Bandsaw Blades Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433531 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Bandsaw Blades Market Size

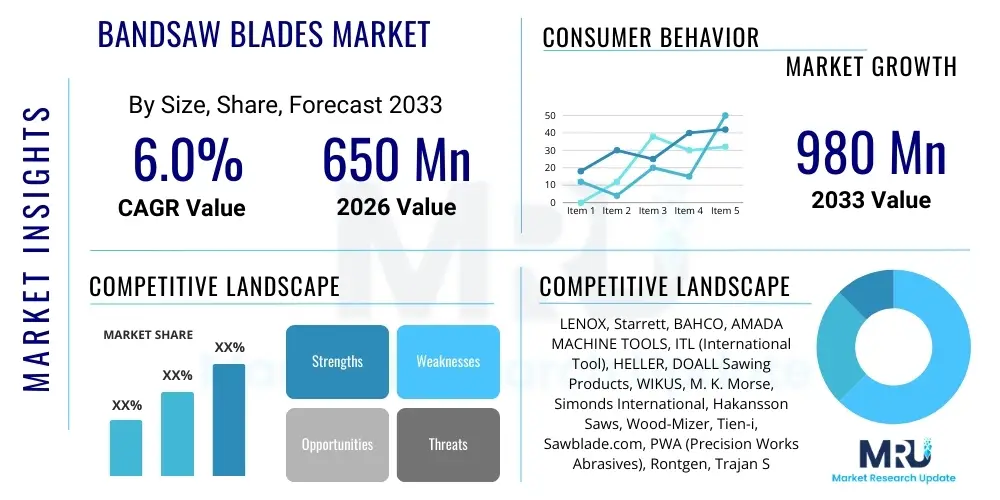

The Bandsaw Blades Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.0% between 2026 and 2033. The market is estimated at $650 Million USD in 2026 and is projected to reach $980 Million USD by the end of the forecast period in 2033.

Bandsaw Blades Market introduction

The Bandsaw Blades Market encompasses the manufacturing, distribution, and sale of continuous strip metal blades designed for cutting various materials, including wood, metal, plastic, and food products. These specialized cutting tools operate on bandsaw machines, utilizing a continuous loop of toothed metal that runs over two or more wheels, offering highly efficient, accurate, and rapid cutting capabilities. Blades vary significantly in material composition—such as carbon steel for general woodworking, bi-metal for versatile metal cutting, and carbide-tipped for high-performance, abrasive materials—as well as tooth geometry, pitch, and set, tailored precisely for specific industrial applications and material hardness.

Major applications of bandsaw blades span critical sectors including industrial metalworking, particularly in automotive, aerospace, and general fabrication industries requiring precision cutting of alloys and structural steel. Furthermore, the construction and woodworking sectors heavily rely on these blades for preparing raw timber, composite panels, and structural components. The fundamental benefits of using bandsaw technology include minimal material wastage (kerf loss), superior surface finish, and the capacity to handle large and irregularly shaped workpieces. The design versatility of the blades allows for straight, curved, or contour cutting, contributing significantly to their essential role in manufacturing processes globally.

The primary driving factors sustaining market growth include the escalating global demand for fabricated metals in infrastructure development, rising industrial automation leading to higher throughput requirements, and significant technological advancements in blade materials and coatings, such as specialized PVD and CVD coatings that extend blade life and enhance performance when cutting exotic or hardened alloys. Increased investment in manufacturing capacity expansion in emerging economies, coupled with stringent precision requirements in the aerospace and medical device sectors, further solidifies the market trajectory. The need for efficient maintenance and replacement cycles due to wear and tear is an inherent growth driver in this consumables market.

Bandsaw Blades Market Executive Summary

The Bandsaw Blades Market exhibits robust growth driven by accelerating industrial output and technological innovation focused on material science and manufacturing efficiency. Current business trends indicate a strong shift towards high-performance bi-metal and carbide-tipped blades, necessitated by the increasing use of challenging materials like titanium, Inconel, and highly abrasive composites in end-use industries such as aerospace and energy. Manufacturers are strategically investing in advanced tooth setting technologies and surface treatments to improve cutting speeds, reduce vibration, and ultimately increase the total operational lifespan of the blades, thereby addressing the core demand for enhanced productivity and reduced downtime in fabrication facilities globally.

Regionally, the Asia Pacific (APAC) stands out as the epicenter of market expansion, fueled by massive government investments in infrastructure, the rapid growth of the automotive manufacturing base in China and India, and the flourishing secondary metals sector. North America and Europe, while mature markets, maintain significant value share due to high adoption rates of premium, specialized blades and strict regulatory standards demanding superior cut quality and material integrity. These established regions prioritize automation and the integration of bandsaw machines into smart factory environments, pushing the demand for blades optimized for automated feeding and monitoring systems. Specific regional growth in MEA and Latin America is intrinsically linked to raw material extraction industries, particularly mining and general structural metal fabrication.

Segment trends highlight the dominance of the metalworking application segment, primarily due to the ubiquitous need for material preparation in heavy industries. Within the blade type segment, the Carbide Tipped segment is poised for the fastest CAGR, reflecting the industry's pivot toward cutting hard and abrasive materials that standard bi-metal blades struggle with, thereby maximizing efficiency. The distribution landscape is evolving with a notable rise in e-commerce and direct digital sales channels, allowing smaller fabricators and maintenance shops greater access to specialized blade inventory and reducing reliance solely on traditional industrial distributors, although distributors remain crucial for bulk and high-service contracts.

AI Impact Analysis on Bandsaw Blades Market

Common user questions regarding AI's impact on the Bandsaw Blades Market generally revolve around how predictive maintenance systems can prolong blade life, whether AI can optimize cutting parameters in real-time for different materials, and the potential for autonomous bandsawing operations. Users express concerns about the integration complexity of AI sensors into existing machinery and the required data infrastructure investment. Analysis indicates key themes centered on efficiency maximization, waste reduction, and the transition from scheduled maintenance to condition-based monitoring. Users expect AI to reduce human error, minimize material waste resulting from premature blade failure, and provide prescriptive recommendations for optimizing the purchasing cycle of consumable blades based on actual usage patterns and machine load data.

- AI-Powered Predictive Maintenance (PPM): Utilizes machine learning algorithms to analyze vibration, temperature, and power consumption data from bandsaw machines to accurately predict the remaining useful life (RUL) of a blade, enabling timely replacement and minimizing unplanned downtime.

- Real-time Cutting Optimization: AI systems adjust parameters such as feed rate, speed (SFM), and coolant application based on material hardness variations and current blade wear, ensuring optimal cutting efficiency and superior surface finish quality.

- Inventory Management Automation: Machine learning models forecast blade consumption rates categorized by material type and size, optimizing inventory levels for manufacturing facilities and reducing carrying costs while preventing stockouts of critical consumables.

- Quality Control via Machine Vision: AI-enhanced vision systems inspect finished cuts for anomalies, chipping, or burrs, identifying premature blade degradation or setup issues before material waste accumulates.

- Autonomous Parameter Calibration: Integration of deep learning models into modern bandsaw CNC controls to automatically select the best blade type, tooth pitch, and operating settings for a newly loaded job, minimizing reliance on operator experience.

- Design Optimization Feedback Loop: AI analyzes performance data (e.g., failure modes, typical wear patterns) across thousands of operational hours, feeding crucial insights back to blade manufacturers to refine tooth geometry and material composition for subsequent product generations.

DRO & Impact Forces Of Bandsaw Blades Market

The Bandsaw Blades market is principally driven by accelerated industrialization in emerging markets, necessitating high-volume material processing, particularly in the structural steel and automotive sectors. This demand is further amplified by continuous material innovation in aerospace and energy, requiring specialized blades capable of cutting difficult, high-strength alloys efficiently. However, the market faces significant restraints, chiefly the volatile cost of specialized raw materials such as tungsten carbide and cobalt, which directly impacts manufacturing costs and retail pricing for high-end blades. The increasing shift towards alternative cutting technologies, such as advanced laser cutting and waterjet processes, particularly for non-ferrous and composite materials, also poses a competitive restraint to traditional bandsawing applications.

Opportunities for market players are abundant, notably through the development of environmentally friendly blade coatings and manufacturing processes that minimize hazardous waste, aligning with global sustainability mandates. Furthermore, the integration of IoT and smart sensors into bandsaw machines opens avenues for service-based revenue models, where manufacturers provide optimized blade management solutions rather than just physical product sales. The growing demand for food processing bandsaw blades—mandated by strict hygiene and sanitation standards—presents a high-growth niche, requiring specialized stainless steel and easy-to-clean designs. Geographical expansion into underdeveloped industrial clusters remains a key strategic opportunity.

The impact forces within this market are multifaceted. The high initial capital cost associated with precision bandsaw machines can limit adoption among smaller enterprises, although this is mitigated by the longevity and efficiency of modern blades. Technological change exerts a strong positive force, particularly the introduction of advanced variable pitch tooth designs which enhance chip evacuation and reduce vibration across diverse material types. Regulatory pressures related to worker safety and material traceability are also influential, compelling manufacturers to adhere to international standards (e.g., ISO) and provide higher quality, more durable products. The lifecycle cost optimization achieved through high-performance blades is the strongest long-term positive impact force, justifying higher initial blade prices through reduced operational expenses and increased throughput.

Segmentation Analysis

The Bandsaw Blades Market is comprehensively segmented based on Type, Application, and Distribution Channel, allowing for granular analysis of demand patterns and strategic market positioning. The segmentation reflects the diverse requirements of end-user industries, where the selection of the correct blade material and geometry is paramount to achieving efficiency and cut quality. Market dynamics vary significantly across these segments; for instance, the demand for Type segments such as Carbide Tipped blades is correlated directly with capital investment cycles in high-precision manufacturing, while the demand for Carbon Steel blades remains stable, driven largely by general maintenance and woodworking activities.

Analysis of the Application segments demonstrates that Metalworking holds the largest market share, driven by infrastructure, automotive body assembly, and machinery production, requiring substantial cutting of ferrous and non-ferrous metals. However, the Food Processing segment is anticipated to witness rapid growth due to increasing automation in meat and fish processing plants globally, demanding specialized hygienic blades. The Distribution Channel segmentation highlights the ongoing transition, where traditional industrial supply houses still dominate for high-volume orders, but the efficiency and convenience of e-commerce platforms are steadily gaining traction, particularly for MRO (Maintenance, Repair, and Operations) purchases.

- By Type:

- Carbon Steel Bandsaw Blades (Primary use: Wood, soft materials, general maintenance)

- Bi-metal Bandsaw Blades (Primary use: Versatile metal cutting, structural steel, tool steel)

- Carbide Tipped Bandsaw Blades (Primary use: Hard metals, titanium, Inconel, abrasive composites, high throughput)

- Diamond Bandsaw Blades (Primary use: Ceramics, stone, specialized abrasive materials)

- By Application/End-Use:

- Metalworking

- Ferrous Metal Cutting (Steel, Cast Iron)

- Non-Ferrous Metal Cutting (Aluminum, Brass, Copper)

- Woodworking (Lumber mills, furniture manufacturing, construction)

- Construction (Structural components, pipe cutting)

- Food Processing (Meat, fish, frozen goods)

- Others (Plastics, Composites, Rubber, Foam)

- By Distribution Channel:

- Direct Sales (OEMs, large fabrication plants)

- Distributors and Industrial Supply Houses (MRO, SMEs)

- E-commerce and Online Retail

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Bandsaw Blades Market

The value chain for the Bandsaw Blades Market is initiated by the upstream segment, which involves the sourcing and processing of specialized raw materials, primarily high-speed steel (HSS), spring steel, powdered metals (for carbide production), and coating materials (e.g., Titanium Nitride). Key upstream suppliers include major metal producers and chemical companies specializing in alloy components. The quality and stable pricing of these raw inputs are critical determinants of final product quality and manufacturing cost. Innovations at this stage, such as novel powder metallurgy techniques for producing finer, tougher carbide particles, significantly influence blade performance and life.

The manufacturing stage follows, where raw strips are subjected to complex processes including welding (forming the loop), precise tooth milling or grinding, heat treatment (hardening and tempering), setting, and finally, coating application. Direct and indirect distribution channels then facilitate market reach. Direct sales are often preferred for highly technical, specialized blades sold directly to major original equipment manufacturers (OEMs) or large industrial accounts requiring tailored service contracts and bulk supply. This channel offers greater control over branding and pricing, ensuring precise application engineering support is provided to the end-user.

Conversely, the downstream segment relies heavily on indirect distribution through a robust network of industrial distributors, local tooling supply houses, and increasingly, specialized e-commerce platforms. These intermediaries are crucial for reaching small to medium-sized enterprises (SMEs), maintenance shops, and general fabricators who require diverse inventory, rapid delivery, and localized technical support. The effectiveness of the distribution channel dictates market penetration, with optimized logistics being key to maintaining market share in this MRO-heavy consumables sector. E-commerce platforms address the growing demand for convenience and competitive pricing, especially for standard blade types.

Bandsaw Blades Market Potential Customers

The primary customers for bandsaw blades are sophisticated industrial entities that utilize these consumables as essential tools in their production or maintenance workflows, prioritizing cutting speed, precision, and blade longevity. The largest segment of end-users encompasses companies within the Metalworking industry, including automotive component manufacturers, aerospace and defense contractors requiring precise cuts on complex alloys, heavy machinery fabricators, and structural steel processors involved in large-scale infrastructure projects. These buyers often purchase high-volume, performance-grade bi-metal and carbide-tipped blades, frequently under multi-year supply contracts.

A secondary, yet significant, customer base resides in the Woodworking and Construction sectors, ranging from large lumber mills that utilize wide band sawmill blades to small custom cabinet makers and general contractors who rely on carbon steel and specialized narrow blades for intricate cuts. Furthermore, the Food Processing industry represents a niche but highly regulated customer segment, requiring specialized stainless steel blades compliant with stringent hygiene standards for cutting meat, bone, and frozen products. Purchases in this sector prioritize sanitation features and corrosion resistance over sheer speed.

Finally, maintenance, repair, and overhaul (MRO) departments across nearly all manufacturing and industrial facilities constitute a continuous demand source. These users require a wide variety of blade types for general shop work, tool steel preparation, and equipment repair. The purchasing decisions for these customers are heavily influenced by product availability, local distributor support, and the perceived overall value (cost per cut), driving consistent demand for efficient, durable, and readily available replacement blades.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $650 Million USD |

| Market Forecast in 2033 | $980 Million USD |

| Growth Rate | 6.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LENOX, Starrett, BAHCO, AMADA MACHINE TOOLS, ITL (International Tool), HELLER, DOALL Sawing Products, WIKUS, M. K. Morse, Simonds International, Hakansson Saws, Wood-Mizer, Tien-i, Sawblade.com, PWA (Precision Works Abrasives), Rontgen, Trajan Sawing, Diamond Saw Works |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bandsaw Blades Market Key Technology Landscape

The technological evolution within the Bandsaw Blades Market is concentrated primarily on material science advancements and precision manufacturing techniques aimed at maximizing efficiency and blade longevity, particularly when cutting high-performance alloys. A core technological focus is the continuous improvement in Bi-Metal and Carbide Tipped blade construction. Modern Bi-Metal blades utilize advanced electron beam welding processes to fuse high-speed steel teeth (M42 or M51) onto a flexible spring steel backing strip, ensuring high cutting hardness while maintaining fatigue resistance. The latest generation employs proprietary heat treatment cycles to optimize the matrix structure of the tooth material, significantly increasing resistance to abrasive wear and impact damage during heavy industrial use, directly addressing the demand for higher cutting speeds and feed rates.

For Carbide Tipped blades, technology is advancing in two key areas: the composition of the carbide powder and the precision of the tip grinding and attachment process. New grades of micro-grain tungsten carbide, often mixed with cobalt binders, offer superior toughness and wear resistance. Furthermore, advanced CNC grinding equipment is utilized to create highly specific, multi-chip tooth geometries—such as variable pitch and specific rake angles—that are precisely tuned to minimize vibration, reduce heat generation, and efficiently break and evacuate chips, which is crucial for cutting difficult materials like stainless steel and tool steel without work hardening. These geometric innovations drastically improve the consistency of the cut and extend the operational window of the blade.

An emerging critical technology is the application of advanced surface coatings, utilizing Physical Vapor Deposition (PVD) or Chemical Vapor Deposition (CVD). These nano-layered coatings, typically comprised of materials like Titanium Nitride (TiN), Titanium Carbonitride (TiCN), or Aluminum Titanium Nitride (AlTiN), provide a formidable thermal barrier and reduce the coefficient of friction. This protective layer mitigates heat buildup in the cutting zone, substantially reducing wear, especially when dry cutting or using minimal lubrication. Manufacturers are also integrating Internet of Things (IoT) sensors into cutting machines and blade holders to collect real-time operational data, allowing for immediate feedback on blade performance and facilitating the development of next-generation blades optimized through data-driven design principles.

Regional Highlights

The global Bandsaw Blades Market exhibits distinct regional dynamics shaped by industrial maturity, technological adoption rates, and specific regulatory environments. North America maintains a strong position characterized by high industrial automation and a strong preference for high-quality, high-performance blades, particularly carbide-tipped variants, driven by demanding sectors like aerospace, energy (oil and gas), and advanced automotive manufacturing. The focus here is on efficiency and minimizing downtime, leading to substantial investment in premium blades and integrated machine monitoring systems. Replacement cycles are managed efficiently through established distribution networks and growing e-commerce platforms, providing reliability for the vast MRO market across the region.

Europe represents a technologically advanced, mature market, where Germany, Italy, and the UK are primary hubs for precision machinery and automotive production. European demand is highly influenced by strict environmental and safety regulations, fostering innovation in blade materials and manufacturing processes that are cleaner and more sustainable. The emphasis on high-quality machine tools translates directly into demand for specialized, high-tolerance bandsaw blades. Eastern Europe is seeing accelerating growth due to industrial relocation and infrastructural development, boosting the consumption of standard and bi-metal blades for general fabrication purposes. Collaboration between blade manufacturers and machine tool builders is particularly strong in this region, leading to highly optimized cutting solutions.

Asia Pacific (APAC) is the fastest-growing region, contributing the largest volume to the global market, led by the colossal manufacturing bases in China and India. This growth is underpinned by extensive investment in infrastructure, rapidly expanding automotive production, and a strong metals processing sector. While price sensitivity is higher in parts of APAC, there is a burgeoning demand for premium bi-metal and carbide blades as quality and precision standards rise, particularly in industries catering to export markets (e.g., high-end electronics, precision component manufacturing). Governments' push for domestic manufacturing capacity and urbanization projects ensures a sustained, high-volume requirement for all categories of bandsaw blades.

Latin America and the Middle East & Africa (MEA) currently hold smaller but promising market shares. In Latin America, demand is heavily tied to the resource extraction industries (mining, timber) and local construction sectors. Brazil, as the largest economy, dominates the regional consumption landscape. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is experiencing significant growth driven by massive diversification projects away from oil dependence, focusing on construction, logistics, and localized manufacturing, resulting in increased consumption of structural steel cutting blades. However, these markets often rely heavily on imports and face logistical challenges that affect supply chain efficiency and product availability.

- Asia Pacific (APAC): Characterized by high-volume demand from China and India; rapid industrial expansion; key focus on structural steel and automotive manufacturing; expected highest CAGR due to infrastructure boom.

- North America: Market leader in value; driven by aerospace and energy sectors; high adoption of automated systems and premium carbide blades; strong existing MRO market base.

- Europe: Focus on precision engineering and regulatory compliance; strong demand for specialized high-tolerance blades in Germany and Italy; growing importance of sustainability in manufacturing processes.

- Latin America: Demand linked to resource industries (mining, forestry) and local construction; high dependency on economic stability and commodity prices; Brazil is the dominant consumer.

- Middle East and Africa (MEA): Growth stimulated by large infrastructure and urbanization projects (e.g., Saudi Vision 2030); increasing local fabrication needs; challenges in establishing reliable local distribution networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bandsaw Blades Market, focusing on strategic developments, core product offerings, and market positioning. These companies are instrumental in driving technological innovation and shaping global supply dynamics.- LENOX (Part of Stanley Black & Decker)

- Starrett

- BAHCO (Part of SNA Europe)

- AMADA MACHINE TOOLS

- ITL (International Tool)

- HELLER

- DOALL Sawing Products

- WIKUS

- M. K. Morse

- Simonds International

- Hakansson Saws

- Wood-Mizer

- Tien-i

- Sawblade.com

- PWA (Precision Works Abrasives)

- Rontgen

- Trajan Sawing

- Diamond Saw Works

Frequently Asked Questions

Analyze common user questions about the Bandsaw Blades market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth in the Bandsaw Blades Market?

The primary driver is the accelerating global investment in industrial infrastructure and manufacturing capacity, particularly in emerging Asian economies. This expansion, coupled with rising demand from highly specialized sectors like aerospace and energy for cutting advanced, complex alloys, necessitates the consistent consumption of high-performance bi-metal and carbide-tipped bandsaw blades.

How does the choice of blade material impact cutting efficiency and blade life?

Blade material directly determines performance: Carbon Steel is suitable for general, soft material cutting but has limited life. Bi-metal blades offer superior durability and versatility for standard metal cutting. Carbide Tipped blades provide the highest resistance to heat and abrasion, mandatory for cutting hardened tool steels, titanium, and highly abrasive composites, thus offering the longest life in demanding applications.

What role does automation play in the future demand for bandsaw blades?

Automation increases demand for high-consistency blades optimized for automated machinery. Automated systems require blades with predictable wear rates and higher tolerances to maintain continuous high-speed operation, driving market preference towards premium, technologically advanced blades compatible with predictive maintenance and IoT monitoring systems.

Which segmentation type is projected to experience the fastest growth rate through 2033?

The Carbide Tipped blade segment, categorized by Type, is projected to register the fastest growth rate. This accelerated adoption is fueled by the continuous shift in manufacturing toward cutting high-strength, difficult-to-machine materials in the automotive and aerospace industries, where conventional blades fail to meet efficiency or precision requirements.

What are the main distribution channels used for bandsaw blades, and which is growing fastest?

The main channels are Direct Sales (for OEMs and large volume clients) and Indirect Sales through industrial Distributors and Supply Houses (MRO). While distributors maintain the largest volume share, the E-commerce and Online Retail channel is experiencing the fastest growth, offering enhanced accessibility, comparative pricing, and streamlined ordering processes for replacement consumables.

What are the key technical challenges facing bandsaw blade manufacturers today?

Manufacturers face the twin challenges of material volatility (managing the cost and supply of critical alloys like cobalt and carbide) and the need to continuously innovate tooth geometry and coating technology to handle new, tougher composite and metallic materials while simultaneously reducing the noise and energy consumption associated with the cutting process.

How is the aerospace industry influencing the bandsaw blade market?

The aerospace industry is a primary driver for innovation, demanding specialized blades capable of highly precise, efficient cutting of exotic materials such as nickel-based superalloys (Inconel) and titanium. This sector mandates extremely high quality and reliability, thereby accelerating the development and adoption of the most advanced carbide and diamond-tipped bandsaw technologies.

In which region are economic diversification efforts contributing to market expansion?

The Middle East and Africa (MEA) region, particularly the GCC nations, is seeing market expansion driven by national economic diversification initiatives (e.g., Saudi Vision 2030). These efforts stimulate massive construction and localized manufacturing sectors, increasing the foundational demand for bandsaw blades used in structural steel and metal fabrication.

Explain the concept of variable pitch tooth design in bandsaw blades.

Variable pitch tooth design involves grouping teeth into repeating patterns where the spacing (pitch) varies. This technology is critical for reducing vibration and harmonic resonance during the cut, minimizing noise, and maximizing chip evacuation, which allows the blade to effectively cut a wider range of material sizes and cross-sections without binding or premature wear.

What is the role of PVD/CVD coatings in enhancing blade performance?

Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) coatings apply thin, hard, ceramic layers (like TiN or AlTiN) to the blade teeth. These coatings significantly reduce the coefficient of friction, act as a thermal barrier, and increase surface hardness, thereby protecting the cutting edge from high temperatures and abrasive wear, leading to extended blade life and faster cutting speeds.

How do global steel production trends affect the Bandsaw Blades market?

Global steel production directly influences demand, as bandsaw blades are essential for cutting raw steel billets, beams, and final products in both primary steel mills and secondary fabrication shops. Increased global infrastructure spending, which boosts steel output, correlates directly with higher demand for industrial-grade metal-cutting bandsaw blades.

What are the specific requirements for bandsaw blades used in food processing applications?

Blades for food processing (primarily meat and fish cutting) must adhere to stringent hygienic standards. They are typically made from specific grades of stainless steel to ensure corrosion resistance and ease of sanitation. The design minimizes crevices where bacteria could accumulate, prioritizing safety and compliance over high cutting speeds.

How do manufacturers measure the overall efficiency and cost-effectiveness of a bandsaw blade?

Efficiency is primarily measured by the Cost Per Cut (CPC) and the Surface Feet per Minute (SFM) achieved before blade failure. CPC factors in the blade purchase price, labor time, machine operating costs, and the total volume or length of material cut, providing a holistic view of the blade's value proposition and economic performance.

What impact does raw material price volatility have on market stability?

Volatile prices for specialty raw materials, such as tungsten carbide, cobalt, and high-speed steel alloys, introduce instability into the supply chain. Manufacturers must either absorb these costs, impacting margins, or pass them on to consumers, which can lead to fluctuating prices for high-performance bandsaw blades and potentially slow procurement cycles for end-users.

Is the aftermarket (replacement blade) segment larger than the OEM segment?

Yes, the aftermarket segment (MRO - Maintenance, Repair, and Operations) for replacement bandsaw blades is substantially larger than the OEM segment. Bandsaw blades are high-wear consumables requiring frequent replacement throughout the lifespan of the machine, ensuring a robust, continuous revenue stream focused on maintenance and operational efficiency.

Which material type is still dominant in the woodworking application sector?

Carbon Steel remains the dominant and most cost-effective blade material for general woodworking applications, including primary log cutting (sawmills) and furniture production. However, bi-metal and specialized carbide blades are increasingly used for cutting high-density fiberboard (HDF) and abrasive composite wood products.

What are the key differences between wide band sawmill blades and narrow metal cutting blades?

Wide band sawmill blades (used for processing large logs) are characterized by their significant width and gauge, designed for stability during deep, long cuts, often running at high tension. Narrow metal cutting blades are smaller, utilize tougher HSS or carbide tips, and feature finer tooth pitches optimized for precision cutting of dense metallic materials rather than bulky wood volumes.

How are environmental concerns influencing the manufacturing of bandsaw blades?

Environmental concerns are pushing manufacturers towards more sustainable practices, including minimizing hazardous waste from cooling lubricants, utilizing non-toxic coatings, and improving recycling programs for spent blades, aiming to reduce the overall environmental footprint of the cutting process.

What is the current trend regarding tooth setting (or set type) in modern blades?

The current trend favors advanced set types, particularly those optimized for chip clearance and reduced friction. Common set types include raker, wavy, and alternate sets, with high-performance bi-metal and carbide blades often employing complex hybrid or staggered sets to ensure precise tracking and rapid evacuation of chips during high-feed cutting operations.

How does the increasing adoption of composites in manufacturing affect blade demand?

The increasing use of abrasive composites (e.g., carbon fiber reinforced plastics) requires highly specialized, extremely hard cutting tools. This trend drives the demand for high-end diamond-coated and highly specific carbide-tipped blades, as conventional metal-cutting blades wear out rapidly when processing these modern, abrasive materials.

What is the significance of the "kerf" in bandsaw blade technology?

Kerf refers to the width of the material removed by the cut. Bandsaw blades are valued for producing a relatively small kerf compared to other cutting methods, which minimizes material wastage, especially critical when cutting expensive or rare alloys. Manufacturers strive to design blades that maximize rigidity while minimizing kerf width.

Why is heat generation a major issue addressed by bandsaw blade R&D?

Excessive heat generation during cutting leads to premature tooth softening, chipping, and rapid blade failure, particularly when cutting high-alloy materials. R&D focuses on thermal-resistant coatings, improved chip evacuation geometries, and optimized coolant application strategies to manage and dissipate heat effectively, maximizing blade lifespan.

Which country in Asia Pacific is expected to lead regional consumption growth?

China is expected to lead regional consumption growth, driven by its massive scale of heavy industry, continuous infrastructure development, and status as the world's largest metal manufacturer and processor. However, India is projected to exhibit the fastest percentage growth rate due to its lower industrial base starting point and rapid urbanization plans.

How has e-commerce changed the traditional distribution model for bandsaw blades?

E-commerce platforms have disrupted the traditional model by offering direct access to specialized blades, transparent pricing, and rapid delivery for MRO purposes, reducing reliance on local distributors for standard inventory. This shift provides smaller fabricators with greater purchasing flexibility and competitive access to premium products globally.

What is the relationship between bandsaw machine precision and blade requirements?

As bandsaw machines become more precise and integrate CNC capabilities, the requirements for blade consistency and tolerance increase proportionally. High-precision machines demand blades with extremely consistent tooth heights, set accuracy, and minimal runout to fully utilize the machine's accuracy potential and avoid costly vibration damage.

How do leading companies use mergers and acquisitions (M&A) in this market?

Leading companies utilize M&A strategically to expand their geographical reach, acquire niche technologies (e.g., specialized coating patents), or consolidate market share. Acquisitions often focus on integrating upstream raw material suppliers or downstream specialized distributors to secure supply chains and enhance market access.

What factors constrain the widespread adoption of carbide-tipped bandsaw blades?

The main constraints are the significantly higher initial cost of carbide-tipped blades compared to bi-metal alternatives and the requirement for robust, highly stable bandsaw machines capable of handling the forces exerted by carbide, limiting their adoption in older or lighter-duty equipment.

Define the Upstream Analysis component of the Value Chain for this market.

Upstream analysis focuses on the sourcing, preparation, and initial manufacturing of raw materials—specifically high-speed steel coil, specialized spring steel backing material, and the powdered tungsten carbide and cobalt used for the tips. This stage determines the foundational metallurgical quality and cost base of the final blade product.

How critical is heat treatment in the bandsaw blade manufacturing process?

Heat treatment is fundamentally critical; it involves precise processes like hardening and tempering to achieve the ideal balance between extreme tooth hardness (for cutting performance) and the necessary ductility/toughness in the backing strip (to resist fatigue and breakage). Failure in heat treatment directly compromises the blade's lifespan and operational safety.

What are the implications of industry 4.0 for bandsaw blade usage?

Industry 4.0 implies greater integration of bandsaw machines into smart factory networks. This drives demand for blades compatible with real-time data monitoring, predictive maintenance algorithms, and automated parameter adjustments, moving the market toward performance-based consumables rather than standard, off-the-shelf tooling.

What is the function of the MRO segment within the overall market structure?

The MRO (Maintenance, Repair, and Operations) segment represents the continual and non-cyclical replacement demand for bandsaw blades across all industries. This segment ensures market stability, as blades wear out irrespective of new capital expenditure cycles, making it the bedrock of the market's continuous revenue stream.

Why is precision grinding vital for carbide-tipped bandsaw blades?

Precision grinding is vital because carbide is extremely brittle. The grinding process must create the exact tooth geometry (rake angle, clearance angle) necessary for efficient cutting and chip flow without introducing micro-cracks or stress points that would lead to catastrophic tip failure under operational stress.

In which application segment is hygienic design a paramount concern?

Hygienic design is a paramount concern specifically in the Food Processing segment, particularly for cutting meat and bone. Blades must be designed for easy cleaning, manufactured from food-grade materials (typically stainless steel), and adhere strictly to food safety regulations (e.g., USDA, FDA standards) to prevent cross-contamination.

How does the growth of electric vehicle (EV) manufacturing influence blade demand?

EV manufacturing influences demand by increasing the use of lightweight materials, such as specific aluminum alloys and carbon composites, in vehicle bodies and battery casings. This necessitates specialized, high-performance bandsaw blades optimized for cutting these non-ferrous, often abrasive, materials efficiently, shifting demand away from traditional structural steel blades.

What is the expected long-term impact of AI on the profitability of end-users?

The long-term impact of AI integration is increased profitability for end-users through optimized operational efficiency. By accurately predicting blade failure, AI minimizes unplanned downtime, reduces material wastage due to bad cuts, and optimizes inventory holding costs, leading to a substantial decrease in the total cost of ownership for cutting operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager