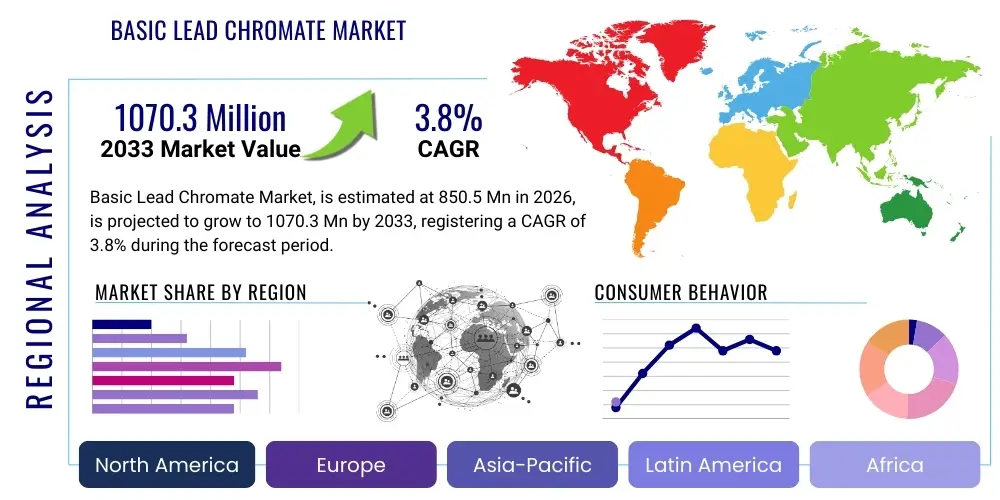

Basic Lead Chromate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439758 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Basic Lead Chromate Market Size

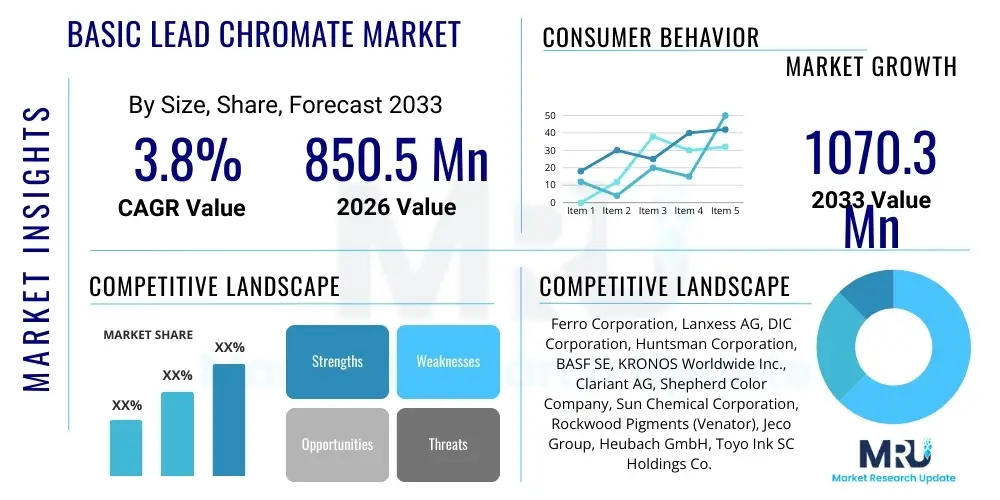

The Basic Lead Chromate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.8% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1070.3 Million by the end of the forecast period in 2033.

Basic Lead Chromate Market introduction

The Basic Lead Chromate market, primarily known for its vibrant yellow, orange, and red inorganic pigments, plays a crucial role in various industrial applications where specific performance characteristics and cost-efficiency are paramount. Basic Lead Chromate (BLC) pigments are chemical compounds characterized by their lead and chromium content, offering exceptional opacity, superior lightfastness, and robust chemical resistance. Historically, these attributes made them indispensable in formulations requiring high durability and color retention.

Major applications for Basic Lead Chromate pigments include industrial paints and coatings, particularly for heavy machinery, automotive refinish, and traffic markings, where their weatherability and chemical stability are highly valued. They are also utilized in the plastics industry, especially for coloring PVC and other engineering plastics, and in printing inks for specialized applications. The core benefits driving their historical adoption stem from their vibrant color spectrum, excellent hiding power, and cost-effectiveness compared to many high-performance organic alternatives.

Despite facing increasing regulatory scrutiny and the emergence of lead-free alternatives, certain driving factors continue to influence the Basic Lead Chromate market. These include persistent demand from specific industrial sectors in developing economies, where cost remains a critical consideration and regulatory frameworks may be less stringent. Furthermore, in some niche applications, the unique performance profile of Basic Lead Chromate pigments, particularly their specific hue, opacity, and durability combination, remains difficult to fully replicate with existing alternatives without significant cost implications or performance trade-offs.

Basic Lead Chromate Market Executive Summary

The Basic Lead Chromate market is undergoing a period of significant transformation, driven by a complex interplay of regulatory pressures, technological advancements in alternatives, and varying regional market dynamics. Business trends indicate a strategic shift by major manufacturers in developed regions towards phasing out BLC production and focusing on safer, lead-free pigment solutions. However, a persistent demand in specific industrial segments, especially in emerging economies, maintains a steady, albeit often niche, market presence for BLC, reflecting the challenges in fully replacing its cost-performance balance.

Regionally, the market exhibits a stark dichotomy. Developed markets in North America and Europe are experiencing a decline in BLC consumption due to stringent environmental and health regulations, such as REACH and RoHS directives, which have spurred the adoption of high-performance organic pigments and inorganic alternatives. Conversely, the Asia Pacific region, particularly countries like China and India, along with parts of Latin America and the Middle East, continues to be a significant consumer. This is attributed to ongoing industrialization, infrastructural development, and a more gradual transition to lead-free policies in certain sectors, where BLC offers an economical solution for specific applications.

Segment trends within the Basic Lead Chromate market highlight a consolidation of demand towards applications where BLC’s unique properties, such as specific yellow/orange hues and weather resistance, are critical and alternatives are either cost-prohibitive or do not meet performance specifications. While the overall market trajectory for BLC is one of gradual decline in general applications, specialized industrial coatings and select plastics continue to rely on these pigments. The market is increasingly fragmented, with a focus on specific end-use industries and geographical pockets where BLC remains a viable, if regulated, choice.

AI Impact Analysis on Basic Lead Chromate Market

The impact of Artificial Intelligence (AI) on the Basic Lead Chromate market is primarily indirect, influencing the broader pigment and chemicals industry through optimization, discovery, and strategic planning, rather than directly innovating Basic Lead Chromate itself. Common user questions revolve around AI's capacity to accelerate the development of lead-free alternatives, enhance manufacturing efficiency for existing pigments, and improve supply chain resilience. Users are keen to understand if AI can predict regulatory shifts, optimize formulation for new materials, or analyze complex market dynamics to inform strategic decisions in a challenging regulatory landscape.

AI's influence in this domain is predominantly seen in its ability to process vast datasets related to material science, regulatory frameworks, and market trends. It assists in accelerating research and development for novel, environmentally friendly pigment formulations that can match or exceed the performance of Basic Lead Chromate. Furthermore, AI-driven analytics can optimize production processes, predict equipment failures, and streamline supply chain logistics for both BLC and its substitutes, leading to cost efficiencies and improved operational performance across the pigment industry.

- AI-driven material science for accelerated discovery and optimization of lead-free pigment alternatives.

- Predictive analytics for demand forecasting and inventory management within the pigment supply chain.

- Optimization of manufacturing processes for pigments, enhancing efficiency and reducing waste.

- Automated analysis of global regulatory landscapes and market trends to inform strategic business decisions.

- Enhanced quality control and formulation development for complex pigment systems using machine learning algorithms.

DRO & Impact Forces Of Basic Lead Chromate Market

The Basic Lead Chromate market is shaped by a complex interplay of drivers, restraints, opportunities, and powerful impact forces that determine its current trajectory and future outlook. Key drivers for continued, albeit specific, demand include the inherent cost-effectiveness of BLC pigments, offering a vibrant color range and excellent opacity at a competitive price point, which is particularly attractive in cost-sensitive industrial applications. Additionally, their superior technical properties, such as high lightfastness, weatherability, and chemical resistance, remain difficult to fully replicate with alternatives across all price and performance tiers, ensuring their use in niche, high-performance, and durable coatings or plastics where longevity is critical.

However, significant restraints severely limit the market's growth and scope. Foremost among these are the increasingly stringent global environmental and health regulations, particularly concerning lead and chromium compounds, which are known toxins. Directives such as the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) actively restrict or ban the use of lead chromates, compelling industries to seek alternatives. Public health concerns and growing consumer awareness regarding hazardous substances also contribute to a negative perception, pressuring manufacturers to adopt safer alternatives and avoid brand image repercussions.

Despite the challenges, certain opportunities exist within the Basic Lead Chromate market. These include demand in less regulated emerging markets, where industrialization and infrastructure development continue at a rapid pace and cost remains a primary driver for material selection. Opportunities also lie in the development of specialized encapsulation technologies or surface treatments that could potentially mitigate the leaching of lead and chromium, thereby extending the usability of BLC in certain controlled applications, although such innovations face immense regulatory hurdles and public acceptance issues. The constant search for ideal performance-to-cost ratios in specific industrial applications means that BLC, even with its regulatory baggage, finds pockets of essential use.

The impact forces influencing the Basic Lead Chromate market are profound. Regulatory bodies wield immense power, capable of imposing outright bans or severe restrictions that can rapidly shrink market segments. Technological advancements in alternative pigments, such as high-performance organic pigments, mixed metal oxides, and encapsulated inorganic pigments, exert continuous pressure by offering viable, safer substitutes. Shifting consumer and industrial preferences towards "green" and sustainable products significantly diminish demand for hazardous materials. Furthermore, raw material availability and pricing fluctuations for lead and chromium compounds can also impact production costs, while geopolitical factors and trade policies can disrupt supply chains and market access, all contributing to a highly dynamic and challenging operational environment for Basic Lead Chromate manufacturers.

Segmentation Analysis

The Basic Lead Chromate market is primarily segmented based on pigment type, application area, and end-use industry, reflecting the diverse requirements and specific niches where these pigments are still utilized. This segmentation provides a granular view of market dynamics, revealing where demand persists despite regulatory challenges and where the shift towards alternatives is most pronounced. Understanding these segments is crucial for analyzing market resilience and identifying areas of potential, albeit limited, growth within this mature and regulated market.

- By Pigment Type:

- Chrome Yellow

- Chrome Orange

- Chrome Red

- Molybdate Orange

- By Application:

- Paints & Coatings

- Industrial Coatings (e.g., agricultural equipment, heavy machinery)

- Automotive Refinish Coatings

- Traffic Markings

- Corrosion Protective Coatings

- Plastics

- PVC (Polyvinyl Chloride)

- Engineering Plastics

- Masterbatches

- Printing Inks

- Ceramics

- Paints & Coatings

- By End-Use Industry:

- Construction

- Automotive

- Industrial Manufacturing

- Consumer Goods (limited due to regulations)

- Packaging (limited due to regulations)

Value Chain Analysis For Basic Lead Chromate Market

The value chain for the Basic Lead Chromate market begins with the upstream sourcing of raw materials, which are critical for pigment synthesis. This segment involves the extraction and processing of lead ore and chromium compounds, along with other necessary chemicals such as sulfuric acid and sodium dichromate. Suppliers of these raw materials, often large mining and chemical companies, form the foundational tier of the value chain. The quality and purity of these raw materials directly impact the final pigment's performance and color characteristics. Managing the supply chain for these often hazardous raw materials also presents environmental and logistical challenges for pigment manufacturers.

Moving downstream, the value chain involves the manufacturing process itself, where basic lead chromate pigments are produced through various precipitation methods, followed by filtration, drying, and milling to achieve desired particle size and dispersion properties. These pigment manufacturers then supply their products to a diverse range of industries. The immediate downstream customers include formulators of industrial paints and coatings, plastic compounders, printing ink manufacturers, and ceramic glaze producers. These entities incorporate BLC pigments into their end products, capitalizing on their specific color, opacity, and durability attributes for various applications.

Distribution channels for Basic Lead Chromate are multifaceted, comprising both direct and indirect sales approaches. For large-volume industrial customers or specialized applications, manufacturers often engage in direct sales, providing technical support and customized solutions. Indirect channels involve a network of distributors, agents, and specialty chemical suppliers who cater to smaller customers or specific regional markets, providing broader reach and local warehousing capabilities. These distributors play a crucial role in managing inventory and facilitating market access, especially in regions with fragmented demand. The evolving regulatory landscape also influences distribution, with stricter controls often requiring specialized handling and documentation across the entire supply chain.

Basic Lead Chromate Market Potential Customers

Potential customers for Basic Lead Chromate pigments are predominantly found within industrial sectors where specific performance criteria, particularly related to color vibrancy, opacity, weatherability, and chemical resistance, are paramount, and where cost-effectiveness remains a significant purchasing factor. Despite the global shift towards lead-free alternatives, certain end-users continue to integrate BLC into their formulations due to its unique property profile and the challenges associated with finding equally effective substitutes at comparable prices for all applications. These customers are often operating in markets or regions with specific needs or regulatory frameworks that still permit its use.

Key end-user segments include industrial paint manufacturers that produce coatings for heavy machinery, agricultural equipment, road markings, and specialized protective finishes. The automotive refinish industry also represents a segment where BLC pigments have historically been valued for their color accuracy and durability. Plastic compounders, particularly those working with PVC and other engineering plastics, utilize BLC for achieving durable colors in applications like window profiles, cables, and certain consumer goods components, though this is heavily influenced by regional regulations.

Furthermore, printing ink manufacturers for specialized industrial applications, as well as producers of ceramic glazes, represent other potential customer bases. These buyers prioritize BLC for its excellent heat stability and chemical inertness in their specific processes. The customer base is increasingly concentrated in regions with less stringent environmental regulations or in niche markets where the transition to alternatives is technically or economically challenging. Engagement with these customers often involves detailed technical discussions about compliance, application performance, and supply chain reliability in a dynamically evolving regulatory environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1070.3 Million |

| Growth Rate | 3.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ferro Corporation, Lanxess AG, DIC Corporation, Huntsman Corporation, BASF SE, KRONOS Worldwide Inc., Clariant AG, Shepherd Color Company, Sun Chemical Corporation, Rockwood Pigments (Venator), Jeco Group, Heubach GmbH, Toyo Ink SC Holdings Co. Ltd., Altana AG, CATHAY INDUSTRIES, Trust Chem Co. Ltd., Cappelle Pigments, Dainichiseika Color & Chemicals Mfg. Co. Ltd., Atul Ltd., Pidilite Industries Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Basic Lead Chromate Market Key Technology Landscape

The technology landscape for the Basic Lead Chromate market, while mature, focuses predominantly on optimizing existing synthesis processes, enhancing pigment properties, and critically, on developing alternatives. The core manufacturing technology for Basic Lead Chromate pigments involves a controlled precipitation process, typically reacting lead salts with chromate salts under specific conditions to yield the desired crystal structure, particle size, and hue. Advancements in this area have historically concentrated on achieving greater consistency in color, improving particle morphology for better dispersion, and enhancing durability through surface treatments, such as silica or alumina encapsulation, to improve lightfastness and weather resistance. These process improvements aim to maximize performance while minimizing raw material usage and waste generation.

Beyond the synthesis of Basic Lead Chromate itself, the broader technological landscape significantly impacts the market through the relentless pursuit of lead-free and chromium-free alternatives. This includes extensive research and development into high-performance organic pigments, complex inorganic colored pigments (CICPs), and specialty encapsulated pigments that can mimic the color, opacity, and durability of BLC without the associated environmental and health risks. Technologies like nanotechnology and advanced material science are being leveraged to engineer new pigment structures and composite materials that offer comparable performance, albeit often at a higher cost. The drive for sustainability and regulatory compliance is the primary technological catalyst in the pigment industry, pushing for innovations that actively displace hazardous materials.

Furthermore, analytical and quality control technologies play a crucial role, ensuring that both Basic Lead Chromate and its alternatives meet stringent performance specifications and, where applicable, regulatory limits for hazardous substances. Spectrophotometry, electron microscopy, and advanced rheology are routinely employed to characterize pigment properties, evaluate dispersion behavior, and predict performance in end applications. The continuous evolution in these analytical tools supports both the refinement of existing BLC production and the accelerated development and validation of next-generation, environmentally sound pigment solutions, ultimately shaping the long-term viability and competitive dynamics of the entire colorants market.

Regional Highlights

- North America: This region has seen a significant decline in Basic Lead Chromate consumption due to strict environmental regulations imposed by agencies like the EPA and OSHA. The market is primarily driven by the transition towards lead-free alternatives in paints, coatings, and plastics. Niche industrial applications, particularly for existing infrastructure maintenance where BLC was historically used, represent residual demand. Innovation here focuses on high-performance organic and inorganic substitutes.

- Europe: The European market for Basic Lead Chromate is severely constrained by stringent regulations, most notably the REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) directive, which has largely phased out BLC in many applications. The emphasis is entirely on sustainable and lead-free solutions. Remaining demand is exceptionally limited, typically to highly specific, authorized industrial uses with controlled environments where no suitable alternatives exist, and where the economic implications of switching are extremely high.

- Asia Pacific (APAC): APAC represents the largest and most dynamic market for Basic Lead Chromate, particularly in rapidly industrializing countries like China, India, and Southeast Asian nations. Factors driving demand include extensive infrastructure development, robust industrial manufacturing, and a more gradual or less uniform implementation of lead-free regulations across all sectors. Cost-effectiveness and the readily available supply of BLC pigments continue to sustain their usage in industrial coatings, plastics, and some automotive refinish applications, although a growing awareness and regulatory shift towards safer alternatives is also evident.

- Latin America: This region exhibits sustained demand for Basic Lead Chromate in specific industrial and construction sectors, driven by ongoing economic development and varying regulatory landscapes across different countries. While there is a gradual shift towards international standards and lead-free products, the cost advantage of BLC still makes it an attractive option for many local manufacturers. Automotive refinish and general industrial coatings are key application areas where BLC maintains a presence.

- Middle East and Africa (MEA): The MEA region is characterized by steady industrial growth, particularly in construction and infrastructure. Demand for Basic Lead Chromate in this region is primarily influenced by economic factors and less stringent environmental regulations compared to Western markets. Industrial paints, protective coatings, and certain plastic applications continue to utilize BLC, though increasing global awareness and the influence of international suppliers are slowly introducing lead-free alternatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Basic Lead Chromate Market.- Ferro Corporation

- Lanxess AG

- DIC Corporation

- Huntsman Corporation

- BASF SE

- KRONOS Worldwide Inc.

- Clariant AG

- Shepherd Color Company

- Sun Chemical Corporation

- Rockwood Pigments (Venator)

- Jeco Group

- Heubach GmbH

- Toyo Ink SC Holdings Co. Ltd.

- Altana AG

- CATHAY INDUSTRIES

- Trust Chem Co. Ltd.

- Cappelle Pigments

- Dainichiseika Color & Chemicals Mfg. Co. Ltd.

- Atul Ltd.

- Pidilite Industries Ltd.

Frequently Asked Questions

What are the primary uses of Basic Lead Chromate?

Basic Lead Chromate is primarily used as a pigment in industrial paints and coatings for heavy machinery, automotive refinish, and traffic markings, as well as in plastics and printing inks, valued for its vibrant color, opacity, and durability.

Why is the Basic Lead Chromate market facing regulatory pressure?

The market faces significant regulatory pressure due to the toxicity of lead and chromium compounds, leading to stringent environmental and health regulations like REACH and RoHS, aiming to restrict or ban its use globally.

What are the main alternatives to Basic Lead Chromate?

Main alternatives include high-performance organic pigments, mixed metal oxides, and various inorganic colored pigments, which offer lead-free and chromium-free solutions for similar applications, often at a higher cost.

Which regions exhibit sustained demand for Basic Lead Chromate?

The Asia Pacific region, particularly China and India, along with parts of Latin America and the Middle East, exhibit sustained demand due to ongoing industrialization, cost-effectiveness, and varying regulatory adoption rates.

How does sustainability impact the Basic Lead Chromate market?

Sustainability significantly impacts the market by driving a global shift towards environmentally friendly and non-toxic materials, pushing manufacturers and end-users away from Basic Lead Chromate and towards lead-free, safer pigment alternatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager