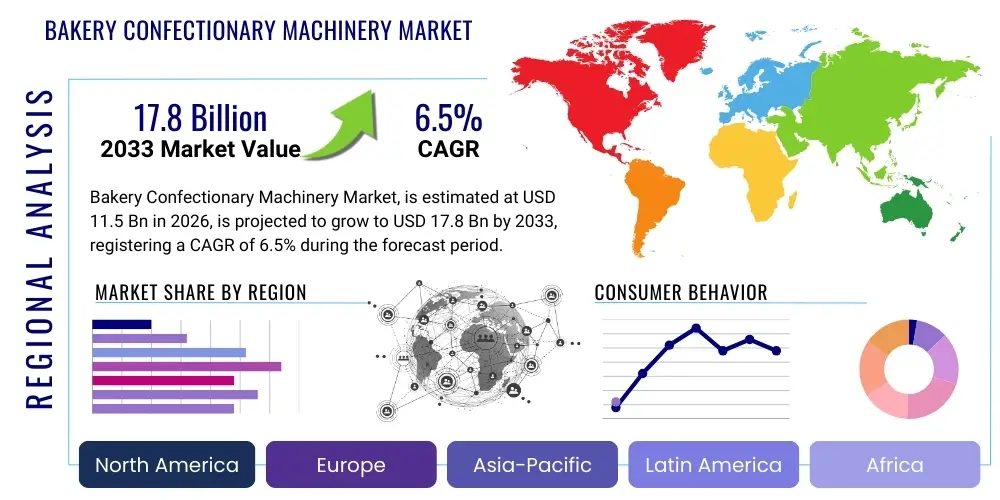

Bakery Confectionary Machinery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437243 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Bakery Confectionary Machinery Market Size

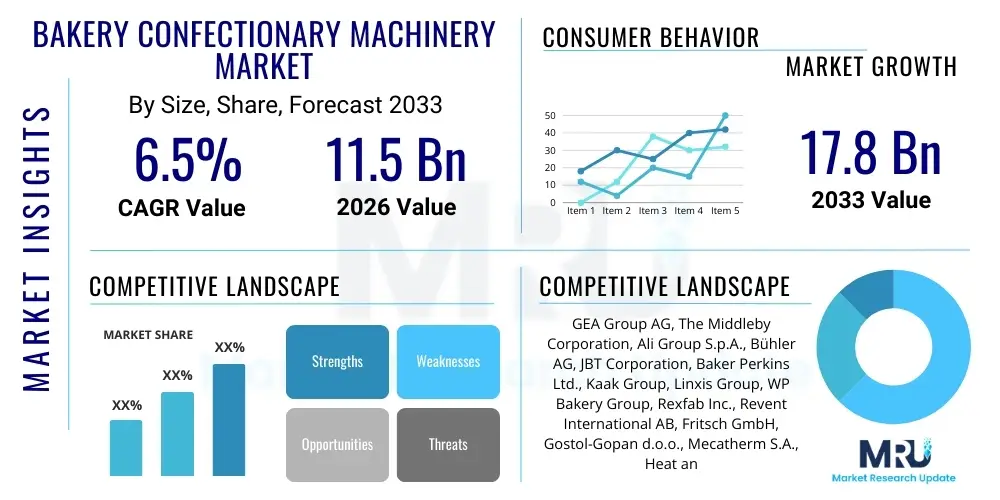

The Bakery Confectionary Machinery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 11.5 billion in 2026 and is projected to reach USD 17.8 billion by the end of the forecast period in 2033.

Bakery Confectionary Machinery Market introduction

The Bakery Confectionary Machinery Market encompasses a wide array of specialized equipment used for the preparation, processing, and finishing of bakery and confectionery products, ranging from large industrial plants to small artisan shops. This market is fundamentally driven by the global surge in consumer demand for convenient, ready-to-eat, and highly standardized processed foods, coupled with the necessity for industrial players to enhance production efficiency and maintain consistent product quality. Key machinery types include mixing and kneading equipment, high-capacity industrial ovens, proofers, dough handling systems, depositors, moulders, and sophisticated packaging lines. The evolution of this industry is marked by a significant shift towards fully automated and integrated production lines, which reduce reliance on manual labor, minimize waste, and ensure compliance with stringent food safety and hygiene regulations worldwide.

Product descriptions within this segment highlight features such as modular design, easy sanitation (CIP systems), energy efficiency, and operational flexibility to handle various raw materials and recipes. Major applications span industrial bread production, biscuit and cracker manufacturing, chocolate processing, cake and pastry mass production, and specialized equipment for fine confectionery items like candies and gums. The primary benefits of deploying modern bakery and confectionery machinery include maximizing throughput, achieving precise ingredient control, ensuring uniformity across product batches, and reducing operational costs associated with labor and energy consumption. Furthermore, advanced machinery allows manufacturers to quickly adapt to changing consumer trends, such as the demand for gluten-free, low-sugar, or specialized artisanal products, thereby providing a competitive edge in a rapidly evolving food landscape.

Driving factors propelling market expansion include rapid urbanization, which increases the consumption of packaged and convenience bakery items; rising disposable incomes in emerging economies, fueling demand for premium confectionery; and technological advancements such as the integration of IoT and robotics, leading to smart factory implementations. Additionally, escalating labor costs, particularly in developed regions, incentivize industrial bakeries to invest heavily in highly automated machinery to maintain profitability and scale production capacity effectively. The competitive environment is characterized by continuous innovation aimed at developing versatile, high-precision, and sustainable equipment solutions that meet global demands for both efficiency and food safety.

Bakery Confectionary Machinery Market Executive Summary

The Bakery Confectionary Machinery Market is undergoing significant transformations driven by industrial automation and the sustained global demand for high-quality, processed baked goods. Current business trends indicate a strong focus on developing multi-functional and modular equipment that allows for rapid changeovers between product lines, addressing the consumer preference for variety. Key manufacturers are investing heavily in connectivity, incorporating sensors and data analytics to enable predictive maintenance and optimize production schedules, effectively aligning the sector with Industry 4.0 paradigms. Sustainability is emerging as a critical competitive factor, with market leaders prioritizing machinery designs that minimize energy consumption and reduce material waste, responding both to regulatory pressures and corporate environmental commitments. Strategic mergers, acquisitions, and partnerships are prevalent, enabling companies to expand their geographical reach and integrate specialized technological capabilities, particularly in robotics and advanced material handling systems.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, primarily due to rapid expansion of the organized retail sector, increasing westernization of dietary habits, and substantial government investments in food processing infrastructure, especially in populous nations like China and India. Europe and North America remain mature markets, characterized by high adoption rates of advanced, highly automated systems focused on labor efficiency and adherence to stringent sanitary standards. Segment trends highlight that automatic machinery currently dominates the market share due to its superior efficiency and precision in high-volume production settings, crucial for industrial bakeries. Furthermore, the bread segment holds the largest application share globally, although the confectionery segment (including chocolates and candies) is exhibiting the highest growth trajectory, spurred by innovation in product formulation and intricate decorative requirements necessitating specialized depositing and wrapping machinery.

The market outlook remains robust, supported by underlying demographic shifts and increasing consumer willingness to pay for premium, consistent-quality baked and confectionery items. Challenges such as supply chain disruptions for specialized components and the high initial capital expenditure required for state-of-the-art equipment persist. However, these are largely mitigated by the long-term returns on investment derived from reduced operational costs and improved product quality. Overall, the market trajectory points toward greater specialization of equipment, deeper integration of digital technologies for operational oversight, and a commitment to hygiene-centric design, ensuring continued expansion and value creation across the entire bakery supply chain.

AI Impact Analysis on Bakery Confectionary Machinery Market

User queries regarding the integration of Artificial Intelligence (AI) in the Bakery Confectionary Machinery Market primarily center on how AI can enhance operational efficiency, ensure product consistency, and minimize downtime. Common themes include the application of machine learning for predictive maintenance schedules, optimizing complex recipe formulations based on real-time ingredient data and final product quality metrics, and utilizing computer vision systems for automated quality control and defect detection at high production speeds. Users express strong expectations that AI will transition machinery from reactive maintenance models to proactive, data-driven operational management, thus maximizing uptime and significantly reducing manual intervention requirements. Concerns often relate to the initial cost of implementing AI infrastructure, the need for specialized technical skills to manage these systems, and data privacy issues surrounding proprietary production processes. In essence, the market anticipates AI as a pivotal technology for achieving true lights-out manufacturing and enhancing competitiveness through precision and repeatability.

- Implementation of predictive maintenance algorithms analyzing machine sensor data to anticipate failures, maximizing machinery uptime.

- Optimization of ingredient blending and mixing processes using machine learning to adjust parameters based on variations in raw material quality, ensuring product uniformity.

- Automated quality inspection systems utilizing AI-powered computer vision to detect subtle defects in shape, color, or topping distribution in real-time.

- Dynamic recipe adaptation based on environmental factors (humidity, temperature) and dough characteristics, leading to superior final product quality.

- Energy consumption optimization across integrated production lines (e.g., ovens, chillers) managed by intelligent energy management systems.

- Enhanced food safety compliance through AI monitoring of cleaning cycles and cross-contamination risk assessment.

- Simulation and virtual commissioning of new equipment and production lines prior to physical installation, speeding up deployment.

DRO & Impact Forces Of Bakery Confectionary Machinery Market

The Bakery Confectionary Machinery Market is shaped by a confluence of accelerating drivers, structural restraints, and emerging opportunities, collectively defining its trajectory. The primary driver is the accelerating global demand for packaged and convenience food items, spurred by busy lifestyles and urbanization, which necessitates high-volume, automated production capabilities. This demand is coupled with the rising costs and scarcity of skilled labor, compelling industrial bakeries globally to invest in sophisticated, fully automatic machinery to reduce reliance on human intervention and ensure stable production output. Furthermore, stringent global food safety regulations, such as those imposed by the FDA and EFSA, push manufacturers toward advanced machinery featuring superior hygienic designs, smooth surfaces, and Clean-in-Place (CIP) capabilities, further driving equipment upgrades and new market sales.

However, the market faces significant restraints, chiefly the substantial initial capital investment required for high-capacity, advanced machinery, which poses a barrier, especially for small and medium-sized enterprises (SMEs). The complexity associated with integrating advanced digital technologies (like IoT and robotics) into existing legacy systems requires specialized technical expertise and substantial training, slowing down adoption rates in certain regions. Furthermore, the specialized nature of component supply chains and potential geopolitical instability can introduce manufacturing and procurement delays, affecting the timely delivery of complex machinery and after-sales support.

Opportunities for growth are concentrated in the adoption of Industry 4.0 technologies, including the integration of IoT, AI, and cloud-based data analytics for improved operational visibility and performance optimization. The growing trend toward specialized dietary products, such as gluten-free, vegan, and fortified baked goods, creates an opportunity for manufacturers to develop highly flexible, customized machinery capable of handling alternative ingredients and processes. Geographically, untapped potential lies within developing markets in Southeast Asia, Latin America, and Africa, where the organized food processing sector is nascent but rapidly expanding. These dynamics solidify the impact forces, pushing the market toward higher automation, improved energy efficiency, and modular design to serve a highly diverse and demanding global consumer base.

Segmentation Analysis

The Bakery Confectionary Machinery Market is structurally segmented based on machinery type, application, and mode of operation, providing a multifaceted view of industry dynamics and specialized requirements. Segmentation by machinery type reflects the core processes involved in baking, encompassing equipment from raw material preparation to final product finishing. Application segmentation highlights the diverse end products served, showing varying demands for precision and scale across bread, biscuit, cake, and chocolate manufacturing. Operational mode segmentation (automatic versus semi-automatic) clearly delineates the adoption rates of advanced, high-throughput systems versus flexible, smaller-scale solutions typically favored by artisan bakeries or facilities in emerging markets just beginning to scale their production capabilities.

Analysis reveals that mixers and industrial ovens dominate the machinery type segment due to their foundational role in almost all production processes. However, specialized machinery, such as sophisticated depositors for confectionery items and high-precision slicers/wrappers, are experiencing rapid value growth driven by the demand for aesthetically pleasing and individually packaged goods. The bread segment consistently maintains the largest volume share globally, reflecting its status as a staple food, while the confectionery segment, particularly chocolate and sugar confectionery, is poised for the fastest expansion in revenue, supported by global indulgence trends and innovative product development.

From an operational standpoint, the shift towards automatic machinery is undeniable, especially in high-labor-cost economies where operational efficiency and scale are paramount. These automatic systems often feature integrated control units, self-diagnostics, and high levels of integration, minimizing product handling and maximizing hygiene. Nevertheless, semi-automatic equipment retains importance in smaller operations and for handling complex, low-volume artisanal products where human expertise is still critical for product differentiation. These clear segmentation profiles allow stakeholders to accurately target investments, tailor product development, and refine their market penetration strategies based on regional technological readiness and product focus.

- By Machinery Type:

- Mixers, Kneaders, and Dough Processors

- Industrial Ovens and Proofers

- Dividers, Rounders, and Moulders

- Depositors, Fillers, and Extruders

- Sheeters and Laminators

- Forming, Cutting, and Slicing Equipment

- Cooling, Freezing, and Handling Systems

- Confectionery Specific Machinery (e.g., Tempering, Coating, Enrobing, Wrapping)

- By Application:

- Bread (Loaves, Rolls, Flatbreads)

- Biscuits, Cookies, and Crackers

- Cakes, Pastries, and Desserts

- Chocolate and Confectionery (Candies, Gums, Jellies)

- Others (Snacks, Waffles, Doughnuts)

- By Operation:

- Automatic Machinery

- Semi-Automatic Machinery

Value Chain Analysis For Bakery Confectionary Machinery Market

The value chain for the Bakery Confectionary Machinery Market begins with the upstream segment, dominated by suppliers of critical raw materials and components, including specialized high-grade stainless steel for hygienic processing, advanced control systems (PLCs, HMI), sensors, motors, and robotic arms. Efficiency in this phase relies heavily on global sourcing networks and the quality control protocols of these suppliers, as the reliability and longevity of the final machinery are directly dependent on component quality. Major machinery manufacturers then integrate these components, focusing on R&D for new designs that prioritize hygiene, energy efficiency, modularity, and seamless integration of software, transforming raw materials into complex, high-precision equipment ready for deployment in food processing environments.

The distribution channel plays a crucial intermediary role, connecting manufacturers to the diverse end-user base. Direct distribution is common for large, high-value, highly customized industrial lines, where manufacturers engage directly with large food corporations to manage complex installations, commissioning, and long-term service contracts. Indirect distribution utilizes specialized dealers, agents, and local distributors, particularly for standard, semi-automatic, or smaller-scale equipment targeted at artisan bakeries and regional food producers. These distributors often provide localized sales support, basic technical services, and manage inventory, proving essential for market penetration in geographically diverse and fragmented markets.

Downstream analysis focuses on the installation, operation, maintenance, and after-sales service phases, which constitute a significant part of the machinery’s lifetime value. End-users, ranging from multinational food giants to local bakeries, require ongoing technical support, spare parts availability, and upgrade capabilities to maintain optimal operational performance. The success of a machinery manufacturer is increasingly tied to the quality of its downstream services, including training, remote diagnostics facilitated by IoT connectivity, and timely delivery of proprietary spare parts, ensuring high customer retention and long-term contract value. This entire chain emphasizes precision engineering and robust after-sales support to sustain the continuous high-volume demands of the food industry.

Bakery Confectionary Machinery Market Potential Customers

The primary consumers and end-users of Bakery Confectionary Machinery represent a broad spectrum of the food processing industry, categorized mainly into industrial bakeries, large-scale confectioners, retail and in-store bakeries, and artisan producers. Industrial bakeries, characterized by high-volume, continuous production, are the largest segment of potential customers, requiring fully automated, high-capacity machinery like tunnel ovens, continuous mixers, and integrated packaging lines. Their purchasing decisions are driven by total cost of ownership (TCO), efficiency gains, and integration capabilities with existing plant infrastructure. These major buyers seek reliable equipment that guarantees consistent product quality across massive batches and complies strictly with international food safety standards.

Large-scale confectionery manufacturers, specializing in chocolate, candies, and gums, constitute another significant customer base, demanding highly precise machinery such as advanced depositors, tempering machines, and intricate wrapping equipment capable of handling delicate ingredients and complex shapes. Furthermore, the burgeoning segment of retail and in-store bakeries, often found within supermarkets and hypermarkets, represents a growing customer base for semi-automatic and modular equipment that balances efficiency with flexibility, allowing them to produce fresh products on-site throughout the day. Their needs focus on ease of use, smaller footprints, and lower energy consumption compared to full industrial setups.

Artisan and specialty food producers, though smaller in volume, are crucial customers for specialized, flexible, and often custom-built machinery that allows for the production of unique, high-value products. Their priorities include equipment that mimics traditional techniques while providing basic automation to manage scaling challenges. Overall, the market for potential customers is diverse, requiring machinery manufacturers to maintain a flexible portfolio ranging from entry-level semi-automatic mixers and proofers to multi-million-dollar, fully integrated, robotic production facilities managed through centralized digital control systems, all centered around improving efficiency and ensuring food safety compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 17.8 Billion |

| Growth Rate | CAGR 6.5 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GEA Group AG, The Middleby Corporation, Ali Group S.p.A., Bühler AG, JBT Corporation, Baker Perkins Ltd., Kaak Group, Linxis Group, WP Bakery Group, Rexfab Inc., Revent International AB, Fritsch GmbH, Gostol-Gopan d.o.o., Mecatherm S.A., Heat and Control, Inc., Tromp Group, Rondo Burgdorf AG, Esmach S.p.A., AMF Bakery Systems, Erika Record LLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bakery Confectionary Machinery Market Key Technology Landscape

The technological landscape of the Bakery Confectionary Machinery Market is defined by the pervasive adoption of automation, digital integration, and advanced manufacturing techniques aimed at precision and hygiene. A major technological thrust involves the integration of the Internet of Things (IoT) sensors and connected devices throughout the production line. This connectivity facilitates real-time data collection on operational parameters such as temperature, mixing speed, energy consumption, and product flow. This data is critical for executing centralized process control, allowing operators to make instant adjustments, thereby minimizing batch variation and optimizing overall equipment effectiveness (OEE). Furthermore, the use of sophisticated Programmable Logic Controllers (PLCs) and Human-Machine Interfaces (HMIs) has made complex machinery easier to operate and monitor, reducing the potential for human error and simplifying training procedures for technical staff.

Advanced robotics and automated handling systems are rapidly replacing manual labor in high-risk or repetitive tasks, particularly in the handling of hot products, loading/unloading ovens, and precise packaging. Collaborative robots (cobots) are increasingly deployed alongside human workers for tasks requiring flexibility, such as decorating or intricate product arrangement, without compromising safety standards. Simultaneously, machine design focuses heavily on hygienic engineering principles (EHEDG standards), employing materials and structures that minimize bacteria entrapment and facilitate fast, efficient, and thorough Clean-in-Place (CIP) or Clean-Out-of-Place (COP) procedures. This technological evolution ensures compliance with stringent global food safety mandates while maximizing throughput.

Emerging technologies like 3D printing (Additive Manufacturing) are being explored for creating customized nozzles, specialized tool parts, and complex molds used in confectionery production, allowing for rapid prototyping and bespoke product development. Another significant trend is the utilization of advanced energy recovery systems and highly efficient oven designs (e.g., regenerative thermal oxidizers and indirect heating systems) to reduce the substantial energy footprint typically associated with industrial baking. These technological innovations collectively position the industry for smarter, faster, more sustainable, and inherently safer food production, driving continuous investment in R&D across leading global manufacturers.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to rapid urbanization, changing dietary preferences favoring Western-style baked goods, and increasing disposable incomes. Countries like China, India, and Southeast Asian nations are witnessing massive investments in setting up large-scale, automated food processing plants to cater to a burgeoning middle-class population. Government initiatives supporting food processing infrastructure further accelerate market expansion, driving demand for both semi-automatic equipment for smaller regional players and high-end industrial lines for multinational entrants.

- Europe: Europe represents a mature market characterized by high adoption of technological advancements and stringent food safety regulations. Demand here is focused on highly energy-efficient, sustainable machinery with advanced digitalization (Industry 4.0 integration) and excellent hygienic design. Western European countries, particularly Germany, Italy, and the Netherlands, are leaders in manufacturing and export of high-precision equipment, with a strong focus on confectionery and specialized pastry machinery. Innovation centers around waste reduction and automation complexity due to high labor costs.

- North America: North America is defined by high labor efficiency requirements and large-scale industrial operations, leading to strong demand for fully automatic systems, robotics, and integrated solutions, particularly in bread and snack production. The market is highly saturated with large manufacturers, and procurement decisions are often driven by the necessity for advanced connectivity, remote diagnostics, and minimizing downtime. High priority is placed on machines compliant with FDA regulations and those that offer data transparency for traceability purposes.

- Latin America (LATAM): The LATAM market is experiencing steady growth, driven by modernization efforts in food processing facilities, especially in Brazil and Mexico. Demand is split between new investments in scalable semi-automatic machinery for local producers and upgrades to fully automated lines by international companies establishing a regional presence. Economic volatility, however, often influences capital expenditure decisions, favoring versatile, moderately priced equipment solutions.

- Middle East and Africa (MEA): Growth in MEA is heterogeneous, spurred by rising wealth in the GCC countries and increasing consumer demand for packaged foods across Africa. Infrastructure development and expanding retail networks create opportunities for importing both standard and specialized bakery equipment. The need for temperature-controlled storage and handling systems is critical in this region due to climatic conditions, influencing specific machinery requirements related to cooling and stabilization processes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bakery Confectionary Machinery Market.- GEA Group AG

- The Middleby Corporation

- Ali Group S.p.A.

- Bühler AG

- JBT Corporation

- Baker Perkins Ltd.

- Kaak Group

- Linxis Group

- WP Bakery Group

- Rexfab Inc.

- Revent International AB

- Fritsch GmbH

- Gostol-Gopan d.o.o.

- Mecatherm S.A.

- Heat and Control, Inc.

- Tromp Group

- Rondo Burgdorf AG

- Esmach S.p.A.

- AMF Bakery Systems

- Erika Record LLC

Frequently Asked Questions

Analyze common user questions about the Bakery Confectionary Machinery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market shift toward automated bakery machinery?

The primary drivers are rapidly increasing labor costs globally, the continuous need for higher production volumes, and stringent regulatory demands for consistent product quality and superior hygiene. Automation minimizes reliance on skilled human labor while maximizing efficiency and adhering strictly to food safety standards through controlled processing environments.

How does Industry 4.0 specifically benefit bakery machinery operations?

Industry 4.0 integrates IoT, AI, and advanced sensors to enable real-time monitoring, data analytics, and predictive maintenance. This results in optimized production schedules, reduced energy consumption, earlier detection of potential machine failures (minimizing expensive downtime), and improved overall equipment effectiveness (OEE) across the entire production line.

Which regional market shows the highest growth potential for bakery machinery investment?

The Asia Pacific (APAC) region, particularly emerging economies like China and India, exhibits the highest growth potential. This growth is fueled by massive urbanization, the expansion of organized retail chains, shifting consumer preferences towards packaged convenience foods, and large-scale modernization of existing local food processing facilities.

What are the critical considerations when selecting new industrial oven technology?

Critical considerations include energy efficiency (gas, electric, or hybrid systems), oven type (tunnel, rack, deck), required throughput capacity, heat uniformity across the baking chamber for consistent product quality, ease of cleaning, and the ability to integrate seamlessly with existing upstream and downstream handling systems for full automation.

What role does hygienic design play in modern confectionery equipment?

Hygienic design is paramount for preventing microbial contamination and ensuring food safety. It dictates the use of high-grade stainless steel, smooth welding, minimized horizontal surfaces, open framework for easy access, and built-in Clean-in-Place (CIP) systems to reduce cleaning time and ensure compliance with stringent international food hygiene regulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager