Banana Paper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432226 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Banana Paper Market Size

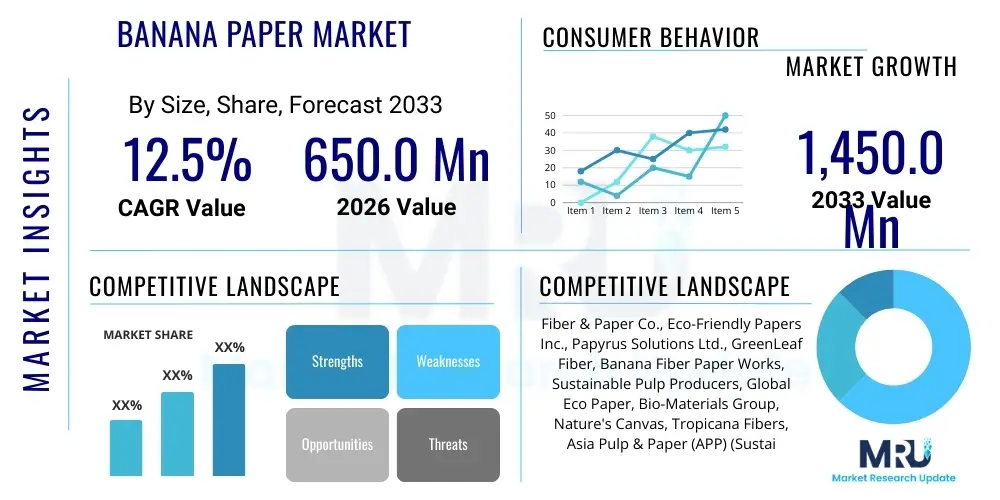

The Banana Paper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% (Include CAGR Word with % Value) between 2026 and 2033. The market is estimated at USD 650.0 Million in 2026 and is projected to reach USD 1,450.0 Million by the end of the forecast period in 2033.

Banana Paper Market introduction

The Banana Paper Market involves the production and commercialization of paper derived from agricultural waste, specifically the fibers extracted from the banana plant’s pseudostem, trunk, or discarded leaves. This innovative product stands out in the global pulp and paper industry due to its inherent sustainability, utilizing a waste stream that is abundant globally after banana harvesting. The process transforms bulky biomass waste into a valuable commodity, contributing significantly to circular economy initiatives and reducing the reliance on virgin wood pulp, which often involves deforestation and high chemical usage.

Major applications for banana paper span across packaging, high-end stationery, craft paper, and specialized security documents. Its high durability, unique texture, and eco-friendly profile make it particularly attractive to consumer goods companies prioritizing sustainability and unique branding opportunities. The paper's robust fiber structure allows for its use in demanding applications where resilience is necessary, such as specialized currency paper or archival documents, though its primary adoption remains concentrated in luxury packaging and artisanal crafts.

The primary driving factors propelling the market include stringent governmental regulations promoting sustainable sourcing, increasing consumer awareness regarding environmental footprint, and the rising corporate demand for biodegradable and compostable packaging alternatives. Banana paper offers substantial environmental benefits, including reduced water usage compared to traditional paper manufacturing, minimal need for bleaching agents due to the fiber’s natural color, and the critical advantage of using non-timber renewable resources, positioning it as a key disruptive technology within the bio-based materials sector.

Banana Paper Market Executive Summary

The global Banana Paper Market is experiencing robust growth driven by the convergence of environmental mandate enforcement and heightened consumer preference for sustainable products. Current business trends indicate a strong move towards diversification of fiber sources, with manufacturers investing heavily in optimized pulping technologies—such as enzymatic or mechanical pulping—to efficiently process banana agricultural waste into high-quality pulp suitable for various paper grades. Strategic alliances between banana farm cooperatives, waste management firms, and paper manufacturers are becoming prevalent, securing a consistent supply chain for the raw biomass necessary for scaled production.

Regionally, the market is profoundly influenced by the geographical distribution of banana cultivation. The Asia Pacific (APAC) region, particularly India, the Philippines, and Ecuador in Latin America (LATAM), dominates both in terms of raw material supply and emerging manufacturing hubs. APAC shows substantial growth potential driven by governmental backing for agricultural waste utilization and massive domestic consumer markets demanding eco-friendly packaging. North America and Europe, while having limited raw material sources, lead in demand and technological adoption, driven by strong commitments to decarbonization and sustainable sourcing mandates within the retail and luxury goods sectors.

Segment trends highlight the dominance of the Packaging application segment, which benefits directly from the global shift away from plastics and traditional composite materials. Within the source segmentation, the Pseudostem Fiber segment holds a significant market share due to the sheer volume of waste generated by this part of the plant post-harvest. Furthermore, the segmentation by end-use shows accelerated adoption within the Commercial and Industrial sectors, which leverage banana paper for high-impact sustainable branding, particularly in the fast-moving consumer goods (FMCG) and luxury industries.

AI Impact Analysis on Banana Paper Market

Common user questions regarding the impact of Artificial Intelligence (AI) in the Banana Paper Market frequently revolve around optimizing complex supply chains, predicting raw material yields, improving pulp quality control, and automating energy-intensive production processes. Users seek confirmation on whether AI can genuinely transform the efficiency of agricultural waste utilization, which is often irregular in quality and availability. Key themes emerging from this user analysis focus on resource management precision, the reduction of operational costs through predictive maintenance, and the potential for AI-driven material science breakthroughs to enhance the paper's functional properties, such as tensile strength or water resistance, thereby expanding its application scope beyond current limitations.

The core expectation is that AI will be pivotal in addressing the unique complexities associated with sourcing and processing non-wood fibers. Unlike standardized wood pulp production, banana fiber extraction involves variability based on plant species, maturity, and processing location. AI-powered image recognition and machine learning algorithms are anticipated to standardize fiber grading and automate separation processes, ensuring consistent input quality crucial for industrial-scale paper production. Furthermore, AI tools are expected to optimize logistics, predicting harvest cycles and coordinating waste collection from numerous dispersed farming operations efficiently, significantly reducing lead times and waste accumulation.

In the manufacturing phase, AI’s impact is substantial in refining the pulping process. Advanced analytics and sensor data collection allow for real-time adjustments to chemical concentrations, temperature, and mechanical refining intensity, maximizing fiber yield while minimizing energy and water consumption. This precision control, unattainable through traditional methods, not only lowers operating expenses but also ensures the final product meets stringent quality specifications required by sophisticated end-users in printing and high-end packaging. Consequently, AI acts as a crucial enabler for scaling banana paper production economically and sustainably.

- AI optimizes agricultural waste collection and logistics using predictive modeling based on harvest cycles.

- Machine Learning (ML) algorithms improve fiber quality grading, ensuring consistent raw material input for pulping.

- Predictive maintenance driven by AI minimizes downtime in specialized fiber extraction and paper manufacturing machinery.

- AI-enhanced process control systems refine pulping parameters (temperature, chemical dosage) to maximize fiber yield and minimize resource consumption.

- Generative AI supports R&D efforts by simulating new fiber combinations and coating formulations to enhance paper properties (e.g., strength, barrier function).

- AI-driven market analysis helps manufacturers forecast demand for sustainable paper products, improving inventory management and pricing strategies.

DRO & Impact Forces Of Banana Paper Market

The Banana Paper Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all contributing to its overall Impact Forces. The primary driver is the accelerating global mandate for sustainable packaging and the commitment of major corporations to reduce their carbon footprint, propelling the search for viable alternatives to conventional wood pulp. Simultaneously, the market faces significant restraints, chiefly the inconsistent global supply chain for banana fiber biomass and the high initial capital investment required for dedicated non-wood pulping machinery. Opportunities are abundant, rooted in expanding the application scope into high-value sectors like specialized barrier packaging and security printing, leveraging the fiber's unique characteristics.

Key drivers include the massive availability of agricultural waste, which ensures a renewable, non-food competing source of cellulose, differentiating it favorably from other biomass sources. Furthermore, favorable regulatory environments in regions like the EU and North America, imposing levies on plastic use and mandating minimum recycled content, significantly boost the competitive edge of banana paper. Consumer sentiment is also a powerful force; the increasing willingness of consumers to pay a premium for certified sustainable and visibly eco-friendly products directly translates into higher demand from retailers and brands, necessitating scalable production solutions for banana paper.

However, scaling remains challenged by critical restraints. The cost of collecting, cleaning, and transporting bulky banana pseudostems from geographically dispersed smallholder farms poses a major logistical and financial hurdle, often making the resulting pulp more expensive than standard wood pulp. Technological maturity is another constraint; while pulping technology exists, adapting it for optimized banana fiber extraction requires specialized machinery and expertise, contributing to slower market penetration in regions lacking sufficient infrastructure or investment capital. Addressing these issues through decentralized processing units and innovative fiber extraction techniques will be paramount for sustained growth.

- Drivers:

- Abundance of banana agricultural waste globally, providing a renewable raw material source.

- Increasing consumer demand for eco-friendly, biodegradable, and compostable packaging solutions.

- Favorable governmental policies and environmental regulations encouraging non-wood fiber utilization and circular economy practices.

- Growing corporate sustainability goals and mandates requiring the elimination of virgin wood pulp where possible.

- Restraints:

- High production costs associated with fiber collection, processing, and transportation due to the dispersed nature of the raw material.

- Inconsistent quality and supply chain variability of banana fibers compared to standardized wood pulp.

- Lack of widespread, scalable, dedicated processing infrastructure for non-wood fibers in emerging markets.

- Resistance from established wood pulp industry players due to perceived higher cost base of non-wood alternatives.

- Opportunities:

- Expansion into niche, high-margin applications such as currency paper, archival paper, and specialized technical textiles.

- Development of hybrid papers combining banana fiber with recycled content or other non-wood fibers to optimize performance and cost.

- Technological advancements in chemical-free pulping and decentralized processing units near banana plantations.

- Securing global certifications (e.g., FSC, Compostable standards) to validate sustainability claims and enhance market acceptance.

- Impact Forces:

- High Intensity Environmental Impact: Strong positive impact due to waste utilization and reduced deforestation pressures.

- Medium Intensity Cost Sensitivity: Ongoing pressure to reduce the price gap with conventional paper, currently slowing mass adoption.

- High Intensity Regulatory Tailwinds: Regulations favoring sustainable materials provide significant competitive advantages.

- Medium Intensity Supply Chain Risk: Dependent on agricultural yield and efficient waste logistics, requiring advanced supply chain management.

Segmentation Analysis

The Banana Paper Market segmentation provides a granular view of how different raw material types are utilized, where the paper finds its application, and which major end-user groups drive consumption. This analysis is crucial for stakeholders to tailor production processes and marketing strategies, identifying the most lucrative market niches and understanding demand elasticity across various product grades. The market is primarily segmented based on the specific part of the banana plant used (Source), the final use category (Application), and the type of consumer (End-Use). The overall growth trajectory of the market is heavily influenced by the Packaging segment, reflecting global trends in consumer behavior and regulatory shifts prioritizing sustainable material alternatives in retail.

The segmentation by Source highlights the technical feasibility and volumetric potential of different agricultural waste streams. Pseudostem fibers, being the most abundant waste material, form the foundation of the largest source segment, requiring robust mechanical and chemical processing. Conversely, Rind/Peel fibers and Trunk fibers offer different qualities—often finer or tougher—lending themselves to specialized, high-quality paper grades, though their availability is comparatively lower. Understanding these differences allows producers to align fiber characteristics with the required performance specifications for specific applications, such as high-tear-strength packaging versus smooth writing paper.

The Application segmentation underscores the versatility of banana paper. While the foundational use includes general writing and printing, the significant growth drivers are the Packaging and Specialty Paper segments. Packaging demand is fueled by the need for sustainable boxes, labels, and protective wraps, particularly in the organic food and luxury goods sectors. Specialty papers, including high-opacity art paper and high-security paper, leverage banana paper’s unique aesthetic and inherent fiber strength. This strategic diversification across applications minimizes reliance on single market sectors and stabilizes demand fluctuations.

- By Source:

- Trunk Fiber

- Pseudostem Fiber

- Rind/Peel Fiber

- By Application:

- Packaging (Boxes, Wraps, Labels)

- Writing Paper

- Craft & Specialty Paper (Art Supplies, Greeting Cards)

- Art & Stationery

- Currency/Security Paper

- By End-Use:

- Commercial (Offices, Printing Houses)

- Industrial (FMCG, Pharmaceutical, Apparel Packaging)

- Household/Retail

- By Fiber Processing Method:

- Chemical Pulping (Soda, Kraft)

- Mechanical Pulping

- Enzymatic Pulping (Bio-pulping)

Value Chain Analysis For Banana Paper Market

The Banana Paper Value Chain is distinct from conventional paper manufacturing, beginning with agricultural waste management rather than forestry. The upstream segment involves the collection of banana harvest residue (pseudostems, leaves) from farms, often requiring complex coordination with decentralized small-scale farmers or large plantations. This raw material then undergoes initial decentralized processing—such as decortication (fiber extraction)—often near the source to reduce transportation costs associated with bulky biomass. Efficiency in this initial stage is critical, as it dictates the quality and cost of the extracted crude fiber before it enters the centralized pulping facility.

The core manufacturing stage involves converting the crude banana fiber into usable pulp through specialized pulping processes (e.g., modified Kraft or eco-friendly methods like enzymatic pulping), followed by sheet formation and finishing. This stage requires significant technological investment to handle the unique fibrous structure of banana waste. Distribution channels are twofold: direct sales to large industrial end-users (like major apparel or cosmetic brands demanding proprietary packaging) and indirect sales through traditional paper distributors, wholesalers, and specialized craft supply retailers, catering to smaller volume or niche markets. The direct channel offers better margin control but requires strong contractual relationships.

The downstream sector focuses on conversion and final consumption. Converters transform the banana paper rolls or sheets into final products such as custom packaging, high-quality printing stock, or specialized craft items. End-users, spanning industrial packagers, commercial printers, and individual consumers, ultimately drive demand. The indirect impact of the waste management companies involved in the initial feedstock collection is substantial, as reliable, high-volume fiber supply depends entirely on efficient upstream waste logistics. This entire chain emphasizes circularity, making the traceability and certification of sustainable sourcing a crucial value-add component for market competitiveness.

Banana Paper Market Potential Customers

Potential customers and key end-users of banana paper are primarily organizations and consumers committed to environmental stewardship and seeking premium, differentiated products. High-end retail brands, particularly those in the luxury goods, cosmetics, and organic food sectors, are significant buyers. These companies use banana paper for primary and secondary packaging, aiming to communicate their sustainability ethos directly to the consumer through tangible, eco-friendly materials. The paper's unique texture and story—derived from agricultural waste—provide a strong marketing narrative, justifying the typically higher price point compared to standard virgin or recycled paper.

Another major segment includes governmental and educational institutions focusing on sustainable procurement policies, especially for specialized uses like high-quality archival documents, official stationery, and art supplies. Printing houses specializing in high-security documents or limited-edition art books represent a niche but high-value customer base, valuing banana paper for its durability and resistance characteristics. Furthermore, the growing segment of independent artists, crafters, and small businesses dedicated to eco-friendly production methods constitutes a significant part of the retail and wholesale demand for specialty banana paper sheets and envelopes.

Industrial users, particularly Fast-Moving Consumer Goods (FMCG) and pharmaceutical companies, are increasingly exploring banana paper for secondary and tertiary industrial packaging applications where biodegradable and compostable attributes are preferred over plastic alternatives. In these large-volume industrial settings, the potential for scalable substitution, especially in regions with robust composting infrastructure, makes them critical long-term growth anchors for the banana paper market. Procurement managers in these sectors are actively seeking suppliers who can demonstrate both supply security and compliance with stringent environmental standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.0 Million |

| Market Forecast in 2033 | USD 1,450.0 Million |

| Growth Rate | 12.5% CAGR ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fiber & Paper Co., Eco-Friendly Papers Inc., Papyrus Solutions Ltd., GreenLeaf Fiber, Banana Fiber Paper Works, Sustainable Pulp Producers, Global Eco Paper, Bio-Materials Group, Nature's Canvas, Tropicana Fibers, Asia Pulp & Paper (APP) (Sustainable Division), Shizen Paper, Agrifiber Innovations, Pulpworks Inc., Earthly Materials, Fiberloop, Banana Leaf Products, Pure Earth Paper, Eco Pulp Systems, Fiber Global |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Banana Paper Market Key Technology Landscape

The technological landscape of the Banana Paper Market is characterized by innovation focused on efficiency, sustainability, and quality enhancement in processing agricultural waste. Key technologies primarily revolve around optimized fiber extraction and environmentally friendly pulping methods. Traditional paper mills rely heavily on the Kraft process; however, banana paper manufacturers are increasingly adopting gentler, lower-impact technologies such as enzymatic pulping (bio-pulping) or thermomechanical pulping (TMP). Enzymatic pulping uses biological catalysts to selectively break down lignin, significantly reducing the need for harsh chemicals and energy, resulting in pulp that retains higher strength and requires less bleaching, thereby boosting the paper's eco-profile and market appeal.

Furthermore, technology related to pretreatment and raw material handling is crucial. Given the bulkiness and high moisture content of banana pseudostems, efficient field-level decortication machines and mobile fiber extraction units are being developed to reduce transport weight and prevent fiber degradation before reaching the centralized mill. Nanocellulose extraction from banana fibers represents an emerging high-tech area. Utilizing techniques like homogenization or chemical treatment, manufacturers can extract nanocellulose, which can be used as a reinforcing agent to drastically improve the barrier properties, tensile strength, and lightness of the final paper product, allowing it to compete effectively in advanced packaging applications.

Digitalization and automation also play a significant role. Modern banana paper mills integrate advanced sensor technology and data analytics to monitor and control parameters like fiber consistency, brightness, and sheet uniformity in real-time. This level of process control ensures quality consistency, which is a common challenge with non-wood fibers, and minimizes resource wastage. The entire technological thrust is aimed at bridging the cost-performance gap between banana paper and established wood-based alternatives, positioning the sustainable product for successful mass-market adoption.

Regional Highlights

The global Banana Paper Market exhibits diverse regional dynamics largely influenced by raw material availability, regulatory frameworks, and consumer purchasing power regarding sustainable goods. The Asia Pacific (APAC) region is currently the epicenter of the market, driven by its dominance in global banana production (e.g., India, China, Philippines, Indonesia). This abundance provides a localized and relatively cost-effective supply chain for raw fibers. Furthermore, rapid industrialization, coupled with increasing governmental pressure to manage agricultural waste and address pollution, has spurred substantial investment in non-wood fiber processing infrastructure across countries like India and Vietnam, establishing APAC as both a major producer and a rapidly expanding consumer of banana paper.

Europe and North America, conversely, are demand-centric regions characterized by high awareness and willingness to pay a premium for eco-friendly materials. Regulatory drivers, such as the European Union’s Circular Economy Package and strict limitations on single-use plastics, create an urgent need for alternatives like banana paper in packaging. Although these regions lack local raw material supply, they lead in processing technology and innovative product development, focusing on high-value applications such as luxury packaging, specialty printing, and high-performance food contact materials. Imports of high-quality banana pulp or semi-finished products from APAC and LATAM are crucial for sustaining demand in these high-value markets, often necessitating complex international certification and traceability protocols.

Latin America (LATAM), particularly Ecuador, Brazil, and Costa Rica, holds strategic importance due to significant banana cultivation and emerging domestic efforts to utilize waste streams for value-added products. LATAM serves primarily as a raw material supplier and a growing manufacturing base, leveraging proximity to the fiber source to achieve cost advantages. Government support for sustainable agriculture and resource valorization in several LATAM countries is slowly paving the way for integrated manufacturing operations. The Middle East and Africa (MEA) region remains nascent but presents opportunities, particularly in countries with large banana plantations (e.g., Uganda, Tanzania) where the focus is transitioning from mere waste disposal to maximizing the economic utility of agricultural residue through localized paper production for domestic consumption and regional export.

- Asia Pacific (APAC): Dominates raw material supply and manufacturing capacity. Growth driven by large-scale agricultural waste management initiatives and burgeoning domestic demand for sustainable packaging in countries like India and the Philippines.

- Europe: Leading consumer market driven by stringent environmental regulations (e.g., single-use plastics bans) and strong corporate social responsibility (CSR) commitments in the retail and luxury sectors. Focuses on high-end, certified banana paper products.

- North America: High-value market characterized by early technology adoption and demand from major FMCG and corporate brands seeking transparent sustainability narratives. Supply relies heavily on imported pulp, driving the need for sophisticated traceability systems.

- Latin America (LATAM): Key region for raw fiber production and decentralized processing. Emerging manufacturing hubs leveraging geographical advantage to supply global markets. Internal market growth is accelerating due to regional sustainability pushes.

- Middle East and Africa (MEA): Nascent market primarily focused on localized small-scale production in banana-growing nations. Potential growth lies in domestic infrastructure development and leveraging biomass for circular economy initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Banana Paper Market.- Fiber & Paper Co.

- Eco-Friendly Papers Inc.

- Papyrus Solutions Ltd.

- GreenLeaf Fiber

- Banana Fiber Paper Works

- Sustainable Pulp Producers

- Global Eco Paper

- Bio-Materials Group

- Nature's Canvas

- Tropicana Fibers

- Asia Pulp & Paper (APP) (Sustainable Division)

- Shizen Paper

- Agrifiber Innovations

- Pulpworks Inc.

- Earthly Materials

- Fiberloop

- Banana Leaf Products

- Pure Earth Paper

- Eco Pulp Systems

- Fiber Global

Frequently Asked Questions

Analyze common user questions about the Banana Paper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is banana paper and how is it sourced?

Banana paper is an eco-friendly paper product made from cellulose fibers extracted from the pseudostems, trunks, or leaves of banana plants, which are typically agricultural waste after fruit harvesting. It repurposes non-food biomass, reducing agricultural waste and minimizing reliance on wood pulp.

Is banana paper truly more sustainable than recycled paper?

Banana paper offers superior sustainability by utilizing virgin non-wood fiber sourced from waste (avoiding deforestation) and often requires less water and fewer harsh chemicals during pulping compared to traditional virgin wood paper. While recycled paper saves trees, banana paper addresses the separate issue of agricultural waste management.

What are the primary applications driving demand for banana paper?

The highest demand is driven by the sustainable Packaging segment, including luxury packaging, food wraps, and specialty boxes, followed closely by high-end stationery, craft papers, and niche applications such as security or archival documents due to its unique fiber strength and texture.

What are the main constraints impacting the scalability of the banana paper industry?

Key constraints include the high initial cost of dedicated fiber extraction technology, logistical challenges in efficiently collecting and transporting bulky, dispersed agricultural waste, and ensuring consistent fiber quality across varied global supply sources.

Which geographical regions lead the production of banana paper?

Asia Pacific (APAC), particularly nations such as India and the Philippines, leads in production due to the enormous volume of banana farming residue available. Latin America also serves as a crucial raw material source and emerging manufacturing hub.

How does the quality of banana paper compare to conventional paper?

Banana paper is generally known for its high durability, unique texture, and excellent tensile strength, making it ideal for specialized applications. Modern processing techniques are improving consistency, allowing it to increasingly substitute conventional paper grades in many packaging and printing uses.

Are there different grades of banana paper available?

Yes, grades vary significantly based on the fiber source (pseudostem vs. leaf), the pulping method (chemical, mechanical, or enzymatic), and subsequent blending. Grades range from rough, thick packaging paper to fine, smooth writing paper, often dictated by the intended application and required performance characteristics.

What role does technology play in improving banana paper production?

Technology, including enzymatic pulping, mobile decortication units, and AI-driven process control, is essential for improving fiber yield, reducing energy consumption, maintaining quality consistency, and lowering the overall production costs, enabling scalability.

Do major governments support the use of banana paper?

Governments, particularly in Europe and parts of Asia, indirectly support the banana paper market through stringent circular economy mandates, agricultural waste management policies, and incentives for sustainable material sourcing, enhancing its competitiveness against conventional materials.

Can banana paper be used in direct food contact applications?

With proper processing and certification, banana paper can be adapted for direct food contact, especially when enhanced with bio-based barrier coatings. Its natural composition and biodegradability make it an attractive alternative to conventional plastic-lined packaging for organic and specialty foods.

What is the difference between trunk fiber and pseudostem fiber in banana paper production?

Pseudostem fiber, which constitutes the main stalk of the plant, is the most abundant source and generally provides standard paper fiber. Trunk fiber, often tougher, is used less frequently but can yield specialty grades with high structural integrity suitable for more demanding applications requiring extreme strength.

How is the cost competitiveness of banana paper expected to evolve?

As production scales up and technological efficiencies (like decentralized processing and enzymatic pulping) reduce raw material collection and processing costs, banana paper is expected to close the current price gap with conventional wood pulp over the forecast period, boosting its mass-market appeal.

Are there ethical sourcing concerns related to banana paper?

Ethical sourcing concerns typically relate to ensuring fair compensation for farmers providing the agricultural residue and verifying sustainable waste collection practices. Certification schemes focused on fair trade and sustainable agriculture are vital for mitigating these concerns and ensuring market integrity.

How does the environmental footprint of banana paper bleaching compare to wood pulp?

Banana fibers naturally possess lighter coloration than many wood pulps, often requiring less intensive or even no chlorine-based bleaching. This significantly reduces the release of harmful environmental effluents associated with the traditional, highly chemical-intensive wood pulp bleaching process.

What potential breakthroughs are anticipated in banana paper technology?

Future breakthroughs are anticipated in nanocellulose extraction from banana fibers for advanced functional packaging, bio-refinery integration to utilize all components of the banana residue, and fully circular, closed-loop water systems in paper mills to minimize environmental impact.

Why is the demand for banana paper growing rapidly in the luxury goods sector?

Luxury brands leverage banana paper's unique story, premium texture, and certified sustainability status to enhance brand narrative and consumer experience. Using agricultural waste material aligns perfectly with high-end ethical and eco-conscious branding strategies.

What is the role of decentralized processing units in the supply chain?

Decentralized units located near banana farms perform initial fiber extraction (decortication). This crucial step reduces the moisture content and bulkiness of the raw material significantly, making transport to centralized mills vastly more economical and logistically viable.

Does the production of banana paper compete with food resources?

No, banana paper production utilizes the pseudostem and leaves, which are non-edible agricultural residues generated after the fruit is harvested. This ensures that the raw material does not compete with food security or land use required for human consumption.

What impact does the use of AI have on fiber sorting and quality control?

AI uses computer vision and machine learning to analyze fiber characteristics, automating the sorting and grading process. This ensures uniform raw material input, drastically improving the consistency and overall quality of the final banana paper product, a critical step for industrial scalability.

Which subsegment of the market segmentation by end-use is expected to show the highest growth?

The Industrial segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by large-volume adoption of banana paper for secondary and tertiary packaging by global FMCG and industrial manufacturers seeking to meet strict corporate sustainability goals.

What challenges exist in scaling up banana paper production for mass markets?

Challenges include securing massive, consistent feedstock supply, standardizing quality control across international fiber sources, and overcoming the current cost premium relative to established wood-based pulp suppliers who benefit from economies of scale.

How is the supply chain variability of banana fiber addressed by producers?

Producers address variability by establishing strong, long-term partnerships with multiple farming cooperatives, investing in standardized mobile decortication technology, and integrating advanced supply chain tracking software to predict and manage yield fluctuations effectively.

What types of innovative coatings are being developed for banana paper packaging?

Innovation is focused on developing bio-based, compostable barrier coatings (e.g., starch-based or wax alternatives) to enhance banana paper's resistance to grease and moisture, expanding its suitability for challenging food packaging applications currently dominated by plastics.

Is banana paper suitable for digital printing technologies?

Yes, advanced grades of banana paper, particularly those subjected to optimized refining and sizing processes, exhibit excellent printability and are suitable for most modern digital and offset printing technologies, catering to both commercial and fine art printing needs.

Which region currently represents the largest market share in terms of revenue?

North America and Europe collectively hold the largest market share in terms of revenue value, despite lower production volumes, due to the high price premium commanded by certified sustainable materials in their mature, high-purchasing-power markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager