Banana Fiber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434407 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Banana Fiber Market Size

The Banana Fiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450.8 Million in 2026 and is projected to reach USD 750.3 Million by the end of the forecast period in 2033. This substantial growth is primarily driven by the escalating global demand for sustainable and biodegradable materials, particularly within the textile, paper, and emerging composite industries.

The market expansion is underpinned by the unique properties of banana fiber, including high tensile strength, low density, and high moisture absorption capacity, positioning it as an ideal substitute for conventional synthetic fibers and even certain natural fibers like jute and flax. Furthermore, the increasing global emphasis on waste reduction and circular economy practices strongly favors banana fiber, as it is derived from the pseudo-stems of banana plants, which are typically discarded after harvesting the fruit. This dual benefit—providing a high-value product while minimizing agricultural waste—is a key economic driver.

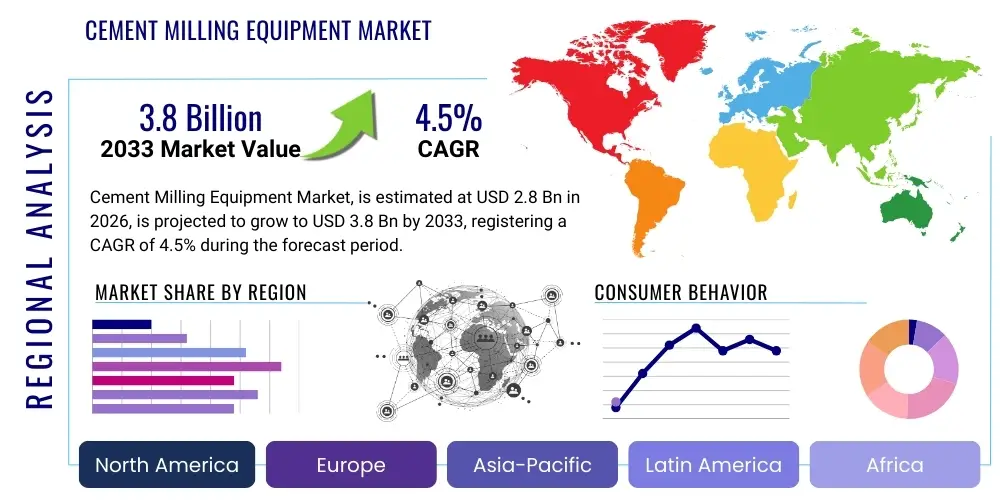

Geographically, Asia Pacific dominates the market due to its high volume of banana cultivation, offering readily available raw materials and established processing infrastructure. However, North America and Europe are exhibiting the highest growth rates, fueled by stringent regulatory frameworks promoting bio-based materials and strong consumer preference shifts towards eco-friendly products in the fashion and automotive sectors. Strategic investments in advanced fiber extraction technologies and research into novel applications, such as medical textiles and advanced packaging, are expected to further accelerate market growth throughout the forecast period.

Banana Fiber Market introduction

The Banana Fiber Market encompasses the global production, processing, and application of natural fibers extracted from the pseudo-stems and leaves of the banana plant (Musa species). Banana fiber, often referred to as musa fiber, is recognized globally for its versatility, durability, and superior sustainability profile. It is a bast fiber, characterized by high cellulose content, which imparts excellent mechanical properties, making it suitable for demanding industrial applications. The product range derived from this fiber includes specialized pulp for high-quality paper, yarns for intricate textiles, raw material for lightweight composite materials, and components for traditional handicrafts, establishing its significance across diverse manufacturing sectors.

Major applications of banana fiber span the textile industry, where it is used to produce eco-friendly fabrics, apparel, and home furnishings; the paper and pulp sector, utilized for currency paper, tea bags, and specialized filtering paper due to its long staple length and robust structure; and the composite materials domain, particularly in the automotive and construction industries as a lightweight and sustainable reinforcement material. The primary benefits driving market adoption include its 100% biodegradability, renewable sourcing as an agricultural byproduct, inherent flame resistance, and exceptional tensile strength, which often rivals synthetic fibers on a weight-to-weight basis. These characteristics make it a crucial component in the global shift towards sustainable manufacturing paradigms.

Key driving factors include the stringent environmental regulations targeting plastic and synthetic fiber pollution, coupled with rapidly evolving consumer consciousness demanding transparency and sustainability in product sourcing. Furthermore, technological advancements in fiber extraction and spinning techniques have significantly reduced processing costs and improved fiber quality consistency, making banana fiber a commercially viable alternative to conventional materials. Government initiatives in developing economies aimed at agricultural waste monetization and rural employment generation also provide substantial momentum to the market, supporting the cultivation and primary processing units globally, thereby securing the supply chain necessary for industrial scale-up.

Banana Fiber Market Executive Summary

The Banana Fiber Market is poised for substantial expansion, driven by powerful global business trends emphasizing circular economy models and material innovation. Key business trends include the vertical integration of textile manufacturers seeking direct control over sustainable sourcing and the proliferation of cross-industry collaborations between agricultural entities and material science firms focused on optimizing fiber properties for high-performance applications, such as automotive interior components. Regionally, Asia Pacific maintains its dominance as the production hub, leveraging vast banana plantations, while Europe and North America lead the consumption and value-addition segments, driven by high environmental standards and premium market demand for sustainable luxury goods. Latin America is also emerging as a critical supply region, enhancing global raw material resilience and diversity.

Segment trends indicate that the textile segment, particularly within the fast-growing sustainable fashion niche, remains the largest consumer, valuing the fiber’s aesthetic versatility and minimal environmental impact. However, the composite segment, including applications in automotive and aerospace, is projected to register the fastest CAGR, propelled by the urgent industry need for lightweight, bio-based alternatives to glass and carbon fibers, contributing to reduced carbon footprints and improved fuel efficiency. Furthermore, demand for specialized banana fiber pulp in the non-woven sector, specifically for medical disposables and advanced filtration systems, is seeing accelerated adoption due reflecting its strength, porosity, and inherent bacteriostatic properties, reinforcing its premium positioning within industrial markets.

Overall, the market dynamic is characterized by a strong push toward advanced processing technologies, notably enzymatic and mild chemical treatments, which aim to enhance the fineness and luster of the fiber without compromising its eco-friendly credentials. The competitive landscape is fragmented, featuring numerous small and medium-sized enterprises (SMEs) focused on ethical sourcing and specialized product development, alongside larger industrial players investing heavily in scaling up production capacity to meet burgeoning industrial demand. Successful market penetration hinges on overcoming supply chain inconsistencies and achieving standardized fiber quality across diverse geographic sourcing regions, a critical factor for adoption by major global manufacturers.

AI Impact Analysis on Banana Fiber Market

User queries regarding the impact of Artificial Intelligence (AI) on the Banana Fiber Market often center on optimizing the complex, multi-stage value chain, from sustainable cultivation to final product manufacturing. Key themes include how AI can enhance the efficiency and yield of banana plant cultivation, minimizing waste and maximizing fiber quality; the application of machine vision systems for automated quality control during the fiber extraction and spinning processes; and the utilization of predictive analytics for accurate demand forecasting in niche markets like biodegradable packaging and high-performance composites. Users are particularly interested in AI's role in standardizing fiber properties, such as consistency in micron size and tensile strength, which is crucial for large-scale industrial adoption where natural variability is a significant challenge, ensuring a consistent and reliable supply for global textile and automotive manufacturers.

AI technologies, including machine learning algorithms and sophisticated data analytics, are increasingly being deployed to address core challenges within banana fiber production, primarily focusing on resource management and product traceability. In agriculture, AI-driven precision farming models analyze soil health, climate data, and plant growth metrics to optimize water usage and determine the optimal time for harvesting the pseudo-stem to maximize fiber yield and quality. Furthermore, leveraging AI in material science allows researchers to simulate fiber modification treatments, predicting the impact of different chemical or enzymatic processes on the final material performance, thereby significantly reducing R&D cycles and accelerating the development of specialized fiber grades required for high-tech applications such as reinforced polymers and medical-grade textiles, ensuring quicker market readiness.

The implementation of AI also extends deeply into the supply chain and market strategy, offering substantial improvements in transparency and operational efficiency, which are highly valued in the ethical sourcing movement. Blockchain technology, often integrated with AI analytics, can provide immutable records of the fiber’s journey from the farm to the consumer, verifying sustainable and fair trade practices. Predictive maintenance models powered by AI are being applied to extraction machinery to minimize downtime and ensure continuous processing, directly impacting the scalability and cost-competitiveness of banana fiber compared to synthetic alternatives. These technological integrations position banana fiber not just as an eco-friendly choice, but as a technically sophisticated material capable of meeting stringent industrial quality standards globally.

- AI-powered machine vision systems enable automated defect detection and quality grading during fiber processing, ensuring standardized output.

- Predictive analytics optimize inventory management and demand forecasting for derived products like pulp and yarn, reducing operational waste.

- Machine learning models enhance precision agriculture practices for banana cultivation, optimizing pseudo-stem harvesting timing for maximum fiber yield and quality.

- AI facilitates the integration of blockchain for verifiable supply chain transparency, essential for meeting ethical sourcing mandates.

- Optimization algorithms aid in designing lightweight and durable composite materials utilizing banana fiber reinforcement for automotive and construction sectors.

DRO & Impact Forces Of Banana Fiber Market

The dynamics of the Banana Fiber Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the impact forces that dictate its trajectory. The primary driver is the overwhelming global paradigm shift toward sustainability, fueled by legislative actions banning single-use plastics and corporate commitments to achieve net-zero emissions, which necessitates the widespread adoption of bio-based materials like banana fiber. This material offers a compelling solution as it utilizes agricultural waste, reducing disposal burdens while providing a highly renewable resource. However, significant restraints include the current high capital investment required for automated, high-efficiency fiber extraction machinery and the lack of standardized global protocols for fiber grading, which creates inconsistencies in quality that deter large-scale industrial buyers who require reliable, uniform feedstocks. Overcoming these quality standardization hurdles is critical for securing market confidence.

Opportunities within the market are abundant, particularly in niche high-growth segments. The development of advanced, high-performance bio-composites reinforced with banana fiber offers immense potential in industries like aerospace and defense, where lightweight materials and high specific strength are paramount. Furthermore, the rising awareness of the fiber’s superior moisture management and antibacterial properties is opening significant avenues in the medical and hygiene textile markets, including wound dressing materials and specialized filtration media. The ability of banana fiber to serve as a sustainable replacement for wood pulp in premium paper products, such as luxury packaging and currency paper, represents another substantial, high-value opportunity, leveraging its long fiber length and inherent durability characteristics.

The impact forces driving growth are predominantly external, anchored in global regulatory changes and pervasive consumer ethical mandates. Conversely, internal friction points, particularly relating to fragmented supply chains and the need for significant R&D investment to further refine fiber properties (such as reducing lignin content or improving dye affinity), act as restraining forces. The overall impact trend, however, is strongly positive; as technological innovations reduce processing costs and quality standardization improves—often through international collaboration and technology transfer—the drivers are projected to progressively outweigh the restraints, leading to a sustained and accelerated market expansion throughout the forecast period, transitioning banana fiber from a niche sustainable material to a mainstream industrial commodity.

Segmentation Analysis

The Banana Fiber Market is meticulously segmented based on Type, Application, and End-Use Industry, allowing for a precise understanding of market dynamics and targeted strategic development. The primary segmentation by Type includes Mechanical Extraction Fiber and Chemical/Enzyme Extraction Fiber, reflecting the different processing methodologies employed to separate the fibers from the banana pseudo-stem, each yielding varying degrees of fineness, softness, and purity suitable for specific end-uses. Application-based segmentation highlights key usage areas such as Textiles (apparel, home furnishings), Paper & Pulp (specialty papers, filtration media), and Composites (automotive parts, construction materials), providing clarity on volume consumption across industrial sectors and indicating which segments are currently generating the highest revenue.

The differences in fiber type extraction methods significantly influence market behavior. Mechanically extracted fibers are generally coarser, retaining more lignin and hemicellulose, making them ideal for high-strength, low-value applications like ropes, sacks, and geo-textiles, often dominating emerging economies due to lower operational costs. Conversely, fibers treated with chemical or enzymatic processes are finer, softer, and possess enhanced dye uptake and pliability, commanding higher prices and driving growth in premium sectors such as sustainable fashion textiles and high-end automotive interiors where aesthetic quality and comfort are critical factors. This dichotomy in processing determines the value proposition and target market for specific fiber producers globally, influencing investment decisions in technology.

Further analysis of the End-Use industries reveals that the Textile sector is currently the largest volume consumer, driven by rapid innovation in blending banana fiber with cotton, silk, and synthetic polymers to create unique, sustainable fabrics. However, the Automotive and Building & Construction industries represent the high-growth frontier for the composites segment. Here, banana fiber acts as a sustainable, lightweight reinforcement, offering better vibration dampening and lower cradle-to-gate carbon emissions compared to traditional synthetic alternatives. This detailed segmentation is crucial for stakeholders to identify optimal entry points, tailor product development, and allocate resources efficiently across regions and target industries that offer the most profitable and sustainable growth opportunities.

- By Type:

- Mechanical Extraction Fiber

- Chemical/Enzyme Extraction Fiber (Treated Fiber)

- By Application:

- Textiles & Apparel (Yarn, Fabric, Clothing, Home Textiles)

- Paper & Pulp (Specialty Paper, Filter Paper, Currency Paper)

- Composites (Automotive, Construction, Packaging)

- Handicrafts & Others (Ropes, Mats, Non-wovens)

- By End-Use Industry:

- Fashion & Apparel

- Automotive

- Building & Construction

- Packaging

- Medical & Hygiene

Value Chain Analysis For Banana Fiber Market

The value chain of the Banana Fiber Market is unique, starting with the agricultural waste stream and culminating in high-value, sustainable consumer and industrial products. The upstream analysis focuses intensely on the cultivation and harvesting of banana crops, which primarily occurs in tropical and subtropical regions such as India, China, the Philippines, and Latin America. The critical step is the timely harvesting of the pseudo-stem, typically after the fruit has been harvested, followed by the initial extraction phase, often performed locally via mechanical decorticators or manually. Efficiency in this initial stage is paramount, as the prompt processing of the pseudo-stem is necessary to prevent fiber degradation, directly influencing the final fiber quality and market price, ensuring that the supply base adheres to stringent quality control standards.

Midstream activities involve sophisticated processing and refinement, where the raw, extracted fiber is subjected to various treatments. This includes chemical degumming, enzymatic treatment, or refining processes to improve properties such as fineness, flexibility, and dye uptake, transforming the rough fiber into industrial-grade yarn, pulp, or non-woven mats. Major players invest heavily in these midstream activities to achieve the consistency required by large-scale manufacturers. Downstream analysis involves the integration of the processed fiber into final product manufacturing. Textiles utilize banana fiber yarn for weaving and knitting; the paper industry uses banana fiber pulp for specialty products; and the automotive sector uses non-woven mats or chopped fibers for composite panel reinforcement. This stage requires strong technical collaboration between fiber producers and end-use manufacturers to tailor fiber specifications precisely to application requirements.

The distribution channel is predominantly business-to-business (B2B), characterized by direct and indirect sales mechanisms. Direct distribution involves bulk sales from large-scale fiber processors to major textile mills, composite manufacturers, or pulp producers under long-term supply contracts, offering stability and predictable pricing. Indirect distribution involves specialized traders, agents, and distributors who manage smaller volumes and cater to niche markets, such as small sustainable fashion brands or local handicraft manufacturers, providing flexibility and geographical reach. Due to the increasing focus on transparency and ethical sourcing, the distribution network must often incorporate robust traceability systems to verify the origin and sustainability certifications of the fiber at every point in the chain, ensuring consumer trust and compliance with evolving regulatory mandates across key importing regions like Europe and North America.

Banana Fiber Market Potential Customers

The Banana Fiber Market targets a diverse array of potential customers, primarily defined by their strategic commitment to sustainability, lightweighting, and high-performance material substitution. The largest segment of end-users/buyers includes the global textile and apparel industry, ranging from mass-market retailers seeking sustainable fabric blends for everyday wear to high-end luxury fashion houses requiring eco-friendly, aesthetically unique fibers for premium collections. These customers value the fiber’s natural sheen, breathability, and eco-credentials, often utilizing it to enhance brand image and comply with increasing consumer demands for ethical sourcing and material transparency, making compliance with global certification standards a critical purchasing criterion.

A second major customer base resides within the automotive and aerospace original equipment manufacturers (OEMs). These industries are intensely focused on reducing vehicle weight to improve fuel efficiency and minimize environmental impact. Banana fiber is highly attractive here as a natural, lightweight reinforcement material for interior components, door panels, dashboards, and exterior body parts, substituting traditional heavier materials like glass fiber and synthetic polymers. The fiber’s excellent specific strength, good acoustic insulation properties, and vibration dampening capabilities make it a technologically superior, sustainable choice for engineering applications, leading to higher adoption rates in electric and hybrid vehicle manufacturing platforms globally.

Furthermore, the packaging and paper industry represents a high-potential customer group, particularly manufacturers focused on specialized and eco-friendly products. This includes companies producing biodegradable food packaging, high-durability specialty papers like currency paper or security documents, and sophisticated filtration media. The long staple length and high wet strength of banana fiber pulp offer superior performance characteristics for these niche applications compared to standard wood pulp, allowing customers to offer premium, differentiated products while achieving their corporate sustainability goals. These buyers are typically focused on consistent fiber quality and competitive bulk pricing to ensure viable integration into their high-volume manufacturing processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.8 Million |

| Market Forecast in 2033 | USD 750.3 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Anubha Industries, Greenwillow Ecological Fabrics, Go Green Textiles, Advantage Fibers, Ankuram, China Textile Academy, Tekstildream, Fiber-Lite Composites, Natural Fiber Solutions, S&S Natural Fibers, Spunlife Fibers, Washi Paper Corporation, Ecocraft Fiber Technologies, GreenTech Fibers, Himalayan Fiber Industries, Shizen Fiber. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Banana Fiber Market Key Technology Landscape

The technological landscape of the Banana Fiber Market is characterized by continuous innovation focused on improving extraction efficiency, refining fiber quality, and developing advanced applications. Traditional fiber extraction relies heavily on manual labor and simple mechanical decortication, which, while cost-effective for localized production, often results in coarse fibers with inconsistent length and high residual lignin content. The current technological focus is shifting towards developing high-throughput, automated mechanical decorticators integrated with sensors and optimization software to ensure consistent fiber separation from the pseudo-stem matrix, significantly improving yield rates and reducing manual intervention across the agricultural supply base, thereby making the fiber suitable for large-scale industrial adoption.

Advanced refinement techniques constitute the second major technological pillar. These include chemical degumming using mild alkali or acid solutions, and increasingly, enzymatic treatments utilizing cellulase and pectinase enzymes. Enzymatic processing is highly favored due to its lower environmental impact and its ability to gently remove lignin and pectin, resulting in finer, softer fibers (micro-fibrillated cellulose) suitable for high-end textiles and advanced composite matrices. Research is also exploring plasma treatment and ultrasonic processing to modify the surface chemistry of the fiber, enhancing its interface adhesion with polymer resins for composite applications and improving dye uptake properties for the demanding fashion industry, thereby expanding the potential application portfolio of the core material.

Furthermore, nanotechnology and material science innovations are playing a crucial role, particularly in utilizing banana fiber waste to create high-value products. Banana fiber cellulosic components are being isolated and converted into nanocrystalline cellulose (NCC) and nanofibrillated cellulose (NFC). These nano-materials possess exceptional mechanical properties and surface area, making them highly valuable for applications in high-barrier packaging films, biomedical scaffolds, advanced filtration membranes, and reinforcing agents in high-performance polymer nanocomposites. This focus on maximizing the value derived from every component of the banana pseudo-stem not only enhances profitability but also aligns perfectly with zero-waste manufacturing principles, positioning the market at the forefront of sustainable material technology innovation globally.

Regional Highlights

The global Banana Fiber Market exhibits pronounced regional variations, primarily driven by raw material availability, processing infrastructure maturity, and local sustainability mandates. Asia Pacific (APAC) stands as the dominant market, owing to the region's expansive banana cultivation areas, particularly in India, the Philippines, China, and Indonesia. This abundant and affordable raw material supply, combined with established labor-intensive and increasingly automated processing capabilities, makes APAC the primary hub for production and export of raw and semi-processed banana fiber. The high domestic consumption within the textile and paper industries further solidifies the region’s market share, despite the lower average price point compared to high-value markets.

Europe and North America represent the highest growth markets, characterized by rapid adoption and premium pricing. Growth in these regions is not driven by raw material supply but by regulatory frameworks—such as the European Union’s Circular Economy Action Plan and stringent mandates on automotive emissions—that strongly incentivize the use of sustainable, bio-based materials. Consumers in these regions demonstrate a strong preference for ethically sourced and certified sustainable products, driving demand for high-quality, refined banana fiber yarn and advanced bio-composites. European countries, particularly Germany and France, lead in the integration of banana fiber composites into the automotive and lightweight construction sectors, requiring superior, consistent fiber quality supported by robust certification systems.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets with significant potential. LATAM, specifically countries like Ecuador, Brazil, and Costa Rica, possesses vast banana cultivation resources and is increasingly focusing on localizing processing to monetize agricultural waste and boost rural economies, transitioning from merely a raw material exporter to a processed fiber supplier. The MEA region is showing promising growth, particularly in textile and handicraft applications, driven by a growing young population and increasing investment in sustainable manufacturing technologies. However, these regions face hurdles related to infrastructure development and access to advanced processing technologies required to compete with established APAC fiber quality standards, necessitating targeted governmental and private sector investments.

- Asia Pacific (APAC): Dominates the market due to large-scale banana cultivation and established processing infrastructure (India, Philippines). Key focus on bulk supply to textile and pulp industries.

- Europe: Exhibits the fastest growth, driven by stringent environmental regulations, high consumer demand for eco-friendly fashion, and strong integration into automotive bio-composites.

- North America: Significant market for high-value applications, focusing on certified sustainable textiles and specialized industrial uses like advanced filtration and medical textiles.

- Latin America (LATAM): Emerging production region with high potential for capitalizing on agricultural waste, focused on establishing modern processing facilities (Ecuador, Brazil).

- Middle East and Africa (MEA): Growing demand for fiber in handicrafts and local textile industries; infrastructural development remains a key challenge for large-scale industrial output.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Banana Fiber Market.- Anubha Industries

- Greenwillow Ecological Fabrics

- Go Green Textiles

- Advantage Fibers

- Ankuram

- China Textile Academy

- Tekstildream

- Fiber-Lite Composites

- Natural Fiber Solutions

- S&S Natural Fibers

- Spunlife Fibers

- Washi Paper Corporation

- Ecocraft Fiber Technologies

- GreenTech Fibers

- Himalayan Fiber Industries

- Shizen Fiber

- Green Banana Paper Inc.

- Twisted Tree Fibers

- Kanpur Flowercycling Private Limited

- Fibers of the Earth

Frequently Asked Questions

Analyze common user questions about the Banana Fiber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the growth of the Banana Fiber Market?

The primary growth drivers are global environmental mandates promoting biodegradability, high consumer demand for sustainable and ethically sourced textiles, and the material’s superior functional properties, such as high tensile strength and lightweight nature, making it ideal for bio-composite substitution in automotive and construction sectors.

How does the quality of banana fiber compare to traditional fibers like cotton or jute?

Banana fiber possesses higher tensile strength and stiffness than both cotton and jute, making it more durable for industrial applications and technical textiles. While typically coarser than cotton, modern enzymatic treatment technologies are producing fine, soft banana fiber suitable for direct apparel use, often surpassing cotton in moisture absorption and sustainability credentials.

Which regions dominate the production and consumption of banana fiber globally?

Asia Pacific, particularly India and the Philippines, dominates global production due to extensive banana cultivation and processing capabilities. However, consumption of high-value, refined fiber is led by Europe and North America, driven by regulatory demands and robust market uptake in premium sustainable fashion and automotive components.

What are the main technical challenges restraining the widespread adoption of banana fiber?

Key challenges include inconsistent fiber quality resulting from varied extraction techniques and regional supply chain fragmentation. High initial capital investment for automated, advanced degumming and spinning machinery also restricts scalability for smaller producers, requiring focused technological standardization and investment to meet industrial volume requirements.

In which emerging applications is banana fiber expected to see the fastest growth?

The fastest growth is projected in the bio-composites segment (automotive and building materials) due to its lightweight properties. Significant expansion is also anticipated in specialized non-woven medical textiles, such as surgical masks and wound dressings, capitalizing on the fiber's natural porosity and antimicrobial characteristics, and in high-security paper production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager