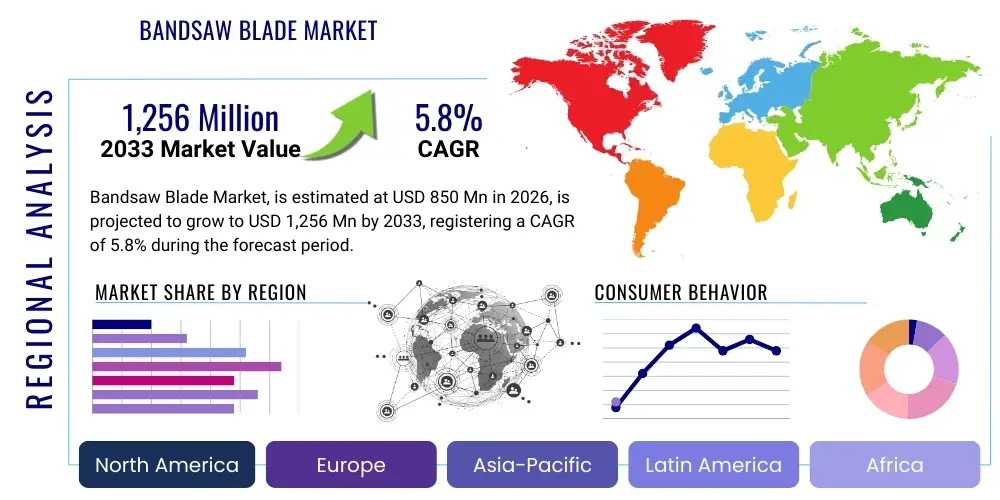

Bandsaw Blade Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434541 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Bandsaw Blade Market Size

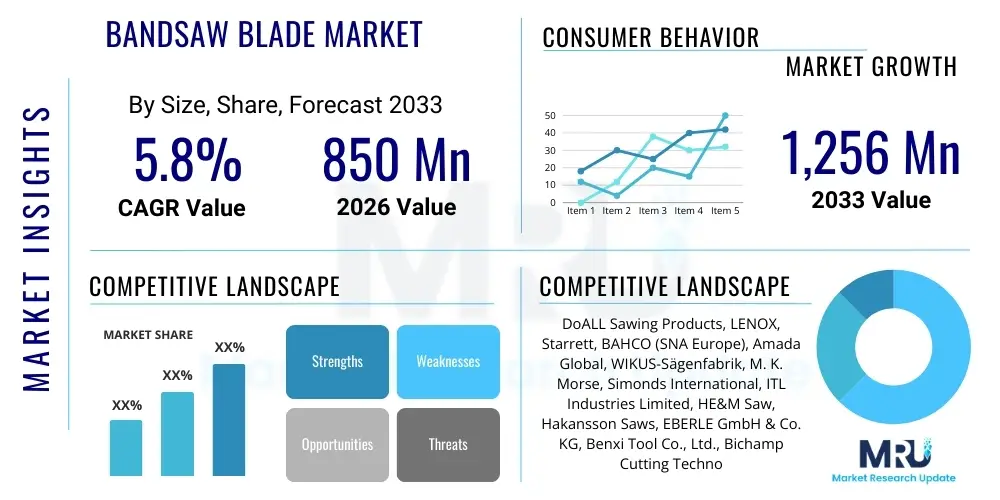

The Bandsaw Blade Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,256 Million by the end of the forecast period in 2033.

Bandsaw Blade Market introduction

The Bandsaw Blade Market encompasses the manufacturing and distribution of continuous metal bands with a serrated or abrasive edge, designed primarily for cutting various materials, including wood, metal, plastic, and composite materials. Bandsaw blades are essential consumables utilized across a wide spectrum of industrial and professional applications, characterized by their efficiency in continuous cutting operations and the ability to produce minimal kerf waste. The market is defined by continuous advancements in material science, focusing on bimetal construction, carbide tipping, and specialized coating technologies (such as PVD or CVD coatings) to enhance durability, cutting speed, and operational lifespan under demanding conditions, thereby driving replacement demand in high-volume production environments.

Major applications of bandsaw blades span heavy industries, including aerospace, automotive manufacturing, construction, and general fabrication. In the metalworking sector, bandsaw blades are indispensable for cutting structural steel, high-performance alloys, and tubes to precise specifications. The woodworking industry relies heavily on these blades for logging, resawing, and detailed curved cutting tasks. The market growth is inherently linked to global infrastructure development, industrial output, and the modernization of manufacturing processes, particularly in rapidly industrializing economies of Asia Pacific where demand for precision metal and wood processing equipment is escalating.

Key benefits driving market adoption include the ability of bandsaws to handle large workpieces, their inherent safety advantages compared to alternative cutting methods, and the efficiency derived from continuous cutting action. Driving factors involve the sustained growth in automotive production requiring precise alloy cutting, the high demand for customized wood products, and technological upgrades leading to the replacement of older high-speed steel (HSS) blades with more efficient bimetal and carbide-tipped variants. Furthermore, stringent requirements for material processing precision in demanding sectors like nuclear energy and aviation ensure continued investment in high-quality, specialized bandsaw blades.

Bandsaw Blade Market Executive Summary

The Bandsaw Blade Market is characterized by robust business trends centered on material innovation and performance optimization. Manufacturers are intensely focused on developing carbide-tipped blades for cutting superalloys and hardened steels, driven by the expanding requirements of the energy and aerospace sectors. A significant business trend involves the shift towards subscription or managed inventory services for high-volume industrial end-users, ensuring consistent blade replacement and optimization consultancy, which secures long-term revenue streams for key market players. Furthermore, consolidation within the supply chain, as larger companies acquire specialized coating and raw material providers, is aimed at securing competitive pricing and proprietary technology, thereby enhancing overall market control and efficiency.

Regional trends indicate that Asia Pacific (APAC) is projected to exhibit the highest growth rate, fueled by massive investment in manufacturing infrastructure, rapid urbanization, and subsequent high demand from the construction and automotive supply chains in countries like China, India, and Southeast Asia. North America and Europe, while mature, maintain dominance in terms of value, driven by high adoption rates of premium, technologically advanced blades (e.g., specialized tool steel matrices and sophisticated geometric tooth designs) required for high-precision, low-volume advanced manufacturing operations. The emphasis in these mature markets is often on reducing operational downtime and increasing efficiency rather than sheer volume.

Segmentation trends highlight the increasing prominence of bimetal and carbide-tipped blades over traditional carbon steel types due to superior life and cutting performance across difficult materials. By application, the metal cutting segment holds the largest market share, driven by industrial fabrication and automotive tooling needs, while the wood cutting segment remains stable, driven by residential and commercial construction activities. Distribution trends show a growing utilization of e-commerce platforms and direct-to-consumer digital channels for small-to-medium enterprises (SMEs) and professional users, complementing the traditional robust distribution network managed by industrial supply houses and authorized dealers, optimizing supply chain logistics and reducing lead times.

AI Impact Analysis on Bandsaw Blade Market

Common user questions regarding AI's influence on the Bandsaw Blade Market primarily revolve around predictive maintenance, optimization of blade manufacturing processes, and smart cutting strategies. Users are keen to understand if AI can forecast blade failure precisely, thereby minimizing unplanned downtime in high-cost manufacturing lines. They also inquire about AI's role in optimizing tooth geometry and material composition based on real-time cutting feedback across diverse materials. The central theme emerging from user concerns is the expectation for AI to transform bandsaw operations from reactive replacement schedules to highly proactive, data-driven performance management, ensuring optimal resource utilization and consistent cut quality, especially in automated industrial settings.

The impact of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is set to revolutionize the operational longevity and efficiency of bandsaw blades within industrial settings. AI facilitates the development of intelligent cutting systems that monitor key parameters—such as vibration, temperature, motor load, and cutting speed—in real-time. By analyzing vast datasets generated during the cutting process, AI models can accurately predict the remaining useful life (RUL) of a blade, signaling the necessity for replacement or adjustment long before catastrophic failure occurs. This capability dramatically reduces unscheduled maintenance and improves overall equipment effectiveness (OEE), providing significant operational cost savings to end-users.

Furthermore, AI is increasingly leveraged in the design and manufacturing phase of bandsaw blades. Generative design algorithms can explore thousands of possible tooth profiles, set angles, and material combinations, optimizing for specific applications, such as high-speed cutting of aerospace-grade titanium or precise contouring of dense composite materials. This optimization, guided by simulated real-world usage data, leads to the production of superior performance blades with enhanced fatigue resistance and extended operational cycles. The integration of digital twins for monitoring blade performance allows manufacturers to iterate design improvements faster, accelerating product development cycles and customizing offerings for specialized industrial needs.

- AI-driven Predictive Maintenance: Utilizing sensor data to forecast blade wear and schedule replacements, minimizing unplanned production stoppages.

- Optimized Cutting Parameters: ML algorithms adjust feed rate, speed, and coolant flow dynamically based on material hardness and geometry for maximum blade life.

- Generative Blade Design: AI aids in optimizing tooth geometry and pitch variability for specific alloy cutting profiles, improving efficiency and reducing noise.

- Automated Quality Control: Computer vision and AI detect microscopic defects during the blade manufacturing process, ensuring strict adherence to quality standards.

- Inventory Management: AI models predict future blade demand based on production schedules and material consumption, streamlining supply chain logistics.

- Enhanced Material Utilization: Smart cutting paths determined by AI reduce kerf waste and maximize the yield from expensive raw materials.

DRO & Impact Forces Of Bandsaw Blade Market

The Bandsaw Blade Market dynamics are primarily shaped by the cyclical demands of the manufacturing and construction industries, coupled with continuous technological advancements in metallurgy and cutting tool design. The key drivers include the global resurgence in automotive and aerospace manufacturing, which requires specialized blades for cutting high-strength, lightweight alloys, and the strong growth trajectory of the furniture and housing construction sectors, particularly in emerging markets. Restraints largely center on the intense competitive pricing pressure from regional low-cost manufacturers, fluctuating costs of raw materials (such as tungsten carbide and specialty tool steels), and the increasing adoption of alternative cutting technologies like laser and waterjet cutting in certain niche applications. Opportunities reside in the development of highly specialized, application-specific blades with advanced coatings that offer significantly improved wear resistance, targeting high-margin industrial applications where initial blade cost is secondary to operational efficiency and output quality. These forces create a dynamic environment where investment in R&D and strategic supply chain management are critical determinants of market success.

Drivers fueling the market include the push for greater automation in industrial processes, which necessitates consistent and high-quality cutting tools capable of operating continuously in robotic systems without frequent manual intervention. Furthermore, the global trend towards energy-efficient manufacturing processes favors bandsaw technology, as it often requires less energy per cut compared to abrasive or milling processes. The robust infrastructure development agenda across regions, specifically for transportation and energy projects, ensures a steady demand for heavy-duty metal-cutting blades. Compliance with strict regulatory standards concerning cut quality and material integrity in safety-critical sectors, such as medical device manufacturing and nuclear power generation, further drives the adoption of premium, certified bandsaw blades.

Conversely, significant restraints are related to the high initial investment required for sophisticated, high-performance bandsaw machines and the associated specialized tooling. The lifespan of a high-end blade, while superior, is highly dependent on correct machine setup, operator skill, and maintenance protocols; improper usage can drastically reduce blade life, leading to user dissatisfaction and increased operational expense. Opportunities for market expansion are abundant in the aftermarket service sector, particularly offering expertise in blade reconditioning, retipping, and providing optimization training to end-users to maximize blade performance. Furthermore, the sustainable manufacturing movement presents an opportunity for manufacturers to innovate recyclable blade materials and environmentally friendly cooling and lubrication systems, appealing to corporate social responsibility initiatives and securing niche markets.

Segmentation Analysis

The Bandsaw Blade Market is comprehensively segmented based on material, application, tooth type, distribution channel, and geography, reflecting the highly specialized nature of the cutting tool industry. The segmentation by material is crucial, as the performance and cost of the blade are directly tied to the substrate used, ranging from basic carbon steel for woodworking to advanced bimetal and carbide-tipped options for rigorous industrial metal cutting. Application segmentation highlights the diverse end-user industries, with metal cutting consistently dominating the market value due to the demanding nature and volume requirements of sectors like aerospace and automotive fabrication, while the wood cutting segment holds significant volume share driven by construction and furniture manufacturing.

Analysis of tooth type reveals segmentation into standard set, raker set, wave set, and specialized variable pitch designs, each optimized for different material cross-sections and chip load characteristics. The adoption of variable pitch blades is growing rapidly as they effectively reduce vibration and noise while offering versatility across varied material sizes. Distribution channels are segmented into direct sales, distributor networks, and online retail, reflecting the strategic importance of efficient logistics in delivering these consumable products globally. Understanding these segments is paramount for manufacturers to tailor their product offerings, pricing strategies, and regional market penetration efforts effectively.

- By Material Type:

- Carbon Steel Blades

- Bimetal Blades (HSS edge welded to a flexible backing)

- Carbide-Tipped Blades

- Diamond-Grit Blades

- Specialty Tool Steel Blades

- By Application:

- Metal Cutting (Ferrous and Non-Ferrous Alloys)

- Wood Cutting (Hardwood, Softwood, Composites)

- Meat Cutting/Food Processing

- Contour and Die Cutting

- Construction and Infrastructure

- By Tooth Type:

- Standard Tooth

- Raker Tooth

- Skip Tooth

- Hook Tooth

- Variable Pitch Tooth

- By Distribution Channel:

- Direct Sales/OEM

- Industrial Distributors and Wholesalers

- E-commerce and Online Retail

- Authorized Dealers

- By End-User:

- Automotive and Transportation

- Aerospace and Defense

- Construction and Infrastructure

- General Fabrication and Machine Shops

- Furniture and Woodworking

- Energy (Oil & Gas, Power Generation)

Value Chain Analysis For Bandsaw Blade Market

The value chain for the Bandsaw Blade Market begins with upstream analysis focusing on raw material procurement, which is a critical determinant of final product quality and cost. Key raw materials include high-speed steel (HSS), specialized alloy steels (for the blade body), and tungsten carbide (for tipping high-performance blades). Sourcing high-quality HSS and ensuring stable supply of refractory metals like tungsten and cobalt is essential. Manufacturers often engage in long-term contracts with specialized steel mills and metallurgical processors to mitigate volatility in commodity prices and guarantee material specifications necessary for demanding applications. The primary manufacturing stage involves strip preparation, tooth generation (milling or grinding), heat treatment, welding (especially for bimetal construction), and specialized surface coating application, processes which add significant value through proprietary technological expertise.

Midstream activities primarily focus on production efficiency, quality assurance, and inventory management. This involves specialized welding techniques (e.g., laser welding for bimetal blades) to ensure the fusion zone integrity and advanced heat treatment to optimize the hardness and flexibility profile of the blade. Distribution channels play a vital role in connecting manufacturers to the diverse global end-user base. The channels are broadly segmented into direct and indirect routes. Direct sales are typically employed for large Original Equipment Manufacturers (OEMs) or key industrial accounts requiring bespoke solutions and technical support. This channel ensures maximum control over product delivery and customer relationship management.

Indirect channels, encompassing a vast network of industrial distributors, local supply houses, and specialized retail outlets, facilitate wider market access, particularly to Small and Medium Enterprises (SMEs) and independent professional shops. The increasing utilization of e-commerce platforms is significantly impacting the indirect channel, offering improved transparency, faster order fulfillment for standardized products, and easier access to technical specifications and comparison tools for buyers. Downstream analysis emphasizes end-user engagement, technical service, and aftermarket support, including offering blade re-sharpening or maintenance training, which enhances customer loyalty and maximizes the operational lifespan of the product, thereby increasing the total value delivered throughout the product lifecycle.

Bandsaw Blade Market Potential Customers

The primary potential customers and end-users of the Bandsaw Blade Market are diverse industrial and manufacturing entities demanding precision cutting tools for material processing. The largest segment of buyers comprises heavy fabrication shops and general machine shops that use bandsaws daily for cutting stock material, prepping components for welding, or creating molds and dies. These customers prioritize blade longevity, versatility across different ferrous and non-ferrous metals, and competitive pricing due to high consumption rates. Furthermore, the automotive manufacturing industry, particularly component suppliers and stamping plants, represents a high-value customer group, requiring highly accurate bimetal or carbide blades for cutting powertrain components, chassis parts, and specialized tooling materials crucial for mass production efficiency.

A secondary, yet highly critical, group of potential customers resides within the specialized high-tech sectors, notably aerospace and defense, and the energy sector (oil & gas, nuclear). These customers demand ultra-premium, carbide-tipped or diamond-coated blades capable of handling exotic materials such as titanium alloys, inconel, and advanced composites, where material integrity and minimal thermal distortion during cutting are non-negotiable requirements. For these high-stakes applications, performance consistency, traceability, and certification are valued far above initial purchase cost, driving demand for specialized, high-margin products tailored for extreme operating conditions and precision tolerances.

The third significant customer segment includes the woodworking industry, ranging from large-scale sawmills and logging operations that require wide, robust carbon steel blades for primary breakdown, to cabinet makers and furniture manufacturers demanding precision narrow blades for resawing and contour cutting of various hardwoods and engineered wood products. Construction sites and DIY/professional home improvement sectors also constitute a stable customer base, primarily consuming smaller, portable bandsaw blades. Market strategies targeting these diverse customers must address specific needs: longevity and material handling for industrial users, certification and precision for aerospace clients, and balance of price and performance for woodworking professionals and DIY users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,256 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DoALL Sawing Products, LENOX, Starrett, BAHCO (SNA Europe), Amada Global, WIKUS-Sägenfabrik, M. K. Morse, Simonds International, ITL Industries Limited, HE&M Saw, Hakansson Saws, EBERLE GmbH & Co. KG, Benxi Tool Co., Ltd., Bichamp Cutting Technology (Hunan) Co., Ltd., Trajan Sawing, Diamond Saw Works, Kinkelder BV, Metamob, TC Bandsaw Blades, Blades Direct |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bandsaw Blade Market Key Technology Landscape

The technological landscape of the Bandsaw Blade Market is characterized by continuous innovation in material science, production precision, and surface engineering, all aimed at enhancing the blade's wear resistance and operational speed. A pivotal technology is the advancement in bimetal construction, where manufacturers employ sophisticated Electron Beam Welding (EBW) to fuse high-performance high-speed steel (HSS) strips onto a highly flexible spring steel backing strip. This composite construction allows the teeth to remain exceptionally hard and sharp, while the body maintains the necessary flexibility to withstand the dynamic stresses encountered in continuous cutting, significantly extending blade life compared to older monometallic designs and making bimetal blades the industry standard for general metal cutting.

The most transformative technology remains the increasing adoption of tungsten carbide tipping. Carbide-tipped blades, achieved through precise brazing or laser deposition techniques, offer unparalleled hardness and heat resistance, enabling significantly faster cutting speeds and longer life, especially when processing highly abrasive materials, hardened steel, or difficult-to-machine superalloys prevalent in aerospace and energy applications. Further enhancing performance, manufacturers are implementing advanced coating technologies, such as Physical Vapor Deposition (PVD) coatings (like TiN, TiAlN, or AlTiN), which reduce friction, prevent material adherence (chip welding), and significantly increase the surface hardness of the tooth, thereby offering specialized solutions for dry cutting or minimal lubrication environments.

Beyond material and surface treatment, advancements in blade geometry and machine-tool integration are critical. Variable pitch and variable set tooth geometries are essential innovations designed to dampen vibration, reduce noise, and minimize harmonic resonance during cutting, allowing the blade to perform efficiently across a wider range of material sizes and shapes without binding or premature wear. Moreover, the integration of sensors and digital monitoring capabilities (IoT) into modern bandsaw machines, often bundled with the blades, allows for precise data collection on blade performance metrics, feeding into optimization cycles and predictive maintenance routines, thereby cementing the role of technology as a primary value differentiator in the competitive landscape.

Regional Highlights

The Bandsaw Blade Market exhibits distinct regional demand profiles shaped by the level of industrialization and dominant manufacturing sectors within each geography. North America and Europe represent mature, high-value markets, characterized by stringent quality standards and a high reliance on advanced, specialized blade technology, particularly carbide-tipped and advanced bimetal blades used in aerospace, medical device manufacturing, and high-precision automotive tooling. Demand growth here is moderate but highly stable, focusing on blade efficiency, reduced operational cost through longevity, and specialized applications rather than sheer volume expansion. Technical expertise and fast supply chain responsiveness are key competitive advantages in these regions.

Asia Pacific (APAC) is the undisputed powerhouse for volume growth and is projected to be the fastest-expanding region throughout the forecast period. This acceleration is driven by colossal government investment in infrastructure (roads, bridges, energy projects), rapid urbanization, and the sustained expansion of manufacturing hubs in China, India, Vietnam, and Indonesia. The automotive supply chain and the massive domestic construction and furniture industries in these nations create an insatiable demand for both standard carbon steel blades and higher-end bimetal products. Local competition is intense, but the sheer scale of manufacturing output ensures sustained market expansion across all segments.

Latin America (LATAM) and the Middle East & Africa (MEA) demonstrate potential, primarily linked to extractive industries (oil, gas, mining) and burgeoning construction activities. Demand in MEA is bolstered by petrochemical infrastructure projects requiring specialized pipe cutting tools, while LATAM's market is highly dependent on localized construction and timber processing activities. These regions often rely on imported premium blades from North America and Europe for specialized tasks but utilize regional or Chinese manufacturers for general-purpose applications, representing a diverse market landscape where pricing and local distribution networks are critical success factors.

- North America (US, Canada): Focus on high-performance carbide blades for aerospace, defense, and high-precision fabrication. Dominated by efficiency and specialized material processing.

- Europe (Germany, UK, Italy): Strong demand driven by the automotive, machinery, and toolmaking sectors, emphasizing quality, sustainability, and adherence to high manufacturing standards. Germany remains a technological hub.

- Asia Pacific (China, India, Japan): Highest volume growth fueled by massive infrastructure, robust automotive production, and expanding general manufacturing bases. Key drivers are urbanization and industrial capacity expansion.

- Latin America (Brazil, Mexico): Market influenced by resource extraction (mining) and agricultural machinery manufacturing, leading to demand for robust, general-purpose metal and wood cutting tools.

- Middle East and Africa (Saudi Arabia, UAE, South Africa): Demand centered on oil & gas pipeline fabrication, construction projects, and large-scale metalworking activities crucial for local economic diversification efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bandsaw Blade Market.- DoALL Sawing Products

- LENOX

- Starrett

- BAHCO (SNA Europe)

- Amada Global

- WIKUS-Sägenfabrik

- M. K. Morse

- Simonds International

- ITL Industries Limited

- HE&M Saw

- Hakansson Saws

- EBERLE GmbH & Co. KG

- Benxi Tool Co., Ltd.

- Bichamp Cutting Technology (Hunan) Co., Ltd.

- Trajan Sawing

- Diamond Saw Works

- Kinkelder BV

- Metamob

- TC Bandsaw Blades

- Blades Direct

Frequently Asked Questions

Analyze common user questions about the Bandsaw Blade market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for carbide-tipped bandsaw blades?

The primary factor driving demand for carbide-tipped bandsaw blades is the increasing requirement to cut high-strength, difficult-to-machine materials such as titanium, superalloys (Inconel), and hardened steels used extensively in the aerospace, defense, and energy sectors. Carbide tipping offers superior hardness and thermal stability, resulting in significantly faster cutting rates and extended blade life compared to bimetal options.

How does the Bimetal segment compare to the Carbon Steel segment in terms of market value?

The Bimetal segment typically commands a much higher market value share than the Carbon Steel segment, especially in industrialized regions. Bimetal blades offer a balance of cutting performance, flexibility, and durability for general metal cutting applications, making them the preferred high-volume industrial choice, while Carbon Steel is primarily reserved for basic wood, plastic, or softer, non-ferrous metal cutting where cost is the overriding factor.

Which geographical region is projected to experience the highest growth rate in the Bandsaw Blade Market?

The Asia Pacific (APAC) region is projected to experience the highest Compound Annual Growth Rate (CAGR) due to rapid industrialization, massive infrastructure development, and the expansion of the automotive and general manufacturing bases in countries like China, India, and Southeast Asia, driving high volume consumption of both machinery and consumable blades.

What role does predictive maintenance play in the future of the Bandsaw Blade Market?

Predictive maintenance, enabled by IoT sensors and AI algorithms, plays a crucial role by transitioning industrial operations from reactive blade replacement to proactive scheduling. This technology forecasts the precise remaining useful life (RUL) of a blade based on real-time operational data, minimizing expensive unplanned downtime, optimizing inventory management, and maximizing overall equipment effectiveness (OEE) for end-users.

What are the key technical specifications customers evaluate when purchasing bandsaw blades for metal cutting?

Key technical specifications evaluated by industrial customers include the blade material (e.g., Bimetal or Carbide), the tooth per inch (TPI) count, the tooth geometry (e.g., variable pitch for vibration dampening), and the coating technology applied. These parameters collectively determine the blade's suitability for specific material hardness, cross-section size, cutting speed, and expected operational lifespan in demanding applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Bimetallic Bandsaw Blade Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (High Speed Steel Band Saw Blade, Tungsten Carbide Band Saw Blade), By Application (Ferrous Metallurgy Industry, Machining, Automobile Industry, Aviation), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Bandsaw Blade Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (High Speed Steel Bandsaw Blade, Carbide Tipped Bandsaw Blade), By Application (Ferrous Metallurgy Industry, Machining, Automobile Industry, Aviation), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager