Balloon Aortic Valvuloplasty Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431552 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Balloon Aortic Valvuloplasty Devices Market Size

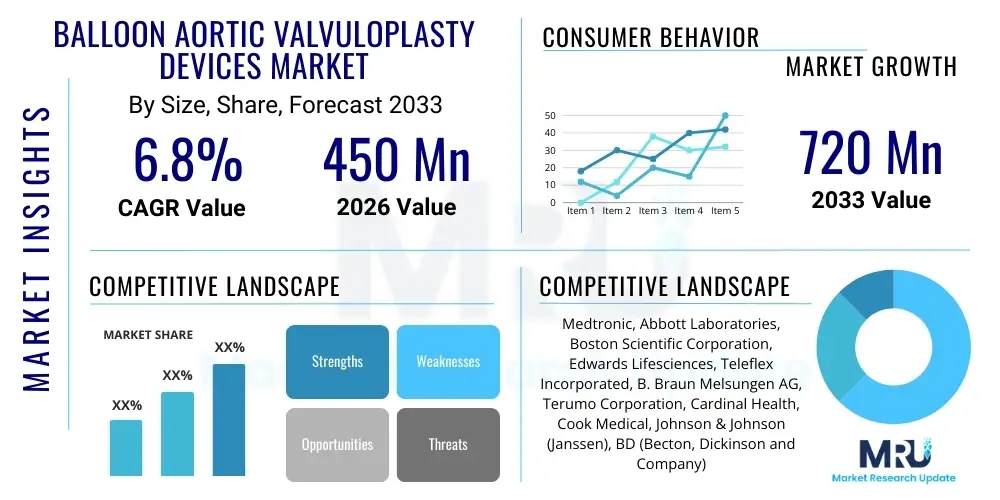

The Balloon Aortic Valvuloplasty Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 720 Million by the end of the forecast period in 2033.

Balloon Aortic Valvuloplasty Devices Market introduction

Balloon Aortic Valvuloplasty (BAV) devices encompass specialized catheters and balloons utilized in a minimally invasive procedure designed to temporarily widen a narrowed aortic valve opening in patients suffering from aortic stenosis. While traditionally viewed as a palliative measure or a bridge-to-TAVR (Transcatheter Aortic Valve Replacement) in high-risk patients, BAV remains critical in emergent situations or when TAVR is contraindicated, allowing for immediate hemodynamic improvement and stabilization. The core product category includes high-pressure, non-compliant balloon catheters specifically engineered to withstand the rigorous force required to fracture calcium deposits within the stiffened valve leaflets, ensuring targeted dilation with minimal risk of rupture or embolization.

Major applications of BAV devices primarily center on patients with severe symptomatic aortic stenosis who require immediate intervention but are not suitable for immediate surgical replacement or TAVR. This includes hemodynamically unstable patients in cardiogenic shock, those needing stabilization prior to major non-cardiac surgery, or patients participating in complex clinical trials where BAV acts as a debulking step. The procedure offers significant, albeit temporary, relief from symptoms like syncope, chest pain, and heart failure, improving the patient's quality of life and functional status in the short term, thereby facilitating subsequent definitive treatment planning.

The market is currently being driven by several key factors, notably the rapid expansion of the geriatric population globally, which inherently possesses a higher incidence of degenerative calcific aortic stenosis. Furthermore, the increasing adoption of minimally invasive interventional cardiology procedures, coupled with improvements in catheter technology leading to better safety profiles and enhanced maneuverability, contributes significantly to market growth. Heightened awareness among clinicians regarding effective bridging therapies and the established role of BAV in the TAVR pathway pipeline further solidify the demand for these specialized devices, especially in developing healthcare economies where access to advanced TAVR technologies might be limited.

Balloon Aortic Valvuloplasty Devices Market Executive Summary

The Balloon Aortic Valvuloplasty Devices Market exhibits robust growth driven by the essential role BAV plays as a crucial interim procedure for high-risk and unstable aortic stenosis patients, positioning it strongly within the overall structural heart market. Business trends indicate a strong focus on developing ultra-low profile balloons and advanced non-compliant materials to enhance procedural safety and efficacy, minimizing vascular complications and improving success rates, which is attracting significant capital investment from established medical device manufacturers. Regional trends highlight North America and Europe as dominant revenue contributors, benefiting from sophisticated healthcare infrastructure and established reimbursement policies for complex structural heart interventions, while the Asia Pacific region is anticipated to demonstrate the fastest growth due to rising incidence of rheumatic heart disease and increasing access to specialized cardiac centers.

Segment trends emphasize the continued dominance of high-pressure non-compliant balloon catheters due to their necessity in achieving effective leaflet separation in calcified valves, although newer technologies focusing on drug-coated balloons for potential anti-restenotic effects are undergoing intensive investigation. The application segment remains heavily concentrated in hospital settings, specifically large teaching and tertiary care cardiac centers equipped with advanced cath labs and surgical backup capabilities, reflecting the high-risk nature of the patient population treated. Overall, the market trajectory is highly sensitive to advancements in TAVR technology, yet BAV maintains its irreplaceable niche as a preparatory and palliative tool, ensuring consistent, targeted demand.

The overarching strategic objective for market participants involves integrating BAV device solutions seamlessly into comprehensive structural heart programs. Companies are prioritizing clinical education and training programs to ensure proper deployment techniques across diverse global markets. Furthermore, strategic mergers and acquisitions focusing on specialized catheter component manufacturers are increasingly common as firms strive for supply chain efficiency and technological competitive advantage. The market’s future stability rests on maintaining clinical relevance through ongoing refinement of devices that reduce procedural time and enhance patient recovery profiles, ensuring BAV remains a viable, cost-effective intervention where TAVR may be delayed or is temporarily unsuitable.

AI Impact Analysis on Balloon Aortic Valvuloplasty Devices Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Balloon Aortic Valvuloplasty (BAV) market predominantly revolve around optimizing procedural planning, enhancing intra-procedural guidance, and improving long-term patient risk stratification. Key themes reveal user expectations for AI to automate the precise measurement of valve annulus size and calcification severity from CT scans, potentially reducing procedural variability and improving balloon sizing accuracy, a critical factor in preventing annular rupture or inadequate dilation. Concerns often center on the validation of AI algorithms against highly variable human anatomical data and the need for robust, real-time feedback systems integrated directly into the cath lab environment. Users anticipate that AI can significantly aid in identifying patients who will derive the most durable benefit from BAV versus those who should proceed immediately to TAVR, thereby streamlining patient flow and resource allocation in structural heart programs.

- AI-enhanced pre-procedural planning through automated CT image segmentation for precise calcification mapping and optimal balloon sizing selection.

- Real-time procedural guidance using AI algorithms to analyze fluoroscopic images, ensuring accurate balloon positioning relative to the valve plane and reducing radiation exposure.

- Predictive analytics models leveraging patient comorbidities and anatomical data to forecast short-term hemodynamic success and long-term risk of restenosis post-BAV.

- Optimization of catheter lab logistics and scheduling by using AI to predict procedural length and required resource intensity based on patient complexity.

- Development of simulation and training platforms utilizing AI to create realistic virtual BAV scenarios for physician training and skill maintenance.

DRO & Impact Forces Of Balloon Aortic Valvuloplasty Devices Market

The Balloon Aortic Valvuloplasty Devices Market is significantly influenced by powerful internal and external forces driving its evolution. The primary Driver is the increasing global prevalence of degenerative aortic stenosis, particularly within the rapidly expanding elderly demographic, coupled with the established utility of BAV as a crucial bridging therapy for high-risk TAVR candidates or emergency palliative care. Restraints primarily stem from the non-definitive nature of BAV, as it is associated with a high rate of recurrence (restenosis) within 6 to 12 months, and the inherent risks of periprocedural complications such as major vascular injury or acute aortic regurgitation. Opportunities are abundant in technological refinement, focusing on developing extremely low-profile delivery systems and integrating advanced imaging modalities to enhance procedural success, alongside expanding market penetration into emerging economies where affordability and accessibility favor BAV over costly TAVR procedures. The collective impact forces highlight a tension between technological innovation (driving device safety) and the therapeutic ceiling imposed by superior definitive procedures (TAVR).

Drivers: The aging global population, characterized by a higher burden of calcific heart valve diseases, necessitates readily available therapeutic options. Additionally, BAV is indispensable in modern interventional cardiology as a stabilizing procedure for patients presenting in critical condition, such as those with cardiogenic shock, offering immediate, life-saving hemodynamic improvement before a definitive surgical or transcatheter treatment can be safely undertaken. The increasing complexity of patient profiles, including those with multiple comorbidities, reinforces the need for temporary, less demanding interventions like BAV, expanding its clinical utilization.

Restraints: The most substantial restraint remains the transient nature of the BAV procedure. The high risk of recurrent stenosis necessitates subsequent intervention (typically TAVR or SAVR), positioning BAV as a temporary fix rather than a permanent solution, which limits its long-term market valuation. Furthermore, the risk of serious complications, including annular tears, severe acute aortic regurgitation, and vascular access site complications, coupled with evolving guidelines that increasingly favor early definitive TAVR, acts as a decelerating force on market growth. The significant skill required for optimal BAV performance also limits its widespread adoption in centers lacking specialized interventional cardiologists.

Opportunities: Significant opportunities exist in geographical expansion, targeting markets in Asia, Latin America, and Eastern Europe where economic constraints and healthcare infrastructure limitations make BAV a more accessible treatment option than TAVR. Product innovation focused on minimizing device profile and improving crossing capabilities in severely calcified valves presents a clear competitive advantage. Furthermore, the integration of BAV procedures with advanced imaging technologies, such as fusion imaging and intracardiac echocardiography, offers a pathway to increased procedural safety and efficacy, enhancing clinical acceptance and improving patient outcomes in complex cases.

Impact Forces: The market faces high competitive intensity from TAVR device manufacturers, which drives continuous pressure on BAV providers to justify the clinical and economic value of their products. Regulatory scrutiny and the need for rigorous clinical data to support device claims further shape the competitive landscape. Overall, the market exhibits moderate to high technological intensity, forcing companies to invest in materials science and catheter design to maintain relevance. Reimbursement policies across different regions heavily dictate procedure volume, with favorable policies in developed markets ensuring consistent utilization, even as a bridge-to-treatment strategy.

Segmentation Analysis

The Balloon Aortic Valvuloplasty Devices Market is structurally segmented primarily based on product type, application, and end-user, reflecting the diverse clinical needs and operational environments in which these devices are deployed. Analyzing these segments provides crucial insight into utilization patterns, technological preferences, and growth trajectories across various healthcare settings. The segmentation highlights the intrinsic link between the type of device used and the specific clinical presentation of the patient, guiding manufacturers towards developing devices optimized for complex, calcified anatomies often encountered in severe aortic stenosis cases requiring immediate palliative care.

Product segmentation focuses on the structural characteristics of the balloon catheters themselves, differentiating based on materials and compliance profiles necessary for effective valve dilation. Application segmentation dictates where the procedures are predominantly performed, overwhelmingly prioritizing hospital settings due to the required intensive care support and surgical backup necessary for high-risk cardiac interventions. End-user segmentation typically targets the demographic populations most affected by aortic stenosis, which is predominantly the geriatric population, demanding devices optimized for aging vasculature and comorbid conditions, influencing device design towards minimizing invasiveness and maximizing ease of delivery.

Understanding the interplay between these segments is vital for strategic planning, ensuring that product development efforts align with the highest-growth application areas, particularly tertiary care hospitals. Furthermore, regional segmentation remains essential, as the adoption rate and choice of BAV devices are heavily influenced by local healthcare budgets, the prevalence of underlying heart diseases (e.g., rheumatic versus degenerative), and the availability of advanced interventional training programs, thereby creating distinct market dynamics across North America, Europe, and Asia Pacific.

- By Product Type:

- High-Pressure Non-Compliant Balloons

- Standard Compliance Balloons

- Specialized Low-Profile Delivery Systems

- By Application:

- Bridge to TAVR (Transcatheter Aortic Valve Replacement)

- Palliative Treatment for Non-TAVR Candidates

- Stabilization in Cardiogenic Shock

- Assessment and Preparation for Non-Cardiac Surgery

- By End-User:

- Hospitals (Tertiary and Quaternary Care Centers)

- Ambulatory Surgical Centers (Limited Use)

- Specialty Cardiac Clinics (Focused on Pre-Procedure Planning)

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of LATAM)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Balloon Aortic Valvuloplasty Devices Market

The Value Chain for the Balloon Aortic Valvuloplasty Devices Market begins with upstream analysis centered on the sourcing and procurement of specialized raw materials, primarily focusing on high-tensile strength polymers, advanced PTFE coatings, and specialized balloon materials (e.g., nylon, polyethylene terephthalate) required to construct non-compliant catheters capable of handling extreme pressures. Manufacturers must ensure stringent quality control over these components, as device failure during inflation can have immediate, catastrophic patient outcomes. Research and Development (R&D) activities at this stage focus heavily on miniaturization, enhancing flexibility, and developing proprietary tip designs for better crossing profiles, representing a critical area for value creation and intellectual property protection.

Midstream activities encompass the precise manufacturing, sterilization, and assembly of the BAV devices, requiring highly controlled environments and adherence to strict regulatory standards (e.g., FDA, CE Mark). Following production, the distribution channel becomes paramount, typically involving a hybrid model that balances direct sales forces, particularly in major North American and European markets where specialized clinical support is essential, with indirect distribution through authorized medical device distributors in smaller or geographically distant markets. The direct channel ensures comprehensive physician training and immediate clinical support, adding significant value by maximizing safe and effective device use, which is crucial for complex structural heart procedures.

Downstream analysis focuses on the final consumption within hospitals and cardiac centers. Value is realized through the clinical outcomes achieved by the procedures, including immediate hemodynamic improvement and successful patient stabilization before definitive therapy. Post-sale services, technical support, and the provision of continuous educational resources for interventional cardiologists are integral to maintaining strong customer relationships and driving repeat usage. The complexity of the procedure and the high-risk nature of the patient population necessitate robust engagement between manufacturers and end-users, solidifying the importance of the direct sales model for delivering technical expertise alongside the physical product.

Balloon Aortic Valvuloplasty Devices Market Potential Customers

The primary and most significant potential customers for Balloon Aortic Valvuloplasty Devices are large tertiary and quaternary care hospitals with dedicated structural heart programs and high-volume cardiac catheterization laboratories. These institutions possess the requisite infrastructure, including advanced imaging capabilities, intensive care units, and on-site cardiothoracic surgery teams, which are essential for managing the high-risk patient population typically undergoing BAV. Within these hospitals, the key decision-makers and end-users are interventional cardiologists specializing in complex coronary and structural heart interventions, often working in multidisciplinary teams alongside cardiac surgeons and cardiac anesthesiologists to determine optimal patient management strategies.

A secondary, yet rapidly expanding, customer segment includes specialized ambulatory surgical centers (ASCs) or dedicated specialty cardiac clinics that focus on peripheral and structural heart diagnostics and pre-procedural stabilization, though BAV procedures themselves are often referred back to the main hospital setting due to the risk profile. These facilities often purchase devices for training and smaller, non-emergent procedures if local regulations permit. Geographically, potential customers are concentrated in regions with high elderly populations and strong healthcare spending, such as the US, Western Europe, and Japan, which exhibit high demand for palliative and bridging therapies for age-related aortic stenosis.

Furthermore, institutions involved in advanced clinical research and TAVR trials represent crucial customers, as BAV is frequently required as a preparatory step to optimize valve landing zones or as a randomization strategy within clinical protocols. Overall, the target customer profile is characterized by a high commitment to minimally invasive techniques and a need for reliable, high-performance devices that can successfully navigate severely calcified and tortuous anatomies, focusing heavily on device reliability and manufacturer support when making procurement decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 720 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Abbott Laboratories, Boston Scientific Corporation, Edwards Lifesciences, Teleflex Incorporated, B. Braun Melsungen AG, Terumo Corporation, Cardinal Health, Cook Medical, Johnson & Johnson (Janssen), BD (Becton, Dickinson and Company), Meril Life Sciences, Lepu Medical Technology, Biotronik, Translumina, MicroPort Scientific Corporation, Getinge AB, LivaNova PLC, W. L. Gore & Associates, Inc., Koninklijke Philips N.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Balloon Aortic Valvuloplasty Devices Market Key Technology Landscape

The technology landscape for Balloon Aortic Valvuloplasty (BAV) devices is characterized by continuous refinement aimed at improving safety, efficacy, and ease of use, despite the procedure itself being mature. A central technological focus involves the development of ultra-low profile balloon catheters and delivery systems. This innovation is critical for mitigating vascular access complications, particularly in the elderly population where peripheral arterial disease is common. Modern devices utilize advanced hydrophilic coatings and specialized balloon folding techniques to minimize the device diameter, allowing for insertion through smaller sheaths, thereby reducing the risk of major access site injury and enhancing overall procedural flow.

Material science plays a pivotal role, driving the creation of high-pressure, non-compliant balloon materials, such as specific grades of nylon or polyethylene terephthalate (PET), that can exert extremely high radial forces necessary to crack heavy calcification on the aortic leaflets without yielding or over-expanding. These materials must maintain integrity under immense pressure while offering consistent, controlled expansion profiles. Furthermore, the integration of rapid exchange or over-the-wire catheter designs allows interventional cardiologists greater control and stability during the crucial dilation phase, particularly in complex anatomies where the valve orifice may be severely distorted or heavily calcified.

Looking forward, the technology landscape is increasingly integrating sophisticated imaging and guidance technologies. Intravascular Ultrasound (IVUS) and Optical Coherence Tomography (OCT) are being utilized more frequently pre- and post-BAV to accurately measure annular dimensions, assess calcium distribution, and confirm optimal deployment without causing undue damage to the surrounding structures. While not directly a device technology, the synergistic use of these imaging modalities with BAV catheters elevates the standard of care, ensuring more predictable outcomes and minimizing complications, demonstrating a trend towards procedure enhancement rather than revolutionary device redesign, given BAV’s role as an interim therapy.

Regional Highlights

- North America: North America, particularly the United States, represents the largest revenue contributor to the BAV Devices Market. This dominance is attributable to the high prevalence of age-related aortic stenosis, sophisticated healthcare infrastructure, high awareness regarding structural heart disease management, and favorable reimbursement policies for complex interventional procedures. The region is characterized by high procedural volumes, driven by the widespread adoption of TAVR programs where BAV is frequently used as a preparatory or bridging procedure. Intense research activities and the presence of major device manufacturers further solidify North America's leading position in technological adoption and market size.

- Europe: Europe holds a substantial market share, driven by similar demographic trends (aging population) and established guidelines for managing severe aortic stenosis. Western European countries, including Germany, the UK, and France, exhibit robust demand due to well-funded public healthcare systems and a high concentration of cardiac centers performing both BAV and TAVR. Regulatory harmonization (CE Mark) facilitates quicker product entry, fostering a competitive environment where technological innovations are rapidly deployed to enhance patient care pathways and address procedural complexities in high-risk patients.

- Asia Pacific (APAC): The APAC region is forecast to experience the fastest market growth during the forecast period. This accelerated expansion is primarily fueled by improving healthcare access, rising medical tourism for complex cardiac interventions, and increasing healthcare expenditure across countries like China, India, and South Korea. Furthermore, the higher incidence of rheumatic heart disease in parts of Asia contributes significantly to the need for valvuloplasty procedures. Market growth is constrained by lower healthcare budgets and fragmented regulatory systems but is increasingly supported by local manufacturing capabilities offering cost-effective device alternatives.

- Latin America (LATAM): The LATAM market demonstrates steady growth, motivated by rising awareness of interventional cardiology techniques and ongoing efforts to upgrade cardiovascular care facilities in countries such as Brazil and Mexico. However, market adoption remains moderate due to economic volatility and challenges related to obtaining specialized training and consistent reimbursement, positioning BAV often as a critical, high-value procedure rather than a widely accessible routine intervention.

- Middle East and Africa (MEA): The MEA market is nascent but shows potential, particularly within the Gulf Cooperation Council (GCC) countries which boast high healthcare spending and a focus on establishing world-class specialty hospitals. Demand is highly localized to urban centers. Challenges include the low general incidence of age-related stenosis in younger populations and reliance on imported expertise and devices, although BAV is often utilized in this region due to its relative affordability compared to full TAVR systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Balloon Aortic Valvuloplasty Devices Market.- Medtronic

- Abbott Laboratories

- Boston Scientific Corporation

- Edwards Lifesciences

- Teleflex Incorporated

- B. Braun Melsungen AG

- Terumo Corporation

- Cardinal Health

- Cook Medical

- Johnson & Johnson (Janssen)

- BD (Becton, Dickinson and Company)

- Meril Life Sciences

- Lepu Medical Technology

- Biotronik

- Translumina

- MicroPort Scientific Corporation

- Getinge AB

- LivaNova PLC

- W. L. Gore & Associates, Inc.

- Koninklijke Philips N.V.

Frequently Asked Questions

Analyze common user questions about the Balloon Aortic Valvuloplasty Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Balloon Aortic Valvuloplasty (BAV) devices in modern cardiology?

BAV devices are specialized catheter-based systems used to temporarily widen the narrowed aortic valve (aortic stenosis) in a minimally invasive procedure. While BAV offers immediate hemodynamic stabilization, its primary function today is palliative or as a critical bridge therapy for high-risk patients awaiting definitive treatment like Transcatheter Aortic Valve Replacement (TAVR) or Surgical Aortic Valve Replacement (SAVR).

How does the high restenosis rate affect the long-term market valuation of BAV devices?

The high rate of restenosis (valve re-narrowing) within 6 to 12 months limits BAV’s status as a definitive treatment, thereby capping its market valuation relative to permanent solutions like TAVR. However, this factor ensures consistent demand for BAV as a necessary, short-term stabilization tool in complex TAVR pathways and emergent clinical scenarios, maintaining its vital niche in structural heart intervention.

Which geographical region exhibits the fastest growth potential for BAV device adoption?

The Asia Pacific (APAC) region is projected to register the fastest growth due to the expansion of healthcare infrastructure, rising prevalence of both degenerative and rheumatic aortic valve disease, and the cost-effectiveness of BAV devices compared to TAVR in economically diverse healthcare systems across countries like China and India.

What are the key technological advancements expected in BAV devices?

Key technological advancements focus on developing ultra-low profile and highly non-compliant balloon catheters to minimize vascular access complications and ensure controlled, effective dilation in severely calcified anatomies. Future developments also involve integrating advanced imaging modalities (like IVUS) for enhanced real-time guidance and procedural accuracy.

Is BAV devices market growth restrained by the widespread adoption of TAVR technology?

Yes, the exponential growth and improved outcomes associated with TAVR restrain the BAV market by reducing the number of patients requiring BAV as a sole treatment. However, TAVR simultaneously supports the BAV market by increasing the population of high-risk patients who require BAV for pre-TAVR stabilization, thereby defining BAV’s enduring role as a prerequisite or preparatory procedure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager