Bamboo Salt Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433510 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Bamboo Salt Market Size

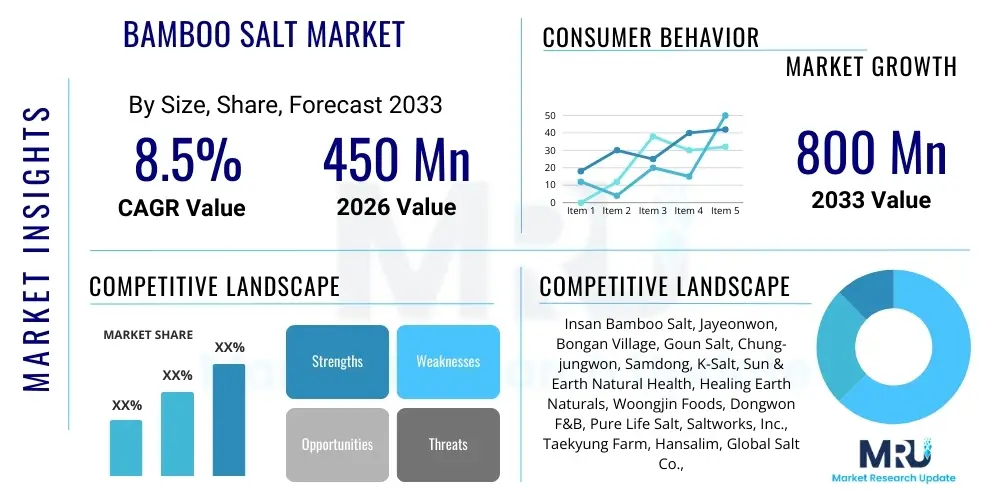

The Bamboo Salt Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 800 Million by the end of the forecast period in 2033.

Bamboo Salt Market introduction

The Bamboo Salt Market encompasses the global trade and consumption of traditional Korean preparation, Jukyeom, which involves packing high-mineral sea salt into carefully selected three-year-old bamboo trunks, sealing the ends with yellow loess clay, and roasting this assemblage multiple times—typically three, five, or nine times—in specialized high-temperature kilns, often reaching temperatures up to 1500°C. This meticulous process is fundamentally transformative, removing heavy metals and harmful impurities present in the raw sea salt while simultaneously infusing the salt with essential minerals, including potassium, calcium, magnesium, and notably, sulfur compounds derived from the bamboo and pine fuel. The resulting product is distinctively alkaline (with a pH often exceeding 10) and possesses a rich, sulfurous flavor profile, setting it apart from all conventional salts. The market's expansion is intrinsically linked to its perceived status as a premium functional food and traditional therapeutic agent, transcending its initial role purely as a culinary seasoning ingredient and establishing strong footholds in the nutraceutical and cosmeceutical industries across Asia and Western economies.

The fundamental product description highlights its preparation methodology as the key differentiator, emphasizing that the number of roasting cycles dictates the final product's purity and alkalinity, with the nine-times roasted variant being the most expensive and therapeutically sought after. Major applications are broad and rapidly diversifying. In the culinary sector, it is utilized as a gourmet finishing salt or low-sodium alternative, particularly favored in high-end Asian fusion restaurants for its unique depth of flavor. Crucially, the pharmaceutical and nutraceutical applications focus on leveraging its alkaline properties for digestive health, detoxification, and mineral supplementation, marketed toward consumers seeking pH balance. Furthermore, the specialized cosmetic industry integrates bamboo salt into high-end oral hygiene products and skincare formulations due to its natural antimicrobial properties and rich mineral content, catering to the growing clean beauty segment. This diversification across high-value applications is a core driving factor, insulating the market against price fluctuations common in standard commodity salt markets.

The growth trajectory of the market is substantially influenced by driving factors such as heightened consumer awareness regarding excessive sodium consumption from conventional sources and the global trend favoring functional ingredients with traceable, traditional provenance. The unique selling proposition of bamboo salt is its dual benefit: it offers a superior mineral profile while maintaining alkalinity, a trait highly valued in holistic health circles. Significant investment by leading South Korean producers in rigorous quality control, modern packaging, and targeted international marketing—often emphasizing the ‘superfood’ status and ancient heritage—has successfully introduced Jukyeom to Western consumers. Furthermore, the shift in regulatory acceptance in certain Western jurisdictions, recognizing traditional preparations as specialized dietary supplements, further lubricates global trade channels, cementing bamboo salt's position as a high-growth niche within the broader functional food and mineral supplement markets globally. The market sustains its premium status through continuous innovation in product form, such as specialized liquid bamboo salt solutions for specific clinical uses or high-purity powder for advanced encapsulation techniques demanded by industrial partners.

Bamboo Salt Market Executive Summary

The global Bamboo Salt Market demonstrates a compelling blend of traditional manufacturing and aggressive modern market penetration, highlighted by a strong projected CAGR of 8.5% through 2033. Current business trends indicate a strategic move toward vertical integration among major players, aiming to control the sourcing of high-quality sea salt and sustainable bamboo, thereby ensuring consistent supply and mitigating price volatility for these critical raw materials. Investment in advanced manufacturing technologies, specifically automated, high-precision kilns utilizing thermal sensors and AI-driven control systems, is essential to standardize the complex roasting process. This standardization addresses international market demands for product uniformity and quality assurance, shifting the competitive focus from sheer volume production to certified, high-grade output, particularly the lucrative nine-times roasted variety. Additionally, collaborations with academic and research institutions are increasing, focusing on scientifically validating the traditional health claims, which is critical for successful market entry into regulated Western nutraceutical sectors and achieving necessary regulatory clearances.

Regionally, the market exhibits a clear polarization. Asia Pacific remains the foundational hub, accounting for the largest share driven by deep-rooted cultural consumption and established production infrastructure in South Korea, providing stability and expertise. However, the future growth engine is unequivocally North America and Europe, where demand for alkaline diets, natural minerals, and premium wellness products is accelerating rapidly, albeit from a smaller initial base. Regional trends indicate that successful market penetration in these Western regions is highly dependent on effective digital education strategies and transparent labeling that clearly articulates the product’s traditional origins and scientifically verified attributes. Regulatory compliance, particularly related to purity and mineral content standards in the EU, dictates the market access strategy for European expansion, often favoring producers capable of providing comprehensive third-party testing reports and verified blockchain traceability. The trend is moving toward localized packaging and branding that caters specifically to regional consumer aesthetics and linguistic requirements, enhancing AEO optimization for consumer searches related to natural health solutions.

Segmentation trends reveal that while volume is dominated by lower-roast (3x/5x) variants used in the Food and Beverages sector due to their lower price point and suitability for general culinary use, the highest value growth and margin potential reside within the high-purity, nine-times roasted segment dedicated to Pharmaceuticals and Nutraceuticals. This segment is leveraging increased investment in specialized functional ingredients research. By product form, the demand for ultra-fine powder is surging, driven by the requirement for precise dosage and consistent quality necessary for encapsulation in health supplements. The cosmetic segment, though smaller, is showing exceptional innovation, integrating bamboo salt into specialized dental, dermal, and high-end spa products that emphasize its natural detoxification properties. Overall, the market is defined by a crucial shift in consumer perception—moving bamboo salt from a mere gourmet food item to an essential functional ingredient, driving significant premiumization across all segments. Key players are aggressively utilizing proprietary e-commerce platforms to capture direct-to-consumer relationships, facilitating detailed product education and maximizing margin capture without relying heavily on traditional retail intermediaries.

AI Impact Analysis on Bamboo Salt Market

Common user questions regarding AI's impact on the Bamboo Salt Market typically revolve around enhancing supply chain traceability, automating the complex 9-roast process for consistent quality, predicting consumer demand for niche functional foods, and optimizing ingredient discovery within the traditional context. Users are keenly interested in how AI can validate and standardize the traditional craft, ensuring that the manual, time-intensive production method scales without compromising authenticity or mineral content. Key themes include the use of machine vision for real-time quality control of roasting temperatures and salt purity, predictive analytics for inventory management of seasonal bamboo and salt harvesting, and leveraging natural language processing (NLP) to analyze massive datasets of traditional medicinal claims, correlating them with modern scientific findings to strengthen market positioning and regulatory adherence. The core expectation is that AI will bridge the gap between ancient preparation methods and modern industrial requirements, significantly reducing operational variability and improving product credibility on the global stage, especially when justifying premium prices to skeptical international buyers accustomed to cheaper alternatives.

In the domain of production, AI is poised to revolutionize the kiln operations which are currently highly susceptible to human error and fuel variability. Advanced machine learning algorithms can analyze real-time data streaming from sophisticated thermal cameras and gas sensors inside the kilns, precisely modulating temperature and airflow to ensure that the chemical reactions necessary for purification and mineral absorption occur identically across every batch, especially during the critical ninth roasting cycle which demands the highest heat and precision. This technological integration not only guarantees superior product consistency, which is vital for pharmaceutical-grade certifications, but also minimizes energy consumption and reduces production costs over the long term, directly addressing one of the market's primary restraints: the high cost and inconsistency of artisanal production. Furthermore, predictive maintenance AI can forecast potential equipment failure in the specialized kilns based on operational stress analysis, ensuring minimal unplanned downtime and maintaining the rigorous, scheduled production required for meeting high-demand periods in crucial export markets like North America.

From a commercial and strategic perspective, AI empowers market players with unparalleled insights into consumer behavior and regulatory compliance. Natural Language Processing (NLP) is being employed to systematically scrape and analyze global regulatory documents, internal quality reports, clinical study databases, and traditional medicinal texts to create robust, defensible scientific narratives for bamboo salt's complex health claims—crucial for navigating the complex and often prohibitive labeling requirements in highly regulated markets such as the European Union and the United States. On the consumer front, AI-driven demand forecasting models analyze data from social media trends, specific search queries (leveraging AEO insights related to alkaline diets and mineral deficiencies), and detailed past sales patterns to optimize inventory levels for different roast grades across various geographic regions. For example, anticipating a surge in alkaline diet popularity in European spring allows producers to proactively increase production of high-alkaline 9x variants, maximizing sales opportunities, minimizing the risk of stockouts, and ensuring that the traditionally lengthy production lead time does not impede market responsiveness to rapidly shifting consumer trends.

- Automated Quality Control: AI-powered sensors monitor roasting temperatures and duration, ensuring consistency across multi-stage processes (e.g., nine-times roasting), critical for achieving optimal mineral structure and purity, reducing reliance on subjective manual judgment and guaranteeing compliance with international purity standards.

- Predictive Demand Forecasting: Machine learning models analyze seasonal consumer health trends, regional dietary shifts, and e-commerce data to accurately predict demand for specific bamboo salt grades (e.g., 3x vs. 9x), optimizing production schedules and raw material procurement (bamboo, sea salt) to enhance supply chain resilience and reduce costly inventory holding times.

- Supply Chain Traceability: Blockchain integrated with AI enhances transparency, tracking the origin of sea salt and bamboo, verifying organic certifications, and ensuring ethical sourcing. This immutable data record provides enhanced consumer trust and strengthens premium product positioning in AEO searches globally, especially concerning sustainability and origin.

- Ingredient R&D Optimization: AI analyzes biochemical assays, mass spectrometry data, and traditional medicinal literature using NLP to rapidly identify specific mineral combinations or sulfur compounds in bamboo salt responsible for reported health benefits, accelerating the development of new, scientifically backed nutraceutical and pharmaceutical applications, thereby expanding market potential beyond traditional culinary use.

- Personalized Marketing and Education: AI tools segment consumers based on health profiles, purchase history, and dietary restrictions, delivering tailored educational content about bamboo salt’s alkaline properties and mineral benefits, thereby efficiently overcoming market unfamiliarity in Western countries and significantly enhancing conversion rates in niche, high-value health markets.

- Operational Efficiency: Robotics and AI vision systems are used for the precision task of packing raw salt into bamboo sections and monitoring the kiln loading process, standardizing raw material preparation, reducing manual labor costs, and improving worker safety during the hazardous high-heat operations inherent in the Jukyeom production process.

- Regulatory Compliance Assistance: AI scans and processes updates in global food safety and dietary supplement regulations (FDA, EFSA), alerting manufacturers to necessary proactive adjustments in labeling, formulation, or processing protocols to maintain market access and prevent costly regulatory non-compliance issues or product recalls.

DRO & Impact Forces Of Bamboo Salt Market

The market trajectory for Bamboo Salt is dictated by a critical balance of robust demand drivers, regulatory and operational restraints, and emerging market opportunities, all shaped by internal and external impact forces that influence profitability and scale. Primary demand drivers include the escalating global movement toward functional foods, particularly those offering verifiable health advantages, and the substantiated scientific evidence supporting bamboo salt's superior mineral profile and effectively lower net sodium index compared to generic table salt. Aggressive marketing campaigns leveraging the product's premium, traditional heritage status—often emphasizing the Korean cultural roots and artisanal quality—also strongly contribute to its market acceptance. These factors collectively push manufacturers to invest in standardized quality and scale production, appealing directly to the increasingly health-literate consumer segment willing to pay a premium for high-integrity nutritional products. The verified alkalinity of 9x roasted salt is a particularly strong driver in Western markets where the alkaline diet trend maintains high consumer interest, providing a strong platform for premium market positioning that is difficult for mass-produced commodity salts to replicate.

However, the inherent complexities of production present significant restraints that cap the market's potential for explosive volume growth. The high production cost associated with the multi-stage, labor-intensive, and energy-intensive roasting process, coupled with the extended lead times necessary for sourcing aged bamboo and performing the sequential roasting cycles, severely limits throughput and scalability, acting as a major financial barrier for new entrants and restricting price competitiveness. Furthermore, strong substitution competition from well-established, cheaper, and globally available specialized salts—such as Himalayan pink salt, Celtic sea salt, and various high-quality gourmet sea salts—dilutes market focus and forces bamboo salt to perpetually justify its significantly higher price point. Regulatory ambiguity in certain Western jurisdictions, where bamboo salt may not be classified conventionally and might be subject to 'novel food' assessments, necessitates lengthy and expensive clinical trials to validate specific health claims before broad consumer marketing, significantly slowing down commercialization outside of established Asian markets.

Opportunities reside predominantly in developing specialized, high-margin applications that capitalize on the unique chemical profile of Jukyeom. This includes expanding rapidly into the pharmaceutical sector by isolating and synthesizing beneficial sulfur compounds (which form during the roasting) for targeted therapeutic applications, thereby moving the product beyond basic supplementation into specialized medical ingredients. Furthermore, increasing adoption in high-end oral care formulations and specialized functional pet nutrition markets opens lucrative, less saturated niches that capitalize on the salt’s antimicrobial and mineralizing properties. Geographically, establishing robust distribution networks in untapped, high-growth regions like major urban hubs in emerging Asian markets (e.g., rapidly industrializing regions of China and India) and affluent areas in the GCC countries offers substantial long-term potential. Successful navigation and proactive engagement with international regulatory bodies, utilizing modern technology like AI-driven compliance checks and detailed scientific reporting, constitute a major opportunity for differentiated players to secure global market acceptance and transition the product from a niche Asian remedy to a globally recognized, high-value functional ingredient.

Segmentation Analysis

The Bamboo Salt market is comprehensively segmented based on its grade/roasting frequency, product form, application area, and distribution channel, providing a granular view of market dynamics and consumer preferences critical for strategic planning and resource allocation. The core differentiation lies intrinsically in the Grade/Roasting Frequency segment, where the complexity, labor, and time invested directly correlate with the price, purity, and alkalinity of the final product. The Nine-Times Roasted segment commands the highest premium and market valuation per unit mass, driven by its exceptional alkalinity, highest verified mineral concentration, and status as the traditional 'medicinal' variant, appealing predominantly to the high-value nutraceutical, institutional buyers, and health practitioners seeking maximum therapeutic effect. Conversely, the Three-Times and Five-Times Roasted segments serve as crucial volume drivers, offering a more economically palatable price point for everyday culinary seasoning, general health maintenance applications, and mass-market distribution, effectively broadening the consumer base beyond the highly specialized segments.

Segmentation by form—powder, granule, and crystal—directly reflects diverse end-user needs and industrial application requirements. The powder form is the single most dominant choice for B2B industrial manufacturers, highly favored for encapsulation in dietary supplements and for easy integration into liquid formulations or ready-to-use food products due to its superior dissolution rate and ability to ensure precise dosage consistency. Granules and crystals primarily serve the gourmet cooking and finishing salt market, appreciated for their textural integrity, visual appeal, and ease of use in cooking and tabletop dispensing. The application analysis confirms the market's multidisciplinary nature; while the Food and Beverages sector maintains the foundational market share due to traditional consumption and established culinary routines, the rapid expansion of the Pharmaceuticals and Nutraceuticals sector is the primary indicator of future value growth. This growth is directly spurred by increasing global health consciousness, consumer demand for natural supplements, and ongoing scientific research validating bamboo salt's efficacy in managing chronic inflammation and optimizing essential metabolic functions, thus cementing its transition into a recognized functional health ingredient.

The analysis of distribution channels highlights the strategic necessity of a flexible, multi-channel approach to maximize market reach and penetration efficiency. Online Retail, encompassing proprietary websites and major global e-commerce platforms, is increasingly important. This digital channel facilitates critical direct-to-consumer education, allows full control over brand messaging regarding authenticity and preparation methods, and enables efficient global shipping of high-margin, premium goods (particularly the 9x grade) to niche international markets. However, Offline Retail, encompassing specialty health food stores, large organic supermarkets, and established Asian grocery chains, remains vital for generating mainstream visibility, driving impulse purchases, and building consumer trust through physical product interaction and immediate availability. Successful market players strategically leverage online channels for detailed product education and high-grade sales, while using offline retail to capture volume sales of culinary-grade bamboo salt and maximize brand omnipresence, ensuring all product tiers are accessible to their respective target consumers.

- By Grade/Roasting Frequency:

- 3x Roasted (Entry-level, culinary focus, essential for volume market penetration)

- 5x Roasted (Mid-tier, general wellness applications, balanced price-to-purity ratio)

- 9x Roasted (Highest Purity, therapeutic and nutraceutical focus, commands maximum premium pricing)

- Other Roasting Frequencies (Customized blends or specialized research batches for specific industrial needs)

- By Form:

- Powder (Dominant form for encapsulation, dietary supplements, and large-scale industrial processing)

- Granules/Crystals (Culinary and finishing salt applications, valued for texture and visual presentation)

- Liquid (Brine Solutions for specialized cosmetic, oral care, or experimental clinical applications, focused on high purity)

- By Application:

- Food and Beverages (Culinary Use, Seasoning, Premium Food Manufacturing – Retains Largest Volume Share)

- Pharmaceuticals and Nutraceuticals (Supplements, Functional Ingredients, Alkaline Therapy – Highest Projected Growth CAGR)

- Cosmetics and Personal Care (Oral Care, Skincare, Spa Treatments – Key innovation and high-margin driver)

- Traditional Medicine (Core historical and cultural utilization in East Asia)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Direct-to-Consumer Websites – Strategic channel for premium grades and global reach)

- Offline Retail (Supermarkets, Hypermarkets, Specialty Health Stores – Critical for volume sales and mainstream visibility of culinary grades)

Value Chain Analysis For Bamboo Salt Market

The Value Chain of the Bamboo Salt Market is characterized by highly specialized, sequential steps, beginning with the meticulous sourcing of raw materials, followed by a demanding, knowledge-driven transformation process, and concluding with sophisticated, niche distribution channels. Upstream activities are critical and demand stringent quality control from the onset, involving the high-standard procurement of naturally evaporated, mineral-rich sea salt, typically sourced from pollution-free, protected tidal flats to ensure minimal initial contamination. Concurrently, the sustainable harvesting of mature bamboo stalks (usually a specific, aged species like 3-5 year old Moso bamboo) is mandatory, as the quality, density, and mineral structure of the bamboo directly influence the crucial infusion process during roasting. Quality assurance at this initial phase is non-negotiable, often involving third-party heavy metal testing of the raw salt and verification of the bamboo’s sustainable provenance. Ensuring environmentally friendly harvesting practices for bamboo is a rising imperative, driven by consumer demand for eco-friendly products, which strengthens the brand narrative and improves GEO positioning for searches related to sustainable functional foods.

The central manufacturing phase—the repeated roasting process—represents the highest value-addition and technical bottleneck in the entire chain. Midstream analysis focuses heavily on optimizing this transformation to ensure consistency across batches. Automation technologies, including precision temperature monitoring via AI-linked thermal sensors, integrated digital control panels, and standardized kiln loading systems, are crucial for achieving product uniformity, particularly in the nine-times roasting cycles which require extremely high heat (up to 1500°C) and perfect timing to achieve the characteristic purple hue, remove all impurities, and achieve the desired high alkalinity. This stage requires significant initial capital expenditure in high-heat engineering, specialized refractory materials, and continuous operational expertise. Downstream operations primarily focus on complex packaging, quality final inspections, and preparation for different application forms. Airtight, moisture-resistant packaging is essential to maintain the product's integrity, preserve the delicate sulfurous aroma, and protect the pH balance during extended storage and long-distance international shipping, ensuring compliance with global import standards.

Distribution is strategically managed through both direct and indirect routes to maximize market reach while preserving brand control and educational messaging. Direct distribution, often utilizing proprietary, AEO-optimized e-commerce platforms and localized flagship stores, allows manufacturers to directly control the educational narrative surrounding the product's benefits, authenticity, and traditional preparation method—vital for justifying the premium price point of high-roast variants to uninformed consumers. Indirect distribution relies on established B2B partnerships with specialized functional ingredient distributors, global pharmaceutical excipient suppliers, and major health food retailer chains. The chosen distribution channel is highly dependent on the target segment: mass-market culinary grades (3x) flow through conventional grocery supply chains, while premium therapeutic grades (9x) necessitate specialized, often temperature-controlled, logistics and detailed documentation required by pharmaceutical industry customers regarding purity and batch control. Maintaining transparency and regulatory compliance throughout the logistical journey is essential for navigating varied international import and food safety regulations, ensuring the product reaches end-users with its quality and provenance fully intact.

Bamboo Salt Market Potential Customers

The potential customer base for Bamboo Salt is exceptionally diverse, spanning sophisticated individual wellness advocates to large-scale international industrial ingredient users across multiple high-value sectors. Individual consumers, constituting the primary end-user market, can be effectively segmented into health optimization enthusiasts, who actively seek highly alkaline and mineral-rich products to complement detox regimes and preventative healthcare routines, often adhering to specific restrictive diets. A significant subset includes patients with dietary restrictions, particularly those monitoring sodium intake due to conditions like hypertension, who rely on bamboo salt for its lower actual sodium content per unit of salinity and its balancing mineral profile. Crucially, the Asian diaspora globally maintains strong cultural ties to Jukyeom, often serving as brand advocates and early adopters in new geographic markets, driving the initial demand and providing cultural legitimacy for the product in Western retail environments through word-of-mouth and cultural heritage validation.

On the commercial side, key B2B customers include the Nutraceutical and Dietary Supplement Industry, representing the fastest-growing application segment. These companies utilize high-purity, often nine-times roasted, bamboo salt powder as a functional excipient or active ingredient in capsules, tablets, and drink mixes targeting areas like pH balance, digestive support, and bone health. The purchasing criteria for this industrial segment are strictly driven by regulatory compliance, consistency in trace mineral composition, verifiable heavy metal clearance documentation, and the supplier's capacity for large-scale, consistently high-quality supply. Another high-growth commercial customer is the Cosmetics and Personal Care sector, particularly high-end oral hygiene brands and natural skincare formulators. These companies value bamboo salt for its natural sulfurous compounds, which exhibit antimicrobial properties, making it an ideal, clean-label ingredient for premium toothpaste, mouthwash, exfoliating body scrubs, and specialized mineral-rich facial treatments that align perfectly with the modern clean beauty and natural ingredient movements.

Additional institutional and commercial buyers include specialized Gourmet Food Importers and High-End Restaurant Chains seeking unique, authentic, and health-forward seasoning ingredients to differentiate their culinary offerings and catering to health-conscious diners. Furthermore, research institutions and specialized medical facilities focused on holistic or alternative medicine frequently purchase therapeutic grades of bamboo salt for in-house clinical studies, examining its potential anti-inflammatory and cellular repair properties, or for dispensing to patients undergoing specific dietary treatments. Targeting this multifaceted customer base necessitates highly segmented marketing strategies: relying heavily on scientific validation, peer-reviewed studies, and verifiable supply chain transparency for B2B industrial clients, while utilizing testimonials, cultural heritage narratives, and digital influence for direct-to-consumer individual buyers, thereby maximizing effective market penetration across all points of the value chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Insan Bamboo Salt, Jayeonwon, Bongan Village, Goun Salt, Chung-jungwon, Samdong, K-Salt, Sun & Earth Natural Health, Healing Earth Naturals, Woongjin Foods, Dongwon F&B, Pure Life Salt, Saltworks, Inc., Taekyung Farm, Hansalim, Global Salt Co., Ltd., Samyang Corporation, Korean Bamboo Salt Co., Hanwoori Co., Ltd., Nature's Reserve, Cheongsu Bamboo Salt, Seoul Global Food, CJ CheilJedang, Daesang Corporation, Salt King International, Green Salt Producers, Premium Health Inc., Gyeongbuk Bamboo Salt. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bamboo Salt Market Key Technology Landscape

The technology landscape in the Bamboo Salt Market is a crucial intersection point between preserving ancient, labor-intensive craft and implementing modern industrial standardization techniques to ensure scalability and regulatory compliance. The primary technological focus is on optimizing the high-temperature kilning process, which is the core value-adding step where the sea salt transforms chemically. Modern, large-scale facilities now primarily employ sophisticated electric or gas-fired kilns constructed with specialized ceramic and refractory materials capable of uniformly withstanding extreme and sustained temperatures (up to 1500°C). These modern systems are absolutely essential for achieving product consistency, incorporating advanced thermal sensors, integrated digital control panels, and automated ventilation systems. These technologies ensure precise temperature curve adherence throughout the multi-cycle roasting process, reducing human variability and guaranteeing the consistent alkaline pH level and chemical purity required for pharmaceutical-grade bamboo salt, thereby overcoming a major limitation associated with traditional, manually operated kilns.

Beyond the demanding roasting process, the technological landscape includes sophisticated processing and quality assurance tools critical for international market acceptance and utilization in various product forms. Post-roasting, the product must be efficiently crushed and prepared. High-precision micronization and grinding technologies are employed to achieve the ultra-fine powder required by nutraceutical manufacturers for encapsulation, ensuring optimal particle size distribution and superior dissolution rates necessary for bioavailability. For quality verification, instrumental analysis technologies such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS) and Atomic Absorption Spectroscopy (AAS) are extensively utilized. These instruments provide definitive, quantitative data on the trace mineral composition (potassium, calcium, magnesium) and, critically, confirm the removal or absence of heavy metal contamination (like lead and cadmium), thereby satisfying the rigorous international food safety standards (e.g., EU and FDA requirements). This significant investment in verifiable scientific data is paramount to supporting premium pricing and building global trust among institutional buyers.

Information technology plays an increasingly pivotal role in supply chain management, operational efficiency, and consumer transparency. The implementation of sophisticated Enterprise Resource Planning (ERP) systems is now standard practice for managing the complex, time-consuming raw material scheduling (bamboo aging, sequential roasting cycles) and accurately tracking batch progression through the multi-stage transformation process. Crucially, blockchain technology is rapidly emerging as a competitive necessity, providing immutable traceability records that link the final packaged product back to the specific raw sea salt origin and roasting batch details. Furthermore, the integration of AI-driven robotics in handling the heavy, repetitive tasks of sealing and moving the hot bamboo salt tubes between kilns improves operational throughput, minimizes the risk of human contamination or error, and significantly enhances worker safety in a high-heat environment. These technological applications collectively enable the traditional craft of bamboo salt production to scale efficiently, meet robust global demand, and consistently maintain the stringent quality requirements expected by high-value industrial and health-conscious consumer segments worldwide, ensuring long-term market credibility and growth.

Regional Highlights

The global Bamboo Salt market displays significant regional disparities, heavily influenced by deep cultural history, varying consumer income levels, and heterogeneous regulatory environments concerning traditional medicine and specialized functional foods. Asia Pacific (APAC) currently dominates the market landscape, with South Korea serving as the undisputed global center for production, technological innovation, consumption, and major export activities. The market's foundation rests on centuries of historical and cultural acceptance of Jukyeom as a traditional health remedy and essential seasoning, ensuring a deep, resilient domestic consumer base. Manufacturers in South Korea benefit from mature, specialized local supply chains for high-quality sea salt and specific bamboo species, alongside a favorable governmental and societal environment that actively promotes traditional Korean health products (K-Health) globally, leveraging soft power to facilitate export. Beyond South Korea, countries like Japan and Taiwan represent mature, high-value markets where bamboo salt is expertly integrated into specialized health food and high-end personal care product lines. China, with its vast and rapidly expanding affluent consumer class seeking premium health supplements and traditional medicinal ingredients, represents a major future volume and revenue driver within the APAC region, though competition from local, sometimes lower-quality, salt alternatives remains intense, requiring strong branding and certification.

North America represents the most dynamic and highest potential growth region outside of Asia, characterized by a highly engaged health and wellness consumer demographic and significantly high disposable incomes allocated to preventative care products. Market penetration here is primarily driven by the dietary supplement sector, where bamboo salt is successfully marketed as a premium alkaline mineral source and a natural detoxification aid, appealing strongly to the widespread clean eating, keto, and alkaline diet communities. The growth acceleration is facilitated by specialized e-commerce platforms, extensive digital marketing, and influential wellness bloggers who advocate for ethnically sourced, traditional ingredients. However, manufacturers must navigate challenges related to product education for consumers unfamiliar with the product and the rigorous regulatory framework of the FDA regarding structure-function claims, necessitating significant investment in scientific substantiation and meticulous labeling. Success in the highly competitive U.S. market often hinges on targeting niche demographics first, such as high-end organic grocers and practitioners of functional medicine, before attempting broader retail penetration, maximizing the impact of AEO-optimized content regarding its mineral superiority and traditional provenance.

Europe mirrors many of the premium health trends seen in North America but operates under stricter unified regulatory oversight, particularly from the European Food Safety Authority (EFSA), which often classifies Jukyeom as a novel food requiring extensive safety and benefit documentation before broad market authorization. Despite these stringent regulatory hurdles, key Western European markets—Germany, the UK, and France—are significant consumers, particularly within the cosmetics and personal care sector where bamboo salt is highly valued for its clean label status and mineral richness in premium skincare and oral care formulations, leveraging consumer preference for natural ingredients. The Middle East and Africa (MEA) and Latin America (LATAM) markets are currently nascent but evolving, with adoption concentrated in high-income urban centers, driven largely by luxury food importers and specialized beauty retailers catering to affluent demographics. Growth in these emerging regions is dependent on overcoming logistical complexities, establishing reliable supply chains, and conducting focused localized consumer education tailored to overcome unfamiliarity with the traditional Korean preparation method, offering long-term opportunities for substantial, albeit premium-focused, market share capture.

- Asia Pacific (APAC): Dominant market, centered in South Korea (production, export, consumption). Strong cultural affinity provides inherent market stability. Emerging rapid growth in major economies like China and India driven by rising middle-class interest in traditional functional ingredients and increased spending on preventative health solutions.

- North America: Highest projected CAGR outside of APAC due to high consumer spending on functional ingredients and the strong influence of alkaline diet trends. Market strategy focuses intensely on supplements, e-commerce direct sales, and clinical validation to establish a credible premium positioning and achieve AEO superiority.

- Europe: Key growth driven by the Cosmetics and Personal Care industry, capitalizing on the natural and mineral content for premium skincare formulations. Regulatory compliance (EFSA approval) is the primary hurdle; market access strongly favors companies that provide extensive safety and purity documentation validated by AI-driven analysis.

- Latin America (LATAM) & Middle East and Africa (MEA): Nascent markets relying heavily on high-end imports and specialty retail channels in wealthy urban centers. Growth is concentrated in metropolitan areas (e.g., Dubai, São Paulo) and requires targeted, luxury branding focused on the exotic wellness positioning of highly purified bamboo salt variants.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bamboo Salt Market.- Insan Bamboo Salt

- Jayeonwon

- Bongan Village

- Goun Salt

- Chung-jungwon

- Samdong

- K-Salt

- Sun & Earth Natural Health

- Healing Earth Naturals

- Woongjin Foods

- Dongwon F&B

- Pure Life Salt

- Saltworks, Inc.

- Taekyung Farm

- Hansalim

- Global Salt Co., Ltd.

- Samyang Corporation

- Korean Bamboo Salt Co.

- Hanwoori Co., Ltd.

- Nature's Reserve

- Cheongsu Bamboo Salt

- Seoul Global Food

- CJ CheilJedang

- Daesang Corporation

- Salt King International

- Green Salt Producers

- Premium Health Inc.

- Gyeongbuk Bamboo Salt

- Natural Mineral Products

- Wellbeing Essence Co.

- Bio-Alkaline Salt Group

Frequently Asked Questions

Analyze common user questions about the Bamboo Salt market and generate a concise list of summarized FAQs reflecting key topics and concerns.What makes Bamboo Salt different from traditional sea salt, and how does its production process affect its alkalinity?

Bamboo salt, or Jukyeom, is fundamentally different due to its unique high-heat roasting process, often repeated nine times, which involves packing high-mineral sea salt into bamboo trunks and sealing the ends with yellow clay. This intense heat removes impurities, infuses essential minerals from the bamboo, and most importantly, elevates the pH level significantly, making it highly alkaline (typically pH 9-12), unlike neutral or slightly acidic conventional salts. The high alkalinity is highly sought after for its purported benefits in balancing the body's pH, justifying its premium pricing in functional food markets globally.

Which application segment holds the largest share of the Bamboo Salt Market, and what is the fastest-growing application?

The Food and Beverages segment currently holds the largest market share by volume, driven by its traditional and ongoing use as a premium, mineral-rich seasoning in Asian and gourmet cuisine. However, the Pharmaceuticals and Nutraceuticals segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by increasing scientific validation of its functional properties, such as mineral bioavailability and anti-inflammatory potential, driving its rapid adoption in therapeutic supplement manufacturing globally.

What are the primary challenges limiting the widespread adoption and mass market growth of Bamboo Salt?

The main challenge restricting mass market growth is the exceptionally high production cost and complexity associated with the multi-stage, high-temperature roasting process (especially for 9x salt), which leads to premium pricing far exceeding conventional salt. Additionally, ensuring consistent quality across varied traditional production batches and overcoming complex international regulatory hurdles regarding specific functional food claims in non-Asian markets remain significant restraints for widespread consumer acceptance and distribution scalability.

How does AI technology influence the quality control and traceability of 9x Roasted Bamboo Salt?

AI technology significantly improves the quality and credibility of 9x roasted bamboo salt by implementing automated monitoring systems, such as thermal sensors and machine vision, for consistent kilning temperatures, ensuring consistent purity and mineral structure across every batch. Integrating AI with blockchain further enhances supply chain traceability, providing verifiable, immutable data on the source of the sea salt and bamboo, thereby assuring B2B partners and consumers of authenticity and premium quality, which is vital for maintaining market trust and command of high margins.

Which regional market is expected to demonstrate the highest growth rate for Bamboo Salt, and what drives this acceleration?

North America is anticipated to demonstrate the highest growth rate (CAGR) outside of the originating Asia Pacific region. This acceleration is primarily driven by the robust market demand for specialized functional ingredients, high consumer awareness regarding preventative health and alkaline diets, substantial disposable income allocated to premium health supplements, and targeted digital marketing efforts that leverage the traditional heritage and superior mineral profile of bamboo salt, maximizing its presence in the highly lucrative health and wellness sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager