Background Screening Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434442 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Background Screening Market Size

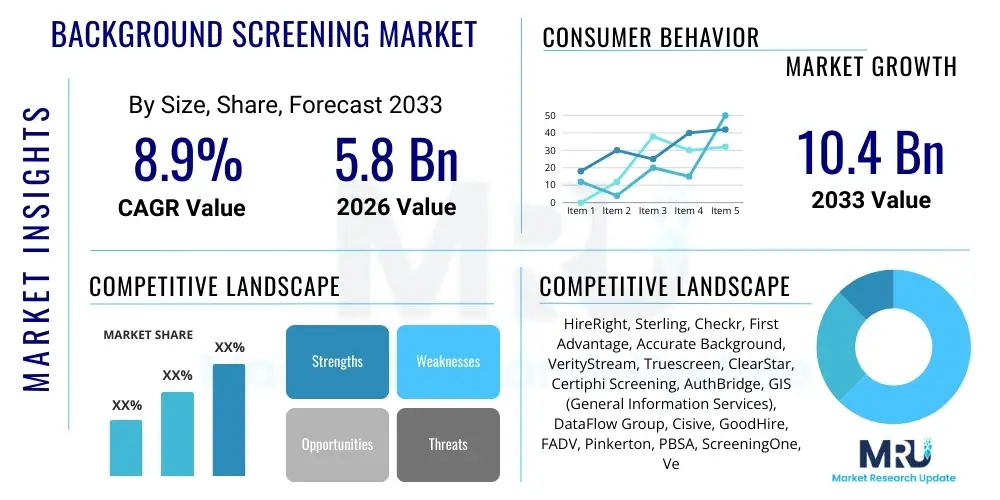

The Background Screening Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 10.4 Billion by the end of the forecast period in 2033.

Background Screening Market introduction

The Background Screening Market encompasses services and technologies utilized by organizations globally to verify the identity, history, and credentials of potential employees, contractors, and tenants. These services are crucial for maintaining workplace safety, ensuring regulatory compliance, mitigating organizational risk, and preserving brand reputation. Key product offerings include criminal record checks, employment history verification, education verification, driving record checks, credit checks, and drug testing. The scope of screening has significantly expanded from traditional employee verification to include due diligence for mergers and acquisitions and enhanced checks for personnel working in highly regulated industries like finance and healthcare. The increasing complexity of global labor laws and the rising incidence of fraudulent credential submissions necessitate robust, technology-driven screening solutions.

Major applications of background screening span across nearly all industry verticals, with the largest demand stemming from sectors characterized by high employee turnover, significant security requirements, or sensitive data handling. These include Banking, Financial Services, and Insurance (BFSI), Information Technology (IT) and Telecom, Healthcare, Government, and Retail. The proliferation of the gig economy and remote work arrangements has further amplified the need for comprehensive and continuous screening processes that extend beyond traditional pre-employment checks. The adoption of cloud-based screening platforms and mobile technologies has enhanced the efficiency and speed of these services, allowing companies to make hiring decisions quickly while adhering to strict compliance standards such as the Fair Credit Reporting Act (FCRA) in the US and General Data Protection Regulation (GDPR) in Europe.

Driving factors for this market are fundamentally rooted in the global emphasis on risk management and compliance mandates. Regulatory pressures compel organizations to implement stringent verification processes, particularly in highly regulated sectors. Furthermore, the desire to foster a trustworthy and secure working environment, coupled with the rising costs associated with bad hires (including financial loss, intellectual property theft, and reputational damage), strongly incentivizes investment in reliable screening solutions. The continuous evolution of digital identity platforms and the integration of advanced data analytics tools are transforming the delivery of screening services, making them faster, more accurate, and globally scalable.

Background Screening Market Executive Summary

The Background Screening Market is experiencing robust growth driven by globalization, stringent regulatory landscapes, and rapid technological integration, particularly in automated data verification and AI-driven analysis. Business trends indicate a strong shift towards continuous screening methodologies rather than one-time pre-employment checks, reflecting an evolving organizational risk posture. Companies are increasingly prioritizing vendor consolidation, opting for comprehensive service providers offering global reach and integrated platforms that can handle diverse regulatory requirements across multiple jurisdictions. Furthermore, market competition is pushing providers to focus heavily on superior candidate experience, ensuring that the screening process is quick, transparent, and user-friendly, minimizing friction in the hiring funnel.

Regionally, North America maintains the dominant market share due to the early adoption of comprehensive regulatory frameworks like the FCRA and a highly litigious business environment that mandates thorough due diligence. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by rapid industrialization, increasing foreign direct investment (FDI), and the formalization of employment processes in emerging economies like India and China. Europe’s market growth is highly influenced by complex data privacy regulations, such as GDPR, which necessitates localized, consent-based screening approaches, driving demand for technologically compliant solutions that specialize in cross-border data management.

Segment trends reveal that the criminal background checks segment remains the foundational component, yet specialized checks like drug testing and professional license verification are gaining prominence, especially in sectors dealing with public safety or sensitive operations. Deployment trends show a clear preference for cloud-based screening solutions due to their scalability, lower operational costs, and ease of integration with existing Human Resources Information Systems (HRIS) and Applicant Tracking Systems (ATS). Service providers offering API-first integrations and modular solutions are gaining a competitive edge by enabling seamless workflows for corporate users.

AI Impact Analysis on Background Screening Market

User inquiries about AI’s role in background screening often center on efficiency gains, data accuracy, ethical considerations, and bias mitigation. Common questions address how AI tools like Machine Learning (ML) and Natural Language Processing (NLP) can accelerate the notoriously slow processes of manual data collection and verification across disparate sources. Users are also keenly interested in the efficacy of AI in detecting sophisticated fraud patterns and validating unstructured data, such as social media content or open web search results. A primary concern revolves around maintaining compliance and fairness; specifically, how providers ensure AI algorithms do not introduce or amplify biases (e.g., racial, socioeconomic) into hiring decisions, prompting discussions around explainable AI (XAI) and algorithmic transparency in the screening process. The consensus is that AI is transformative, shifting the industry from mere data retrieval to predictive risk analysis, but its implementation must be rigorously audited for ethical and legal compliance.

- Automated Data Aggregation: AI leverages NLP and ML to quickly aggregate and process vast amounts of data from diverse, often unstructured, sources, significantly reducing manual search time.

- Fraud Detection: Machine learning models analyze historical screening data and user input patterns to identify anomalies and indicators of potential fraudulent documentation or identity theft with higher accuracy than human review.

- Risk Scoring and Prediction: AI algorithms develop predictive risk scores based on aggregated data, assisting organizations in making informed decisions beyond simple pass/fail metrics.

- Enhanced Candidate Experience: AI-powered chatbots and automated communication platforms streamline the consent and disclosure process, improving transparency and speed for candidates.

- Adverse Action Compliance Support: Tools utilizing NLP can automatically flag records requiring deeper legal review based on jurisdiction-specific regulations, ensuring compliance during the adverse action process.

- Bias Mitigation: Development of audited, unbiased algorithms aims to filter out protected class information or non-relevant historic data points to ensure fairness and adherence to Equal Employment Opportunity (EEO) guidelines.

- Continuous Monitoring: AI facilitates real-time monitoring of professional licenses, certifications, and driving records, moving screening from a static event to a dynamic, ongoing process.

DRO & Impact Forces Of Background Screening Market

The market is dynamically shaped by powerful drivers and restraints, tempered by significant opportunities that fuel future growth. Key drivers include mandatory regulatory compliance across multiple jurisdictions, such as the need to adhere strictly to industry-specific mandates in finance (anti-money laundering checks) and healthcare (patient safety protocols), making screening a non-negotiable operational cost. The heightened global awareness of corporate liability and the increasing threat of insider threats necessitate comprehensive risk management strategies implemented through sophisticated screening protocols. Conversely, major restraints involve the complex and fragmented nature of global data privacy laws, particularly GDPR and CCPA (California Consumer Privacy Act), which complicate cross-border data transfer and require significant investment in specialized compliance infrastructure. Furthermore, the inherent variability and incompleteness of public records databases in certain emerging markets present challenges to achieving timely and accurate verification.

Opportunities for market expansion are primarily centered on technology and geographical penetration. The shift towards the gig economy and the necessity for instant verification services create a demand for API-driven, high-throughput screening solutions. Furthermore, the potential integration of blockchain technology for secure, tamper-proof credential management offers a revolutionary opportunity to enhance trust and efficiency. The COVID-19 pandemic catalyzed the adoption of remote hiring practices, permanently increasing the demand for digital identity verification and global background checks. Service providers who successfully integrate sophisticated AI for automated verification while maintaining strict ethical and compliance standards are well-positioned to capitalize on these trends.

Impact forces currently governing the market dynamics include the rapidly changing legal landscape and technological innovation. Legal precedents concerning negligent hiring and regulatory enforcement actions force corporate clients to adopt best practices, driving demand. On the technology front, the convergence of identity-as-a-service (IDaaS) platforms and screening technology is transforming the delivery model. The power of buyers (large enterprises) remains moderate to high, as they demand customized, integrated solutions and competitive pricing. The threat of substitutes is low, as human-based manual investigation is inefficient and non-compliant, solidifying the market position of technology-enabled screening service providers.

Segmentation Analysis

The Background Screening Market is meticulously segmented based on Type, End-User Industry, Service Offered, and Deployment Model, reflecting the diverse needs of organizations across the globe. Understanding these segments is critical for providers seeking to tailor their offerings and for corporate buyers aiming to select the most appropriate suite of services. The segmentation by Type is driven by legal necessities, with core offerings like criminal checks forming the market backbone. Segmentation by End-User reflects the variable sensitivity and regulatory requirements across sectors, with the BFSI and Healthcare industries requiring the most rigorous and multi-layered screening protocols due to their high-stakes operational environments and stringent governmental oversight. The segmentation analysis helps identify high-growth niches, such as professional license verification and continuous monitoring services, which are experiencing accelerated demand.

The Service Offered segment highlights the diversification of verification processes beyond simple data retrieval. Drug testing, often mandatory in high-risk environments (e.g., transportation, manufacturing), remains a steady segment. Identity and address verification services are foundational, but the complexity increases with international checks, requiring specialized capabilities in multi-language and multi-jurisdictional data retrieval. The deployment model segmentation underscores the ongoing digital transformation, showing a pronounced trend toward cloud-based models. Cloud solutions offer unparalleled advantages in terms of real-time updates, integration capabilities with other HR tech stacks, and global accessibility, positioning them as the preferred choice for multinational corporations and high-volume recruiters seeking operational efficiency.

The market’s future growth will be heavily influenced by how these segments intersect with regulatory requirements. For example, the increasing use of contractors and contingent workers demands scalable, fast screening (deployment focus), while the sensitive nature of financial data demands highly secure, compliant checks (end-user and service focus). Specialized services catering to niche regulatory needs, such as sanctions list screening (OFAC, UN, etc.) in the financial sector, demonstrate the complexity and tailored nature of modern background screening solutions, moving far beyond basic reference checks.

- By Type:

- Criminal Background Checks

- Education and Employment Verification

- Credit History Checks

- Drug and Health Screening

- Identity Verification

- Reference Checks

- Driving Records (MVR) Checks

- By End-User Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology (IT) and Telecom

- Healthcare and Life Sciences

- Government and Public Sector

- Retail and E-commerce

- Manufacturing

- Transportation and Logistics

- By Service Offered:

- Verification Services (Education, Employment, License)

- Screening Services (Criminal, Credit, Identity)

- Consulting and Advisory Services

- Continuous Monitoring Services

- By Deployment Model:

- Cloud-based

- On-premise

Value Chain Analysis For Background Screening Market

The value chain for the Background Screening Market initiates with upstream activities focused on data acquisition and technology infrastructure development. Upstream participants include public record repositories, government agencies (courts, police departments, educational institutions), and specialized data aggregators. Critical activities at this stage involve negotiating access agreements with official sources, maintaining real-time connectivity, and developing proprietary technology platforms—including AI and API infrastructure—required for automated data retrieval and processing. The quality and accessibility of these upstream data sources directly dictate the speed and accuracy of the final screening report, making strategic partnerships with reliable data providers a key competitive factor.

The midstream phase involves the core service provision, where screening companies transform raw data into compliant, actionable reports. This stage encompasses data scrubbing, verification (often requiring human intervention for difficult cases or international checks), compliance review (ensuring adherence to FCRA, GDPR, etc.), and report generation. Technological investment in this phase focuses on security (data encryption), workflow automation, and the integration of client-facing dashboards. Distribution channels are primarily direct, involving contractual agreements between the screening provider and the corporate client (HR departments or Chief Security Officers). However, indirect distribution through integration partners, such as HRIS/ATS vendors (e.g., Workday, SuccessFactors), is increasingly vital, as clients prefer embedded screening capabilities within their existing talent management platforms.

Downstream activities focus on the delivery and utilization of the final report by the end-user (the hiring organization). This includes providing advisory services related to adverse action procedures, continuous monitoring alerts, and compliance guidance. Effective downstream service ensures that clients not only receive accurate data but also understand how to use it legally and efficiently in their decision-making process. The distribution strategy heavily favors API integration (indirect channel) because it enables seamless, automated report delivery and management, minimizing the administrative burden on the end-user and cementing the screening provider's position as an indispensable part of the client’s talent acquisition ecosystem.

Background Screening Market Potential Customers

Potential customers for background screening services are overwhelmingly organizations that hire, onboard, or contract individuals, spanning virtually every sector that requires a secure and compliant workforce. The primary end-users are Human Resources departments, responsible for pre-employment checks, and increasingly, Security and Compliance departments, which handle ongoing due diligence and regulatory reporting. The key driver for purchase is the size and scope of the workforce, with large multinational corporations being the largest consumers due to their high volume of hires and complex jurisdictional requirements. These large enterprises demand global coverage, API integration, and superior compliance guarantees.

Specific high-priority customer segments include the Banking, Financial Services, and Insurance (BFSI) industry, where regulatory requirements like Know Your Employee (KYE) and compliance with anti-money laundering (AML) directives necessitate rigorous, often continuous, screening, including sanctions list checks. Similarly, the Healthcare sector is a critical customer base, requiring detailed checks on medical certifications, license validity, and patient safety clearances. These sectors seek specialized screenings that mitigate risks associated with fraud, theft, and patient endangerment, often requiring customized solutions that integrate deeply with their proprietary credentialing systems.

Beyond traditional full-time employment, the rapid expansion of the gig economy and the rise of platform-based services (transportation, delivery, short-term rentals) have created a massive new customer segment demanding extremely high-volume, instant, and scalable identity and criminal checks. These customers prioritize speed and mobile-friendly verification methods, driving technological innovation in automated ID scanning and facial recognition. Therefore, potential customers range from small businesses utilizing self-service screening portals to large government entities requiring top-tier security clearances, with the common thread being the imperative to verify trust and minimize organizational risk.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 10.4 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HireRight, Sterling, Checkr, First Advantage, Accurate Background, VerityStream, Truescreen, ClearStar, Certiphi Screening, AuthBridge, GIS (General Information Services), DataFlow Group, Cisive, GoodHire, FADV, Pinkerton, PBSA, ScreeningOne, Verified Credentials, PeopleCheck |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Background Screening Market Key Technology Landscape

The technology landscape of the Background Screening Market is rapidly evolving, moving away from manual data retrieval towards fully automated, integrated, and predictive solutions. Key enabling technologies include Application Programming Interfaces (APIs), which facilitate seamless integration of screening services directly into client Human Resources Information Systems (HRIS) and Applicant Tracking Systems (ATS). This API-first approach drastically reduces time-to-hire and improves data flow consistency. Furthermore, Machine Learning (ML) and Natural Language Processing (NLP) are essential for handling unstructured data (e.g., court records, foreign language documents) and automating the comparison and validation of candidate information against public records, thereby improving the efficiency and accuracy of preliminary checks.

Cloud computing architecture is foundational to modern screening platforms, offering scalability necessary to handle fluctuating hiring volumes and providing the global accessibility required by multinational clients. The adoption of advanced digital identity verification tools, including biometric verification, facial recognition, and secure document scanning, ensures compliance with 'right to work' regulations while mitigating identity fraud at the source. Providers are heavily investing in robust cybersecurity measures, data encryption, and localized data residency capabilities to protect sensitive personal information and comply with regional data protection mandates like GDPR.

Future technological developments are focusing on the integration of Distributed Ledger Technology (DLT), or blockchain, to create secure, verifiable digital identities and credential wallets. This technology promises to dramatically speed up the verification process by providing immutable records of education, employment history, and professional certifications that can be instantly shared and trusted. Additionally, the development of sophisticated risk scoring models that use predictive analytics, rather than simple historical data reports, represents a significant technological leap, allowing organizations to better understand and manage complex talent risks in real-time.

Regional Highlights

The global Background Screening Market demonstrates varied maturity levels and growth trajectories across different regions, influenced primarily by regulatory complexity, economic stability, and the formalization of employment practices. North America, specifically the United States, represents the largest and most mature market segment. This dominance is attributable to the high regulatory environment, stringent corporate compliance standards (driven by FCRA and state-specific laws), and a strong cultural reliance on due diligence to mitigate liability risks in a highly litigious society. Technology adoption, particularly in integrating screening services with major HR platforms, is highest here, characterized by sophisticated continuous monitoring services and advanced identity verification techniques. The market structure is highly competitive, featuring both large global providers and innovative tech-focused startups.

Europe presents a unique challenge and opportunity due to the fragmentation of legal frameworks across member states and the overarching influence of GDPR. The market requires localized expertise, emphasizing consent management and data minimization principles, which often results in longer turnaround times compared to North America. Growth in Europe is steady, driven by the need for compliance in cross-border hiring within the European Union and the growing awareness among employers regarding insider risk management. Key markets include the UK, Germany, and France, where regulations regarding the use of criminal records and social media checks are particularly restrictive, necessitating highly specialized, compliant screening workflows.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, propelled by rapid economic expansion, increasing professionalization of recruitment, and significant foreign investment inflow, which brings international compliance standards. While some economies like Australia and Singapore have mature screening markets, emerging economies like India and China are experiencing explosive growth as multinational companies establish operations and require standardized verification protocols. Challenges in APAC include accessing reliable public data sources, varying levels of data digitization, and navigating diverse privacy laws. The Middle East and Africa (MEA) market is smaller but growing, driven by large infrastructure projects and governmental initiatives requiring high-security clearances, though growth is often hampered by bureaucratic complexities and limited accessible digital records in many African nations.

- North America (Dominant Market): Characterized by high regulatory rigor (FCRA), advanced technology adoption (AI, APIs), and high demand for specialized checks (MVR, professional licensing).

- Europe (Compliance-Driven Growth): Driven by GDPR requirements and cross-border hiring needs; market requires highly customized, consent-focused solutions and data residency compliance.

- Asia Pacific (Fastest Growth): Fueled by economic formalization, FDI, and expanding workforce; key focus on education and employment verification due to credential fraud risks.

- Latin America (Emerging Market): Growth tied to urbanization and institutional governance improvements; challenges include fragmented public records and regulatory volatility.

- Middle East and Africa (Niche Growth): Demand concentrated in BFSI, Oil & Gas, and Government sectors; focused on identity verification and international sanctions checks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Background Screening Market.- HireRight

- Sterling

- Checkr

- First Advantage

- Accurate Background

- VerityStream

- Truescreen

- ClearStar

- Certiphi Screening

- AuthBridge

- GIS (General Information Services)

- DataFlow Group

- Cisive

- GoodHire

- FADV

- Pinkerton

- PBSA (Professional Background Screening Association)

- ScreeningOne

- Verified Credentials

- PeopleCheck

- PreCheck

- TazWorks

Frequently Asked Questions

Analyze common user questions about the Background Screening market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major regulatory trends are currently influencing the Background Screening Market?

The market is significantly shaped by global data privacy laws, particularly the GDPR in Europe and the CCPA in California, which dictate strict rules for data collection, storage, and cross-border transfer, necessitating advanced data security and consent management platforms. Additionally, "Ban the Box" legislation across various US jurisdictions restricts employers' ability to ask about criminal history early in the hiring process, forcing screening providers to adapt their reporting formats and timing for compliance.

How is the adoption of Artificial Intelligence (AI) transforming background checks?

AI, through Machine Learning and Natural Language Processing, is transforming checks by automating the verification of unstructured data (court records), improving the speed of data aggregation, and enhancing the accuracy of identity checks. AI is also crucial for developing predictive risk scores and enabling near real-time continuous monitoring, shifting the industry toward proactive risk management rather than static retrospective reports.

What is Continuous Background Screening and why is it becoming essential?

Continuous background screening involves the ongoing monitoring of an employee's status (e.g., criminal records, professional licenses, driving records) after they are hired, rather than relying solely on a one-time pre-employment check. This practice is essential for mitigating post-hire organizational risk, ensuring ongoing regulatory compliance (especially in highly regulated sectors like transportation and healthcare), and responding instantly to status changes that affect employment eligibility.

Which industry segment generates the highest demand for rigorous background screening services?

The Banking, Financial Services, and Insurance (BFSI) sector consistently generates the highest demand for the most rigorous and specialized screening services. This is due to stringent governmental mandates regarding anti-money laundering (AML), fraud prevention, and the handling of sensitive financial data, requiring comprehensive credit checks, sanctions list screening, and detailed professional history verification.

What are the primary factors driving the growth of cloud-based deployment in this market?

Cloud-based deployment is driven by the need for scalability, seamless integration, and cost efficiency. Cloud platforms allow clients to quickly manage high volumes of checks, easily integrate screening workflows with existing HRIS/ATS systems via APIs, and ensure global accessibility and data residency compliance, crucial for multinational corporations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Background Screening Solutions Market Statistics 2025 Analysis By Application (Small and Medium Enterprises (SMEs), Large Enterprises), By Type (Cloud-based, On-premises), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Background Screening Solutions Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cloud-based, On-premises), By Application (Small and Medium Enterprises (SMEs), Large Enterprises), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager