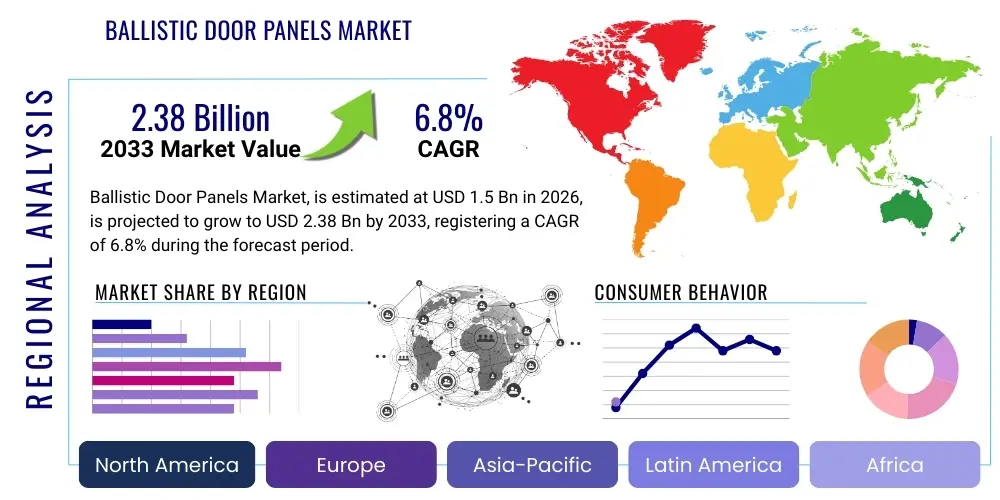

Ballistic Door Panels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439129 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Ballistic Door Panels Market Size

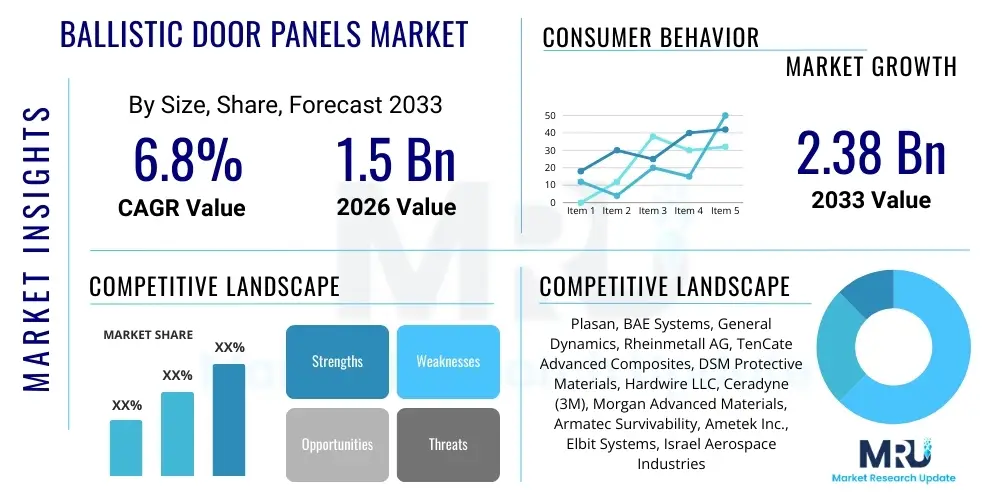

The Ballistic Door Panels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.38 Billion by the end of the forecast period in 2033.

Ballistic Door Panels Market introduction

The Ballistic Door Panels Market encompasses the design, manufacture, and deployment of specialized armor plating or composite inserts intended for integration into doors of vehicles, buildings, and critical infrastructure to enhance resistance against kinetic energy threats, fragmentation, and direct small arms fire. These panels are engineered using advanced materials such as high-strength steel alloys, ceramic composites, aramid fibers (like Kevlar), and ultra-high molecular weight polyethylene (UHMWPE) to offer protection levels specified by international standards, such as those set by the National Institute of Justice (NIJ) or STANAG.

The core product, ballistic door panels, serves a crucial role in improving occupant survivability and asset security across various high-risk environments. Major applications span military armored vehicles, executive protection fleets (VIP transport), cash-in-transit vehicles, law enforcement patrol units, and increasingly, critical infrastructure like government buildings, financial institutions, and educational facilities seeking active shooter protection. The primary benefit derived from these panels is the reliable mitigation of specific ballistic threats without significantly compromising the functional integrity or weight limits of the protected structure, ensuring mission readiness and personnel safety.

Key driving factors accelerating market expansion include escalating global geopolitical instability, rising instances of targeted violence (both civil unrest and terror threats), and the corresponding increase in defense and internal security spending by national governments. Furthermore, stringent regulatory requirements mandating higher safety standards for personnel operating in high-threat zones, coupled with technological advancements leading to lighter and more effective composite armor solutions, continue to push the adoption rate of ballistic door panels across both governmental and commercial sectors.

Ballistic Door Panels Market Executive Summary

The Ballistic Door Panels Market is characterized by robust growth, driven primarily by continuous modernization programs in defense and increasing demand for armored civilian vehicles in emerging economies. Current business trends indicate a strong shift toward lightweight, modular armor solutions, specifically utilizing advanced composite materials over traditional steel, to reduce vehicle weight and improve fuel efficiency while maintaining high levels of protection. Strategic collaborations between material science companies and defense contractors are shaping product innovation, focusing on multi-hit capability and enhanced protection against armor-piercing rounds. Furthermore, the market exhibits consolidation among key defense players who are integrating ballistic panel manufacturing capabilities vertically to control supply chain reliability and quality assurance.

Regional dynamics highlight North America and Europe as established, mature markets emphasizing technological sophistication and replacement cycles, particularly within military and VIP protection segments. Conversely, the Asia Pacific (APAC) region, led by countries like China, India, and South Korea, is experiencing rapid growth, fueled by rising internal security challenges, expansive urbanization requiring critical infrastructure protection, and significant military procurement drives. The Middle East and Africa (MEA) region remains a vital, high-demand market due to sustained regional conflicts and substantial expenditure on homeland security and critical energy infrastructure protection, positioning it as a key focus area for specialized armor providers.

Segment trends demonstrate that the Composite Materials segment (Aramid and UHMWPE) is poised for the fastest growth, largely displacing traditional steel in high-mobility applications where weight reduction is critical. In terms of protection level, panels meeting NIJ Level III and Level IV specifications dominate procurement, reflecting the prevalent threats encountered globally. The End-Use analysis reveals that Military & Defense remains the largest revenue contributor, but the Commercial & Civilian Security segment (including armored cash-in-transit, embassies, and schools) is accelerating significantly, driven by corporate risk mitigation strategies and heightened societal concerns regarding safety.

AI Impact Analysis on Ballistic Door Panels Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Ballistic Door Panels Market often center on how AI can enhance the design process, optimize material usage, and improve the speed and accuracy of threat assessment influencing panel deployment. Key themes include the use of machine learning (ML) in predictive failure analysis, optimizing material layering for specific threat profiles, and leveraging generative design algorithms to create complex, lightweight structures that maximize energy absorption. Users are concerned with the integration timeline, initial investment costs for adopting AI-driven design tools, and the capability of AI to simulate real-world ballistic events more accurately than traditional finite element analysis (FEA), potentially reducing lengthy and expensive physical testing cycles.

AI’s influence is primarily felt in the research and development (R&D) phase, offering revolutionary tools for material scientists and armor engineers. Machine learning algorithms can process vast datasets related to material stress responses, thermal resistance, and ballistic performance characteristics of various composites and alloys. This predictive modeling capability allows manufacturers to rapidly iterate design improvements, testing thousands of permutations virtually before committing to physical prototyping. This acceleration in the R&D pipeline is critical for reducing time-to-market for next-generation, multi-threat ballistic panels, ensuring that protection technologies remain ahead of evolving ammunition capabilities.

Furthermore, AI-driven process optimization is impacting manufacturing and supply chain efficiency. AI systems are increasingly utilized for real-time quality control during composite layup and curing processes, identifying minute defects that could compromise the panel’s integrity. In terms of deployment, AI-powered threat analysis tools can help end-users, particularly military and law enforcement, determine the optimal type and placement of ballistic panels based on current intelligence regarding regional threat levels, operational environment factors, and vehicle usage patterns, ensuring resources are allocated effectively and protection levels are appropriate for the specific mission risk.

- AI-enabled Generative Design: Optimizes panel geometry and material distribution for maximum strength-to-weight ratio.

- Machine Learning (ML) Material Science: Predicts performance characteristics of new composite blends, reducing physical testing requirements.

- Quality Control Automation: Utilizes computer vision and ML to detect micro-structural flaws during the manufacturing of ceramic and composite layers.

- Predictive Maintenance: AI algorithms analyze panel history and stress data to predict replacement cycles or required repairs for armored fleets.

- Dynamic Threat Modeling: AI tools integrate real-time intelligence to recommend specific armor protection levels required for evolving operational environments.

DRO & Impact Forces Of Ballistic Door Panels Market

The dynamics of the Ballistic Door Panels Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively dictate market trajectory and investment priorities. The primary Drivers stem from persistently high global threat levels, encompassing state-sponsored conflicts, asymmetric warfare, terrorism, and escalating crime rates, which necessitate enhanced protection for personnel and assets. These drivers are intrinsically linked to significant governmental procurement cycles, particularly defense modernization programs aimed at replacing aging armored fleets with platforms utilizing superior, lighter ballistic protection. The continuous technological advancements in material science, offering lighter, multi-layered composite panels that maintain high effectiveness, further fuel demand as they address the critical constraint of vehicle weight.

Significant Restraints challenge market expansion, primarily focused on the high cost associated with advanced ballistic materials (especially ceramics and aramid fibers) and the specialized, often complex manufacturing processes required for composite panels. Regulatory hurdles and the necessity for rigorous, time-consuming international ballistic testing certifications (e.g., NIJ, VPAM, STANAG 4569) impose delays and costs on product introduction. Moreover, the inherent trade-off between the level of protection provided and the resulting increase in vehicle mass continues to be a crucial design limitation, particularly for high-mobility, civilian-disguised vehicles.

Opportunities for growth are concentrated in emerging commercial applications, particularly the massive potential within school security, healthcare facilities, and widespread use in critical infrastructure protection against active shooter scenarios. Furthermore, the development of intelligent armor systems, integrating sensors and real-time situational awareness technologies with ballistic panels, presents a lucrative future market segment. The Impact Forces analysis indicates that the market operates under high regulatory pressure (Threat of New Entrants is moderate due to capital requirements and certifications), strong buyer power (driven by government tenders and specifications), and high pressure from substitutes (e.g., electronic surveillance, non-ballistic security solutions, though these cannot replace physical protection), necessitating continuous innovation to maintain competitive advantage.

- Drivers:

- Increased global geopolitical instability and asymmetric threats.

- Rising defense budgets and vehicle fleet modernization programs.

- Technological breakthroughs yielding lightweight, high-performance composite armor.

- Growing requirement for enhanced security in critical infrastructure and civilian assets.

- Restraints:

- High cost of advanced composite and ceramic materials.

- Strict regulatory compliance and lengthy, expensive certification processes.

- Compromise between ballistic protection level and operational vehicle weight/payload capacity.

- Dependence on specialized, often limited, raw material supply chains.

- Opportunities:

- Expansion into commercial security sectors (schools, hospitals, corporate campuses).

- Development of hybrid armor systems integrating active and passive protection technologies.

- Growth in specialized segments such as drone countermeasures and blast mitigation panels.

- Untapped potential in retrofit and upgrade markets for existing fleets.

- Impact Forces (Porter's Five Forces):

- Bargaining Power of Suppliers: Moderate to High (due to specialized material suppliers).

- Bargaining Power of Buyers: High (driven by large-volume government tenders and strict technical specifications).

- Threat of New Entrants: Moderate (High capital requirement, but material science innovators pose a disruptive risk).

- Threat of Substitutes: Moderate (Focus on physical barrier security limits effective substitution).

- Competitive Rivalry: High (Dominated by a few established defense contractors vying for major contracts).

Segmentation Analysis

The Ballistic Door Panels Market is intricately segmented based on material composition, end-use application, technology utilized, and the certified level of protection offered. Understanding these segments is crucial for manufacturers to tailor product development and market entry strategies effectively. Segmentation by material is foundational, distinguishing between traditional metallic solutions (high-strength steel) and advanced non-metallic solutions (ceramics, aramid, and polyethylene), each offering unique performance characteristics related to weight, cost, and effectiveness against specific threat types. This material-based diversification allows producers to serve the diverse requirements of the military, who often prioritize maximum protection, versus civilian security firms, who frequently prioritize reduced weight and lower cost.

The application segment provides insight into where demand is most intense. The Military & Defense segment drives innovation and high-level protection requirements, focusing on vehicle doors, crew compartments, and hardened structures. Conversely, the Law Enforcement and Commercial End-Use segments focus on lighter, more discreet integration into standard vehicle platforms (e.g., SUVs) and fixed architectural installations. Growth in the Commercial segment is accelerating due to rising corporate demand for executive protection services and the hardening of corporate infrastructure against evolving security risks.

Further segmentation by technology, such as layered armor versus hybrid systems, indicates the ongoing shift toward integration. Hybrid systems, which combine ceramics for initial impact mitigation and composite backings for energy absorption, represent the cutting edge of armor technology, offering superior performance against multi-hit scenarios and specific high-velocity threats. The segmentation by NIJ or STANAG protection levels directly reflects the operational requirements, ensuring that panels deployed match the anticipated threat matrix, thereby optimizing both cost and weight efficiency for the specific mission or deployment environment.

- By Material Type:

- High-Strength Steel Alloys

- Aramid Composites (e.g., Kevlar, Twaron)

- Ceramic Plates (Alumina, Silicon Carbide, Boron Carbide)

- Ultra-High Molecular Weight Polyethylene (UHMWPE)

- Hybrid Materials (Combination of ceramic strike face and composite backing)

- By Protection Level (Standardized):

- NIJ Level IIIA (Handgun threats)

- NIJ Level III (Rifle threats)

- NIJ Level IV (Armor-piercing rifle threats)

- STANAG 4569 (Levels 1 to 5)

- Custom/Proprietary Protection Levels

- By End-Use Application:

- Military & Defense (Armored Personnel Carriers, Tactical Vehicles)

- Law Enforcement & Homeland Security (Patrol Vehicles, SWAT Transport)

- Commercial Security & VIP Protection (Armored Executive Vehicles, Cash-in-Transit)

- Critical Infrastructure (Data Centers, Power Plants, Financial Institutions)

- Architectural Security (Safe Rooms, Building Doors and Frames)

- By Technology:

- Monolithic Panels

- Layered Armor Systems

- Hybrid Ceramic-Composite Systems

- Spall Liner Integration Systems

Value Chain Analysis For Ballistic Door Panels Market

The value chain for the Ballistic Door Panels Market begins with the upstream segment, which is dominated by specialized raw material suppliers. These suppliers provide high-performance materials critical for armor fabrication, including high-purity ceramic powders (like boron carbide and silicon carbide), specialized steel alloys, and aramid and polyethylene fibers. This phase is characterized by high technical barriers to entry and strong bargaining power held by a limited number of specialized material manufacturers. Cost and material innovation at this initial stage significantly dictate the final product's performance and price point, making long-term procurement contracts and supply chain assurance crucial for panel manufacturers.

The midstream segment involves the core manufacturing processes: material processing, panel fabrication, and integration. This includes the intricate process of ceramic pressing and sintering, composite layering (layup and curing), and precision machining necessary to create panels that fit specific door geometries while maintaining integrity. Manufacturing typically requires high capital investment in specialized equipment, testing facilities, and adhering to strict quality control standards. Direct and indirect distribution channels facilitate product movement. Direct distribution often involves large, multi-year contracts between major defense contractors and government agencies, where panels are integrated directly into new vehicle production lines or supplied for overhaul and modification programs. These direct sales are characterized by rigorous oversight and customized specifications.

The downstream segment focuses on end-user integration, aftermarket services, and distribution to smaller commercial and civilian clients. Indirect distribution channels utilize specialized security integrators, vehicle up-armoring companies, and authorized dealers who retrofit existing vehicles or install panels into architectural structures. Potential customers include defense ministries, law enforcement agencies, private security firms, and corporate security divisions. Aftermarket services, including maintenance, inspection, and certification renewal, form an increasingly important part of the value chain, ensuring the long-term effectiveness and compliance of deployed ballistic protection systems, particularly for civilian fleets operating under varied threat levels.

Ballistic Door Panels Market Potential Customers

The demand for ballistic door panels is concentrated among high-risk operational environments and entities responsible for personnel and asset protection. The largest and most consistent purchasers are governmental organizations, specifically national Ministries of Defense and Internal Security agencies. These end-users require customized, high-level protection for military vehicle platforms, command centers, and critical state buildings, driving demand for technologically advanced and highly certified Level III and Level IV composite panels. Procurement is often done through large, competitive tenders and requires adherence to strict military standards like STANAG 4569, focusing heavily on proven survivability metrics and durability under extreme conditions.

A rapidly expanding customer base resides within the law enforcement sector, encompassing police departments, federal agencies (such as border patrol and anti-drug units), and specialized tactical teams (SWAT). These customers prioritize panels that offer a balance between protection and maneuverability, requiring lighter panels suitable for integration into standard patrol vehicles and tactical entry vehicles. Furthermore, the increasing threat environment has pushed cash-in-transit companies and private security firms, offering VIP and executive protection, to become significant buyers. For these commercial entities, the emphasis is placed on discreet integration, minimizing the visible signature of the armored protection while maximizing occupant safety.

Finally, the architectural security segment represents a substantial, emerging consumer group. Potential customers include owners and operators of critical infrastructure such as data centers, financial institutions, energy utilities, and communication hubs, where protection against forced entry and deliberate attack is paramount. Following societal incidents, educational institutions (K-12 schools and universities) and healthcare facilities are also increasingly investing in high-security doors and ballistic window/door inserts as a preventative measure against active threats. These customers often seek modular, scalable, and aesthetically acceptable solutions that integrate seamlessly into existing architectural designs, driven by safety compliance standards and insurance requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.38 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Plasan, BAE Systems, General Dynamics, Rheinmetall AG, TenCate Advanced Composites, DSM Protective Materials, Hardwire LLC, Ceradyne (3M), Morgan Advanced Materials, Armatec Survivability, Ametek Inc., Elbit Systems, Israel Aerospace Industries (IAI), MKU Limited, DuPont, Saab AB, Ultra Electronics, Patriot3, Inc., Federal Signal Corporation, Tencate Industrial Fabrics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ballistic Door Panels Market Key Technology Landscape

The technology landscape of the Ballistic Door Panels Market is defined by the relentless pursuit of superior ballistic protection combined with minimal weight penalties. The most crucial advancements revolve around high-performance composite manufacturing, particularly the refinement of thermoset and thermoplastic composite systems utilizing aramid and Ultra-High Molecular Weight Polyethylene (UHMWPE) fibers. These materials, often consolidated under extreme pressure and heat, offer exceptional energy absorption characteristics and multi-hit capability while being substantially lighter than traditional metallic armor. Innovations in matrix materials and fiber weaving patterns are continuously improving the performance efficiency of these composites against specific high-velocity rifle rounds, driving widespread adoption across modern military and law enforcement vehicle platforms.

Hybrid armor systems represent the cutting edge of current technology. These systems strategically combine different material classes, typically pairing a hard, brittle strike face (like Silicon Carbide or Boron Carbide ceramics) with a ductile, energy-absorbing backing layer (often UHMWPE or specialized composite fabrics). The ceramic layer fractures and defeats the projectile’s tip, dispersing kinetic energy, while the composite backing catches fragments and absorbs residual momentum. The technological complexity lies in optimizing the adhesive bond between these disparate materials and ensuring structural integrity under sequential impacts, a critical factor for maintaining operational readiness in combat scenarios or protracted security incidents.

Further technological differentiation includes advanced manufacturing techniques such as 3D printing for complex panel geometries and the increasing integration of spall liners. Spall liners, typically lightweight composite layers installed on the inner surface of the door, are designed to catch secondary fragmentation (spall) resulting from the projectile impact on the primary armor. This technology significantly enhances occupant safety. Additionally, nanotechnology is beginning to influence material development, with researchers exploring the use of carbon nanotubes and grapheme additives to create next-generation, ultra-lightweight ceramic matrices and composite binders that promise unprecedented levels of ballistic resistance at reduced thickness, potentially revolutionizing the future design of armored doors and structural protection systems.

Regional Highlights

The Ballistic Door Panels Market exhibits distinct growth patterns and maturity levels across different global regions, primarily influenced by local geopolitical stability, defense expenditure cycles, and regulatory environments concerning civilian security.

- North America: This region is characterized by high market maturity and technological leadership. The United States drives significant demand through massive defense procurement programs (such as the Joint Light Tactical Vehicle program) and substantial expenditure on homeland security. The market here demands the highest protection levels (Level IV and above) and lightweight composite solutions. The civilian sector, particularly private security and cash-in-transit, maintains steady demand, fueled by a stringent regulatory environment and the prevalence of active security concerns. The focus is on R&D for next-generation, multi-threat armor systems and seamless integration into highly sensitive infrastructure.

- Europe: Europe represents a mature but growing market, propelled by continuous defense modernization programs across NATO member states and increasing political instability on its eastern borders. The demand is segmented, with Western Europe focusing on high-end, discreet VIP protection and critical infrastructure hardening, while Eastern European nations prioritize military vehicle protection adhering to STANAG standards. Restraints include strict EU regulations regarding material sourcing and disposal, pushing manufacturers toward sustainable, high-recyclability composite solutions.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by rapid urbanization, increasing internal and cross-border security challenges (e.g., border disputes, maritime security), and massive military buildup in countries like China, India, and Australia. While price sensitivity remains a factor in civilian applications, large-scale government contracts prioritize effective, often locally manufactured, ballistic solutions. This region presents significant opportunities for suppliers capable of scaling production and navigating complex local procurement policies.

- Middle East and Africa (MEA): This region is a major consumer due to protracted conflicts, terrorism, and substantial wealth dedicated to internal security and defense. MEA demands robust, high-durability solutions capable of performing under extreme climatic conditions (high temperatures, sand). Military sales dominate, focusing heavily on upgrading existing fleets and acquiring new armored vehicles, ensuring consistent high demand for Level III and Level IV protection panels suitable for harsh, unpredictable environments.

- Latin America: This market is driven primarily by escalating organized crime and the resulting need for armored civilian vehicles (cash-in-transit, executive protection) in countries like Brazil and Mexico. Demand for military applications is steady but smaller compared to other regions. The market typically favors cost-effective, proven steel or standard composite solutions, though high-end composite demand is growing in VIP and political protection circles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ballistic Door Panels Market.- Plasan

- BAE Systems

- General Dynamics Land Systems

- Rheinmetall AG

- TenCate Advanced Composites (Toray Group)

- DSM Protective Materials

- Hardwire LLC

- Ceradyne Inc. (A 3M Company)

- Morgan Advanced Materials

- Armatec Survivability Corporation

- Ametek Inc.

- Elbit Systems Ltd.

- Israel Aerospace Industries (IAI)

- MKU Limited

- DuPont de Nemours, Inc.

- Saab AB

- Ultra Electronics

- Patriot3, Inc.

- Federal Signal Corporation

- NP Aerospace

Frequently Asked Questions

Analyze common user questions about the Ballistic Door Panels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary material differences between ceramic and composite ballistic door panels?

Ceramic panels typically use a hard, brittle strike face (like Boron Carbide) designed to shatter incoming projectiles, suitable for defeating high-velocity armor-piercing threats. Composite panels, often using aramid or UHMWPE fibers, rely on layering and tensile strength to catch and dissipate kinetic energy, offering better multi-hit performance against standard rounds and being significantly lighter than steel, though usually heavier than optimized ceramic systems for Level IV threats.

How does the National Institute of Justice (NIJ) standard relate to Ballistic Door Panels?

The NIJ standard (especially 0108.01 for vehicular armor materials) defines the protection levels (e.g., Level III and IV) that door panels must meet to withstand specific calibers and velocities of small arms fire. While primarily US-focused, it is a globally recognized benchmark. Compliance guarantees a tested level of performance and is a mandatory requirement for government and defense contracts in many jurisdictions.

What is the main driver for the adoption of lightweight ballistic materials?

The primary driver is reducing the overall weight penalty associated with armoring vehicles. Excessive weight negatively impacts fuel efficiency, maintenance costs, maneuverability, and component lifespan. Lightweight materials like composites and hybrid ceramics allow vehicles to maintain mission-critical performance capabilities while maximizing personnel safety against current threat matrices.

Which end-use application segment is exhibiting the fastest growth in demand?

The Commercial Security & Critical Infrastructure segment is currently showing the fastest relative growth. This acceleration is due to rising geopolitical risks translating into increased investment in executive protection, securing high-value assets (like data centers and banks), and the emergent need for architectural hardening in high-traffic civilian areas such as schools and corporate campuses.

How does AI technology influence the cost-effectiveness of ballistic door panel production?

AI influences cost-effectiveness primarily by optimizing material usage through generative design, reducing waste, and drastically cutting the time and expense associated with physical testing. By simulating complex ballistic impacts and identifying optimal material arrangements virtually, AI minimizes the number of expensive prototype iterations required before mass production begins.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager