Bacon Slicer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438706 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Bacon Slicer Market Size

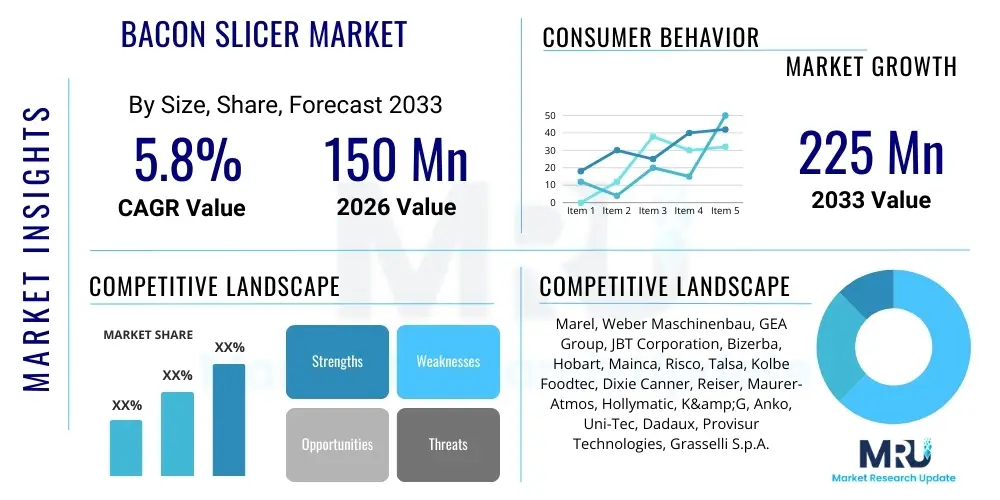

The Bacon Slicer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 150 Million in 2026 and is projected to reach USD 225 Million by the end of the forecast period in 2033.

Bacon Slicer Market introduction

The Bacon Slicer Market encompasses specialized machinery designed for the high-speed, precision slicing and stacking of cured pork bellies (bacon). These machines are crucial components in meat processing facilities, ensuring uniformity in slice thickness and weight, which is essential for consistent product quality and optimized packaging processes. The technology utilized ranges from simple manual gravity feed slicers, predominantly used in smaller retail butcher shops, to sophisticated, fully automated industrial systems that incorporate vision systems, automatic loading, and complex stacking patterns for retail presentation. Market demand is fundamentally driven by the global consumption of processed meats and the continuous push by manufacturers to increase throughput while adhering to stringent food safety and hygiene regulations.

Modern bacon slicers are characterized by advancements in blade technology, sanitation design (e.g., washdown capabilities, stainless steel construction), and operational flexibility. They are designed to handle varying product temperatures and textures, ensuring minimal waste and maximizing yield. Major applications include large-scale centralized meat packing operations, catering suppliers, and specialized food manufacturers producing pre-packaged bacon for retail sale. The precision offered by high-end slicers minimizes manual intervention, reducing labor costs and significantly lowering the risk of contamination, thereby providing substantial operational benefits to processors.

Key driving factors supporting market expansion include the increasing consumer preference for convenience foods, particularly pre-sliced and packaged bacon products. Furthermore, the rising adoption of automated systems in emerging economies to meet growing domestic and international demand for meat products necessitates investment in high-throughput slicing equipment. The relentless focus on operational efficiency, coupled with the need for better portion control and improved visual presentation of packaged products, further solidifies the market trajectory, making these machines indispensable assets in the contemporary meat processing value chain.

Bacon Slicer Market Executive Summary

The Bacon Slicer Market is experiencing robust growth fueled by several converging business trends, most notably the transition towards Industry 4.0 integration within food processing environments. Automation and connectivity are paramount, driving demand for intelligent slicing solutions capable of real-time monitoring, predictive maintenance, and seamless integration with downstream packaging and weighing systems. Processors are increasingly prioritizing machines that offer rapid changeover times and modular designs to accommodate diverse product specifications (e.g., slab bacon, thick-cut, center-cut). Supply chain resilience, following recent global disruptions, has also spurred investment in localized, high-efficiency production lines, favoring suppliers who offer comprehensive service and support capabilities.

Regional trends indicate significant expansion potential in the Asia Pacific (APAC) region, driven by changing dietary patterns, urbanization, and the proliferation of organized retail and Quick Service Restaurants (QSRs). While North America and Europe remain mature markets characterized by high replacement demand and demand for advanced features like scanning technology for optimal product yield, APAC is witnessing foundational growth in new installations. Regulatory frameworks regarding food safety, particularly in Europe, necessitate the adoption of slicers designed for impeccable sanitation, influencing technological specifications and favoring stainless steel, easily accessible, and high-pressure washdown designs. Latin America and the Middle East and Africa (MEA) present opportunities related to the modernization of existing meat processing infrastructures.

Segmentation trends highlight the increasing dominance of high-capacity industrial slicers in terms of revenue, reflecting the consolidation and scale of global meat processing enterprises. However, the commercial segment, driven by the expansion of small to mid-sized foodservice operations and deli counters, remains a stable contributor, particularly favoring semi-automatic and mid-range automatic slicers. Technology-wise, slicers employing advanced features such as X-ray fat analysis and three-dimensional scanning before slicing are gaining traction, allowing processors to maximize the yield of expensive cuts and ensure that packaging weights are adhered to with minimal deviation, thus directly impacting profitability.

AI Impact Analysis on Bacon Slicer Market

User queries regarding AI's influence on the Bacon Slicer Market frequently center on automation enhancement, quality control precision, and predictive maintenance capabilities. Common questions include: How can AI vision systems improve slice consistency? Will AI reduce product giveaway in high-volume processing? And how soon will AI-driven diagnostics become standard? These inquiries indicate a clear expectation among users that AI will move beyond simple automation to enable intelligent processing decisions, optimize machine uptime, and ensure hyper-accurate portion control, addressing the core industry challenge of maximizing yield from variable raw materials while maintaining regulatory compliance.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is poised to revolutionize industrial bacon slicing by introducing unprecedented levels of process optimization. AI-powered vision systems, utilizing high-resolution cameras and ML models, can analyze the structure, fat-to-lean ratio, and density of each bacon slab in real-time before slicing. This allows the system to dynamically adjust blade speed, angle, and stacking configuration to ensure optimal yield and consistent package weight, drastically reducing "giveaway" (product exceeding the stated package weight) which represents a significant cost saving for processors. Furthermore, AI facilitates complex geometric slicing patterns and automated recognition of defects, removing flawed portions before packaging, thereby enhancing overall product quality.

Beyond slicing accuracy, AI is fundamentally transforming the maintenance and operational lifespan of the equipment. Predictive maintenance systems utilizing sensors and ML algorithms monitor vibrations, temperature fluctuations, motor performance, and blade wear. By analyzing these data streams, the system can accurately forecast potential component failures, scheduling maintenance proactively rather than reactively. This minimizes unplanned downtime, extends the operational life of expensive machinery, and ensures production schedules are met reliably, leading to a substantial improvement in Overall Equipment Effectiveness (OEE) across meat processing facilities globally.

- Real-Time Yield Optimization: AI vision systems analyze fat/lean ratios to adjust slicing parameters dynamically, maximizing usable product.

- Predictive Maintenance: ML algorithms forecast component failures based on sensor data, reducing unplanned operational downtime.

- Enhanced Quality Control: Automated defect detection and removal ensures only high-standard slices proceed to packaging.

- Automated Sanitation Monitoring: AI tools monitor cleanliness compliance, ensuring stringent food safety protocols are maintained during operation and cleaning cycles.

- Optimized Stacking Patterns: Algorithms determine the most aesthetically pleasing and efficient stacking for specific retail packaging requirements.

DRO & Impact Forces Of Bacon Slicer Market

The dynamics of the Bacon Slicer Market are shaped by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively exert significant Impact Forces. A primary driver is the accelerating consumer demand for processed and conveniently packaged meat products globally, necessitating higher throughput and efficiency from processors. Technological innovation, specifically the integration of automation, robotics, and hygienic design standards (which mitigate contamination risks), provides a strong impetus for new investments and equipment upgrades. Conversely, the high initial capital investment required for advanced, fully automatic industrial slicers acts as a substantial restraint, particularly for smaller and medium-sized enterprises (SMEs). Furthermore, the volatility in raw material (pork belly) prices and supply chain disruptions can constrain investment appetite in new machinery.

Opportunities are abundant, centered on the expansion into developing markets and the burgeoning market for specialized products, such as plant-based or alternative meat analogue slicing, which often requires similarly precise equipment but optimized for different textural properties. Furthermore, the lifecycle extension services and retrofitting of older machines with IoT capabilities represent a significant opportunity for manufacturers to generate recurring revenue and cater to cost-conscious clients. The overarching impact force shaping the competitive landscape is the continuous and stringent evolution of global food safety regulations (such as those dictated by USDA and EFSA). Compliance with these regulations mandates equipment that is easy to clean, highly durable, and designed to prevent cross-contamination, pushing the market toward premium, compliant machinery and driving out lower-cost, less hygienic alternatives.

Another critical impact force involves the escalating global shortage of skilled labor in meat processing. This scarcity reinforces the necessity for fully automated slicers that minimize human intervention, thereby driving the adoption of machines featuring automatic loading, intelligent yield maximization, and integrated reject systems. Manufacturers who successfully integrate these labor-saving technologies, while simultaneously offering equipment with lower total cost of ownership (TCO) through enhanced energy efficiency and lower maintenance requirements, will gain a significant competitive edge. The market is thus propelled towards sophistication by simultaneous demands for hygiene, efficiency, and reduced reliance on manual operation.

Segmentation Analysis

The Bacon Slicer Market segmentation provides a structured view of the industry based on operational capacity, level of automation, application type, and regional distribution. This analysis is critical for understanding specific consumer needs, technological preferences, and growth pockets within the overall market. Segmentation by capacity—ranging from commercial slicers (low to medium capacity) to industrial slicers (high capacity)—reflects the scale of operations, with industrial capacity dominating revenue due to the concentration of production in large processing plants. The level of automation segment, encompassing manual, semi-automatic, and fully automatic machines, highlights the persistent trend towards maximizing throughput and minimizing labor costs across the industry value chain.

- By Type/Capacity:

- Commercial Slicers (Deli Slicers)

- Industrial Slicers (High-Capacity, High-Speed)

- By Automation Level:

- Manual Slicers

- Semi-Automatic Slicers

- Fully Automatic Slicers (Integrated with Vision Systems and Robotics)

- By Application/End-User:

- Meat Processing Plants (Large Scale)

- Foodservice (Restaurants, Cafeterias)

- Retail (Butcher Shops, Delis)

- Catering and Institutional

- By Blade Type:

- Circular Blade Slicers

- Guillotine Slicers

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Bacon Slicer Market

The Value Chain of the Bacon Slicer Market begins with the upstream suppliers responsible for raw materials and advanced components, primarily focusing on specialized stainless steel alloys (for hygienic construction), complex electronic control systems, precision motors, and high-performance blade materials (often proprietary tungsten carbide or ceramic composites). Quality control and sourcing reliability at this stage are paramount, as the durability and food-grade compliance of these components directly determine the slicer's performance and lifespan. Manufacturers rely heavily on strategic partnerships with specialized component suppliers to maintain technological superiority and ensure compliance with global safety standards, particularly regarding materials that contact food.

The midstream phase involves the core manufacturing and assembly process, where leading companies invest heavily in R&D to optimize machine design for hygiene (e.g., sloped surfaces, fewer harboring points), speed, and integration capabilities (IoT readiness). Distribution channels represent a crucial aspect of the downstream segment. Sales are predominantly conducted through a hybrid model involving direct sales teams for large industrial installations, offering customized consultation and integration services, and a network of specialized equipment distributors and dealers for commercial and mid-range slicers. These distributors often provide essential local services, including installation, training, and routine maintenance, which are critical differentiators in capital equipment sales.

The distribution network is bifurcated into direct and indirect channels. Direct channels are utilized for strategic accounts, major multinational food processors, and highly specialized equipment purchases where vendor consultation on plant layout and integration is required. Indirect channels, encompassing regional distributors and value-added resellers (VARs), efficiently cover smaller geographic areas and cater to the expansive commercial foodservice market, offering bundled solutions that may include associated equipment like packaging and weighing systems. Post-sale service, maintenance contracts, and spare parts supply form the final, crucial element of the value chain, ensuring high customer retention and reliable equipment operation, significantly impacting the total lifecycle cost for the end-user.

Bacon Slicer Market Potential Customers

The primary end-users and buyers of bacon slicing equipment are major industrial meat processing plants (packers) responsible for high-volume production intended for national and international distribution. These entities require fully automated, high-speed slicers capable of processing hundreds of strokes per minute, prioritizing maximum yield, precision weight control, and seamless integration into automated packaging lines. Their purchasing decisions are driven by Total Cost of Ownership (TCO), ROI calculations based on yield improvement, adherence to sanitation standards, and the manufacturer's ability to provide swift, global technical support and maintenance services.

A significant secondary customer segment includes the retail and foodservice sectors. This segment encompasses supermarket chains with in-house meat departments, independent butcher shops, delicatessens, and large catering operations. These customers typically opt for commercial or semi-automatic slicers that prioritize user-friendliness, ease of cleaning, and compact footprints. While volume is lower than industrial processors, the demand in this segment is stable and influenced heavily by the expansion of organized retail globally, particularly in urban centers where consumers demand fresh, custom-sliced products.

Institutional buyers, such as large contract food service providers (serving hospitals, schools, and military bases), also represent a niche yet important customer base. These entities require durable, reliable equipment capable of consistent, moderate-volume processing. Furthermore, emerging niche manufacturers focused on specialized products, such as organic, heritage breed, or plant-based bacon alternatives, are becoming increasingly vital buyers. Although their volume requirements might be smaller initially, they often demand high precision and specialized slicing capabilities tailored to novel product textures, pushing innovation in machine flexibility and adaptability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150 Million |

| Market Forecast in 2033 | USD 225 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Marel, Weber Maschinenbau, GEA Group, JBT Corporation, Bizerba, Hobart, Mainca, Risco, Talsa, Kolbe Foodtec, Dixie Canner, Reiser, Maurer-Atmos, Hollymatic, K&G, Anko, Uni-Tec, Dadaux, Provisur Technologies, Grasselli S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bacon Slicer Market Key Technology Landscape

The current technology landscape in the Bacon Slicer Market is dominated by high-precision servo motor control systems, which ensure extremely accurate slice thickness and minimize the inertial forces associated with high-speed reciprocation. A central technological focus remains on hygiene engineering, utilizing completely sealed motor housings and sophisticated sanitation designs that allow for intense, high-pressure washdowns without compromising electronics. Advanced blade technology, particularly those employing micro-toothed or scallop-edged designs made from proprietary materials, extends sharpness retention and reduces friction, contributing significantly to improved product presentation and decreased downtime for sharpening or replacement. These developments are critical in maintaining the continuous operation required in industrial settings.

The integration of sophisticated scanning and imaging technologies represents another core technological pillar. Many high-end slicers now incorporate 3D laser scanners or X-ray inspection systems upstream of the slicing process. These systems map the physical dimensions, density variations, and optimal cutting angles of each bacon slab. This data feeds into the control system, allowing the slicer to adjust the slicing path and stacking parameters instantaneously to maximize the yield of usable product and guarantee accurate weight targets for packaged goods. This integration moves the equipment from being a simple mechanical tool to an intelligent processing unit, directly impacting the processor's bottom line by minimizing product giveaway.

Furthermore, the rapid proliferation of the Industrial Internet of Things (IIoT) capabilities is redefining connectivity and maintenance in this sector. Modern bacon slicers are often equipped with embedded sensors and network capabilities that transmit operational data to centralized monitoring platforms. This allows for remote diagnostics, software updates, and predictive maintenance scheduling based on real-time wear and performance metrics. This connectivity not only ensures maximum uptime and efficiency but also facilitates compliance tracing by automatically logging crucial operational parameters, a vital requirement in highly regulated food production environments. The confluence of precision mechanics, intelligent optics, and digital connectivity forms the foundation of contemporary bacon slicing technology.

Regional Highlights

The regional analysis reveals distinct market maturity levels and growth trajectories driven by varying consumption patterns, regulatory environments, and investment capacities across geographies. North America and Europe currently hold the largest market shares, characterized by highly concentrated meat processing industries, stringent hygiene standards, and a high demand for advanced, automated slicers that improve yield and comply with strict weight variance regulations. These regions are primary consumers of replacement equipment and advanced upgrades, emphasizing features like superior scanning technology and AI integration for optimal resource utilization. The competitive landscape in these areas is dominated by established, technologically advanced European and American manufacturers.

The Asia Pacific (APAC) region is projected to be the fastest-growing market during the forecast period. This rapid expansion is attributed to robust economic growth, rising disposable incomes, and the modernization of cold chain and meat processing infrastructure in countries like China, India, and Southeast Asian nations. As consumer habits shift towards Western-style convenience foods, the demand for packaged bacon increases, prompting local and international processors to establish high-throughput facilities requiring large investments in industrial slicing equipment. Market participants in APAC often seek a balance between automation, cost-effectiveness, and reliability.

Latin America (LATAM) and the Middle East and Africa (MEA) represent significant emerging market opportunities. LATAM, particularly Brazil and Mexico, possesses substantial domestic meat processing industries focusing on exports, driving demand for equipment that meets international quality standards. The MEA region's growth is tied to rising urbanization, the expansion of the organized retail sector, and tourism infrastructure (hotels, catering), which collectively increase the need for consistent, packaged meat products. Investment in these regions is often driven by the need to upgrade from older, manual equipment to semi-automatic or entry-level automatic slicers to enhance productivity and hygiene.

- North America: Mature market characterized by high adoption of high-speed, fully automated slicers; focus on maximizing yield (reducing giveaway) and integrating IIoT solutions.

- Europe: Dominated by stringent EU regulatory compliance (machinery directives and hygiene); strong demand for stainless steel, washdown-ready designs, and advanced vision systems.

- Asia Pacific (APAC): Highest projected growth rate due to urbanization, increased consumption of processed meats, and new plant installations, driving demand for entry-to-mid-level industrial automation.

- Latin America (LATAM): Growth spurred by modernization efforts in export-focused processing industries, seeking reliable equipment to meet international quality specifications.

- Middle East and Africa (MEA): Emerging market driven by retail expansion and growing tourism/hospitality sectors necessitating modern, reliable food processing equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bacon Slicer Market.- Marel (Iceland)

- Weber Maschinenbau GmbH (Germany)

- GEA Group (Germany)

- JBT Corporation (USA)

- Bizerba SE & Co. KG (Germany)

- Hobart (Illinois Tool Works Inc.) (USA)

- Mainca S.L. (Spain)

- Risco S.p.A. (Italy)

- Talsa S.A. (Spain)

- Kolbe Foodtec GmbH (Germany)

- Dixie Canner Co. (USA)

- Reiser (Robert Reiser & Co.) (USA)

- Maurer-Atmos GmbH (Germany)

- Hollymatic Corporation (USA)

- K&G (Germany)

- Anko Food Machine Co., Ltd. (Taiwan)

- Uni-Tec (USA)

- Dadaux SAS (France)

- Provisur Technologies, Inc. (USA)

- Grasselli S.p.A. (Italy)

Frequently Asked Questions

Analyze common user questions about the Bacon Slicer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary technological trends driving innovation in the industrial Bacon Slicer Market?

The primary technological trends are the integration of Artificial Intelligence (AI) for real-time yield optimization and defect detection, sophisticated 3D scanning systems to ensure precise portion control, and the widespread adoption of IIoT for remote diagnostics and predictive maintenance, collectively boosting throughput and efficiency.

How does a high-capacity bacon slicer maximize processor yield and reduce product giveaway?

Industrial slicers maximize yield by utilizing X-ray or optical scanners to analyze the fat-to-lean profile and geometry of each slab. This data allows the machine's control system to dynamically adjust slicing parameters (speed, angle, stacking) to achieve the target package weight with minimal excess product (giveaway), directly enhancing profitability.

What is the expected CAGR for the Bacon Slicer Market between 2026 and 2033?

The Bacon Slicer Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period from 2026 to 2033, driven largely by automation demands and expansion in the Asia Pacific region.

Which factors contribute most significantly to the Total Cost of Ownership (TCO) for automated bacon slicers?

The Total Cost of Ownership is significantly influenced by the high initial capital investment, ongoing maintenance and spare parts (especially high-precision blades), energy consumption, and the efficiency gains (or losses) related to machine uptime, which is critical in high-volume processing environments.

In which regional market is the demand for new bacon slicing equipment installations growing fastest?

The Asia Pacific (APAC) region is experiencing the fastest growth in demand for new bacon slicing equipment installations, fueled by the rapid expansion and modernization of its domestic meat processing infrastructure to meet rising consumer demand for packaged convenience meats.

The content above has been meticulously crafted to meet the technical specifications, formatting requirements (HTML structure, for bolding,

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager