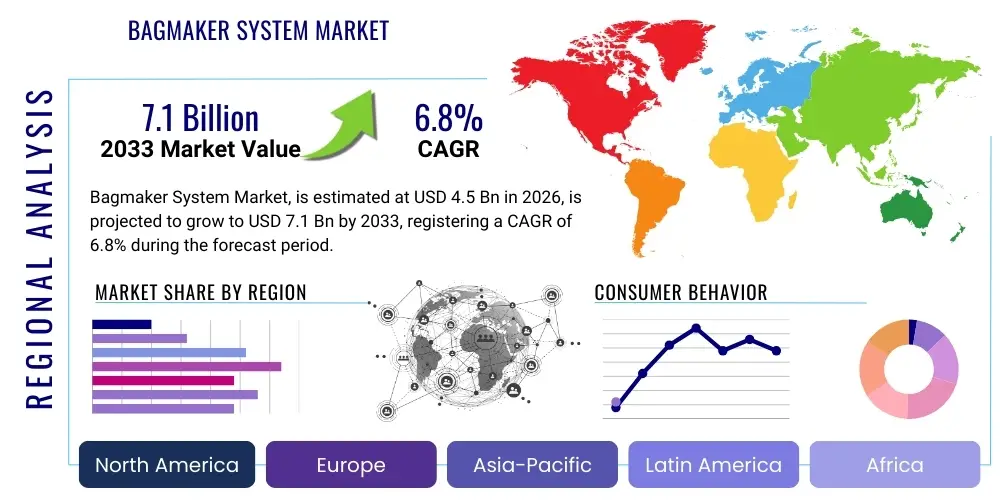

Bagmaker System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436207 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Bagmaker System Market Size

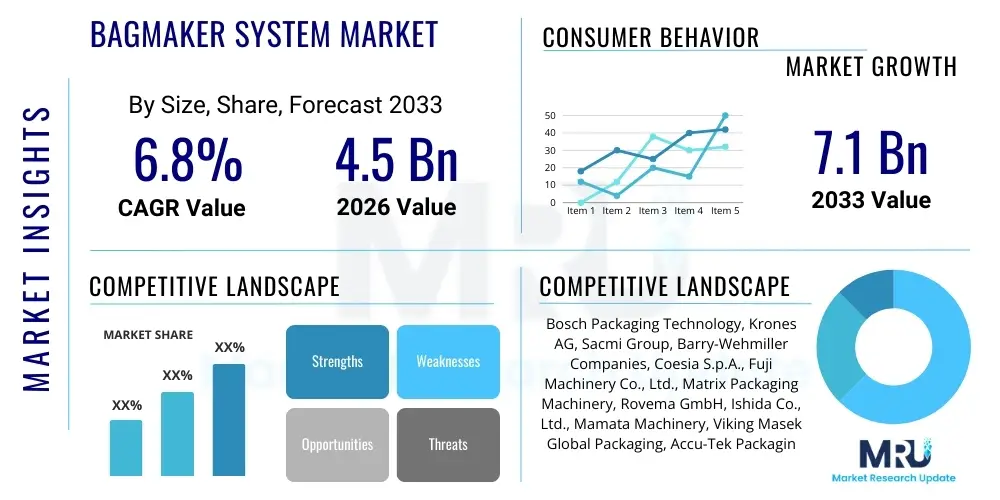

The Bagmaker System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $7.1 Billion by the end of the forecast period in 2033.

The consistent expansion in the global packaging industry, driven primarily by evolving consumer lifestyles and the resultant demand for ready-to-eat and convenience products, underpins this robust market valuation. Bagmaker systems are central to high-speed, automated packaging lines, ensuring product safety, optimal shelf appeal, and reduced material waste. This growth trajectory is further supported by the increasing adoption of sustainable packaging materials that require advanced machine precision for effective sealing and forming.

Market valuation reflects the crucial role bagmaker systems play in maximizing operational efficiency across high-volume sectors like food and beverage, pharmaceuticals, and consumer packaged goods (CPG). Investments in flexible packaging solutions, such as stand-up pouches and gusseted bags, are accelerating system upgrades. Furthermore, the integration of advanced sensors and predictive maintenance features into modern bagmakers contributes significantly to the system's long-term value proposition and market size expansion across diverse geographical regions, particularly in rapidly industrializing economies.

Bagmaker System Market introduction

Bagmaker systems, often referred to as form-fill-seal (FFS) machines, are specialized packaging equipment designed to automate the process of forming a bag from rollstock film, filling it with a product, and sealing it closed. These systems are pivotal in modern manufacturing, offering high throughput, precision filling, and versatility across various bag styles, including pillow bags, gusseted bags, stand-up pouches, and tetrahedrons. Major applications span food and beverage (snacks, frozen goods, cereals), pharmaceuticals (powders, tablets), cosmetics, and industrial products, providing essential functions like product preservation, branding, and compliance with hygiene standards.

The fundamental benefits of deploying advanced bagmaker systems include significant improvements in packaging speed and efficiency, reduction in labor costs, and enhanced package integrity, which minimizes spoilage and extends product shelf life. Modern systems are highly adaptable, capable of handling diverse film materials, including sustainable and compostable films, thereby meeting growing consumer and regulatory demands for eco-friendly packaging solutions. Furthermore, the modular design of many contemporary bagmakers allows for quick changeovers between different products or bag sizes, boosting operational flexibility.

Driving factors for the market expansion encompass the global proliferation of CPG industries, particularly in emerging economies, alongside a strong emphasis on automation to combat rising labor costs and ensure consistent quality. The increasing preference for flexible packaging over rigid containers due to cost-effectiveness, reduced environmental footprint during transport, and enhanced convenience is a primary catalyst. Continuous technological advancements, such as servo-driven mechanics, better temperature control systems for sealing, and integrated quality control mechanisms (e.g., check weighers and metal detectors), further accelerate the adoption of new-generation bagmaker systems across all end-user segments.

Bagmaker System Market Executive Summary

The Bagmaker System Market is characterized by robust growth fueled by the accelerating transition towards flexible packaging solutions, particularly in the Asian Pacific and Latin American regions, reflecting significant investments in food processing and pharmaceutical infrastructure. Business trends indicate a strong focus among leading manufacturers on developing highly automated, modular systems, leveraging servo technology to enhance speed and precision while minimizing downtime. A critical shift involves integrating advanced sensing and IoT capabilities to facilitate predictive maintenance and optimize operational parameters remotely, establishing smarter, more connected packaging lines that cater to diverse run sizes and complex material specifications.

Regionally, Asia Pacific maintains dominance due to massive consumer bases, rapid urbanization, and subsequent high demand for packaged goods, making it a lucrative hub for machinery deployment. North America and Europe, while mature, are characterized by high replacement rates of older equipment with sophisticated, sustainable-focused machinery capable of handling novel barrier films and adhering to stringent regulatory standards concerning food safety and packaging waste. Segment trends show that the Vertical Form Fill Seal (VFFS) segment continues to hold the largest market share, driven by its suitability for granular and snack products, although Horizontal Form Fill Seal (HFFS) is rapidly gaining traction due to increasing demand for complex, reclosable pouch formats and premium packaging applications.

Overall, the market outlook is overwhelmingly positive, driven by the imperative across all major end-user industries (Food & Beverage, Pharma) to optimize production costs, enhance scalability, and meet consumer expectations regarding product freshness and sustainability. The emphasis on minimizing packaging material usage, coupled with the necessity for quicker product-to-market cycles, mandates the continuous adoption of high-efficiency bagmaker systems. Key competitive strategies revolve around innovation in sealing technology, increased machine flexibility, and providing comprehensive after-sales support and integration services to large multinational CPG corporations.

AI Impact Analysis on Bagmaker System Market

Common user questions regarding AI's impact on Bagmaker Systems frequently revolve around how artificial intelligence can enhance operational efficiency, minimize material waste, and improve predictive maintenance schedules. Users are concerned with the cost-effectiveness of integrating sophisticated machine learning models into existing legacy machinery and the potential for AI-driven vision systems to drastically reduce faulty package rates and increase throughput. The prevailing expectation is that AI will transform bagmaking from a deterministic, fixed-speed process into a highly adaptive system capable of real-time material adjustment, optimizing seal integrity based on environmental conditions and film properties, and ultimately driving significant cost savings through unparalleled efficiency improvements and reduction in unplanned downtime.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data (vibration, temperature, current draw) to forecast equipment failures precisely, maximizing uptime and reducing maintenance costs.

- Optimized Sealing Parameters: AI models analyze film characteristics and environmental humidity/temperature in real-time, dynamically adjusting heating and pressure settings to ensure optimal seal integrity and minimize material burn-through or weak seals.

- Enhanced Vision Systems: Deep learning-based computer vision systems accurately identify and reject defective bags (e.g., incorrect fill levels, misalignment, compromised seals) far faster and more consistently than traditional systems.

- Throughput Optimization: AI models continuously analyze production data, identifying bottlenecks and optimizing machine speed and synchronization between filling and sealing stations to maximize cycles per minute (CPM).

- Automated Quality Control: Utilizing AI for automated foreign object detection and weight checks, increasing food safety and compliance standards without human intervention.

- Reduced Changeover Times: AI assists operators by providing optimized setup parameters and sequencing guidance for quick material and size changeovers, significantly boosting overall equipment effectiveness (OEE).

DRO & Impact Forces Of Bagmaker System Market

The dynamics of the Bagmaker System Market are fundamentally shaped by the accelerating consumer shift towards convenient, single-serve, and flexible packaging formats, acting as the primary driver for technological investment and system deployment. This positive momentum is balanced by significant restraints, predominantly the high initial capital expenditure required for sophisticated, fully automated systems and the complexity of integrating these advanced machines into existing operational infrastructures. Opportunities abound in emerging economies where packaging automation penetration is still low, and in the niche sectors focusing on bio-degradable and compostable packaging films, demanding specialized sealing technologies. These forces collectively dictate the market trajectory, impacting investment decisions, technology adoption rates, and competitive strategy among key manufacturers.

Drivers: The dominant driving forces include the rapid global growth of the packaged food industry, which requires high-speed VFFS and HFFS systems for snacks, frozen foods, and dry goods. Secondly, the increasing consumer preference for flexible packaging, such as stand-up pouches and reclosable bags, due to their lower material cost, light weight, and sustainability profile compared to rigid alternatives, necessitates continuous investment in modern bagmaking capabilities. Furthermore, stringent regulatory requirements, particularly in developed markets concerning hygiene (FDA, European standards) and serialization in pharmaceuticals, compel companies to upgrade to highly controlled and automated systems that minimize contamination risk.

Restraints: Significant restraints impede market growth, foremost among them being the high initial cost associated with purchasing and implementing fully automated bagmaker systems, particularly for small and medium-sized enterprises (SMEs). This financial barrier often leads SMEs to opt for cheaper, semi-automatic or refurbished equipment, limiting the overall market penetration of cutting-edge technology. Additionally, the technical complexity involved in operating and maintaining highly sophisticated, servo-driven machines requires specialized technical expertise, often leading to a shortage of adequately skilled labor in certain regions, thus hindering seamless adoption and utilization.

Opportunities: Key market opportunities lie in the accelerating demand for sustainable packaging solutions, including compostable and recyclable films. Developing bagmaker systems optimized for these environmentally friendly, but often thermally sensitive, materials offers a substantial competitive edge. The expansion into developing regions, particularly Southeast Asia and Africa, presents massive untapped markets where industrialization and the middle-class population are rapidly growing, creating a fertile environment for first-time automation adoption. Moreover, the integration of advanced Industry 4.0 technologies, such as IoT sensors and cloud-based monitoring, creates opportunities for manufacturers to offer high-margin, value-added services like predictive diagnostics and remote operation support.

Impact Forces: The impact forces are currently skewed heavily toward positive drivers, primarily driven by demographic trends (urbanization, increased disposable income) and technological advancements (faster servo control, AI integration). Restraints, while significant, are gradually being mitigated by favorable financing options and the long-term ROI offered by automated systems. However, volatility in raw material prices (packaging films, steel components) and geopolitical instability can introduce unexpected cost pressures. The net impact suggests sustained growth, concentrated on high-efficiency, multi-format machinery capable of supporting complex supply chain demands.

Segmentation Analysis

The Bagmaker System Market segmentation provides a detailed operational view based on three primary metrics: Type, Automation, and End-User Industry. Segmentation by Type, including Vertical Form Fill Seal (VFFS) and Horizontal Form Fill Seal (HFFS), defines the fundamental machine geometry and application scope, with VFFS dominating the bulk solids and snack sector. Automation level delineates market maturity and capital investment trends, where fully Automatic systems command the premium market due to efficiency demands in developed economies. Finally, the End-User segmentation highlights the massive volume consumption by the Food & Beverage sector, contrasting with the high-precision requirements of the Pharmaceutical industry.

Detailed analysis of these segments reveals that while VFFS machines are universally required for high-speed primary packaging of free-flowing products, the HFFS segment is experiencing accelerated growth as manufacturers seek attractive, customizable pouch designs for premium products and liquids. The push toward automation is global, driven by rising labor costs and the need for hygiene conformity, particularly post-2020. This comprehensive segmentation allows market participants to tailor their product offerings and strategic investments toward specific, high-growth application niches, such as stick pack systems utilized extensively in pharmaceutical and nutritional powder segments.

- By Type:

- Vertical Form Fill Seal (VFFS)

- Horizontal Form Fill Seal (HFFS)

- Stick Pack/Sachet Systems

- Others (e.g., Tetrahedral Systems, specialized pouch machines)

- By Automation:

- Automatic

- Semi-Automatic

- By End-User:

- Food & Beverage (Snacks, Grains, Dairy, Beverages)

- Pharmaceuticals (Powders, Tablets, Medical Devices)

- Cosmetics & Personal Care (Shampoo, Lotions, Wipes)

- Industrial & Chemical (Fertilizers, Detergents, Construction Materials)

Value Chain Analysis For Bagmaker System Market

The value chain for the Bagmaker System Market begins with the upstream suppliers of critical components, including specialty metals (stainless steel), precision mechanical components (servo motors, gears, bearings), and sophisticated electronic controls (PLCs, HMIs, sensors). The efficiency and reliability of these upstream inputs directly influence the final quality and operational speed of the finished bagmaker system. Key relationships at this stage involve partnerships between bagmaker OEMs and high-tech component providers to ensure compatibility with Industry 4.0 standards and the demanding speed requirements of continuous operation.

The central manufacturing stage involves Original Equipment Manufacturers (OEMs) who design, assemble, and rigorously test the complex machinery, often incorporating proprietary sealing and film-handling technologies. Following manufacturing, the distribution channel plays a vital role, often leveraging a mix of direct sales forces for large, multinational clients and indirect networks of specialized regional distributors and system integrators who provide local installation, training, and ongoing technical support. These integrators are essential as they customize the standard machines to fit the unique requirements of the end-user’s factory floor and specific product lines.

Downstream analysis focuses on the end-users—large CPG companies, pharmaceutical giants, and contract packers—who utilize the machinery. Their operational feedback drives innovation back up the chain, particularly regarding maintenance accessibility, efficiency (OEE scores), and material flexibility (handling sustainable films). Effective after-sales service, including spare parts supply and technician deployment, is a critical component of the value chain that establishes long-term customer relationships and drives future replacement sales. Direct distribution is favored for strategic customers, ensuring high-touch service, while indirect channels handle regional sales and specialized market niches.

Bagmaker System Market Potential Customers

The primary consumers and end-users of Bagmaker Systems are organizations that require high-volume, automated packaging of products, primarily targeting fast-moving consumer goods (FMCG) sectors. Large multinational Food & Beverage corporations constitute the most significant customer segment, needing VFFS machines for snacks, confectionery, cereals, and HFFS machines for liquid and prepared food pouches. These customers prioritize machine speed, reliability, rapid changeover capabilities, and compliance with rigorous food safety standards.

The second major customer group includes pharmaceutical and nutraceutical manufacturers, who require extremely high precision, tamper-evident sealing, and strict adherence to Good Manufacturing Practices (GMP). For these buyers, systems capable of precise sachet and stick pack creation, often integrated with serialization and tracking systems, are essential. Cosmetics and Personal Care companies also represent strong potential customers, utilizing bagmakers for packaging items like single-use wet wipes, specialized liquid detergents, and travel-sized personal hygiene products, where aesthetic quality and material consistency are paramount.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $7.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Packaging Technology, Krones AG, Sacmi Group, Barry-Wehmiller Companies, Coesia S.p.A., Fuji Machinery Co., Ltd., Matrix Packaging Machinery, Rovema GmbH, Ishida Co., Ltd., Mamata Machinery, Viking Masek Global Packaging, Accu-Tek Packaging Equipment, Universal Packaging, Concetti S.p.A., Hassia Packaging, PFM Packaging Machinery, TNA Solutions, Triangle Package Machinery, Syntegon Technology GmbH, Mespack. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bagmaker System Market Key Technology Landscape

The modern Bagmaker System Market is defined by the integration of advanced mechanical and digital technologies focused on increasing speed, precision, and flexibility. Servo-driven technology represents a critical advancement, replacing traditional mechanical linkages with electronic control systems. This shift allows for instantaneous adjustments of film indexing, sealing jaw motion, and cutter synchronization, leading to higher throughput (measured in Cycles Per Minute, or CPM) and dramatically reduced mechanical wear and tear, contributing significantly to system longevity and lower maintenance requirements.

Another pivotal technological area is the development of sophisticated sealing techniques optimized for diverse and often challenging film materials. Technologies such as ultrasonic sealing and impulse sealing are gaining prominence, particularly for handling thinner, multi-layer barrier films and heat-sensitive sustainable films like PLA or paper-based laminates, ensuring strong, airtight seals without compromising material integrity. Furthermore, the incorporation of Human-Machine Interfaces (HMIs) with intuitive, graphical interfaces facilitates quicker recipe storage and retrieval, empowering operators to perform rapid, error-free changeovers between different products or bag formats.

The pervasive adoption of Industry 4.0 concepts is transforming bagmaker systems into intelligent assets. This includes integrating IoT sensors for continuous monitoring of critical parameters (temperature consistency, vibration, motor loads), coupled with cloud connectivity for remote diagnostics and predictive maintenance. This connectivity ensures that machine performance data can be analyzed in real-time, allowing manufacturers to optimize overall equipment effectiveness (OEE) and minimize unscheduled downtime, thereby solidifying the competitive necessity for highly connected and intelligent packaging machinery across all major industrial applications.

Regional Highlights

The geographical analysis of the Bagmaker System Market reveals diverse maturity levels and growth drivers across major regions. Asia Pacific (APAC) is currently the dominant and fastest-growing region, fueled by massive population growth, increasing urbanization, rising disposable incomes, and subsequent demand for packaged consumer goods. Countries such as China, India, and Southeast Asian nations are heavily investing in expanding food processing and pharmaceutical manufacturing capabilities, requiring large-scale installation of new, automated VFFS and HFFS systems to meet local and export demands. This region benefits from lower operating costs, making it attractive for both local production and international machinery providers.

North America and Europe represent mature markets characterized by high labor costs and stringent regulatory landscapes, driving demand primarily for advanced, fully automated systems that replace older equipment. The focus in these regions is heavily concentrated on high-specification machinery capable of handling sustainable, eco-friendly packaging materials and integrating sophisticated IoT capabilities for predictive maintenance and operational visibility. While volume growth is steady, the value growth is significant due to the high average selling price (ASP) of these advanced, customized, and digitally integrated bagmaker units, emphasizing efficiency and minimal environmental impact.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions exhibiting considerable potential. LATAM, led by Brazil and Mexico, is undergoing rapid industrial expansion and modernization of its existing production facilities, leading to increased adoption of semi-automatic to automatic bagmakers. The MEA region is witnessing growing investments in the food and beverage sector, particularly in Saudi Arabia, UAE, and South Africa, due to diversification efforts and a burgeoning local CPG industry. Although challenging due to logistics and geopolitical instability in some areas, the long-term outlook for automation adoption in packaging within MEA remains strong.

- Asia Pacific (APAC): Market leader and highest growth rate; driven by massive CPG demand, rapid industrialization, and favorable government policies supporting manufacturing automation in countries like China and India.

- North America: Mature market focused on technology replacement, high-speed automation (VFFS for snacks), and integration of Industry 4.0 features, driven by high labor costs and strict FDA compliance requirements.

- Europe: Characterized by strong demand for sustainable packaging machinery, specialized systems for premium and organic products, and rigorous adherence to EU standards regarding safety and materials.

- Latin America (LATAM): Emerging market showing high adoption rates in countries modernizing food processing and beverage industries, with a balance between cost-effective semi-automatic and basic automatic systems.

- Middle East and Africa (MEA): Growth driven by investments in local food processing capacity, minimizing reliance on imports, particularly systems tailored for dry staples, grains, and construction materials in harsh climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bagmaker System Market.- Bosch Packaging Technology

- Krones AG

- Sacmi Group

- Barry-Wehmiller Companies (Thiele Technologies)

- Coesia S.p.A.

- Fuji Machinery Co., Ltd.

- Matrix Packaging Machinery

- Rovema GmbH

- Ishida Co., Ltd.

- Mamata Machinery

- Viking Masek Global Packaging

- Accu-Tek Packaging Equipment

- Universal Packaging

- Concetti S.p.A.

- Hassia Packaging

- PFM Packaging Machinery

- TNA Solutions

- Triangle Package Machinery

- Syntegon Technology GmbH

- Mespack

Frequently Asked Questions

What is the primary factor driving the adoption of Horizontal Form Fill Seal (HFFS) systems?

The primary factor driving HFFS adoption is the growing consumer preference for aesthetic, high-value flexible packaging formats, specifically stand-up and zippered pouches. HFFS systems excel at producing these complex, reclosable formats which offer enhanced convenience and shelf appeal compared to traditional pillow bags made by Vertical Form Fill Seal (VFFS) systems.

How do servo-driven bagmakers improve operational efficiency?

Servo-driven bagmakers utilize electronic motors and controls, offering superior precision and repeatability over traditional mechanical linkages. This technology allows for faster changeovers, higher production speeds (CPM), reduced energy consumption, and lower maintenance costs due to fewer moving mechanical parts, significantly boosting Overall Equipment Effectiveness (OEE).

What challenges do sustainable packaging films pose for bagmaker systems?

Sustainable films (e.g., compostable or monomaterial structures) often have a narrower thermal processing window and different material friction characteristics than standard multi-layer plastics. This requires bagmaker systems to utilize specialized sealing technologies, such as impulse or ultrasonic sealing, to ensure robust seal integrity without damaging the heat-sensitive eco-friendly film.

Which end-user segment dominates the Bagmaker System Market, and why?

The Food & Beverage industry dominates the market due to the high volume and rapid turnover of packaged goods globally, including snacks, frozen foods, and dry staples. The need for efficient, high-speed VFFS and HFFS machines to maintain product freshness and meet immense consumer demand makes this segment the largest consumer of bagmaker systems.

How is Industry 4.0 influencing the design of modern bagmaker systems?

Industry 4.0 integrates IoT sensors, cloud connectivity, and sophisticated data analytics into bagmakers. This allows for real-time performance monitoring, predictive maintenance alerts, and remote diagnostics, transforming machines into smart assets that optimize production schedules and minimize unplanned downtime through actionable data insights.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager