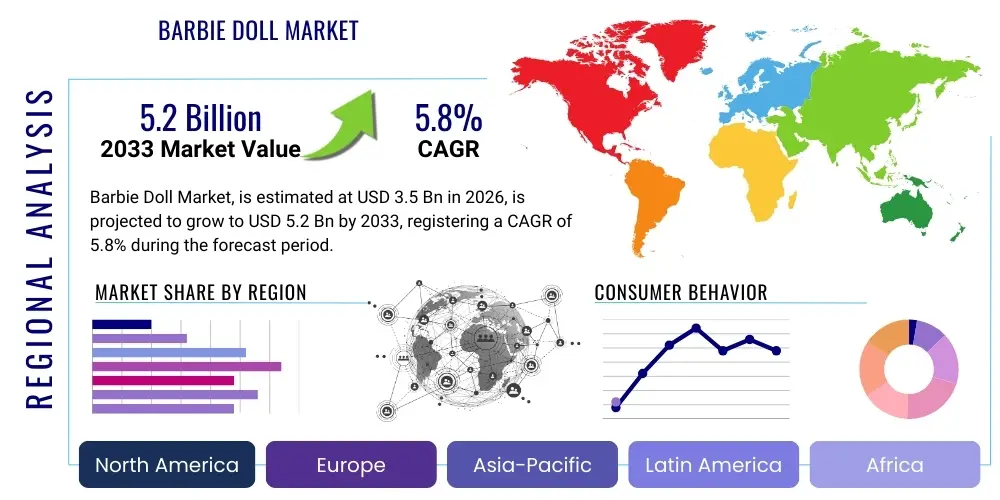

Barbie Doll Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437186 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Barbie Doll Market Size

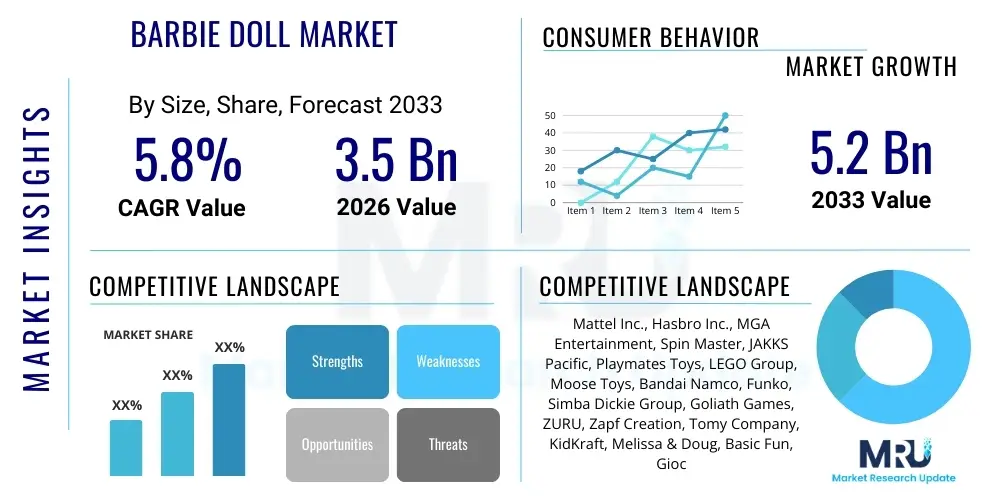

The Barbie Doll Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by continuous brand revitalization efforts, successful cinematic and media tie-ins, and the strategic expansion into diverse product lines catering to global inclusivity demands. Furthermore, increasing disposable income in emerging economies and the sustained nostalgic appeal among adult collectors contribute significantly to the overall market expansion and revenue generation throughout the projection period.

The resilience of the Barbie brand, despite intense competition from digital entertainment and alternative toy types, is underpinned by its adaptive marketing strategies that leverage social media presence and collaborations with high-fashion designers and cultural icons. The shift towards collectible, high-value dolls, often released in limited editions, has bolstered the average selling price and augmented the luxury segment of the market. Market stakeholders are focusing on enhancing the interactive experience through augmented reality (AR) applications and associated digital content, ensuring the brand remains relevant to modern consumer preferences and digital natives.

Barbie Doll Market introduction

The Barbie Doll Market encompasses the global sale and distribution of fashion dolls, related accessories, apparel, and affiliated consumer products under the iconic Barbie brand, predominantly owned by Mattel Inc. Initially launched in 1959, Barbie represents a significant segment of the global doll and plush toy industry. The core product is a fashion doll that serves as a platform for imaginative play, storytelling, and fashion expression. Major applications include entertainment for children aged 3 to 12, collectible items for adult enthusiasts, and the use of the brand in media franchises, educational materials, and lifestyle products.

The primary benefits associated with the Barbie brand include fostering creativity, promoting diverse career aspirations through various doll iterations (e.g., astronaut, doctor, CEO), and encouraging social-emotional development through role-playing. Recent product innovations focus heavily on promoting diversity, inclusivity, and body positivity, aligning the brand with contemporary societal values, thereby enhancing its acceptance across varied demographics. Key driving factors sustaining the market include strong parental preference for traditional imaginative play, massive global brand recognition, successful media adaptation (such as the recent cinematic success), and continuous product diversification into themes like careers, travel, and historical figures.

The market landscape is characterized by constant innovation in material science, packaging sustainability, and digital integration. The strategic management of intellectual property rights and cross-licensing deals significantly broadens the market reach beyond physical doll sales into areas like video games, consumer electronics accessories, and themed experiences. The sustained investment in marketing campaigns that emphasize empowerment and self-expression ensures long-term brand equity and customer loyalty across multiple generations, providing a solid foundation for continued market penetration globally.

Barbie Doll Market Executive Summary

The Barbie Doll Market is experiencing robust revitalization driven by significant business trends centered on brand diversification, sophisticated media strategies, and a pivot towards sustainable and inclusive product offerings. Regionally, while North America and Europe remain dominant revenue generators due to established consumer bases and high retail penetration, the Asia Pacific region is demonstrating the highest growth velocity, fueled by rapid urbanization, rising middle-class disposable incomes, and the adoption of Western consumer culture. Strategic segmentation analysis indicates strong performance in the Fashionista segment, which emphasizes diversity, and a burgeoning high-margin collectible market catering to adult fans (kidults), offsetting slowdowns in certain traditional retail channels.

Key business trends involve leveraging digital platforms for direct-to-consumer (D2C) sales and utilizing powerful intellectual property (IP) assets to create integrated entertainment ecosystems. The success of the 2023 movie release exemplified the potential of large-scale media events to drive massive retail sales across all product segments. Regional trends highlight intense marketing focus on emerging markets like India, China, and Brazil, where brand awareness is expanding through localized campaigns and partnerships. Furthermore, European markets prioritize sustainability, pushing manufacturers towards eco-friendly materials and minimal packaging, influencing global production standards and supply chain logistics.

Segment trends underscore the importance of age-based marketing, with the 7-12 years age group representing the largest volume consumers, while the 13+ years segment (collectors) contributes disproportionately to profit margins due to premium pricing. Distribution channels are rapidly shifting, with e-commerce platforms becoming the primary growth engine, offering enhanced product variety and direct access to niche collectible lines. The market is consolidating around major players who invest heavily in innovation and strategic licensing agreements to maintain competitive dominance and secure intellectual property rights across various multimedia platforms globally.

AI Impact Analysis on Barbie Doll Market

User inquiries regarding AI's impact on the Barbie Doll Market frequently revolve around personalization, manufacturing efficiency, and the development of 'smart' dolls. Common concerns center on how AI can enhance the play experience without compromising privacy or increasing costs, and the potential for AI-driven design tools to rapidly iterate on new doll concepts. Users expect AI to revolutionize supply chain predictability, optimize inventory levels based on real-time trend analysis, and create highly customizable products allowing consumers to design unique dolls. The summarized key themes indicate high expectation for personalized product recommendations and AI-enhanced interactive accessories, alongside concerns about job displacement in design and manufacturing sectors, thus driving focus toward ethical AI implementation.

The application of Artificial Intelligence is fundamentally transforming product development cycles and consumer engagement within the Barbie ecosystem. AI-powered trend analysis tools are used to swiftly identify emerging fashion trends, color palettes, and cultural movements, allowing designers to prototype and launch new doll series with unprecedented speed, significantly reducing time-to-market. Furthermore, generative AI is playing a critical role in creating diverse narratives, backstories, and interactive dialogue for related digital content and potential smart doll functionalities, ensuring relevance and continuous engagement with a digitally savvy young audience.

Operationally, AI algorithms optimize global supply chain logistics, predict demand fluctuations across disparate regional markets, and enhance manufacturing processes through predictive maintenance and quality control automation. This not only leads to cost efficiencies but also supports Mattel's commitment to reducing waste and improving sustainability efforts by minimizing overproduction. In marketing, AI drives hyper-personalized advertising campaigns, ensuring that specific product lines (e.g., career dolls, fashion dolls, collectibles) are marketed effectively to the most receptive demographic segments, maximizing conversion rates and overall sales effectiveness across all distribution channels globally.

- AI-driven personalized doll recommendations and customization tools.

- Optimization of manufacturing processes using machine learning for efficiency and quality control.

- Predictive analytics for inventory management and global supply chain optimization.

- Generative AI used in accelerating new doll design and trend forecasting.

- Development of advanced interactive "smart" accessories and digital play experiences.

- Enhanced consumer data analysis to refine marketing strategies and product mixes.

- Automation of tedious tasks in packaging and assembly lines, reducing operational costs.

DRO & Impact Forces Of Barbie Doll Market

The dynamics of the Barbie Doll Market are shaped by powerful Drivers, inherent Restraints, strategic Opportunities, and overarching Impact Forces that dictate market performance and strategic direction. Key drivers include successful brand narrative adaptation, the growing global middle class, and the robust expansion of the collector community, particularly the high-value adult segment. Restraints primarily involve intense competition from digital entertainment (video games, streaming content), regulatory complexities related to toy safety standards, and increasing consumer scrutiny regarding material sourcing and environmental sustainability, which imposes higher production costs.

Significant opportunities exist in digital transformation, specifically the integration of physical play with augmented reality (AR) and virtual worlds (metaverse), extending the play life of the physical doll. Furthermore, leveraging strategic partnerships with major entertainment franchises and influential social media personalities provides avenues for new product lines and expanded market reach. The impact forces compelling change include shifts in parental purchasing power influenced by economic volatility, the pervasive influence of social media trends on children's preferences, and the mandatory pivot towards environmentally friendly operations and ethical labor practices throughout the global supply chain, demanding constant innovation.

The sustained cultural relevance of the brand acts as a major driver, constantly reinforced by media campaigns and historical achievements, making it a resilient product category. Conversely, the high barrier to entry for accessories and competitive pricing pressures from generic or lower-cost alternatives restrain margin growth in volume segments. Navigating these forces requires continuous investment in research and development to maintain product innovation, alongside sophisticated risk management strategies to handle supply chain disruptions and rapidly evolving consumer tastes in a highly fragmented and globalized toy industry, ensuring long-term profitability and brand leadership.

Segmentation Analysis

The Barbie Doll Market is meticulously segmented based on product type, age group, and distribution channel to effectively capture varied consumer demands and optimize marketing strategies. Product segmentation differentiates between traditional play dolls, the highly diverse Fashionista line, and the premium Signature/Collector series, each targeting distinct price points and consumer motivations. Age group segmentation—ranging from young children initiating imaginative play to adolescent and adult collectors—helps tailor product complexity and associated media content. Distribution channel analysis confirms the growing importance of e-commerce relative to traditional brick-and-mortar retail, driven by convenience and wider accessibility to specialized collectible items, thus influencing logistical and inventory planning.

Understanding these segments is crucial for competitive advantage. For instance, the high growth observed in the 7-12 years age group reflects the peak period for imaginative play, necessitating frequent, affordable product updates and accessories. Meanwhile, the Signature segment, though smaller in volume, demands premium materials, limited production runs, and highly specialized marketing appealing to sophisticated adult consumers who prioritize intrinsic value and investment potential. This targeted approach allows the brand to maximize revenue across the economic spectrum, mitigating dependence on any single consumer demographic or product category.

Furthermore, segmentation allows for regional adaptations. In culturally diverse markets, segmentation by product type must heavily incorporate local fashion and cultural icons, ensuring maximum relatability and market penetration. The continuous evolution of the Fashionista line, offering various body shapes, skin tones, and hairstyles, directly addresses the growing demand for representation, a key driver across all geographical segments. Strategic marketing efforts are therefore customized per segment, leveraging digital media for younger audiences and specialized collector forums for premium segments to maintain sustained market momentum.

- Product Type:

- Traditional Play Dolls

- Fashionista Line Dolls (Diversity and Inclusivity focus)

- Signature and Collector Series Dolls (Premium/Limited Edition)

- Age Group:

- 3-6 Years (Introductory Play)

- 7-12 Years (Imaginative and Social Play)

- 13+ Years (Adolescent and Adult Collectors)

- Distribution Channel:

- Offline Retail (Toy Stores, Department Stores, Mass Merchandisers)

- E-commerce (Brand Websites, Third-Party Marketplaces)

- Specialty Stores and Collector Outlets

Value Chain Analysis For Barbie Doll Market

The Value Chain for the Barbie Doll Market is complex, beginning with upstream activities dominated by raw material sourcing, primarily plastics, textiles, and packaging materials, where sustainability and ethical sourcing are becoming critical differentiators. Upstream analysis involves rigorous research and development (R&D) in material science to achieve bio-based or recycled plastics, and sophisticated mold design for doll production. Manufacturing is typically outsourced to specialized facilities in Asia (primarily China, Vietnam, and Indonesia) to leverage cost efficiencies, though quality control and ethical labor monitoring are paramount to maintaining brand reputation and regulatory compliance across diverse markets.

Downstream activities focus heavily on branding, marketing, and global distribution. Effective brand management, including high-profile collaborations and media integration, drives consumer demand and dictates pricing strategies. The distribution channel is bifurcated into direct and indirect routes. Direct distribution includes the brand's proprietary e-commerce platforms and flagship stores, offering greater control over pricing and customer experience, particularly vital for high-value collector items. Indirect distribution relies on established networks of global mass merchandisers, specialty retailers, and large third-party e-commerce giants, providing scale and market penetration necessary for volume sales and general market reach.

The optimization of logistics is a continuous challenge, requiring sophisticated inventory management systems to ensure timely product delivery, especially during peak holiday seasons. The interplay between physical retail (mass merchandisers handling high volume, low margin) and e-commerce (handling wide variety, often higher margin, and specialized products) determines overall channel effectiveness. Success in the Barbie doll market value chain relies on minimizing the cost of goods sold (COGS) through efficient upstream sourcing while maximizing brand perceived value through sophisticated downstream marketing and robust intellectual property protection, ensuring profitability at scale across all global regions.

Barbie Doll Market Potential Customers

Potential customers for the Barbie Doll Market fall into several distinct yet overlapping categories, primarily categorized by age and purchasing motivation. The core customer base comprises parents and grandparents (the purchasing decision-makers) targeting children aged 3 to 12 years (the end-users) who seek creative, imaginative, and narrative-driven play experiences. This segment demands products that are safe, durable, and offer educational or aspirational themes, often prioritizing volume and accessibility, leading to high dependence on mass market distribution channels and competitive pricing strategies that appeal to budget-conscious households globally.

A rapidly expanding and highly profitable secondary segment includes 'Kidults' and dedicated adult collectors (aged 18 to 60+). These buyers are motivated by nostalgia, investment value, limited edition exclusivity, and the artistic merit of the doll design, seeking premium, high-fidelity products, often purchased through direct-to-consumer channels or specialty collector outlets. This group is less price-sensitive and contributes significantly to the brand's luxury and high-margin product revenue streams. Targeting this demographic requires specialized marketing that emphasizes heritage, design fidelity, and collectible status, distinct from marketing aimed at younger audiences.

Furthermore, educational institutions and themed entertainment providers (e.g., museums, theme parks) represent institutional buyers, albeit smaller in volume, utilizing Barbie products for educational programming, exhibits, or branded merchandise, underscoring the brand's cultural impact. Future expansion of the customer base involves aggressively targeting emerging markets in APAC and Latin America, focusing on localized products that resonate culturally, thereby broadening the geographic reach of the core consumer segment and fostering a new generation of brand loyalists through culturally sensitive product introductions and localized media campaigns tailored to specific regional preferences and economic conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mattel Inc., Hasbro Inc., MGA Entertainment, Spin Master, JAKKS Pacific, Playmates Toys, LEGO Group, Moose Toys, Bandai Namco, Funko, Simba Dickie Group, Goliath Games, ZURU, Zapf Creation, Tomy Company, KidKraft, Melissa & Doug, Basic Fun, Giochi Preziosi, Character Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Barbie Doll Market Key Technology Landscape

The technology landscape influencing the Barbie Doll Market is increasingly focused on enhancing realism, fostering digital interaction, and ensuring sustainable manufacturing practices. Key technologies revolve around advanced polymer science, enabling the creation of diverse textures and flexible body types crucial for the Fashionista line's emphasis on diversity and movement. Sophisticated 3D printing and rapid prototyping technologies dramatically shorten the design-to-production cycle, allowing the brand to capitalize quickly on fleeting fashion trends and media momentum. Furthermore, computer-aided design (CAD) is essential for developing complex, realistic accessories and ensuring precise mold engineering for high-volume manufacturing with strict quality standards globally.

Beyond material and manufacturing, the crucial technological frontier lies in digital integration. Augmented Reality (AR) applications are being developed to link physical dolls with interactive digital environments, extending the imaginative play beyond the physical toy and providing rich, engaging narratives accessible via mobile devices. This integration leverages technologies like fiducial markers and object recognition to bridge the gap between physical and digital worlds, satisfying the expectations of modern, digitally native consumers. Furthermore, the exploration of low-power connectivity and sensory technology in specialized doll lines allows for rudimentary "smart" interactions, creating personalized play responses that enhance the perceived value and sophistication of the product.

Finally, the focus on sustainable technology is paramount. Manufacturers are investing in technologies related to closed-loop recycling processes for plastics and innovative, minimally packaged designs that utilize advanced material engineering to maintain product safety and durability while minimizing environmental footprint. Advanced data analytics and AI modeling are crucial technological tools used to forecast optimal production quantities, thereby reducing waste and streamlining logistics, aligning technological investment with corporate social responsibility (CSR) goals that are increasingly demanded by consumers, especially in mature Western markets, dictating necessary shifts in the core operational technology stack.

Regional Highlights

Regional dynamics play a significant role in determining the overall market performance, with distinct consumer preferences and economic conditions shaping product strategy across major geographical regions. North America, driven by the United States, represents the largest revenue share due to high brand loyalty, strong marketing presence, and high consumer spending on toys and collectibles. This region acts as the primary testing ground for innovative and premium products, particularly those aimed at the adult collector segment, benefiting from a well-established retail infrastructure and advanced e-commerce penetration which supports high-volume sales and logistical efficiency.

Europe constitutes the second-largest market, characterized by mature economies and a high demand for sustainable and ethically sourced products. European consumers, particularly in Western markets like Germany, France, and the UK, place a strong emphasis on quality certifications and adherence to strict toy safety standards. The market here is slightly more fragmented, requiring localized marketing efforts, but the demand for diverse and inclusive doll lines is notably high, mirroring the region's focus on social representation and educational play, prompting continuous product diversification and alignment with contemporary cultural norms.

Asia Pacific (APAC) is forecast to be the fastest-growing region, presenting substantial untapped potential driven by demographic shifts, escalating disposable income, and expanding urbanization across economic powerhouses such as China and India. The rapid adoption of digital shopping habits in APAC further accelerates market penetration, especially for specialized products. However, success in this region mandates significant localization efforts, including adapting fashion, themes, and media narratives to resonate with specific local cultures, a critical strategy for converting potential consumer volume into realized market share and establishing long-term brand equity in highly diverse and competitive regional settings.

- North America: Dominant market share; key driver for premium and collector segments; high e-commerce penetration; high influence on global trends and media strategies.

- Europe: Strong demand for sustainable and ethically produced toys; mature market focusing on regulatory compliance and high-quality standards; strong adoption of inclusive doll lines.

- Asia Pacific (APAC): Highest growth rate; massive consumer base potential in China and India; increasing urbanization and disposable income; critical region for strategic localization and digital distribution expansion.

- Latin America (LATAM): Growing market with volatile economic conditions; high sensitivity to pricing; focus on core, affordable product lines; high potential for media-driven sales boosts due to strong cultural ties to media franchises.

- Middle East and Africa (MEA): Niche but expanding market; regulatory and cultural complexities requiring highly localized product and marketing adjustments; emerging potential in urban centers with Westernized consumer behavior patterns.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Barbie Doll Market.- Mattel Inc.

- Hasbro Inc.

- MGA Entertainment

- Spin Master

- JAKKS Pacific

- Playmates Toys

- LEGO Group

- Moose Toys

- Bandai Namco

- Funko

- Simba Dickie Group

- Goliath Games

- ZURU

- Zapf Creation

- Tomy Company

- KidKraft

- Melissa & Doug

- Basic Fun

- Giochi Preziosi

- Character Group

Frequently Asked Questions

Analyze common user questions about the Barbie Doll market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Barbie Doll Market through 2033?

The Barbie Doll Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven largely by brand revival efforts and expansion into global emerging markets, particularly within the Asia Pacific region.

How is the Barbie brand addressing modern consumer demands for diversity and inclusivity?

The brand addresses diversity through its successful Fashionista line, which consistently introduces dolls with varied body types, skin tones, hairstyles, and physical disabilities, ensuring broader representation and cultural relevance among diverse global consumers.

Which geographical region holds the largest market share for Barbie dolls?

North America currently holds the largest market share, characterized by high consumer spending, strong brand loyalty, and significant activity within the high-value adult collector segment, making it the primary revenue generator.

What role does e-commerce play in the distribution channel for Barbie dolls?

E-commerce is a critical and fast-growing distribution channel, facilitating direct-to-consumer sales for exclusive and collectible dolls, and providing broad accessibility for the core product lines, thereby enhancing inventory management and global reach.

What are the primary challenges facing the long-term growth of the Barbie Doll Market?

Key challenges include intense competition from screen-based digital entertainment, the necessity for constant innovation to maintain relevance, regulatory pressures concerning sustainable sourcing and manufacturing, and managing complex global supply chain logistics.

The strategic analysis confirms that sustainable profitability in the Barbie Doll Market hinges upon the manufacturer’s ability to consistently innovate across product design, materials science, and digital integration. Continuous investment in intellectual property protection and sophisticated marketing campaigns that resonate with both nostalgic adult collectors and contemporary young consumers remains crucial. Furthermore, the pivot towards high-margin collectible segments and robust expansion into fast-growing regions like APAC will be essential to sustain the projected CAGR and navigate increasing competitive pressures from both traditional toy rivals and emerging digital platforms. Market leadership requires a balanced approach that leverages historical brand equity while aggressively adopting future technologies, including artificial intelligence for design efficiency and advanced data analytics for precise market forecasting and personalized consumer outreach strategies to ensure brand longevity and market dominance against evolving societal and technological backdrops.

The focus on environmental, social, and governance (ESG) factors is increasingly impacting the operational framework, especially within upstream manufacturing and packaging. Consumer preferences, particularly in Western Europe, strongly favor transparency regarding material composition and ethical labor practices, pushing the industry leader to establish rigorous standards that often exceed regulatory minimums. This commitment to sustainability, though increasing initial capital expenditure, serves as a powerful long-term competitive differentiator, appealing to environmentally conscious parental buyers and socially aware collectors, ultimately reinforcing brand trust and premium positioning in key global markets, solidifying its place as a trendsetter in the modern toy industry.

Forecasting future trends indicates a continued blurring of lines between physical and digital play, with Augmented Reality (AR) being standardized across new product launches. This technological integration is not merely a feature but a fundamental extension of the play pattern, allowing consumers to interact with their physical dolls in expansive, dynamic virtual environments. This digital convergence, coupled with targeted localization of products to cater to the cultural nuances of high-growth markets, forms the core strategy for exceeding current market forecasts. Stakeholders must prioritize agility in supply chain management and responsiveness to rapid shifts in consumer interests driven by social media trends to fully capitalize on the projected market expansion, ensuring product freshness and relevance throughout the forecast period ending in 2033.

The high valuation of the Barbie brand, particularly its intangible assets like global recognition and cultural impact, provides a unique moat against competitive threats. However, maintaining this valuation requires careful brand guardianship, avoiding controversies, and ensuring continuous alignment with contemporary social values. The success of the recent media push demonstrates the immense power of integrated marketing across cinema, streaming, and retail, setting a new benchmark for intellectual property management within the toy industry. Future revenue streams will increasingly derive from licensing intellectual property for related consumer goods and themed experiences, extending the brand footprint far beyond the traditional doll aisle and diversifying the overall business risk profile, ensuring a resilient financial outlook.

Regional competitive dynamics vary significantly. In North America, competition centers on innovation and marketing spend, while in Asia Pacific, the focus is more on strategic pricing and establishing robust local distribution networks to compete effectively against entrenched local players and fast-growing domestic alternatives. The challenge for market leaders is to maintain a premium perception globally while also offering entry-level price points accessible to growing middle-class segments in emerging economies. This requires sophisticated multi-tiered product strategies tailored specifically to the unique economic realities and consumer psychologies of each major geographic segment to maximize both volume sales and margin preservation, securing the USD 5.2 Billion forecast target by the end of 2033.

In conclusion, the Barbie Doll Market stands at an inflection point, transitioning from a solely physical toy segment into a comprehensive entertainment and lifestyle brand. Strategic imperatives include leveraging AI for rapid design iteration and personalized engagement, prioritizing sustainable manufacturing methods, and continually refreshing the brand narrative to maintain cultural relevance across generational and geographical divides. The robust performance projected in the collectible segment, combined with high-volume growth potential in APAC, solidifies the optimistic outlook for this iconic market segment, confirming its enduring appeal and capacity for strategic evolution in a rapidly changing global consumer landscape.

Further examination of ancillary markets, such as clothing, miniature furniture, and digital accessories, reveals significant cross-segment revenue opportunities. These non-doll segments often exhibit higher margins and less volatile demand patterns, providing crucial diversification and revenue stability. The symbiotic relationship between the core doll product and its vast ecosystem of accessories is fundamental to the long-term value proposition, encouraging repeat purchases and enhancing the depth of imaginative play. Companies are increasingly using loyalty programs and subscription models, leveraging digital platforms, to tie consumers into this broader ecosystem, effectively raising the customer lifetime value (CLV) and creating predictable revenue streams that support continuous research and development investment needed to stay ahead of competitive pressures and evolving societal trends in the global toy marketplace.

The regulatory environment, particularly concerning chemical safety and ethical supply chains, remains a persistent factor influencing operational costs and manufacturing complexity. Compliance with standards such as the European Union’s Toy Safety Directive and stringent labor laws requires ongoing auditing and investment in advanced material testing technologies. While compliance adds overhead, it also ensures consumer confidence, particularly among discerning parents who prioritize child safety. This focus on ethical and safe production practices acts as an implicit barrier to entry for smaller, non-compliant competitors, subtly consolidating market power among established industry leaders capable of absorbing these regulatory compliance costs and maintaining rigorous quality control globally.

In analyzing the competitive landscape, it is evident that differentiation is increasingly achieved through the narrative power of the brand rather than solely through physical product features. Successful campaigns emphasize aspirational careers, cultural milestones, and emotional connection, transforming the doll from a simple toy into a vehicle for storytelling and personal expression. This focus on intangible value creation is supported by massive investments in media production and celebrity partnerships, ensuring continuous visibility and cultural resonance across diverse global markets, fundamentally insulating the brand from generic competitive threats and securing its long-term premium positioning within the doll and fashion toy category.

The economic impact of global inflationary trends and currency fluctuations presents a tactical challenge, especially in managing international pricing strategies and procurement costs. Manufacturing in USD-sensitive regions while selling in disparate local currencies necessitates sophisticated financial hedging and flexible supply chain agreements. Companies must balance the need to absorb some cost increases to maintain competitive pricing in sensitive markets while strategically raising prices in more resilient consumer bases like North America. Effective financial management and strategic sourcing are thus non-negotiable components of maintaining profitability and market share growth throughout the volatile economic cycles anticipated during the forecast period.

Finally, the evolution towards sustainable and interactive play experiences is driving material science innovation. Research into biodegradable or rapidly renewable materials for doll bodies and packaging is accelerating, driven both by consumer demand and regulatory pressures to reduce plastic waste. The ultimate integration of technology, represented by 'smart' features and digital extensions, aims to future-proof the product, ensuring that the Barbie doll remains relevant to a generation increasingly comfortable navigating hybrid physical-digital play environments, sustaining the brand’s iconic status well beyond the 2033 forecast horizon and securing its position as a cultural and commercial powerhouse globally. This comprehensive strategy across technology, sustainability, and narrative is crucial for achieving and potentially surpassing the expected market valuation in the coming years.

The strategic deployment of localized marketing campaigns is critical for unlocking growth potential in diverse regions such as the Middle East and parts of Asia, where cultural sensitivities and media consumption habits vary dramatically from Western markets. Marketing efforts must transition from generic global advertisements to tailored content that features culturally appropriate narratives, apparel, and endorsed media personalities relevant to the local consumer base. This hyper-local approach requires deep regional market intelligence and flexible content production capabilities, ensuring the brand message of empowerment and aspiration is translated effectively without cultural missteps, thereby fostering genuine connection and driving adoption rates in complex, fragmented markets.

Furthermore, the segmentation of the market by distribution channel highlights a crucial area for capital investment. While e-commerce provides scalability and lower overheads for the collector segment, the physical retail presence remains vital for the core child demographic, where in-store visibility and tactile experience drive impulsive purchases, particularly during seasonal peaks. Therefore, maintaining strong relationships with mass merchandisers (e.g., Walmart, Target) globally and optimizing shelf placement, often involving significant co-operative marketing investments, is essential for securing high-volume sales and maintaining brand ubiquity, creating a necessary dual-channel strategy that balances digital efficiency with essential physical market presence.

The innovation pipeline within the Barbie Doll Market must address both physical durability and digital functionality. Upcoming releases are expected to integrate advanced haptic feedback technologies and improved voice recognition capabilities in 'smart' accessories, enhancing the immersive quality of interactive play. This technological arms race, driven by competition from highly sophisticated electronic toys, mandates continuous R&D spending. Success will be defined by the ability to offer enhanced technological features at price points accessible to the broad volume market, rather than confining such innovations solely to the premium collector series, thereby driving overall market adoption and technological differentiation from lower-cost generic alternatives and securing sustained consumer interest.

The collector market (13+ years segment) provides essential brand halo effects, leveraging exclusivity and high artistic value to reinforce the premium positioning of the entire product portfolio. Limited edition collaborations with high-end fashion houses, prominent artists, and major cinematic franchises not only generate immediate high-margin revenue but also create significant media buzz that trickles down, driving interest in the more accessible mainstream lines. This strategic use of exclusivity maintains the brand's luxury perception while keeping the core product within reach of the mass market, illustrating a sophisticated pricing and positioning strategy that utilizes segmentation to maximize both volume and profitability across the entire economic spectrum of consumers.

In conclusion of the detailed analysis, the future trajectory of the Barbie Doll Market is inextricably linked to its successful execution of a global, multi-faceted strategy centered on digital innovation, unwavering commitment to social relevance and diversity, and meticulous management of its complex global supply chain. The brand's ability to successfully navigate societal trends, technological disruption, and economic fluctuations will solidify its dominant position, ensuring that the projected market expansion culminating in USD 5.2 Billion by 2033 is realized, sustained by generations of loyal consumers and a highly optimized, resilient operational framework, underpinning its cultural and commercial significance in the global toy landscape for decades to come.

The long-term resilience of the Barbie Doll Market is further assured by its strategic capacity for cross-generational appeal. The concept of "hand-me-down" nostalgia plays a vital role, where parents who grew up with the brand introduce it to their children, creating a cyclical demand pattern unique to established legacy brands. This intergenerational continuity minimizes marketing costs for brand awareness and reinforces the product's status as a trusted, traditional play item, providing a critical buffer against the highly volatile nature of many modern toy trends. Leveraging this unique heritage through specific product lines and nostalgic marketing campaigns remains a foundational pillar of the brand’s enduring success and market stability, especially in mature markets where brand loyalty is deeply ingrained in consumer purchasing habits over decades.

Operational efficiency gained through digital transformation, particularly in inventory management and predictive sales analytics, is now recognized as a core competency. Utilizing machine learning models to analyze geopolitical stability, localized holiday periods, and micro-seasonal trends allows for highly accurate production forecasts, minimizing costly air freight and reducing stock-outs during critical retail periods. This precision in operational planning translates directly into enhanced profitability and improved distributor relationships, providing a competitive edge over rivals who rely on less sophisticated forecasting and supply chain management techniques, showcasing the strategic importance of data science in the modern toy market's operational excellence framework.

Finally, the expanding global intellectual property (IP) portfolio, which includes streaming series, video games, and licensing agreements with major theme parks and apparel manufacturers, ensures that the brand remains highly visible and culturally pervasive outside of the core toy retail environment. This IP monetization strategy serves as a critical revenue diversifier and significantly increases the touchpoints consumers have with the brand, fostering continuous engagement and reinforcing brand awareness among non-toy purchasers. The synergistic effect of these media investments on retail sales of the physical doll demonstrates a sophisticated business model where entertainment value drives commercial success, securing a robust future for the Barbie Doll Market that transcends simple product transactions and establishes the brand as a key player in the global entertainment ecosystem.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager