Bamboo Disposable Nappies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433834 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Bamboo Disposable Nappies Market Size

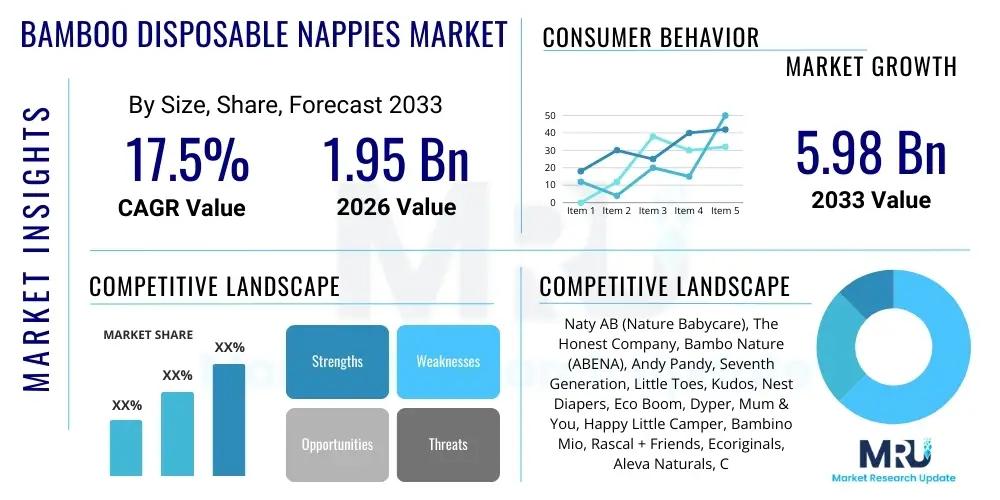

The Bamboo Disposable Nappies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.5% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 5.98 Billion by the end of the forecast period in 2033.

Bamboo Disposable Nappies Market introduction

The Bamboo Disposable Nappies Market represents a critical shift within the broader hygiene products sector, moving towards sustainable and biodegradable alternatives to conventional petroleum-based plastic diapers. These products utilize bamboo viscose fiber for the core material, primarily due to its exceptional softness, high absorbency, and inherent antimicrobial properties, making them highly desirable for sensitive baby skin. Market growth is fundamentally driven by escalating environmental consciousness among millennials and Gen Z parents, coupled with increasing disposable incomes in emerging economies, enabling consumers to choose premium, eco-friendly options over traditional, cheaper plastic counterparts. The product’s description emphasizes its rapid biodegradability compared to standard diapers, which take hundreds of years to decompose, thus positioning bamboo nappies as an essential solution for reducing landfill burden associated with baby care products globally.

Major applications of bamboo disposable nappies revolve exclusively around infant and toddler hygiene, specifically targeting parents who prioritize health, sustainability, and quality. While the core application remains standard daily use, the premium positioning allows manufacturers to target specific niche segments, such as babies suffering from sensitive skin conditions or eczema, where the hypoallergenic nature of bamboo is a significant benefit. The market scope includes various size classifications—newborn, infant, toddler, and pull-up pants—ensuring comprehensive coverage for all stages of early childhood development. Geographically, adoption is highest in regions with strong regulatory frameworks promoting sustainable packaging and high levels of consumer awareness regarding microplastic pollution and its derived environmental consequences. This global movement towards 'green parenting' acts as a persistent catalyst for product innovation and market penetration.

The primary benefits driving market expansion include superior skin breathability, minimizing diaper rash incidence, and the compelling ecological profile of bamboo—a highly renewable resource requiring minimal water and no pesticides to grow. Driving factors encompass strategic marketing efforts highlighting the natural origin and non-toxic composition of the products, increased availability through specialized e-commerce platforms and organic retail channels, and supportive government initiatives that subsidize or promote the production and sale of bio-based consumer goods. However, the premium price point compared to mass-market diapers remains a notable challenge, necessitating continuous innovation in manufacturing processes to achieve cost efficiencies and broaden consumer access, thereby maximizing long-term market potential and mainstream adoption across diverse socio-economic strata.

Bamboo Disposable Nappies Market Executive Summary

The global Bamboo Disposable Nappies Market is characterized by robust growth, primarily fueled by shifting consumer preferences towards sustainable parenting practices and stringent environmental regulations impacting disposable plastic goods. Business trends indicate a strong focus on strategic mergers, acquisitions, and partnerships, particularly between established hygiene product corporations and innovative bio-material startups, aiming to secure sustainable supply chains and leverage patented fiber technologies. Product innovation is heavily concentrated on enhancing biodegradability timelines for non-bamboo components (like elastics and backsheets) and improving absorption capacity without increasing overall product thickness. A significant trend involves direct-to-consumer (D2C) e-commerce models, which allow specialty brands to build trust and market narratives around ethical sourcing and transparency, often bypassing traditional retail distribution complexities.

Regional trends reveal that North America and Europe currently dominate the market in terms of value, driven by high consumer spending power and mature eco-conscious consumer bases. The European Union, specifically, enforces strict regulations on packaging waste, accelerating the switch to bamboo and other plant-derived materials. Meanwhile, the Asia Pacific (APAC) region is projected to register the fastest growth rate, propelled by rapid urbanization, increasing middle-class populations in China and India, and a burgeoning awareness of infant health combined with the availability of specialized foreign and domestic brands. Investment in manufacturing capacity is increasingly moving towards Southeast Asia to capitalize on proximity to raw bamboo sourcing and lower operational costs, thereby supporting regional supply chain efficiency and reducing logistics-related carbon footprints.

Segmentation trends highlight that the pull-up pants segment is experiencing accelerated adoption due to convenience for mobile toddlers and effective leakage protection, though the traditional open-style diaper segment maintains the largest market share by volume. In terms of distribution, online retail channels, including dedicated brand websites and large marketplace platforms like Amazon, significantly overshadow conventional brick-and-mortar stores, offering greater product variety and detailed information regarding sustainability certifications. Furthermore, the market is segmenting based on material composition innovation, with products featuring high percentages of bio-plastics (like PLA or Mater-Bi) integrated with bamboo fiber gaining traction, targeting consumers demanding near-100% compostability, moving beyond simple biodegradability claims to verifiable, end-of-life solutions.

AI Impact Analysis on Bamboo Disposable Nappies Market

Analysis of common user questions related to AI's impact on the Bamboo Disposable Nappies Market reveals several key themes: concerns about supply chain resilience, expectations for personalized product recommendations, and inquiries into AI-driven sustainable material optimization. Users frequently ask how AI can track and verify the ethical sourcing of bamboo, optimize inventory management to reduce waste, and predict shifts in consumer demand for eco-friendly products. The central expectation is that AI systems will dramatically enhance efficiency in the highly sensitive raw material procurement process—ensuring quality and sustainability certifications—and drastically improve the consumer experience through hyper-personalized sizing and subscription service models. The primary concern revolves around the accessibility of AI technology for smaller, specialized bamboo nappy companies compared to large established hygiene players, fearing market consolidation driven by technological advantage and data exploitation.

- AI-powered demand forecasting optimizing inventory levels and reducing overstocking, which is crucial for products with specific shelf-life requirements and high freight costs.

- Implementation of traceability systems using blockchain integrated with AI to verify sustainable sourcing of bamboo fiber, enhancing consumer trust and combating 'greenwashing'.

- Utilization of machine learning algorithms to analyze material performance data, accelerating R&D for enhanced absorbency, breathability, and optimized biodegradability components.

- AI-driven consumer behavior analysis facilitating highly personalized subscription box services, tailoring sizing and delivery schedules to individual baby growth curves.

- Optimization of complex logistics and supply chain routes, minimizing carbon emissions associated with transporting raw materials (bamboo pulp) and finished goods.

- Deployment of AI vision systems in manufacturing for quality control, instantly identifying and rejecting flawed nappies, improving overall product consistency and reducing manufacturing waste.

DRO & Impact Forces Of Bamboo Disposable Nappies Market

The market is predominantly driven by escalating global environmental awareness and consumer preference for biodegradable products, coupled with rising concerns over chemical exposure in traditional diapers. Key restraints include the significantly higher manufacturing cost compared to standard polyethylene-based diapers, which translates to a premium retail price, limiting penetration in price-sensitive markets. Opportunities are abundant in expanding into untapped emerging economies, developing advanced certification standards for compostability, and innovating hybrid materials that balance sustainability, performance, and cost. The major impact forces are the potent push from favorable regulatory environments in developed regions that penalize non-sustainable waste management, and the strong consumer pull driven by effective digital marketing focusing on health benefits and environmental stewardship, thereby creating a virtuous cycle favoring bio-based products over conventional disposable options.

Segmentation Analysis

The Bamboo Disposable Nappies Market is strategically segmented based on product type, size, distribution channel, and material composition to address diverse consumer needs and operational complexities. Segmentation by product type delineates between standard open diapers and convenient pull-up pants, catering to different developmental stages of infants. Size segmentation is crucial for fit and leakage prevention, encompassing typical categories from newborn to XXL. Material composition analysis focuses on the degree of sustainability, separating products based on the percentage of bio-based materials used in the backsheet, absorbent core, and leg cuffs, which heavily influences the final product cost and environmental claims. The distribution channel breakdown reveals the dominance of online retail, aligning with the target demographic’s preference for convenience and information access, enabling niche brands to thrive without needing expansive physical retail footprints, which is a key factor in market access and scaling.

- By Product Type:

- Open Diapers (Standard Taped Nappies)

- Pull-up Pants (Training Pants)

- By Size:

- Newborn (Size 0/1)

- Infant (Size 2/3)

- Toddler (Size 4/5)

- Junior/XL (Size 6+)

- By Distribution Channel:

- Online Retail (E-commerce platforms, Brand Websites)

- Offline Retail (Supermarkets, Hypermarkets, Pharmacies, Specialty Stores)

- By Material Composition:

- High Bio-Content (70% - 100% Bio-based Materials)

- Mid Bio-Content (40% - 70% Bio-based Materials)

Value Chain Analysis For Bamboo Disposable Nappies Market

The value chain for the Bamboo Disposable Nappies Market starts with upstream analysis, which is critical due to the specialized nature of the core raw material. Upstream involves the sustainable cultivation and harvesting of fast-growing bamboo species, followed by the complex processing required to convert raw bamboo stalks into soft, highly absorbent bamboo viscose (or pulp). This stage requires specialized chemical treatments and fiber manufacturing technologies to ensure the material retains its hypoallergenic and antimicrobial properties while meeting specific tensile strength and comfort standards required for baby products. Securing reliable, certified sustainable sources of bamboo is a primary concern, as volatility in agricultural output or regulatory scrutiny regarding the chemical retting process can significantly impact material availability and manufacturing costs, necessitating long-term contracts with certified suppliers, often based in Asia.

The midstream process focuses on manufacturing and production, where the bamboo fiber is combined with other essential components—such as biodegradable backsheets (often PLA or potato starch derivatives), super-absorbent polymers (SAPs), and flexible elastics—to form the finished diaper. This stage relies heavily on advanced converting machinery designed to handle natural and delicate fibers while maintaining high-speed production. Downstream analysis encompasses the distribution and sales network. Due to the product's premium positioning and target demographic, the distribution channel heavily favors specialized direct and indirect routes. Direct sales via e-commerce websites and subscription services allow brands maximum control over branding, pricing, and customer relationship management, fostering loyalty within the niche market segment.

Indirect distribution primarily uses major online marketplaces (Amazon, Target Online) and specialty organic retail stores and pharmacies, rather than general supermarkets, to maintain the product’s premium identity and reach the specific target consumer actively seeking eco-friendly options. Effective distribution hinges on efficient inventory management and reliable third-party logistics (3PL) providers capable of handling cross-border shipments for global consumer bases, especially as a significant portion of sales occurs internationally. The focus throughout the entire value chain remains on verifiable sustainability at every step, as this constitutes the core competitive advantage of the bamboo nappy category compared to conventional hygiene products, influencing every decision from sourcing to final consumer delivery.

Bamboo Disposable Nappies Market Potential Customers

The primary target end-users and buyers of bamboo disposable nappies are predominantly Millennial and Gen Z parents residing in urban and suburban areas of developed economies, characterized by high digital literacy and strong environmental values. These customers are generally high-income or dual-income households willing to pay a significant premium for products that align with their ethical standards regarding sustainability and baby health. They prioritize product transparency, ingredient safety (seeking out certifications like OEKO-TEX or FSC), and demonstrable environmental responsibility, often viewing the higher cost as an investment in their child's well-being and the planet’s future. These consumers are proactive researchers, relying heavily on peer reviews, social media influencers, and specialized parenting blogs to inform their purchasing decisions, making targeted digital marketing and content strategy critical for market penetration and sustained customer acquisition efforts.

Secondary potential customers include specialized institutional buyers, such as eco-conscious daycare centers, maternity hospitals, and neonatal units that have adopted 'green initiatives' to reduce their environmental footprint and offer hypoallergenic options to patients. While this segment represents a smaller volume compared to individual household consumers, institutional adoption validates the product's safety and quality, providing significant credibility. Furthermore, parents in rapidly developing nations, especially those with increased exposure to global sustainability trends and improved access to cross-border e-commerce, represent a growing demographic. These consumers are increasingly seeking higher-quality, safer alternatives to local conventional brands, driven by rising health awareness regarding plastic and chemical exposure in infants, leading to expanding demand particularly in large metropolitan areas across Asia and Latin America.

The demographic profile of the potential customer is further refined by those specifically seeking solutions for sensitive skin issues, such as chronic diaper rash, eczema, or contact dermatitis. The inherent breathability and hypoallergenic nature of bamboo viscose fiber provide a significant therapeutic advantage over plastic-based alternatives, attracting a highly loyal segment willing to overlook the cost differential for improved health outcomes. Marketing efforts must therefore simultaneously appeal to environmental concerns and demonstrate tangible health benefits, utilizing certifications and clinical endorsements where applicable. Targeting this dual-motivation—health and sustainability—ensures maximum resonance with the core consumer base and drives reliable, repeat purchases crucial for stabilizing brand market share in this competitive specialty segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 5.98 Billion |

| Growth Rate | 17.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Naty AB (Nature Babycare), The Honest Company, Bambo Nature (ABENA), Andy Pandy, Seventh Generation, Little Toes, Kudos, Nest Diapers, Eco Boom, Dyper, Mum & You, Happy Little Camper, Bambino Mio, Rascal + Friends, Ecoriginals, Aleva Naturals, Cutie Pea, Offspring, Moltex, Green Sprout |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bamboo Disposable Nappies Market Key Technology Landscape

The technological landscape for bamboo disposable nappies is rapidly evolving, focusing on optimizing fiber conversion, enhancing absorption capabilities, and achieving verifiable end-of-life biodegradability. The core technology lies in the efficient and environmentally sound production of bamboo viscose or pulp, transitioning away from conventional chemical processes towards closed-loop systems like the Lyocell method, which minimizes solvent usage and maximizes fiber quality. This technological refinement is critical for ensuring the bamboo fiber maintains superior softness and breathability. Further innovations involve the engineering of the absorbent core, utilizing advanced Super Absorbent Polymers (SAPs) that are either bio-based (derived from starch or cellulose) or significantly reduced in quantity, allowing for a thinner, yet highly effective, diaper profile. The integration of these bio-SAPs is crucial for meeting consumer expectations regarding performance while accelerating the degradation process post-disposal.

Beyond the core materials, significant technological investment is directed towards the outer layers and components. Specifically, advancements in bio-plastic films, such as polylactic acid (PLA) derived from corn starch or other renewable resources, are replacing traditional petroleum-based polyethylene backsheets. These PLA films must be engineered to provide adequate liquid barrier protection without compromising the overall breathability of the nappy, a delicate balance that requires precision polymer science. Furthermore, ultrasonic bonding techniques are increasingly replacing traditional adhesives containing harmful chemicals, improving product safety and further enhancing the product's environmental profile. These manufacturing technologies allow for faster, cleaner assembly processes, simultaneously reducing energy consumption and the reliance on potentially toxic binding agents, directly addressing consumer safety concerns.

A crucial technological development involves the implementation of industrial composting certification technologies. Brands are now investing in third-party validation processes and material formulations (like Mater-Bi or similar certified bio-polymers) to ensure that claims of 'biodegradable' or 'compostable' are technically achievable in municipal waste facilities. This involves extensive testing under specific temperature and humidity conditions, which necessitates collaboration between manufacturers, material scientists, and waste management infrastructure providers. The rise of smart packaging, employing QR codes and digital tracing technology, is also a key feature, allowing consumers instant access to sustainability reports, ingredient sourcing information, and disposal instructions, thereby leveraging technology to build unparalleled transparency and consumer confidence in the ecological claims of bamboo disposable products.

Regional Highlights

- North America: This region, particularly the United States and Canada, represents a high-value market driven by high disposable income, established eco-conscious consumer segments, and strong e-commerce infrastructure. The market penetration of specialty bamboo brands is higher here compared to conventional mass-market diapers, supported by robust marketing focused on health, wellness, and chemical-free living. Regulatory bodies are increasingly scrutinizing green marketing claims, pushing manufacturers towards verifiable certifications and transparent sourcing, which favors established bamboo brands with robust supply chain documentation.

- Europe: Europe is a key growth accelerator, heavily influenced by strict EU directives targeting plastic waste reduction, particularly in packaging and single-use items. Countries like Germany, the UK, and the Nordics show exceptionally high per capita spending on sustainable baby care products. The demand here is driven by institutional initiatives (e.g., in hospitals and daycares) to adopt certified sustainable products, coupled with a strong cultural emphasis on environmental protection and verifiable compostability standards.

- Asia Pacific (APAC): APAC is poised for the fastest growth, largely due to rapidly expanding middle classes in China, India, and Southeast Asian nations. While the price sensitivity remains higher than in the West, growing consumer awareness regarding infant health, coupled with increased availability of high-quality local and international bamboo brands, is driving adoption. Furthermore, this region is critical for raw material sourcing (bamboo cultivation), giving localized brands a significant logistical and cost advantage over international competitors, accelerating the establishment of regional manufacturing hubs.

- Latin America (LATAM): The LATAM market is emerging, characterized by fragmented distribution and variable consumer awareness. Demand is centralized in major metropolitan areas such as São Paulo and Mexico City, where consumer behavior mirrors Western trends regarding environmental concerns and higher purchasing power. Market development depends heavily on improving distribution channels and tackling the premium price barrier through local production and targeted education campaigns highlighting the long-term cost benefits of healthier, rash-reducing diapers.

- Middle East and Africa (MEA): This region currently holds the smallest market share but presents significant long-term opportunities, particularly in the GCC countries, where high birth rates and luxury consumer spending drive demand for premium, imported goods. The market penetration is primarily focused on urban centers, where international brands emphasize the hypoallergenic and high-quality aspects of bamboo fiber. Growth is contingent upon overcoming logistical complexities and establishing reliable, temperature-controlled distribution networks, especially in warmer climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bamboo Disposable Nappies Market.- Naty AB (Nature Babycare)

- Bambo Nature (ABENA)

- The Honest Company

- Dyper

- Little Toes

- Andy Pandy

- Seventh Generation

- Eco Boom

- Kudos

- Nest Diapers

- Mum & You

- Happy Little Camper

- Bambino Mio

- Rascal + Friends

- Ecoriginals

- Aleva Naturals

- Cutie Pea

- Offspring

- Moltex

- Green Sprout

Frequently Asked Questions

Analyze common user questions about the Bamboo Disposable Nappies market and generate a concise list of summarized FAQs reflecting key topics and concerns.Are bamboo disposable nappies truly biodegradable and compostable?

Bamboo disposable nappies are generally marketed as biodegradable due to the bamboo viscose fiber component, which naturally breaks down faster than traditional plastic. However, the degree of true compostability depends heavily on the auxiliary materials used (like SAPs, backsheets, and elastics). Products must be explicitly certified (e.g., DIN CERTCO or BPI) as industrially compostable to break down completely in commercial facilities, as not all home composting setups can achieve the necessary heat and microbial activity. Consumers should check the percentage of bio-based materials (often listed as 70-85% bio-based) and required disposal method for the specific brand.

How do bamboo nappies compare in performance and leakage protection against standard diapers?

Modern bamboo disposable nappies offer comparable, and often superior, performance to conventional diapers. The highly porous structure of bamboo viscose enhances breathability and wicking capabilities, reducing moisture build-up and lowering the risk of diaper rash. Absorption efficiency is achieved by incorporating bio-based or reduced volumes of high-performance Super Absorbent Polymers (SAPs) into the core. Leading brands invest heavily in structural design (e.g., enhanced leg cuffs and triple-layer protection) to ensure excellent fit and effective leakage barriers, maintaining overnight reliability equivalent to premium conventional brands.

Why are bamboo disposable nappies significantly more expensive than regular diapers?

The higher cost is primarily attributed to specialized sourcing and manufacturing processes. Raw bamboo fiber processing into textile-grade viscose is more resource-intensive and expensive than producing petroleum-based plastics. Furthermore, brands prioritize securing certified, sustainably sourced bamboo, often adhering to FSC standards, adding to material costs. Finally, the integration of advanced bio-based components (like PLA backsheets and bio-SAPs) and smaller production scales compared to mass-market plastic diaper giants contribute to the premium retail pricing necessary to maintain profitability and cover sophisticated sustainable supply chain management.

Which regions are leading the consumption and growth of the Bamboo Disposable Nappies Market?

North America and Europe currently dominate the market in terms of overall market value, driven by high consumer spending on specialty sustainable goods and stringent regulatory frameworks promoting eco-friendly products. However, the Asia Pacific (APAC) region, particularly China and India, is projected to register the fastest growth rate. This accelerated growth in APAC is fueled by expanding middle-class populations, increasing health and environmental awareness, and localized manufacturing advantages close to the primary bamboo raw material sources.

What role does sustainability certification play in purchasing decisions for bamboo nappies?

Sustainability certification is paramount for consumer trust and purchasing decisions in this niche market. Key certifications such as FSC (Forest Stewardship Council) ensure the bamboo pulp is sourced from responsibly managed forests, while OEKO-TEX confirms the absence of harmful substances in the finished product. These certifications directly validate brand claims regarding environmental responsibility and non-toxicity, serving as critical differentiators in a crowded market where consumers are highly skeptical of vague 'green' claims. Verifiable third-party seals significantly influence buyer loyalty among the eco-conscious parent demographic.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager