Badminton Shoes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432498 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Badminton Shoes Market Size

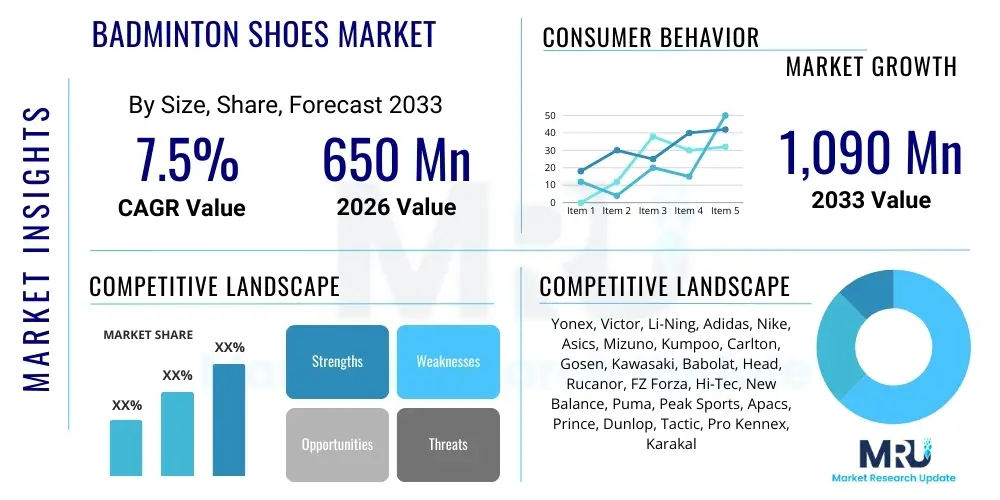

The Badminton Shoes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,090 Million by the end of the forecast period in 2033.

Badminton Shoes Market introduction

The Badminton Shoes Market encompasses specialized footwear designed to meet the rigorous demands of badminton, a sport characterized by explosive lateral movements, quick stops, and vertical leaps. Unlike conventional athletic shoes, badminton footwear is engineered with non-marking soles, enhanced lateral stability features, superior cushioning to absorb impact from repetitive jumping, and lightweight construction to minimize fatigue. The core product description revolves around optimizing grip, minimizing slide, and providing essential ankle support crucial for preventing common badminton-related injuries, such as sprains, Achilles tendonitis, and strains resulting from sudden changes in direction. The technological focus in this market centers on integrating proprietary rubber compounds for sole construction that offer both exceptional grip and longevity, alongside advanced lightweight materials like EVA and specialized engineered mesh for the upper components to balance crucial durability with maximum breathability. The specific design elements address the unique stresses placed on the foot and ankle during the game, which involves rapid forward lunges followed by powerful backward pushes and rapid cross-court sprints, demanding biomechanically sound protection.

Major applications of these specialized shoes span across professional competitive play, where adherence to BWF standards is mandatory, high-intensity amateur recreational engagement, and comprehensive training regimes at academies. High-level applications in professional circuits necessitate shoes that offer maximum kinetic energy return and precision court handling. The performance demands include highly responsive feedback to the court surface, enabling players to react instantaneously. This segment drives the demand for premium models incorporating the latest cushioning and torsion control technologies. Simultaneously, the burgeoning global interest in fitness and casual sports participation is significantly expanding the amateur segment, requiring robust, comfortable, and moderately priced footwear. The distinct benefits of wearing specific badminton shoes include substantial improvement in on-court performance through optimized traction, enhanced player safety by mitigating slip hazards on wooden or synthetic courts, and long-term joint health preservation due to targeted shock absorption capabilities that reduce the cumulative stress on the lower extremities, differentiating them vastly from general indoor court shoes.

Key driving factors fueling market expansion include the increasing global participation rates in badminton, primarily driven by demographic shifts and the sport’s popularity across densely populated Asia Pacific nations, including China, India, Indonesia, and Malaysia, where government and private investment in sports facilities is escalating. Furthermore, the rising awareness among players and coaches about the critical role specialized footwear plays in injury prevention and optimizing performance is boosting consumer willingness to invest in higher-quality, feature-rich products. The proliferation of professional badminton leagues, such as the Premier Badminton League (PBL) and various BWF Super Series events worldwide, coupled with strategic marketing and athlete sponsorship deals by major sporting goods manufacturers like Yonex and Li-Ning, further solidifies the market's growth trajectory. These factors encourage not only initial purchases but also frequent replacement cycles based on product wear and tear and the introduction of new, superior technological models, ensuring consistent demand velocity throughout the forecast period.

Badminton Shoes Market Executive Summary

The Badminton Shoes Market is exhibiting robust business trends, chiefly characterized by aggressive innovation in material science aimed at optimizing the triad of lightweight construction, dynamic stability, and superior energy return. Manufacturers are heavily investing in proprietary research and development to create unique sole technologies, such as advanced hexagonal traction patterns and specialized polymer compositions, that offer unparalleled grip without compromising the crucial court feel required by elite athletes. A significant business trend involves the rapid adoption of sustainable manufacturing practices and the integration of recycled or bio-based materials in shoe components, which holds particular resonance with environmentally conscious consumers in mature markets like Europe and North America. Moreover, the strategic pivot towards Direct-to-Consumer (D2C) online sales channels is becoming a cornerstone for market penetration, allowing major brands to bypass multi-level distribution costs, exercise greater control over brand messaging, and utilize rich customer data for personalized product recommendations and efficient inventory management, thereby significantly enhancing overall profitability and market responsiveness.

Regionally, the Asia Pacific (APAC) region continues to exert its market dominance, commanding the largest revenue share due to the immense scale and cultural significance of badminton, supported by massive participation rates and extensive sports infrastructure across the sub-continent. However, significant growth momentum is observed in North America and Europe, where market expansion is fueled by increasing multicultural migration, rising general health and wellness awareness programs, and strategic brand positioning targeted at university-level competitive sports and affluent amateur segments. These regions, while smaller in volume, drive high average selling prices (ASPs) due to demand for premium, technologically differentiated products. Emerging economies in Latin America and the Middle East are also presenting substantial, high-CAGR opportunities as rising disposable incomes enable greater spending on specialized athletic gear, necessitating localized product lines and tailored distribution strategies to navigate complex regional purchasing habits and supply chain challenges.

Analysis of segment trends reveals a persistent, strong consumer preference for Low-Ankle shoe designs, which dominate the market based on the perceived advantages of increased agility and reduced weight, making them the default choice for the majority of competitive players. Conversely, High-Ankle models maintain a stable, albeit smaller, niche driven by players requiring maximum remedial ankle support or those utilizing highly aggressive, injury-prone playing styles. Material segmentation highlights the ongoing transition towards advanced, engineered polymer compounds. This includes proprietary lightweight EVA foams being strategically combined with highly durable, non-marking rubber outsoles and engineered mesh uppers that maximize ventilation. The End-User analysis confirms a critical duality: the Professional segment dictates the pace of technological innovation and commands the highest ASPs, while the Amateur/Recreational segment contributes the vast majority of unit volume to the overall market, compelling manufacturers to effectively balance investment between cutting-edge R&D and mass-market cost optimization.

AI Impact Analysis on Badminton Shoes Market

User queries regarding the impact of Artificial Intelligence (AI) on the Badminton Shoes Market exhibit a strong emphasis on biomechanical personalization, performance optimization, and operational efficiency improvements. A major theme centers around the expectation that AI and machine learning (ML) algorithms will soon be capable of analyzing vast datasets of human movement and foot strike patterns to design shoes that are perfectly calibrated to an individual's unique gait, playing dynamics, court surface preference, and historical injury susceptibility, fundamentally transforming the fit and performance paradigm beyond traditional mass customization. Users are also deeply interested in the integration of micro-sensors and AI processing capabilities within the footwear itself, which could provide sophisticated, real-time feedback metrics on lateral acceleration, impact loading, fatigue onset, and jump dynamics, effectively turning the shoe into an intelligent training partner. Furthermore, the commercial appeal of AI is rooted in its ability to enhance market responsiveness and reduce time-to-market for new, complex designs.

Concerns frequently raised include the potential prohibitive cost of AI-engineered or bespoke footwear, potentially limiting access only to elite athletes, and issues surrounding data security and the privacy implications of collecting sensitive biomechanical data through smart shoes. Users seek assurance that these technological advancements will eventually democratize access to high-performance footwear across all price points through optimized manufacturing processes. Expectations are particularly high regarding how AI can revolutionize the supply chain. Specific industry applications involve utilizing predictive analytics to forecast demand based on complex variables like localized tournament schedules, economic indicators, and seasonal trends, leading to optimized inventory allocation, reduced warehousing costs, and minimized risks associated with rapid shifts in consumer demand patterns.

- AI-Driven Generative Design: Using ML to simulate countless material combinations and structural geometries, leading to optimal sole patterns and cushioning stiffness tailored for specific court movements (e.g., maximizing grip during a jump smash landing).

- Biometric Customization Platforms: Developing platforms where AI analyzes 3D foot scans and pressure mapping data to recommend or directly engineer custom midsole densities and arch supports, significantly minimizing the risk of pronation or supination-related injuries.

- Integrated Performance Tracking: Embedding highly sensitive micro-gyroscopes and accelerometers connected to AI processors to accurately track player metrics, providing coaches and athletes with objective data on court coverage efficiency and energy expenditure.

- Predictive Maintenance and Durability Modeling: AI algorithms analyzing usage data to predict when shoe components (like cushioning or outsole integrity) will fail, allowing the system to alert the player for timely replacement and minimizing mid-game equipment failure.

- Smart Inventory and Logistics: Utilizing deep learning to manage complex global supply chains, optimizing production runs based on nuanced regional demands and political/logistical stability forecasts, ensuring faster market response times.

DRO & Impact Forces Of Badminton Shoes Market

The market’s momentum is powerfully steered by drivers such as the increasing global professionalization of badminton, exemplified by high-stakes international tournaments and the lucrative contracts associated with elite performance, which necessitate the constant adoption of the highest specification protective and performance footwear. A crucial driver is the scientific dissemination of knowledge regarding sports injury mechanics, compelling competitive players at all levels to invest in footwear explicitly designed to mitigate high-impact stress and lateral strain. This growing health and safety consciousness, coupled with the mandatory requirement for non-marking soles in the vast majority of modern indoor sports facilities globally, acts as a continuous, reinforcing demand mechanism. Additionally, effective brand marketing featuring elite athletes creates aspirational demand, particularly among younger demographic segments across Asia and Europe, driving consumers towards premium, technologically differentiated products.

Growth, however, is significantly restrained by the high inherent cost of research-intensive specialized materials and advanced manufacturing techniques, which keeps premium product prices elevated, making them inaccessible to lower-income segments in crucial emerging markets. A severe constraint is the pervasive issue of intellectual property infringement and the flood of counterfeit, low-quality footwear, especially through unauthorized online channels. These counterfeits not only divert substantial revenue but also pose significant safety risks to users, damaging the overall brand equity and integrity of legitimate manufacturers. Furthermore, raw material price volatility, particularly fluctuations in rubber, synthetic polymer costs, and global shipping tariffs, can quickly erode profit margins if not strategically managed through forward contracts and diversified sourcing channels, posing persistent operational headwinds that require careful risk assessment.

Opportunities for expansion are abundant, particularly in leveraging untapped consumer bases within emerging economies (e.g., India, Brazil) where rising middle-class disposable incomes are increasingly channeled into health and sports activities, coupled with the development of formal badminton infrastructure. Technologically, the opportunity lies in mass-market adoption of smart manufacturing techniques like 3D printing for customized components, which promises to reduce production time and enhance personalization at scale. The key impact forces dictating future market direction include rapid technological cycles, where new material breakthroughs quickly render older models obsolete, forcing accelerated R&D investment. Regulatory forces, particularly those governing material safety and ethical sourcing practices, influence supply chain decisions. Finally, the socio-cultural force of social media and influencer marketing has become a dominant factor, drastically shaping consumer aesthetics and brand loyalty, meaning marketing agility is as vital as product performance in determining market leadership.

Segmentation Analysis

The Badminton Shoes Market segmentation provides a strategic framework for manufacturers to precisely align product development, marketing spend, and distribution logistics with distinct consumer groups and functional requirements. This structured analysis is vital for differentiating highly technical, performance-driven models from volume-based, comfort-focused offerings. Segmentation is meticulously conducted across product design attributes (Type, Material), user engagement level (End-User), and transactional mechanisms (Distribution Channel). Effective segmentation permits brands to optimize resource allocation, for example, by focusing premium, High-Ankle, carbon-plated shoes through specialist offline retailers catering to professional players, while directing mass-market Low-Ankle, EVA-based models through high-volume e-commerce platforms accessible to amateur players globally.

The product type segmentation, dichotomized into Low-Ankle and High-Ankle designs, reflects a fundamental trade-off between mobility and stability. Low-Ankle shoes are overwhelmingly dominant, favored by the majority of competitive and fast-moving players who prioritize maximum freedom of movement and lighter weight, essential for quick footwork. Conversely, High-Ankle shoes occupy a niche where injury rehabilitation, maximum protective reassurance, or highly aggressive, injury-prone playing styles necessitate superior vertical ankle support and structural rigidity. Material segmentation is equally critical, directly impacting cost, weight, and lifespan. The industry standard utilizes specialized, non-marking rubber outsoles for court grip, combined with lightweight polymer compounds like EVA or specialized proprietary foams in the midsole for targeted cushioning. The upper construction often employs engineered mesh for breathability and synthetic leather or PU for structural integrity and high abrasion resistance in key stress zones, balancing lightweight design with necessary durability against dragging and scraping.

The End-User analysis is critical for pricing and marketing strategy; the Professional segment demands relentless technological updates, brand endorsements, and accepts higher price points, acting as the industry's test bed for innovation. The Amateur/Recreational segment, while less focused on absolute cutting-edge technology, is the primary driver of market volume and revenue stability. This segment requires durable, comfortable, and aesthetically pleasing options at competitive prices, favoring versatile designs. Distribution channel segmentation highlights the ongoing digital disruption: while offline channels (especially specialist sports stores) retain importance for providing essential fit verification and product expertise, online channels are experiencing exponential growth, driven by consumer demand for convenience, price transparency, and the vast logistical reach of global e-commerce giants, reshaping traditional retail dynamics in favor of digitally proficient brands and requiring omnichannel integration for optimal market coverage.

- By Type:

- Low-Ankle Shoes (Dominant Segment: Optimized for agility and speed)

- High-Ankle Shoes (Niche Segment: Prioritized for maximum stability and injury protection)

- By Material:

- Rubber Outsole (Non-marking, proprietary traction compounds)

- EVA Midsole (Standard lightweight cushioning)

- Proprietary Foam Midsoles (Advanced shock absorption and energy return)

- Polyurethane (PU) and Synthetic Leather Upper (Durability and structure)

- Engineered Mesh Upper (Breathability and weight reduction)

- By End-User:

- Professional Players (High frequency, premium technology demand)

- Amateur/Recreational Players (High volume, balance of comfort and price)

- By Distribution Channel:

- Offline (Specialty Sport Stores, Department Stores, Branded Outlets)

- Online (E-commerce Platforms, Brand Websites, Digital Marketplaces)

Value Chain Analysis For Badminton Shoes Market

The intricate value chain of the Badminton Shoes Market commences with rigorous upstream sourcing, focusing on obtaining specialized, performance-critical raw materials. This segment is highly concentrated, relying on a finite number of global chemical and polymer producers for non-marking rubber formulations, high-rebound foams (like proprietary EVA variants), high-tensile synthetic fabrics, and advanced composite materials such as carbon fiber for stability plates. Successful management in this upstream phase requires robust quality control protocols to ensure material consistency, as minute variations in polymer composition can drastically affect the shoe’s grip, cushioning, and longevity. Supply chain stability, particularly concerning key suppliers in East Asia, is a critical risk factor, necessitating long-term contracts and strategic inventory buffering to mitigate global logistics volatility and fluctuating petroleum-derived feedstock prices.

Midstream processing involves highly complex and labor-intensive manufacturing and assembly. The construction of a high-performance badminton shoe is multilayered, integrating precision-molded midsoles, sophisticated torsion control plates (often specialized TPU or carbon fiber), and heat-bonded uppers. Major brands predominantly outsource or operate manufacturing hubs in Southeast Asia (Vietnam, Indonesia) and Mainland China, capitalizing on established expertise, high production capacity, and lower labor costs. Manufacturing efficiency is a key competitive differentiator, focused on minimizing material waste through precision cutting (crucial for material cost control) and implementing advanced automation for precision tasks like sole attachment and component integration, ensuring structural integrity that can withstand extreme court stresses. Quality assurance checkpoints throughout assembly are mandatory to prevent defects related to bonding and alignment, which could compromise both performance and player safety, often involving complex machine vision systems for verification.

Downstream activities center on effectively reaching the global consumer base through strategically managed distribution channels. Direct channels, including flagship stores and proprietary e-commerce platforms, are increasingly vital for premium brands to manage brand image, collect direct customer feedback, and capture higher profit margins by eliminating intermediary costs. Indirect channels remain essential for high-volume sales; these encompass large multi-brand sporting goods chains (providing broad accessibility and physical fitting), and powerful global e-commerce platforms (offering price competitiveness and logistical speed). Effective downstream success relies on highly targeted marketing campaigns, robust athlete endorsement portfolios, and agile inventory allocation across regional distribution centers to meet localized spikes in demand associated with major tournaments or seasonal purchasing cycles, necessitating sophisticated demand forecasting tools and flexible regional merchandising strategies.

Badminton Shoes Market Potential Customers

Potential customers for specialized badminton shoes can be categorized primarily into three distinct archetypes based on their playing frequency, skill level, and commitment to investment. The most valuable segment comprises elite professional athletes and highly competitive amateur league players who play five or more times per week and view their footwear as performance equipment. These end-users are intensely focused on technological superiority, lightweight design, and maximum injury mitigation capabilities. They are highly brand-loyal to performance specialists (Yonex, Victor, Li-Ning) and are willing to pay a significant premium for the latest models that feature carbon fiber stability plates, proprietary cushioning systems, and advanced seamless upper materials. Their purchasing criteria are non-negotiable regarding immediate grip, responsiveness, and structural longevity, driving continuous investment in the highest tier of products regardless of cost.

The second, largest volume segment consists of recreational players, university club members, and general fitness enthusiasts who engage in the sport one to four times per week. This demographic seeks a balanced value proposition, prioritizing comfort, general durability, and multi-purpose functionality at a mid-range price point. While they appreciate safety features, their decision-making is heavily influenced by general athletic brand recognition (e.g., Nike, Adidas offering versatile court shoes) and accessible, convenient retail distribution channels, particularly through large online marketplaces. Marketing strategies targeting this group must emphasize the balance between essential performance benefits derived from specialized features and overall cost-effectiveness, positioning the product as a vital safety upgrade from generic athletic footwear without the extreme price tag of the professional models, often relying on simplified technology messaging.

The third key customer group involves institutional buyers, specifically junior badminton academies, high school athletic programs, and municipal sports centers, who purchase shoes in bulk quantities. These entities prioritize robust durability, standardized safety compliance for large groups, and attractive volume discounts, necessitating a strong B2B sales approach. Their purchasing decision is highly rational and cost-driven, often focusing on reliable mid-tier models that can withstand intensive daily use by multiple, developing users over prolonged periods. For manufacturers, securing large-scale B2B contracts with these institutions provides reliable, high-volume recurring revenue streams, requiring dedicated sales teams focused on inventory standardization, compliance certifications, and comprehensive warranty and service agreements tailored to institutional budget cycles and mass-usage wear and tear profiles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,090 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Yonex, Victor, Li-Ning, Adidas, Nike, Asics, Mizuno, Kumpoo, Carlton, Gosen, Kawasaki, Babolat, Head, Rucanor, FZ Forza, Hi-Tec, New Balance, Puma, Peak Sports, Apacs, Prince, Dunlop, Tactic, Pro Kennex, Karakal |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Badminton Shoes Market Key Technology Landscape

The technological landscape in the Badminton Shoes Market is fiercely competitive and centered on solving biomechanical challenges inherent to the sport, particularly high-impact landings and rapid directional shifts. Primary technological investment targets the outsole, where specialized, non-marking rubber formulations are continuously refined to improve the coefficient of friction on wooden and synthetic court surfaces without exhibiting excessive stickiness that could cause abrupt stops and subsequent knee injuries. Manufacturers utilize complex, often proprietary, tread patterns—such as radial blades, hexagonal cells, or specialized suction cups—engineered to optimize multidirectional grip and minimize the collection of dust. This focus on molecular composition and geometrical precision is paramount for ensuring player safety and maximizing instantaneous responsiveness during explosive court coverage maneuvers.

Midsole technology represents the second critical area of innovation, focusing heavily on advanced cushioning systems that must simultaneously absorb extreme impact energy and provide quick, powerful energy return for subsequent movements (spring-back effect). This is achieved through proprietary polymer foams (e.g., specialized EVA variations, injected polyurethane, or advanced nitrogen-infused dual-density foams) that are strategically placed in high-impact zones like the heel and forefoot. Furthermore, structural integrity is ensured by integrating torsion control mechanisms, typically rigid thermoplastic polyurethane (TPU) plates or lightweight carbon fiber shanks embedded beneath the arch. These shanks prevent excessive shoe deformation and twisting during aggressive lateral lunges, directly protecting the foot and ankle from sprains and strains, a common industry benchmark for professional-grade footwear.

The emerging technological paradigm involves the incorporation of lightweight construction materials and sophisticated fit systems, increasingly leveraging digital design tools. Upper construction increasingly utilizes engineered mesh, fused materials, and seamless bonding techniques to reduce overall weight, eliminate unnecessary stitching that could cause friction, and improve comfort. Advanced fit technologies include internal bracing systems, external support cages (often made of durable PU), and dynamic lacing systems that actively lock the foot in place during intense movement without restricting necessary natural articulation. Looking forward, the integration of smart sensors for performance tracking and the use of 3D printing for rapid prototyping and personalized component manufacturing signal the next wave of technological disruption, promising shoes that are lighter, safer, and tailored precisely to individual athlete needs, continually pushing the boundaries of what specialized footwear can achieve through advanced engineering and personalized manufacturing protocols.

Regional Highlights

- Asia Pacific (APAC): Dominance, Consumption, and Innovation Catalyst: The APAC region is unequivocally the largest and most influential market for badminton shoes, constituting the epicenter of global demand, consumption, and manufacturing. Countries such as China, Indonesia, Malaysia, and India boast hundreds of millions of participants, establishing badminton as a national priority sport and cultural phenomenon. The robust and highly competitive regional club scene, combined with government backing for national sports development, sustains massive market volume. Furthermore, APAC serves as the primary global supply chain hub, benefiting from cost efficiencies, skilled labor in footwear manufacturing, and proximity to raw material suppliers, solidifying its role as both the largest consumer base and the central innovation catalyst for the entire industry, driving rapid replacement cycles and technological adoption.

- North America: Premiumization and Health-Driven Adoption: North America represents a niche but highly profitable market segment characterized by a strong consumer preference for premium, high-ASP products. Market growth is driven by demographic changes, specifically increased immigration from Asian communities, and the growing mainstream recognition of badminton as an excellent high-intensity, low-impact exercise suitable for year-round indoor play. North American consumers exhibit a high awareness of brand marketing, sustainability credentials, and specialized features, driving demand for the most technologically advanced and aesthetically appealing models, positioning this region as critical for top-tier brand positioning and luxury product launch strategies. The consumer base here tends to research product specifications extensively before purchase.

- Europe: Maturity, Compliance, and Stability: The European market is mature, characterized by steady, predictable growth fueled by well-organized national federations and a strong club infrastructure, particularly in countries with high disposable income like Germany, the UK, Denmark, and the Netherlands. Demand is exceptionally sensitive to safety compliance, specifically the mandatory use of non-marking soles in private and public sports halls. Consumers here prioritize durability, precise fit, and reliability, often relying on the expertise provided by specialized sports retailers for guidance. The market is less susceptible to rapid volume fluctuations but offers stable returns on mid-to-high-range products that comply with stringent European quality and environmental standards, making ethical sourcing a significant competitive factor.

- Latin America (LATAM): High Growth Potential and Price Sensitivity: LATAM holds immense potential for high percentage growth, driven by increasing economic stability, a burgeoning middle class, and targeted investment in developing organized sports infrastructure across major urban centers in Brazil, Mexico, and Argentina. The market is acutely price-sensitive, meaning mid-range, durable, and value-oriented products are expected to capture the majority of market share. Strategic challenges in this region involve navigating complex import tariffs and establishing efficient, localized distribution networks to ensure product accessibility across diverse geographical terrains and socio-economic segments, requiring adaptive pricing models and strong partnerships with local sporting goods distributors.

- Middle East and Africa (MEA): Infrastructure Investment and Luxury Niche: Growth in the MEA region is closely tied to large-scale government investment in world-class sports facilities, particularly in the UAE, Qatar, and Saudi Arabia, often linked to hosting international sporting events and promoting health initiatives. While overall volume remains low, the region offers a niche for high-end, luxury sports brands catering to expatriate communities and affluent local populations, driving demand for technologically advanced, often custom-designed footwear. In Africa, market development is primarily focused on South Africa and emerging economies, where growth is constrained by lower disposable incomes but spurred by philanthropic and government efforts to promote sports participation, often requiring robust, entry-level, and durable institutional-grade footwear for training academies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Badminton Shoes Market.- Yonex Co., Ltd. (Global Market Leader and Innovation Driver)

- Victor Rackets Industrial Corp. (Strong focus on high-performance gear)

- Li-Ning Company Limited (Dominant in the Chinese and Asian markets)

- Adidas AG (Leveraging global athletic brand recognition)

- Nike, Inc. (Focus on innovation and general court shoe overlap)

- ASICS Corporation (Renowned for cushioning and ergonomic design)

- Mizuno Corporation (Known for Wave technology in stability)

- Kumpoo (Emerging Asian brand with competitive pricing)

- Carlton Sports (Traditional British brand focused on quality)

- Gosen Co., Ltd. (Specialized sports equipment manufacturer)

- Kawasaki Sports (Strong presence in niche Asian markets)

- Babolat (Diversified racket sports manufacturer)

- Head N.V. (Utilizing cross-sport technologies)

- Rucanor BV (Focus on recreational and entry-level products)

- FZ Forza (Danish brand strong in European distribution)

- Hi-Tec Sports (Global outdoor and court shoe presence)

- New Balance Athletics, Inc. (Expanding court sport portfolio)

- Puma SE (Re-entering the court sports segment strategically)

- Peak Sport Products Co., Ltd. (Strong Chinese domestic market presence)

- Apacs Sports (Value-oriented Asian producer)

Frequently Asked Questions

Analyze common user questions about the Badminton Shoes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between badminton shoes and regular running shoes?

Badminton shoes are engineered specifically for explosive lateral stability, rapid multi-directional pivots, and maximizing grip using proprietary non-marking rubber outsoles and integrated torsion control systems. Running shoes prioritize linear motion, forward cushioning, and energy return during heel-to-toe rolling, fundamentally lacking the necessary lateral containment and structural rigidity required for badminton's extreme side-to-side movements, which significantly increases the risk of ankle and knee injuries on the court.

Which material technologies are critical for performance in premium badminton footwear?

Critical material technologies include specialized, high-density EVA or proprietary polymer foam compounds in the midsole for shock absorption and rapid energy return, coupled with rigid torsion control elements (e.g., carbon fiber shanks) integrated into the arch to stabilize the foot. The outsole must use engineered, non-marking rubber with specific radial or hexagonal tread patterns optimized for instantaneous friction on wooden or synthetic court surfaces.

How does the distribution channel segmentation impact pricing in the market?

Online D2C (Direct-to-Consumer) channels generally offer lower prices due to reduced operational overhead and the ability to bypass traditional retail margins, promoting sharp price competitiveness. Conversely, offline specialty sports stores often sustain higher pricing but justify this through the added value of providing expert, personalized fitting consultations, immediate product availability, and crucial post-sale support, catering primarily to the performance-conscious consumer.

What role does injury prevention play in current badminton shoe design trends?

Injury prevention is a non-negotiable central design pillar. This focus drives continuous innovation toward enhanced ankle support through strategic upper reinforcement and internal bracing, coupled with maximum shock absorption capability in the midsole to mitigate cumulative stress on the player's knee and ankle joints from repetitive jumping and landing. Non-slip outsole compounds are also essential to prevent catastrophic falls and twists during fast maneuvers.

Why is the Asia Pacific region the dominant market for badminton shoes?

APAC dominance is rooted in the region's immense cultural penetration and massive participant base across densely populated countries like China, Indonesia, and India. This established consumer ecosystem is further reinforced by the concentration of global footwear manufacturing and supply chain expertise within the region, creating a centralized, cost-effective hub for both global production and high domestic consumption volume.

How does AI contribute to manufacturing efficiency and customization in the industry?

AI significantly enhances manufacturing efficiency by optimizing factory logistics, predicting component demand using machine learning, and streamlining complex assembly processes. In customization, AI uses algorithms to analyze individual biomechanical data derived from foot scans and movement tracking, enabling generative design systems to rapidly produce personalized shoe components, thus moving toward bespoke footwear solutions.

What is the typical lifespan of a professional-grade badminton shoe?

The lifespan of a professional-grade badminton shoe is highly variable but generally shorter than that of recreational footwear, typically lasting between three to six months for daily high-intensity players. This shorter lifecycle is due to the extreme lateral stresses placed on the specialized lightweight cushioning and structural components, which rapidly degrade integrity and require frequent replacement to maintain peak performance and safety standards.

Which factors influence consumer preference between Low-Ankle and High-Ankle shoe designs?

Consumer preference hinges on agility versus maximum support. Low-Ankle shoes are preferred by the majority seeking maximum speed, flexibility, and lightweight feel, essential for quick footwork. High-Ankle shoes are chosen by players with pre-existing ankle instability issues or those who employ aggressive court movements that necessitate remedial protection, prioritizing structural rigidity over marginal speed gains.

How do manufacturers combat the threat posed by counterfeit badminton shoes?

Manufacturers combat counterfeits through robust intellectual property litigation, advanced anti-counterfeiting measures such as embedded RFID chips or secure QR codes for authenticity verification, and strategically utilizing direct sales channels to control product distribution. They also engage in extensive consumer education to highlight the safety risks and performance deficiencies associated with non-genuine products.

What are the key sustainability trends impacting the production of badminton shoes?

Key sustainability trends involve the increasing use of recycled plastics and bio-based synthetic materials for shoe uppers and laces. Manufacturers are also focusing on reducing chemical waste and energy consumption during the manufacturing process, implementing zero-waste cutting technologies, and adopting modular designs that allow for easier material breakdown and recycling at the end of the product's life cycle.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager