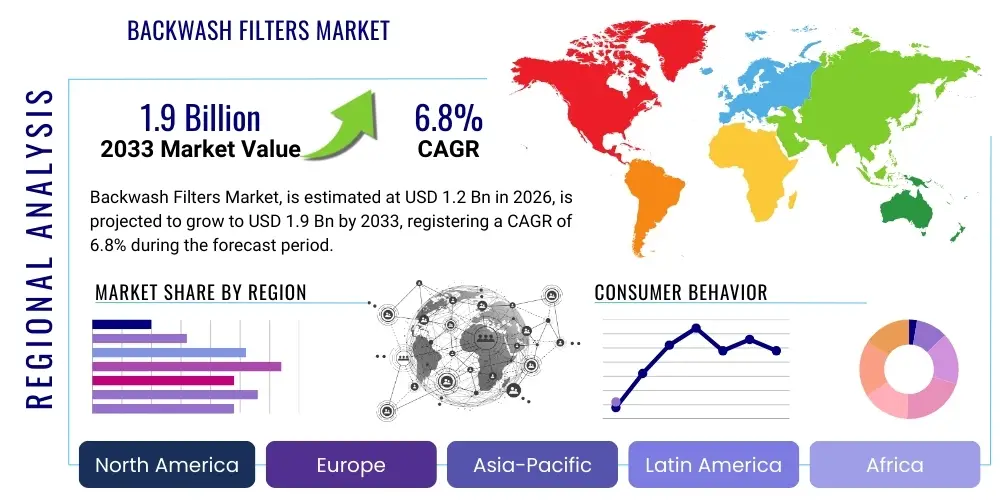

Backwash Filters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439142 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Backwash Filters Market Size

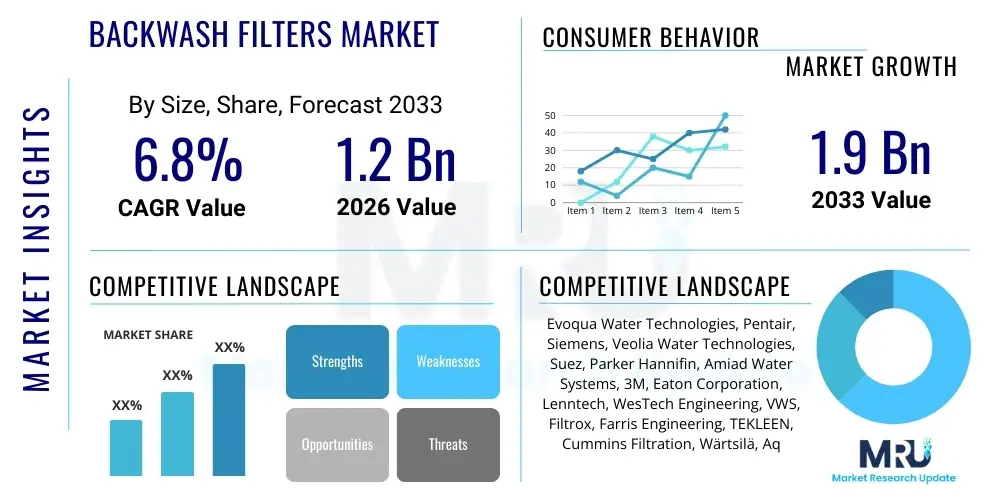

The Backwash Filters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033.

Backwash Filters Market introduction

Backwash filters constitute a crucial component of modern water treatment and process fluid management systems, designed to remove suspended solids, sediment, and contaminants from water streams without requiring frequent manual intervention or disposable cartridges. The core function of these filters revolves around a self-cleaning mechanism, where the flow of water is periodically reversed or diverted, using the clean filtrate or an external source, to dislodge accumulated particles from the filter media or screen. This inherent capability for automated self-maintenance ensures continuous operation, minimizes downtime, and significantly reduces the operational expenditure associated with traditional filtration methods, making them indispensable in large-scale industrial and municipal applications.

The primary application areas for backwash filters are expansive, covering municipal water purification plants, industrial wastewater treatment facilities, cooling tower systems, power generation, and specialized applications such as microfiltration pre-treatment and irrigation systems. Product offerings range from granular media filters (sand, activated carbon, multimedia) to screen and disk filters, tailored to specific water quality requirements and particle size removal efficiency. The rising global emphasis on water conservation and the stringent regulatory environment governing discharge quality are collectively driving the adoption of highly efficient, reliable filtration technologies like backwash systems across diverse sectors, particularly in regions facing severe water stress or aging infrastructure.

The market benefits significantly from technological advancements focused on improving efficiency and reducing water wastage during the backwash cycle. Key driving factors include escalating global demand for clean drinking water, rapid industrialization, especially in the Asia-Pacific region, and the imperative for industries to comply with zero liquid discharge (ZLD) mandates. Furthermore, the integration of smart sensors and predictive maintenance capabilities is enhancing the utility of automatic backwash filters, positioning them as fundamental assets in achieving sustainable and cost-effective fluid management across various critical infrastructure domains.

Backwash Filters Market Executive Summary

The Backwash Filters Market exhibits robust growth, primarily fueled by global demographic expansion, increasing industrial water consumption, and mandated wastewater recycling practices. Current business trends indicate a strong shift towards automatic and smart backwash systems that incorporate Internet of Things (IoT) connectivity for remote monitoring and predictive maintenance. Manufacturers are focusing on developing modular, compact designs that offer higher throughput and require less footprint, appealing particularly to dense urban and retrofit environments. Furthermore, sustainability is a key market differentiator, with companies developing optimized backwash sequences that minimize the amount of water required for cleaning, addressing operational costs and environmental concerns simultaneously. The competitive landscape is characterized by strategic mergers, acquisitions, and technology licensing aimed at consolidating specialized expertise in media filtration and control systems.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, attributed to large-scale infrastructure projects, rapid urbanization, and massive governmental investments in improving municipal water supply and sanitation infrastructure across countries like China and India. North America and Europe, while mature, maintain steady growth driven by the need to upgrade aging water treatment facilities, strict enforcement of environmental protection standards (such as the EU Water Framework Directive), and increasing adoption of backwash filters in specialized industrial processes like pharmaceuticals and food and beverage manufacturing. The Middle East and Africa (MEA) region shows significant potential due to escalating water scarcity issues driving investment in desalination pre-treatment and industrial process water reuse facilities.

Segment-wise, automatic backwash filters dominate the market due to their operational efficiency, reduced manual labor requirements, and integration ease into existing automated systems. Among media types, multimedia filtration remains critical for robust particle removal across various industrial applications, while specialized media like activated carbon filters see rising demand for contaminant removal beyond suspended solids. The industrial end-user segment, particularly power generation and chemical processing, represents the largest revenue share, demanding high-flow rate and pressure-resistant backwash systems. However, the municipal sector is expected to show the fastest CAGR as governments worldwide prioritize ensuring safe and reliable public water access, necessitating continuous, high-volume filtration solutions.

AI Impact Analysis on Backwash Filters Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can optimize the operational parameters of backwash filter systems, specifically focusing on predictive maintenance, backwash frequency optimization, and energy efficiency maximization. Key user concerns revolve around the return on investment (ROI) of integrating complex AI platforms, the accuracy of predictive algorithms in highly variable flow conditions, and the potential for AI-driven automation to reduce human oversight requirements. The overarching expectation is that AI integration will shift filter maintenance from reactive scheduling (time-based or pressure drop-based) to proactive, condition-based interventions, leading to significant savings in water, energy, and chemical usage while prolonging the filter media lifespan.

The integration of AI into backwash filter systems is transforming traditional fluid management into smart, responsive processes. AI algorithms analyze continuous data streams from sensors measuring pressure differential, flow rates, turbidity levels, and water quality parameters. By correlating these variables with historical cleaning cycles, ML models can accurately predict the optimal moment to initiate a backwash sequence, ensuring cleaning occurs precisely when necessary to maintain filtration efficiency without premature or excessive water usage. This predictive optimization minimizes the volume of backwash water discharged, substantially improving the net water recovery rate of the treatment plant, which is critical for sustainable operations.

Furthermore, AI facilitates fault detection and diagnostics far beyond human capacity. By identifying subtle anomalies in operational patterns—such as small variations in valve response times or slight degradation in media performance—AI systems can alert operators to potential mechanical failures before they lead to system downtime. This capability transitions maintenance strategies from periodic checks to true predictive maintenance, thereby reducing catastrophic failures, extending the operational lifespan of the equipment, and lowering the total cost of ownership (TCO). This level of operational sophistication is increasingly demanded by large industrial complexes where continuous process flow is non-negotiable.

- AI algorithms optimize backwash frequency based on real-time water quality and differential pressure data.

- Predictive maintenance models forecast component failures (e.g., valve wear, sensor drift) reducing unscheduled downtime.

- Machine learning improves energy efficiency by minimizing pump run times associated with unnecessary backwash cycles.

- AI facilitates anomaly detection, quickly identifying unusual clogging patterns or external system disturbances.

- Integration with centralized SCADA systems allows for global optimization across multiple filter units in a facility.

- Enhanced data analytics provides detailed operational reports for regulatory compliance and process improvement.

DRO & Impact Forces Of Backwash Filters Market

The Backwash Filters Market is strongly influenced by a confluence of accelerating drivers (D), persistent restraints (R), and emerging opportunities (O), shaping its growth trajectory. The fundamental drivers include stringent environmental regulations concerning water discharge quality and the escalating global population, which necessitates massive investment in municipal water infrastructure upgrades to ensure safe drinking water supply. Opportunities arise from leveraging digitalization—specifically IoT and AI—to enhance operational efficiency, and expanding into niche markets such as pharmaceutical ultrapure water systems and microplastics removal applications. Conversely, the market faces restraints such as the high initial capital expenditure required for sophisticated automated systems and the energy demands associated with large pump systems, particularly in regions with unstable power grids. These forces necessitate strategic adaptation by market participants to remain competitive and compliant.

The key driving force remains the increasing pressure on global water resources, pushing industries and municipalities toward resource reuse and conservation. Backwash filters, being self-cleaning, are inherently suitable for continuous flow processes required in sectors like power, oil & gas, and manufacturing, where downtime translates directly into significant financial loss. The regulatory framework across developed economies, mandating stricter limits on effluent total suspended solids (TSS) and turbidity, strongly favors automated, high-efficiency filtration solutions. Furthermore, governmental initiatives promoting infrastructure modernization, particularly in Asia, contribute substantial momentum to the market, generating demand for large-scale, resilient filtration systems capable of handling varying raw water qualities.

However, the market's growth potential is partially constrained by technological complexity and cost barriers. The installation of advanced, automatic backwash systems often involves significant upfront investment in sensing equipment, control logic, and higher-specification materials, which can deter adoption among smaller industrial players or financially constrained municipalities. Another restraint is the environmental footprint of the backwash cycle itself; although efficient, the process still requires water, and the subsequent handling and disposal of the highly concentrated backwash sludge or effluent stream represent additional operational challenges and costs. Addressing these restraints through modular design, lifecycle cost reduction, and improved sludge dewatering technologies presents significant avenues for future opportunity.

Segmentation Analysis

The Backwash Filters Market segmentation is crucial for understanding specific product adoption patterns and tailored market demands across various industries. The market is primarily categorized based on the type of automation used, the filtration media employed, and the specific application sector (end-user). These segmentations allow vendors to target specific operational requirements, such as high-pressure resistance needed in oil and gas, or the high flow capacity critical for municipal water intake plants. The dominance of automatic systems reflects the overarching industry trend toward automation and minimal labor requirement, while the proliferation of end-use segments underscores the universal need for effective solid-liquid separation across the global economy.

- By Type: Automatic Backwash Filters, Semi-Automatic Backwash Filters, Manual Backwash Filters

- By Media: Sand Media, Activated Carbon Media, Multimedia, Specialized Polymer/Resin Media, Other Media

- By End-User: Municipal Water Treatment, Industrial Water Treatment (Power Generation, Oil & Gas, Chemicals & Petrochemicals, Food & Beverage, Pharmaceuticals & Life Sciences, Mining), Commercial (Hospitality, Institutional), Residential

- By Region: North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA)

Value Chain Analysis For Backwash Filters Market

The value chain for the Backwash Filters Market begins with the sourcing and manufacturing of raw materials, primarily specialized components such as corrosion-resistant steels, plastics (PVC, HDPE), filter media (silica sand, garnet, activated carbon), and advanced control systems (PLCs, sensors, actuators). Upstream activities involve media processing and component fabrication, where quality control and material specifications are paramount, especially for high-pressure or high-corrosion environments like seawater desalination or chemical processing. Efficiency in this stage relies on secure supply chains and robust manufacturing techniques to ensure durability and long-term performance of the filter vessels and internal components.

Midstream activities encompass the actual assembly, integration, and testing of the complete backwash filter system. Original Equipment Manufacturers (OEMs) design sophisticated filter geometries and control logic systems, often incorporating proprietary software for optimizing backwash cycles. Distribution channels play a critical role, categorized into direct sales (for large, custom industrial projects involving complex engineering) and indirect channels (utilizing distributors, agents, and system integrators for smaller commercial or municipal standard systems). System integrators are particularly important as they often couple the backwash filter unit with other pre-treatment or post-treatment processes, offering comprehensive water management solutions to the end-user.

The downstream segment focuses on installation, commissioning, after-sales service, and maintenance. Given the mission-critical nature of water treatment, comprehensive service contracts, timely media replacement, and access to spare parts are essential. Direct service provision allows manufacturers to gather crucial operational data for product improvement, while authorized local service providers ensure rapid response times globally. The value generated throughout the chain is increasingly shifting towards intellectual property related to control algorithms and media efficiency, rather than solely the physical hardware, emphasizing the importance of continuous R&D and digital service offerings.

Backwash Filters Market Potential Customers

The primary customers and end-users of backwash filters span a broad spectrum, fundamentally defined by the requirement for continuous solid-liquid separation and the protection of downstream equipment. The municipal water treatment sector constitutes a cornerstone buyer base, utilizing these filters extensively for pre-treatment before processes like reverse osmosis (RO) or slow sand filtration, ensuring public health and system integrity. These users prioritize reliability, large throughput capacity, and compliance with stringent government regulations regarding potable water quality.

In the industrial sphere, the clientele is diverse and highly demanding. Key buyers include power generation plants (thermal and nuclear) that use backwash filters to protect boiler feed water systems and cooling towers from fouling; the oil and gas industry for produced water treatment and injection water filtration; and the chemicals and petrochemicals sectors for protecting sensitive catalysts and maintaining product quality. These industrial users focus heavily on robustness, chemical resistance, high temperature/pressure capabilities, and minimal process interruption, viewing the filters as essential components for operational continuity and asset protection.

Emerging potential customers are found within specialized sectors like the food & beverage industry, requiring high sanitary standards and reliable pre-filtration for water used in product formulation, and the pharmaceutical industry, demanding ultra-pure water with strict control over particulate matter. Furthermore, the agricultural sector, particularly large-scale automated irrigation systems, represents a growing customer base, utilizing backwash filters to prevent emitter clogging caused by sediment and organic matter, thereby maximizing water usage efficiency and system longevity. Customization, efficiency, and proven regulatory compliance are key purchasing criteria for these varied customer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evoqua Water Technologies, Pentair, Siemens, Veolia Water Technologies, Suez, Parker Hannifin, Amiad Water Systems, 3M, Eaton Corporation, Lenntech, WesTech Engineering, VWS, Filtrox, Farris Engineering, TEKLEEN, Cummins Filtration, Wärtsilä, Aquamatic, Kinetico, Culligan |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Backwash Filters Market Key Technology Landscape

The technology landscape of the Backwash Filters Market is characterized by continuous innovation focused on optimizing the filtration and cleaning processes while minimizing resource consumption. One critical technological advancement is the shift towards advanced membrane filtration systems (microfiltration and ultrafiltration) that often incorporate highly efficient backwash capabilities. These membrane systems offer superior particle removal efficiencies, targeting finer contaminants that traditional media filters might miss. The backwash mechanism in these advanced units is often pulse-based or utilizes chemically enhanced backwash (CEB) to ensure membrane surface cleanliness without compromising structural integrity, thereby extending service life and reducing the frequency of costly replacement cycles.

Another significant area of technological progress is the refinement of automated control systems. Modern backwash filters leverage sophisticated programmable logic controllers (PLCs) coupled with differential pressure transmitters and turbidity sensors to initiate and manage the cleaning cycle precisely. The utilization of Variable Frequency Drives (VFDs) on backwash pumps allows for optimized flow rates and pressure regulation, leading to substantial energy savings compared to older, fixed-speed pump installations. Furthermore, digital twin technology is beginning to be applied, allowing operators to simulate various flow and fouling scenarios in a virtual environment to fine-tune backwash protocols before implementing them in the field, maximizing operational effectiveness.

Material science and media innovation also represent a core technological pillar. There is a growing focus on developing lighter, more durable, and corrosion-resistant materials for filter housings and internal components, such as fiberglass-reinforced plastics and specialized alloys, reducing the overall weight and maintenance burden. For media filters, advancements include the development of multilayer or graded media that enhance filtration depth and capacity, alongside the introduction of specialized media like activated alumina or ion exchange resins integrated into the backwashable design to handle specific chemical contaminants alongside suspended solids. These technological improvements collectively enhance performance metrics, reduce environmental impact, and lower the long-term operational costs for end-users.

Regional Highlights

The global Backwash Filters Market displays significant regional variation in growth drivers, technological maturity, and application intensity.

- Asia Pacific (APAC): Dominates the market share and is expected to record the highest CAGR during the forecast period. This growth is driven by massive government expenditure on addressing water scarcity and pollution resulting from rapid industrialization and population growth in China, India, and Southeast Asian nations. The region presents strong demand across municipal and heavy industrial sectors (power, chemicals).

- North America: Characterized by high technological maturity and strict regulatory frameworks (e.g., EPA standards). Market growth is stable, primarily fueled by the replacement and modernization of aging water infrastructure, coupled with high adoption rates in the food & beverage and pharmaceutical industries where quality control is paramount.

- Europe: Exhibits steady, regulation-driven growth, spurred by EU directives promoting water reuse and pollution reduction (Water Framework Directive). Key demand centers are Germany, the UK, and France, where advanced backwash filtration is crucial for protecting sensitive membrane technologies used in wastewater recycling and industrial processes.

- Middle East and Africa (MEA): Shows rapid emerging market potential, specifically due to extensive investments in desalination plants to combat severe water scarcity. Backwash filters are critically important here for pre-treatment of seawater (to prevent fouling of RO membranes), driven by large-scale public and private infrastructure projects in the GCC countries.

- Latin America: Growth is moderate but promising, driven by urbanization and the need for reliable water services in countries like Brazil and Mexico. The mining sector is a major end-user, requiring robust filtration systems for process water management and environmental compliance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Backwash Filters Market.- Evoqua Water Technologies

- Pentair

- Siemens (through related subsidiaries/acquisitions)

- Veolia Water Technologies

- Suez

- Parker Hannifin

- Amiad Water Systems

- 3M

- Eaton Corporation

- Lenntech

- WesTech Engineering

- VWS (Veolia Water Solutions)

- Filtrox

- Farris Engineering

- TEKLEEN

- Cummins Filtration

- Wärtsilä

- Aquamatic

- Kinetico

- Culligan

- Forsta Filters Inc.

- WTE Wassertechnik GmbH

- Netafim Ltd.

- SPX FLOW, Inc.

Frequently Asked Questions

Analyze common user questions about the Backwash Filters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of automatic backwash filters over manual or semi-automatic systems?

Automatic backwash filters significantly enhance operational efficiency and reduce labor costs by employing sensors and automated controllers (PLCs) to initiate cleaning based on optimal criteria like differential pressure or time intervals. This ensures continuous filtration, minimizes human error, and optimizes water consumption during the cleaning cycle, leading to lower operating expenditure (OPEX) and consistent effluent quality.

How does the choice of filter media affect the performance and application of a backwash filter system?

The media choice (e.g., sand, multimedia, activated carbon) dictates the removal efficiency and the type of contaminants targeted. Sand and multimedia are ideal for heavy particulate removal (turbidity, TSS), while activated carbon is necessary for adsorbing organic contaminants, color, and odor. Proper media selection is critical to meet specific water quality standards and protect downstream, more sensitive processes like reverse osmosis membranes.

Which end-user segment drives the highest demand and growth rate in the backwash filters market?

Currently, the Industrial Water Treatment segment, particularly Power Generation and Oil & Gas, accounts for the largest revenue share due to the critical need for high-volume, reliable process water filtration. However, the Municipal Water Treatment sector is projected to exhibit the fastest growth rate, driven by global urbanization, aging infrastructure upgrades, and increasing regulatory enforcement concerning potable water standards.

What role does digitalization, such as IoT and AI, play in modern backwash filter operations?

Digitalization allows for integration of IoT sensors to collect real-time performance data (pressure, flow). AI and machine learning algorithms use this data to predict the precise moment a cleaning cycle is required, optimizing the backwash process for minimal water use and maximum energy efficiency, and enabling true predictive maintenance to avoid unexpected system failures.

What are the key challenges associated with the implementation of large-scale backwash filtration systems?

Major challenges include the high initial capital investment required for automated, high-capacity units, the need for stable infrastructure to support advanced control systems, and the ongoing operational cost and complexity associated with handling and disposing of the concentrated backwash effluent (sludge) in an environmentally compliant manner.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager