Banana and Tip Connectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432176 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Banana and Tip Connectors Market Size

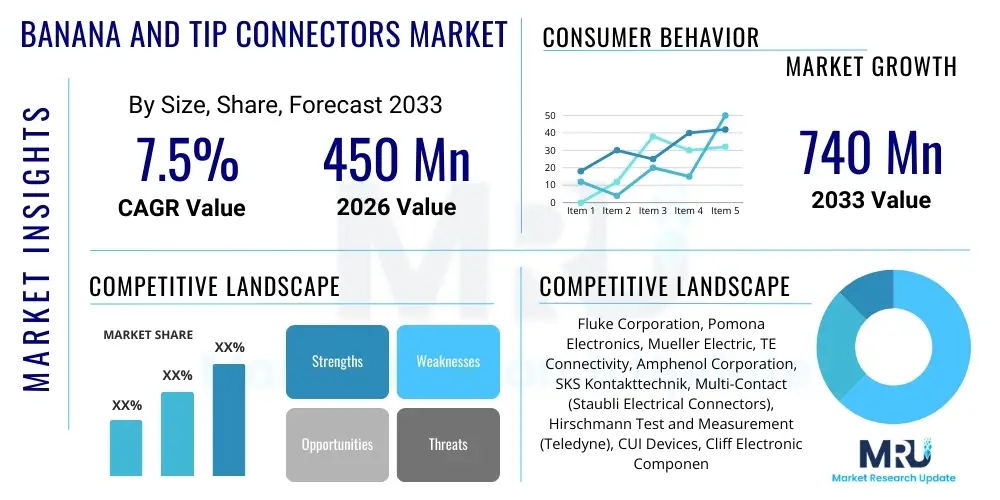

The Banana and Tip Connectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 740 Million by the end of the forecast period in 2033. This growth trajectory is underpinned by the consistent demand emanating from global electronics R&D investments and stringent regulatory requirements mandating the use of certified, high-safety testing components across critical industrial sectors.

Banana and Tip Connectors Market introduction

Banana and tip connectors represent foundational elements within the architecture of electrical and electronic testing, providing robust, temporary, and highly reliable interfaces essential for precise measurement, power delivery, and signal transmission during diagnostic procedures. These connectors are instrumental in establishing contact between testing apparatus—such as multimeters, oscilloscopes, and power supplies—and the circuits or devices under test (DUTs). Their design integrity is paramount, characterized by the mechanical functionality of the banana plug's spring-loaded leaf or crown system, which ensures maximal surface contact area within a corresponding jack, thereby minimizing contact resistance and thermal accumulation, crucial parameters for maintaining measurement accuracy, particularly in high-current applications. The market's stability is directly attributable to the standardized 4mm format, globally accepted for laboratory and industrial applications, providing universal interoperability across diverse equipment portfolios. Manufacturers continually invest in material science to enhance the longevity and safety profile of these core components, focusing on highly durable insulation materials and non-corrosive contact platings to meet advanced performance requirements.

The operational benefits derived from using certified banana and tip connectors are multifaceted, extending beyond mere electrical conductivity to encompass critical safety and efficiency advantages. The widespread adoption of fully insulated, shrouded, and stackable connectors facilitates complex circuit probing and allows for parallel measurements without compromising safety standards, mitigating the risk of accidental shorting or shock in crowded lab environments. Key driving factors sustaining market vitality include the accelerated global rollout of 5G infrastructure, necessitating expansive testing of network hardware and components; the mandatory compliance with stringent international electrical safety standards, which forces periodic upgrades of legacy, uninsulated equipment; and the rapid global expansion of the Electric Vehicle (EV) industry, requiring specialized high-amperage connectors for reliable battery management system (BMS) testing and charging infrastructure diagnostics. This confluence of technological advancement and regulatory enforcement ensures a sustained and premium demand for high-quality connectivity solutions.

Furthermore, the utility of these connectors spans across various specialized sub-sectors, including medical device calibration, avionics maintenance, and highly automated industrial quality control processes. For example, in medical electronics, tip connectors are often utilized for low-voltage, high-precision signal testing where measurement repeatability is non-negotiable. The enduring standardization of the interface, despite rapid digitalization of test equipment interfaces (e.g., adoption of PXI and LXI standards), confirms their persistent role as the essential physical boundary layer for electrical interaction. The longevity of the banana and tip connector market is secured by its simple, effective, and inherently flexible design, which remains indispensable for manual troubleshooting and field diagnostics, activities that cannot be fully digitized or automated, cementing their foundational status in electrical engineering practices worldwide, ensuring continuous demand across maintenance, repair, and operational activities globally.

Banana and Tip Connectors Market Executive Summary

The Banana and Tip Connectors Market Executive Summary reveals a dynamic yet structurally robust environment where growth is highly correlated with capital expenditure in high-tech manufacturing and infrastructure development, particularly within emerging Asian economies. Current business trends indicate a strong competitive emphasis on vertical integration, allowing key manufacturers to control the quality of raw materials, ensuring compliance with extremely low-resistance specifications required for precision instrumentation. Strategic partnerships between connector suppliers and Tier 1 test equipment OEMs are becoming crucial, focusing on co-developing integrated, pre-certified test lead assemblies that minimize risk and enhance system performance out of the box. A notable strategic shift involves manufacturers leveraging modular design principles to offer highly configurable connector systems, enabling quick customization for specialized industrial monitoring applications and catering to niche markets such as high-altitude aerospace testing or extreme temperature environments, thereby maximizing product versatility and market reach.

Regional dynamics clearly delineate the market into high-growth volume markets (APAC) and high-value compliance markets (North America and Europe). In APAC, especially within Southeast Asian nations and Greater China, the market expansion is fueled by unprecedented growth in consumer electronics production, massive government investment in utility-scale power grids, and the localization of advanced manufacturing facilities, driving demand for cost-effective, high-volume components. Conversely, European markets exhibit stable, quality-driven demand, heavily influenced by the adoption of industry-specific regulations, such as those governing the automotive sector (e.g., VDA standards), which prioritize connectors with specialized chemical resistance and extended vibration tolerance, demanding meticulous material certification and supply chain transparency. The regional disparity necessitates differentiated market entry and pricing strategies for global manufacturers to capture both volume and value segments efficiently, often requiring localized manufacturing hubs in high-growth regions.

Analysis of segment trends highlights the increasing dominance of the Insulated/Shrouded segment, a trend universally observed across all major geographies due to global regulatory convergence towards enhanced electrical safety. From an application perspective, the Automotive & Transportation sector exhibits accelerated growth rates, driven by the shift towards 800V and higher power architectures in EVs, which mandates ultra-reliable, high-current connectors often incorporating advanced insulation materials like PFA or ETFE for superior heat dissipation and dielectric strength. Furthermore, the segmentation by termination method shows a growing preference for crimp-type and screw-set connections over traditional solder connections in industrial settings, favoring rapid field installation, maintenance flexibility, and mechanical robustness against repeated stress. These segmentation movements reflect a market maturity where customization and enhanced safety features are increasingly becoming non-negotiable competitive differentiators, shifting the purchasing criteria beyond mere cost considerations to total lifetime value, risk mitigation, and verifiable compliance.

AI Impact Analysis on Banana and Tip Connectors Market

User queries regarding AI's influence frequently explore the longevity of manual testing methods, the necessity for 'smarter' connectors, and how AI-driven analytics impact component replacement decisions. These questions reflect an underlying concern about the future relevance of standardized physical interfaces in an increasingly software-defined testing landscape. The central analytical conclusion is that while AI does not physically replace the connector, it fundamentally elevates the performance requirements demanded from it. AI-driven test platforms, utilized in areas like semiconductor burn-in testing or complex system integration, rely on acquiring vast amounts of precise, low-noise data in rapid succession. This requirement translates directly into the need for connectors offering superior consistency in contact resistance, enhanced shielding against electromagnetic interference (EMI), and maximum reliability over extended cycle counts, ensuring that the data integrity feeding the AI algorithm is impeccable and free from physical connection artifacts, thereby driving demand for premium product lines.

The most immediate and substantial influence of Artificial Intelligence lies in optimizing the utilization and maintenance of the equipment to which these connectors are attached. For instance, AI algorithms applied to Continuous Monitoring Systems (CMS) in critical infrastructure can analyze minute fluctuations in resistance or temperature measured through the banana connection point. By recognizing these subtle degradation signatures, the AI system can predict imminent connector failure or test lead wear, triggering a proactive replacement order. This shift from reactive to predictive maintenance stabilizes demand for replacement components and reduces costly downtime significantly, creating a specialized market for high-durability, traceable connectors that can reliably operate within the monitoring ecosystem. This proactive management, guided by AI, necessitates higher quality assurance standards from manufacturers and improved meta-data collection capabilities from the test setup itself.

Furthermore, AI is instrumental in increasing the complexity and speed of automated test sequences, pushing the physical limits of connector design. In high-throughput manufacturing quality assurance, connectors are subjected to continuous mating and unmating cycles. AI-optimized robotic handling minimizes physical wear, but the intrinsic connector design must accommodate thousands, if not tens of thousands, of cycles without degradation. Consequently, market innovation is focused on advanced metallurgical treatments and high-performance housing materials to survive these AI-driven testing regimes. The long-term expectation is the development of ‘smart connectors’—perhaps featuring integrated micro-transponders or passive NFC tags—which allow the AI system to instantaneously confirm the connector type, calibration status, and usage history, thereby enhancing the auditability and reliability of the automated testing process, moving the connector from a simple passive component to an integrated data-providing asset within the Industrial IoT framework, providing usage metrics and aiding inventory management.

- AI systems require ultra-low resistance and noise-free data streams, compelling a shift toward premium gold-plated, high-integrity connectors for complex measurements.

- Integration of AI in predictive maintenance increases the average lifespan but stabilizes replacement demand by eliminating unexpected failures and managing lifecycle planning precisely.

- Automation driven by AI necessitates connectors designed for extreme mechanical durability and high mating cycle counts, especially in robotic test fixtures.

- The increased volume and velocity of testing data processed by AI highlight the need for enhanced Electromagnetic Compatibility (EMC) in connector design to ensure data fidelity.

- Future product evolution includes embedded identification tags (RFID/NFC) within connectors to provide real-time status and usage data for AI-powered equipment management systems, facilitating better asset utilization.

DRO & Impact Forces Of Banana and Tip Connectors Market

The market trajectory for Banana and Tip Connectors is powerfully shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). A primary driver is the pervasive and non-negotiable regulatory environment centered around electrical safety, encapsulated by global standards such as IEC 61010. This regulation fundamentally reshapes the market by mandating the retirement of older, uninsulated components and ensuring robust demand for compliant, shrouded, and CAT III/IV-rated connectors, driving high-margin replacement cycles across established industrial economies. Concurrent with safety mandates, the substantial global proliferation of high-voltage systems—particularly in EV charging networks, renewable energy farms, and high-density industrial control panels—escalates the need for specialized, highly insulated, and durable connectors capable of safely handling elevated power levels, thus expanding the high-end segment of the market significantly, reflecting structural changes in power consumption and distribution.

However, the market faces significant restraints that necessitate proactive manufacturer management. The most pronounced is the endemic issue of low-cost, substandard counterfeit connectors originating from unregulated sources, particularly impacting market share in developing regions. These illicit products compromise electrical safety, erode customer confidence in non-branded components, and exert downward pressure on legitimate manufacturer pricing, especially in commodity segments, threatening safety compliance across the industrial base. Furthermore, technological displacement, though slow, poses a long-term restraint, as high-end digital communication and high-speed data acquisition sometimes bypass traditional analog probing interfaces in favor of specialized digital bus probes or proprietary interconnect solutions in closed testing systems. This requires continuous product innovation to ensure the conventional banana interface retains its relevance through enhanced performance characteristics like high frequency response or specialized material resilience against environmental factors.

Opportunities for strategic growth are abundant, primarily revolving around technological differentiation and expansion into underserved vertical markets. The convergence of industrial processes with the Internet of Things (IIoT) creates a burgeoning need for modular, field-deployable testing apparatus, opening opportunities for weatherproof, ruggedized connector solutions designed for remote monitoring and diagnostics, requiring enhanced ingress protection (IP ratings). Additionally, the development and commercialization of new energy storage technologies, beyond current lithium-ion chemistries, demands specialized testing connectors capable of handling unique chemical and temperature profiles, enabling early market capture in emerging energy segments. Finally, leveraging advanced manufacturing techniques like precision 3D printing for specialized insulation housings can allow manufacturers to rapidly prototype and deliver highly customized solutions tailored for niche scientific research and specialized defense applications, cementing the market’s defensive growth strategy against digital substitution while ensuring adaptability to cutting-edge technical requirements.

Segmentation Analysis

The segmentation of the Banana and Tip Connectors Market provides a detailed structural framework vital for understanding consumer purchasing behavior and application-specific requirements across disparate industrial and academic environments. Market analysis relies heavily on differentiating products based on their intrinsic safety features, which directly correspond to the application's risk profile. The primary segmentation by insulation type (shrouded vs. uninsulated) dictates suitability for professional versus educational use, with the former rapidly gaining mandated global predominance. Further categorization by current rating (low, medium, high) allows manufacturers to target applications ranging from delicate electronic signal monitoring (milliamps) to heavy-duty power distribution diagnostics (hundreds of amps), requiring fundamentally different contact materials, spring mechanisms, and housing architectures. This granular segmentation enables precise forecasting and targeted product development aligned with end-user safety and performance needs, ensuring optimal product-market fit.

Segmentation by end-user application is arguably the most strategically important, revealing which sectors are driving volume and which are generating high-value demand. The Test and Measurement (T&M) segment remains the largest volume consumer, dictated by the baseline requirement for instruments like DMMs and signal generators across all technical fields. However, the Automotive and Industrial Automation segments exhibit the highest growth elasticity, tied to technological revolutions such as the shift to autonomous driving and high-speed manufacturing processes. These applications impose severe performance constraints related to vibration, temperature cycling, and chemical exposure, spurring demand for high-specification, custom-engineered connectors featuring superior sealing and locking mechanisms that surpass standard requirements, thereby commanding premium pricing and higher margins for specialty manufacturers who can provide certified, robust solutions.

- By Product Type:

- Standard Banana Plugs (4mm, non-stackable)

- Tip Jacks and Receptacles (Panel Mount, PCB Mount)

- Stacking and Patching Plugs (Side-Stacking, End-Stacking)

- Binding Posts and Turrets (Screw Terminal Integration)

- Miniature and Micro Plugs (2mm, 1mm variations for fine pitch testing)

- Retractable Shroud Plugs (CAT III/IV compliant)

- In-line Jacks and Adapters

- By Current Rating:

- Low Current (1A - 10A, general electronics)

- Medium Current (10A - 30A, bench testing equipment)

- High Current (30A - 500A+, specialized power applications, EV testing, energy storage)

- By Termination Method:

- Solder Type (Permanent fixture, high signal integrity focus)

- Crimp Type (Robust mechanical connection, industrial application, field assembly)

- Screw/Set-Screw Type (Field serviceable, maintenance-friendly)

- Quick-Connect/Insulation Displacement Connectors (IDC) for harnesses

- By Insulation Type:

- Fully Insulated/Shrouded Connectors (Safety critical, industrial standard)

- Partially Insulated Connectors (Binding posts, sometimes used in low CAT environments)

- Uninsulated Connectors (Educational/low-voltage use only, legacy equipment)

- High Dielectric Strength Insulators (PTFE, Silicone, PFA for extreme conditions)

- By End-User Application:

- Test and Measurement (T&M) Instruments (General Lab Use, Oscilloscopes, DMMs)

- Automotive and Transportation (High-Voltage EV Diagnostics, On-Board Testing)

- Telecommunications and Networking (5G Base Station Testing, Cable Diagnostics)

- Industrial Automation and Control (PLC Interfaces, Sensor Probing)

- Education and Research Laboratories (Physics, Electrical Engineering Training)

- Power Generation and Distribution (Grid Analysis, Solar/Wind Farms Maintenance)

- Medical Devices and Diagnostics (Calibration and Maintenance of Patient Monitoring Systems)

- Aerospace and Defense (Specific MIL-Spec Compliance and Avionics Testing)

- By Material Plating:

- Nickel Plated (Standard durability and cost-effectiveness)

- Gold Plated (Optimal conductivity, corrosion resistance, high fidelity signal preservation)

- Tin Plated (Cost-effective alternative, suitable for higher current applications)

- Rhodium/Palladium Plated (Ultra-high reliability, specialized scientific applications)

Value Chain Analysis For Banana and Tip Connectors Market

The value chain of the Banana and Tip Connectors Market is structured around the transformation of highly specified metals and polymers into precision engineered electrical components, culminating in complex distribution to global end-users. Upstream activities are critical, centering on the sourcing of high-purity copper, brass alloys (often free-machining brass for efficiency), and specialized conductive spring materials (like Beryllium Copper, known for its fatigue resistance). Manufacturers must maintain rigorous material certifications (e.g., ISO 9001, conflict minerals compliance) and leverage sophisticated computer numerical control (CNC) machining and injection molding techniques to achieve the precise dimensional tolerances required for consistent electrical contact and reliable spring action. Controlling material inputs and achieving scale in plating operations—whether high-volume nickel or demanding low-thickness gold plating—are key upstream competitive advantages that dictate overall product cost and performance ceiling, requiring deep supplier relationships and material hedging strategies to mitigate commodity price volatility.

The midstream focus involves assembly, where the metallic conductors are encapsulated by insulating housings, followed by stringent multi-level Quality Assurance (QA). This phase includes dielectric withstand testing, insertion/withdrawal force validation, and contact resistance measurement over a specified cycle count, ensuring the final assembly meets the designated CAT ratings and global safety standards (UL/CE). Distribution forms the bridge to the downstream market, utilizing a dual channel approach. Direct sales are managed through manufacturer field sales teams, primarily targeting major OEMs like Keysight, Tektronix, and Fluke, where bespoke orders, technical consultation, and large volume contracts govern the relationship. These direct relationships require robust technical support, including failure analysis and customization services, but offer higher transactional efficiency and predictable revenue streams derived from multi-year contracts and standardized product specifications integrated into the OEM's test equipment.

The indirect channel, comprising global and regional distributors (e.g., specialized electronics distributors, catalog houses, and e-commerce platforms), serves the massive MRO, small R&D lab, and educational segments. This channel thrives on efficient inventory management, rapid fulfillment, and the ability to stock a comprehensive range of non-standard and legacy components. The proliferation of specialized B2B e-commerce platforms has significantly boosted the indirect channel’s reach, enabling smaller manufacturers to compete globally, albeit intensifying price transparency and competition. Downstream market performance is critically dependent on product reliability and perceived brand reputation, particularly in high-risk applications where connector failure can lead to catastrophic equipment damage or personnel injury, thereby reinforcing the market's preference for established, certified brands over generic alternatives, despite higher price points, leading to a strong brand loyalty element within the purchasing decision criteria.

Banana and Tip Connectors Market Potential Customers

The market for Banana and Tip Connectors is sustained by four distinct categories of potential customers, each possessing unique purchasing drivers and volume requirements. The largest foundational customer base consists of industrial and power utilities, encompassing electrical contractors, regional power grid operators, and large manufacturing facilities requiring continuous monitoring and troubleshooting of complex machinery and distribution panels. These customers prioritize connectors with high durability, superior resistance to industrial solvents or harsh environments, and stringent CAT IV compliance for safety when working on primary power lines and heavy equipment. Their procurement is highly formalized, frequently involving bulk purchases through dedicated industrial supply distributors to meet the MRO needs of vast operational footprints and minimize supply chain disruptions during critical maintenance windows.

A second critical segment comprises specialized high-technology manufacturers, particularly those in the Aerospace and Defense (A&D) and high-density semiconductor fabrication sectors. These customers require extremely specialized, often miniaturized or custom-designed tip connectors that adhere to rigorous military (MIL-SPEC) or aerospace quality standards. Their demands center not on volume, but on ultra-low tolerance, high signal integrity, exceptional reliability under extreme operational conditions (vibration, temperature cycling), and complete material traceability documentation. Purchasing decisions in this segment are dominated by technical specification compliance and vendor qualification, making them a high-margin, technically demanding customer base requiring collaborative engineering support from the connector manufacturer throughout the design and testing phases.

The third customer category includes independent electrical technicians, small repair shops, and hobbyists. These end-users, while buying in smaller individual quantities, collectively form a significant volume of indirect demand, typically satisfied through local retail outlets and major online electronics component marketplaces. Price sensitivity is higher in this segment, but the requirement for functional reliability remains essential for professional reputation. Lastly, academic and governmental research institutions represent a stable, institutional customer base. These organizations often require durable, standard 4mm banana plugs for general laboratory instruction and complex research setups. Their purchasing cycles are tied to fiscal year budgets and often favor bulk contracts through educational procurement channels, balancing cost-effectiveness with the need for reliable equipment that can withstand heavy student use over many years, often prioritizing educational bundles and robust, color-coded product lines for ease of teaching and demonstration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 740 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fluke Corporation, Pomona Electronics, Mueller Electric, TE Connectivity, Amphenol Corporation, SKS Kontakttechnik, Multi-Contact (Staubli Electrical Connectors), Hirschmann Test and Measurement (Teledyne), CUI Devices, Cliff Electronic Components, Cal Test Electronics, E-Z-Hook, Binder GmbH, ITT Cannon, Neutrik AG, Samtec, LEMO SA, HARTING Technology Group, Switchcraft Inc., RS Pro (Electrocomponents), Weidmüller Interface GmbH & Co. KG, Phoenix Contact. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Banana and Tip Connectors Market Key Technology Landscape

The technological landscape supporting the Banana and Tip Connectors Market is characterized by incremental innovation primarily focused on optimizing physical properties to meet demanding performance and safety criteria. Core advancements center on the metallurgical formulation of the contact elements. Modern high-reliability connectors utilize specialized spring mechanisms, often constructed from heat-treated Beryllium Copper or Phosphor Bronze, which maintain optimal spring force and electrical contact integrity across thousands of mating cycles, crucial for long-term reliability in automated test systems. Furthermore, manufacturers employ sophisticated, multi-layer plating processes—such as Nickel underlayers followed by Gold plating—to maximize surface conductivity and corrosion resistance, ensuring minimal signal degradation when testing sensitive microelectronics or high-frequency circuits where resistance stability is paramount for accurate measurement and compliance with advanced metrology standards, pushing the technological envelope for low-impedance connections.

A significant technological driver is the ongoing evolution of insulation and safety mechanisms. The shift from basic PVC sheathing to advanced thermoplastic elastomers and high-performance engineering plastics like PTFE (Polytetrafluoroethylene) or PFA (Perfluoroalkoxy) provides superior resistance to extreme temperatures, UV exposure, and harsh chemical solvents commonly found in industrial maintenance environments. The pinnacle of safety technology is the integrated retractable shroud mechanism, an engineering solution that requires precision molding and robust internal spring components to ensure the shroud reliably covers the conductive tip unless fully engaged in a female jack compliant with IEC 61010. This complex mechanical design is a substantial technological barrier, separating commodity connector manufacturers from high-end safety-certified vendors, ensuring that the market continuously moves towards enhanced operational safety across all high-voltage applications and contributing significantly to the premiumization of certified test leads.

Current R&D is also focused on enhancing connector durability and user-friendliness through modular design principles. This includes developing high-flexibility silicone cable jackets that resist kinking and cracking under repeated handling, extending the lifespan of test leads. Moreover, in specialized applications such as high-current battery testing (above 100A), technological solutions involve robust ventilation features or optimized contact geometry (e.g., lamella or multi-contact systems) to efficiently manage and dissipate heat generated by resistance, preventing thermal runaway and ensuring measurement stability under sustained load. The adoption of laser etching, integrated resistance identification, and sophisticated color-coding systems for rapid identification and polarization confirmation further reflects the market’s commitment to combining robust engineering with practical, error-reducing operational features, ultimately leveraging precision manufacturing to reinforce the fundamental reliability of these essential interfaces in the era of high-speed automation and high-power electronics, including the incorporation of features that support digital auditing and calibration tracking.

Regional Highlights

Regional consumption patterns in the Banana and Tip Connectors Market are highly stratified, reflecting global industrial concentration and regulatory maturity. Asia Pacific (APAC) stands as the undisputed epicenter of both supply and burgeoning demand, heavily influencing global market volume. The region benefits from enormous capital investment flowing into 5G network build-outs, the rapid establishment of Giga-factories for EV battery production, and unparalleled scale in consumer electronics assembly, particularly in Tier 1 and Tier 2 cities in China, Vietnam, and India. The demand in APAC is characterized by a strong mix of high-volume, cost-competitive standard products for educational and small industrial use, coupled with specialized, high-performance connectors required by advanced semiconductor testing facilities and OEM assembly lines, driving the highest regional CAGR globally and continually setting new benchmarks for production capacity and cost efficiency.

North America and Europe, while growing at a more moderate pace, command a premium market valuation due to their intense focus on safety, quality certification, and niche technical requirements. In North America, the market is sustained by stringent industry regulations in aerospace, military, and oil & gas sectors, requiring connectors with specific material compliance, extreme temperature performance, and long-term warranties, often necessitating vendor certification to MIL-SPEC standards. European demand is fundamentally shaped by the EU’s comprehensive safety and environmental directives (e.g., REACH, RoHS, mandatory CE marking), which drives continuous replacement and upgrade cycles for certified, high-quality, and often domestically manufactured products. These regions demonstrate low tolerance for risk, heavily favoring established brands and full traceability, which ensures sustainable, high-margin revenue for manufacturers specializing in certified safety and precision, leading to high average selling prices (ASPs).

Latin America (LATAM) and the Middle East & Africa (MEA) present markets of latent potential, dependent largely on macroeconomic stability and infrastructure investment cycles. LATAM's growth is predominantly linked to modernization projects in the automotive aftermarket and telecommunications sectors, transitioning from informal to formalized testing standards, thereby slowly increasing demand for compliant connectors and professional-grade diagnostic tools. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is a key target for high-specification power connectors due to massive investments in large-scale renewable energy projects (solar farms, high-voltage DC transmission). Market penetration in MEA, however, requires careful logistical planning and reliance on strategic distributor partnerships capable of navigating varied import regulations and providing localized technical support, focusing on ruggedized equipment suitable for harsh desert climates and remote operational environments where connector durability is a primary performance metric.

- Asia Pacific (APAC): Highest growth rate fueled by semiconductor manufacturing, aggressive EV expansion, and 5G infrastructure deployment. Largest market for production volume and increasingly consuming high-end certified products.

- North America: High-value market focused on regulatory compliance (UL listed, CAT III/IV), demanding premium, specialized connectors for aerospace, defense, and high-tech medical device testing. Demand driven by system maintenance and safety upgrades, resulting in high ASPs.

- Europe: Mature market with stable, quality-driven demand; highly regulated environment necessitates full compliance with IEC and regional standards; strong segment activity in renewable energy testing and specialized industrial automation.

- Latin America (LATAM): Emerging market driven by industrial modernization and increasing adoption of professional diagnostic equipment in automotive and general electronics repair sectors, seeking cost-effective compliance solutions.

- Middle East and Africa (MEA): Growth focused on significant energy infrastructure investments (solar, smart grid) and oil & gas maintenance, requiring high-reliability, durable, and temperature-resistant power connectors with robust IP ratings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Banana and Tip Connectors Market.- Fluke Corporation

- Pomona Electronics

- Mueller Electric

- TE Connectivity

- Amphenol Corporation

- SKS Kontakttechnik

- Multi-Contact (Staubli Electrical Connectors)

- Hirschmann Test and Measurement (Teledyne)

- CUI Devices

- Cliff Electronic Components

- Cal Test Electronics

- E-Z-Hook

- Binder GmbH

- ITT Cannon

- Neutrik AG

- Samtec

- LEMO SA

- HARTING Technology Group

- Switchcraft Inc.

- RS Pro (Electrocomponents)

- Weidmüller Interface GmbH & Co. KG

- Phoenix Contact

Frequently Asked Questions

Analyze common user questions about the Banana and Tip Connectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between shrouded and unshrouded banana plugs?

Shrouded (insulated) banana plugs feature a plastic sheath that covers the metallic contact tip, only retracting when fully inserted into a corresponding jack. This design minimizes the exposed conductive surface area, drastically enhancing user safety and compliance with modern high-voltage standards (e.g., IEC 61010-1 Cat III/IV), making them standard for professional test environments, whereas unshrouded plugs are typically used in low-voltage or educational settings where hazard risk is minimized and regulatory requirements are less stringent.

Which material plating offers the best performance for high-fidelity measurements?

Gold plating over a suitable base metal, such as brass or copper, offers superior performance for high-fidelity and low-current measurements. Gold is chemically inert and highly resistant to oxidation and corrosion, ensuring the lowest possible contact resistance over time and minimizing signal noise, which is critical for sensitive instruments like oscilloscopes and high-precision multimeters in advanced R&D laboratories and calibration settings.

How is the growth of Electric Vehicles (EVs) impacting the demand for these connectors?

EV growth significantly boosts demand for specialized, high-current banana and tip connectors (often rated 50A or higher) designed for rigorous battery pack testing, rapid charging system diagnostics, and power electronics development. These specialized applications require connectors with superior thermal management properties, robust silicone insulation, and high reliability to ensure safe and accurate measurements of large power flows in high-voltage DC systems, driving market expansion in the high-amperage segment.

What is the expected Compound Annual Growth Rate (CAGR) for the market?

The Banana and Tip Connectors Market is projected to experience a steady Compound Annual Growth Rate (CAGR) of approximately 7.5% between 2026 and 2033. This growth is primarily fueled by accelerated regulatory compliance mandates globally, rapid expansion in the Asian electronics manufacturing base, and increasing worldwide investment in industrial automation, advanced testing technology, and green energy infrastructure projects requiring robust connectivity.

What regulatory standards primarily govern the market for safety?

The primary regulatory standard governing safety is IEC 61010, specifically pertaining to Measurement Categories (CAT I through CAT IV). This standard dictates the required insulation, voltage rating, and physical design (such as the mandatory use of retractable shrouded plugs) for test leads and connectors based on the potential transient energy present in the testing environment, ensuring comprehensive operator protection from severe electrical hazards across all industrial and field applications.

Why are materials like PTFE or Silicone becoming popular for insulation?

PTFE and Silicone are increasingly popular insulation materials because they offer superior chemical resistance, high dielectric strength, and excellent thermal stability compared to traditional PVC. Silicone provides exceptional flexibility and remains pliable at low temperatures, while PTFE offers outstanding resistance to aggressive solvents and extremely high temperatures, making them ideal for rigorous industrial, chemical, and aerospace testing applications where material failure is unacceptable.

How do counterfeit products restrain market growth?

Counterfeit products significantly restrain market growth by introducing substandard components that fail to meet safety ratings, leading to performance issues and catastrophic failures. Their pervasive presence, particularly in price-sensitive regions, undercuts legitimate manufacturers, erodes customer trust in non-branded components, and forces legitimate players to compete aggressively on price, compromising overall market revenue integrity and safety standards, posing a continuous quality challenge.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager