Bacillus Coagulans Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431832 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Bacillus Coagulans Market Size

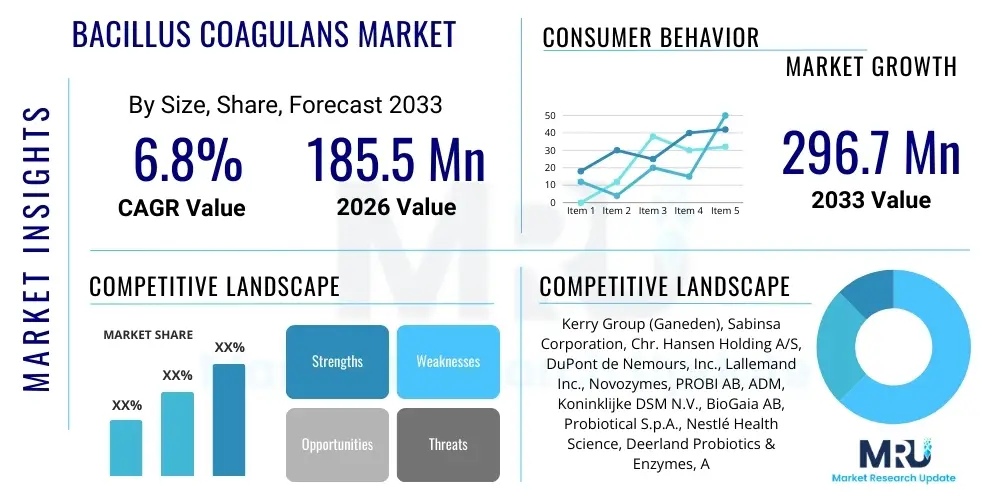

The Bacillus Coagulans Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 185.5 million in 2026 and is projected to reach USD 296.7 million by the end of the forecast period in 2033.

Bacillus Coagulans Market introduction

The Bacillus Coagulans Market encompasses the global trade and utilization of this specific spore-forming probiotic microorganism, widely recognized for its robust resilience to harsh processing conditions and the acidic environment of the stomach. Unlike many traditional probiotics that require refrigeration and face significant viability challenges during manufacturing and digestion, B. coagulans survives the digestive tract, ensuring higher efficacy and making it a preferred ingredient in functional food, beverages, and shelf-stable dietary supplements. This resilience is fundamentally driving its adoption across diverse food and healthcare matrices, positioning it as a cornerstone ingredient in the global digestive wellness movement. The rising consumer awareness regarding gut health, immunity, and the gut-brain axis further fuels the demand for potent, stable probiotic solutions.

The primary applications of Bacillus coagulans span several sectors, most notably dietary supplements, where it is often combined with prebiotics (symbiotics) or other probiotic strains to maximize health benefits, functional foods and beverages (such as fortified cereals, snacks, and juices), and the burgeoning field of medical food. Key benefits driving its utilization include documented efficacy in treating irritable bowel syndrome (IBS), reducing symptoms of inflammatory bowel disease (IBD), supporting nutrient absorption, and bolstering systemic immunity. Its versatility allows for inclusion in innovative product formats, including baked goods and hot beverages, environments where standard, non-spore-forming probiotics would typically perish, thus expanding the scope of probiotic delivery.

Several major driving factors are propelling market expansion. Firstly, the escalating prevalence of lifestyle-related digestive disorders globally mandates effective prophylactic and therapeutic nutritional interventions. Secondly, significant advancements in encapsulation and spore stabilization technologies have improved cost-effectiveness and scalability for manufacturers. Lastly, increasing regulatory acceptance and Generally Recognized as Safe (GRAS) status in major economic regions (like North America) have lowered market entry barriers and boosted consumer and manufacturer confidence. The synergistic effect of these technical capabilities and underlying consumer trends establishes a strong growth trajectory for the Bacillus coagulans market over the forecast period.

Bacillus Coagulans Market Executive Summary

The global Bacillus Coagulans market demonstrates vigorous growth, underpinned by significant shifts in consumer dietary preferences towards preventive health solutions and gut health optimization. Business trends indicate a strong move toward vertical integration among key players, focusing on proprietary strain development and specialized stabilization methods to secure competitive advantages. Mergers and acquisitions, particularly involving large food and beverage conglomerates acquiring specialized probiotic ingredient suppliers, are defining the competitive landscape, aiming to capitalize on patented delivery systems. Furthermore, innovation is centered on developing condition-specific formulations, such as those targeting mood improvement or sports recovery, broadening the product appeal beyond traditional digestive support.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, driven by large populations, increasing disposable incomes, and the strong cultural acceptance of functional foods and traditional fermented products. North America and Europe, however, maintain the largest market shares due to high healthcare expenditure, established supplement industries, and stringent but clear regulatory frameworks that encourage ingredient innovation and consumer trust. Regulatory harmonization across the European Union and increasing transparency in labeling within the US are critical factors influencing regional adoption rates. Emerging markets in Latin America and the Middle East are also beginning to recognize the economic and health benefits of incorporating stable probiotics into staple food items, signaling future market diversification.

Segmentation analysis highlights the functional foods and beverages segment as the primary revenue generator, owing to the mass market appeal and convenience of food-based delivery. However, the pharmaceutical and medical nutrition segments are anticipated to witness the highest Compound Annual Growth Rate (CAGR), driven by rigorous clinical validation and the development of high-potency, therapeutic-grade products addressing severe gastrointestinal conditions. Regarding product form, lyophilized powder remains dominant due to its stability and ease of integration into manufacturing processes, although liquid suspension formats tailored for specific beverage applications are gaining traction, reflecting manufacturers' efforts to meet diverse end-user application requirements while maintaining high spore counts.

AI Impact Analysis on Bacillus Coagulans Market

Common user questions regarding AI's impact on the Bacillus Coagulans market often revolve around efficiency gains in strain optimization, personalized probiotic recommendation systems, and accelerating clinical trial design. Users are concerned about how AI can refine fermentation processes to maximize yield and purity, and whether machine learning algorithms can predict the efficacy of specific B. coagulans strains against complex diseases like IBD or metabolic syndrome. The core expectation is that AI will transcend traditional trial-and-error research, enabling precision probiotic development tailored to individual human microbiomes and genetic profiles, thereby revolutionizing product efficacy and consumer personalization in the gut health space.

- AI-driven optimization of fermentation kinetics: Machine learning algorithms analyze vast datasets of culture conditions (temperature, pH, nutrient ratios) to identify optimal parameters, significantly reducing batch variation and maximizing Bacillus coagulans spore yield and purity.

- Predictive modeling for strain efficacy: AI analyzes genomic data of various B. coagulans strains against specific disease biomarkers (e.g., inflammation markers) to predict therapeutic potential before extensive in vivo testing, accelerating R&D cycles.

- Personalized probiotic recommendations: Integration of AI with microbiome sequencing and patient data allows for highly customized formulation suggestions, matching specific B. coagulans strains or combinations to individual gut health needs.

- Automation in Quality Control (QC) and stability testing: AI-powered imaging and sensor technology rapidly assesses spore count, viability, and stability in final products, ensuring consistent quality and adherence to regulatory standards across large production volumes.

- Supply chain optimization: AI forecasting models predict demand fluctuations for high-demand ingredients like B. coagulans, ensuring efficient inventory management and minimizing waste, especially critical for global distribution networks.

- Identification of novel synergistic ingredients: Machine learning screens potential prebiotics, postbiotics, or botanical extracts that exhibit synergistic effects when combined with B. coagulans, leading to next-generation symbiotic formulations.

- Enhanced drug discovery and repurposing: AI aids pharmaceutical applications by screening the anti-pathogenic or immunomodulatory properties of B. coagulans metabolites, potentially leading to new treatments for infectious diseases or autoimmune conditions.

- Accelerated regulatory submission preparation: Natural Language Processing (NLP) tools expedite the drafting and review of complex technical documentation required for GRAS or Novel Food status submissions, based on established regulatory precedents and scientific literature.

DRO & Impact Forces Of Bacillus Coagulans Market

The market dynamics are defined by a powerful convergence of drivers and constraints, balanced by significant future opportunities, creating a complex set of impact forces. The primary driver is the scientifically proven stability and superior survivability of Bacillus coagulans spores under diverse conditions (heat, pH, moisture), which drastically reduces formulation challenges compared to non-spore-forming probiotics like Lactobacilli and Bifidobacteria. This intrinsic stability unlocks the potential for incorporating probiotics into novel food matrices such as snack bars, hot beverages, and confectionery, which were previously inaccessible. Coupled with the rising global awareness of the microbiome's central role in health—extending beyond digestion to include mental well-being and immune defense—consumer pull for effective, shelf-stable ingredients is immense.

However, the market faces notable restraints. The primary impediment is the high cost associated with proprietary high-yield fermentation processes and subsequent downstream processing (including encapsulation and drying) required to produce high-purity, therapeutic-grade spores. This cost structure can limit mass market adoption in price-sensitive regions or segments. Furthermore, while regulatory acceptance is growing, the heterogeneous regulatory landscape across different jurisdictions poses a significant challenge; varying standards for labeling, claim substantiation, and maximum inclusion levels create operational friction for global players. Consumer skepticism regarding the efficacy of dietary supplements, particularly in regions prone to health misinformation, also presents a soft restraint that requires continuous investment in educational marketing and robust clinical validation.

Opportunities for exponential growth are concentrated in clinical applications and emerging geographic markets. The development of high-dose, pharmaceutical-grade B. coagulans products targeting specific clinical endpoints (e.g., chronic diarrhea, antibiotic-associated dysbiosis) represents a high-value niche. Geographically, significant opportunities exist in developing economies in Africa and parts of Southeast Asia, where the need for stable, easily distributable nutritional interventions for gut health is acute. The key impact forces are primarily technological advancement—specifically, continuous improvements in microencapsulation techniques that promise even greater stability and controlled release capabilities, pushing the boundaries of formulation possibilities and cementing B. coagulans as a versatile powerhouse ingredient in the global functional health market.

Segmentation Analysis

The Bacillus Coagulans market is meticulously segmented based on product form, application, and distribution channel to address the diverse needs of manufacturers and end-users across the health and nutrition spectrum. Understanding these segments is crucial for strategic market positioning, as each category exhibits unique growth drivers, regulatory hurdles, and competitive landscapes. The form of the product dictates its suitability for various manufacturing processes, while the application determines the required potency and regulatory pathway. The increasing sophistication in product formulation is creating cross-segment opportunities, such as combining high-stability powders into complex functional beverages.

- By Product Form:

- Lyophilized Powder (Dominant due to stability and ease of handling)

- Liquid Suspension (Growing segment, preferred for beverage fortification)

- Granules and Tablets (Used mainly in direct-to-consumer supplement formats)

- By Application:

- Dietary Supplements (Largest volume segment, includes capsules, tablets, and powders)

- Functional Foods & Beverages (Fastest growing segment, includes fortified dairy, baked goods, snacks, and juices)

- Pharmaceuticals (High-value segment, therapeutic use for severe GI disorders)

- Animal Feed (Focus on livestock and pet health for improved gut function and feed conversion)

- By Distribution Channel:

- Online Retail (Experiencing rapid growth, direct-to-consumer models, and specialized health platforms)

- Pharmacy & Drug Stores (Traditional channel, essential for medicinal and high-potency supplements)

- Supermarkets & Hypermarkets (Primary channel for functional foods and beverages)

- Direct Sales (Business-to-Business ingredient supply)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Bacillus Coagulans Market

The value chain for the Bacillus Coagulans market is complex, beginning with the upstream sourcing and cultivation of proprietary strains and extending through highly specialized fermentation, stabilization, and final product formulation. Upstream activities involve extensive R&D to identify, characterize, and genetically stabilize high-performance strains capable of optimal sporulation and clinical efficacy, often requiring significant initial investment in biotechnology infrastructure. Key upstream challenges include maintaining strain purity, scaling fermentation from laboratory to commercial levels while ensuring cost-efficiency, and securing intellectual property rights for patented strains, which act as crucial barriers to entry for new competitors. The quality and purity of raw materials, such as fermentation media components, directly impact the final spore yield and quality, making vendor selection a critical competitive factor.

The middle segment of the value chain is dominated by specialized ingredient manufacturers who process the cultivated biomass. This involves crucial steps like separation, drying (e.g., lyophilization or spray drying), and stabilization techniques to convert the liquid culture into a shelf-stable ingredient powder. Efficiency in this stage, particularly the drying methodology, determines the final cost of the ingredient and its viability percentage, directly influencing the final product's claimable probiotic count. Quality control and assurance are paramount here, involving rigorous testing for contaminants and validation of spore count using standardized methods. Companies that master proprietary microencapsulation or matrix stabilization technologies command premium pricing and stronger market positions due to superior product performance.

Downstream activities involve distribution and marketing through various channels to the end-user. Direct distribution channels involve ingredient suppliers selling directly Business-to-Business (B2B) to large functional food manufacturers, pharmaceutical companies, or contract supplement manufacturers. Indirect channels typically involve specialized distributors and brokers who manage logistics and regional compliance, facilitating the flow of ingredients to smaller or geographically diverse formulators. The final leg involves sales to consumers via retail channels—online marketplaces, pharmacies, and physical stores. Successful players in the downstream sector excel in compliance documentation, strong technical support, and consumer education, demonstrating how Bacillus coagulans addresses specific health needs, thereby maximizing pull-through demand for the ingredient in final consumer products.

Bacillus Coagulans Market Potential Customers

The primary customers and end-users of Bacillus coagulans are highly diversified, spanning multiple industries driven by the common goal of enhancing human and animal health through stable microbiome support. The largest volume buyers are manufacturers in the dietary supplement industry, who incorporate B. coagulans into capsules, powders, and gummies, often positioning them for daily digestive and immune maintenance. These buyers prioritize ingredient stability, third-party clinical data supporting efficacy claims, and the ability to combine the probiotic with vitamins, minerals, or botanicals without viability loss. Their purchasing decisions are heavily influenced by consumer trends favoring clean label ingredients and specialized condition-specific formulations, demanding flexible ingredient formats.

The functional foods and beverages industry represents the segment with the highest growth potential for ingredient suppliers. Food and beverage manufacturers utilize Bacillus coagulans due to its heat and pressure resilience, making it ideal for pasteurized juices, baked goods, fortified waters, and specialized nutritional bars. These buyers require ingredients that do not alter the organoleptic properties of the finished product and are robust enough to withstand high-volume processing environments. The objective here is mass market appeal, integrating probiotics into everyday consumer staples to achieve wellness goals passively. Large multinational food companies frequently source B. coagulans through long-term supply agreements to ensure consistent quality and volume for global product launches.

Additional significant end-user categories include pharmaceutical and medical nutrition companies, which demand the highest purity and regulatory compliance (e.g., GMP standards) for therapeutic applications, and the robust animal feed industry. In veterinary applications, B. coagulans is used to improve the gut health of livestock, reducing the reliance on antibiotics and enhancing feed conversion ratios, offering substantial economic benefits to agricultural producers. These buyers focus intensely on cost-per-effective-dose and data demonstrating performance improvement in animal health metrics. Furthermore, specialized cosmetic and personal care brands are emerging customers, exploring the topical application of probiotics for skin microbiome balancing, opening entirely new application avenues for the spore-forming ingredient.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Million |

| Market Forecast in 2033 | USD 296.7 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kerry Group (Ganeden), Sabinsa Corporation, Chr. Hansen Holding A/S, DuPont de Nemours, Inc., Lallemand Inc., Novozymes, PROBI AB, ADM, Koninklijke DSM N.V., BioGaia AB, Probiotical S.p.A., Nestlé Health Science, Deerland Probiotics & Enzymes, AB-Biotics SA, UAS Laboratories (now owned by Chr. Hansen), Danisco (now owned by DuPont), Syngene International Ltd., Lonza Group, Sanofi S.A., Jarrow Formulas. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bacillus Coagulans Market Key Technology Landscape

The successful commercialization and deployment of Bacillus coagulans heavily relies on advanced fermentation and stabilization technologies, which form the core technological landscape of the market. The fundamental technology is submerged fermentation, optimized through sophisticated bioreactor design and process control systems that maintain ideal conditions (e.g., anaerobic or microaerophilic states, specific temperature gradients, and nutrient delivery profiles) necessary for high-density vegetative growth and subsequent efficient sporulation. Manufacturers continuously invest in optimizing these upstream processes to achieve higher colony-forming unit (CFU) counts per gram of biomass, ensuring economic feasibility at commercial scales. Chemostat and fed-batch fermentation techniques are commonly employed, alongside proprietary media formulations designed to reduce costs while maximizing spore yield and minimizing waste byproducts.

The most critical technological differentiator lies in downstream processing, specifically focused on achieving maximum spore viability and stability throughout the drying and formulation stages. Key technologies include advanced lyophilization (freeze-drying) and sophisticated spray-drying techniques, often utilizing protective matrices (e.g., maltodextrins, trehalose) to shield the spores from thermal and mechanical stress. Novel stabilization technologies, such as microencapsulation using lipid or protein coatings, are emerging to further enhance resilience against moisture, oxygen, and processing heat, allowing B. coagulans integration into even more challenging food environments like breakfast cereals or high-protein powders. The focus of technological innovation is moving beyond mere survivability toward controlled release mechanisms, ensuring the spores activate optimally only upon reaching the lower gastrointestinal tract.

Furthermore, analytical technology plays a crucial role in maintaining high product standards and supporting efficacy claims. Advanced molecular biology techniques, including Quantitative Polymerase Chain Reaction (qPCR) and Next-Generation Sequencing (NGS), are utilized for precise strain identification, quality control, and monitoring of genetic stability. Flow cytometry is increasingly adopted for rapid and accurate determination of viable spore counts, replacing slower traditional plating methods. Intellectual property surrounding these processing methodologies, particularly specialized spore coating compositions and unique fermentation methods that reduce purification complexity, represents a significant competitive advantage. The convergence of these biotechnological advancements ensures that B. coagulans remains a leading choice for stable probiotic ingredient development globally.

Regional Highlights

Geographically, the Bacillus Coagulans market is analyzed across North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA), with each region exhibiting distinct consumption patterns and regulatory environments. North America, driven by high consumer awareness regarding digestive wellness and a mature dietary supplement market, holds the largest market share. The presence of key industry players, robust R&D infrastructure, and proactive adoption of novel functional foods contribute significantly to market dominance. The GRAS status accorded to several B. coagulans strains by the U.S. Food and Drug Administration (FDA) has facilitated widespread incorporation into various product formats, including innovative beverage applications and sports nutrition products.

Europe represents the second-largest market, although it faces comparatively stricter regulatory scrutiny, particularly concerning health claims for probiotics under the European Food Safety Authority (EFSA). This has driven companies in the region to focus on clinically validated, high-dose pharmaceutical applications and marketing based on established structure-function claims. The rising demand for clean label and organic functional foods, particularly in Western European countries like Germany and the UK, is encouraging the use of B. coagulans due to its natural stability and non-GMO sourcing potential. Innovation in European markets is heavily geared towards sustainable sourcing and transparent supply chains, aligning with prevalent consumer ethics.

Asia Pacific (APAC) is projected to be the fastest-growing market, primarily fueled by rapid urbanization, increasing per capita income, and a strong cultural affinity for functional and traditional foods with inherent health benefits, particularly in countries like Japan, South Korea, and China. Regulatory reforms in emerging Asian economies, simplifying approval processes for novel food ingredients, further accelerate market penetration. The primary demand in APAC comes from the functional foods and beverages segment, where B. coagulans is integrated into dairy alternatives, traditional fermented foods, and immunity-boosting beverages. Latin America and MEA are emerging markets characterized by lower current penetration but vast untapped potential, contingent upon improving infrastructure for food distribution and increasing health expenditure.

- North America: Market leader; driven by high supplement consumption, FDA GRAS approvals, and extensive integration into sports nutrition and convenience foods. Key markets include the United States and Canada, focusing on personalized nutrition.

- Europe: High demand for premium, clinically validated products; constrained by stringent EFSA health claims regulations. Growth is concentrated in pharmaceutical and high-end natural health food sectors (Germany, UK).

- Asia Pacific (APAC): Fastest-growing region; supported by large populations, rising incomes, and cultural acceptance of functional health concepts. Major growth engines are China, India, and ASEAN countries, heavily utilizing B. coagulans in beverages and traditional fortified foods.

- Latin America (LATAM): Emerging market characterized by growing awareness of gut health and increasing investment in the local food processing industry, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Nascent market, primarily driven by international imports and institutional health initiatives focused on nutritional deficiencies and digestive issues; stability of B. coagulans is critical for distribution in hot climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bacillus Coagulans Market.- Kerry Group (GanedenBC30)

- Sabinsa Corporation (LactoSpore)

- Chr. Hansen Holding A/S

- DuPont de Nemours, Inc.

- Lallemand Inc.

- Novozymes

- PROBI AB

- Archer Daniels Midland (ADM)

- Koninklijke DSM N.V.

- BioGaia AB

- Probiotical S.p.A.

- Deerland Probiotics & Enzymes

- AB-Biotics SA

- UAS Laboratories (acquired by Chr. Hansen)

- Danisco (acquired by DuPont)

- Syngene International Ltd.

- Lonza Group

- Sanofi S.A.

- Nestlé Health Science

- Jarrow Formulas

Frequently Asked Questions

Analyze common user questions about the Bacillus Coagulans market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Bacillus Coagulans and why is it preferred over traditional probiotics?

Bacillus Coagulans is a spore-forming, lactic acid-producing probiotic bacterium. It is highly preferred because its spore structure grants exceptional stability, allowing it to survive harsh manufacturing processes, shelf storage without refrigeration, and the acidic environment of the stomach, ensuring a higher delivery rate of viable cells to the intestine compared to non-spore-forming strains.

Which application segment drives the highest growth for Bacillus Coagulans?

The Functional Foods and Beverages segment is the primary growth driver. Due to its superior heat and pressure stability, B. Coagulans can be successfully incorporated into everyday products like fortified coffee, tea, juices, and baked goods, significantly expanding the consumer base beyond traditional dietary supplement users.

What are the main regulatory hurdles affecting the Bacillus Coagulans market?

The main hurdles involve obtaining approval for specific health claims, particularly in regions like the European Union (EU) where the European Food Safety Authority (EFSA) imposes rigorous standards for claim substantiation. Varying regulatory definitions and dosage requirements across international markets also create complexity for global manufacturers.

How does the use of AI influence the production cost of Bacillus Coagulans?

AI reduces production cost by optimizing fermentation processes. Machine learning analyzes complex culture parameters to maximize spore yield and purity, minimizing batch failures, reducing energy consumption, and ensuring cost-effective scalability, thus lowering the overall cost per effective dose.

What role does North America play in the global Bacillus Coagulans market?

North America holds the largest market share due to its established dietary supplement industry, high consumer awareness of gut health, and favorable regulatory environment, including the widespread granting of GRAS status to popular B. Coagulans strains, fostering diverse product innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager