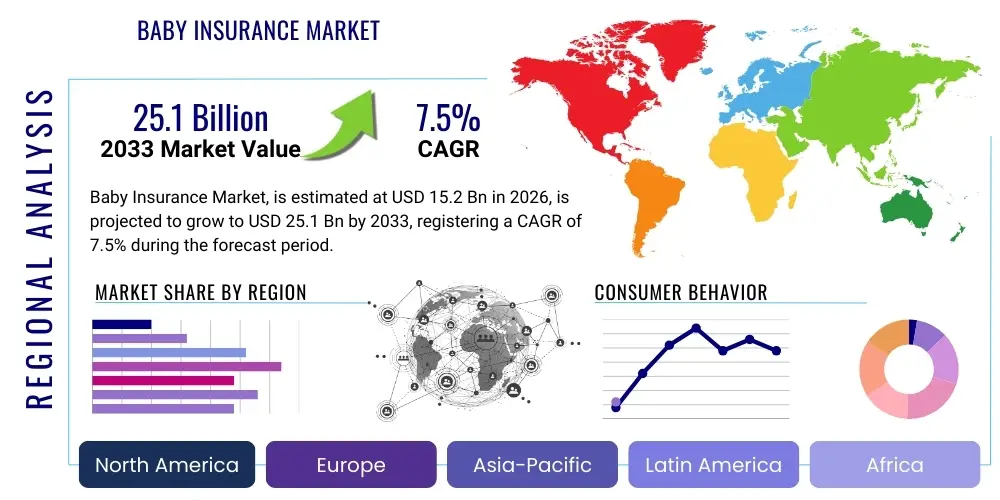

Baby Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436886 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Baby Insurance Market Size

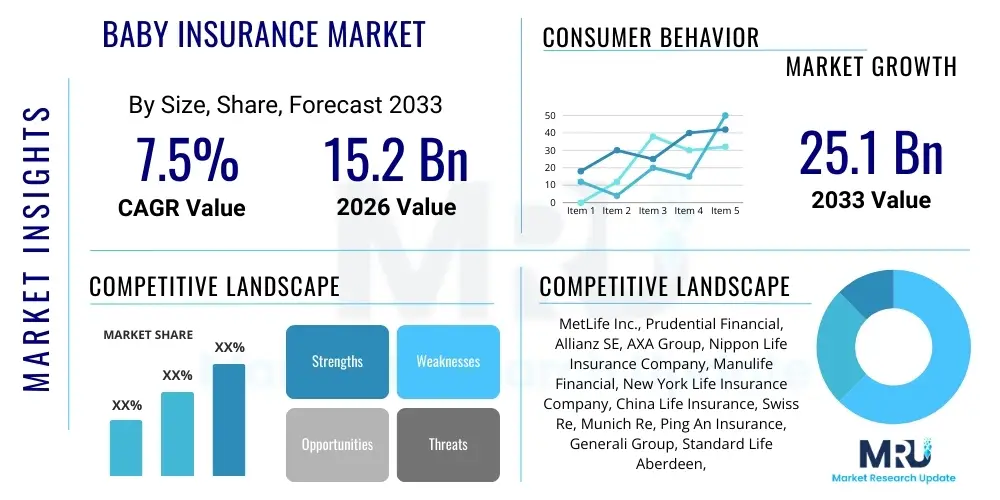

The Baby Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% (CAGR) between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 25.1 Billion by the end of the forecast period in 2033.

Baby Insurance Market introduction

The Baby Insurance Market, often encompassed within specialized juvenile life or child health insurance plans, provides crucial financial protection against unforeseen events, primarily health-related costs and future educational expenses for children from infancy through adolescence. These products are designed not only to cover immediate medical needs, such as congenital conditions or early childhood illnesses that might be expensive without coverage, but also to establish a financial foundation for the child's long-term future. Products range significantly, including whole life policies for children that build cash value, term life policies (less common but available), and comprehensive health riders attached to parental policies or standalone child health plans focused on critical illness coverage.

Major applications of baby insurance include mitigating the substantial financial risk associated with pediatric critical care, providing a tax-advantaged savings vehicle for education funding (depending on the type of policy and jurisdiction), and ensuring insurability later in life, regardless of future health developments. The core benefit proposition is financial security and peace of mind for parents, knowing that their child’s well-being is protected from unexpected financial burdens. Furthermore, specific policies offer guaranteed future purchase options, allowing the child to increase coverage significantly without new medical examinations upon reaching adulthood, cementing its value as an early investment in financial planning.

Driving factors for market growth are rooted in increasing parental awareness regarding the escalating costs of quality healthcare and higher education globally. Demographic shifts, including delayed parenthood leading to higher disposable incomes among new parents, also contribute significantly. Regulatory environments that encourage early financial planning and the development of innovative, flexible insurance products customized for juvenile risk profiles further accelerate market adoption. The continuous expansion of digital platforms enabling easier policy comparison and purchase also plays a crucial role in lowering friction for consumers seeking specialized coverage for their infants.

Baby Insurance Market Executive Summary

The Baby Insurance Market is characterized by robust growth driven by the convergence of heightened healthcare expenditure anxieties and a strong cultural emphasis on financial preparedness for offspring. Business trends highlight a significant pivot toward digitized policy administration and personalized product bundles that combine health protection with savings components, often leveraging indexed universal life features tailored for young beneficiaries. Insurers are increasingly forming strategic partnerships with pediatric healthcare providers and financial advisory firms to broaden distribution channels and offer integrated solutions, moving away from purely reactive risk coverage to proactive financial planning tools. Competition is intensifying among specialized niche providers and established global life insurers seeking to capture the highly valuable, long-term juvenile policy segment.

Regionally, the market exhibits uneven growth, with Asia Pacific (APAC) emerging as the primary growth engine, fueled by rapidly expanding middle-class populations, high savings rates, and government initiatives promoting comprehensive family financial planning, particularly in countries like China and India. North America and Europe maintain maturity, focusing on product innovation, such as integrating wellness programs and mental health riders specifically tailored for children. Latin America and the Middle East & Africa (MEA) present significant untapped potential, driven by improving economic stability and rising penetration rates of formal insurance products, though regulatory fragmentation remains a challenge that influences local market strategies.

Segment trends reveal that the Health Insurance segment, specifically Critical Illness Riders for newborns and infants, holds the largest market share due to immediate parental concerns regarding congenital defects and severe early childhood diseases. However, the Life Insurance segment, particularly Whole Life plans, is projected to register the fastest growth rate as parents increasingly recognize these products as dual-purpose instruments—offering lifelong protection while serving as educational savings vehicles. Distribution preference is clearly shifting toward online aggregators and direct-to-consumer digital channels (D2C), which offer transparency and convenience, though traditional agency networks remain vital for complex, high-value policy consultations.

AI Impact Analysis on Baby Insurance Market

Analysis of common user questions related to the impact of AI on the Baby Insurance Market reveals key themes centered around policy affordability, underwriting speed, and fairness in risk assessment. Users frequently ask: "How can AI lower my premiums for baby insurance?" "Will AI make underwriting decisions faster for children with complex medical histories?" and "Are AI algorithms biased against babies with certain genetic markers?" These questions underscore a high expectation that AI will deliver personalized, cost-effective policies while simultaneously expressing concerns about transparency, data privacy, and ethical implementation, particularly concerning the sensitive health data of minors.

The prevailing sentiment suggests that consumers anticipate AI to revolutionize the claims process and policy customization. They expect machine learning models to analyze vast datasets of pediatric health outcomes, genetic predispositions, and family medical histories more accurately and quickly than traditional methods, leading to fairer pricing models. However, there is a distinct anxiety regarding the potential for AI systems to flag conditions that are manageable or non-severe, resulting in unwarranted exclusions or highly inflated premiums, which could limit access to vital coverage for vulnerable groups. Insurers must address these concerns by ensuring explainable AI (XAI) is integrated into their underwriting pipelines to maintain consumer trust and regulatory compliance.

The primary transformative influence of AI is observed in streamlining operational efficiencies, allowing insurers to rapidly introduce new, dynamic products suited to evolving parental needs, such as coverage for specific developmental delays or mental health conditions in early childhood. Predictive analytics driven by AI models can forecast market demand for specialized riders, optimize pricing based on real-time epidemiological data, and drastically reduce the incidence of fraud in claims related to pediatric care. This efficiency not only improves the bottom line for carriers but, ideally, should translate into more competitive pricing and quicker policy issuance for prospective parents.

- Enhanced Personalized Risk Assessment: AI algorithms analyze genetic data, family history, and regional health data to provide highly specific risk profiles for infants, leading to optimized, tailored premium structures.

- Automated Underwriting and Instant Policy Issuance: Utilization of Machine Learning (ML) speeds up the evaluation of applications, minimizing human error and enabling near-instantaneous policy approval for standard applicants.

- Fraud Detection and Prevention: AI monitors pediatric claims for suspicious patterns or inflated costs, protecting the financial integrity of insurance pools and stabilizing pricing.

- Development of Dynamic Pricing Models: Algorithms continuously adjust premiums based on macroeconomic factors, healthcare inflation forecasts, and aggregated policyholder behavior data specific to juvenile cohorts.

- Improved Customer Experience via Chatbots and Virtual Assistants: AI-powered tools handle basic policy queries, claims submissions, and enrollment guidance, offering 24/7 support to busy parents.

DRO & Impact Forces Of Baby Insurance Market

The Baby Insurance Market is fundamentally shaped by powerful interconnected forces: Drivers (D), Restraints (R), and Opportunities (O). The primary drivers include the universally rising costs of specialized pediatric healthcare, particularly for critical or chronic conditions, and the increasing parental recognition of insurance as a fundamental wealth protection and transfer tool, utilized early in life to maximize cash value growth. These factors create an ongoing, persistent demand for comprehensive, early-entry insurance products. However, the market faces significant restraints, chiefly high premium costs associated with comprehensive plans covering all potential risks, coupled with the inherent complexity of navigating diverse insurance products, which often leads to consumer hesitation or reliance on less-optimized, general family plans. Furthermore, regulatory hurdles, particularly concerning the protection and use of minor children’s highly sensitive health data, impose significant compliance burdens on market players.

Opportunities within this domain are substantial and often technology-driven. The rise of Insurtech and digital distribution channels presents a massive opportunity to simplify the purchasing experience, making complex products more accessible and understandable to a wider demographic of new parents who rely heavily on online research and comparison. Secondly, there is a clear opportunity for product innovation focused on integrating health and wellness benefits, such as subsidized vaccinations, developmental screenings, or mental health support for young children, transforming the policy from a purely risk-mitigating tool into a proactive health maintenance partnership. These innovations not only attract tech-savvy parents but also differentiate offerings in a crowded financial services landscape. The ability to cross-sell or bundle juvenile policies with existing parental life or retirement plans further maximizes customer lifetime value.

Impact forces dictate the speed and direction of market development. Societal impact forces, such as changing family structures and increased focus on early childhood investment, continuously bolster demand. Economic forces, including global economic stability and disposable income levels, directly influence the uptake of optional, long-term savings-linked insurance products. Technological impact forces, particularly the adoption of advanced data analytics and AI in underwriting, are fundamentally altering how risk is calculated and priced, improving efficiency and potentially democratizing access to policies. Finally, competitive forces push companies toward continuous product feature enhancement and service excellence, ensuring that the market evolves rapidly to meet the detailed requirements of discerning modern parents.

Segmentation Analysis

The Baby Insurance Market is segmented comprehensively based on product type, coverage amount, distribution channel, and geography, reflecting the varied needs and purchasing behaviors of parents globally. Product type segmentation is critical as it distinguishes between policies focused on pure risk transfer (health/critical illness) and those that combine protection with long-term savings accumulation (life insurance). Segmentation by coverage amount helps insurers target specific socio-economic groups, ranging from basic, affordable coverage to high-net-worth policies featuring significant investment components. Understanding these segments is vital for developing targeted marketing strategies and optimizing product portfolios for maximum market penetration and profitability.

The segmentation based on distribution channel highlights the ongoing shift towards digital platforms, though traditional channels remain essential for policies requiring deep consultation and financial planning advice. Furthermore, geographic segmentation is crucial for adapting policies to local regulatory environments, cultural preferences regarding child investment, and regional variations in healthcare costs. For instance, policies in high-income regions might emphasize investment performance and tax efficiency, while those in emerging markets often prioritize critical illness coverage and protection against endemic health risks. This multi-dimensional segmentation ensures that carriers can effectively address the specific risk tolerances and financial goals of their diverse customer base.

- By Product Type:

- Life Insurance (Whole Life, Term Life, Universal Life)

- Health Insurance (Critical Illness Riders, Specific Disease Coverage)

- Endowment and Education Plans

- By Coverage Amount:

- Below $50,000

- $50,000 – $200,000

- Above $200,000

- By Distribution Channel:

- Agents and Brokers

- Bancassurance

- Online Channels (Direct-to-Consumer, Aggregators)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Baby Insurance Market

The Value Chain for the Baby Insurance Market begins with the upstream activities of product conceptualization and actuarial science. Upstream analysis involves highly specialized data gathering on pediatric morbidity, mortality rates, and future healthcare cost projections, requiring collaboration with medical experts and statistical modeling firms. Key players in this stage are reinsurance companies and specialized actuarial consultants who define the risk parameters and pricing mechanisms necessary to structure sustainable and profitable juvenile policies. Efficiency in this stage dictates the competitiveness of the final product, as accurate risk assessment ensures appropriate reserves and fair premium calculation, directly influencing the consumer value proposition.

Midstream activities encompass policy manufacturing, underwriting, and distribution management. This is where carriers leverage technology, particularly AI and robust CRM systems, to manage applications, conduct medical underwriting (if required), and service policies. Distribution channels, including agents, brokers, bancassurance partners, and digital aggregators, form the core pipeline connecting the product to the end consumer. The shift toward digital channels emphasizes optimizing the user interface and ensuring a seamless, compliant purchasing journey. High commission rates or technology investment in distribution are significant cost drivers in this segment, influencing the operational structure of the entire market.

Downstream activities focus on claims processing, customer service, and policy maintenance throughout the child's lifespan. Direct channels involve the insurance carrier handling all aspects from sales to servicing, offering maximum control over the customer experience. Indirect channels rely on third-party administrators (TPAs) or brokerage firms to manage ongoing client relationships, particularly for complex claims or policy changes. The post-sales experience, including the speed and fairness of claims settlement, is a critical component that drives customer retention and brand reputation, significantly impacting future policy sales and long-term viability in the specialized baby insurance segment.

Baby Insurance Market Potential Customers

Potential customers for the Baby Insurance Market primarily consist of financially secure, young to middle-aged parents who prioritize proactive financial planning and risk mitigation for their children. The demographic usually includes first-time parents or growing families who have stable incomes and a high degree of awareness regarding the potential long-term costs associated with health crises or future education. These buyers are often concentrated in urban and suburban areas with higher access to formal financial literacy resources and tend to be tech-savvy, relying on online research and comparisons before making significant long-term financial commitments. They view baby insurance not merely as a cost, but as a critical investment tool.

A secondary, yet rapidly expanding customer base includes grandparents and affluent family members who purchase policies as gifts or wealth transfer mechanisms. These buyers often opt for high-cash-value whole life policies, intending to secure the child's insurability and provide a substantial financial asset upon their majority. This segment is less price-sensitive and focuses heavily on policy guarantees, financial strength ratings of the insurer, and the potential for cash accumulation over several decades. Insurers target this group through wealth management advisors and private banking channels, offering specialized, premium-tier products.

Key End-Users/Buyers of the product are predominantly parents aged 28 to 45, falling within middle to upper-middle income brackets, who exhibit high consumer loyalty to brands that offer transparency, flexible payment options, and integrated policy management tools. Their purchasing decisions are heavily influenced by the perceived credibility of the insurer and endorsements from trusted pediatric or financial planning sources. The marketing efforts targeting this group must focus on the dual benefits of protection and savings, clearly demonstrating how early investment yields substantial lifelong advantages for the child.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 25.1 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MetLife Inc., Prudential Financial, Allianz SE, AXA Group, Nippon Life Insurance Company, Manulife Financial, New York Life Insurance Company, China Life Insurance, Swiss Re, Munich Re, Ping An Insurance, Generali Group, Standard Life Aberdeen, Dai-ichi Life Holdings, John Hancock, MassMutual, Züricher Kantonalbank, Lincoln Financial Group, RGA, AIG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Baby Insurance Market Key Technology Landscape

The technological landscape supporting the Baby Insurance Market is heavily centered on digital transformation, leveraging data analytics and cloud computing to streamline processes and enhance customer interaction. Core technology adoption includes robust Customer Relationship Management (CRM) systems integrated with policy administration software, allowing insurers to track the customer journey from inquiry through policy issuance and claims processing. Cloud-native platforms are critical for scalability, enabling insurers to handle large volumes of sensitive pediatric health data securely while complying with stringent data privacy regulations like GDPR and HIPAA. Furthermore, advanced data visualization tools are employed to simplify complex actuarial data for internal teams and to create clearer, more transparent policy illustrations for consumers.

A significant technological focus area is the implementation of Artificial Intelligence (AI) and Machine Learning (ML) for advanced risk assessment and predictive modeling. Insurers are utilizing ML algorithms to analyze non-traditional data sources—such as demographic trends, localized epidemiological data, and aggregated anonymized health records—to refine juvenile mortality tables and predict future health risks more accurately than traditional models. This leads to micro-segmentation of risk and the creation of highly specialized product variants, ultimately allowing for more competitive pricing for low-risk infants. Blockchain technology is also being explored, albeit slowly, for secure, immutable record-keeping of medical histories and policy terms, potentially accelerating claims settlement through smart contracts.

The proliferation of mobile applications and digital portals constitutes the primary interface technology for customers. These platforms facilitate self-service tasks such as premium payments, accessing policy documents, and initiating claims, significantly improving the overall parental experience. Telematics and integration with pediatric wellness apps, while still nascent, represent an emerging technology trend. These integrations allow parents to share aggregated, anonymized data on child health indicators (e.g., activity levels, sleep patterns) in exchange for premium discounts or enhanced wellness rewards, driving behavioral modification and potentially reducing long-term health risks, creating a virtuous feedback loop for the insurer.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing region due to explosive growth in the middle-class segment, cultural emphasis on familial investment, and high savings rates, particularly in East and Southeast Asian countries. The large population base, coupled with increasing penetration of formal insurance products and supportive government policies encouraging long-term savings (like education funds), makes this a dynamic and highly competitive region. Key markets like China and India are driving innovation in digital distribution and policy bundling.

- North America: North America holds a substantial market share, characterized by high disposable incomes and high healthcare costs, leading to strong demand for specialized critical illness and whole life policies that serve as wealth transfer instruments. The market is mature, emphasizing technological integration (AI underwriting) and sophisticated product structures, focusing on tax efficiency and guaranteed insurability options for future policy conversion.

- Europe: Growth is steady but moderate, influenced by strong state-sponsored healthcare systems which often reduce the need for basic health coverage but elevate demand for private critical illness riders and specialized educational endowments. Regulatory harmonization efforts, especially across the European Union, impact product structure and cross-border selling, demanding high compliance standards regarding data protection (GDPR) for minors.

- Latin America (LATAM): This region shows promising potential, driven by economic recovery and increasing financial literacy. The market is focused on basic protection and affordable term life policies, with growing interest in critical illness coverage due to variable quality of public healthcare infrastructure. Market penetration is still lower compared to developed regions, indicating significant opportunity for expansion.

- Middle East and Africa (MEA): Growth is localized, heavily influenced by oil wealth and demographic profiles in the GCC countries. Demand here centers on high-value, Sharia-compliant Takaful insurance products for children. In Africa, the market is highly fragmented, with penetration concentrated in economically stable countries like South Africa, focusing on affordable micro-insurance riders attached to parental policies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Baby Insurance Market.- MetLife Inc.

- Prudential Financial

- Allianz SE

- AXA Group

- Nippon Life Insurance Company

- Manulife Financial

- New York Life Insurance Company

- China Life Insurance

- Swiss Re

- Munich Re

- Ping An Insurance

- Generali Group

- Standard Life Aberdeen

- Dai-ichi Life Holdings

- John Hancock (Manulife Subsidiary)

- MassMutual

- Züricher Kantonalbank

- Lincoln Financial Group

- Reinsurance Group of America (RGA)

- American International Group (AIG)

Frequently Asked Questions

Analyze common user questions about the Baby Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Child Life Insurance and Child Health Insurance?

Child Life Insurance provides a death benefit and often accumulates cash value over time, serving as a financial safety net and long-term savings vehicle. Child Health Insurance primarily covers medical expenses, hospitalization, and critical illness treatments incurred during childhood, focusing purely on health risk mitigation.

When is the optimal time to purchase baby insurance for maximum benefit?

The optimal time is shortly after birth, as infants are typically in peak health, securing the lowest possible premium rates and guaranteeing insurability regardless of any future health issues that may arise during early childhood development. Early purchase maximizes the policy's cash value accumulation period.

How does AI impact the cost of baby insurance premiums?

AI impacts costs by enabling insurers to conduct granular risk assessment using vast health datasets, leading to more accurate underwriting. For healthy babies, this often translates to lower, more personalized premiums; however, for those with identified risks, premiums might be adjusted upward based on predictive modeling.

Are baby insurance premiums tax-deductible or is the cash value tax-free?

In many jurisdictions, the premiums for personal life insurance are generally not tax-deductible. However, the cash value growth within certain permanent policies (like Whole Life) often accumulates on a tax-deferred basis, and the death benefit is typically paid out tax-free to the beneficiary.

Can a child life insurance policy be converted or transferred to the child later in life?

Yes, permanent child life insurance policies are typically owned by the parent or guardian but can be easily transferred to the child upon reaching the age of majority (18 or 21). Many policies also include a Guaranteed Insurability Rider, allowing the adult child to purchase significant additional coverage without medical underwriting.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager