Base Epoxy Resins Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437843 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Base Epoxy Resins Market Size

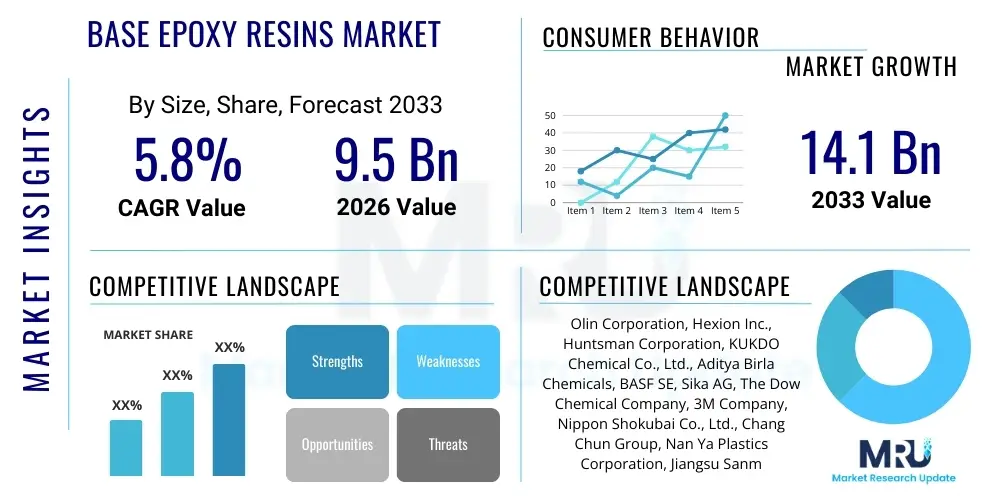

The Base Epoxy Resins Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 14.1 Billion by the end of the forecast period in 2033.

Base Epoxy Resins Market introduction

Base epoxy resins, predominantly synthesized from epichlorohydrin and bisphenol A (BPA) to form Diglycidyl Ether of Bisphenol A (DGEBA), serve as the foundational building blocks for a vast array of high-performance materials. These thermosetting polymers are distinguished by their excellent adhesion, chemical resistance, mechanical strength, and superior electrical insulating properties, making them indispensable across critical industrial sectors. Their robust nature allows them to be formulated into advanced coatings, structural adhesives, sophisticated composites, and encapsulation materials required for severe operating environments.

The primary applications of base epoxy resins span high-demand industries such as aerospace, automotive, electronics, construction, and marine infrastructure. In coatings, they provide exceptional corrosion and weather resistance for protective paints and powder coatings used on pipelines, storage tanks, and industrial flooring. As adhesives, they offer high-strength bonding crucial for composite components in wind turbine blades and aircraft structures. Their inherent stability is also paramount in the electrical and electronics sector, utilized in potting compounds, printed circuit boards (PCBs), and insulators to ensure component longevity and operational reliability under thermal and electrical stress.

Key driving factors accelerating the market expansion include the global surge in construction activities, particularly in developing economies, which necessitates high-durability protective coatings and floorings. Furthermore, the increasing adoption of lightweight materials in the automotive and aerospace industries to enhance fuel efficiency and reduce emissions mandates the use of epoxy-based composites. Regulatory pressures favoring environmentally benign formulations are also pushing innovation towards bio-based and waterborne epoxy systems, ensuring continuous product development and market relevance.

Base Epoxy Resins Market Executive Summary

The Base Epoxy Resins Market is characterized by robust growth driven primarily by escalating demand from high-performance applications in construction and renewable energy sectors, particularly wind turbine manufacturing. Business trends highlight a significant shift toward developing specialized, high-functionality resins, including enhanced flexibility and rapid-curing systems, catering to automated manufacturing processes. Strategic initiatives focusing on backward integration to secure epichlorohydrin and BPA supply chains are crucial for major players to mitigate price volatility. Furthermore, sustainability is becoming a core business driver, pushing companies to invest heavily in bio-based epoxy alternatives and recycling technologies to align with global environmental mandates and consumer preferences, especially in mature markets like Western Europe and North America.

Regionally, Asia Pacific (APAC) maintains its dominance, driven by massive infrastructure investments, rapid industrialization, and high output from key manufacturing hubs, notably China, India, and South Korea, which are major producers and consumers of electronic components and automotive parts. While APAC provides volume growth, North America and Europe lead in technological innovation and the adoption of advanced, specialty resin grades for aerospace and high-end automotive applications. Emerging economies in Latin America and the Middle East & Africa (MEA) are witnessing accelerated growth, fueled by burgeoning construction projects and diversification into domestic manufacturing, though their market share remains comparatively smaller but rapidly expanding.

In terms of segment trends, Diglycidyl Ether of Bisphenol A (DGEBA) remains the largest segment by type due to its versatility and cost-effectiveness, though specialty resins like epoxy novolacs and cycloaliphatic epoxies are capturing higher market share in niche applications requiring extreme temperature or chemical resistance. The Coatings application segment holds the dominant share, indispensable for protective and decorative finishes. However, the Composites segment is exhibiting the highest growth rate, primarily attributed to their critical use in electric vehicle components, lightweighting initiatives in transportation, and the ongoing expansion of the global wind energy capacity which relies heavily on epoxy resins for large-scale rotor blades.

AI Impact Analysis on Base Epoxy Resins Market

User queries regarding AI's influence on the Base Epoxy Resins Market primarily revolve around optimizing formulation and predicting material performance, minimizing production waste, and enhancing supply chain resilience. Key user concerns include understanding how AI-driven predictive modeling can accelerate the development of novel epoxy systems, particularly bio-based variants, and how machine learning (ML) algorithms can be integrated into Quality Control (QC) processes to detect subtle batch variations, ensuring consistent high-grade output required for sensitive applications like aerospace composites. There is also significant interest in AI's role in improving the complex logistics and inventory management of volatile raw materials such as epichlorohydrin and bisphenol A, mitigating operational risks associated with price fluctuations and unexpected supply disruptions across diverse global manufacturing sites.

AI's application in materials science promises to revolutionize the traditionally slow and costly process of developing new epoxy chemistries. By leveraging computational power, researchers can simulate millions of molecular combinations and curing schedules, rapidly identifying optimal formulations that meet stringent performance criteria, such as specific glass transition temperatures or enhanced thermal stability, long before extensive laboratory synthesis is required. This predictive capability significantly reduces R&D cycles and expenditure, particularly beneficial for specialized resins like those used in 3D printing or high-frequency electronics encapsulation, fostering faster market entry for innovative products.

Furthermore, the integration of AI and Industrial Internet of Things (IIoT) across manufacturing facilities is enhancing operational efficiency. Machine learning models analyze real-time sensor data from reactors, mixers, and filtration units to precisely control reaction parameters (temperature, pressure, feed rates), minimizing off-spec batches and energy consumption. This optimization not only lowers manufacturing costs but also contributes directly to sustainability goals by reducing chemical waste generation, a critical environmental challenge for the chemical industry. The net effect is a move toward hyper-efficient, highly automated production environments capable of dynamic adjustment to raw material quality variations and fluctuating energy costs.

- AI-driven Predictive Formulation: Accelerating R&D for novel epoxy compositions, including bio-based resins, by simulating material properties and curing kinetics.

- Optimized Quality Control (QC): Using ML algorithms on spectrometer and rheometer data to ensure batch-to-batch consistency and early detection of polymerization anomalies.

- Supply Chain Resilience: Employing advanced analytics to forecast raw material price volatility and demand shifts, enabling proactive procurement strategies for BPA and epichlorohydrin.

- Smart Manufacturing: Integration of IIoT sensors and AI for real-time control of polymerization reactors, maximizing yield and minimizing energy consumption in exothermic processes.

- Digital Twin Modeling: Creating virtual representations of manufacturing plants to test new process parameters and scale-up strategies without disrupting physical production.

- Market Trend Forecasting: Analyzing global construction, automotive, and wind energy data to predict regional demand for specific resin grades and optimize production scheduling.

DRO & Impact Forces Of Base Epoxy Resins Market

The dynamics of the Base Epoxy Resins Market are shaped by a complex interplay of robust demand drivers stemming from modernization and infrastructure development, countered by significant regulatory and supply chain constraints, while opportunities arise from technological advancements. The pervasive need for durable, high-performance materials in demanding environments, coupled with the rapid expansion of wind energy capacity and the electrification of vehicles, fuels substantial market growth. Conversely, the market faces headwinds primarily related to the volatility of key petrochemical feedstocks, notably crude oil derivatives and bisphenol A (BPA), which directly impacts manufacturing costs and profit margins. Furthermore, increasing scrutiny and regulatory actions against the use of traditional BPA-based resins in food contact and consumer applications necessitate costly R&D into alternative chemistries, presenting both a restraint and a pivotal opportunity for innovation.

Key drivers include the global infrastructural boom, particularly the construction of high-speed rail networks, bridges, and industrial complexes in Asia and the Middle East, demanding high volumes of protective coatings and concrete repair compounds based on epoxy. The mandatory shift towards lightweighting in the transportation sector, propelled by stringent emission standards, accelerates the adoption of epoxy-carbon fiber composites in aerospace and high-end automotive manufacturing. Opportunities abound in the development of specialty and differentiated resins, such as waterborne and powder epoxy systems that minimize Volatile Organic Compound (VOC) emissions, aligning with stricter environmental regulations. Furthermore, the burgeoning demand for high-reliability electrical insulation in EV batteries and energy storage systems presents a high-value niche for specialized cycloaliphatic epoxies.

The impact forces currently exerting the strongest influence on the market structure are the stringent regulatory environment in developed regions concerning BPA toxicity and VOC emissions, which necessitates rapid formulation changes and compliance investments, thereby raising the barrier to entry for conventional producers. Simultaneously, the persistent supply chain fragility, exacerbated by geopolitical factors affecting oil and gas prices, directly dictates the profitability of epoxy producers who rely on reliable access to intermediate chemicals. The competitive landscape is intensely segmented, with pricing pressure exerted by large-scale Asian manufacturers focusing on commodity grades, while Western companies maintain market dominance through specialization in high-performance and tailored resin systems, driving continuous technological evolution and product differentiation.

- Drivers: Growing construction and infrastructure development globally; increasing demand for lightweight composites in aerospace and automotive industries; rapid expansion of wind energy sector requiring high-strength adhesives and coatings.

- Restraints: Volatile prices of raw materials (Bisphenol A and Epichlorohydrin); stringent environmental regulations regarding VOC emissions and BPA exposure; limited availability of specialized curing agents impacting high-temperature performance.

- Opportunities: Technological advancements in bio-based and sustainable epoxy formulations; surging demand for epoxy resins in 3D printing and additive manufacturing; high-growth potential in emerging applications like advanced electrical insulation for Electric Vehicles (EVs).

- Impact Forces: Intense vertical integration among large chemical manufacturers to secure raw material supply; rising costs of regulatory compliance impacting small and medium enterprises (SMEs); accelerated focus on performance-driven, specialty resins over commodity grades.

Segmentation Analysis

The Base Epoxy Resins Market is systematically segmented based on Type, Application, and End-Use Industry, reflecting the diverse performance requirements and end-market demands placed upon these versatile polymers. The segmentation by Type, encompassing major categories like DGEBA, Epoxy Novolac, and Aliphatic Epoxies, highlights the foundational role of standard resins (DGEBA) while acknowledging the rising importance of specialty resins tailored for high chemical or thermal resistance. Market growth is heavily dictated by the balance between volume sales of commodity DGEBA for coatings and the higher value commanded by specialty Novolacs crucial for protective linings in severe industrial environments.

The Application segmentation reveals the broad functional utility of epoxy resins, dominated by Coatings, Adhesives, and Composites. The Coatings sector remains the market's backbone, driven by general industrial maintenance and infrastructure protection. However, the fastest growth is observed within the Composites segment, directly correlating with the increased production of lightweight structural components for wind turbine blades, high-end sporting goods, and critical components in the aerospace industry, where the superior strength-to-weight ratio of epoxy composites is non-negotiable. This rapid shift in composite adoption significantly influences R&D investment towards high-modulus, fast-curing resin systems suitable for automated manufacturing.

End-Use Industry segmentation illustrates the economic drivers, with Construction, Automotive, and Electrical & Electronics being the foremost consumers. The cyclical nature of the Construction industry heavily influences overall market demand, particularly for floor coatings, grouts, and sealants. Conversely, the Electrical & Electronics sector provides stable, high-value demand, requiring ultra-pure and specialized resins for encapsulation, ensuring protection and insulation of sensitive components like semiconductors and LEDs. Future market expansion will be heavily dependent on technological advancements within the automotive sector, driven by the shift towards electric mobility and the subsequent need for robust, high-voltage battery encapsulation and structural bonding solutions.

- By Type:

- Diglycidyl Ether of Bisphenol A (DGEBA)

- Diglycidyl Ether of Bisphenol F (DGEBF)

- Epoxy Novolac Resins

- Aliphatic Epoxies

- Cycloaliphatic Epoxies

- Others (Brominated, Glycidylamine, etc.)

- By Application:

- Coatings (Protective, Marine, Powder Coatings)

- Adhesives (Structural, General Purpose)

- Composites (Aerospace, Wind Energy, Automotive)

- Electrical & Electronics (Encapsulation, Potting, PCBs)

- Tooling & Molding

- Others (Civil Engineering, Consumer Goods)

- By End-Use Industry:

- Construction (Residential, Commercial, Infrastructure)

- Automotive & Transportation

- Aerospace & Defense

- Marine

- Wind Energy

- Electrical & Electronics

- Industrial

Value Chain Analysis For Base Epoxy Resins Market

The value chain for the Base Epoxy Resins Market commences with the upstream segment, which is dominated by the production of foundational petrochemical raw materials: Epichlorohydrin (ECH) and Bisphenol A (BPA). ECH is typically derived from propylene, while BPA is synthesized from phenol and acetone. The cost and supply stability in this upstream segment significantly dictates the final pricing of base resins, making vertical integration into these raw materials a crucial strategic advantage for large chemical conglomerates. Fluctuations in crude oil prices directly impact ECH production costs, introducing inherent volatility that is then passed down the value chain, influencing the profitability of mid-stream resin manufacturers who are not integrated.

The midstream phase involves the core manufacturing of the base epoxy resins, where ECH and BPA react to produce DGEBA or specialized derivatives. This phase requires significant capital investment in reaction technology, quality control systems, and formulation expertise. Manufacturers in this segment range from global giants with extensive product portfolios specializing in high-performance grades to regional players focusing on cost-effective, commodity-grade resins. Following synthesis, the resins are formulated with various curing agents, additives, fillers, and diluents to create application-specific systems (e.g., fast-cure adhesives, UV-resistant coatings) tailored for downstream processors.

The downstream segment involves the distribution and final application of the formulated epoxy systems. Distribution channels are varied, including direct sales to large industrial customers (e.g., wind turbine manufacturers, aerospace companies) for bulk applications, and indirect channels through specialized chemical distributors catering to small- and medium-sized enterprises (SMEs) in construction and general manufacturing. End-users, such as composite fabricators, coating applicators, and electronics assemblers, require technical support and highly specific product characteristics. The quality of application often depends on the expertise of these end-users, highlighting the importance of technical service provided by resin manufacturers and distributors to ensure optimal material performance in demanding environments.

Base Epoxy Resins Market Potential Customers

Potential customers for base epoxy resins are highly diverse, spanning sectors where superior structural integrity, chemical resistance, and electrical insulation are paramount. The largest cohort of buyers are formulators and compounders who purchase base resins in bulk to mix with curing agents, modifiers, and fillers, creating tailored systems sold directly to end-use industries. These intermediate buyers require high-volume, consistent-quality resins (DGEBA) at competitive prices to maintain stable product lines for protective coatings and structural adhesives used ubiquitously across general industrial applications and infrastructure projects. Their purchasing decisions are driven primarily by resin purity, viscosity, and long-term supply agreements.

Another major segment of buyers comprises large Original Equipment Manufacturers (OEMs) in specialized industries such as aerospace, wind energy, and high-end automotive manufacturing. These customers typically require smaller volumes of highly specialized and qualified epoxy systems, such as advanced epoxy novolacs or cycloaliphatic epoxies, that meet extremely rigorous performance specifications (e.g., fire retardancy, high glass transition temperature, rapid curing cycles). For aerospace applications, for example, purchasing decisions are dictated by qualification standards (like those set by regulatory bodies) and technical partnerships with resin suppliers to co-develop proprietary composite matrices that ensure product compliance and optimal performance under extreme operational conditions.

The third key segment includes subcontractors and applicators within the construction and marine maintenance sectors. These buyers utilize pre-formulated epoxy systems for protective floor coatings, concrete repair, grouting, and anti-corrosion marine paints. While price sensitivity is generally higher in the construction segment, the demand for long-lasting, durable solutions that reduce lifecycle maintenance costs ensures a steady market for high-quality, specialized coating systems. The increasing regulatory emphasis on sustainable building materials is also driving this customer base towards seeking waterborne and solvent-free epoxy options.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 14.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Olin Corporation, Hexion Inc., Huntsman Corporation, KUKDO Chemical Co., Ltd., Aditya Birla Chemicals, BASF SE, Sika AG, The Dow Chemical Company, 3M Company, Nippon Shokubai Co., Ltd., Chang Chun Group, Nan Ya Plastics Corporation, Jiangsu Sanmu Group Co., Ltd., Spolchemie, DIC Corporation, Evonik Industries AG, Kolon Industries, Inc., SWANCOR Holding Co., Ltd., Atul Ltd., Wuxi Bluebird Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Base Epoxy Resins Market Key Technology Landscape

The technology landscape for Base Epoxy Resins is evolving rapidly, driven by the dual pressures of enhancing performance characteristics and achieving sustainability objectives. Traditional synthesis predominantly involves the reaction of Bisphenol A (BPA) with Epichlorohydrin (ECH) under alkaline conditions. However, manufacturers are increasingly adopting advanced process technologies, such as continuous polymerization methods, to improve yield, consistency, and energy efficiency compared to traditional batch processes. A major technological focus is on developing methods to manufacture high-purity, low-viscosity liquid epoxy resins (LERs) that facilitate ease of formulation and application, particularly important for high-solids or solvent-free coating systems that minimize environmental impact.

A pivotal technological shift involves the development and commercialization of non-BPA based epoxy precursors, responding to growing regulatory concerns and market demand for safer chemicals. Technologies focusing on replacing Bisphenol A with alternatives like Bisphenol F, or bio-based feedstocks derived from vegetable oils, lignin, or terpenes, represent the cutting edge of material innovation. While bio-based epoxies currently face challenges related to cost-competitiveness and equivalent performance properties (such as glass transition temperature), ongoing R&D in enzyme-catalyzed synthesis and genetic engineering of microbial factories aims to overcome these limitations, securing a sustainable long-term feedstock supply and positioning companies as market leaders in green chemistry.

Furthermore, technology enabling tailored resin systems, specifically for additive manufacturing (3D printing) and rapid-cure composites, is gaining traction. This involves synthesizing specialty resins with precise curing kinetics, often utilizing UV or electron beam curing technologies, allowing for instant hardening and high throughput required in complex manufacturing processes like filament winding for pressure vessels or stereolithography (SLA). The use of nanotechnology, specifically incorporating carbon nanotubes, graphene, or nanoclays into the epoxy matrix, is a key technology for enhancing mechanical properties, thermal conductivity, and electrical insulation performance, thereby maximizing the utility of base resins in next-generation electronic and aerospace applications.

Regional Highlights

Regional dynamics play a crucial role in shaping the global Base Epoxy Resins Market, reflecting varied levels of industrial maturity, infrastructure spending, and regulatory environments. Asia Pacific (APAC) currently holds the dominant market share and exhibits the highest growth trajectory globally. This dominance is attributable to robust manufacturing output across China, India, and Southeast Asia, coupled with aggressive governmental spending on infrastructure, including bridges, ports, and renewable energy projects. China, in particular, serves as the global epicenter for both production and consumption, driven by its massive electronics manufacturing base and its world-leading position in wind energy installations, which consume vast quantities of epoxy composites for turbine blades.

North America and Europe represent mature markets characterized by stringent environmental regulations and a focus on high-value, specialty applications. While volume growth may be slower than in APAC, these regions drive technological innovation, particularly in aerospace, high-performance automotive composites, and advanced electrical encapsulation systems. Regulatory mandates, such as the European Union's REACH framework, necessitate the use of low-VOC and non-BPA alternatives, pushing manufacturers towards advanced waterborne and bio-based resin technologies. The demand for lightweight materials in the aerospace sector (Boeing, Airbus) and the burgeoning electric vehicle market heavily influence the consumption of high-modulus specialty epoxies in these regions.

Latin America and the Middle East & Africa (MEA) are categorized as emerging markets, showing accelerated, albeit smaller-scale, growth. The MEA region's growth is predominantly fueled by mega-construction projects (e.g., Saudi Arabia’s Vision 2030 initiatives) and heavy investment in oil, gas, and petrochemical infrastructure, driving demand for heavy-duty protective and anti-corrosion coatings based on epoxy. In Latin America, urbanization and expanding automotive assembly plants, particularly in Mexico and Brazil, contribute significantly to the demand for structural adhesives and automotive coatings, signifying promising future market opportunities contingent upon economic stability and continued foreign direct investment.

- Asia Pacific (APAC): Market leader by volume; driven by infrastructure construction, electronics manufacturing, and massive wind energy expansion in China and India.

- North America: High-value market focused on aerospace composites, protective coatings for oil and gas infrastructure, and specialized resins for electric vehicle battery applications.

- Europe: Technology leader in sustainable and high-performance resins; driven by stringent environmental standards (REACH) and high demand from the automotive and general industrial sectors.

- Middle East & Africa (MEA): Rapid growth attributed to large-scale construction projects, petrochemical industry expansion, and increasing demand for anti-corrosion marine coatings.

- Latin America: Emerging market growth supported by automotive production, urbanization trends, and localized infrastructure spending.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Base Epoxy Resins Market.- Olin Corporation

- Hexion Inc.

- Huntsman Corporation

- KUKDO Chemical Co., Ltd.

- Aditya Birla Chemicals

- BASF SE

- Sika AG

- The Dow Chemical Company

- 3M Company

- Nippon Shokubai Co., Ltd.

- Chang Chun Group

- Nan Ya Plastics Corporation

- Jiangsu Sanmu Group Co., Ltd.

- Spolchemie

- DIC Corporation

- Evonik Industries AG

- Kolon Industries, Inc.

- SWANCOR Holding Co., Ltd.

- Atul Ltd.

- Wuxi Bluebird Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Base Epoxy Resins market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Base Epoxy Resins Market?

The key drivers include massive global investment in infrastructure and construction, especially in Asia Pacific, coupled with the escalating demand for lightweight, high-strength composites in the aerospace and automotive sectors, and the rapid expansion of wind turbine manufacturing utilizing epoxy systems for rotor blades.

How do regulatory changes, such as restrictions on Bisphenol A (BPA), affect the epoxy market?

BPA restrictions, particularly in Europe and North America, act as a significant restraint, compelling manufacturers to rapidly invest in R&D for alternative, non-BPA epoxy precursors like Bisphenol F and various bio-based derivatives, thereby driving innovation in sustainable, compliant resin chemistries.

Which application segment holds the largest market share for base epoxy resins?

The Coatings application segment maintains the largest market share, driven by the pervasive need for protective, anti-corrosion, and aesthetic finishes in industrial, marine, and infrastructure environments globally. However, the Composites segment exhibits the fastest growth rate.

What is the future outlook for sustainable and bio-based epoxy resins?

The future outlook is highly positive. Sustainability is a major opportunity, with significant technological advancements focusing on developing cost-effective, high-performance epoxy resins derived from renewable biomass sources such as vegetable oils, positioning these bio-based solutions as critical substitutes for petrochemical dependence.

How does the volatility of raw material prices impact epoxy resin producers?

The high volatility of key feedstocks, particularly Bisphenol A and Epichlorohydrin, which are linked to crude oil prices, significantly impacts the operating margins of epoxy producers. This volatility forces companies to engage in vertical integration or secure long-term supply agreements to mitigate cost risks and maintain competitive pricing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager