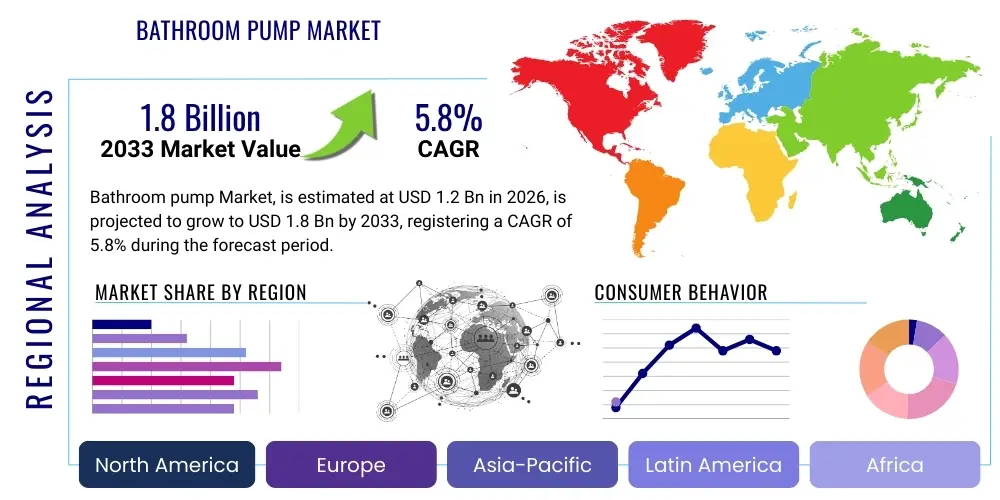

Bathroom pump Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434458 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Bathroom pump Market Size

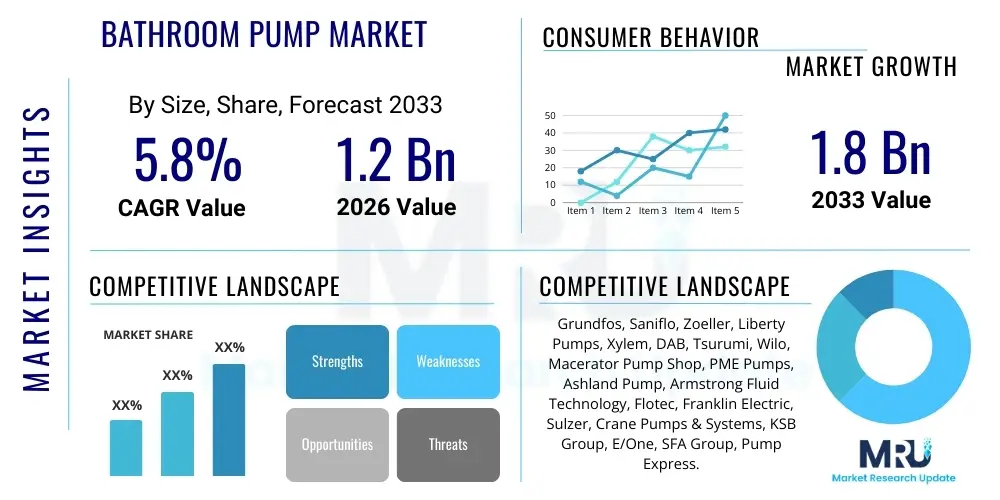

The Bathroom pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

Bathroom pump Market introduction

The Bathroom Pump Market encompasses specialized pumping systems designed to transport wastewater (black water or gray water) from bathroom fixtures, particularly in locations where gravity drainage is infeasible or expensive, such as basements, attic conversions, or remote parts of a building distant from the main soil stack. These systems are critical components in modern infrastructure, allowing for flexible architectural design and the conversion of non-traditional spaces into habitable bathrooms. The primary product types include macerating pumps, which grind solids before pumping, and gray water pumps, which handle wastewater without solids. Market growth is intrinsically linked to global trends in urbanization, increasing residential renovation projects, and the expansion of commercial and hospitality sectors requiring decentralized wastewater solutions.

Technological advancements are driving the market toward more compact, energy-efficient, and quiet units. Modern bathroom pumps often feature sophisticated sensor technology for automated operation and leak detection, enhancing reliability and reducing maintenance requirements for end-users. The integration of high-performance materials, particularly corrosion-resistant plastics and alloys, ensures longevity, a crucial factor given the harsh environment these pumps operate in. Furthermore, regulatory mandates concerning wastewater disposal and sanitation standards in developed economies continue to push the adoption of certified and efficient pumping solutions, making compliance a key driver for replacement and upgrade cycles.

Major applications span residential use (adding bathrooms below the sewer line or in modular homes), commercial spaces (restaurants, small offices), and institutional settings (hospitals, schools). The principal benefit of these pumps lies in their ability to eliminate the need for costly and complex major plumbing modifications, such as trenching or breaking concrete floors, thereby offering a cost-effective and swift solution for bathroom additions. Key driving factors include rising disposable incomes leading to increased home renovation activity, the necessity of auxiliary bathrooms in high-density urban settings, and favorable governmental policies supporting smart building construction and infrastructure modernization.

Bathroom pump Market Executive Summary

The global Bathroom pump Market is experiencing robust expansion, fundamentally driven by sustained growth in the residential construction and remodeling sectors, particularly across North America and the Asia Pacific region. Business trends indicate a strong move toward product differentiation based on noise reduction, footprint minimization, and integration capabilities with smart home ecosystems. Key manufacturers are focusing on developing high-efficiency motor technologies, such as permanent magnet motors and variable speed drives (VSDs), to meet stringent energy consumption standards and provide superior flow dynamics, addressing common consumer pain points related to noise and power usage. Mergers, acquisitions, and strategic collaborations, especially between traditional pump manufacturers and IoT solution providers, are shaping the competitive landscape, emphasizing the shift from simple hydraulic devices to smart plumbing appliances.

Regional trends reveal that while mature markets like Europe and North America maintain significant market share through replacement demand and adoption of premium, high-specification units, the Asia Pacific region is poised for the highest growth trajectory. This rapid expansion is fueled by massive infrastructure projects, burgeoning urbanization rates in countries like China and India, and the consequential demand for reliable and decentralized sanitation facilities in new residential towers and commercial complexes. Regulatory harmonization efforts across the EU concerning waste handling and plumbing standards further bolster market stability, ensuring continued demand for compliant, technologically advanced products. Furthermore, economic stability in key emerging markets is allowing for increased investment in high-quality building materials, including sophisticated wastewater pumping systems.

Segment trends highlight the dominance of the macerating pump segment due to its versatility in handling black water and enabling complete bathroom installations anywhere in a property. However, the gray water pump segment is showing accelerated growth, particularly in commercial applications where large volumes of water from sinks and showers need to be managed separately. In terms of application, the residential segment remains the largest consumer, driven by DIY renovation projects and basement conversions. Crucially, the market is observing a significant segment shift toward digital monitoring solutions, where pumps are equipped with sensors capable of transmitting diagnostic data to users or maintenance professionals, significantly reducing potential downtime and preempting catastrophic failures.

AI Impact Analysis on Bathroom pump Market

User inquiries regarding AI's influence in the Bathroom Pump Market primarily revolve around concepts of predictive maintenance, failure diagnostics, and optimization of pump lifespan and energy consumption. Users are keen to understand how AI algorithms can analyze operational data—such as run times, vibration levels, and power draw deviations—to forecast potential mechanical failures (e.g., impeller blockage or motor overheating) before they occur. A core expectation is that AI integration will shift the industry from reactive repair models to proactive servicing, drastically minimizing unexpected disruptions in bathroom functionality. Furthermore, there is significant interest in AI’s role in optimizing pumping schedules based on predicted usage patterns in large commercial settings, ensuring peak efficiency and reducing overall electricity costs associated with wastewater management systems.

- AI enables predictive maintenance algorithms that analyze real-time sensor data (vibration, temperature, current draw) to forecast equipment failure, optimizing service schedules.

- Machine learning models can dynamically adjust pump speed and operation cycles (Variable Speed Drives) based on predicted wastewater inflow, maximizing energy efficiency and minimizing noise pollution.

- AI-powered diagnostic tools assist technicians remotely in identifying complex blockages or electrical faults, speeding up troubleshooting and reducing onsite repair time.

- Integration with smart home systems allows AI to learn user habits, tailoring pump operation to minimize disruption during quiet hours and optimizing overall home utility management.

- Data analytics driven by AI provide manufacturers with invaluable insights into product performance under diverse real-world conditions, informing future R&D for more robust and reliable designs.

- Automated alert systems using AI can notify facility managers instantly of unusual operational parameters, such as persistent high-frequency running or low pressure, indicating an imminent clog or leak.

DRO & Impact Forces Of Bathroom pump Market

The dynamics of the Bathroom pump Market are governed by a complex interplay of drivers (D), restraints (R), and opportunities (O), collectively influenced by various internal and external impact forces. Key drivers include the exponential rate of global urbanization, which necessitates decentralized and reliable sanitation solutions in densely populated areas, and the sustained boom in residential renovation and conversion projects seeking cost-effective plumbing alternatives. Conversely, significant restraints involve the relatively high initial capital expenditure associated with purchasing and installing high-quality, macerating pump systems compared to traditional gravity-fed plumbing, alongside consumer concerns regarding potential complex maintenance requirements and the perceived noise levels of older pump models. Opportunities for market expansion are abundant in the integration of Internet of Things (IoT) capabilities, offering remote monitoring and self-diagnostic features, and the increasing demand for sustainable, energy-efficient pumping solutions in compliance with green building standards globally. These forces shape investment decisions, R&D priorities, and competitive strategies within the market.

A primary driver is the accelerating trend of utilizing previously inaccessible spaces—such as basements, garages, and lofts—for residential living or commercial utility, especially in land-constrained metropolitan areas. This architectural flexibility is almost entirely dependent on reliable pump technology to manage waste. However, the market faces a substantial restraint related to regional regulatory variations and the need for specialized installation expertise. Improper installation can lead to premature failure, generating negative consumer perceptions and high post-sales support costs for manufacturers. Impact forces, such as fluctuating raw material costs (e.g., specialized plastics, high-grade stainless steel for grinding mechanisms), directly influence product pricing and profitability margins across the value chain. Furthermore, the increasing stringency of wastewater discharge regulations globally acts as a powerful external force, pushing manufacturers towards advanced treatment and robust anti-clogging technologies.

The most compelling opportunities lie in addressing sustainability and connectivity. Developing high-efficiency pumps that minimize power consumption is becoming a crucial competitive differentiator, aligning with global climate goals and reducing operating costs for end-users. The rising adoption of smart building technologies provides an avenue for manufacturers to integrate pumps seamlessly into centralized building management systems (BMS), moving the product from a discrete plumbing device to an essential, monitored utility component. External impact forces, such as disruptive entry by specialized electronics or software firms offering monitoring platforms, could potentially shift the value distribution away from traditional pump hardware manufacturers toward data service providers. Therefore, continuous innovation in pump design combined with sophisticated digital integration capabilities is essential for sustained market leadership.

Segmentation Analysis

The Bathroom pump Market is extensively segmented based on product type, application, and distribution channel, providing a granular view of market dynamics and targeted consumer needs. The segmentation based on product type—primarily macerating pumps, gray water pumps, and sewage ejector systems—is the most influential, dictating the operational parameters and suitable usage scenarios for each unit. Macerating pumps, characterized by integrated cutting blades or grinders, dominate the black water segment, essential for handling waste from toilets. Gray water pumps, conversely, are designed for relatively clean wastewater from sinks, showers, and washing machines, often prioritizing high flow rates and quiet operation. The application segment, divided into residential, commercial, and industrial, reflects diverse demand patterns; residential installations favor smaller, quieter units for renovations, while commercial and industrial settings demand high-capacity, heavy-duty systems with enhanced durability and redundancy features.

Detailed analysis of the segmentation reveals that the commercial application segment, which includes hotels, restaurants, and institutional buildings, exhibits higher average transaction values due to the requirement for multi-unit installations and more robust pumping technologies capable of handling intermittent high-volume usage. Furthermore, the segmentation by distribution channel—spanning wholesale plumbing suppliers, specialized distributors, and online retail platforms—shows a clear trend toward digital procurement, particularly in the DIY residential sector, although professional contractors still rely heavily on specialized wholesale networks for technical support and immediate supply availability. Understanding these segment dynamics is critical for manufacturers to tailor their marketing strategies, product portfolios, and supply chain logistics effectively to meet the varied needs across the global user base.

The differentiation in product specifications based on regional regulatory environments also creates sub-segmentation effects. For instance, in regions with extremely strict building codes, pumps certified for specific anti-backflow mechanisms and robust pressure handling capabilities command a premium. Segmentation based on power source (e.g., conventional electric vs. battery-backup systems) is gaining importance, particularly in regions prone to power outages, highlighting a niche but growing demand for systems offering uninterrupted sanitation functionality. This detailed breakdown ensures that market forecasts accurately reflect shifts in technological adoption and consumer preference within specific end-use environments.

- Product Type:

- Macerating Pumps (Black Water Handling)

- Gray Water Pumps (Sink, Shower, Laundry Wastewater)

- Sewage Ejector Pumps (High Capacity, Industrial/Multi-unit Commercial Use)

- Application:

- Residential (Basement Conversions, Loft Bathrooms, Granny Flats)

- Commercial (Hotels, Restaurants, Retail Outlets)

- Industrial (Factories, Warehouses, Modular Offices)

- Distribution Channel:

- Wholesale Distributors

- Retail Channels (Including Specialized Plumbing Stores)

- E-commerce Platforms and Direct Sales

- Operational Mechanism:

- Submersible Pumps

- Non-Submersible Pumps (Dry Well/Above Floor)

Value Chain Analysis For Bathroom pump Market

The value chain for the Bathroom pump Market begins with upstream activities involving the sourcing of highly specific raw materials and components, including corrosion-resistant plastics (like polyethylene and polypropylene), specialized metallic alloys for grinding mechanisms (stainless steel, hardened steel), high-efficiency electric motors, and advanced electronic components for sensor technology and control units. Key raw material suppliers, predominantly chemical and metals manufacturers, exert influence on the overall cost structure, particularly in periods of commodity price volatility. Manufacturers (the core segment) invest heavily in R&D to optimize hydraulic design, noise reduction, and smart features. Vertical integration is a notable trend, with major players often manufacturing key components, such as motors and control panels, internally to ensure quality control and optimize supply chain resilience. Upstream excellence is defined by material science innovation that enhances pump longevity and performance in challenging waste environments.

Midstream activities primarily encompass the manufacturing, assembly, quality control, and testing phases. Due to the critical nature of the product—failure results in immediate sanitation issues—rigorous testing protocols are mandatory to comply with international standards (e.g., CE, UL, CSA certification). Distribution channels form the critical link to the downstream market. For the professional segment (contractors and builders), large specialized wholesale plumbing distributors dominate, providing essential logistics, inventory management, and technical support. These wholesalers often hold long-term relationships with both manufacturers and installation professionals, making them pivotal in market access and product recommendation. Conversely, for the residential DIY market and small-scale renovation projects, direct and indirect e-commerce platforms are increasingly important, offering greater price transparency and direct access to consumer reviews and installation guides.

The downstream sector involves installation contractors, maintenance service providers, and finally, the end-users (residential homeowners, facility managers). The role of qualified installers is crucial, as the performance and reliability of the bathroom pump system are heavily dependent on correct installation relative to the sewer line and electrical supply. Direct sales, though less common, are typically reserved for large commercial or institutional projects requiring bespoke engineering solutions. Ongoing maintenance and after-sales support represent a significant, high-margin opportunity within the value chain, focusing on preventative maintenance contracts facilitated by remote diagnostics capabilities inherent in newer smart pump models. The efficiency of this downstream ecosystem directly impacts brand reputation and repeat business.

Bathroom pump Market Potential Customers

The diverse clientele for the Bathroom pump Market can be broadly categorized into three major groups: residential end-users, commercial enterprises, and institutional or public sector entities, each driven by distinct purchasing criteria and application needs. Residential customers represent the largest volume segment, primarily driven by home improvement, renovation, and expansion projects. This includes homeowners looking to convert basements into habitable spaces, add bathrooms in attics, or install utility rooms far from the main plumbing stacks. Their purchasing decisions are highly influenced by factors such as noise level, system compactness, ease of installation, and product warranty, often seeking solutions marketed through retail channels and supported by consumer reviews and reliable service networks. The growth in multi-generational housing further accelerates this demand for auxiliary and decentralized bathroom facilities.

Commercial enterprises, encompassing hospitality (hotels, resorts), food service (restaurants, cafes), and small to medium-sized commercial office buildings, constitute a segment characterized by high demand for durability and capacity. These customers often require robust, continuous-duty systems with higher flow rates and specialized features, such as duplex configurations for redundancy, to ensure uninterrupted service to patrons or tenants. The purchasing process in this segment is typically managed by facility managers, general contractors, or specialized plumbing firms, where total cost of ownership (TCO), reliability, and compliance with commercial building codes are the paramount considerations. Commercial customers prioritize long-term performance and minimal downtime over initial acquisition cost.

Institutional and public sector buyers, including municipalities, schools, hospitals, and large industrial facilities, represent the highest-capacity segment, often utilizing sewage ejector pumps alongside macerating and gray water systems. These organizations require systems that can handle high peak flows and varied wastewater compositions, often adhering to strict environmental and governmental procurement standards. Decisions are influenced by lifecycle costing, adherence to complex engineering specifications, and the availability of extensive service contracts. Specific customers in this domain include modular building manufacturers who integrate pump systems directly into prefabricated units, and infrastructure developers planning decentralized sanitation in remote or challenging geographical locations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Grundfos, Saniflo, Zoeller, Liberty Pumps, Xylem, DAB, Tsurumi, Wilo, Macerator Pump Shop, PME Pumps, Ashland Pump, Armstrong Fluid Technology, Flotec, Franklin Electric, Sulzer, Crane Pumps & Systems, KSB Group, E/One, SFA Group, Pump Express. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bathroom pump Market Key Technology Landscape

The technological landscape of the Bathroom pump Market is undergoing significant transformation, primarily driven by the need for enhanced efficiency, reliability, and reduced acoustic output. A pivotal technological advancement is the widespread adoption of Variable Speed Drives (VSDs) or Variable Frequency Drives (VFDs) in premium pump systems. VSD technology allows the pump motor to modulate its speed dynamically in response to the incoming fluid level or required discharge pressure. This modulation prevents the pump from running at maximum capacity unnecessarily, leading to substantial energy savings, minimized wear and tear on mechanical components, and, crucially, significant reductions in operational noise. Modern VSD controllers often incorporate complex algorithms to optimize performance, contributing to the shift towards 'smart' pumping solutions that learn and adapt to usage patterns.

Materials science innovation constitutes another critical component of the key technology landscape. Manufacturers are increasingly utilizing specialized thermoplastic materials and engineered polymers in the construction of pump casings, impellers, and tanks. These materials offer superior resistance to corrosion, chemical degradation from harsh cleaning agents, and abrasion from wastewater solids, substantially extending the operational life of the unit compared to older cast iron or basic plastic models. Furthermore, the macerating element itself has seen advancements, moving towards hardened stainless steel or carbide alloy blades engineered with specific geometries to handle tougher materials, such as feminine hygiene products or disposable wipes, which are notorious for causing blockages in older or lower-quality pumps. The goal is to maximize the unit’s reliability and minimize service call frequency related to clogging.

Perhaps the most disruptive technological trend is the integration of Internet of Things (IoT) sensors and connectivity modules, enabling remote monitoring and predictive diagnostics. These systems incorporate sensors for temperature, vibration analysis, float switch operation, and current draw, transmitting data via Wi-Fi or cellular networks to cloud platforms accessible by end-users or service contractors. This connectivity facilitates real-time performance tracking and allows for immediate alerts in case of operational anomalies. Advanced technology also includes integrated backflow prevention valves designed with higher efficacy and improved sealing capabilities, ensuring compliance with strict sanitary codes and protecting the municipal water supply. These integrated technologies redefine the bathroom pump from a simple mechanical device to a sophisticated, digitally managed component of the building’s utility system.

Regional Highlights

The global Bathroom pump Market exhibits heterogeneous growth patterns across major geographical regions, influenced by varying levels of urbanization, regulatory frameworks, construction activities, and disposable incomes. North America and Europe currently represent the most mature markets, characterized by high adoption rates, stringent plumbing codes, and a strong emphasis on replacement and renovation cycles. In North America, particularly the US and Canada, demand is continuously driven by basement renovations, the addition of accessory dwelling units (ADUs), and the widespread reliance on macerating systems for complex residential plumbing solutions. European growth is sustained by rigorous environmental protection standards (WEEE and RoHS compliance) and a substantial market for high-efficiency, quiet pumps tailored for dense urban environments and historic building renovations where conventional plumbing is difficult.

The Asia Pacific (APAC) region is projected to register the fastest growth rate during the forecast period. This rapid expansion is fundamentally linked to unparalleled rates of infrastructure development, massive housing projects, and fast-paced urbanization across key economies such as China, India, and Southeast Asian nations. As urban density increases, the need for decentralized and adaptable sewage solutions becomes critical, driving the adoption of both commercial and residential bathroom pumps. While price sensitivity remains a factor in certain sub-regions, the growing middle class is increasingly demanding higher quality, certified plumbing products, moving away from low-cost, unbranded alternatives.

Latin America (LATAM), and the Middle East and Africa (MEA) represent emerging markets with substantial untapped potential. In the MEA region, large-scale construction projects in the hospitality and commercial real estate sectors (driven by economic diversification efforts in the Gulf countries) are creating significant demand for heavy-duty sewage and gray water pumping systems. In LATAM, fluctuating economic stability can restrain market growth, yet steady residential building activity and increasing regulatory attention to sanitation standards are gradually promoting the adoption of compliant and efficient bathroom pump technologies. Manufacturers focusing on these regions must address specific challenges related to local power grid stability and variable water quality.

- North America: Market maturity defined by high replacement demand and significant use in basement conversions. Focus on smart diagnostics and energy efficiency driven by consumer expectation and code requirements.

- Europe: Growth sustained by strict adherence to environmental regulations and the necessity of specialized systems for renovating historically protected buildings. High demand for low-noise and compact units.

- Asia Pacific (APAC): Leading growth region fueled by massive urbanization, infrastructure investment, and rising middle-class disposable income, driving new construction in both residential and commercial sectors.

- Latin America (LATAM): Emerging market characterized by infrastructural gaps and increasing government focus on sanitation improvement, offering opportunities for cost-effective, durable pump solutions.

- Middle East and Africa (MEA): Demand concentrated in high-value commercial and hospitality projects, particularly in the GCC states, requiring robust and high-capacity pumping solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bathroom pump Market.- Grundfos

- Saniflo (SFA Group)

- Zoeller Company

- Liberty Pumps

- Xylem Inc.

- DAB Pumps SpA

- Tsurumi Manufacturing Co., Ltd.

- Wilo SE

- Macerator Pump Shop

- PME Pumps

- Ashland Pump

- Armstrong Fluid Technology

- Flotec (Pentair)

- Franklin Electric

- Sulzer Ltd.

- Crane Pumps & Systems

- KSB Group

- E/One (Environment One Corporation)

- Pump Express

- Macerator Pump Services

Frequently Asked Questions

Analyze common user questions about the Bathroom pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors determine the necessity of installing a bathroom pump system?

Bathroom pump systems are necessary when a new bathroom or utility fixture is located below the main sewer line (like in a basement) or is situated far away from the soil stack, preventing effective gravity drainage. They utilize specialized motors and often macerating blades to grind waste and pump it vertically or horizontally to the main sewer connection.

How does the noise level of modern macerating pumps compare to older models?

Modern macerating and gray water pumps have significantly reduced noise levels due to technological advancements, including improved motor encapsulation, acoustic insulation materials, and the use of Variable Speed Drive (VSD) technology. High-quality contemporary models are designed to operate minimally above ambient background noise levels during typical usage cycles.

What is the difference between macerating pumps and sewage ejector pumps?

Macerating pumps are typically smaller, residential-focused units that grind solid waste before pumping the slurry through smaller discharge pipes (often 3/4 to 1 inch). Sewage ejector pumps are larger, heavy-duty systems designed for higher volumes, using large impellers to move ungrounded solids through larger discharge pipes (2 inches or more), making them suitable for commercial or multi-family installations.

Are smart bathroom pump systems more energy efficient?

Yes, smart bathroom pump systems are generally more energy efficient. They incorporate sensors and VSDs that allow the pump to run only at the necessary speed and duration based on actual inflow demands, avoiding the inefficient, full-throttle operation typical of older, fixed-speed pumps. Integrated AI can further optimize run cycles based on learned usage patterns.

What are the primary maintenance considerations for bathroom pump users?

The primary maintenance considerations involve preventing foreign objects (such as wipes, sanitary products, and excessive hair) from entering the system, as these can cause clogs or damage the macerator blades. Regular inspection, utilizing specialized cleaning agents approved by the manufacturer, and relying on remote diagnostic alerts in smart systems are key to ensuring long-term operational reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager