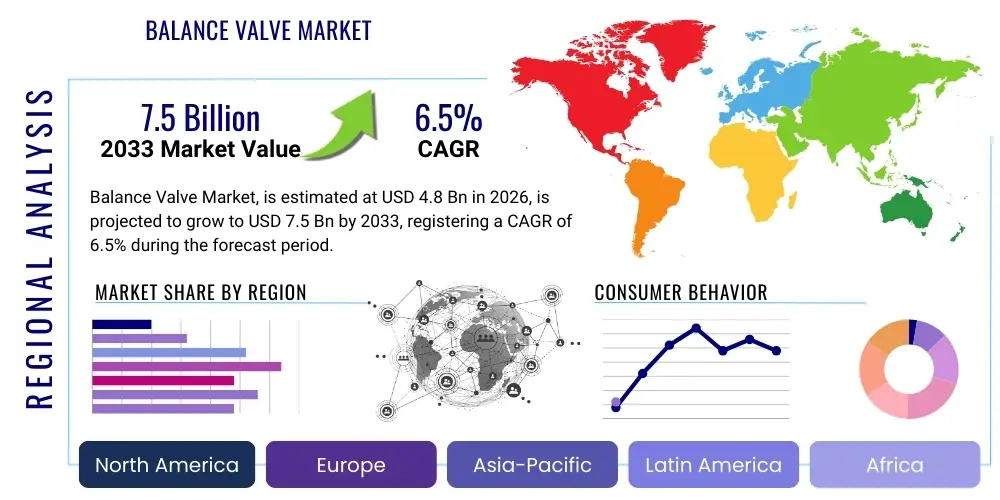

Balance Valve Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439112 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Balance Valve Market Size

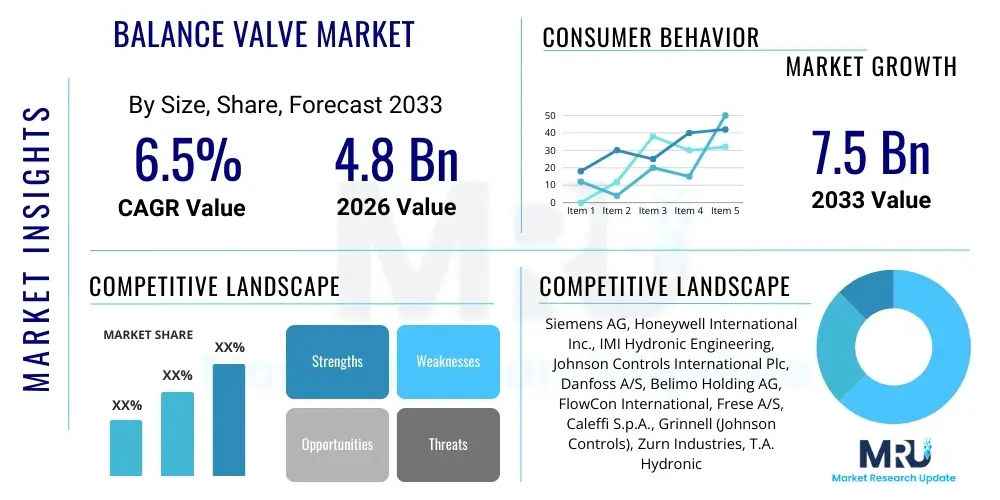

The Balance Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating global focus on energy conservation, optimizing the performance of Heating, Ventilation, and Air Conditioning (HVAC) systems in commercial and residential infrastructure, and the mandatory implementation of stringent building efficiency codes across developed and rapidly developing economies. The adoption of advanced valve technologies, particularly Pressure Independent Control Valves (PICVs), is a key factor enabling precise flow management and energy savings, thereby fueling market expansion.

Balance Valve Market introduction

The Balance Valve Market encompasses specialized fluid control devices designed to ensure optimal flow distribution within closed-loop hydronic systems, primarily used for heating and cooling in buildings. These valves maintain the specified flow rate through circuits regardless of pressure fluctuations, which is critical for maximizing the efficiency and performance of terminal units like chillers, boilers, heat exchangers, and fan coil units. Products range from basic manual balancing valves to sophisticated automatic balancing valves, including differential pressure control valves (DPCVs) and the highly efficient Pressure Independent Control Valves (PICVs), which integrate balancing and control functions into a single unit, providing superior hydraulic stability and reducing installation complexity. The fundamental purpose of these products is to eliminate the 'overflow' or 'underflow' of water, ensuring that every coil receives its designed flow, thereby preventing energy wastage and occupant discomfort.

Major applications for balancing valves are concentrated within the commercial building sector, including large office complexes, hospitals, data centers, and educational institutions, where complex HVAC networks require minute flow precision to maintain indoor climate control and operational efficiency. The rising global demand for sustainable infrastructure, coupled with technological advancements integrating these valves with Building Management Systems (BMS), is intensifying market penetration. Furthermore, the integration of smart actuators and connectivity features transforms these valves from passive flow regulators into active components of a smart building ecosystem. These intelligent valves allow for real-time monitoring, remote diagnostics, and dynamic flow adjustments based on occupancy and external temperature variations, dramatically improving system reliability and reducing lifecycle operational costs.

The primary benefit derived from the utilization of balancing valves is significant energy savings, as they prevent pump overwork and ensure that heating or cooling energy is delivered precisely where needed, avoiding the "low Delta T syndrome" often associated with poorly balanced systems. Driving factors for the market include rapid urbanization leading to extensive commercial construction, especially in Asia Pacific; governmental mandates promoting green building certifications (like LEED and BREEAM); and the increased prevalence of district heating and cooling networks that necessitate precise hydraulic balancing to operate efficiently across extensive geographical areas. The increasing replacement of older, inefficient manual valves with modern, automatic, pressure-independent variants is a persistent driver contributing to revenue growth across all key regions.

Balance Valve Market Executive Summary

The Balance Valve Market is currently characterized by a strong shift toward automation and digitalization, moving away from traditional manual balancing methods toward high-precision Pressure Independent Control Valves (PICVs) and Differential Pressure Control Valves (DPCVs). Business trends emphasize the consolidation of flow control solutions, with leading manufacturers focusing on developing integrated valve and actuator packages that offer seamless connectivity with advanced Building Management Systems (BMS) and IoT platforms. Key industry players are strategically investing in materials science to produce corrosion-resistant valves suitable for various fluid types and temperatures, thereby expanding application scope beyond traditional HVAC into process industries and utilities. The competitive landscape is defined by innovation in smart features, remote commissioning capabilities, and offering total system optimization services, positioning the market growth less on volume and more on value-added technological integration.

Regional trends indicate that the Asia Pacific (APAC) region, particularly China and India, represents the fastest-growing market, propelled by unprecedented investment in smart city projects, massive infrastructure development, and supportive government policies aimed at reducing carbon emissions from the construction sector. North America and Europe, while mature, maintain strong market demand, driven primarily by stringent regulatory environments promoting energy retrofitting in existing commercial infrastructure, coupled with the established adoption of district heating networks, particularly in Scandinavian countries and Germany. The focus in these mature markets is on replacing legacy systems with modern, highly accurate PICVs to comply with evolving energy performance directives, ensuring sustained revenue generation through replacement cycles and technological upgrades rather than solely new construction volumes.

Segmentation trends highlight the dominance of the Automatic Balancing Valve segment, specifically PICVs, due to their superior performance in maintaining stable differential pressure and flow rates, simplifying commissioning, and reducing total system energy consumption compared to their manual counterparts. The Commercial Application segment remains the largest end-user category, driven by the size and complexity of commercial HVAC systems, which benefit most significantly from precise flow control in terms of cost savings and improved comfort indices. Furthermore, there is an increasing demand for specialized balance valves crafted from robust materials like stainless steel and specialized alloys, necessitated by challenging operating environments such as high-rise buildings requiring higher pressure ratings, or industrial processes involving corrosive fluids, showcasing a premium segment growth trend.

AI Impact Analysis on Balance Valve Market

Common user questions regarding AI's influence on the Balance Valve Market center around how artificial intelligence can move balancing from a static, commissioning process to a dynamic, continuous optimization activity. Users are concerned with the practical integration of predictive maintenance capabilities—specifically, whether AI can accurately forecast valve failure or drift from optimal settings based on historical sensor data, reducing unexpected downtime. There is significant interest in AI-driven commissioning, automating the complex flow calculation and adjustment procedures that traditionally require skilled technicians, thereby improving speed and accuracy. Additionally, users seek understanding of how AI algorithms, integrated with Building Management Systems (BMS), can dynamically adjust valve settings in real-time in response to load fluctuations, weather data, and occupancy patterns, ensuring peak energy efficiency (AEO focus: Dynamic flow optimization, predictive failure, automated commissioning).

The introduction of AI significantly enhances the utility of smart balancing valves by processing the vast amounts of pressure, temperature, and flow data collected by integrated IoT sensors. AI algorithms analyze these operational datasets to identify inefficiencies, such as minor pressure drops or flow anomalies that indicate fouling, leakage, or potential actuator failure, long before they escalate into major system faults. This shift from reactive maintenance to AI-driven predictive maintenance allows facility managers to optimize maintenance schedules, significantly reducing operational expenditure and extending the lifespan of the entire hydronic system. Consequently, the value proposition of connected balancing valves increases dramatically, encouraging faster adoption in large-scale commercial deployments.

Furthermore, AI facilitates advanced system-level optimization by dynamically controlling the setpoints of hundreds of balancing and control valves simultaneously based on a holistic view of the building's energy consumption and comfort requirements. For instance, in a large office building, AI can correlate external weather forecasts and scheduled occupancy data to modulate flow rates across different zones. This level of granular, non-linear control surpasses traditional static programming, leading to measurable reductions in pump energy usage and improved thermal comfort consistency, thus establishing AI as a core technology enabling next-generation high-efficiency HVAC solutions.

- AI algorithms enable predictive maintenance by analyzing sensor data for anomalies indicating valve wear or drift.

- Machine learning facilitates dynamic balancing, optimizing flow rates in real-time based on varying load conditions and occupancy.

- AI integration standardizes and accelerates commissioning processes through automated calibration and diagnostics.

- Enhanced energy modeling and system simulation capabilities improve the prescriptive control outputs for smart actuators.

- AI integration supports self-healing systems where valves autonomously adjust to minor pressure shocks or pump failures.

DRO & Impact Forces Of Balance Valve Market

The Balance Valve Market is propelled by strong Drivers rooted in global energy efficiency mandates and the persistent need to reduce operational costs associated with HVAC systems, where balancing valves are instrumental in achieving required hydraulic stability and pump efficiency. Conversely, Restraints include the relatively high initial capital expenditure required for sophisticated Pressure Independent Control Valves (PICVs) compared to simple manual valves, alongside the complexity of integrating advanced digital valves into legacy Building Management Systems (BMS). Significant Opportunities lie in the massive retrofit market across aging infrastructure in North America and Europe, alongside the development of smart cities globally that demand fully integrated, energy-efficient flow control solutions. The key Impact Forces driving the market include regulatory enforcement of high-efficiency building codes and the increasing market dominance of digital, connected valve technology, which offers superior lifecycle cost benefits despite higher upfront investment.

Drivers are primarily centered on regulatory pressures, such as the European Union's Energy Performance of Buildings Directive (EPBD) and similar standards in the US, which necessitate verifiable and optimized flow control systems. The quantifiable energy savings achieved through proper balancing—often leading to a significant reduction in pump energy consumption—provides a powerful economic incentive for end-users, especially in large commercial and institutional settings where HVAC costs constitute a major operational expense. Furthermore, the push toward occupant comfort and the minimization of complaints about uneven heating or cooling also acts as a psychological driver, favoring high-precision automatic balancing solutions that ensure stable thermal environments.

However, the market faces significant Restraints related to market education and initial investment perception. While PICVs offer long-term savings, their higher initial price tag can deter budget-constrained developers or facility managers opting for simpler, less effective manual balancing options. The complexity involved in specifying and commissioning advanced control valves, often requiring specialized skills that may be scarce in certain geographies, also slows adoption. Opportunities, conversely, are abundant, particularly in the retrofit market where replacing older, inefficient manual valves with automatic alternatives yields immediate and substantial energy returns. The rapid expansion of district cooling and heating networks in urban centers worldwide creates dedicated, large-scale demand for high-capacity, robust balancing and differential pressure control technology.

Segmentation Analysis

The Balance Valve Market is meticulously segmented based on Type, Application, Material, and Distribution Channel, reflecting the diverse requirements of the global hydronic systems market. The Type segmentation is crucial, differentiating between Manual Balancing Valves (requiring physical adjustment), Automatic Balancing Valves (self-regulating differential pressure or flow), and highly sophisticated Pressure Independent Control Valves (PICVs) which combine balancing and modulating control functions. This segmentation clearly illustrates the industry's trend toward automation and precision, with PICVs rapidly gaining market share due to their superior performance characteristics and simplified commissioning process, particularly in variable volume systems where pressure conditions fluctuate significantly. Understanding these technological divisions is essential for manufacturers and procurement specialists aiming to optimize system performance and capital outlay.

Application analysis highlights that commercial buildings, encompassing offices, hotels, and retail spaces, represent the largest and most valuable segment, driven by the massive scale and complexity of their HVAC infrastructure and stringent requirements for energy reporting and indoor air quality. However, the residential sector is emerging as a strong growth segment, primarily due to the increasing adoption of multi-family dwellings and centralized apartment heating/cooling systems, especially in densely populated urban centers. Material segmentation, covering Ductile Iron, Bronze, Stainless Steel, and Brass, reflects the necessary balance between cost, durability, and corrosion resistance, with specialized materials like stainless steel seeing increased use in high-purity or chemically aggressive industrial applications.

Geographically, the market is broadly segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with APAC projected to exhibit the fastest growth owing to significant investment in new construction and infrastructure modernization. The segmentation based on Distribution Channel (OEMs, Aftermarket, Distributors) helps map the competitive landscape and supply chain dynamics, illustrating the critical role of specialized HVAC distributors and system integrators who provide the necessary technical expertise for complex installations and ongoing maintenance. These distinct segments reveal that market strategies must address the varied needs of high-volume, low-margin residential applications versus high-specification, critical infrastructure commercial projects.

- By Type:

- Manual Balancing Valves

- Automatic Balancing Valves

- Pressure Independent Control Valves (PICV)

- Differential Pressure Control Valves (DPCV)

- Automatic Flow Limiters (AFL)

- By Application:

- Commercial Buildings (Office, Retail, Healthcare, Hospitality)

- Residential Buildings (Multi-Family, Single-Family)

- Industrial Facilities (Manufacturing, Process Plants)

- District Heating and Cooling Networks (DHC)

- By Material:

- Brass

- Bronze

- Ductile Iron

- Stainless Steel and Specialty Alloys

- By Distribution Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket Sales and Replacement

- Wholesalers and Distributors

Value Chain Analysis For Balance Valve Market

The Value Chain for the Balance Valve Market begins with the Upstream Analysis, which focuses heavily on the procurement of raw materials, primarily specialized metals such as brass, bronze, ductile iron, and stainless steel. The quality and price volatility of these metals significantly impact manufacturing costs. Key upstream activities involve precision casting, forging, and sourcing of specialized components like seals, springs, and high-precision electronic actuators for smart valves. Relationship management with specialized metal suppliers and foundry operations is crucial for ensuring material quality, compliance with international standards (e.g., lead-free requirements), and maintaining resilience against supply chain disruptions, especially for rare earth metals utilized in advanced actuator magnets.

The midstream stage involves the core manufacturing processes, including CNC machining, assembly, quality control testing, and integration of electronic components for smart valves. Differentiation in the midstream primarily occurs through technological innovation, specifically the engineering prowess required to manufacture highly precise PICV cartridges and robust, durable valve bodies capable of handling high pressure and temperature differentials. Post-production, the Distribution Channel plays a critical role. Direct sales to Original Equipment Manufacturers (OEMs) of HVAC systems constitute a substantial portion, providing valves pre-installed in chillers or AHUs. However, the most vital channel for replacement and retrofitting is the network of specialized Wholesalers, Distributors, and certified System Integrators who provide essential installation and technical support services to the end-user.

Downstream analysis centers on installation, commissioning, and aftermarket services. Commissioning, particularly for complex automatic balancing systems, requires specialized engineering software and skilled technicians to ensure system design specifications are met. Direct customer engagement occurs through Facility Management teams, consulting engineers, and mechanical contractors, who are the final decision-makers regarding product selection and installation quality. The aftermarket segment, driven by replacement and maintenance cycles, is highly profitable and necessitates a robust supply of spare parts and skilled service personnel. The increasing adoption of IoT-enabled valves is shifting the value proposition toward ongoing data analysis and predictive maintenance services, creating new revenue streams in the downstream portion of the chain.

Balance Valve Market Potential Customers

The primary End-Users and Buyers of balancing valves are organizations and professionals involved in the design, construction, operation, and maintenance of large-scale commercial and institutional hydronic systems, driven by the critical need for hydraulic efficiency and energy cost control. This group includes Mechanical, Electrical, and Plumbing (MEP) Consulting Engineers, who specify the valve types during the design phase based on project requirements, ensuring compliance with energy codes and design performance metrics. Commercial Real Estate Developers and General Contractors purchase these valves in bulk for new construction projects, prioritizing cost-effectiveness, reliability, and ease of installation and commissioning, making them key volume purchasers in the market.

A second crucial customer segment comprises HVAC System Integrators and specialized Mechanical Contractors. These entities purchase valves from distributors or directly from OEMs, and their expertise is pivotal in the successful installation and precise commissioning of complex automatic balancing systems. Their purchasing decisions are heavily influenced by product quality, supplier support, and the speed and simplicity of the commissioning process, favoring products like PICVs that reduce labor time and eliminate callbacks due to balancing issues. The relationship with these installers is critical as they often determine the brand preference at the point of implementation, even if the consultant specified a generic requirement.

Finally, Facility Managers (FMs) and Property Management Firms represent the core aftermarket demand and are key drivers for high-performance, digitally connected valves. FMs are responsible for the ongoing operational efficiency and maintenance of existing building stock. Their purchasing criteria focus on durability, minimizing energy consumption (OpEx reduction), and the capability for remote monitoring and diagnostics offered by smart valves. For district heating and cooling operations, the end-user is typically a municipal utility or private energy service company, which demands extremely robust, high-pressure, and high-flow automatic balancing solutions for large-scale energy distribution networks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, Honeywell International Inc., IMI Hydronic Engineering, Johnson Controls International Plc, Danfoss A/S, Belimo Holding AG, FlowCon International, Frese A/S, Caleffi S.p.A., Grinnell (Johnson Controls), Zurn Industries, T.A. Hydronics, Vexve Oy, AVK Holding A/S, Oventrop GmbH & Co. KG, Bray International, GF Piping Systems, NIBCO Inc., KSB SE & Co. KGaA, Armstrong Fluid Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Balance Valve Market Key Technology Landscape

The contemporary Balance Valve Market technology landscape is predominantly defined by the evolution of Pressure Independent Control Valves (PICVs), which represent a fundamental technological shift from traditional differential pressure management to flow rate control independent of pressure fluctuations. PICVs integrate a flow control valve and an automatic balancing valve into a single, compact body. The core technology involves a dynamic differential pressure regulator mechanism, often a specialized membrane or cartridge, which ensures that the pressure drop across the modulating control element remains constant. This constant pressure drop guarantees that the flow rate is determined solely by the actuator position, leading to accurate flow delivery under all load conditions, significantly enhancing the energy efficiency and stability of variable flow systems and simplifying the often time-consuming commissioning process required for manual systems.

Beyond the core PICV mechanism, the market is rapidly embracing digitization and connectivity through the integration of sophisticated electronic actuators and Internet of Things (IoT) capabilities. Modern balancing valves are increasingly equipped with smart actuators that feature embedded microprocessors for precise positioning, self-calibration, and communication protocols (such as BACnet or Modbus) necessary for integration with advanced Building Management Systems (BMS). This connectivity enables real-time performance monitoring, remote diagnostics, and dynamic setpoint adjustments based on external and internal environmental conditions. The data generated by these smart valves regarding flow, temperature, and actuator position is crucial for optimizing system-wide performance and implementing predictive maintenance strategies powered by cloud-based analytics platforms.

Further technological advancements focus on actuator motor technology and communication reliability. The move towards highly efficient, brushless DC motors in actuators provides precise control, lower power consumption, and extended operational lifecycles. Furthermore, the development of specialized materials, such as robust polymer compounds and specialized alloys, is crucial for improving valve longevity and ensuring chemical compatibility in non-traditional applications like high-purity water or corrosive industrial fluids, broadening the addressable market beyond conventional HVAC applications. The standardization of commissioning tools, often utilizing mobile applications to facilitate wireless configuration and data logging, also represents a critical technological component improving ease of deployment and reducing installation costs.

Regional Highlights

The global Balance Valve Market exhibits varied growth trajectories across major geographical regions, influenced by regional construction cycles, energy regulations, and the maturity of HVAC and district energy infrastructure. North America, characterized by stringent energy codes (such as ASHRAE standards) and a high adoption rate of advanced control systems in commercial real estate, represents a mature market focused on replacement and technological upgrades. The high energy costs and strong regulatory emphasis on quantifiable building performance drive continuous demand for high-precision PICVs and smart, connected valve solutions, particularly in large metropolitan areas requiring complex zoning and sophisticated thermal management systems.

Europe holds a commanding position, largely due to its established and expanding District Heating and Cooling (DHC) networks, particularly across Northern and Central European nations. DHC systems inherently require robust Differential Pressure Control Valves (DPCVs) and high-quality automatic balancing solutions to manage pressure fluctuations across vast, interconnected piping networks. Moreover, European Union directives pushing for Nearly Zero-Energy Buildings (NZEB) and aggressive energy efficiency targets necessitate the mandatory use of automatic balancing technology in new construction and major renovations, providing consistent, policy-driven demand across the continent.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This exponential growth is underpinned by massive urbanization, unprecedented levels of infrastructure development (e.g., airports, hospitals, high-rise residential complexes), and emerging smart city initiatives in countries like China, India, and Southeast Asia. While cost-sensitive, the rapid adoption of modern HVAC standards in large commercial projects, often influenced by international design firms, drives significant procurement of automatic and Pressure Independent Control Valves, quickly shifting the market away from older manual systems. The sheer volume of new construction projects guarantees substantial long-term market expansion in this region, making it the primary target for global manufacturers.

- North America: Strong focus on high-efficiency retrofits, stringent ASHRAE standards, and high adoption of smart, IoT-enabled balancing solutions in commercial and institutional buildings.

- Europe: Driven by mature and expanding District Heating and Cooling (DHC) networks and strict EU energy performance regulations (NZEB, EPBD), favoring PICVs and DPCVs for hydraulic stability.

- Asia Pacific (APAC): Highest growth trajectory, fueled by rapid urbanization, massive commercial and residential construction booms, and increasing awareness of the benefits of hydraulic balancing in new smart cities projects.

- Latin America: Emerging market with increasing adoption spurred by foreign investment in infrastructure and a gradual transition toward modern building energy efficiency standards, focusing on cost-effective, reliable valve technology.

- Middle East and Africa (MEA): Growth driven by mega-projects (e.g., Gulf States), requiring large, high-pressure balancing valves for district cooling systems essential in extreme climatic conditions, prioritizing robust and durable materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Balance Valve Market.- Siemens AG

- Honeywell International Inc.

- IMI Hydronic Engineering

- Johnson Controls International Plc

- Danfoss A/S

- Belimo Holding AG

- FlowCon International

- Frese A/S

- Caleffi S.p.A.

- Grinnell (Johnson Controls)

- Zurn Industries

- T.A. Hydronics

- Vexve Oy

- AVK Holding A/S

- Oventrop GmbH & Co. KG

- Bray International

- GF Piping Systems

- NIBCO Inc.

- KSB SE & Co. KGaA

- Armstrong Fluid Technology

Frequently Asked Questions

Analyze common user questions about the Balance Valve market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Balance Valve in an HVAC system?

The primary function of a balance valve is to regulate and maintain the specified flow rate of fluid (water) through each circuit in a hydronic system, regardless of pressure fluctuations. This ensures that all terminal units (like fan coils or radiators) receive the correct amount of heating or cooling medium, optimizing system efficiency and occupant comfort.

What is the key difference between Manual and Automatic Balancing Valves?

Manual valves require physical adjustment and re-commissioning whenever system parameters change, offering static balancing. Automatic valves, particularly Pressure Independent Control Valves (PICVs), dynamically adjust flow rates to remain constant despite pressure changes elsewhere in the system, providing superior stability and significant energy savings without manual intervention.

Why are Pressure Independent Control Valves (PICVs) dominating market growth?

PICVs are dominating because they combine the functions of balancing and control into a single unit, simplifying system design and dramatically reducing commissioning time and complexity. They ensure hydraulic stability, prevent pump overwork, and are highly compatible with variable flow systems, leading to substantial energy cost reductions over the system’s operational lifespan.

How does the integration of IoT and AI affect the Balance Valve Market?

IoT integration allows balancing valves to communicate performance data (flow, pressure, temperature) to Building Management Systems (BMS) in real-time. AI uses this data for predictive maintenance, anticipating potential failures, and enabling dynamic, continuous flow optimization, shifting balancing from a static process to an adaptive, energy-saving operational strategy.

Which geographical region shows the highest growth potential for Balance Valve adoption?

The Asia Pacific (APAC) region, driven by rapid urbanization, significant investment in commercial and residential construction, and the push for modern, high-efficiency infrastructure in countries like China and India, exhibits the highest growth potential for the adoption of automatic balancing valve technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager