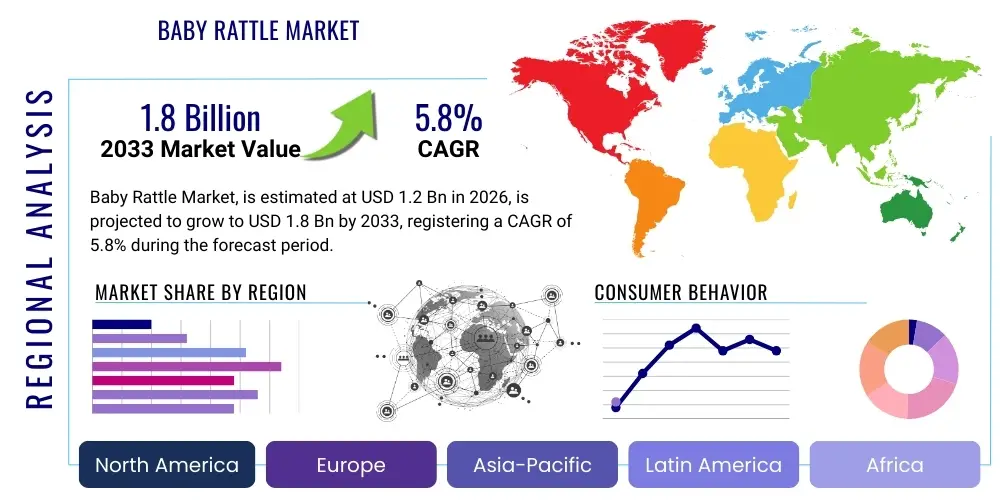

Baby Rattle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438007 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Baby Rattle Market Size

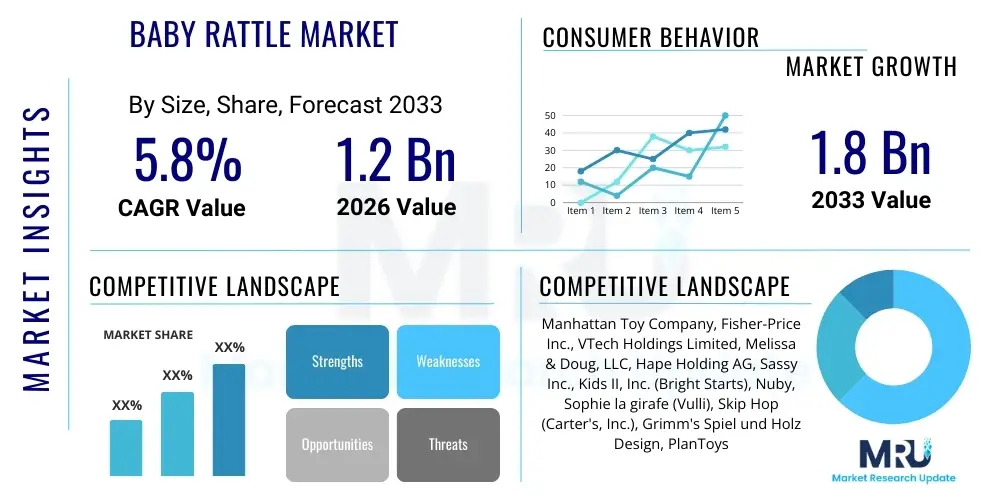

The Baby Rattle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

Baby Rattle Market introduction

Baby rattles are fundamental developmental toys engineered specifically for infants, primarily serving the dual purpose of auditory and sensory stimulation while simultaneously promoting the development of crucial early motor skills, such as grasping reflexes and hand-eye coordination. These products constitute a vital component of the early childhood education and entertainment sector, maintaining a perennial demand within the juvenile products industry. The market segmentation is largely driven by material composition, encompassing an increasing array of choices including certified sustainable wood, pharmaceutical-grade, BPA-free plastics, organic cotton fibers, and food-grade silicone. This material diversification directly addresses the contemporary shift in parental purchasing behavior towards products prioritizing safety, non-toxicity, and ecological sustainability.

The contemporary market growth trajectory for baby rattles is intrinsically linked to macro-economic indicators such as rising global birth rates, augmented discretionary spending capacity within burgeoning middle classes in emerging economies, and a significantly heightened global awareness regarding the scientific importance of structured early sensory play. Modern rattles are technologically advanced compared to their predecessors, often incorporating sophisticated ergonomic profiles, specialized textures engineered for alleviating teething discomfort, and multi-functional designs that surpass the rudimentary function of mere noise generation. This move towards integrated design necessitates continuous innovation in manufacturing processes and material science to meet consumer expectations for both developmental utility and product longevity.

The core benefits derived from baby rattles include facilitating auditory differentiation, establishing and refining the infant's grasping reflexes, and providing structured practice for visual tracking, which is foundational for cognitive development. Key driving factors fueling market expansion are stringent, evolving safety standards mandated by international regulatory bodies such as the U.S. Consumer Product Safety Commission (CPSC) and the European Union’s EN 71 directives. These regulatory pressures necessitate constant product redesign, material integrity verification, and sophisticated testing protocols. Furthermore, the market's inherent accessibility and relative affordability cement rattles as consistently popular choices for baby shower gifts and initial toy purchases, guaranteeing a stable, robust demand across diverse socioeconomic demographics globally.

Baby Rattle Market Executive Summary

The Baby Rattle Market is undergoing a structural transformation characterized by robust business trends pivoting towards high-margin, environmentally sustainable, and technologically integrated product offerings. Manufacturers are strategically concentrating on incorporating certified sustainable sourcing practices, such as obtaining the Global Organic Textile Standard (GOTS) certification for fabric components and utilizing Forest Stewardship Council (FSC) certified wood, to cater explicitly to the demands of the eco-conscious consumer base. The competitive landscape is marked by strategic acquisitions and partnerships among large established juvenile product corporations, alongside vigorous market disruption from specialized niche brands focusing on artisanal or personalized rattle designs. The overarching strategic objective remains uncompromising product safety compliance and the expansion of direct-to-consumer (D2C) channels to maximize profitability, gather instantaneous customer feedback, and mitigate reliance on conventional, volume-based mass retail structures.

From a geographical standpoint, the Asia Pacific (APAC) region has been identified as the epicenter of accelerated growth, fueled by immense population sizes, substantial economic growth, particularly in nations like the People’s Republic of China and the Republic of India, and significant demographic shifts towards urban environments, correlating with increased expenditure on premium infant care and developmental products. Conversely, the mature markets of North America and Western Europe continue to set global precedents for premium pricing, innovative features, and sophisticated safety features. These regions are the primary adopters of 'smart' rattles, which integrate advanced interactive elements, sound recording capabilities, and specialized developmental tracking functionalities, driving the technological frontier of the market segment.

The segmentation analysis reveals definitive preference shifts, with the Material segment showing a pronounced market migration toward silicone and certified natural wooden rattles, largely due to superior perceived safety, resistance to microbial growth, and inherent durability when compared to conventional plastic materials. Within the Distribution Channel segment, sophisticated e-commerce platforms have established dominance, providing consumers with unparalleled product variety, competitive pricing, and logistical convenience, particularly vital for specialty and customized high-end rattle brands. Furthermore, there is a burgeoning consumer inclination towards multi-sensory rattles—products designed to offer simultaneous visual contrast, varied tactile textures, and acoustically optimized soothing sounds—reflecting a desire among modern parents for maximized developmental efficacy within a singular, high-utility product.

AI Impact Analysis on Baby Rattle Market

Analysis of common user questions regarding Artificial Intelligence integration in the Baby Rattle Market consistently highlights themes related to guaranteed safety, highly personalized developmental assessment, and the potential convergence of traditional play with automated intelligence. Typical inquiries include: "How can AI algorithms definitively assure the absence of choking hazards in complex rattle assemblies?", "What mechanisms can AI use to tailor the sound frequencies or textural feedback of a rattle to optimize soothing effects for my unique child?", and "Will the introduction of AI-powered functionalities diminish the importance of simple, fundamental tactile toys in early development?" These questions underscore parental concerns focusing on leveraging AI to deliver measurable developmental advantages and uncompromised product safety, critically demanding that data privacy and ethical manufacturing practices are rigorously maintained throughout the lifecycle of smart toys.

Currently, the most significant practical application of AI resides in refining advanced manufacturing execution systems (MES) and optimizing the complexity of the global supply chain, rather than directly integrating intelligence into the traditional physical rattle mechanism. Major manufacturers are deploying sophisticated AI and machine learning algorithms for predictive maintenance and failure analysis, enabling proactive identification of potential stress points or material inconsistencies, thereby ensuring that all raw materials and finished products exceed the extremely high safety tolerances required for juvenile products. Furthermore, AI-driven demand forecasting dynamically manages global inventory levels and mitigates risk associated with volatile supply chain disruptions, ensuring continuous sourcing of crucial, certified components, such as non-toxic pigments and ethically sourced woods, effectively supporting the industry's premiumization trend.

For the future, the strategic integration of AI is poised to fundamentally redefine the premium 'smart rattle' subsegment by enabling highly personalized and adaptive sensory stimulation. Forthcoming models are expected to incorporate miniature, non-invasive sensors linked to neural network algorithms. These systems will autonomously monitor and interpret infant behavioral data—suching as the force and duration of grasping, observable agitation levels, and preferential response to specific auditory inputs. This derived behavioral data, when processed through secure companion applications, will furnish parents with precise, actionable developmental metrics and allow the rattle's output (e.g., dynamically altering soundscapes, light sequences, or mild vibration pulses) to adapt in real-time. This profound shift transforms the baby rattle from a passive instrument into an active, data-collecting, and adaptive developmental partner, thereby justifying a substantial increase in perceived value and price positioning in the specialized market segment.

- AI optimizes supply chain logistics through predictive sourcing, ensuring timely acquisition of certified, non-toxic raw materials.

- Advanced predictive analytics utilize machine learning to identify potential mechanical or material defects during complex manufacturing processes, significantly enhancing overall toy safety standards and quality assurance.

- Future product integration includes sophisticated smart sensors and microprocessors designed for non-invasive tracking of infant interaction patterns, motor skills development, and key sensory milestones.

- AI-driven companion apps provide parents with personalized, data-backed feedback, longitudinal usage analytics, and bespoke recommendations tailored to the infant’s observed developmental progress.

- Automated quality control systems use machine vision to verify compliance with stringent regulatory requirements (e.g., size consistency, absence of small parts) crucial for preventing choking hazards.

DRO & Impact Forces Of Baby Rattle Market

The propulsion of the Baby Rattle Market is primarily driven by the escalating global prioritization of evidence-based early childhood education and the scientifically validated importance of structured play in sensory and motor skill acquisition. A paramount driver is the institutional endorsement and widespread dissemination of standardized pediatric guidelines, which unequivocally advocate for introducing simple, multi-sensory stimuli during the crucial first six months of life, thereby creating a non-negotiable, recurring market demand for high-quality, certified developmental rattles. Concurrently, the exponential expansion of global e-commerce infrastructure serves as a critical enabler, providing specialized and sustainability-focused brands with unprecedented reach into global consumer markets, facilitating convenient access to niche, premium products adhering to rigorous organic certification and non-toxic material sourcing mandates.

Nevertheless, the market must navigate substantial restraints, chiefly originating from the increasingly complex and non-negotiable regulatory environment demanding absolute zero-tolerance for physical choking hazards, small parts detachment, and the presence of banned toxic substances, such as heavy metals and certain phthalates. Compliance with a multitude of heterogeneous international safety specifications (e.g., the U.S. ASTM F963, the international ISO 8124, and the EU’s REACH directives) mandates significant capital investment in internal testing laboratories, third-party certification audits, and rigorous material traceability systems. This burdensome compliance structure acts as a significant barrier to entry for smaller manufacturers and intrinsically inflates production overheads, potentially restraining competitive pricing strategies across the mass market segment.

Strategic opportunities for market expansion are abundant, particularly in the realm of material engineering, focusing on the accelerated development and integration of novel sustainable and entirely biodegradable materials, such as bio-plastics derived from plant starch or composites reinforced with bamboo fiber. This innovation directly addresses the intensifying consumer demand for environmentally responsible products, enhancing brand reputation. Furthermore, there is a profitable, untapped niche in the development of specialized therapeutic rattles, expertly designed for infants diagnosed with specific sensory processing disorders or those participating in early intervention physiotherapy programs, creating a high-margin submarket with strong clinical support. The overall market dynamics are governed by high impact forces, driven fundamentally by the non-cyclical nature of birth rates and the powerful, trust-building influence of pediatric marketing and non-negotiable safety mandates, ensuring market stability despite intense competitive pressures and inflationary material costs.

Segmentation Analysis

The Baby Rattle Market is structurally analyzed across several critical axes: material composition, specific product functionality, primary distribution methodologies, and defined geographic regions. This multi-layered segmentation is instrumental for achieving a comprehensive understanding of current consumer preferences, purchasing behaviors, and regional market nuances. Segmentation based on material type is arguably the most indicative of market trends, clearly reflecting the accelerating paradigm shift away from commodity plastics towards certified natural, non-toxic, and renewable resources, a trend predominantly fueled by elevated parental awareness concerning infant health and ecological footprint.

Segmentation by product functionality distinguishes between basic, single-function rattles and complex, multi-functional items, such as specialized teething rattles, musical devices, or those integrated into soft play mats. Each functional category targets distinct developmental stages, specific parental needs (e.g., pain relief during teething), and corresponds to varying consumer expenditure tiers. The analysis of distribution channels provides crucial insights into logistical efficacy and market access, confirming the irreversible dominance of sophisticated online retail platforms that efficiently cater to modern consumer demands for selection breadth and purchase convenience across diverse product types, from standard plastic units to exclusive, handcrafted wooden rattles.

The age group segmentation (0-6 months vs. 6-12 months) reflects the necessary evolution of product features, where younger infants require simpler, lightweight items focused purely on auditory and grasping stimuli, while older infants demand more complex textures, resistance for teething, and heightened interactive features. Understanding this developmental progression allows manufacturers to precisely tailor product portfolios and marketing communication strategies, ensuring the rattles meet the increasingly specific functional and safety requirements as the infant matures and transitions into more advanced play activities.

- By Material Type:

- Plastic Rattles (Conventional & Advanced BPA-Free Polymers)

- Wooden Rattles (FSC-Certified Maple, Beech, Sustainable Bamboo Composites)

- Silicone Rattles (Food-Grade and Medical-Grade Silicone Elastomers)

- Fabric/Knitted Rattles (Certified Organic Cotton, Sustainable Wool Fiber)

- By Product Type:

- Handheld Rattles (Classic designs emphasizing grasping)

- Wrist/Ankle Rattles (Wearable designs for passive movement stimulation)

- Rattle Sets/Gift Boxes (Curated collections for retail gifting)

- Teether Rattles (Integrated soft materials for gum relief, complex textural profiles)

- Musical/Electronic Rattles (Products incorporating sound chips or smart features)

- By Distribution Channel:

- Offline Channels (Specialty Baby Retail Stores, Regional Hypermarkets/Supermarkets, Pharmacy Retail)

- Online Channels (Global E-commerce Marketplaces (Amazon, Alibaba), Direct-to-Consumer (D2C) Brand Websites, Social Commerce Platforms)

- By Age Group:

- 0-6 Months (Focus on lightweight, high-contrast, auditory stimulation)

- 6-12 Months (Focus on durability, complex textures, teething functionality, and advanced motor skill development)

Value Chain Analysis For Baby Rattle Market

The value chain of the Baby Rattle Market commences with the highly regulated upstream segment, focusing on the procurement and initial processing of certified raw materials. Given the product's direct contact with infants, this stage necessitates meticulous verification of material purity, ensuring the complete absence of regulated toxins (e.g., heavy metals, phthalates, BPA). Manufacturers must prioritize establishing fully transparent and auditable supply chains with specialized vendors capable of providing certified food-grade silicone, FSC-compliant wood batches, and GOTS-certified organic textile fibers. The efficacy and ethical integrity of this upstream segment directly determine the final product's compliance status, its market positioning (especially in the premium and ethical categories), and ultimately, the manufacturer's operational costs based on sourcing complexity and certification fees.

The midstream segment encompasses sophisticated manufacturing, intricate assembly, and highly rigorous multi-stage quality control procedures. This stage involves converting raw materials into finished rattles, integrating specialized design features such as ergonomic handles, specific texture gradients, and encapsulated sound elements. Manufacturing methodologies utilized include high-precision plastic injection molding, automated CNC machining for wooden components to ensure dimensional stability and lack of splintering, and clean-room assembly for electronic components in smart rattles. Quality control is an intensive process, involving impact testing, tensile strength measurement to prevent small part detachment (the primary choking risk), and chemical leaching tests, all mandated to comply with divergent international regulatory thresholds like those set by Health Canada or TUV Nord. Efficient midstream management is critical for minimizing defects and maintaining the crucial element of consumer trust.

Downstream activities focus on the strategic distribution and market placement, covering both direct and highly leveraged indirect routes to the ultimate consumer. Indirect distribution, facilitated through massive retail networks like hypermarkets, specialized international baby retail chains (e.g., Mothercare, Babies R Us), and large-scale e-commerce behemoths, accounts for the overwhelming majority of market volume, benefiting from high foot traffic and logistical scale. Conversely, direct distribution, primarily managed through dedicated company brand websites and localized boutique showrooms, is optimally utilized for personalized, high-margin, or highly exclusive rattle designs, offering manufacturers enhanced control over pricing, brand messaging, and direct, unfiltered feedback collection, thereby bypassing typical retailer margin pressures and inventory commitments.

Baby Rattle Market Potential Customers

The foundational demographic segment comprising the core potential customers for baby rattles includes expectant parents, newly transitioned parents navigating the infant stage, and close immediate family members (such as grandparents, uncles, and aunts) purchasing essential developmental tools for infants within the 0 to 12-month age bracket. This primary consumer group is characterized by a high degree of health and safety sensitivity, displaying a strong preference for rattles constructed from certified non-toxic, chemical-free materials, featuring designs that maximize ease of grasping, and products that explicitly align with publicized pediatric recommendations for sensory development stimulation. Their purchasing decisions are profoundly influenced by digitally accessible factors, including authentic peer reviews on parenting blogs, endorsements from established pediatric health professionals, and effective brand narratives disseminated through modern social media platforms.

A significant, high-volume secondary customer base includes institutional entities such as commercial daycare operations, structured educational nurseries, specialized pediatric therapeutic clinics, and maternity ward units within hospitals. These institutional clients procure rattles in substantial quantities, necessitating products that offer exceptional durability, possess robust structural integrity to withstand intensive usage, and are designed for effortless, rapid sterilization procedures to maintain stringent institutional hygiene protocols. These professional purchasers typically favor industrial-grade silicone or highly resilient wooden rattles that promise extended operational lifespans and strict compliance with specific institutional safety procurement standards, often prioritizing functional longevity and bulk pricing structures over individualized aesthetic appeal or personalization features.

Furthermore, the discretionary Gift-Buyer Segment represents an economically vital portion of the market volume, particularly around major cultural events, holidays, and traditional baby showering occasions. Gift buyers actively seek products that present high aesthetic value and perceived quality, leading to robust demand for premium rattle sets, often presented in luxurious, environmentally conscious, or keepsake packaging. This segment demonstrates a lower sensitivity to price points compared to routine household purchases, thereby propelling demand for personalized, artisanal, or luxury-positioned rattles—such as bespoke engraved wooden models or handcrafted textile designs—allowing major brands and niche providers to successfully achieve substantially higher average selling prices (ASPs) within this specific high-end purchasing channel.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Manhattan Toy Company, Fisher-Price Inc., VTech Holdings Limited, Melissa & Doug, LLC, Hape Holding AG, Sassy Inc., Kids II, Inc. (Bright Starts), Nuby, Sophie la girafe (Vulli), Skip Hop (Carter's, Inc.), Grimm's Spiel und Holz Design, PlanToys, Green Toys Inc., Oli & Carol, Tikiri Toys, Mombella, Pigeon Corporation, Nûby, Hevea Baby, Cloud b, Fat Brain Toys, Infantino. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Baby Rattle Market Key Technology Landscape

The technological evolution defining the Baby Rattle Market, despite the product’s apparent simplicity, is characterized by intense focus on advanced material science, ultra-precision manufacturing techniques, and the strategic adoption of low-power, non-emissive electronic integration in the emerging smart toy sub-sector. Core technological breakthroughs concentrate on formulating advanced polymer compounds that are demonstrably non-leaching, highly resilient against wear and tear, and fully biodegradable, serving as direct, compliant replacements for legacy plastics. This shift necessitates the use of specialized material testing technologies to verify compliance with evolving chemical safety mandates across diverse global jurisdictions. Techniques such as plasma surface treatment and advanced ultraviolet (UV) curing processes for silicone components are increasingly deployed to impart superior antimicrobial properties and enhance hygienic standards, critical features for products that are constantly exposed to oral contact.

Furthermore, the design mandate for incorporating complex, multi-sensory features demands significant precision engineering in acoustics and tactile surface fabrication. For musical or electronic rattles, this technological requirement involves the miniaturization and encapsulation of highly reliable, low-energy micro-electronics that are rigorously protected against moisture ingress (drool resistance) and frequent high-impact stress, while also ensuring strict adherence to global safety limits for electromagnetic frequency (EMF) radiation. Manufacturing innovations, including multi-axis robotic assembly and high-resolution Selective Laser Sintering (SLS) 3D printing, are utilized to rapidly prototype and produce intricate geometric textures and optimized ergonomic profiles. These advanced processes allow manufacturers to achieve specific tactile stimulation points and handle designs that are impossible or cost-prohibitive using traditional injection molding or woodworking methods, significantly accelerating the design-to-market cycle for novel developmental products.

The most transformative technological advancement is centered within the nascent ‘smart rattle’ segment, which merges traditional toy functionality with sophisticated computational capability. These premium products integrate secure Bluetooth Low Energy (BLE) communication protocols, highly efficient miniature microprocessors, and proprietary machine learning algorithms designed to passively monitor play duration, track the nuances of motor skill usage, and provide adaptive feedback. The foundational technological architecture must incorporate sophisticated, multi-layered cybersecurity protocols to rigorously protect sensitive longitudinal child data, which is a major compliance and consumer trust concern globally. This level of technological integration elevates the rattle’s function beyond a mere static object, establishing it as a connected developmental data hub, demanding specialized expertise encompassing both consumer electronics reliability engineering and secure pediatric data management.

Regional Highlights

The global Baby Rattle Market is geographically diverse, exhibiting distinct consumption patterns and growth drivers dictated by regional socioeconomic factors, cultural traditions concerning infant care, and prevailing regulatory frameworks. North America, anchored by the substantial economies of the United States and Canada, functions as a mature, high-value consumer base characterized by high levels of disposable income and a strong cultural emphasis on premium, safety-certified, and ethically sourced juvenile products. Market demand is critically shaped by powerful societal trends prioritizing holistic early development and ecological sustainability, resulting in disproportionately high adoption rates of sophisticated wooden and silicone rattles sourced from both established brands and specialized artisanal producers. Mandates for comprehensive compliance with the CPSC and ASTM standards are rigorously enforced, compelling manufacturers to invest heavily in transparent material sourcing and rigorous third-party safety testing, factors which contribute to the region's higher average selling prices (ASPs) but simultaneously reinforce high levels of consumer confidence.

The European market mirrors North America’s focus on high quality, but places an even stronger, legally codified emphasis on environmental stewardship and aesthetic design excellence, particularly evident in the highly discerning consumer bases of Scandinavia, Germany, and the Benelux region. Demand is consistently high for products meeting strict environmental and material certifications, such as the EU’s CE Marking and OEKO-TEX standards, making ethical sourcing a primary competitive differentiator. The European Union’s unified yet complex Toy Safety Directive (EN 71) standardizes material purity and mechanical safety requirements across member states, requiring continuous and expensive product re-certification cycles. While Western Europe dictates the high-end trend narrative, the rapidly developing markets of Eastern Europe are posting significantly higher year-on-year volume growth, driven by swiftly increasing national disposable incomes and a pronounced, accelerating consumer shift away from uncertified, low-cost imports towards internationally recognized brands synonymous with guaranteed safety and developmental quality.

The Asia Pacific (APAC) region fundamentally dominates the market in terms of sheer volume consumption and represents the most substantial engine for future growth potential globally. Populous nations such as China, the Republic of India, and Indonesia are experiencing epochal market expansion, fueled by unprecedented economic growth, pervasive urbanization leading to smaller family units with more concentrated spending power, and a rapidly expanding, aspirational middle class keen to allocate significant expenditure towards superior international and domestic infant developmental products. Although deep-seated, traditional cultural preferences for localized toy designs remain influential, there is a swift, measurable escalation in consumer preference for high-tech, multi-functional, and certified safe rattles associated with reputable international safety endorsements. However, the operational challenge within APAC lies in navigating the fragmented landscape of local quality standards enforcement and mitigating the proliferation of uncertified, lower-cost parallel imports, necessitating sophisticated, geographically optimized supply chain control and anti-counterfeiting strategies by major international players.

- North America: High demand for premium, scientifically endorsed, organic, and smart rattles; market strategy rigidly dictated by stringent CPSC/ASTM safety standards and consumer focus on brand transparency.

- Europe: Leading globally on sustainability focus (FSC wood, organic textiles); market strictly governed by the comprehensive EN 71 directives; significant volume growth derived from rapidly modernizing Eastern European economies.

- Asia Pacific (APAC): Largest and fastest growing region; tremendous volume demand driven by massive middle-class expansion in China and India; increasing, critical adoption of international material safety and quality assurances.

- Latin America (LATAM): Market expansion contingent on regional economic stability; consumption skewed towards durable, value-driven plastic and lower-cost certified product alternatives.

- Middle East & Africa (MEA): Sustained baseline demand due to high birth rates; targeted growth opportunities exist in affluent urbanized zones for high-end, premium, and internationally branded certified rattles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Baby Rattle Market.- Manhattan Toy Company

- Fisher-Price Inc.

- VTech Holdings Limited

- Melissa & Doug, LLC

- Hape Holding AG

- Sassy Inc.

- Kids II, Inc. (Bright Starts)

- Nuby

- Sophie la girafe (Vulli)

- Skip Hop (Carter's, Inc.)

- Grimm's Spiel und Holz Design

- PlanToys

- Green Toys Inc.

- Oli & Carol

- Tikiri Toys

- Mombella

- Pigeon Corporation

- Nûby

- Hevea Baby

- Cloud b

- Fat Brain Toys

- Infantino

Frequently Asked Questions

Analyze common user questions about the Baby Rattle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards wooden and silicone baby rattles?

The primary driver is heightened parental concern over safety, product integrity, and ecological sustainability. Food-grade silicone and naturally sourced, certified wood (such as maple or beech) are universally perceived as superior non-toxic, chemical-free alternatives to conventional petrochemical plastics, appealing directly to health-conscious consumers who prioritize durable, non-leaching, and BPA-free products for sensitive infant use.

How do global safety regulations impact Baby Rattle Market growth?

Extremely stringent international regulations (e.g., CPSC, EN 71, and REACH directives) enforce zero-tolerance standards on material toxicity, physical integrity, and small part hazards. While these mandates substantially increase manufacturing costs, complexity, and require expensive certification, they critically boost fundamental consumer trust, effectively weeding out low-quality, unsafe competition, thus fostering structured, sustainable growth within the certified market segment.

Is the integration of smart technology a major trend in the Baby Rattle segment?

Yes, secure smart technology represents an emerging, high-value strategic trend. Modern smart rattles incorporate non-invasive sensors, robust Bluetooth connectivity, and proprietary algorithms within companion applications to track interaction metrics, provide personalized developmental feedback, and dynamically tailor soothing sensory experiences. This transforms the product from a static object into an adaptive, data-driven developmental monitoring tool, successfully targeting the premium, high-tech parenting segment.

Which distribution channel dominates sales in the Baby Rattle Market?

Highly advanced Online Channels, including major global e-commerce marketplaces (such as Amazon and Alibaba) and dedicated direct-to-consumer (D2C) brand websites, overwhelmingly dominate market volume sales. They provide unparalleled selection breadth, greater pricing transparency, instant access to authenticated user reviews, and superior logistical convenience, consistently outperforming traditional, localized offline retail infrastructures.

What factors differentiate a therapeutic rattle from a standard rattle?

Therapeutic rattles are specifically designed in consultation with pediatric specialists and occupational therapists to address specific sensory integration needs. They feature scientifically calibrated weights, highly defined tactile textures, and acoustically optimized sounds (often low-frequency) intended to provide specific calming or stimulating input for infants with diagnosed sensory processing sensitivities, serving a niche clinical market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager