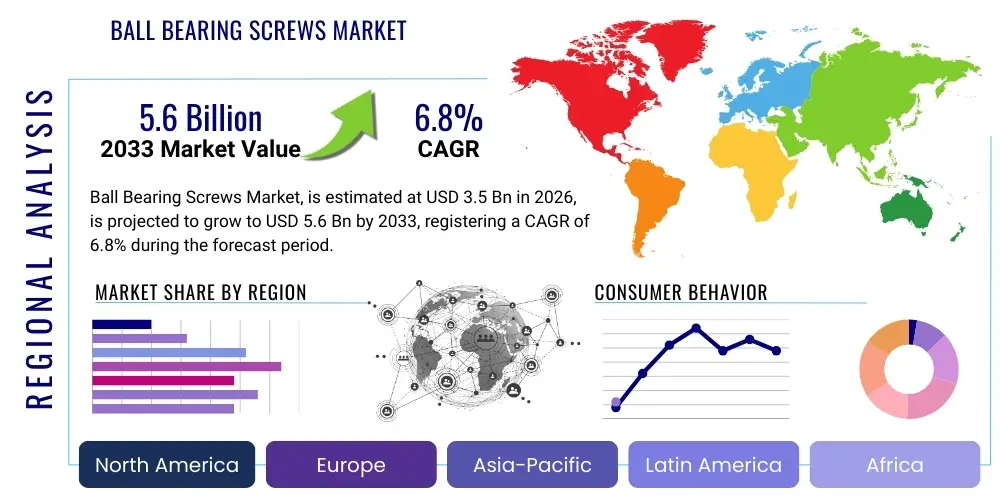

Ball Bearing Screws Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439022 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Ball Bearing Screws Market Size

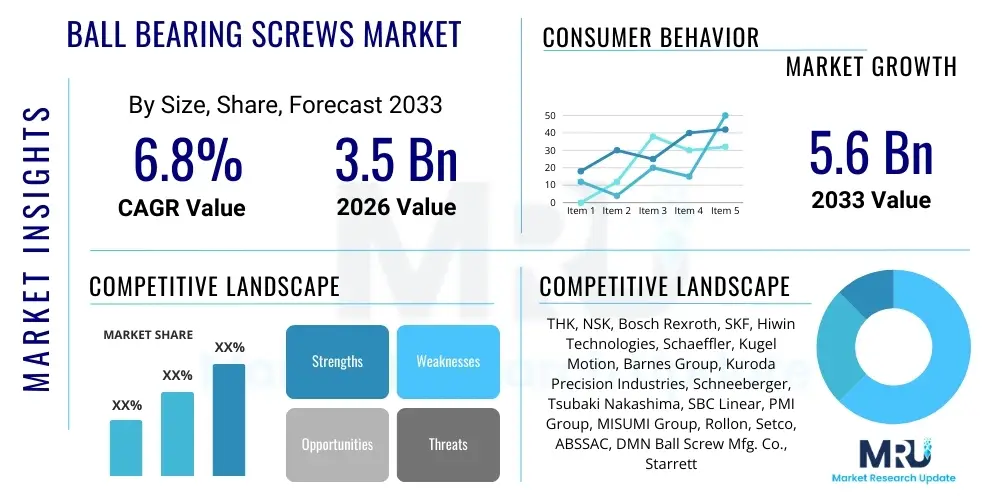

The Ball Bearing Screws Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating global demand for high-precision linear motion systems, primarily across advanced manufacturing sectors such as robotics, CNC machining, and semiconductor fabrication. The increasing complexity and speed requirements in automated processes necessitate reliable, efficient, and highly accurate mechanical components, positioning ball bearing screws as critical enablers of modern industrial productivity and quality control.

Ball Bearing Screws Market introduction

The Ball Bearing Screws Market encompasses the global production and distribution of mechanical linear actuators that translate rotational motion into linear motion with minimal friction. These screws, often referred to simply as ball screws, utilize ball bearings as a rolling interface between the screw shaft and the nut, thereby achieving efficiencies typically exceeding 90%. This superior efficiency, combined with high precision, high load capacity, and long service life, makes ball bearing screws indispensable components in sophisticated machinery across various industries. The core functionality relies on the precise recirculation of the ball bearings within the helical raceways, ensuring smooth, accurate movement required for delicate positioning tasks and heavy-duty industrial applications.

Major applications of ball bearing screws span sectors requiring stringent positional accuracy and robust performance. These include high-end machine tools (such as milling machines and lathes), industrial robotics for pick-and-place and welding operations, sophisticated medical equipment (like CT scanners and surgical robots), and demanding aerospace systems (including flight control surfaces and landing gear actuation). The benefit profile of these components is centered on energy savings due to reduced friction, exceptional repeatability, and minimal backlash, which directly translates to improved product quality and reduced operational costs for end-users. Their ability to handle high thrust loads while maintaining precise movement is a key differentiating factor against traditional lead screws.

Key driving factors accelerating market growth include the pervasive trend towards industrial automation, particularly Industry 4.0 initiatives globally, which prioritize integrated, precise, and fast manufacturing processes. Furthermore, the rapid expansion of the electric vehicle (EV) manufacturing infrastructure, which relies heavily on automated assembly lines and specialized tooling, creates substantial demand. The increasing reliance on complex, multi-axis motion systems in emerging fields like additive manufacturing (3D printing) and specialized handling equipment for large-scale logistics also contributes significantly to market expansion, ensuring sustained growth throughout the forecast period.

Ball Bearing Screws Market Executive Summary

The Ball Bearing Screws Market is characterized by robust growth, fueled predominantly by technological advancements in precision engineering and the continuous adoption of automation technologies across developed and emerging economies. Business trends highlight a strong focus on miniaturization for applications in micro-robotics and compact medical devices, alongside the development of high-load, high-speed screws optimized for heavy industry and advanced machine tools. Strategic partnerships between raw material suppliers, specialized manufacturers, and system integrators are becoming crucial for providing customized linear motion solutions, moving away from purely standardized product offerings toward application-specific engineering. Manufacturers are also heavily investing in advanced materials and surface treatment technologies to enhance wear resistance and extend service intervals, addressing the industry's demand for zero-maintenance components.

Regionally, the Asia Pacific (APAC) continues to dominate the market, driven by massive investments in manufacturing capabilities, particularly in China, Japan, South Korea, and Taiwan, which are global hubs for automotive, electronics, and semiconductor production. North America and Europe demonstrate mature market characteristics, with growth focused on replacement demand, modernization of legacy industrial infrastructure, and high-value applications in aerospace and medical technology where stringent certification standards apply. Regional trends also show increasing adoption of domestically sourced, high-quality ball screws in Europe due to geopolitical supply chain shifts, while APAC benefits from the scale of mass production and competitive pricing structures.

Segment trends reveal that the Rolled Ball Screws segment holds a dominant share due to cost-effectiveness and suitability for general industrial automation where ultra-high precision is not paramount, such as material handling. However, the Ground Ball Screws segment is experiencing faster growth, driven by the escalating requirements for sub-micron precision in high-end applications like ultra-precision machining centers and optical measurement devices. In terms of application, the Automation & Robotics segment is the primary growth driver, reflecting the global imperative to enhance productivity and reduce labor dependency through advanced automated systems. Furthermore, the market sees significant differentiation based on diameter, with small-diameter screws increasingly preferred in semiconductor and medical fields, emphasizing precision and compactness.

AI Impact Analysis on Ball Bearing Screws Market

User queries regarding the impact of Artificial Intelligence (AI) on the Ball Bearing Screws market frequently revolve around predictive maintenance capabilities, optimization of manufacturing processes, and the role of AI in driving demand for ultra-precise motion systems. Users are concerned with how AI-driven machine learning algorithms can minimize downtime, improve the longevity of critical components like ball screws, and identify potential failures before they occur. The key themes summarized from user expectations involve AI's capacity to integrate sensor data (vibration, temperature, current load) collected from motion systems to build accurate degradation models, thereby shifting maintenance strategies from time-based or reactive to condition-based and proactive. There is also a strong interest in AI-optimized design processes, enabling faster iteration and superior performance characteristics for new ball screw generations.

AI’s influence extends directly into the performance and operational lifespan of ball bearing screws through advanced monitoring systems. By employing AI algorithms to analyze real-time data streams from integrated sensors—monitoring parameters such as acoustic emissions, temperature fluctuations in the nut, and motor current draw—manufacturers and end-users can gain profound insights into the screw's operational health. This data-driven approach allows for the early detection of subtle signs of wear, lubrication breakdown, or misalignment, which are precursors to catastrophic failure. Consequently, the mean time between failures (MTBF) is extended, and maintenance schedules are optimized precisely when needed, dramatically reducing overall operating expenses and improving machine uptime, which is vital in high-throughput production environments.

Furthermore, AI-driven process optimization is transforming the manufacturing of the ball screws themselves. Machine learning models are being utilized to fine-tune complex manufacturing processes like thread grinding and surface finishing, ensuring tighter tolerances and higher consistency than achievable through conventional statistical process control methods. By analyzing manufacturing data, AI can dynamically adjust machine settings to compensate for factors such as tool wear or thermal drift, leading to the production of superior quality components with exceptional positional accuracy and reduced friction coefficients. This push for manufacturing excellence, spurred by AI, directly supports the demand for ball screws capable of meeting the stringent requirements of new-generation CNC machines and advanced wafer processing equipment.

- AI enables predictive maintenance systems through real-time sensor data analysis (vibration, thermal signatures).

- Optimizes lubrication management, extending the useful life of the ball screw assembly.

- Drives demand for smart ball screws equipped with integrated IoT sensors and connectivity.

- Facilitates advanced process control in manufacturing, achieving tighter geometric tolerances (Ground Ball Screws).

- Enhances design optimization by simulating performance under various loads and environmental conditions using machine learning.

- Supports complex motion control in collaborative robots and autonomous mobile robots (AMRs), increasing system precision requirements.

- Improves inventory management and supply chain resilience by predicting component replacement needs accurately.

DRO & Impact Forces Of Ball Bearing Screws Market

The Ball Bearing Screws market is strategically influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). The paramount driver is the relentless global pursuit of industrial automation and the resultant proliferation of robotics and computer numerical control (CNC) machinery across all manufacturing tiers. Restraints primarily involve the high initial cost associated with manufacturing high-precision ground ball screws and the susceptibility of standard ball screws to contamination, necessitating stringent sealing and maintenance regimes. Opportunities emerge from key technological shifts, notably the accelerating market penetration of electric vehicles (EVs), which require precision manufacturing equipment, and the rise of advanced additive manufacturing (3D printing) platforms that rely on accurate linear motion for layered material deposition.

Impact forces on the market are multifaceted, stemming from both microeconomic demands and macroeconomic policy shifts. Demand-side forces are strongly positive, driven by the global capital expenditure on factory modernization and the necessity for higher throughput and quality in end-user industries like aerospace and medical devices. Supply-side pressures are dominated by the volatility in raw material costs, particularly high-grade steel alloys required for durability, and the scarcity of skilled technicians capable of maintaining and integrating complex linear motion systems. Furthermore, regulatory forces, such as increasing energy efficiency standards for industrial machinery, favor the high-efficiency design of ball screws over less efficient alternatives, reinforcing market penetration.

The critical impact forces can be categorized into technological innovation, competitive intensity, and environmental compliance. Continuous technological advancement, particularly in materials science (e.g., ceramics, specialized coatings) and manufacturing techniques (e.g., precision rolling), constantly reshapes competitive dynamics. High competitive intensity among key global players (e.g., THK, NSK, Bosch Rexroth) drives price optimization and fosters rapid product diversification. Lastly, environmental sustainability pushes manufacturers towards developing lighter, more durable, and energy-saving screws, aligning with global efforts to reduce the carbon footprint of industrial operations, creating both compliance challenges and significant innovation opportunities.

- Drivers: Intensifying industrial automation and robotics adoption; increasing demand for high-precision CNC machine tools; growth in semiconductor manufacturing equipment (wafer handling).

- Restraints: High initial investment and manufacturing complexity for ground screws; susceptibility to contamination and requirement for meticulous lubrication; challenges related to noise and vibration in high-speed applications.

- Opportunities: Expansion of the Electric Vehicle (EV) manufacturing sector; application growth in advanced medical devices and surgical robotics; integration into large-format 3D printing and advanced logistics systems (e.g., automated storage and retrieval systems - AS/RS).

- Impact Forces: Technological breakthroughs in materials (wear resistance); stringent quality and precision standards (ISO, DIN); geopolitical stability affecting global supply chains for specialized steel.

Segmentation Analysis

The Ball Bearing Screws market is segmented based on several key factors, including the manufacturing process (Type), physical dimensions (Diameter), and primary end-use application. Understanding these segments is crucial for strategic market entry and product development, as requirements vary dramatically between, for example, high-volume automotive production and low-volume, ultra-precision aerospace manufacturing. The segmentation reflects the diverse needs of the industrial landscape, ranging from cost-effective solutions for general automation to highly engineered components for critical, high-load, or high-speed environments. The dominant market segmentation distinguishes between screws produced through precision rolling, which balances performance and cost, and those produced by precision grinding, which offers the highest possible accuracy and stiffness.

The market segmentation by Type—Ground Ball Screws versus Rolled Ball Screws—highlights a crucial trade-off. Ground ball screws command a significant premium due to the intricate post-machining processes required to achieve micron-level accuracy and minimal backlash, making them essential for high-end applications like optical equipment and specialized jig boring machines. Conversely, rolled ball screws offer significant cost advantages and sufficient accuracy for most general industrial applications, including factory automation, material handling, and standard machine tools. The proliferation of affordable automation solutions is bolstering the Rolled segment's volume dominance, while the Ground segment maintains leadership in value due to its indispensable role in enabling cutting-edge manufacturing processes.

Segmentation by Application is perhaps the most dynamic area, with the rapid ascent of the Robotics and Automation sector driving innovation. While traditional applications like Machine Tools remain foundational, newer segments like Medical and Semiconductor are demanding increasingly specialized ball screw designs characterized by non-magnetic materials, vacuum compatibility, or exceptionally quiet operation. The trend toward customized, application-specific solutions underscores the necessity for manufacturers to offer broad portfolios covering different diameter ranges, lead accuracy classes, and environmental protection features, thereby maximizing market penetration across diverse industrial ecosystems globally.

- By Type:

- Ground Ball Screws (High precision, low friction, minimal backlash)

- Rolled Ball Screws (Cost-effective, standard precision, high volume applications)

- By Diameter:

- Small Diameter (Under 20 mm, used in medical, semiconductor, and compact robotics)

- Medium Diameter (20 mm to 50 mm, used in general CNC and industrial machinery)

- Large Diameter (Above 50 mm, used in heavy machinery, injection molding, and large press brakes)

- By Application:

- Machine Tools (Milling, Lathes, Grinding)

- Automation & Robotics (Assembly, Pick-and-Place, Automated Guided Vehicles - AGVs)

- Aerospace & Defense (Actuators, Control Surfaces)

- Medical Equipment (Scanners, Diagnostic Imaging, Surgical Robots)

- Semiconductor Manufacturing Equipment (Wafer Processing, Inspection)

- Others (3D Printing, Material Handling, Logistics Systems)

Value Chain Analysis For Ball Bearing Screws Market

The value chain for the Ball Bearing Screws Market begins intensely in the upstream segment with the procurement and processing of specialized raw materials, primarily high-grade, high-carbon chromium bearing steel (e.g., AISI 52100 or equivalent). This stage involves steel production, forging, and specialized heat treatment to achieve the necessary hardness and durability for the raceways. Supplier relationships at this stage are critical, as the purity, consistency, and structural integrity of the steel directly dictate the ultimate performance and longevity of the finished ball screw assembly. High precision in raw material preparation is crucial, especially for ground screws, impacting subsequent manufacturing costs and lead times. The upstream phase also includes sourcing complementary components like high-tolerance ball bearings, seal kits, and specific lubrication systems.

The midstream component, which constitutes the core manufacturing process, involves precision machining, including thread cutting, rolling, or grinding of the screw shaft and the corresponding nut. The distinction between rolling and grinding dictates the precision tier of the final product. Rolling processes involve lower cost and higher volume, while grinding requires sophisticated, climate-controlled environments and specialized grinding machines to achieve geometric perfection. Subsequent processes include rigorous quality control, heat treatment, surface finishing (such as chrome plating or black oxide treatment), and the precise assembly of the screw, nut, and ball recirculation mechanism. The ability to integrate proprietary recirculation designs and specialized sealing technologies is a key value-add at this stage, differentiating premium manufacturers.

The downstream segment focuses on distribution channels and end-user engagement. Ball bearing screws are primarily distributed through a mix of direct sales channels, especially for large OEMs (Original Equipment Manufacturers) requiring customized specifications, and indirect channels comprising authorized regional distributors, specialized industrial supply houses, and global e-commerce platforms focused on machine components. Distributors play a vital role in providing local inventory, technical support, and rapid delivery, which are critical factors in minimizing machine downtime for end-users. After-sales support, including installation assistance, maintenance training, and repair services, completes the downstream value proposition, ensuring optimal system performance and customer loyalty, especially in mission-critical applications like aerospace and high-speed rail systems.

Ball Bearing Screws Market Potential Customers

The primary customers for ball bearing screws are large industrial manufacturers and equipment builders (OEMs) who require highly accurate linear motion components for their end products. These customers include global manufacturers of CNC machine tools such as milling centers, lathes, and grinding machines, where the ball screw’s accuracy determines the precision of the final machined part. The robust demand also originates from the rapidly expanding robotics and automation sector, covering industrial articulated robots, pick-and-place systems, gantry robots, and automated guided vehicles (AGVs), which rely on ball screws for swift and repeatable positioning tasks in assembly lines and warehouses.

Beyond traditional heavy industry, significant customer segments include the aerospace and defense sectors, where specialized, often highly customized ball screws are utilized in critical flight control systems, thrust vectoring, and landing gear mechanisms, demanding adherence to the highest reliability and material standards. Similarly, the medical device industry represents a high-growth customer base, utilizing small-diameter, high-precision screws in diagnostic equipment (MRI, CT scanners), laboratory automation devices, and advanced surgical robotic systems where ultra-smooth, noise-free, and repeatable movement is paramount for patient safety and diagnostic accuracy. These customers prioritize quality and certification over cost, driving demand for premium ground ball screw products.

A burgeoning potential customer base lies within the high-technology and emerging manufacturing sectors, including semiconductor fabrication plants (fabs) and large-format 3D printing equipment manufacturers. Semiconductor production requires motion systems capable of navigating sub-micron distances for wafer handling and inspection, necessitating specialized, vacuum-compatible ball screws. Furthermore, the burgeoning demand for large, industrial-grade additive manufacturing machines, which utilize ball screws for Z-axis control and extruder positioning across extensive build volumes, highlights a significant future opportunity. These diverse customer needs underscore the market's resilience, as demand is spread across cyclical and non-cyclical industrial segments, mitigating risk for manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | THK, NSK, Bosch Rexroth, SKF, Hiwin Technologies, Schaeffler, Kugel Motion, Barnes Group, Kuroda Precision Industries, Schneeberger, Tsubaki Nakashima, SBC Linear, PMI Group, MISUMI Group, Rollon, Setco, ABSSAC, DMN Ball Screw Mfg. Co., Starrett, Thomson Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ball Bearing Screws Market Key Technology Landscape

The technology landscape of the Ball Bearing Screws market is continually evolving, driven by the push for higher speeds, heavier loads, and improved durability within compact footprints. A primary technological focus remains on the precision manufacturing processes themselves. Advancements in thread grinding technology, utilizing high-speed CNC grinders and ceramic grinding wheels, are achieving previously unattainable levels of accuracy (down to JIS C0 class), drastically reducing cumulative pitch errors and backlash. Simultaneously, the manufacturing of rolled ball screws has seen process refinements, such as induction hardening of screw shafts prior to rolling, improving the load capacity and fatigue life of the more cost-effective products, bridging the performance gap between rolled and ground options for many industrial applications.

Material science and surface engineering represent another critical technology frontier. Manufacturers are increasingly utilizing specialized alloy steels with enhanced wear resistance and thermal stability to cope with the high-duty cycles and frictional heat generated in high-speed applications. Crucially, the application of various protective coatings, such as Diamond-Like Carbon (DLC) or specific chemical vapor deposition (CVD) coatings, is gaining traction. These coatings minimize friction coefficients, reduce the reliance on conventional lubrication, and offer superior corrosion resistance, making the screws suitable for operation in harsh, contaminated, or food-processing environments where traditional oil lubrication is problematic or prohibited. This focus on low-friction technology directly supports energy efficiency goals for industrial machinery.

Furthermore, the integration of smart technologies is fundamentally transforming ball screw systems from passive mechanical components into intelligent subsystems. This includes embedding miniature sensors for real-time condition monitoring, tracking parameters such as temperature, vibration, and axial load variations. This data is fed into sophisticated control systems, often managed by AI, to enable predictive maintenance and optimal operation. Technological developments in the ball recirculation mechanisms are also critical, focusing on quieter operation and smoother transitions for the bearings, thereby allowing for higher operational speeds while minimizing noise and vibration, essential for medical and semiconductor applications. The move toward zero-backlash systems, often achieved through preloading mechanisms, is a standard technological requirement across all high-performance segments.

Regional Highlights

The global Ball Bearing Screws market exhibits significant regional disparities in terms of maturity, growth drivers, and application focus, necessitating tailored strategies for market penetration.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, largely due to China's dominant position as the world’s manufacturing hub and continuous investment in industrial automation, robotics, and high-speed rail. Countries like Japan and South Korea lead in technological adoption, particularly in semiconductor equipment and high-precision CNC machines, fueling demand for top-tier ground ball screws. Taiwan remains a major global supplier, providing competitive and high-quality components for both domestic and international consumption.

- North America: This region is characterized by high demand from the aerospace, defense, and medical sectors, which prioritize reliability, performance, and adherence to rigorous quality standards (e.g., ITAR compliance). Growth is driven by the modernization of legacy industrial infrastructure and robust domestic investment in electric vehicle manufacturing facilities and associated supply chains, demanding large-diameter, high-load screws for pressing and assembly operations.

- Europe: Europe represents a mature market with a strong emphasis on advanced machine tools, automotive manufacturing (high-end and specialized vehicles), and renewable energy systems. Germany, Italy, and Switzerland are key demand centers, driven by strict requirements for efficiency and precision (often driven by Industry 4.0 standards). The trend here focuses on customized, energy-efficient linear motion components and localized sourcing to ensure supply chain resilience and quality control.

- Latin America (LATAM): The market is emerging, with growth tied primarily to infrastructure development, mining, and localized automotive assembly. Demand is often focused on cost-effective, durable rolled ball screws suitable for general industrial applications and material handling equipment, with Brazil and Mexico acting as regional anchors.

- Middle East and Africa (MEA): This region is heavily influenced by large-scale capital projects in oil and gas (for specialized equipment), construction, and nascent manufacturing diversification efforts. Demand is sporadic but growing, particularly in technologically advanced hubs like the UAE and Saudi Arabia, driven by government initiatives to modernize industrial capabilities and reduce reliance on hydrocarbon revenues.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ball Bearing Screws Market.- THK Co., Ltd.

- NSK Ltd.

- Bosch Rexroth AG

- SKF AB

- Hiwin Technologies Corp.

- Schaeffler AG

- Kugel Motion Ltd.

- Barnes Group Inc.

- Kuroda Precision Industries Ltd.

- Schneeberger AG

- Tsubaki Nakashima Co., Ltd.

- SBC Linear Co., Ltd.

- PMI Group

- MISUMI Group Inc.

- Rollon S.p.A.

- Setco Sales Co.

- ABSSAC Ltd.

- DMN Ball Screw Mfg. Co.

- Starrett S.A.

- Thomson Industries, Inc.

Frequently Asked Questions

Analyze common user questions about the Ball Bearing Screws market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Ground Ball Screws and Rolled Ball Screws?

Ground Ball Screws are manufactured using precision grinding after heat treatment, offering superior positional accuracy (JIS C0 to C5 class), minimal backlash, and higher stiffness, making them ideal for high-end CNC machine tools. Rolled Ball Screws are cold-rolled, offering high production volume and cost-effectiveness with sufficient accuracy (JIS C7 to C10 class) for general industrial automation and material handling applications.

How does the adoption of Industry 4.0 technologies influence the demand for Ball Bearing Screws?

Industry 4.0 drives demand by necessitating smart, high-precision linear motion systems for automated factories. This requires ball screws to be integrated with sensors for condition monitoring and predictive maintenance (supporting IoT/AI), ensuring maximum machine uptime and superior manufacturing quality essential for complex, connected production processes.

Which industry application contributes most significantly to the growth of the Ball Bearing Screws Market?

The Automation and Robotics application segment is the largest growth driver. The global push for increased productivity and reduced manual labor across manufacturing, logistics, and assembly sectors relies heavily on industrial robots and automated motion systems, all of which use high-performance ball screws for precise, repeatable movement.

What are the key technological advancements expected in Ball Bearing Screws?

Key advancements include enhanced surface coatings (like DLC) for reduced friction and increased wear resistance, integration of miniature condition monitoring sensors (smart screws) for predictive maintenance, and the development of specialized materials for use in extreme environments (e.g., vacuum compatibility or non-magnetic properties for medical devices).

What is the current market projection (CAGR and value) for the Ball Bearing Screws Market?

The Ball Bearing Screws Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, expanding from an estimated USD 3.5 Billion in 2026 to USD 5.6 Billion by the close of the forecast period in 2033, driven by global industrial modernization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager