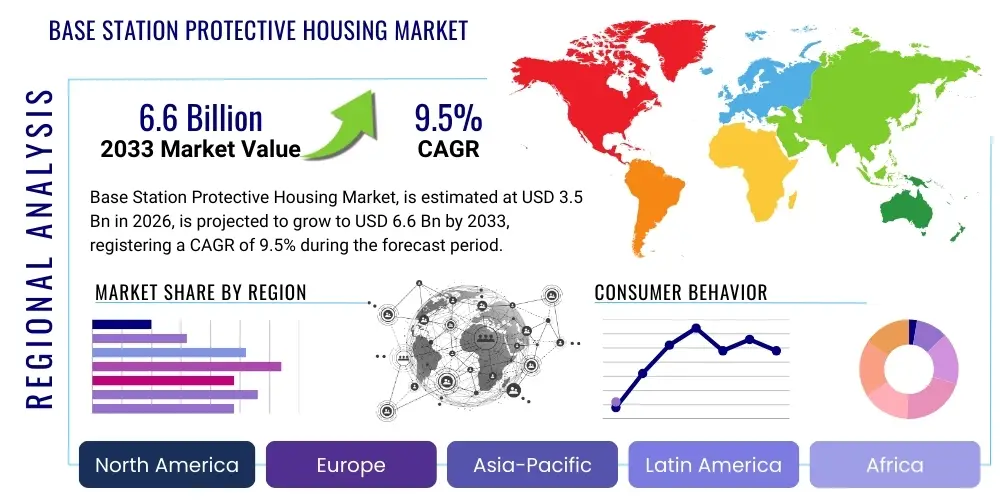

Base Station Protective Housing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438882 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Base Station Protective Housing Market Size

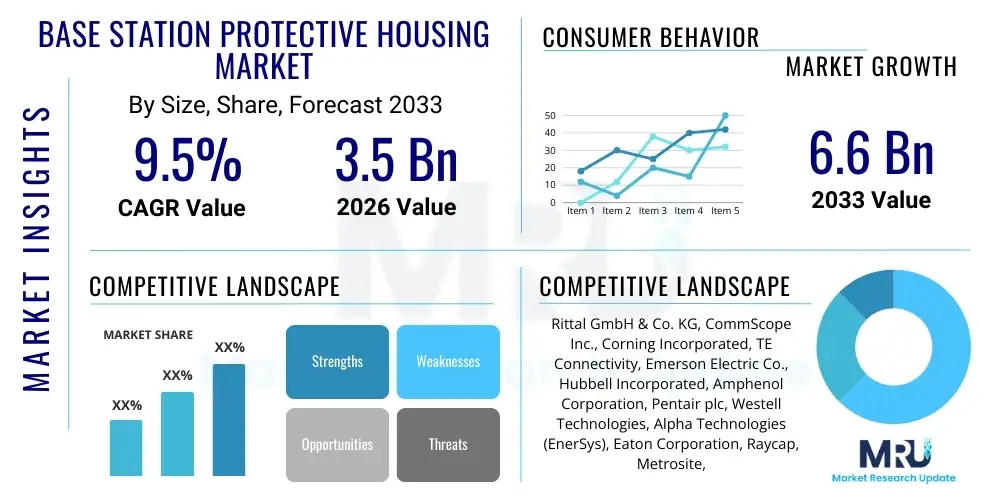

The Base Station Protective Housing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.6 Billion by the end of the forecast period in 2033.

Base Station Protective Housing Market introduction

The Base Station Protective Housing Market encompasses specialized enclosures designed to shield sensitive telecommunication equipment, such as radios, antennas, and power systems, utilized in cellular base stations (ranging from macro cells to small cells) from environmental hazards, vandalism, and extreme weather conditions. These housings are critical components of modern cellular networks, ensuring operational longevity, minimizing downtime, and providing essential thermal management and electromagnetic shielding required by high-performance 4G and 5G infrastructure. The market’s evolution is intrinsically linked to global network densification efforts, particularly the widespread rollout of 5G New Radio (NR) technology, which necessitates a significantly higher number of smaller, distributed base stations compared to previous generations.

The core product description focuses on robust enclosures manufactured typically from corrosion-resistant materials like specialized aluminum alloys, advanced composite materials, or durable engineered plastics, often featuring integrated cooling solutions such as heat sinks, fans, or passive cooling mechanisms. Major applications span urban and rural network installations, rooftop placements, and integration into street furniture (for small cells), serving Mobile Network Operators (MNOs), Tower Companies (Towercos), and enterprises establishing private 5G networks. These protective solutions are essential for maintaining network reliability and adhering to stringent regulatory standards concerning equipment safety and environmental impact.

The primary benefits derived from high-quality protective housing include enhanced physical security, superior ingress protection (IP ratings against dust and moisture), and optimal thermal regulation, which directly impacts the performance and lifespan of expensive electronic components. Driving factors for market expansion include the exponential increase in global mobile data traffic, mandatory regulatory requirements for infrastructure resilience, the proliferation of Internet of Things (IoT) devices necessitating massive machine-type communications (mMTC), and government initiatives aimed at universal broadband coverage. These macro trends ensure sustained demand for advanced, durable, and highly integrated protective enclosures capable of accommodating increasingly complex network architectures.

Base Station Protective Housing Market Executive Summary

The global Base Station Protective Housing Market is characterized by robust business trends driven primarily by the ongoing 5G deployment cycle, leading to a structural shift towards small cell and distributed antenna system (DAS) architectures, which require smaller, aesthetically pleasing, and more durable housings for dense urban environments. Key business developments involve material innovation, focusing on lighter weight, better heat dissipation properties, and enhanced stealth capabilities to blend infrastructure seamlessly into the surroundings. Competition is intensifying around specialized thermal management solutions and the integration of smart monitoring features within the housing units, allowing for predictive maintenance and remote diagnostics, thus offering value-added services beyond mere physical protection. Furthermore, sustainable manufacturing practices and the use of recyclable materials are becoming significant differentiation points for manufacturers targeting environmentally conscious MNOs.

Regionally, Asia Pacific (APAC) stands as the primary growth engine, fueled by aggressive 5G infrastructure investments in China, South Korea, Japan, and India, which are rapidly deploying vast numbers of base stations to support massive populations and industrial IoT applications. North America and Europe show steady, mature growth, focusing on retrofitting existing macro sites and deploying small cells to address urban density and capacity bottlenecks. Regulatory environments in Europe emphasize aesthetic integration and strict environmental compliance, driving demand for specialized, non-metallic composite housings. Emerging markets in Latin America and the Middle East and Africa (MEA) are contributing to growth through foundational 4G network expansion and initial 5G pilot projects, prioritizing cost-effectiveness and ruggedized protection against severe environmental conditions.

Segment trends indicate a strong move towards composite and engineered plastic housings, challenging the traditional dominance of aluminum, due to superior radio frequency (RF) transparency and weight reduction, particularly vital for pole-mounted and aerial installations. The small cell housing segment is experiencing the fastest growth rate, significantly outpacing macro cell housing, reflecting the strategy of network densification. Application-wise, urban deployments remain the largest revenue generator, but the market for specialized ruggedized housings for remote, rural, or extreme environment installations (such as offshore wind farms or mining sites) is expanding rapidly, requiring higher IP and NEMA ratings and specialized anti-vandalism features, ensuring segmented innovation across the product portfolio.

AI Impact Analysis on Base Station Protective Housing Market

Common user questions regarding AI's influence on the Base Station Protective Housing Market typically revolve around how AI can optimize the physical design, operational efficiency, and maintenance requirements of the enclosures. Users frequently inquire about the role of AI in predictive cooling management, designing housings that minimize heat stress on components, and utilizing sensor data integrated into the housing for real-time diagnostics and fault prediction. There is significant interest in AI-driven modeling to optimize material usage and structural integrity against specific localized environmental factors (e.g., wind load, humidity, solar radiation) before physical prototyping. Furthermore, users seek understanding on how smart, AI-enabled housings can reduce the frequency of costly site visits by autonomously reporting potential physical breaches or thermal anomalies, thereby translating network intelligence into physical asset management efficiency.

The primary impact of Artificial Intelligence on this market is transforming the housing from a passive protective shell into an active, intelligent infrastructure component. AI algorithms analyze vast datasets streaming from environmental sensors, vibration monitors, and thermal cameras embedded within the enclosure, allowing MNOs to shift from reactive maintenance to highly efficient predictive models. This capability mandates that future protective housings be designed with integrated sensor arrays and standardized interfaces for edge computing devices necessary to run these AI models locally. This integration affects the housing's internal layout, cabling requirements, and heat dissipation needs, pushing manufacturers to design 'smarter' enclosures that facilitate edge computing deployments securely and efficiently.

The adoption of AI-enhanced network planning also influences the physical distribution and scaling of base stations. AI-driven site selection and capacity planning determine the optimal size and type of housing required for localized coverage gaps, accelerating the deployment of customized small cell enclosures that fit specific streetscapes or building profiles. Consequently, housing manufacturers must leverage advanced AI tools in their design phase for topology optimization and material selection, ensuring the final product meets stringent performance metrics while minimizing the total cost of ownership (TCO) for the network operators, reflecting a convergence of digital intelligence and physical engineering in product development.

- AI-driven predictive maintenance reduces physical inspection costs and extends housing lifecycle.

- Real-time data analysis of internal temperature and humidity optimizes integrated cooling system performance.

- Generative AI design tools accelerate the optimization of enclosure aerodynamics and thermal efficiency.

- AI algorithms assist in structural integrity assessment, predicting wear and tear based on environmental factors.

- Integration of AI processors requires specialized housing designs facilitating secure edge computing within the base station.

- Smart housing sensors feed data directly into network management systems for intelligent resource allocation.

DRO & Impact Forces Of Base Station Protective Housing Market

The Base Station Protective Housing Market is strongly driven by the unrelenting global rollout of 5G networks, necessitating far greater infrastructure density and the corresponding need for robust, environmentally adaptive enclosures for both macro sites and the rapidly expanding ecosystem of small cells and Distributed Antenna Systems (DAS). This massive increase in deployed units translates directly into higher demand for protective solutions capable of handling the increased thermal loads generated by 5G equipment while ensuring high-level ingress protection in diverse installation environments (rooftops, utility poles, street furniture). Market growth is further compounded by regulatory imperatives in various regions mandating infrastructure hardening against increasingly volatile weather patterns and the rising criticality of telecommunication networks as essential national infrastructure.

However, the market faces significant restraints, primarily revolving around the high initial capital expenditure associated with high-specification, ruggedized housing, particularly those incorporating advanced cooling technologies or stealth aesthetics required in stringent urban planning zones. Furthermore, standardization challenges exist globally; the lack of universal standards for small cell mounting and housing dimensions complicates mass production and limits economies of scale for specialized vendors. Supply chain volatility, particularly concerning critical materials like high-grade aluminum alloys and advanced composites, also poses a risk, potentially leading to price fluctuations and delayed deployment schedules for network operators attempting rapid expansion.

Opportunities abound, particularly in the integration of protective housing with emerging technologies such as multi-access edge computing (MEC) and open RAN (O-RAN) architectures. Housings designed specifically to accommodate the heterogeneous equipment and power requirements of MEC deployments, often requiring specialized thermal and security features, represent a high-value niche. Additionally, the increasing demand for private 5G networks across industrial sectors (manufacturing, logistics, mining) offers a fertile opportunity for vendors to supply highly customized, ruggedized enclosures tailored to specific enterprise operational environments. The market impact forces are significantly high, primarily positive, driven by technological adoption cycles (5G/6G) and critical infrastructure needs, but moderately constrained by cost sensitivity and the need for greater regulatory uniformity in deployment standards.

Segmentation Analysis

The Base Station Protective Housing Market is comprehensively segmented based on several critical parameters: Material Type, which influences durability and RF performance; Enclosure Type, reflecting the scale and power of the underlying telecommunication equipment; and Application, defining the environment and regulatory constraints of the installation site. This segmentation structure provides a granular view of market dynamics, highlighting areas of rapid innovation such as composite materials and small cell enclosures. Understanding these segments is vital for manufacturers to tailor their R&D investments and marketing strategies, ensuring alignment with the specific technical and aesthetic demands of different network deployment scenarios globally. The trend toward network densification is accelerating growth in all segments related to smaller, distributed units.

- By Material Type:

- Aluminum Alloys

- Composite Materials (Fiberglass, Carbon Fiber)

- Engineered Plastics (Polycarbonate, ABS)

- Stainless Steel

- By Enclosure Type:

- Macro Cell Housing

- Small Cell Housing (Micro, Pico, Femto Cells)

- Distributed Antenna System (DAS) Housings

- Integrated Cabinet Solutions

- By Application:

- Urban & Suburban Installations

- Rural & Remote Installations

- Indoor/In-Building Solutions (Enterprise & Public Spaces)

- Specialized Environments (Industrial, Military, Offshore)

- By Cooling Technology:

- Passive Cooling (Heat Sinks, Natural Convection)

- Active Cooling (Fan-based Systems, Air Conditioning Units)

- Hybrid Cooling Systems

Value Chain Analysis For Base Station Protective Housing Market

The value chain for the Base Station Protective Housing Market begins with upstream activities dominated by raw material suppliers, including producers of specialized metals (aluminum, steel), advanced chemical companies providing composite resins and coatings, and component manufacturers specializing in high-performance gaskets, seals, and locking mechanisms. The quality and availability of these materials significantly dictate the performance parameters (IP rating, thermal conductivity) and cost structure of the final product. Key activities in the upstream segment focus heavily on material science innovation, particularly around lightweighting and developing environmentally resistant finishes necessary for long-term outdoor deployment. Suppliers must adhere to stringent material quality standards defined by the telecommunication industry.

The middle segment of the chain involves the core manufacturing and assembly processes carried out by Original Equipment Manufacturers (OEMs) and specialized housing vendors. This phase encompasses precision engineering, welding, casting, advanced Computer Numerical Control (CNC) machining, and the integration of specialized thermal management hardware. Manufacturers often collaborate closely with Radio Access Network (RAN) equipment providers (like Ericsson, Nokia, Huawei) to ensure the housing perfectly fits the electronic payload and cooling requirements. Distribution channels are typically a mix of direct sales to large Mobile Network Operators (MNOs) or Tower Companies (Towercos) through negotiated contracts, and indirect sales facilitated by system integrators and electrical distributors who manage multi-vendor installation projects, particularly for smaller deployments or specialized enterprise networks.

Downstream activities center around installation, deployment, and post-sales support. Towercos and MNOs are the primary end-users responsible for the physical deployment and maintenance of these housings. Logistics management, ensuring that the often heavy and bulky enclosures are delivered efficiently to sometimes remote installation sites, is a critical component of the downstream value. The transition towards small cell architecture increases the reliance on system integrators for localized installation and maintenance services. The entire chain is characterized by a strong emphasis on logistics efficiency, quality control, and the ability to customize products rapidly to meet diverse site-specific requirements.

Base Station Protective Housing Market Potential Customers

The primary customers and end-users of Base Station Protective Housing are organizations responsible for building, operating, and maintaining wireless communication infrastructure. Mobile Network Operators (MNOs) represent the largest buying segment globally, encompassing major telecommunication giants that require thousands of standardized and customized enclosures for their extensive macro and small cell networks. Their buying decisions are driven by total cost of ownership (TCO), network reliability, and the need for housings that comply with strict thermal performance requirements necessary for modern high-capacity 5G equipment. MNOs prioritize durability and standardization to simplify logistics and maintenance across their vast footprint.

Tower Companies (Towercos), such as American Tower, Crown Castle, and Indus Towers, are increasingly important buyers, as they manage the passive infrastructure (towers, poles, rooftops) upon which MNOs lease space for active equipment. Towercos require highly ruggedized, standardized, and secure housings that maximize the longevity of the infrastructure asset and minimize interference. Their procurement is highly centralized and focused on enclosures that offer maximum flexibility to accommodate various tenant equipment configurations, emphasizing modular and scalable designs that can handle future technology upgrades efficiently.

A rapidly expanding customer base includes System Integrators and specialized Enterprise Clients. System Integrators purchase housings as part of turn-key solutions for municipal, transportation, or private industrial network deployments, focusing on customized aesthetics and specialized IP ratings. Enterprise Clients, particularly those in heavy industries (oil & gas, mining, manufacturing) and government/defense sectors, are utilizing protective housings for private 5G and mission-critical networks (MCNs), requiring enclosures with the highest security features, extreme environmental resilience, and strict certifications for explosion protection or electromagnetic compatibility (EMC).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.6 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rittal GmbH & Co. KG, CommScope Inc., Corning Incorporated, TE Connectivity, Emerson Electric Co., Hubbell Incorporated, Amphenol Corporation, Pentair plc, Westell Technologies, Alpha Technologies (EnerSys), Eaton Corporation, Raycap, Metrosite, Zhejiang Huaou Electronics Co., Ltd., Eltek ASA, Intertek Group plc, Vertiv Holdings Co, Fibox Oy Ab, Schott AG, ZPAS Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Base Station Protective Housing Market Key Technology Landscape

The technological landscape of the Base Station Protective Housing Market is rapidly evolving, driven by the intense demands of 5G for enhanced thermal management and signal transparency, coupled with the necessity for greater physical and digital security. A core technology focus is on advanced thermal management systems, moving beyond traditional air conditioning units towards sophisticated passive and hybrid cooling solutions. This includes phase-change materials (PCMs) integrated into the housing walls to absorb and release heat, specialized heat pipe technologies that efficiently transfer heat away from sensitive components, and high-efficiency heat exchangers designed to reduce power consumption while maintaining optimal operating temperatures for high-power radios and edge computing gear, which is critical for operational longevity and reducing site energy costs.

Another significant technological advancement lies in materials science, particularly the development and deployment of high-performance composite materials and non-metallic enclosures. These advanced materials, often incorporating specialized fiberglass or carbon fiber reinforced polymers, offer superior radio frequency (RF) transparency compared to traditional metal cabinets, which minimizes signal loss and complexity associated with integrating antennas directly into the housing structure. Furthermore, these composites offer excellent corrosion resistance, reduced weight for easier installation on poles and rooftops, and are essential for achieving aesthetic concealment goals in urban areas, where physical visibility is often restricted by municipal regulations, driving innovation in material composites that simulate traditional architectural surfaces.

The rise of 'smart' housing technologies represents the digital convergence within the product category. Modern enclosures are increasingly equipped with integrated Internet of Things (IoT) sensors for environmental monitoring, including shock sensors (for vandalism detection), sophisticated humidity and temperature probes, and smart locking systems offering remote access control and audit trails. These integrated monitoring technologies are crucial for enabling predictive maintenance protocols and enhancing asset security, providing MNOs with real-time actionable data about the physical status of remote sites. Furthermore, the design process itself now heavily utilizes simulation technologies like Computational Fluid Dynamics (CFD) and Finite Element Analysis (FEA) to ensure optimal structural integrity and thermal performance under diverse and extreme environmental conditions before manufacturing commences, accelerating product development cycles significantly.

Regional Highlights

The regional market dynamics for Base Station Protective Housing demonstrate significant divergence based on the maturity of 5G deployment, regulatory frameworks, and geographical infrastructure priorities. Each major region offers unique growth vectors and technological demands, shaping the strategies of key market participants.

- Asia Pacific (APAC): APAC dominates the market both in terms of volume and growth potential, primarily driven by mass-scale 5G rollouts in highly populated nations like China, India, South Korea, and Japan. This region exhibits massive demand for both high-capacity macro cell enclosures and an enormous volume of small cell housings needed for dense urban areas. The market focus here is on achieving rapid deployment scalability, cost-effectiveness, and enclosures capable of withstanding intense environmental variability, ranging from extreme heat and monsoon seasons to high levels of pollution.

- North America: The North American market is characterized by robust investment in network modernization, the expansion of fixed wireless access (FWA), and the growing necessity for private 5G networks in industrial and defense sectors. Demand is high for advanced, highly secured enclosures with superior thermal management capabilities to support Multi-access Edge Computing (MEC) deployments. Aesthetic considerations are moderately important, and adherence to strict NEMA standards for environmental protection is mandatory, driving focus towards high-security, standardized macro and pole-top small cell solutions.

- Europe: The European market demonstrates steady growth, strongly influenced by aesthetic integration requirements and strict environmental and energy efficiency regulations. This drives demand for aesthetically sensitive small cell housings designed to look like street furniture or architectural features, often utilizing non-metallic composites for stealth and lightweight properties. The focus is also on retrofitting existing urban infrastructure and ensuring compliance with stringent safety and electromagnetic compatibility (EMC) standards across various member states.

- Latin America (LATAM): LATAM represents an emerging market characterized by foundational network expansion and initial phases of 5G rollout, particularly in major economies like Brazil and Mexico. Demand is geared towards cost-effective, ruggedized housings that can withstand challenging installation logistics and provide strong anti-vandalism features due to security concerns in certain areas. Growth is expected to accelerate as MNOs secure the necessary spectrum and capital for wider-scale network densification programs.

- Middle East and Africa (MEA): This region shows specialized demand for housings that offer extreme thermal resilience due to high ambient temperatures, requiring highly efficient active and hybrid cooling solutions. Key markets in the Middle East are investing heavily in smart city initiatives and specialized oil and gas communications infrastructure, necessitating highly customized, certified enclosures for harsh industrial environments. Africa's growth is centered on expanding basic 4G coverage, prioritizing durable, tamper-proof, and easily deployable solutions for remote and rural sites.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Base Station Protective Housing Market.- Rittal GmbH & Co. KG

- CommScope Inc.

- Corning Incorporated

- TE Connectivity

- Emerson Electric Co.

- Hubbell Incorporated

- Amphenol Corporation

- Pentair plc

- Westell Technologies

- Alpha Technologies (EnerSys)

- Eaton Corporation

- Raycap

- Metrosite

- Zhejiang Huaou Electronics Co., Ltd.

- Eltek ASA

- Intertek Group plc

- Vertiv Holdings Co

- Fibox Oy Ab

- Schott AG

- ZPAS Group

- Huawei Technologies Co., Ltd. (Supplier/OEM)

- Nokia Corporation (Supplier/OEM Partner)

Frequently Asked Questions

Analyze common user questions about the Base Station Protective Housing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Small Cell Protective Housing?

The primary driver is global 5G network densification, which mandates the deployment of thousands of smaller base stations (micro, pico, femto cells) in dense urban and suburban areas to increase network capacity and reduce latency, requiring aesthetically discrete and highly protective enclosures.

How does 5G technology impact the design requirements for base station enclosures?

5G requires enclosures to manage significantly higher heat loads due to powerful equipment, necessitating advanced passive and hybrid thermal management systems. Additionally, enclosures must often be RF-transparent (using composite materials) and highly compact for installation on street furniture or rooftops.

What are the key material trends influencing the market?

The market is shifting towards lightweight composite materials and engineered plastics (e.g., fiberglass, polycarbonate) for small cell applications due to their superior RF transparency, corrosion resistance, and aesthetic flexibility, though rugged aluminum alloys remain dominant for large macro sites requiring maximum physical security and heat dissipation.

What role does Artificial Intelligence play in modern protective housing?

AI enables 'smart' housing through integrated IoT sensors, facilitating predictive maintenance by monitoring temperature, humidity, and physical intrusion in real-time. This reduces operational expenditure (OpEx) by minimizing unnecessary site visits and extending component lifespan.

Which region holds the largest market share for Base Station Protective Housing?

Asia Pacific (APAC) holds the largest market share due to the aggressive and high-volume deployment of 5G infrastructure, particularly in China, South Korea, and India, which requires substantial investment in new macro and dense small cell protective infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager