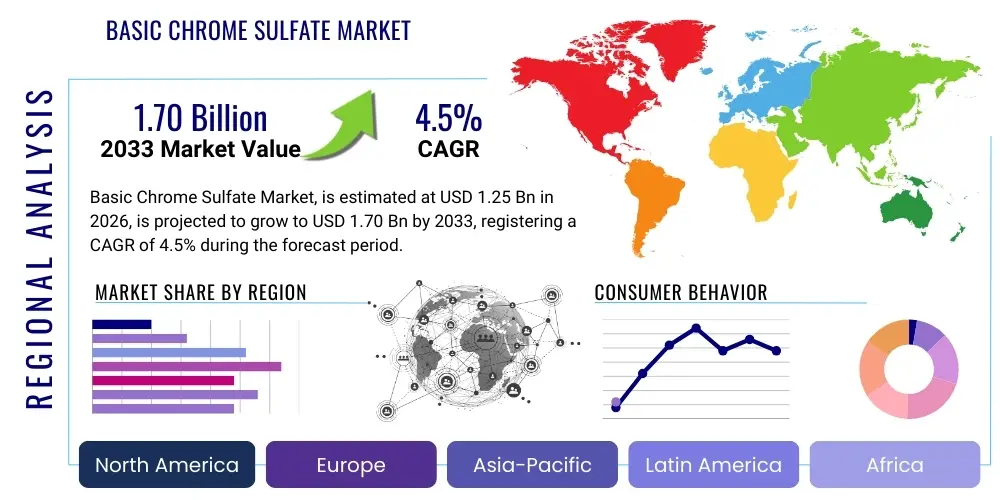

Basic Chrome Sulfate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435932 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Basic Chrome Sulfate Market Size

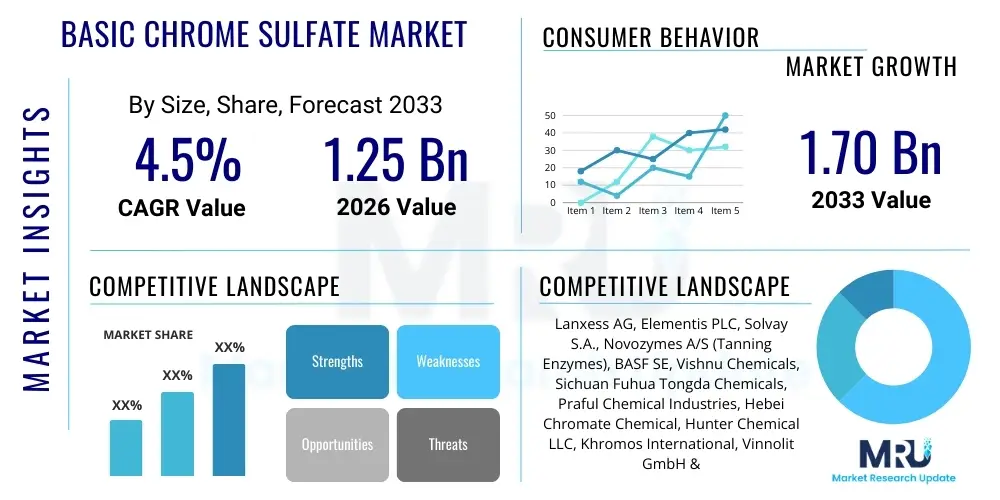

The Basic Chrome Sulfate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.70 Billion by the end of the forecast period in 2033. This steady growth trajectory is primarily underpinned by the persistent global demand for leather goods, particularly from emerging economies in Asia Pacific, where traditional chrome tanning remains the preferred method due to its cost-effectiveness, speed, and ability to produce high-quality, stable leather products.

Basic Chrome Sulfate Market introduction

Basic Chrome Sulfate (BCS), chemically represented as Cr(OH)SO, is a crucial inorganic chemical widely recognized as the primary tanning agent utilized across the global leather industry. Its introduction revolutionized leather production due to its exceptional ability to quickly penetrate hide structures and effectively stabilize collagen fibers, resulting in superior shrinkage temperature, strength, and softness compared to vegetable tanning methods. BCS is typically produced by the reduction of hexavalent chromium compounds using reducing agents like sulfur dioxide or molasses, followed by neutralization and sulfation processes to achieve the required basicity and concentration for industrial application. The resulting product is critical for producing approximately 80% to 90% of the world’s finished leather.

The primary applications of Basic Chrome Sulfate are heavily concentrated within the tanning and finishing stages of leather manufacturing, providing the necessary chemical links to convert raw hides into durable, commercially viable leather suitable for footwear, apparel, automotive upholstery, and luxury goods. Beyond the dominant leather sector, BCS finds niche applications in the production of specific chromium pigments, certain drilling fluids used in the oil and gas sector, and as a feedstock for other specialized chromium compounds. Its effectiveness stems from the formation of stable coordination complexes with the carboxylic acid groups present in the collagen structure, thereby locking the fibers in place and preventing degradation.

Despite facing intense scrutiny related to environmental, social, and governance (ESG) standards, particularly concerning the potential presence of residual hexavalent chromium (Cr VI), the market is driven by several compelling factors. Chief among these drivers is the unmatched performance profile of chrome-tanned leather, coupled with robust demand for quality leather products globally, especially in high-growth consumer markets. Ongoing technological advancements focus on optimizing the chrome tanning process itself, including high-exhaustion tanning techniques and effective chrome recycling systems, aiming to reduce waste and minimize the environmental footprint, thereby sustaining the chemical's relevance in the modern industrial landscape.

Basic Chrome Sulfate Market Executive Summary

The Basic Chrome Sulfate market operates under a complex dynamic characterized by strong industrial demand from the APAC leather sector juxtaposed against stringent environmental regulations, predominantly originating in Europe and North America. Current business trends indicate a critical focus on improving production efficiencies and minimizing the conversion risk of Cr III (tanning agent) to the toxic Cr VI (regulated substance) during manufacturing and post-tanning processes. Leading manufacturers are investing heavily in closed-loop systems and developing high-stability BCS variants to reassure end-users and regulatory bodies of product safety and environmental stewardship, ensuring market resilience despite competition from chrome-free alternatives.

Regionally, the market exhibits a distinct bifurcation: Asia Pacific, particularly China, India, and Pakistan, acts as the global manufacturing and consumption powerhouse for Basic Chrome Sulfate due to the large scale of their tanning industries and relatively flexible regulatory oversight compared to the West. Conversely, Europe, though a smaller consumer, exerts immense influence through regulations like REACH, which dictates safety and quality standards globally, pushing manufacturers worldwide toward cleaner production and enhanced supply chain transparency. These regional trends dictate pricing structures, trade flows, and the adoption rate of new technologies aimed at chemical consumption reduction.

Segmentation trends reveal that the market is predominantly driven by the technical grade used in mainstream tanning operations, but there is growing demand for specialized, high-purity grades for niche applications and for use in specific high-exhaustion systems that maximize chrome uptake, minimizing waste in the spent liquor. Furthermore, the rising awareness of sustainability is catalyzing interest in advanced chrome management systems, including sophisticated recycling technologies and substitutes. These segment shifts underscore the industry's gradual move toward sustainable practices without fully abandoning the performance advantages offered by BCS, reflecting a cautious but necessary evolution in chemical usage within the global manufacturing ecosystem.

AI Impact Analysis on Basic Chrome Sulfate Market

User queries regarding AI's influence on the Basic Chrome Sulfate market primarily center on optimization, sustainability monitoring, and compliance predictability, reflecting widespread industry concern over regulatory risk and resource management. Users frequently ask how machine learning can predict fluctuations in chromite ore and energy prices, crucial inputs for BCS production, and how AI systems can be leveraged to ensure consistency in the reduction process, thereby preventing the unwanted formation of hexavalent chromium (Cr VI). Key concerns revolve around integrating complex AI models into legacy tannery operations and utilizing predictive analytics to optimize chrome exhaustion rates in the tanning baths, minimizing chemical wastage and reducing effluent treatment costs. The expectation is that AI will transform resource management from reactive measurement to proactive optimization, significantly enhancing regulatory compliance and operational efficiency across the highly segmented value chain.

- AI-driven Supply Chain Optimization: Utilizing machine learning algorithms to predict demand cycles for leather goods, optimizing inventory levels of BCS, and forecasting lead times for raw material procurement (chromite ore, sulfuric acid).

- Predictive Quality Control: Implementing AI sensors and models in manufacturing facilities to monitor reduction reaction kinetics, ensuring optimal basicity and concentration, and proactively identifying conditions that could lead to Cr VI formation.

- Environmental Compliance Prediction: Deploying neural networks to analyze real-time effluent data (pH, temperature, chromium concentration) against regulatory limits, alerting operators before non-compliance thresholds are breached, especially concerning spent chrome liquor management.

- Chrome Exhaustion Optimization: Using AI to analyze the specific properties of different hide batches and adjust tanning parameters (time, temperature, BCS concentration) dynamically, maximizing chrome uptake (exhaustion) and minimizing residual chrome waste.

- Raw Material Price Forecasting: Analyzing global geopolitical factors, mining output, and energy costs to generate highly accurate predictions for chromite ore pricing, enabling better long-term procurement and hedge strategies for BCS producers.

- Automated Process Documentation: Leveraging robotic process automation (RPA) and AI to standardize and manage the immense documentation required for stringent regulations like REACH, improving transparency and auditability.

DRO & Impact Forces Of Basic Chrome Sulfate Market

The Basic Chrome Sulfate market is defined by a fierce push-and-pull dynamic where robust, fundamental drivers encounter significant regulatory and environmental resistance, shaping its impact forces. The primary driver is the enduring preference for chrome-tanned leather globally due to its superior physical characteristics (tensile strength, durability, and versatility) and the cost efficiency of the process relative to available alternatives. However, this industrial necessity is constantly restrained by the intense regulatory pressure, particularly concerning the environmental toxicity and carcinogenicity associated with hexavalent chromium, which mandates substantial investment in waste treatment and chrome recycling systems, particularly in developed markets. This regulatory environment creates a powerful impact force, compelling the industry towards sustainable innovation and process refinement to mitigate risks while retaining performance advantages. Opportunities exist in developing cleaner, high-exhaustion tanning technologies and expanding into niche applications where BCS remains unmatched, providing pathways for sustained, though highly scrutinized, market growth.

Segmentation Analysis

The Basic Chrome Sulfate market is fundamentally segmented across three primary axes: Grade, Application, and Geographic Region, each reflecting distinct value chain requirements and regulatory exposures. Segmentation by Grade is critical as it distinguishes between the standard technical grades, typically used for bulk leather production, and specialized, higher-purity grades required for high-exhaustion tanning processes, which demand tighter control over iron and other trace metal contaminants to ensure superior leather quality and minimize effluent impact. Application segmentation is predominantly centered on the tanning sector but also includes smaller, high-value segments like pigment manufacturing and catalytic applications. Regional segmentation, as discussed, highlights the core demand centers in Asia Pacific versus the regulatory influence exerted by North America and Europe, dictating market growth rates and technological adoption across these segments.

Detailed analysis of the Grade segment reveals significant market differentiation based on chromium content, basicity (the percentage of hydroxyl groups attached to the chromium atoms, usually 33% to 42%), and stability. Technical grade BCS (often used in mass-market footwear) prioritizes cost-effectiveness and process speed, while specialty grades (utilized for automotive or luxury leather) focus on stability against oxidation and minimal insoluble content, ensuring consistency in high-quality products. Furthermore, the market is increasingly seeing demand for stabilized liquid BCS solutions, which reduce dusting hazards and simplify automated dosing processes in modern tanneries. The shifts in consumption patterns within these grades reflect the global trend of consolidating tanning operations into highly efficient industrial parks, mainly located in Asia.

The structure of the market, dictated by these segmentations, necessitates that chemical manufacturers tailor their product offerings and distribution strategies. For instance, companies targeting the European luxury goods market must provide extensive documentation proving the absence of Cr VI traces and ensure compliance with strict waste management protocols, driving up the cost of specialized grades. Conversely, suppliers catering to bulk production in developing markets compete primarily on price and reliable volume supply of technical grade material. Understanding these nuanced segmentation requirements is essential for strategic market positioning and identifying high-growth pockets, especially within the chemical recycling and high-exhaustion segments which align with global sustainability mandates.

- By Grade

- Technical Grade (Standard 33% Basic)

- High Purity/Specialty Grade (High Basicity and Stability)

- Liquid Solutions

- By Application

- Leather Tanning (Footwear, Apparel, Upholstery, Automotive)

- Pigment Manufacturing

- Catalysis and Chemical Synthesis

- Drilling Muds

- By Region

- North America (NA)

- Europe (EU)

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

- By Basicity Level

- 30% - 35%

- 36% - 40%

- Above 40% (High Basicity)

Value Chain Analysis For Basic Chrome Sulfate Market

The value chain for Basic Chrome Sulfate begins intensely upstream with the extraction and processing of chromite ore, primarily sourced from regions like South Africa, Kazakhstan, and India. This raw material is then processed into intermediate chromium compounds, typically sodium dichromate, which requires significant energy input and adherence to stringent safety protocols due to the toxic nature of intermediate hexavalent chromium compounds. The manufacturing stage involves the carefully controlled reduction of these intermediates using agents like sulfur dioxide or organic compounds, followed by the addition of sulfuric acid to achieve the final BCS product with the desired basicity. Due to the high regulatory risks associated with Cr VI handling during the production process, upstream analysis focuses critically on safety compliance, sustainable sourcing of chromite, and energy efficiency in conversion plants.

Midstream activities involve sophisticated distribution channels necessary to move the specialized chemical to geographically diverse tanning clusters. Direct distribution models are often employed for large, consolidated tanneries or for multinational chemical corporations that require guaranteed quality and large volumes. However, indirect channels, relying on regional chemical distributors and specialized leather chemical suppliers, are crucial for reaching the fragmented small and medium-sized tanneries prevalent across Asia and Latin America. The distribution stage must navigate complex international hazardous goods shipping regulations, necessitating specialized packaging, labeling, and logistical expertise, significantly influencing the landed cost of the product at the end-user site.

The downstream segment is dominated by the leather manufacturing industry, which utilizes BCS in the core tanning process. Successful downstream integration requires technical support from BCS suppliers to help tanneries optimize chrome bath exhaustion, manage pH levels, and implement chrome recovery and recycling technologies. The ultimate end-users—footwear manufacturers, automotive suppliers, and luxury goods brands—indirectly exert significant pressure on the BCS value chain. Their demand for sustainability certifications and chrome-free guarantees pushes the entire chain toward cleaner production methods and traceability. This vertical pressure ensures that both direct supply (manufacturer to large tannery) and indirect supply (through specialized agents) must maintain impeccable quality control to avoid regulatory risks linked to the final consumer product.

Basic Chrome Sulfate Market Potential Customers

The primary customer base for Basic Chrome Sulfate consists of large-scale commercial tanneries and specialized hide processing units globally, which rely on the chemical for transforming raw hides into stable leather known as "wet blue." These customers can be stratified into major purchasing tiers: multinational tanning conglomerates that operate highly efficient, high-volume production facilities, often integrated across multiple countries, and smaller, localized tanneries that serve specific domestic or regional markets. Multinational tanneries demand standardized, bulk supply, often negotiating long-term contracts directly with BCS manufacturers, while smaller operators typically source through regional chemical distributors, seeking flexibility and localized technical assistance.

Beyond the core tanning sector, potential customers include chemical formulating companies that blend BCS with other specialty chemicals (such as fat liquors and dyes) to create proprietary tanning packages sold to the final users. Additionally, manufacturers involved in producing high-performance functional pigments, particularly those based on chromium oxides, constitute a smaller but significant customer segment, valuing high purity and specific basicity levels of the BCS. Emerging customers also include industrial waste management firms focusing on chemical reclamation; these entities utilize spent chrome liquors from tanneries as a low-cost feedstock for generating recycled BCS, thereby creating a circular economy loop within the industrial segment.

Understanding the purchasing criteria of these diverse potential customers is crucial for market penetration. Large tanneries prioritize price stability, supply reliability, and documentation demonstrating minimal risk of Cr VI contamination. In contrast, specialty chemical formulators prioritize the chemical reactivity and purity profile of the BCS to ensure compatibility with their proprietary formulations. All customer tiers, however, are increasingly influenced by regulatory bodies and brand owners, meaning that demonstrable sustainability credentials, waste reduction claims, and clear traceability protocols have transitioned from being optional advantages to mandatory requirements for suppliers in the current market climate.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.70 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lanxess AG, Elementis PLC, Solvay S.A., Novozymes A/S (Tanning Enzymes), BASF SE, Vishnu Chemicals, Sichuan Fuhua Tongda Chemicals, Praful Chemical Industries, Hebei Chromate Chemical, Hunter Chemical LLC, Khromos International, Vinnolit GmbH & Co. KG, Nippon Chemical Industrial Co., Ltd., Nanhai Chemical Co., Ltd., Zschimmer & Schwarz GmbH & Co KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Basic Chrome Sulfate Market Key Technology Landscape

The technology landscape in the Basic Chrome Sulfate market is primarily focused on achieving higher sustainability and process efficiency, driven by the imperative to minimize environmental impact, particularly concerning residual chromium in wastewater. A key technological advancement is the widespread adoption of high-exhaustion tanning systems, which utilize specialized grades of BCS and optimized process parameters (like careful pH and temperature control) to maximize the uptake of chrome into the hide, often achieving exhaustion rates exceeding 95%. This drastically reduces the concentration of unreacted chrome in the spent liquor, minimizing the load on downstream effluent treatment plants and conserving raw materials. This shift requires sophisticated chemical dosing and monitoring equipment, often incorporating automation and sensor technology.

Another critical area of innovation involves Chrome Recovery and Recycling (CRR) technologies. Advanced CRR systems, employing techniques such as chemical precipitation (using magnesium oxide) followed by acidification, allow tanneries to precipitate chromium from the spent liquor and redissolve it to create a secondary Basic Chrome Sulfate solution that can be reused in subsequent tanning cycles. While traditional CRR methods exist, modern systems focus on producing high-purity recycled chrome suitable for high-quality leather, overcoming historical challenges related to product instability and sludge disposal. These systems are particularly vital in regions like Europe and increasingly in large industrial tanning clusters in China, where zero-liquid discharge goals are becoming standard.

Furthermore, technology is enhancing the upstream production of BCS itself. Manufacturers are increasingly utilizing cleaner reduction technologies, focusing on reducing agents that minimize unwanted byproducts and investing in continuous flow processes rather than traditional batch reactors to ensure greater consistency and control over the crucial basicity parameter. This includes rigorous online monitoring of the Cr III/Cr VI ratio throughout the synthesis process to guarantee compliance with global limits before the product is even shipped. The integration of digital twins and advanced process control (APC) systems is slowly beginning to optimize energy consumption and throughput in these chemical manufacturing facilities, ensuring that BCS remains competitive against newer, chrome-free tanning alternatives.

Regional Highlights

- Asia Pacific (APAC): APAC remains the epicenter of the Basic Chrome Sulfate market, serving as both the largest production base and the dominant consumer globally. Countries such as China, India, and Pakistan host massive, integrated leather manufacturing clusters where chrome tanning is the default method for producing high volumes of cost-effective leather goods, including footwear and basic upholstery. The regional growth is fueled by strong domestic demand and significant export capacity, though increasingly, regulatory bodies within these nations are starting to enforce stricter effluent treatment standards, driving demand for high-exhaustion technologies and local chrome recycling infrastructure.

- Europe: Europe is characterized by slow growth in consumption but immense influence in regulatory standards and technological development. The region's tanneries, which cater primarily to high-end automotive and luxury fashion markets, demand the highest quality and compliance standards, often requiring BCS suppliers to certify against the stringent requirements of REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals). The European market is the primary driver for research into sustainable chrome management and serves as a testing ground for chrome-free alternatives, yet BCS retains a stronghold in niche, performance-critical applications due to its superior finishing qualities.

- North America: The North American market is highly mature and smaller in volume compared to APAC, focusing mainly on specialty leather segments such as high-performance protective wear, equestrian products, and specific automotive trims. Consumption is stable, but there is a strong emphasis on supply chain transparency and corporate social responsibility (CSR). Suppliers must demonstrate impeccable environmental records and robust measures to prevent Cr VI contamination. While the regional market is relatively stable, it heavily influences global sourcing decisions through major corporate brands that demand ethical and sustainable chemical inputs globally.

- Latin America (LATAM): LATAM presents a moderate growth region, with countries like Brazil and Argentina having substantial livestock industries and established tanning sectors. The market dynamics here are similar to APAC in that local consumption is high, but regulatory compliance is gradually tightening. Brazil, in particular, is a significant global supplier of automotive leather, necessitating a focus on high-quality BCS that meets global manufacturer specifications. Investment in modern effluent treatment and chrome recovery systems is crucial for regional suppliers to maintain access to lucrative international export markets.

- Middle East and Africa (MEA): This region is primarily a net importer of BCS, with tanning activities centered in countries like Turkey (serving as a gateway to Europe) and specific nations in North and East Africa. Growth is dependent on local economic development and the ability to export finished leather products. The market is fragmented, often relying on global distributors, and technological adoption, particularly regarding chrome recycling, lags behind other regions, though there is increasing pressure for modernization to meet international buyer standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Basic Chrome Sulfate Market.- Lanxess AG

- Elementis PLC

- Solvay S.A.

- Vishnu Chemicals

- Sichuan Fuhua Tongda Chemicals

- Praful Chemical Industries

- Hebei Chromate Chemical

- Hunter Chemical LLC

- Khromos International

- Nippon Chemical Industrial Co., Ltd.

- Novozymes A/S (Indirect influence via enzyme technology)

- BASF SE

- Cromogenia-Units SA

- Nanhai Chemical Co., Ltd.

- Zschimmer & Schwarz GmbH & Co KG

- Brother Enterprises Holding Co., Ltd.

- Jiangsu Chuanxin Group

- Al-Mutlaq Group

- Fujian Zhenxin Chemical Industrial Co., Ltd.

- TFL Group

Frequently Asked Questions

Analyze common user questions about the Basic Chrome Sulfate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Basic Chrome Sulfate and why is it essential for leather manufacturing?

Basic Chrome Sulfate (BCS) is a chromium(III) salt used as the primary tanning agent globally. It is essential because it quickly stabilizes the collagen fibers in raw hides, imparting high thermal resistance, flexibility, and durability, features unmatched by most non-chrome alternatives, making it crucial for high-quality, stable leather production.

What are the main environmental concerns surrounding the use of Basic Chrome Sulfate?

The primary concern is the potential for oxidation of the non-toxic chromium(III) used in tanning to toxic, carcinogenic hexavalent chromium (Cr VI) during subsequent processing or due to improper disposal of spent liquor. Regulations like REACH mandate strict control over Cr VI levels in the finished leather and industrial effluent, driving the adoption of recycling and high-exhaustion technologies.

Which geographical region dominates the consumption and production of Basic Chrome Sulfate?

Asia Pacific (APAC), particularly China and India, dominates both the production and consumption of Basic Chrome Sulfate. This is due to the concentration of large-scale, cost-competitive tanning industries in the region, supporting global demand for leather products, particularly footwear and accessories.

How is technological innovation affecting the future market stability of Basic Chrome Sulfate?

Innovation is focused on 'cleaner chrome' utilization. Key technological advancements, including high-exhaustion tanning systems and advanced chrome recycling methods, are stabilizing the market by significantly reducing chromium waste and minimizing environmental risk, thus countering the threat posed by chrome-free alternatives and complying with global regulatory demands.

Are chrome-free tanning methods expected to fully replace Basic Chrome Sulfate?

While chrome-free methods (like aldehyde, vegetable, or synthetic tanning) are growing, they are unlikely to fully replace BCS soon. BCS offers superior technical performance characteristics (higher shrinkage temperature and softness) for a wide range of applications at a competitive cost, meaning chrome-free alternatives typically serve specific niche markets, such as certain eco-labeled products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager