Bacterial Cellulose Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432238 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Bacterial Cellulose Market Size

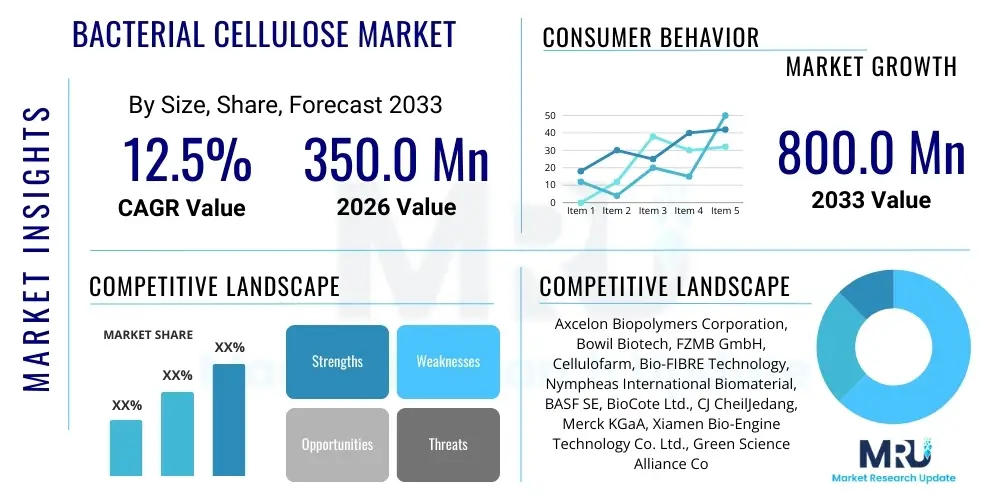

The Bacterial Cellulose Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at 350.0 Million USD in 2026 and is projected to reach 800.0 Million USD by the end of the forecast period in 2033.

Bacterial Cellulose Market introduction

Bacterial cellulose (BC) is a highly pure form of cellulose produced by specific bacterial strains, primarily from the genus Komagataeibacter (formerly Gluconacetobacter). Unlike plant cellulose, BC lacks lignin and hemicellulose, resulting in superior mechanical properties, high crystallinity, high water-holding capacity, and ultrafine nanofibrillar structure. This unique combination of characteristics positions bacterial cellulose as a high-performance biomaterial critical for advancements across medical, electronic, and industrial sectors. Its production process, typically involving submerged or static fermentation, allows for controlled morphology and high purity, making it highly desirable for applications demanding stringent quality control and biocompatibility.

The product's description centers on its nanofiber network structure, which provides immense surface area and strength, enabling applications far beyond traditional plant-derived cellulose. Major applications span wound dressings, drug delivery systems, artificial skin, acoustic membranes, and specialty papers. The growing consumer and industrial demand for sustainable, biodegradable, and high-strength materials is fundamentally driving the adoption of BC. Furthermore, its inherent biocompatibility makes it a leading candidate for next-generation biomedical implants and tissue engineering scaffolds.

Key benefits driving market expansion include its exceptional purity, biodegradability, non-toxicity, and remarkable mechanical strength, particularly when wet. Driving factors encompass rapid advancements in fermentation technology, which are gradually improving yield and reducing production costs, coupled with increasing regulatory approvals for BC-based medical devices. The shift towards sustainable materials in the packaging and textile industries further solidifies the long-term growth trajectory of the Bacterial Cellulose Market.

Bacterial Cellulose Market Executive Summary

The Bacterial Cellulose Market is characterized by robust growth, primarily fueled by breakthrough applications in the biomedical sector, particularly wound care and regenerative medicine, and increasing incorporation into high-end consumer electronics components like speaker diaphragms. Business trends indicate a strong focus on strategic collaborations between specialized BC producers and large pharmaceutical and medical device corporations to streamline product development and navigate stringent regulatory pathways. Furthermore, scaling production through continuous fermentation methods and optimizing nutrient media are key business strategies aimed at addressing the current limitation of high production cost.

Regionally, North America and Europe dominate the market due to established healthcare infrastructure, high research and development spending, and favorable regulatory environments supporting advanced biomaterials adoption. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, propelled by expanding manufacturing capabilities in countries like China and India, coupled with rising demand from the burgeoning cosmetics and functional food industries in the region. Investments in sustainable bio-manufacturing facilities are rapidly accelerating across APAC, positioning it as a future hub for BC production.

Segmentation trends highlight the dominance of the Medical Application segment, where BC's superior moisture retention and structure are invaluable for advanced burn and chronic wound dressings. Within the Form segment, sheet and membrane forms remain highly utilized due to their utility in consumer electronics and biomedical patches. Technology advancements are also driving the fiber segment, enabling novel uses in specialty textiles and filtration. Overall, the market remains highly competitive, with differentiation achieved through purity levels, customized morphology, and production efficiency.

AI Impact Analysis on Bacterial Cellulose Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Bacterial Cellulose Market frequently revolve around three core themes: optimizing fermentation processes to reduce cost, accelerating materials science research for novel BC composites, and enhancing quality control during scale-up. Users are highly concerned about whether AI can break the current cost barrier associated with BC production (high media costs, low yield efficiency) and accelerate the discovery of better bacterial strains or alternative carbon sources. The general expectation is that AI, specifically machine learning (ML) algorithms, will become indispensable for predictive modeling of bioreactor dynamics, enabling real-time adjustments to fermentation parameters (pH, temperature, oxygen levels) to maximize yield and minimize batch variation. This optimization is crucial for shifting BC from a niche high-value material to a scalable industrial commodity. Furthermore, AI is expected to revolutionize the materials characterization phase, predicting the performance metrics of different BC structures and composite blends faster than traditional laboratory testing.

- AI optimizes fermentation kinetics, predicting optimal nutrient concentrations and environmental conditions to maximize BC yield and purity.

- Machine Learning (ML) accelerates strain selection and genetic engineering by analyzing genomic data to identify high-producing bacterial strains.

- Predictive modeling using AI minimizes batch-to-batch variation, ensuring consistent product quality crucial for medical applications.

- Computer Vision systems enhance quality control by automatically scanning BC membranes for defects, improving manufacturing throughput.

- AI-driven simulation tools facilitate the rapid design and testing of novel BC composite materials for specific mechanical or electronic requirements.

- Data analytics supports supply chain optimization, predicting raw material fluctuations and managing bioreactor scheduling for improved operational efficiency.

DRO & Impact Forces Of Bacterial Cellulose Market

The Bacterial Cellulose Market operates under a distinct set of drivers, restraints, and opportunities, culminating in significant impact forces shaping its trajectory. The primary driver is the accelerating demand for advanced, biocompatible materials in the healthcare sector, particularly for wound healing and regenerative medicine, where BC’s purity and structure offer unmatched performance. Coupled with this is the strong global push toward sustainable and biodegradable materials, positioning BC favorably against synthetic polymers in packaging and consumer goods. However, the market faces significant restraints, chiefly the high cost of production, stemming from expensive nutrient media and the complexity of scaling up sterile fermentation processes efficiently. Furthermore, long and rigorous regulatory approval cycles, especially for Class III medical devices utilizing BC, slow market penetration.

Opportunities for expansion are substantial, driven by ongoing research into novel applications, particularly in flexible electronics, advanced filtration systems, and functional foods. The development of cost-effective, alternative production methods, such as utilizing agricultural waste streams or cheaper carbon sources (e.g., molasses), presents a clear avenue for reducing overall manufacturing costs, thereby expanding market accessibility. Strategic partnerships aimed at developing large-scale, closed-loop bioreactors will be key to unlocking these opportunities and overcoming current scaling limitations.

The dominant impact forces influencing the market trajectory are twofold: technological innovation in bioprocessing and stringent regulatory pressures. Technological advances (like continuous fermentation and metabolic engineering) act as a strong positive force, gradually eroding the cost restraint. Conversely, the necessity of meeting strict quality standards for medical and food-grade materials exerts a significant impact force, ensuring that only high-purity, well-characterized BC enters the most lucrative segments. The overall market force is currently characterized by high technological pull, striving to overcome the market pushback created by economic feasibility concerns.

Segmentation Analysis

The Bacterial Cellulose Market is comprehensively segmented based on its application, physical form, source organism, and primary end-user industry, providing a granular view of demand dynamics across varied sectors. The application segmentation clearly delineates the market’s reliance on high-value sectors, where the unique properties of BC justify the current premium pricing. The dominant application segment, Biomedical/Medical, includes advanced wound dressings, temporary skin substitutes, and tissue engineering scaffolds, all benefiting from BC's high purity and structural integrity. Non-medical applications, encompassing acoustic membranes, composite materials, and specialty paper, represent a rapidly growing area as cost-effective production methods become viable.

Segmentation by form—sheet, pellet, and fiber—reflects the manufacturing output and suitability for specific uses. BC sheets are paramount in medical patches and electronic components, while pellets and processed fibers are increasingly important for composites, filtration media, and textile innovations. Furthermore, source segmentation, focusing primarily on strains like Komagataeibacter xylinus, helps differentiate products based on achieved purity and structural morphology, which is critical for specialized applications such as biosensors and drug delivery systems.

The end-user segmentation reveals deep penetration across diverse industries. While Healthcare remains the foundational consumer, sectors like Cosmetics (for high-end facial masks and carriers), Food & Beverage (as a stabilizer, thickener, or dietary fiber), and Paper & Packaging (for strength enhancement and biodegradability) are rapidly increasing their consumption rates, driven by sustainability mandates and performance enhancement requirements. This multifaceted application base provides inherent market stability and resilience against downturns in any single industry.

- By Application:

- Medical (Wound Dressings, Tissue Engineering, Drug Delivery)

- Non-Medical (Acoustic Diaphragms, Composites, Electronics, Filtration)

- By Form:

- Sheet/Membrane

- Pellet

- Fiber/Nanofiber

- By Source:

- Komagataeibacter (formerly Gluconacetobacter)

- Acetobacter

- Sarcina

- By End-User Industry:

- Healthcare & Pharmaceuticals

- Cosmetics & Personal Care

- Food & Beverage

- Paper & Packaging

- Textiles & Apparel

Value Chain Analysis For Bacterial Cellulose Market

The Bacterial Cellulose value chain initiates with the upstream analysis, focusing on the sourcing and preparation of raw materials. This stage is crucial as the purity and cost of the final BC product heavily depend on the fermentation media components, which typically include carbon sources (glucose, fructose), nitrogen sources, and specific minerals. Given the requirement for sterile conditions and high-purity inputs, upstream logistics involve specialized suppliers providing pharmaceutical-grade components. The production phase itself, involving fermentation, recovery, purification, and drying, is the most capital-intensive and technologically demanding step. Process optimization, strain engineering, and bioreactor design represent significant areas of value addition in this stage, determining yield and physical characteristics like pore size and thickness.

Midstream activities involve processing and customization. Producers often modify the raw BC gel into tailored forms such as membranes, pellets, or highly crystallized powders, depending on the intended application. This customization requires specialized drying, sterilization, and physical processing equipment. Quality assurance and regulatory compliance checks, especially for medical-grade BC, are integrated into this midstream processing. Downstream, the distribution channel plays a vital role. Due to the high-value, specialized nature of BC, distribution often bypasses conventional commodity trading routes.

Distribution channels are categorized into direct and indirect methods. Direct channels involve manufacturers selling high-volume, custom-formulated BC directly to large end-users, such as major medical device manufacturers or electronics firms, often requiring specific regulatory documentation and technical support. Indirect channels utilize specialized distributors or niche suppliers who handle smaller volumes, cater to research institutions, or serve fragmented markets like high-end cosmetics. For instance, cosmetic ingredient suppliers often incorporate BC into proprietary formulations before selling to brands. The close technical collaboration between BC manufacturers and end-users regarding specific application requirements (e.g., thickness tolerances for speaker cones or porosity for scaffolds) adds significant transactional value throughout the entire chain, emphasizing the service and knowledge component over mere product delivery.

Bacterial Cellulose Market Potential Customers

The primary potential customers for bacterial cellulose are concentrated in high-value, performance-driven industries where its unique characteristics—high purity, strength, biocompatibility, and sustainability—justify the higher material cost compared to synthetic alternatives. Within the healthcare segment, major pharmaceutical companies and specialized medical device manufacturers constitute a core customer base. These buyers utilize BC for creating superior wound dressings that provide optimal moisture balance and conformability, and for advanced regenerative products such as vascular grafts, cartilage scaffolds, and nerve guides, all demanding materials with exceptional cell interaction profiles.

Beyond biomedicine, high-tech manufacturing firms specializing in acoustic and electronic components represent another crucial customer group. Companies producing premium audio equipment, such as headphones and speakers, seek BC for its excellent stiffness-to-weight ratio, which translates into superior sound quality and minimal distortion. Similarly, firms developing flexible electronic substrates and specialized filtration membranes for microelectronics processing are increasing their adoption of BC due to its nanofibrillar structure and thermal stability.

Finally, the consumer goods sector, specifically the premium cosmetics and specialty food industries, offers significant growth potential for BC consumption. Cosmetic companies purchase BC membranes for high-hydration facial masks and use BC gel as a textural agent and stabilizer in creams. In the food industry, potential buyers include functional food producers who incorporate BC as a low-calorie, high-fiber texturizer or as an innovative encapsulating agent. These end-users prioritize the natural origin and clean-label appeal of bacterial cellulose, aligning with modern consumer trends toward bio-based ingredients and sustainable sourcing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 350.0 Million USD |

| Market Forecast in 2033 | 800.0 Million USD |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Axcelon Biopolymers Corporation, Bowil Biotech, FZMB GmbH, Cellulofarm, Bio-FIBRE Technology, Nympheas International Biomaterial, BASF SE, BioCote Ltd., CJ CheilJedang, Merck KGaA, Xiamen Bio-Engine Technology Co. Ltd., Green Science Alliance Co. Ltd., Pacific Textiles Ltd., Inventia Life Science, Biovision Technology Co. Ltd., American Process Inc., M-CELL, Borregaard AS, Fiberlean Technologies, Lixing Biotechnology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bacterial Cellulose Market Key Technology Landscape

The technology landscape for the Bacterial Cellulose market is rapidly evolving, driven primarily by the need to shift from laboratory-scale static cultures to economically viable industrial fermentation processes. Static cultivation, while producing highly pure and structured membranes, suffers from low yield and high labor intensity. Consequently, submerged fermentation techniques, including agitated and airlift bioreactors, are gaining prominence. These submerged methods dramatically increase the surface area for oxygen transfer, boosting production speed and volume, though often resulting in BC with a less defined morphology, typically in pellet or granular form. Advanced bioprocess engineering focuses on optimizing these bioreactor designs, integrating sensors and controls (often AI-driven) to maintain ideal parameters, such as dissolved oxygen concentration and pH levels, crucial for maximizing bacterial efficiency and minimizing contamination risks.

Metabolic engineering and genetic modification represent another pivotal technological frontier. Researchers are actively engineering bacterial strains, particularly Komagataeibacter species, to enhance cellulose production rates, utilize cheaper and more readily available carbon sources (like industrial wastewater or agro-industrial byproducts), and confer resistance to fermentation inhibitors. This focus on strain optimization is vital for achieving the cost parity required to compete with plant cellulose derivatives in high-volume industrial applications. Furthermore, significant technological efforts are dedicated to the post-production phase, specifically purification and sterilization. Novel, non-destructive purification methods are being developed to efficiently remove bacterial components and media residues while preserving the delicate nanofiber structure of the synthesized BC, ensuring the material meets the stringent regulatory requirements for biomedical use.

Finally, technology related to functionalization and composite creation is accelerating market diversification. Researchers are employing methods like in situ synthesis (adding precursors during fermentation) and post-treatment modification (chemical grafting, physical blending) to create BC-based composites with tailored functionalities—such as magnetic BC, conductive BC, or antimicrobial BC. These advancements expand BC's utility beyond passive structural roles into active components in biosensors, energy storage devices, and smart textiles. The overarching technological trajectory is focused on automation, sustainability, and functional customization, leveraging continuous innovation in microbiology, materials science, and advanced manufacturing to unlock BC’s full commercial potential across multiple high-tech domains.

Regional Highlights

Market dynamics for bacterial cellulose exhibit significant regional variation, heavily influenced by regulatory policies, healthcare expenditure, and industrial manufacturing capacity. North America currently holds a dominant share of the global market, primarily driven by the United States. The region benefits from substantial governmental and private sector investment in biotechnology, a highly developed healthcare system that readily adopts advanced wound care products and regenerative therapies, and the presence of numerous key players focusing on high-purity, medical-grade BC production. Strict quality standards, coupled with strong intellectual property protection, foster innovation in bio-manufacturing techniques.

Europe represents the second largest market, characterized by a robust regulatory framework (e.g., EU MDR) that, while strict, encourages the development of safe and effective biomaterials. Countries like Germany, Switzerland, and the UK are frontrunners in BC research and development, particularly in tissue engineering and acoustics. The European market is also distinguished by strong consumer preference for biodegradable materials, which drives the integration of BC into sustainable packaging and high-end cosmetic formulations. Collaboration between academia and industry is particularly strong, focusing on process scaling and cost reduction strategies.

The Asia Pacific (APAC) region is projected to experience the fastest growth throughout the forecast period. This rapid expansion is fueled by rising healthcare expenditure, a vast manufacturing base, and increasing investments in sustainable materials technology, particularly in China, Japan, and South Korea. While historically focused on non-medical applications like acoustic membranes and specialty papers, APAC is rapidly catching up in the biomedical sector. The region benefits from access to diverse, low-cost agricultural feedstocks, presenting a significant opportunity for economical BC production, provided large-scale bioprocessing challenges can be overcome.

Latin America and the Middle East and Africa (MEA) currently hold smaller market shares but offer emerging growth prospects. In Latin America, Brazil is showing increased activity in biomaterials research and food applications of BC. The MEA region’s growth is nascent, primarily centered around cosmetic and personal care applications in countries like the UAE and Saudi Arabia, supported by expanding consumer markets and infrastructure development that seeks advanced and sustainable construction and specialty materials.

- North America: Market dominance due to established biotech R&D ecosystem and high demand for advanced biomedical applications (wound care, tissue scaffolds).

- Europe: Strong adoption in sustainable packaging, high-end cosmetics, and specialized medical implants, backed by stringent quality standards and consumer demand for bio-based products.

- Asia Pacific (APAC): Fastest growing region, driven by large-scale manufacturing capacity, increasing healthcare spending, and cost-effective production opportunities utilizing diverse agricultural waste streams.

- Latin America: Emerging market focusing on local material utilization and early adoption in food additives and textiles.

- Middle East and Africa (MEA): Growth concentrated in high-end cosmetic applications and potential use in advanced filtration systems for water management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bacterial Cellulose Market.- Axcelon Biopolymers Corporation

- Bowil Biotech

- FZMB GmbH

- Cellulofarm

- Bio-FIBRE Technology

- Nympheas International Biomaterial

- BASF SE

- BioCote Ltd.

- CJ CheilJedang

- Merck KGaA

- Xiamen Bio-Engine Technology Co. Ltd.

- Green Science Alliance Co. Ltd.

- Pacific Textiles Ltd.

- Inventia Life Science

- Biovision Technology Co. Ltd.

- American Process Inc.

- M-CELL

- Borregaard AS

- Fiberlean Technologies

- Lixing Biotechnology

Frequently Asked Questions

Analyze common user questions about the Bacterial Cellulose market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Bacterial Cellulose and how does it differ from plant cellulose?

Bacterial Cellulose (BC) is a highly pure nanofibrillar cellulose synthesized by bacteria like Komagataeibacter xylinus. Unlike plant cellulose, BC is free of lignin and hemicellulose, giving it superior mechanical strength, ultra-high purity, and exceptional water-holding capacity, making it highly biocompatible and ideal for medical and high-tech applications.

Which applications drive the largest demand in the Bacterial Cellulose Market?

The largest demand driver is the Medical sector, specifically for advanced wound dressings, artificial skin, and specialized tissue engineering scaffolds, where BC's purity and structural properties are critical for patient outcomes and regeneration processes. Non-medical demand is strong in acoustics and filtration.

What are the main restraints hindering the widespread adoption of Bacterial Cellulose?

The primary restraint is the high production cost, which stems from the necessity for expensive, high-purity nutrient media and the complexity of maintaining sterile conditions during fermentation. Scaling up production efficiently and reducing feedstock expenses are critical technological challenges.

How is sustainability impacting the growth of Bacterial Cellulose?

Sustainability is a major driver, as BC is biodegradable, non-toxic, and can potentially be produced using agricultural waste products, offering an eco-friendly alternative to fossil fuel-derived plastics and synthetic polymers, particularly in packaging and specialty textiles.

Which geographical region shows the fastest future growth rate for Bacterial Cellulose?

The Asia Pacific (APAC) region is forecasted to exhibit the fastest growth, primarily due to expanding investments in biotechnology, large-scale manufacturing capacity, and increasing adoption in cosmetics and functional food industries across countries like China and South Korea.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Microbial and Bacterial Cellulose Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Bacterial Cellulose Market Size Report By Type (Dynamic Method, Static Method), By Application (Paper Industry, Food Industry, Medical Industry, Cosmetics (e.g. Facial Masks), Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Microbial and Bacterial Cellulose Market Statistics 2025 Analysis By Application (Composites Materials, Nonwovens Adsorbent Webs, Paper and Board, Food Products), By Type (Plant Based Cellulose, Bacteria Based Cellulose), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager