Backcountry Skis Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438870 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Backcountry Skis Market Size

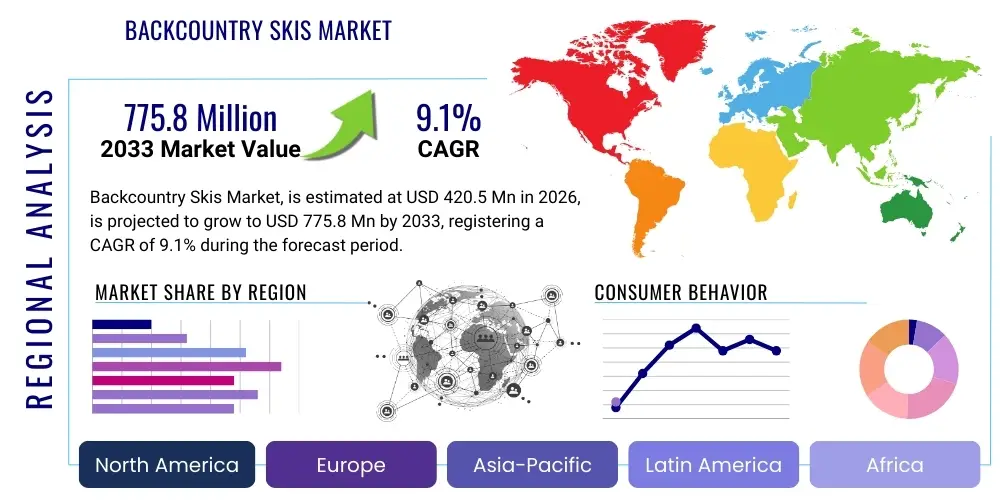

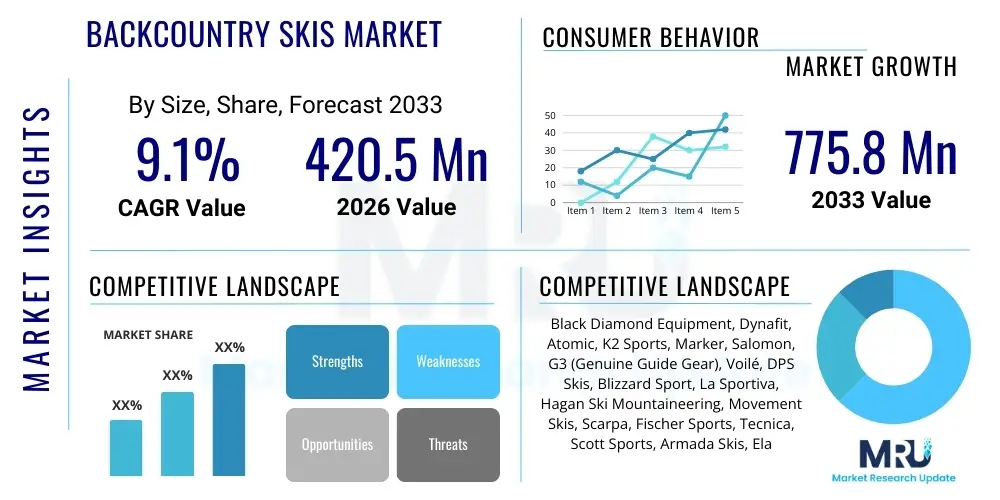

The Backcountry Skis Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.1% between 2026 and 2033. The market is estimated at USD 420.5 million in 2026 and is projected to reach USD 775.8 million by the end of the forecast period in 2033.

Backcountry Skis Market introduction

The Backcountry Skis Market encompasses the design, manufacturing, and distribution of specialized skiing equipment tailored for use outside of marked ski resort boundaries. This equipment, which includes skis, bindings, boots, and associated safety gear (like avalanche beacons and probes), is designed to facilitate both uphill climbing (ski touring or skinning) and downhill descent in ungroomed, often remote, terrain. The core product, the backcountry ski, typically features a lighter weight construction and specific shapes (such as rocker profiles) to enhance maneuverability and flotation in deep powder snow while minimizing energy expenditure during ascent. The rising popularity of ski mountaineering, freeride touring, and availing pristine, uncrowded skiing experiences are primary factors fueling demand.

Major applications of backcountry skis span recreational ski touring, demanding ski mountaineering expeditions, and professional guiding services. The inherent benefit of this equipment is the unparalleled freedom it offers, allowing users to explore remote mountain environments independently of lifts. This market segment is characterized by a strong emphasis on safety features, advanced material science (e.g., carbon fiber and specialized wood cores), and innovative binding systems that transition easily between walk mode and ski mode. Manufacturers are continuously innovating to reduce weight without compromising downhill performance, addressing the dual demands of efficient ascent and robust control during descent.

The primary driving factors propelling the growth of the Backcountry Skis Market include the increasing global interest in outdoor adventure sports, particularly in developed economies, coupled with significant technological advancements in gear lightness and durability. Furthermore, climatic concerns and the desire to avoid increasingly crowded resort slopes post-pandemic have pushed a segment of traditional alpine skiers towards touring. Enhanced accessibility to educational resources regarding avalanche safety and the proliferation of organized backcountry touring groups further normalize and popularize this demanding sport, thereby expanding the consumer base.

Backcountry Skis Market Executive Summary

The Backcountry Skis Market is experiencing robust expansion driven by changing consumer preferences toward experiential tourism and outdoor fitness. Key business trends include the consolidation of niche touring brands by major snow sports conglomerates seeking to capitalize on this high-growth segment, alongside a strong emphasis on direct-to-consumer (D2C) channels for specialized and high-margin products. Innovation remains centered on material science, particularly the utilization of advanced composites like carbon fiber to achieve optimal weight-to-performance ratios, crucial for demanding multi-day tours. Sustainability and ethical sourcing of materials are emerging as critical competitive differentiators, influencing purchasing decisions among environmentally conscious consumers.

Regionally, North America and Europe, especially the Alpine countries (France, Austria, Switzerland, Italy), dominate the market in terms of sales volume and technological adoption. These regions possess established mountain cultures, extensive backcountry terrain, and mature safety infrastructure. However, the Asia Pacific region, particularly Japan and parts of South Korea and China, is projected to exhibit the highest growth rate, fueled by rising disposable incomes, infrastructure development in mountain regions, and growing participation rates in niche snow sports. The seasonality of the market dictates cyclical inventory management, but year-round training and safety education initiatives contribute to sustained industry engagement.

In terms of segment trends, the 'Ski Touring Skis' segment, characterized by moderate weight and balanced performance, maintains the largest market share, serving the broad recreational touring base. Conversely, the 'Ultralight Ski Mountaineering Skis' segment is demonstrating the fastest growth, appealing to highly specialized users focused on speed and endurance challenges. By application, recreational use far outweighs professional use, but the latter drives technological advancements, which eventually trickle down into the mass market. The ongoing development of hybrid binding systems capable of supporting both pin and frame setups further blurs traditional segment boundaries, offering consumers greater flexibility and performance customization.

AI Impact Analysis on Backcountry Skis Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Backcountry Skis Market frequently revolve around personalized gear recommendations, predictive avalanche risk modeling, and optimizing equipment design. Users are keen to know how AI can move beyond general advice to offer precise sizing, stiffness, and mounting position recommendations based on individual biometric data, touring style, and intended terrain. A major concern is the reliability and accessibility of AI-driven safety tools, such as real-time risk assessment utilizing sensor data (weather, snowpack stability) fed into machine learning models. Expectations are high that AI will streamline complex logistical decisions for manufacturers and enhance the consumer experience through dynamic product configurations and highly personalized digital safety tutorials. Furthermore, there is interest in how generative design powered by AI can push the boundaries of materials science and ski geometry, leading to lighter, stronger, and more energy-efficient equipment tailored for specific backcountry niches.

- AI-powered predictive modeling for highly localized avalanche risk assessment based on sensor data aggregation and historical patterns.

- Machine learning algorithms optimizing the supply chain and inventory management for highly seasonal and segmented equipment lines.

- Generative design tools assisting manufacturers in creating novel ski geometries and core constructions to maximize weight savings and performance.

- Personalized gear recommendation engines utilizing user touring history, physical characteristics, and terrain preference data for optimal equipment matching.

- Enhanced customer service and troubleshooting via AI chatbots providing immediate, technical support for binding installation and maintenance.

- AI-driven analysis of snow structure and weather patterns to inform real-time route planning and safety advice via wearable technology.

DRO & Impact Forces Of Backcountry Skis Market

The Backcountry Skis Market is significantly shaped by a confluence of driving factors, critical restraints, and substantial growth opportunities. The core driver is the exponential growth in adventure tourism and the pursuit of solitude in nature, accelerated by global events that encouraged outdoor recreation away from congested areas. Technological innovation, particularly in light weight materials like carbon fiber and advanced polymer binding components, directly enhances product desirability by reducing the physical exertion required for uphill travel. However, the market faces structural restraints primarily related to the high initial cost of specialized equipment, which acts as a barrier to entry for casual skiers. Furthermore, the inherent safety risks associated with avalanche terrain necessitate extensive training and specialized safety gear, creating a dependency on educational resources and limiting spontaneous market entry. These forces collectively dictate the market trajectory, creating specific areas where investment and innovation yield the highest returns.

Key impact forces further intensify the market dynamics. Economically, the market is highly sensitive to discretionary spending, meaning downturns can impact the sales of high-end, specialized gear. Regulatory forces, particularly those governing access to public lands and wilderness areas, influence where and how consumers use the products, impacting demand regionally. Sociocultural trends, such as the increasing focus on physical fitness and endurance sports, bolster the appeal of ski touring as a demanding and rewarding physical activity. The primary opportunity lies in the global expansion of accessible and high-quality backcountry education and guided services, which directly mitigate the restraint posed by safety concerns. Development of rental and fractional ownership models for expensive equipment also presents a path to broadening the consumer base beyond affluent enthusiasts, further amplifying market reach.

The industry must strategically navigate the balance between product innovation—reducing weight while maintaining downhill integrity—and making the sport safer and more accessible. Successfully addressing the safety learning curve through digital tools, integrated safety features in the gear itself, and standardized educational platforms represents the most potent avenue for sustained market growth. The environmental impact of manufacturing materials and the carbon footprint associated with travel to remote skiing locations also represent long-term forces that necessitate proactive solutions, driving demand for sustainable product lines and ethical supply chains. The collective interplay of these forces ensures a dynamic and increasingly sophisticated market landscape.

Segmentation Analysis

The Backcountry Skis Market is systematically segmented based on ski type, application, component, and distribution channel, reflecting the diverse needs and expertise levels of the end-user base. Ski Type segmentation distinguishes between ultralight gear optimized for competitive ski mountaineering, touring skis designed for balanced all-day use, and heavy-duty freeride touring skis preferred for aggressive descents. This distinction is crucial as it directly relates to material costs and manufacturing complexity. The component segmentation includes skis, specialized touring boots, bindings (pin-tech vs. frame), and essential accessories like skins and safety equipment, acknowledging that consumers often purchase these items separately based on compatibility and specific performance needs.

Application segmentation typically divides the market into Recreational/Enthusiast use and Professional/Guided use. The recreational segment drives the overall market volume, focusing on ease of use and durability, whereas the professional segment demands the highest performance, reliability, and cutting-edge features. Analyzing these segments helps manufacturers tailor marketing strategies and product development pipelines. For instance, recreational users often prioritize integrated safety features and forgiving ski geometries, while professionals prioritize minimal weight and maximum stiffness for demanding conditions.

- By Ski Type:

- Ultralight Ski Mountaineering Skis

- All-Round Touring Skis (50/50 Ascent/Descent)

- Freeride Touring Skis (Descent-Focused)

- By Component:

- Skis

- Touring Bindings (Pin, Hybrid, Frame)

- Touring Boots

- Accessories (Skins, Poles, Safety Gear)

- By Application:

- Recreational Use

- Professional/Guided Use

- Competitive Ski Mountaineering

- By Distribution Channel:

- Specialty Retail Stores

- Online Retail (E-commerce)

- Mass Merchandise Retailers

Value Chain Analysis For Backcountry Skis Market

The value chain for the Backcountry Skis Market begins with the upstream segment, which involves the sourcing and processing of specialized raw materials. This includes high-performance wood cores (like Paulownia or Ash), advanced composites (carbon fiber, fiberglass), specialized plastics for boot shells and binding components, and high-quality P-Tex base material. Given the premium nature of backcountry equipment, ensuring a stable and traceable supply of these materials, particularly sustainable or ethically sourced wood and carbon fiber, is paramount. Relationships with specialized composite manufacturers and core suppliers are critical for maintaining the high standards of lightness and structural integrity required for touring gear.

The core manufacturing and assembly stage involves high-precision processes, including pressing skis, injection molding plastic boot shells, and assembling complex metal binding mechanisms. Quality control is rigorous, especially for pin-tech bindings where tolerances must be extremely tight for safety. Following manufacturing, products enter the distribution channel, which is typically split between direct and indirect routes. Direct distribution (D2C) via brand websites allows manufacturers to capture higher margins and maintain direct communication with the highly engaged customer base. Indirect distribution relies heavily on specialty outdoor retail stores, which provide essential expertise, fitting services, and safety consultation that online channels often lack, particularly for complex items like bindings and boots.

The downstream analysis focuses on the end-user and post-sale services. Specialty retailers and online platforms connect the products to the end consumers (ski tourists, mountaineers). Crucially, the downstream segment includes complementary services such as avalanche safety education, gear tuning, and rental programs, all of which enhance the overall market ecosystem. Effective collaboration between manufacturers and specialty retailers regarding product knowledge transfer and technical support is essential for consumer satisfaction and mitigating safety risks inherent to the sport. The value chain is inherently linear but relies heavily on sophisticated logistics to manage the highly seasonal demand cycles.

Backcountry Skis Market Potential Customers

The primary end-users and buyers of backcountry skiing equipment fall into several distinct yet overlapping demographic and psychographic categories, ranging from novices transitioning out of resort skiing to highly specialized professionals. The largest potential customer base comprises recreational ski tourists, typically affluent individuals aged 30 to 55, residing in proximity to mountainous regions or engaging in destination ski travel. These buyers prioritize versatile, durable gear that offers a balanced performance profile—sufficiently light for comfortable ascent but robust enough for confident descent on varied snow conditions. Their purchasing decisions are often influenced by online reviews, brand reputation for durability, and recommendations from peers or certified guides.

A rapidly growing segment consists of fitness-focused endurance athletes, often younger (25-40), who view ski touring as a demanding winter training activity. These customers exclusively target the ultralight ski mountaineering segment, prioritizing minimal weight above all else, often utilizing competitive-grade equipment. Their purchasing decisions are highly technical, driven by material specifications, gram count, and suitability for vertical gain challenges. Furthermore, professional mountain guides, search and rescue teams, and avalanche forecasters constitute the essential professional segment, demanding the highest reliability, ease of repair in the field, and integration with professional safety systems (e.g., specialized radio harnesses and GPS compatibility).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 420.5 million |

| Market Forecast in 2033 | USD 775.8 million |

| Growth Rate | CAGR 9.1% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Black Diamond Equipment, Dynafit, Atomic, K2 Sports, Marker, Salomon, G3 (Genuine Guide Gear), Voilé, DPS Skis, Blizzard Sport, La Sportiva, Hagan Ski Mountaineering, Movement Skis, Scarpa, Fischer Sports, Tecnica, Scott Sports, Armada Skis, Elan Skis, Roxa. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Backcountry Skis Market Key Technology Landscape

The technological landscape of the Backcountry Skis Market is defined by the relentless pursuit of weight reduction without compromising torsional rigidity and damping characteristics. A primary technological focus is the advanced use of composite materials. Manufacturers are heavily investing in proprietary carbon fiber laminates and unique layups, often utilizing pre-impregnated (prepreg) carbon sheets, which allow for extremely precise control over resin content and fiber placement. This minimizes weight while strategically stiffening the ski edges and core structure. Furthermore, the development of specialized wood cores, frequently utilizing lightweight Paulownia wood complemented by denser laminates (e.g., beech or bamboo) in high-stress areas, optimizes the weight-to-performance ratio, ensuring the ski performs predictably in highly variable backcountry snow.

Another crucial technological area is binding innovation, specifically the evolution of pin-tech systems. Modern pin bindings are dramatically lighter and more reliable than earlier iterations, featuring improved release mechanisms (both lateral and vertical) that enhance safety during falls while maintaining efficient pivot points for ascent. The emergence of hybrid bindings, which combine the lightweight climbing efficiency of pin systems with the robust retention and elasticity of alpine-style heel pieces, represents a significant technological leap. This hybridization caters directly to the growing segment of freeride tourers who demand uncompromising downhill performance alongside manageable uphill weight, effectively merging traditionally separate market segments.

Finally, technology extends beyond the ski and binding to digital integration and accessories. The market is increasingly adopting micro-GPS tracking within boots and specialized pole handles for enhanced navigation and emergency location capabilities. Electronic avalanche transceivers continue to see technological improvements, including multi-antenna systems and sophisticated signal processing to speed up victim searches. Future innovations are expected to heavily leverage sensor integration into safety gear, providing real-time data on snowpack vibration and temperature, feeding into personal risk assessment tools and further enhancing the overall safety ecosystem for consumers.

Regional Highlights

The global Backcountry Skis Market demonstrates distinct regional consumption patterns and growth dynamics, largely correlated with the presence of mature snow sports cultures and accessible mountain ranges. Europe, particularly the Alpine region, currently holds the dominant market share due to its entrenched culture of ski mountaineering, high population density around world-class touring terrain, and high levels of discretionary income. Countries like Switzerland, Austria, and France are hubs for both manufacturing innovation and end-user adoption, setting global trends in equipment design and safety standards. The maturity of the guiding and safety education industry in these regions supports sustained participation.

North America (primarily the US and Canada) represents the second-largest market and a major epicenter for freeride touring, with substantial growth attributed to the vast, accessible backcountry areas in the Rockies and the Pacific Northwest. The American market often drives trends in wide, descent-focused backcountry skis and advanced hybrid bindings. Post-pandemic, North America has seen an accelerated shift from resort skiing to touring due to capacity limitations and a preference for solitude. Significant regional investment in avalanche safety resources and organized touring groups continues to fuel expansion.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally, driven by infrastructure development in mountain tourism in countries like Japan, where deep, reliable powder snow attracts international visitors, and China, where the government is actively promoting winter sports participation. While currently smaller, the increasing affluence and Westernization of leisure activities in key APAC nations suggest substantial future market potential for specialized, high-end touring gear. Latin America (Chile and Argentina) and MEA remain niche markets, focused mainly on specific high-altitude mountain ranges, but they offer niche opportunities for specialized expedition equipment.

- Europe: Dominant market share; driven by established Alpine touring culture, high disposable income, and strong presence of leading manufacturers (e.g., Austria, Germany). Focus on traditional ski touring and lightweight gear.

- North America: Strong growth in recreational and freeride touring; large consumer base in the Western US and Canada; high adoption rate of hybrid binding technologies.

- Asia Pacific (APAC): Highest projected CAGR; fueled by developing ski resorts, increasing middle-class participation in China, and unique powder appeal in Japan.

- Latin America (LATAM): Niche market concentrated around the Andes mountains; seasonal demand for expedition and professional guiding equipment.

- Middle East & Africa (MEA): Minimal market presence, centered on expatriate communities and specialized high-altitude mountaineering expeditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Backcountry Skis Market.- Black Diamond Equipment

- Dynafit

- Atomic

- K2 Sports

- Marker

- Salomon

- G3 (Genuine Guide Gear)

- Voilé

- DPS Skis

- Blizzard Sport

- La Sportiva

- Hagan Ski Mountaineering

- Movement Skis

- Scarpa

- Fischer Sports

- Tecnica

- Scott Sports

- Armada Skis

- Elan Skis

- Roxa

Frequently Asked Questions

Analyze common user questions about the Backcountry Skis market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Backcountry Skis Market?

The market is primarily driven by the increasing global demand for adventure tourism and outdoor recreation, coupled with technological advancements that make touring gear lighter, safer, and more performance-oriented, encouraging a shift away from crowded traditional resorts.

Which segment of backcountry ski components is experiencing the fastest innovation?

The binding segment is seeing the fastest innovation, specifically the development and refinement of hybrid bindings that offer the light weight of pin technology for efficient ascent combined with the safety and robust performance of alpine bindings for aggressive downhill skiing.

How significant are safety concerns as a restraint in the Backcountry Skis Market?

Safety concerns, particularly related to avalanche risk, constitute a major restraint. The high requirement for specialized training, knowledge, and mandatory safety gear (beacon, shovel, probe) acts as a significant barrier to entry for novice skiers.

Which geographical region is projected to have the highest CAGR?

The Asia Pacific (APAC) region, driven by expanding winter sports infrastructure and rising disposable incomes in countries like China and Japan, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) through 2033.

What role does AI play in the future of backcountry equipment?

AI is expected to play a crucial role in enhancing safety through highly personalized predictive avalanche risk modeling and optimizing the manufacturing process via generative design to create lighter, stronger, and more energy-efficient backcountry skis.

Advanced Market Dynamics and Competitive Landscape Assessment

The competitive environment within the Backcountry Skis Market is intensely focused on innovation speed and brand loyalty, operating primarily as an oligopoly where a few major global players (like Amer Sports brands) compete with highly specialized, niche touring companies (like Dynafit and G3). Success hinges on optimizing the weight-to-performance ratio—the perennial challenge of making equipment light enough for long ascents yet stiff and damp enough for demanding high-speed descents. This requires continuous investment in materials science, particularly the development of proprietary carbon fiber matrixes and sophisticated core structures. Niche players often gain advantage through superior technical expertise in specific segments, such as minimalist ski mountaineering gear, while large established brands leverage extensive distribution networks and cross-segment bundling (e.g., offering a ski, binding, and skin package).

Pricing strategy in this market is highly tiered, reflecting the premium positioning of the gear. High-end, carbon-intensive touring setups command significant price premiums, justified by the specialized research and development invested. Retail dynamics are shifting, with direct-to-consumer (D2C) sales gaining traction, allowing brands to control narrative, pricing, and capture higher margins. However, specialty retailers remain vital as they provide essential technical services, such as boot fitting and binding mounting, which require expert physical interaction. Competitive differentiation is increasingly achieved not just through the hardware but also through digital integration, offering consumers tools for route planning, safety tutorials, and community engagement, transforming the purchase into a comprehensive backcountry experience.

Strategic alliances and acquisitions are becoming common as large companies seek to rapidly integrate niche innovations. For example, a major ski manufacturer might acquire a small binding technology company to secure proprietary lightweight technology. Long-term market stability requires manufacturers to proactively address sustainability concerns. Consumers are increasingly scrutinizing the environmental impact of composite materials and demanding transparency in supply chains, forcing companies to invest in recycled materials, non-toxic epoxy resins, and responsible forestry practices for wood cores. This focus on corporate social responsibility is quickly transitioning from a desirable feature to a fundamental competitive requirement, influencing brand reputation and long-term viability in core European markets.

COVID-19 Pandemic Impact Analysis

The COVID-19 pandemic significantly accelerated the growth trajectory of the Backcountry Skis Market, largely acting as a net positive force. Initial disruptions in 2020 involved supply chain instability, particularly affecting the sourcing of specialized components from Asia, leading to temporary inventory shortages. However, the subsequent societal shift towards outdoor, self-powered recreation dramatically increased consumer demand. With many traditional ski resorts imposing capacity restrictions, requiring reservations, or temporarily closing, alpine skiers sought alternatives, discovering the freedom and lower-contact nature of ski touring. This influx of "resort refugees" into the backcountry significantly broadened the market base, driving unprecedented demand for starter touring setups.

The immediate consequence was a massive spike in sales for essential safety gear, entry-level touring skis, and readily available instructional services. Manufacturers quickly pivoted to optimize their supply chains to meet this surging, unexpected demand, prioritizing production lines for touring gear over traditional alpine equipment. This period saw a demographic shift where younger, fitness-oriented consumers adopted the sport. The increased participation, however, also placed stress on existing safety infrastructure and prompted calls for more readily available avalanche education, which in turn spurred growth in related service sectors.

In the longer term, the pandemic cemented backcountry skiing as a mainstream snow sport rather than a niche pursuit. While supply chains have stabilized, the heightened consumer awareness and established participation habits have persisted. This structural change means the market now operates from a higher baseline volume than pre-2020 projections indicated. The ongoing challenge for the industry is to retain these new participants by ensuring the gear is accessible, affordable, and safe to use, thereby capitalizing on the permanent cultural shift toward independent outdoor adventure catalyzed by the global health crisis.

Market Opportunity Assessment: Unlocking Niche Segments

Significant opportunities for sustained market expansion exist within underserved or emerging niche segments. One key area is the continued development of gear specifically optimized for diverse female body mechanics. While historically gear has been designed around male anthropometrics, there is a growing realization that women require specifically tuned skis, boots, and bindings that cater to generally lighter weights, lower centers of gravity, and specific calf muscle geometry. Companies that successfully invest in genuine, performance-driven women-specific designs, moving beyond simple color palette changes, can capture a highly loyal and rapidly expanding segment of the market.

Another major opportunity lies in improving the accessibility of the market entry point. The high cost of a complete touring setup often deters casual interest. Manufacturers and retailers can mitigate this barrier through the widespread implementation of sophisticated rental programs that allow consumers to test high-end gear before committing to a purchase. Furthermore, the development of integrated educational platforms—leveraging augmented reality (AR) or advanced simulation for avalanche risk understanding and gear usage—can demystify the complex safety requirements, making the sport more approachable and less intimidating for newcomers, thereby widening the funnel of potential long-term customers.

Finally, geographic market expansion into emerging economies, particularly in the APAC region, presents lucrative growth avenues. Establishing strong local partnerships, tailoring product lines to specific regional snow conditions (e.g., deep, cold powder in Japan versus more continental, icy conditions elsewhere), and localizing marketing content are essential steps. Investment in local manufacturing or assembly facilities within these regions could also reduce logistics costs and tariff exposures, providing a crucial competitive edge in capturing nascent consumer demand as mountain tourism infrastructure matures across Asia.

Regulatory and Safety Landscape Analysis

The Backcountry Skis Market operates within a complex and highly decentralized regulatory framework, heavily influenced by regional access laws and self-imposed industry safety standards. Unlike traditional ski resorts, which are governed by strict operational codes, backcountry skiing is governed primarily by public land access regulations which vary significantly between countries (e.g., US Forest Service, European Alpine Clubs). Changes in land use permits, environmental protection laws, and restrictions on motorized access (e.g., snowmobiles) directly impact where and how backcountry skiers can operate, thus influencing equipment demand and regional market activity.

A critical component of this landscape is the standardization of safety equipment. While not mandated by governmental bodies in most recreational settings, the industry adheres to rigorous standards for avalanche transceivers (often meeting CE or FCC requirements) and binding release mechanisms (TÜV certification is common for release values). Industry organizations, such as the International Ski Mountaineering Federation (ISMF) and various national avalanche centers, play a de facto regulatory role by setting best practices for safety training, equipment quality, and communication protocols, which manufacturers actively integrate into product development and marketing efforts to establish trust and credibility.

Future regulatory trends are likely to focus on liability and resource management. As participation grows, there is increasing pressure on governments to fund search and rescue operations, potentially leading to user fees or required permits for access to certain high-risk zones. Furthermore, environmental regulations concerning materials (e.g., EU regulations on chemicals and plastics) are increasingly influencing manufacturing processes, pushing companies towards more sustainable and traceable material sourcing. Adherence to these evolving safety standards and environmental mandates is not only regulatory compliance but a necessary component of maintaining brand integrity and consumer trust in a risk-sensitive market.

Consumer Behavior and Preference Trends

Consumer behavior in the Backcountry Skis Market is sophisticated, driven by a strong desire for customization, authenticity, and environmental responsibility. Modern consumers are exceptionally well-informed, relying heavily on peer reviews, detailed specifications, and professional guide endorsements before making high-value purchases. There is a discernible trend towards modularity and system integration. Buyers prefer equipment (skis, boots, bindings) that is explicitly designed to work seamlessly together, simplifying the transition between uphill and downhill modes and maximizing energy transfer.

A major preference trend involves the 'weight versus width' debate. While ski mountaineers relentlessly pursue the lightest gear, the broader recreational segment is trending towards wider, more descent-focused touring skis (around 95mm to 110mm underfoot) that still utilize lightweight construction. This trend reflects the desire for superior flotation and performance in deep snow, even if it means carrying a slightly heavier setup uphill, demonstrating a preference for the quality of the descent experience. The demand for 'hybrid' performance is paramount—gear must be versatile enough to handle both technical ice climbs and deep powder descents in a single outing.

The psycho-social element of seeking solitude and a deeper connection to nature significantly influences purchasing behavior, particularly among affluent consumers. They often prioritize brands that align with strong outdoor ethics and sustainability commitments. This demographic is willing to pay a premium for certified carbon-neutral products or gear utilizing recycled and non-toxic components. Furthermore, the consumption of safety education (courses, books, digital tools) is increasingly viewed as an integral part of the equipment purchase, reflecting a matured understanding of the risks associated with the sport and a commitment to responsible participation.

These detailed analyses and forecasts provide a robust foundation for strategic planning within the global Backcountry Skis Market, highlighting areas of investment, risk management, and long-term competitive advantage in this dynamic outdoor sports segment.

The demand for specialized soft goods is also noteworthy. Technical apparel for ski touring must balance breathability during intense uphill activity with protection against harsh weather during descents or transitions. This has led to material innovations, such as highly permeable and wind-resistant soft shells and specialized layering systems that integrate with the safety harness systems. Consumers seek integration between their apparel and their hard goods, demanding pockets and features designed to easily access beacons, skins, and water bottles without removing layers or backpacks.

The purchasing cycle for backcountry gear is often longer than for alpine equipment, involving extensive research and often professional consultations for boot fitting and binding choices. This emphasizes the critical role of specialty retailers, despite the growth of e-commerce. Retailers who offer comprehensive fitting services and host community-focused events or safety clinics build crucial long-term relationships and brand loyalty. Moreover, the used equipment market is vibrant, particularly for bindings and skis, indicating a strong secondary market and a consumer focus on investment longevity and repairability, rather than rapid obsolescence.

Finally, social media platforms and influencer endorsements hold significant sway, especially among younger buyers. Brands must navigate the challenge of maintaining an authentic, expert-driven image while appealing to a broader, digitally native audience. Authentic content featuring professional athletes or certified guides demonstrating proper technique and safety awareness is far more effective than traditional product advertising, reinforcing the market’s core value of competence and responsibility in hazardous environments.

Future Outlook and Strategic Recommendations

The Backcountry Skis Market is poised for sustained high growth, contingent upon the industry's ability to effectively manage safety concerns and enhance accessibility. The future outlook suggests a continued convergence of lightweight climbing technology with high-performance descent characteristics, potentially standardizing the hybrid binding as the primary system. Geographically, while Europe and North America will remain the primary revenue generators, the rate of development in infrastructure and participation in Asia will necessitate significant strategic attention and localized product offerings from global manufacturers.

From a strategic perspective, companies should prioritize three key areas. Firstly, accelerated investment in safety education integration is paramount. This means developing proprietary digital platforms that interface with equipment to provide risk information, connecting users to certified training providers, and potentially subsidizing entry-level safety courses. This transforms a market restraint (safety risk) into a competitive advantage (safety assurance).

Secondly, manufacturers must commit to verifiable sustainability across their entire supply chain. Achieving market differentiation through certified ethical sourcing of wood cores, minimizing the use of toxic resins, and demonstrating a reduced carbon footprint for production will be essential for winning over the discerning European and North American consumer bases. Thirdly, fostering direct engagement with the end-user through D2C channels is necessary to capture higher margins and gather crucial, real-time feedback on product performance in the field, driving rapid iterative design improvements, particularly in the highly complex and technical boot and binding segments.

The future of the backcountry market is inextricably linked to the preservation of the mountain environments it relies upon. Therefore, brands that position themselves as stewards of these environments—through responsible manufacturing, advocacy for access, and financial support for conservation—will establish the strongest long-term market positions. Failure to address accessibility issues, particularly the high cost and safety barriers, risks limiting the market's expansion potential, leaving it confined to an affluent, expert niche rather than a widely adopted recreational pursuit.

Focusing on modular equipment systems that allow users to upgrade components incrementally, rather than replacing entire setups, can also enhance accessibility and sustainability, catering to the economically conscious consumer. Furthermore, utilizing advanced data analytics from integrated sensors in boots and skis can refine future product development, leading to genuinely personalized gear that caters precisely to individual biomechanics and touring objectives, solidifying market leadership through customization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager