Bake Off Bakery Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434253 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Bake Off Bakery Products Market Size

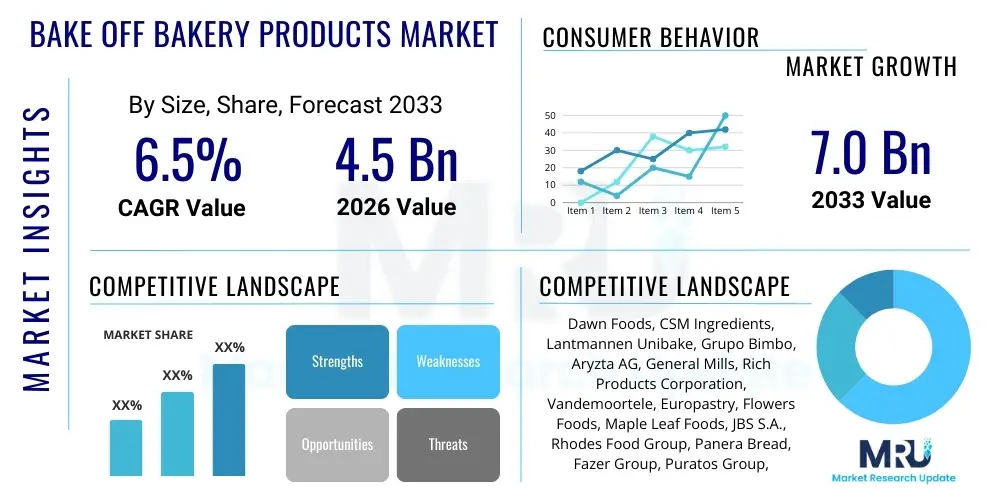

The Bake Off Bakery Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 7.0 billion by the end of the forecast period in 2033.

Bake Off Bakery Products Market introduction

The Bake Off Bakery Products Market encompasses pre-prepared, often frozen, doughs, batters, and partially baked goods that require minimal preparation or finishing steps (such as thawing, proofing, or final baking) at the point of sale or consumption. This category includes everything from frozen bread rolls and croissants to pre-portioned cake batters and specialized pastry items designed for fast deployment in both commercial and retail settings. The core value proposition of these products is unparalleled convenience, minimizing labor costs, ensuring consistent quality, and reducing waste for end-users, particularly within the foodservice industry and increasingly in modern retail chains that operate in-store bakeries without extensive skilled staff.

The increasing pace of modern life and the rising consumer demand for fresh, high-quality baked goods, often available on demand, are the primary drivers propelling the expansion of this market. Bake off products address the logistical challenges associated with traditional baking, allowing establishments such as hotels, cafes, quick-service restaurants (QSRs), and supermarkets to offer 'freshly baked' items throughout the day without the need for sophisticated, large-scale baking infrastructure or overnight preparation shifts. Furthermore, technological advancements in freezing and packaging techniques have significantly extended the shelf life of these products while maintaining flavor and textural integrity, making them highly attractive for international distribution and standardized menu operations across large chains.

Major applications of bake off products span across the entire food service value chain, including catering services, institutional kitchens, and specialty retail stores. The inherent benefits, such as streamlined production schedules, simplified inventory management, and reduced dependence on skilled bakers, translate directly into improved operational efficiency and profitability for businesses. As consumers increasingly prioritize speed and convenience without compromising perceived freshness or quality, the market for bake off solutions continues to innovate, introducing healthier options, specialized dietary ranges (gluten-free, vegan), and authentic regional specialties to broaden their appeal and penetrate new consumer segments globally.

Bake Off Bakery Products Market Executive Summary

The Bake Off Bakery Products Market is experiencing robust growth driven predominantly by the escalating demand for convenience and operational efficiency across the global foodservice sector. Business trends indicate a pronounced shift towards sophisticated freezing technologies, such as blast freezing and cryopreservation, which ensure superior quality retention of complex bakery items like laminated doughs and artisan breads. Manufacturers are investing heavily in automation and standardization to manage high-volume production while maintaining the artisanal characteristics demanded by modern consumers. Furthermore, the market is capitalizing on the premiumization trend, offering high-margin, specialized bake off products that cater to gourmet preferences and specific dietary requirements, thereby boosting average revenue per unit.

Geographically, North America and Europe remain mature, highly profitable markets, characterized by established cold chain infrastructure and high consumption rates in both retail in-store bakeries (ISBs) and QSRs. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, fueled by rapid urbanization, expanding middle-class disposable incomes, and the Westernization of dietary patterns. Regional trends highlight significant opportunities in developing economies where modern retail formats are proliferating, requiring ready-to-bake solutions to establish competitive, high-quality bakery offerings quickly. Regulatory environments concerning food safety, particularly related to frozen goods and ingredient traceability, are also shaping regional market entry strategies and supply chain compliance efforts.

Segmentation trends reveal that the frozen dough segment, particularly for pastries and specialty breads, holds the largest market share due to its versatility and ease of use, minimizing preparation steps at the end-user location. Within end-user segments, the Hotels, Restaurants, and Cafes (HORECA) sector remains the dominant consumer, valuing consistency and waste reduction. However, the retail channel, spurred by the expansion of dedicated in-store bakeries, is displaying the highest rate of growth. Looking ahead, the trend toward clean label ingredients, natural preservatives, and non-GMO formulations within the bake off sector is expected to significantly influence product development and marketing strategies throughout the forecast period, addressing growing consumer skepticism about processed foods.

AI Impact Analysis on Bake Off Bakery Products Market

Users frequently inquire about how Artificial Intelligence (AI) can optimize the notoriously complex cold chain logistics and manage inventory volatility inherent in the bake off market. Key questions center on predictive maintenance for freezing equipment, demand forecasting accuracy to minimize waste of perishable frozen goods, and the role of machine learning in recipe optimization for texture and shelf-life stability. The consensus among these inquiries suggests high expectations for AI to solve persistent challenges related to operational costs, ingredient variability, and real-time quality assurance across large, geographically dispersed production facilities. Users are particularly interested in AI's capacity to personalize production batches based on localized consumer preferences identified through geospatial and demographic data analysis, thereby transforming mass production into mass customization within the frozen bakery domain.

The introduction of AI-driven systems promises revolutionary changes in the manufacturing efficiency and supply chain responsiveness for bake off products. By leveraging vast datasets on historical sales, seasonal fluctuations, local events, and even real-time weather patterns, AI algorithms can dramatically enhance demand forecasting accuracy, allowing manufacturers to optimize production schedules and reduce costly inventory write-offs due to expiration. Furthermore, in the complex freezing and proofing stages, machine vision systems powered by AI are deployed to monitor dough structure, color, and size uniformity instantaneously, ensuring that every batch meets stringent quality specifications before freezing, leading to significantly higher consistency in the final baked product, which is critical for maintaining brand trust in this highly competitive space.

Beyond logistics and quality control, AI is transforming product development itself. Machine learning models are being utilized to analyze ingredient interactions and consumer feedback, accelerating the creation of new, specialized formulations, such as those focusing on reduced sugar or high protein content. These models can predict the optimal ratios of flour, yeast, fat, and stabilizers required to achieve desired texture and performance characteristics after the freeze-thaw cycle and subsequent baking, a process that traditionally relied heavily on protracted human trial-and-error. Consequently, the adoption of AI is leading to faster time-to-market for innovative bake off products and providing a competitive advantage to firms capable of integrating smart automation into their core manufacturing processes.

- AI-powered predictive demand forecasting reduces inventory obsolescence and optimizes cold storage capacity.

- Machine learning algorithms enhance quality control through real-time monitoring of dough density and temperature profiles during freezing.

- AI optimizes complex cold chain logistics, predicting transit times and identifying potential temperature excursions.

- Generative AI assists in faster R&D by simulating ingredient performance in specialized bake off recipes.

- Automation and robotic integration in packaging, driven by computer vision, improve throughput and hygiene standards.

DRO & Impact Forces Of Bake Off Bakery Products Market

The dynamics of the Bake Off Bakery Products Market are shaped by powerful Drivers promoting adoption, structural Restraints limiting expansive growth, and lucrative Opportunities for innovation, all under the influence of persistent Impact Forces. The primary driver is the undeniable consumer demand for convenience coupled with the perception of freshness, which bake off solutions successfully bridge. This is reinforced by the severe labor shortages impacting the global foodservice industry, making the reliance on pre-prepared, standardized doughs a necessity rather than a choice. Conversely, significant restraints include the high capital investment required for establishing and maintaining a robust, end-to-end cold chain infrastructure, as well as the substantial energy costs associated with continuous freezing and storage. Furthermore, persistent consumer perceptions regarding the inferior quality or additive content of frozen vs. scratch-made goods pose a psychological barrier that requires sustained marketing efforts to overcome.

Opportunities for market expansion are concentrated in two key areas: geographic penetration into emerging markets, particularly in Asia and Latin America where modern retail is rapidly displacing traditional food sourcing, and product diversification into niche dietary segments. The rising prevalence of food allergies, coupled with lifestyle choices such as veganism and keto diets, opens substantial avenues for specialized, premium bake off products that command higher prices and differentiation. Successful manufacturers are also leveraging Opportunities to integrate with e-commerce and direct-to-consumer (D2C) channels, offering frozen or par-baked gourmet goods directly to home consumers who seek high-quality baking results with minimal effort. This D2C channel demands innovative packaging and micro-logistics solutions tailored for smaller, frequent deliveries.

The overall market trajectory is influenced by several critical Impact Forces. Regulatory scrutiny, particularly in Europe, concerning food labeling, clean ingredient sourcing, and sustainable packaging, compels manufacturers to invest in environmentally friendly and transparent production methods. Economic volatility, particularly fluctuating global commodity prices for essential ingredients like wheat, sugar, and dairy, heavily impacts production costs and profit margins, forcing companies to adopt sophisticated hedging strategies. Technological advancement, particularly in high-speed mixing, controlled fermentation, and rapid freezing techniques (like cryogenic freezing), acts as a fundamental Impact Force, continuously improving product quality and operational scale, which is essential for competitiveness in this highly consolidated industry.

Segmentation Analysis

The Bake Off Bakery Products Market is comprehensively segmented based on product type, degree of preparation, end-user application, and distribution channel, reflecting the diversity of consumer needs and operational requirements across the value chain. Product segmentation typically divides the market into categories such as bread (rolls, baguettes, loaves), pastries (croissants, Danish pastries, doughnuts), and cakes and cookies. This categorization allows manufacturers to specialize in core competencies, often focusing on the technical challenges associated with freezing specific dough structures, such as the lamination required for high-quality pastry products. The frozen dough segment generally dominates due to its convenience and versatility, allowing end-users to manage proofing and final baking times precisely.

The analysis by End-User is crucial, distinguishing between the high-volume, standardized demands of the HORECA sector (Hotels, Restaurants, and Catering) and the distinct needs of the Retail/In-Store Bakery segment. HORECA customers prioritize consistency, bulk packaging, and efficiency, integrating bake off products into complex menu operations. Conversely, Retail customers focus on visual appeal, quick turnover, and variety, using these products to create an enticing 'freshly baked' atmosphere designed to drive foot traffic and increase basket size. The institutional segment, including schools, hospitals, and corporate cafeterias, represents a steady demand stream focused primarily on nutrition, cost-effectiveness, and ease of handling in large-scale kitchens.

Further segmentation by distribution channel highlights the critical role of cold chain management. Traditional distribution through specialized food service distributors remains central for B2B transactions, ensuring the stringent temperature requirements are met during transit. However, the rapidly growing e-commerce channel is necessitating new packaging innovations and logistics partnerships to enable direct sales to smaller businesses and individual consumers. Understanding these segments is paramount for market players, allowing for targeted product development, specialized packaging solutions, and optimized inventory positioning across diverse geographic and logistical landscapes.

- By Product Type:

- Bread (Loaves, Rolls, Baguettes)

- Pastries (Croissants, Danish, Puff Pastry)

- Cakes and Desserts (Muffins, Brownies, Doughnuts)

- Savory Baked Goods (Pizzas, Sausage Rolls)

- By Preparation Stage:

- Frozen Dough

- Par-Baked Products

- Fully Baked Frozen Products (Ready-to-Thaw)

- By End-User:

- HORECA (Hotels, Restaurants, Cafes)

- Retail (Supermarkets, Hypermarkets, Convenience Stores, In-Store Bakeries)

- Institutional (Schools, Hospitals, Airlines)

- By Distribution Channel:

- Food Service Distributors

- Retail Channels (Direct Sale)

- E-commerce/D2C

Value Chain Analysis For Bake Off Bakery Products Market

The Value Chain for the Bake Off Bakery Products Market is characterized by high levels of specialization and complexity, particularly concerning the logistics of temperature control. The upstream segment involves the sourcing and processing of raw materials, including flour, yeast, fats, sweeteners, and specialized stabilizers necessary for surviving the freeze-thaw process. This segment is highly consolidated, relying on major global agricultural commodity suppliers and specialized ingredient companies that provide technical expertise on formulation stability. Maintaining consistent quality in raw materials is paramount, as variations can critically impact the final product's volume, texture, and shelf life after baking, compelling manufacturers to implement rigorous quality checks and maintain strong, long-term relationships with key suppliers.

The core manufacturing stage involves complex processing steps: mixing, shaping, fermentation (often controlled), rapid freezing (blast freezing is common), and precise packaging. This stage represents the highest value addition, utilizing sophisticated, automated machinery to achieve consistency at industrial scales. The resulting frozen or par-baked goods then enter the downstream segment, where the distribution channel plays a vital, non-negotiable role. The entire distribution process relies on an unbroken cold chain (typically -18°C or lower) managed by specialized third-party logistics (3PL) providers and refrigerated transport fleets. Any break in this cold chain compromises product safety and quality, highlighting the high barrier to entry in distribution.

Distribution channels for bake off products are bifurcated into direct and indirect routes. Direct distribution typically involves large manufacturers supplying major supermarket chains or national QSR chains with their own centralized distribution centers, allowing for greater control over delivery schedules and temperature parameters. Indirect distribution, which accounts for the majority of the market, involves specialized foodservice distributors who manage inventory and delivery to smaller, independent restaurants, cafes, and local retail outlets. These distributors are crucial for market penetration, acting as the primary link between producers and a fragmented customer base, often offering mixed pallets containing a variety of frozen and non-frozen food items. Their expertise in regional logistics and localized customer service is essential for effective market reach and product penetration.

Bake Off Bakery Products Market Potential Customers

The primary customers and end-users of Bake Off Bakery Products are large entities within the food service and retail industries that prioritize operational efficiency, consistent product quality, and rapid response to demand fluctuations. The most significant segment remains the HORECA sector, including global hotel chains and franchise restaurants, which leverage these products to maintain uniform menu standards across different geographic locations while drastically simplifying kitchen operations and reducing reliance on skilled labor. These buyers seek comprehensive product portfolios from manufacturers, often demanding custom formulations and packaging solutions tailored to their specific operational workflows, such as oven-to-table portion sizes and precise thaw times.

The Retail segment, encompassing major supermarket chains (hypermarkets, discounters, and convenience stores), represents the fastest-growing customer base. These retailers utilize in-store bakeries (ISBs) fueled by bake off products to create a sensory experience—the smell of freshly baked bread—that enhances the store environment and encourages impulse purchases. Retail buyers are highly sensitive to price, packaging aesthetics, and logistics, demanding frequent, reliable deliveries of high-quality products that meet rigorous food safety standards and have an appealing, artisanal appearance to compete effectively with traditional bakeries. The flexibility offered by bake off items allows these stores to quickly adapt their offerings based on peak hours or seasonal demands without excess inventory risk.

Beyond these two major categories, institutional buyers—such as large contract caterers servicing schools, government facilities, and corporate campuses—constitute a steady and substantial customer base. These buyers focus heavily on volume, nutritional compliance, and cost control, seeking bulk-packaged products that require minimal handling and can be prepared efficiently in institutional kitchens operating under tight budgetary constraints. The appeal of bake off products to this segment lies in their predictable portion costs and guaranteed preparation consistency, which are vital for managing large-scale feeding operations and adhering to stringent public health guidelines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dawn Foods, CSM Ingredients, Lantmannen Unibake, Grupo Bimbo, Aryzta AG, General Mills, Rich Products Corporation, Vandemoortele, Europastry, Flowers Foods, Maple Leaf Foods, JBS S.A., Rhodes Food Group, Panera Bread, Fazer Group, Puratos Group, Bakels Group, Nestlé S.A., Cargill, Archer Daniels Midland (ADM) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bake Off Bakery Products Market Key Technology Landscape

The success of the Bake Off Bakery Products Market is intrinsically linked to advancements in food science and industrial engineering, focusing primarily on achieving optimal product quality after the harsh physical process of freezing and thawing. A core technology is blast freezing or cryogenic freezing, which rapidly reduces the product temperature, minimizing the formation of large ice crystals that can damage the gluten structure of the dough. Preserving the delicate cellular structure is vital, particularly in high-fat products like croissants, to ensure proper rise and flakiness during the final bake-off stage. Continuous technological refinement in these freezing methods allows manufacturers to offer a broader range of complex, sensitive bakery items in frozen form, expanding market possibilities beyond basic bread products.

Another crucial technological area is the development of specialized ingredients and mixing equipment designed specifically for frozen dough performance. Manufacturers rely on proprietary dough conditioners, specific yeast strains, and hydrocolloids that maintain dough elasticity and fermentation activity after extended periods in deep freeze. The equipment side involves highly precise, automated mixers and laminators (for pastry) integrated with temperature control systems to ensure consistent dough temperatures, which is critical for standardized, large-scale output. These systems often incorporate sophisticated sensors and IoT connectivity to monitor and adjust processes in real-time, minimizing human error and ensuring operational consistency across multiple production lines.

Furthermore, technology related to the final end-user preparation is rapidly evolving. This includes advanced, multi-stage proofing cabinets that precisely control temperature and humidity for optimal frozen dough activation, and smart ovens integrated with pre-programmed settings optimized for specific par-baked products. The integration of IoT allows manufacturers to track product performance, monitor cold chain integrity during transport, and even provide remote diagnostics and recipe updates to ovens and proofers located at the customer site (e.g., in a QSR franchise). This holistic approach, from rapid freezing technology to smart preparation equipment, ensures that the perceived ‘freshness’ and quality consistency remain high, reinforcing the value proposition of bake off solutions.

Regional Highlights

The geographical analysis of the Bake Off Bakery Products Market reveals distinct growth trajectories and market characteristics influenced by local consumer behavior, logistics infrastructure, and economic development levels. North America (including the U.S. and Canada) is a mature, highly competitive market characterized by advanced adoption rates, especially within large quick-service restaurant chains and supermarket in-store bakeries. The region's growth is driven by continuous product innovation, particularly focusing on healthy, clean-label, and indulgent premium options. The extensive existing cold chain infrastructure supports high-volume distribution and rapid market access for new frozen products, making it a critical revenue generator.

Europe holds a dominant position, primarily due to the strong presence of major global bakery manufacturers and a long-standing culture of consuming high-quality, artisanal bread and pastry products. Countries like Germany, France, and the UK demonstrate high penetration rates in both retail and HORECA segments. The European market leads in the trend toward sustainability, demanding environmentally friendly packaging and ethically sourced ingredients. Regulatory standards related to food safety and ingredient disclosure are particularly stringent here, influencing product development towards natural and low-additive formulations, pushing the boundaries of technology in stabilization and preservation.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. The surging growth is fueled by rapid urbanization, expanding organized retail formats, and increasing disposable incomes leading to a preference for Western-style diets. Countries such as China, India, and Southeast Asian nations present enormous untapped potential, particularly as local players begin to establish their own modern cold chain logistics. The increasing number of shopping malls, convenience stores, and international food franchises necessitates standardized, convenient baking solutions, making APAC a lucrative target for global manufacturers seeking long-term expansion and strategic investment in localized production facilities.

- North America: Market maturity, strong retail integration, high demand for high-protein and gluten-free bake off options, driving technological advancements in freezing efficiency.

- Europe: Dominant market share, driven by strong HORECA sector demand, emphasis on high-quality artisanal frozen products, and strict regulatory focus on clean label and sustainability.

- Asia Pacific (APAC): Highest projected CAGR, powered by urbanization, growth in modern retail (in-store bakeries), rising disposable income, and increasing adoption of Western consumption patterns.

- Latin America (LATAM): Developing market, characterized by increasing foreign investment in foodservice infrastructure, growing middle-class base, and opportunities for par-baked bread and savory items.

- Middle East and Africa (MEA): Emerging market focused on hospitality and tourism sectors, requiring consistent, high-quality frozen bakery products for upscale hotels and international franchises; cold chain development is a key challenge.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bake Off Bakery Products Market.- Dawn Foods

- CSM Ingredients

- Lantmannen Unibake

- Grupo Bimbo

- Aryzta AG

- General Mills

- Rich Products Corporation

- Vandemoortele

- Europastry

- Flowers Foods

- Maple Leaf Foods

- JBS S.A.

- Rhodes Food Group

- Panera Bread

- Fazer Group

- Puratos Group

- Bakels Group

- Nestlé S.A.

- Cargill

- Archer Daniels Midland (ADM)

Frequently Asked Questions

Analyze common user questions about the Bake Off Bakery Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for bake off bakery products?

The major driver is the accelerating demand for convenience and operational efficiency within the foodservice and retail sectors. Bake off products reduce labor costs, eliminate the need for specialized bakers on site, and ensure product quality consistency, allowing businesses to offer 'freshly baked' goods on demand throughout the day.

How do technological advancements influence the quality of frozen dough?

Technological advancements, particularly rapid freezing methods like blast freezing and the development of specialized dough conditioners, minimize the damage caused by ice crystal formation. This preserves the gluten structure, leading to better volume, texture, and rise during the final baking process, ensuring high-quality, artisanal results.

Which regional market is exhibiting the highest growth rate for bake off products?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapid expansion of modern retail formats, growing urbanization, and increasing consumer acceptance of packaged and frozen food solutions across major economies like China and India.

What is the most significant operational challenge faced by this market?

The most significant operational challenge is maintaining a robust, unbroken cold chain logistics network from the manufacturing site to the point of sale. Any temperature fluctuation during storage or transit can compromise product safety, quality, and shelf life, necessitating substantial infrastructure investment and sophisticated monitoring systems.

How are changing consumer dietary trends impacting the market?

Changing consumer trends are pushing manufacturers towards innovation in specialty products. This includes the development of clean label items, products with reduced sugar and sodium, and specialized dietary formulations such as gluten-free, vegan, and high-protein baked goods, catering to niche market demands and premium pricing segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager