Baby Oral Care Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438325 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Baby Oral Care Market Size

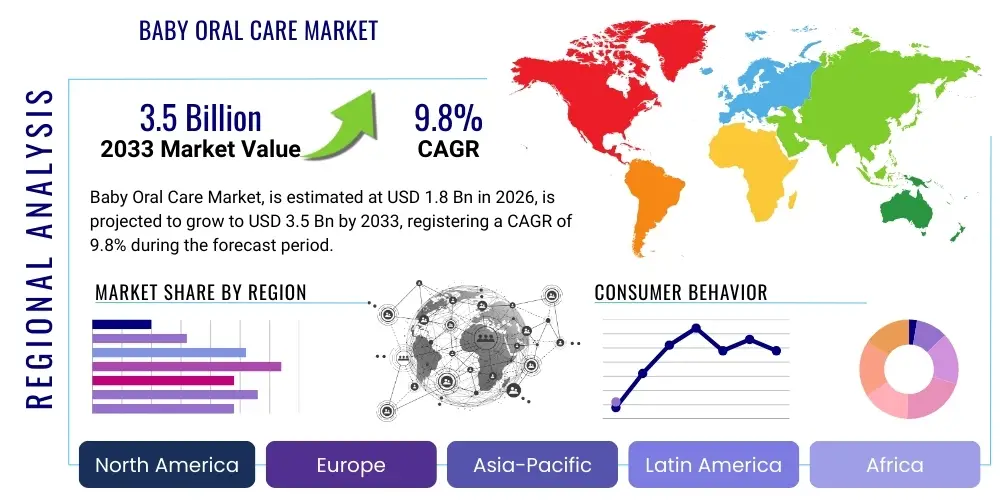

The Baby Oral Care Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.5 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by heightened parental awareness regarding the critical importance of pediatric dental health management starting from infancy, coupled with proactive recommendations from dental professionals and pediatricians advocating for early oral hygiene routines. The increased availability of specialized, segment-specific products, such as fluoride-free training toothpaste, ergonomically designed silicone finger brushes, and soothing oral gels, caters directly to the unique physiological needs of infants and toddlers, thereby expanding the consumer base and increasing the average transaction value within the segment.

Baby Oral Care Market introduction

The Baby Oral Care Market encompasses a diverse range of specialized hygiene products designed for infants and toddlers, typically from birth up to the age of three, focusing on preventing early childhood caries and establishing healthy oral habits. Key product categories include non-fluoride and low-fluoride toothpastes, soft-bristled baby toothbrushes, silicone teething brushes, oral wipes, and gentle mouth rinses specifically formulated to be swallowed safely in small amounts. Major applications involve daily cleaning of gums and newly erupted primary teeth, mitigating the risk of bacterial buildup, and providing relief during the teething phase. The primary benefits offered by these products include minimizing enamel erosion, fostering parental involvement in preventive healthcare, and addressing the heightened sensitivity of babies' oral tissues. The market is primarily driven by expanding healthcare infrastructure in emerging economies, stringent regulatory oversight ensuring product safety, and sophisticated marketing campaigns emphasizing the long-term cognitive and developmental benefits associated with excellent early oral hygiene practices, significantly influencing purchase decisions among new parents globally.

Baby Oral Care Market Executive Summary

The global Baby Oral Care Market is undergoing significant transformations driven by evolving consumer preferences leaning heavily toward natural and organic formulations, coupled with a dominant shift toward e-commerce distribution channels that offer convenience and product transparency. Current business trends highlight intensive product innovation focusing on material safety, specifically the elimination of controversial additives such as parabens, SLS, and artificial colorants, leading to premiumization of the product segment. Regionally, the Asia Pacific (APAC) market, spearheaded by countries like China and India, exhibits the most rapid growth due to increasing birth rates, rising disposable incomes, and the swift adoption of Western oral hygiene standards, whereas North America and Europe maintain market maturity characterized by high expenditure on specialized and sustainable product offerings. Segment trends indicate that the demand for fluoride-free toothpaste remains robust for the youngest consumer cohort (0-2 years), but there is a noticeable acceleration in the adoption of low-dose fluoridated options for toddlers (2-3 years) in alignment with updated pediatric dental guidelines, while e-commerce platforms continue to capture market share, offering extensive product catalogs and personalized subscription models for consumables.

AI Impact Analysis on Baby Oral Care Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is poised to revolutionize the Baby Oral Care Market by enhancing consumer engagement, streamlining product development, and optimizing supply chain logistics. Common user inquiries often revolve around personalized product recommendations based on a baby's specific developmental stage, the reliability of AI-driven diagnostic tools for identifying early signs of oral health issues (such as teething complications or incipient decay), and the effectiveness of AI-powered educational content delivered through smart home devices or parental apps. Consumers express expectations for AI models to analyze data points like feeding habits, sleep patterns, and geographical location to suggest the most appropriate toothpaste formulation (e.g., natural versus low-fluoride) and brushing technique for their child, addressing the anxiety often associated with initial oral care decisions. Furthermore, significant concern centers on how AI can monitor inventory and predict seasonal demand spikes, particularly for specialized products like teething gels, ensuring consistent availability across diverse retail environments.

AI's primary influence will manifest in sophisticated, predictive analytics that allow manufacturers to tailor product portfolios precisely to micro-market demands, reducing waste and accelerating the speed-to-market for new, highly specific baby oral care solutions. This data-driven approach allows companies to move beyond traditional demographic segmentation, offering hyper-personalized subscription boxes containing products curated based on a child’s specific eruption timeline, diet, and known sensitivities, thereby greatly enhancing customer loyalty and lifetime value. Moreover, AI is critical in enhancing the safety profile of products by simulating the interaction of new ingredients and packaging materials with sensitive baby tissues, substantially reducing the necessity for lengthy, traditional testing protocols and facilitating faster compliance with stringent international pediatric health standards, reinforcing market confidence in product efficacy and safety.

The application of computer vision and machine learning extends into the realm of consumer interaction through sophisticated parenting applications. These tools can utilize smartphone cameras to help parents track the progress of tooth eruption, evaluate the coverage and pressure applied during brushing (particularly when paired with smart toothbrushes), and alert parents to non-standard oral conditions that might warrant a virtual consultation with a pediatric dentist. This early diagnostic capability, enabled by AI image processing, significantly enhances preventative care by bridging the gap between routine home care and professional dental check-ups, especially critical in regions where access to specialized pediatric dentistry is limited. The resulting data streams provide invaluable feedback to R&D departments, creating a continuous loop of improvement that fuels iterative product design focused on ergonomic efficiency and enhanced palatability for infants.

- AI-driven personalized product recommendations based on baby's age, dietary intake, and regional water fluoridation levels.

- Predictive supply chain management optimizing inventory for highly volatile consumables like teething wipes and gels.

- Development of smart oral care devices leveraging AI algorithms for real-time coaching on correct brushing duration and pressure application.

- AI-enhanced parental mobile applications offering image analysis for early detection of oral lesions or developmental milestones.

- Use of Machine Learning in R&D to simulate ingredient interactions and predict toxicity profiles, speeding up safe formulation development.

DRO & Impact Forces Of Baby Oral Care Market

The dynamics of the Baby Oral Care Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the key Impact Forces that dictate strategic decisions and market trajectory. The primary Driver is the globally rising awareness among first-time parents and subsequent generations about the lifelong consequences of early childhood oral health, vigorously supported by expansive public health campaigns and updated guidelines from organizations like the American Academy of Pediatric Dentistry (AAPD) and the European Academy of Paediatric Dentistry (EAPD). This heightened educational emphasis directly translates into increased demand for preventative and specialized products, viewed not as optional accessories but as essential components of infant well-being. Coupled with this is the rapid expansion of organized retail and e-commerce, which provides unprecedented access to niche, international brands, boosting overall market penetration, particularly in urban and semi-urban areas of developing nations, where middle-class populations are rapidly expanding and prioritizing premium infant care items.

Conversely, the market faces significant Restraints, most notably the high price sensitivity among certain demographic segments, particularly concerning premium, natural, or organic formulations which often carry a substantial cost markup compared to conventional adult oral care products. Regulatory ambiguity, especially regarding the appropriate use and concentration of fluoride in products intended for infants (0-2 years), creates consumer confusion and apprehension, occasionally leading to parental hesitancy in adopting pediatrician-recommended products. Furthermore, the reliance on high-quality, safe raw materials, such as food-grade silicone and meticulously sourced natural ingredients, exposes manufacturers to supply chain volatility and increased scrutiny concerning contamination risks, necessitating costly, advanced quality control protocols that limit economies of scale and constrain profitability margins for smaller market entrants, thereby acting as a barrier to rapid expansion.

The most compelling Opportunities for market growth reside in the expansion of oral care telemedicine services and the creation of highly specialized product lines addressing specific developmental or physiological conditions. The digitalization of pediatric dentistry opens avenues for brands to offer value-added services, such as virtual consultations and personalized usage tracking, transforming product sales into integrated health solutions. From a product perspective, significant potential lies in developing probiotic oral care products formulated for infants to support a healthy oral microbiome, as well as innovative, sustainable packaging solutions (e.g., biodegradable tubes and recyclable applicators) that appeal directly to the environmentally conscious Millennial and Gen Z parent demographic. The synergistic combination of robust drivers, focused mitigation of restraints through transparent consumer education, and proactive exploitation of technological opportunities suggests a sustained, high-growth trajectory for the specialized baby oral care sector in the long term.

Segmentation Analysis

The segmentation of the Baby Oral Care Market is crucial for understanding specific consumer needs and tailoring product development and marketing strategies effectively. This analysis breaks down the market across key dimensions, including the nature of the product, the ingredients utilized in formulation, and the channels through which these products reach the end consumer. The segmentation highlights the underlying dynamics driven by safety standards and parental concern. The predominance of fluoride-free products in the formulation segment underscores the widespread precaution taken by parents regarding accidental ingestion by infants, driving significant innovation in alternative, naturally derived cleaning agents. Similarly, the increasing complexity of product types, moving beyond simple toothbrushes to specialized oral wipes and teething kits, reflects the market's response to the need for hygiene solutions across various infant development stages, optimizing market saturation.

The distribution channel segmentation reveals the critical shift toward digital commerce, as e-commerce platforms offer unparalleled convenience, detailed product information, and access to peer reviews, which are highly valued by modern parents. While traditional channels like supermarkets and pharmacies remain important for immediate purchases and professional recommendation access, the growth engine is increasingly powered by online sales, requiring brands to invest heavily in digital shelf optimization and direct-to-consumer models. This granularity in segmentation allows stakeholders to identify high-potential niches, such as premium natural formulations sold exclusively through specialty pediatric pharmacies or subscription services targeting the 6-12 month age bracket, ensuring that resources are allocated efficiently to capitalize on emerging consumption patterns and demographic shifts in purchasing power.

- By Product Type:

- Baby Toothpaste (Fluoride-Free, Low-Fluoride Training Paste)

- Baby Toothbrush (Finger Brushes, Training Brushes, Electric/Battery Operated Brushes)

- Oral Wipes/Gauze (For Gum Cleaning)

- Oral Accessories (Teething Gels/Solutions, Mouth Rinses, Tongue Cleaners)

- By Formulation:

- Fluoride-Free Formulations

- Fluoridated Formulations (Low Concentration)

- Natural/Organic Formulations (Containing Xylitol, Herbal Extracts, etc.)

- By Distribution Channel:

- Supermarkets/Hypermarkets

- Pharmacies/Drug Stores

- E-commerce (Online Retail)

- Specialty Stores (Baby Stores)

Value Chain Analysis For Baby Oral Care Market

The Value Chain for the Baby Oral Care Market is characterized by stringent quality control and complex regulatory adherence, starting with the upstream analysis involving the sourcing of raw materials. Given the sensitivity of the end consumers, the sourcing of ingredients is exceptionally critical, focusing on non-toxic, food-grade materials such as BPA-free plastics, high-grade silicone for brushes, and naturally derived or pharmaceutically pure active ingredients like Xylitol, chamomile, and low-dose fluoride salts for formulations. Suppliers must adhere to exacting safety standards, often incurring higher costs, which influence the final product price. Manufacturing processes require specialized facilities that prevent cross-contamination and meet ISO standards for medical or pediatric device production, necessitating high capital investment and specialized expertise in compounding gentle yet effective formulations that are often designed to be safely ingested in small quantities, significantly differentiating this sector from adult oral care manufacturing.

The downstream analysis focuses heavily on market penetration strategies and consumer engagement. Distribution channels are highly fragmented but increasingly centralized through e-commerce platforms. Direct channels involve manufacturers selling via their own websites, offering subscription services and capturing valuable consumer data, which enhances targeted marketing efforts. Indirect channels, including large hypermarkets, specialized baby boutiques, and pharmacies, rely on strong relationships and in-store prominence, often requiring significant trade spend and educational materials targeting the new parent demographic. Pharmacies and drug stores play a crucial role due to the trust associated with healthcare professionals, acting as a critical point for pediatric recommendations, particularly for medicated or specialized teething solutions, emphasizing the importance of detailed product knowledge among retail staff.

Optimization across the distribution channel focuses on speed, security, and traceability to maintain product integrity and consumer confidence. The logistics of delivering temperature-sensitive or highly regulated goods necessitates advanced warehousing and transport protocols. Ultimately, the successful execution of the value chain is predicated on maintaining transparency from raw material sourcing to the final sale, leveraging digital platforms to communicate ingredient safety and product efficacy. This holistic approach ensures compliance, minimizes risk exposure associated with product recalls, and builds enduring brand loyalty among discerning parents who prioritize safety and natural ingredients above cost considerations, thereby justifying the premium pricing often associated with high-quality baby oral care products.

Baby Oral Care Market Potential Customers

The primary potential customers in the Baby Oral Care Market are parents, particularly Millennial and Gen Z individuals who are raising infants and toddlers (aged 0–3 years). This demographic segment is characterized by high levels of digital literacy, a strong inclination towards preventative healthcare, and a deep commitment to sourcing highly transparent, safe, and often premium products for their children. These buyers are typically highly engaged in research, utilizing online communities, social media endorsements from parenting influencers, and detailed ingredient lists before making a purchase decision. They prioritize formulations that are natural, free from perceived harmful chemicals (like SLS, parabens, artificial dyes), and ethically sourced, reflecting a broader trend towards sustainability and wellness in infant care products. Their purchasing behavior is often dictated by trust in professional recommendations from pediatricians and dentists, making these key stakeholders critical influencers in the decision-making process.

A significant subset of potential customers includes grandparents and gift-givers, though their purchasing decisions are largely guided by the preferences and specific product requests of the parents. Institutional buyers, such as daycare centers and specialized pediatric clinics, also represent a growing customer base, purchasing in bulk essential items like oral wipes and training brushes to maintain mandated hygiene standards within their facilities. These institutional customers often prioritize bulk pricing, durability, and compliance with stringent public health regulations. The increasing global birth rate, coupled with rising disposable incomes in emerging markets, continually replenishes and expands the core customer base of new parents, ensuring sustained demand for essential, specialized oral hygiene solutions tailored for the specific developmental needs of babies and young children.

The purchasing cycle for baby oral care products is characterized by low inertia and frequent repurchase, driven by the rapid growth and changing needs of the infant—moving from silicone finger brushes to infant toothbrushes, and eventually to training toothpaste. Manufacturers target these shifts by offering age-specific kits and subscription services, capitalizing on the parental desire for convenience and ensuring they transition seamlessly within the brand's product ecosystem as their child matures. The high engagement and concern of these customers mean that successful market players must focus not only on product quality but also on educational content and supportive digital tools that address parental anxieties related to teething, first teeth eruption, and preventative measures against early childhood caries, positioning the product not merely as a commodity but as a vital health intervention tool.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Colgate-Palmolive Company, Procter & Gamble (P&G), Johnson & Johnson, Church & Dwight Co., Inc., Pigeon Corporation, Combi Corporation, The Himalaya Drug Company, Nûby, Oral-B (P&G subsidiary), Jack N' Jill Kids, RADIUS, LLC, Green Sprouts, Weleda, Hello Products LLC, Tom's of Maine, Chicco (Artsana Group), Mamaearth, Earth Mama Organics, Dr. Brown's, California Baby. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Baby Oral Care Market Key Technology Landscape

The Baby Oral Care Market is increasingly adopting advanced materials science and digital integration to enhance product safety, efficacy, and consumer engagement. A fundamental technological focus is on materials used in toothbrushes and accessories, emphasizing non-toxic, food-grade silicone and thermoplastic elastomers (TPEs) that are soft, durable, and free of BPA, Phthalates, and PVC, addressing key parental safety concerns. The development of specialized, ultra-soft PBT (Polybutylene Terephthalate) or nylon bristles, specifically tipped and densely packed, ensures gentle yet effective cleaning for sensitive baby gums and newly emerging teeth. Furthermore, ergonomic design technology dictates the shape and size of brush handles and heads, ensuring they are perfectly sized for the baby's mouth and comfortable for the parent or caregiver's grip during the assisted brushing phase, thereby maximizing compliance and ease of use in daily routines.

In the formulation segment, technological advancements center on developing effective cleaning and therapeutic agents that are safe for accidental ingestion. This includes utilizing plant-derived ingredients and naturally occurring sugar alternatives like Xylitol, which has proven anti-caries benefits, in formulations that mimic the efficacy of traditional fluoride pastes without the associated risks of fluorosis in infants. Microencapsulation technology is also being explored to stabilize sensitive natural extracts and deliver them effectively upon contact with saliva. Furthermore, the development of single-dose, pre-saturated oral wipes utilizes advanced non-woven fabric technology combined with sterile solutions, providing a convenient, hygienic, and highly portable method for cleaning gums and teeth on the go, addressing the needs of modern, mobile parenting lifestyles and ensuring consistency in hygiene practices outside the home environment.

Perhaps the most transformative technology is the integration of smart features into baby oral care devices, borrowing principles from the broader consumer electronics market. The introduction of Bluetooth-enabled smart toothbrushes designed for toddlers (typically ages 2 and up) connects to educational gaming applications on parental smartphones. These brushes utilize built-in sensors and accelerometers to track brushing patterns, duration, and coverage, providing immediate, gamified feedback to the child and generating detailed performance reports for the parent and, potentially, the pediatric dentist. This digital feedback loop leverages Generative Engine Optimization principles by collecting vast amounts of real-world usage data, which manufacturers can use to refine future product designs, optimize app algorithms for improved user experience, and generate highly targeted, contextual recommendations for complementary oral care accessories, driving both sales and improved hygiene outcomes.

Regional Highlights

- North America: This region represents a mature and highly profitable market, characterized by elevated consumer spending on premium, specialty baby products and a high degree of penetration of preventative oral care practices. The market is primarily driven by rigorous pediatric dental recommendations and high parental awareness of early childhood caries risks. Key trends include the dominance of natural, organic, and certified fluoride-free formulations, coupled with a growing demand for smart oral care devices that provide data and tracking features, appealing to the tech-savvy consumer base. The competitive landscape is dense, with major multinational corporations competing alongside innovative, clean-label startup brands, focusing heavily on sustainability and transparency in ingredient sourcing and packaging, particularly in the United States and Canada where regulatory standards are strict. The significant market presence of e-commerce ensures broad access to diverse product lines.

- Europe: The European market is defined by stringent regulatory environments, particularly the European Union's cosmetic directives, which enforce meticulous safety standards for ingredients used in products for children. Growth is steady, fueled by high healthcare standards and strong governmental support for preventative health programs. Consumers in Western Europe, especially in the Nordics and Germany, exhibit a strong preference for sustainable and eco-friendly products, driving demand for biodegradable packaging and ethically produced, minimal-ingredient formulations. While the market for fluoride-free options is substantial, there is also consistent, regulated growth in low-fluoride training pastes, aligning with localized public health strategies regarding water fluoridation. The distribution landscape is slightly more reliant on pharmacy channels and specialized baby retailers compared to the heavy e-commerce dependency seen in the US.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market globally, propelled by rapidly increasing birth rates, significant economic growth, and the expansion of the middle class in populous countries such as China, India, and Southeast Asian nations. Urbanization leads to greater exposure to Western healthcare and hygiene standards, spurring the adoption of specialized baby oral care routines. Unlike North America, the market here is characterized by high price sensitivity outside of Tier 1 cities, but there is explosive demand for value-added products and convenient formats like oral wipes. Local manufacturers are rapidly innovating to offer affordable alternatives, although high-end, international brands retain significant cachet, driven by perceptions of superior quality and safety assurance, particularly in the sensitive baby care segment. E-commerce platforms, particularly regional giants, are critical for market expansion into non-metro areas.

- Latin America (LATAM): The LATAM market shows promising growth potential, primarily influenced by rising health expenditure and demographic shifts favoring younger populations. Market adoption is uneven, with countries like Brazil and Mexico showing higher maturity and penetration rates than smaller nations. Key drivers include increased educational efforts by pediatric dental associations and government initiatives promoting oral health awareness from an early age. The main challenge remains affordability, which often leads consumers to favor budget-friendly options, though premium brands focused on natural ingredients are gaining traction among affluent urban consumers, often imported via specialty distributors. The market is characterized by a strong presence of local manufacturers adapting international standards to regional ingredient availability.

- Middle East and Africa (MEA): This region is characterized by fragmented but developing markets, where growth is concentrated in the Gulf Cooperation Council (GCC) countries due to high disposable incomes and sophisticated retail infrastructure. Parental concern for purity and safety drives demand for high-quality, international brands. In Africa, the market penetration is lower, largely constrained by limited access to specialized products and economic challenges. However, awareness campaigns and improving distribution networks, particularly through pharmacy chains and large urban supermarkets, are slowly enhancing market access, with a growing focus on basic, affordable oral cleaning solutions for infants, providing a robust long-term opportunity for market entry and expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Baby Oral Care Market.- Colgate-Palmolive Company

- Procter & Gamble (P&G)

- Johnson & Johnson

- Church & Dwight Co., Inc.

- Pigeon Corporation

- Combi Corporation

- The Himalaya Drug Company

- Nûby

- Oral-B (P&G subsidiary)

- Jack N' Jill Kids

- RADIUS, LLC

- Green Sprouts

- Weleda

- Hello Products LLC

- Tom's of Maine

- Chicco (Artsana Group)

- Mamaearth

- Earth Mama Organics

- Dr. Brown's

- California Baby

Frequently Asked Questions

Analyze common user questions about the Baby Oral Care market and generate a concise list of summarized FAQs reflecting key topics and concerns.When should I start brushing my baby’s teeth and what is the safest type of toothpaste to use?

Oral hygiene should begin even before the first tooth erupts, by gently cleaning the gums twice daily using a sterile oral wipe or a soft gauze wrapped around a finger. Once the first tooth appears, typically around six months, transition to a soft-bristled finger brush and use a fluoride-free training toothpaste. Pediatric dental associations recommend starting with a 'smear' of fluoride toothpaste (containing 1,000 ppm fluoride) around age two, or earlier if the child is at high risk for caries, ensuring strict adherence to the smallest possible amount (a grain of rice size).

What key safety features should I look for when purchasing a baby toothbrush?

Prioritize toothbrushes made from non-toxic, food-grade materials like BPA-free silicone or thermoplastic elastomers (TPEs). The brush head must be appropriately sized for an infant’s mouth, and bristles should be ultra-soft and rounded to prevent irritation to sensitive gums. Look for ergonomic designs that offer a comfortable, non-slip grip for the assisting parent. For electric brushes, verify the sonic vibration frequency is gentle and certified specifically for pediatric use, with safety mechanisms preventing over-pressure.

Are natural or organic baby toothpaste formulations genuinely safer and more effective than conventional options?

Natural and organic formulations appeal to parents concerned about chemical exposure, often substituting traditional ingredients with alternatives like Xylitol (a proven anti-caries agent), herbal extracts (chamomile, calendula), and natural flavors. While they reduce exposure to artificial additives, their effectiveness relies heavily on the presence of clinically supported ingredients such as Xylitol. Conventional fluoride toothpastes remain the gold standard for cavity prevention as per major dental guidelines; therefore, the choice depends on balancing parental preference for natural ingredients against professional recommendations for optimized caries prevention tailored to the child's risk profile.

How is the rise of e-commerce impacting the accessibility and competitive dynamics of baby oral care products?

E-commerce platforms significantly boost accessibility by providing consumers in geographically diverse areas access to niche, international, and specialized baby oral care brands that may not be available in local stores. This channel fosters competition by reducing barriers to entry for Direct-to-Consumer (D2C) specialty brands focused on natural or sustainable formulations. Consumers benefit from detailed product comparisons, extensive reviews, and convenient subscription services, driving market growth and increasing the velocity of new product introduction and adoption within the segment.

What is the future outlook for smart toothbrushes and AI integration in the infant and toddler oral care segment?

The future outlook is highly positive, driven by technological convergence and parental demand for measurable health outcomes. Smart toothbrushes, paired with AI-powered mobile apps, will move beyond basic timing to offer sophisticated, personalized feedback on technique, coverage, and developmental tracking (like tooth eruption charts). AI integration will enhance predictive modeling for product replenishment and offer personalized advice on managing conditions like teething discomfort, transforming oral care devices into integrated digital health tools that optimize preventative dental hygiene from birth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager