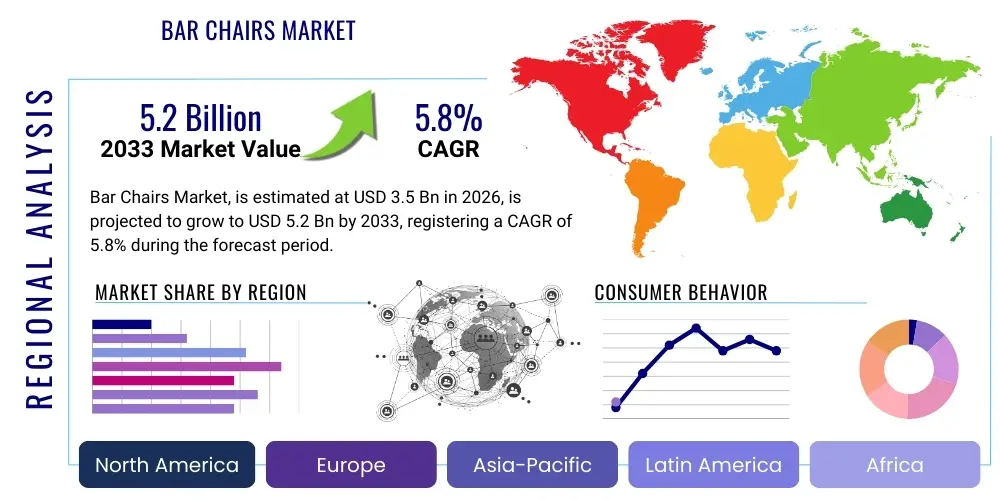

Bar Chairs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438944 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Bar Chairs Market Size

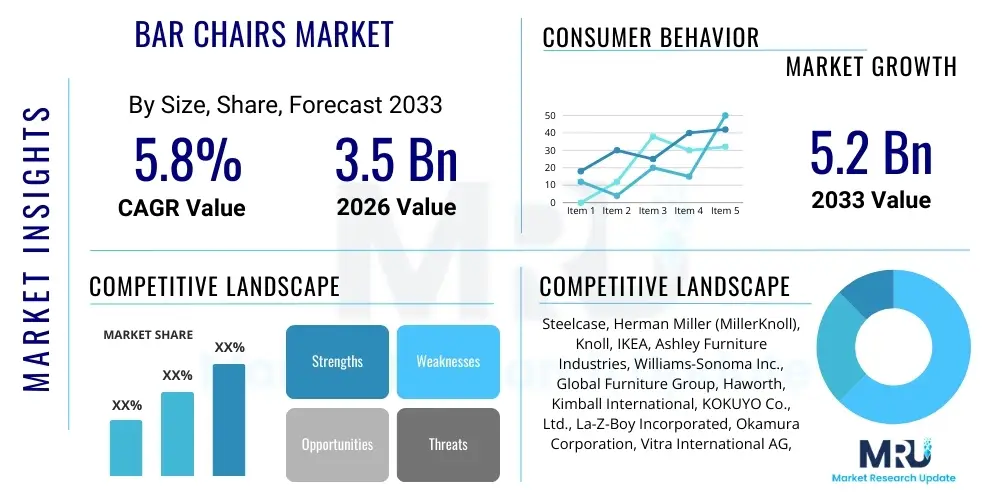

The Bar Chairs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Bar Chairs Market introduction

The Bar Chairs Market encompasses the design, manufacturing, distribution, and sale of specialized seating solutions characterized by their elevated height, primarily intended for use at kitchen islands, bars, high-top tables, and counter spaces. These products bridge the gap between functional seating and aesthetic interior design, serving both commercial sectors, such as hospitality and food service, and residential consumers seeking modernized kitchen and entertainment areas. Key product differentiators include adjustable height mechanisms, material composition (metal, wood, plastic), backrest support types (backed or backless), and overall design aesthetics, ranging from minimalist modern to rustic industrial styles. The foundational element driving demand is the sustained global trend toward open-concept living spaces and the increasing integration of home bar setups.

Major applications of bar chairs are broadly segmented into commercial and residential usage. In the commercial sphere, they are essential components of restaurants, cafes, hotels, corporate breakrooms, and co-working spaces, where they facilitate high-density seating arrangements and contribute significantly to the establishment's ambiance and branding. Residential applications are centered on enhancing kitchen utility, providing comfortable breakfast bar seating, and outfitting dedicated home entertainment zones. The benefits associated with high-quality bar chairs include optimized space utilization, ergonomic support at elevated surfaces, and significant contribution to interior decor, offering a strong blend of utility and style that justifies premium pricing in certain segments.

Driving factors for the Bar Chairs Market include the robust recovery and expansion of the global hospitality industry post-pandemic, characterized by new restaurant openings and significant hotel renovations. Furthermore, urbanization trends, coupled with shrinking residential unit sizes, necessitate multi-functional furniture solutions like bar chairs that can maximize vertical space efficiency. The proliferation of e-commerce platforms has also democratized access to specialized furniture designs, enabling niche manufacturers to reach broader consumer bases efficiently. Continuous innovation in materials, particularly sustainable and lightweight options, further stimulates replacement cycles and market growth across developed and developing economies.

Bar Chairs Market Executive Summary

The global Bar Chairs Market exhibits resilient growth, fundamentally underpinned by transformative shifts in interior design preferences favoring elevated seating and the rapid expansion of the global food and beverage sector. Current business trends indicate a strong move towards customization and modular designs, allowing end-users to tailor seating to specific spatial and ergonomic requirements. Manufacturers are prioritizing supply chain diversification to mitigate volatility in raw material costs, particularly timber and specialized metals. The increasing adoption of ergonomic and smart furniture features, such as integrated charging ports and adjustable lumbar support, represents a significant avenue for value addition and premium market penetration, highlighting innovation as a core competitive differentiator.

From a regional perspective, North America and Europe maintain dominance, driven by high disposable incomes and established commercial infrastructure, though the Asia Pacific (APAC) region is poised for the fastest expansion. This accelerated growth in APAC is primarily attributed to rapid commercial real estate development, increasing consumer spending on home aesthetics, and the proliferation of international hospitality chains expanding into emerging urban centers. Specific trends within APAC include a preference for space-saving, foldable designs in smaller metropolitan apartments and a growing demand for durable, weather-resistant materials for outdoor bar setups in temperate zones, emphasizing regional adaptation in product offerings.

Segmentation trends reveal that the metal segment, primarily due to its durability and industrial aesthetic appeal, holds a substantial market share, though the wood segment commands high value due to craftsmanship and perceived quality, especially in the luxury residential market. By application, the commercial sector remains the largest revenue generator, demanding bulk orders of highly durable, standardized products. However, the residential segment demonstrates a higher Compound Annual Growth Rate, fueled by remodeling activities and the increasing integration of home entertainment systems. Distribution channels are undergoing transformation, with online retail platforms capturing a rapidly increasing share, offering greater variety and direct-to-consumer delivery efficiency, challenging traditional brick-and-mortar furniture retail models.

AI Impact Analysis on Bar Chairs Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Bar Chairs Market revolve heavily around how technology can enhance personalization, optimize manufacturing processes, and revolutionize the consumer buying experience. Users frequently inquire about AI's role in predictive design—determining popular styles and colors before they hit the market—and optimizing the supply chain, particularly minimizing waste in material cutting and managing inventory levels across vast SKU ranges. Concerns often focus on the potential for AI-driven automation to displace skilled furniture craftsmen and whether hyper-personalized, algorithmically designed chairs will lack the timeless aesthetic value traditionally associated with human-designed furniture. Expectations center on faster delivery times, lower costs resulting from production efficiency, and immersive virtual reality (VR) shopping experiences powered by AI rendering capabilities.

AI's influence is rapidly manifesting across the value chain, extending from initial design concept to post-sale customer support. In the design phase, generative AI tools are used to rapidly prototype hundreds of ergonomic variations based on anthropometric data and current trend forecasting, significantly reducing the time-to-market for new models. Furthermore, AI-driven demand forecasting algorithms allow manufacturers to adjust production schedules dynamically, preventing overstocking of slow-moving items and ensuring adequate supply of highly requested products, leading to improved operational efficiency and reduced warehousing costs. This integration allows for a more agile manufacturing environment capable of supporting mass customization.

On the consumer side, machine learning algorithms are utilized in e-commerce platforms to provide highly tailored product recommendations, matching specific bar chair styles and materials to the user’s previously viewed items, spatial dimensions provided, and stated design preferences. This capability enhances conversion rates and reduces product returns by improving the initial fit between the product and customer expectation. In manufacturing operations, AI-powered robotics are increasingly deployed for precision tasks such as welding metal frames, complex wood carving, and upholstery alignment, ensuring consistent quality and enabling higher throughput compared to traditional manual processes. The optimization of logistical routes and last-mile delivery scheduling using AI further reduces shipping costs and enhances customer satisfaction.

- AI-driven Predictive Design: Generative algorithms model future aesthetic trends and functional requirements.

- Optimized Manufacturing: Machine learning enhances efficiency in material cutting (reducing scrap) and automated assembly lines (improving consistency).

- Supply Chain Optimization: AI forecasting reduces inventory risk and optimizes raw material procurement cycles.

- Personalized Retail: Recommender systems offer tailored bar chair options based on user behavior and spatial requirements (AEO focus).

- Automated Quality Control: Computer vision systems detect minute defects in upholstery, welding, and finish during production.

- Enhanced Customer Experience: AI-powered chatbots handle design inquiries and complex customization requests instantly.

DRO & Impact Forces Of Bar Chairs Market

The Bar Chairs Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively exert significant impact forces on market trajectory and competitive intensity. A primary driver is the accelerating urbanization globally, which increases demand for compact, multi-functional furniture suitable for dense residential settings. Concurrently, the robust expansion of the quick-service restaurant (QSR) and fast-casual dining segments worldwide necessitates large-scale procurement of durable, standardized bar seating, providing consistent volume growth. Opportunities lie in the growing consumer preference for sustainable and eco-friendly furniture, pushing manufacturers towards recycled and responsibly sourced materials, and capitalizing on the burgeoning market for smart furniture, incorporating features like wireless charging.

However, the market faces inherent restraints, most notably the volatility and price inflation of essential raw materials, including structural steel, specialized alloys, and premium hardwoods, which directly compress profit margins. Furthermore, the furniture market, particularly the premium segment, is highly sensitive to economic downturns and fluctuations in consumer discretionary spending, posing a continuous risk. Counteracting these restraints, the market is benefiting from strong impact forces such as evolving consumer aesthetics, which frequently dictate style changes and stimulate product innovation. Regulatory forces related to safety standards, particularly concerning stability and fire resistance in commercial settings, also impact design and manufacturing investments, effectively raising the barrier to entry for smaller, non-compliant players. This competitive pressure drives continuous improvement in product engineering and material science.

Specific drivers include the resurgence of the hotel and hospitality sector investments across emerging markets, coupled with increasing remodeling activities in established markets focused on enhancing guest experience through contemporary design elements. The high demand for durable, industrial-style seating for office breakout areas also contributes significantly to commercial sales volume. Key restraints involve the logistical complexities associated with shipping large, bulky furniture items, which necessitate specialized packaging and freight solutions, often impacting the final retail price. Additionally, the proliferation of counterfeit or low-quality imports, particularly in developing economies, erodes market share for established brands focusing on verifiable quality and longevity. Successfully navigating these forces requires strategic sourcing, technological investment, and effective brand differentiation based on design pedigree and sustainability credentials.

Segmentation Analysis

The Bar Chairs Market is systematically segmented based on material, product type, end-user, and distribution channel, providing granular insights into consumer preferences and market structure. This segmentation is crucial for stakeholders to identify high-growth niches and tailor their product strategies accordingly. The material segmentation (wood, metal, plastic, upholstery) reflects fundamental differences in cost structure, design durability, and aesthetic application, with each category appealing to distinct market tiers—from budget-conscious institutional buyers to luxury residential consumers prioritizing bespoke craftsmanship. The continuous cross-pollination of materials, such as combining metal frames with upholstered seating, creates hybrid segments that cater to ergonomic and stylistic demands simultaneously.

Product type segmentation differentiates between fixed-height and adjustable-height chairs, and between designs with full backrests, low backrests, or backless stools. Adjustable-height bar chairs, offering versatility for different counter heights and users, are experiencing strong demand in the residential sector. Conversely, fixed-height, robust models remain the standard for high-traffic commercial environments where stability and standardization are paramount. The end-user classification is pivotal, distinguishing between the high-volume, durability-focused commercial sector (hotels, restaurants, bars) and the design-centric, high-margin residential sector. Analyzing these end-user needs dictates specifications related to fire safety, weight capacity, and ease of cleaning, directly influencing manufacturing processes.

The distribution channel analysis confirms the growing power of e-commerce and specialized online furniture retailers, providing expansive inventory selection and highly efficient logistics compared to traditional channels. However, specialized interior design firms and contract furniture suppliers still dominate bulk commercial procurement, offering consultation and installation services. Understanding these segment dynamics allows manufacturers to optimize inventory, streamline supply chains, and execute targeted marketing campaigns, leveraging AEO principles to capture specific search intent related to material durability or design aesthetic within different demographic purchasing groups globally.

- By Material:

- Wood (Hardwood, Plywood, Bamboo)

- Metal (Steel, Aluminum, Wrought Iron)

- Plastic (Polypropylene, Polycarbonate)

- Upholstery/Fabric (Leather, Vinyl, Textile)

- Mixed Materials

- By Product Type:

- Adjustable Height Bar Stools

- Fixed Height Bar Chairs

- Backless Stools

- Full-Backed Chairs

- By End-User:

- Commercial (Hotels, Restaurants, Bars, Cafes, Corporate Offices)

- Residential (Home Kitchens, Entertainment Rooms, Patios)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Direct-to-Consumer Websites)

- Offline Retail (Furniture Stores, Specialty Retailers, Department Stores)

- Contract and Wholesale (Interior Design Firms, Bulk Suppliers)

Value Chain Analysis For Bar Chairs Market

The value chain for the Bar Chairs Market is characterized by multiple stages, starting from raw material procurement and culminating in end-user installation and disposal. Upstream analysis focuses heavily on the sourcing and initial processing of critical raw materials, primarily timber, steel, aluminum, and specialized polymer resins. Raw material costs often constitute the largest variable component of production expenses, making strategic supplier relationships and hedging against price volatility crucial for margin maintenance. Efficient upstream operations involve verifying sustainable sourcing certifications, optimizing initial material preparation (e.g., kiln-drying wood, alloy treating metal), and ensuring quality control before component manufacturing begins. Failures in upstream quality directly impact downstream production efficiency and product longevity.

Midstream activities involve core manufacturing, including cutting, shaping, welding, molding, assembly, and finishing processes (such as powder coating or specialized lacquering). Manufacturers are increasingly adopting advanced automation and CNC (Computer Numerical Control) machining to achieve precision, reduce labor costs, and handle complex design geometries, which is particularly vital for mass-customized orders. Effective midstream management requires rigorous quality assurance testing for stability, load-bearing capacity, and finish durability, ensuring products meet international safety standards (e.g., ANSI/BIFMA for commercial seating). This stage also includes the integration of secondary components, such as footrests, hydraulic lifting mechanisms, and padding materials, which significantly influence the final product's ergonomic performance and perceived value.

The downstream segment concentrates on distribution, sales, and post-purchase services. Distribution channels are varied, involving both direct and indirect routes. Direct distribution involves manufacturers selling directly to large commercial clients or consumers via their proprietary e-commerce portals (Direct-to-Consumer or D2C), offering maximum control over branding and pricing. Indirect distribution relies on wholesalers, contract furniture suppliers, and large online marketplaces like Amazon or Wayfair. Contract channels are essential for securing high-volume commercial bids, where specialized logistics, including white-glove delivery and installation, are often required. The shift towards online retail necessitates optimized logistics for handling bulky items, emphasizing robust packaging and streamlined returns processes to maintain consumer satisfaction and competitive edge within the digital sales environment.

Bar Chairs Market Potential Customers

The potential customer base for the Bar Chairs Market is expansive and highly stratified, encompassing both large institutional buyers focused on durability and volume, and individual consumers prioritizing design, aesthetics, and comfort. The primary and most profitable segment consists of commercial enterprises within the hospitality sector. This includes premium hotel chains and resorts undergoing refurbishment cycles, high-end restaurants demanding bespoke seating arrangements that align with sophisticated interior themes, and fast-casual dining establishments requiring resilient, easy-to-clean, high-density seating. These buyers prioritize warranty length, material fire rating compliance, and the ability to source replacement parts efficiently, often engaging in long-term contract relationships with established furniture suppliers to ensure continuity of supply and standardization across multiple locations.

A rapidly growing segment comprises corporate offices and co-working spaces. As workplace design evolves toward more flexible, less formal environments, bar chairs are increasingly used in communal kitchens, collaboration zones, and casual meeting areas to foster a dynamic, relaxed atmosphere. Procurement managers in this sector seek chairs that blend ergonomic support suitable for light-duty work with modern, aesthetically pleasing designs that contribute to employee wellness and attraction. The emphasis here is often on mobility (castors) and versatile design features, such as height adjustment suitable for diverse user populations, aligning with contemporary commercial real estate design standards focusing on employee comfort and visual appeal.

The residential market represents the second major customer cohort, driven by individual household purchases during kitchen renovations, new home construction, or redecoration cycles. Customers in this segment are highly motivated by interior design trends, focusing on material finish (e.g., brass accents, reclaimed wood), comfort for extended family use, and personalization options (upholstery color and fabric choice). E-commerce platforms specifically target this segment using advanced visual search tools and augmented reality applications, allowing consumers to virtually place bar chairs in their homes before purchase, effectively blurring the line between traditional retail browsing and digital sales. Furthermore, interior designers and architects act as crucial intermediaries, influencing significant purchasing decisions for both high-net-worth residential projects and boutique commercial establishments, making them critical targets for marketing outreach.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Steelcase, Herman Miller (MillerKnoll), Knoll, IKEA, Ashley Furniture Industries, Williams-Sonoma Inc., Global Furniture Group, Haworth, Kimball International, KOKUYO Co., Ltd., La-Z-Boy Incorporated, Okamura Corporation, Vitra International AG, RH (Restoration Hardware), Humanscale. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bar Chairs Market Key Technology Landscape

The Bar Chairs Market, while seemingly traditional, relies heavily on sophisticated manufacturing and design technologies to achieve the requisite quality, durability, and stylistic complexity demanded by modern consumers and commercial buyers. A key area of technological advancement is Computer Numerical Control (CNC) machining, particularly crucial for woodworking and metal fabrication. CNC routers and laser cutters ensure extremely high precision in cutting complex geometries for curved wood components and intricate metal joints, minimizing material waste and guaranteeing perfect alignment during final assembly. This precision is non-negotiable for producing ergonomically sound bar chairs that must withstand rigorous commercial use and high load capacities, thus integrating advanced computer-aided manufacturing (CAM) processes is standard practice among leading market players.

Material science innovation represents another significant technology pillar. Manufacturers are increasingly utilizing hydroforming and robotic welding technologies for metal chairs, allowing for the creation of lightweight yet incredibly strong frames with seamless joints, enhancing both aesthetics and structural integrity. For plastic and polymer chairs, advanced injection molding techniques enable rapid prototyping and large-scale production of complex ergonomic shapes using high-performance, often recycled, engineering plastics like specialized polycarbonates or reinforced polypropylene. Furthermore, the development of performance finishes, such as specialized powder coatings that offer superior chip, fade, and corrosion resistance, significantly extends the product lifespan, which is a major value proposition, especially in outdoor or high-moisture environments typical of bar settings.

Beyond manufacturing, digital technology plays a critical role in customer engagement and design iteration. The use of 3D scanning and printing technologies allows designers to quickly iterate on prototypes, testing ergonomic features and aesthetic variations before committing to expensive tooling. Furthermore, consumer-facing technologies, including Augmented Reality (AR) applications embedded within retail websites, empower customers to visualize how specific bar chair models will appear within their actual space, drastically improving purchasing confidence and reducing returns—a key logistical challenge for bulky furniture. The continuous development of specialized testing equipment to simulate long-term wear and tear, ensuring compliance with rigorous BIFMA standards for commercial furniture, further underscores the importance of technology in maintaining competitive advantage and addressing evolving regulatory requirements.

Regional Highlights

The North American market, comprising the United States and Canada, represents a mature yet highly lucrative segment for bar chairs, characterized by high consumer spending power and a massive, consolidated hospitality infrastructure. Demand is primarily driven by large-scale commercial tenders for hotel chains, upscale restaurants, and the ubiquitous presence of professional sports bar environments. The regional preference leans towards durable, metal-framed adjustable stools for commercial use and highly customized, upholstered chairs with robust ergonomic features for the residential sector, aligning with large American kitchen designs. The presence of major e-commerce furniture retailers originating from this region also facilitates efficient distribution, driving online sales growth and promoting rapid uptake of new design trends, maintaining its position as a global trendsetter in residential interior design.

Europe holds a substantial market share, marked by a strong emphasis on design heritage, quality craftsmanship, and stringent regulatory standards (e.g., REACH compliance). Countries like Italy, Germany, and Scandinavia are central to both high-end manufacturing and design innovation. The European market prioritizes sustainability and longevity, leading to higher demand for responsibly sourced wood and furniture designed for easy repair and recycling. The market is segmented between high-volume commercial markets in Western Europe and the rapidly expanding residential renovation sector in Central and Eastern Europe. The strong café culture and high density of small, independent restaurants necessitate aesthetically appealing yet space-efficient seating solutions, often driving demand for minimalist and stackable bar chair designs.

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid urbanization, burgeoning middle-class disposable incomes, and explosive growth in the food service and hotel industries, particularly in populous nations like China, India, and Southeast Asian economies. Investment in commercial real estate and infrastructure development is a primary catalyst. While price sensitivity remains a factor in certain sub-segments, there is a clear rising demand for branded, high-quality, and modern furniture mirroring Western trends, driving significant opportunities for international exporters. The smaller average living space in major Asian cities also necessitates highly compact, multi-functional bar stools, which is a unique regional product requirement influencing local manufacturing specifications.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets offering growth potential, though they face unique challenges. In LATAM, growth is correlated with fluctuating economic stability and tourism development, focusing primarily on resort and leisure infrastructure projects that require large quantities of durable outdoor bar seating. The MEA region, particularly the Gulf Cooperation Council (GCC) states, experiences high demand driven by massive luxury infrastructure projects, including world-class hotels and themed restaurants, which demand ultra-premium, bespoke, and often highly ornate or technologically integrated bar chairs, commanding significant average selling prices and focusing on imported high-end European designs.

- North America: Dominant market share, driven by large commercial procurement (hotels, restaurants), high residential renovation activity, and strong e-commerce penetration.

- Europe: Focus on design innovation, sustainability (FSC-certified wood), and adherence to strict regulatory standards; strong growth in contract furniture segments.

- Asia Pacific (APAC): Fastest growing region, fueled by rapid urbanization, commercial expansion, and rising middle-class consumer demand for modern aesthetics.

- Latin America: Growth tied to tourism and resort development, characterized by demand for weather-resistant outdoor seating solutions.

- Middle East & Africa (MEA): High-value market segment driven by luxury infrastructure projects, favoring custom, high-end imported furniture.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bar Chairs Market.- Steelcase

- Herman Miller (MillerKnoll)

- Knoll

- IKEA

- Ashley Furniture Industries

- Williams-Sonoma Inc.

- Global Furniture Group

- Haworth

- Kimball International

- KOKUYO Co., Ltd.

- La-Z-Boy Incorporated

- Okamura Corporation

- Vitra International AG

- RH (Restoration Hardware)

- Humanscale

- Kartell S.p.A.

- Fritz Hansen

- Poltrona Frau Group

- Bernhardt Furniture Company

- Tribe Design Pvt. Ltd.

- Inter IKEA Systems B.V.

- Wayfair LLC

- Target Corporation (Threshold Brand)

- Crate and Barrel

Frequently Asked Questions

Analyze common user questions about the Bar Chairs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current market outlook and growth forecast for the Bar Chairs industry?

The Bar Chairs Market is positioned for robust growth, projected to achieve a CAGR of 5.8% through 2033, driven primarily by sustained global expansion in the hospitality and food service sectors and accelerating residential remodeling focused on open-concept kitchens. Key growth regions include North America and the rapidly urbanizing Asia Pacific, emphasizing durable, aesthetically modern, and often adjustable seating solutions to meet evolving consumer needs.

Which materials are dominating the Bar Chairs market and what are their specific advantages?

Metal, particularly steel and aluminum, currently dominates due to its superior durability, structural integrity, and versatility in achieving various industrial or modern aesthetics suitable for high-traffic commercial environments. Wood materials (hardwood, reclaimed timber) maintain a strong position in the high-end residential segment, valued for their warmth, traditional craftsmanship, and sustainability credentials, commanding premium price points in luxury markets.

How is the integration of technology, such as AI and AR, impacting the manufacturing and purchasing of bar chairs?

AI is significantly impacting manufacturing through generative design optimization and predictive inventory management, leading to reduced waste and faster iteration cycles. In purchasing, Augmented Reality (AR) applications allow consumers to accurately visualize bar chairs in their home spaces before buying, drastically improving customer confidence, reducing purchase hesitation, and lowering product return rates, thereby optimizing the digital sales channel.

What are the primary factors restraining market growth and how are manufacturers mitigating these challenges?

The principal restraints include the high volatility in raw material costs (steel, timber) and the substantial logistical expenses associated with shipping bulky furniture items. Manufacturers mitigate these challenges by diversifying global sourcing strategies, investing in lightweight yet durable materials, and optimizing packaging designs to reduce shipping volume, alongside strategic pricing models and hedging against commodity price fluctuations.

In the segmentation analysis, which end-user segment demonstrates the highest potential for future market expansion?

While the Commercial sector (hotels, restaurants) currently generates the highest revenue volume, the Residential end-user segment is forecasted to exhibit the highest growth rate. This accelerated expansion is attributed to increasing consumer investment in home amenities, the rising popularity of integrated home bars and kitchen islands, and efficient distribution via e-commerce platforms targeting individual consumer purchases and remodeling projects globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager