Battery Electric Car Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435201 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Battery Electric Car Market Size

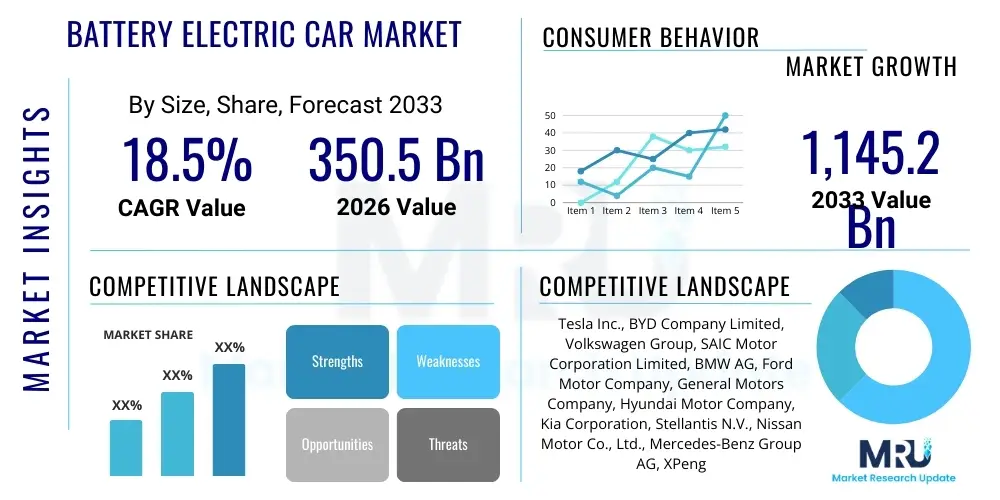

The Battery Electric Car Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 350.5 Billion in 2026 and is projected to reach USD 1,145.2 Billion by the end of the forecast period in 2033.

Battery Electric Car Market introduction

The Battery Electric Car (BEC) Market encompasses the sales, manufacturing, and supporting ecosystem for passenger vehicles powered exclusively by electrical energy stored in rechargeable battery packs. These vehicles, often termed BEVs, represent a fundamental shift from internal combustion engines, offering zero tailpipe emissions and significantly reduced operating costs. The core product involves a high-voltage battery pack, an electric motor (or multiple motors), and advanced power electronics governing energy flow and regeneration. Major applications span personal mobility, ride-sharing fleets, and governmental use, driven by global mandates focused on decarbonization and air quality improvement in urban centers. The transition is heavily supported by technological breakthroughs in battery density and charging speed, making BEVs increasingly viable alternatives to traditional automobiles, especially as range anxiety diminishes.

The primary benefits driving rapid consumer adoption include superior energy efficiency, substantial government incentives (tax credits, subsidies, preferential parking), and the inherent performance advantages provided by electric powertrains, such as instant torque delivery and quiet operation. Furthermore, the longevity and declining cost of lithium-ion batteries, alongside the development of robust public and residential charging infrastructure, solidify the market's trajectory. Key driving factors propelling this market expansion include stringent emission regulations enforced across major economies like the European Union and China, coupled with original equipment manufacturers (OEMs) committing multi-billion dollar investments toward electrifying their entire model portfolios, effectively normalizing BEV options for consumers across all price points and vehicle segments.

Battery Electric Car Market Executive Summary

The Battery Electric Car market is characterized by intense competition, rapid technological evolution, and significant governmental intervention driving demand. Current business trends indicate a vertical integration strategy among leading OEMs, particularly involving joint ventures or direct investments in battery supply chains to secure raw materials and control costs, crucial for achieving price parity with gasoline vehicles. The market is moving away from niche positioning toward mass-market acceptance, necessitating efficient, high-volume production models, particularly in the compact and SUV segments. Key challenges involve managing geopolitical risks related to critical mineral sourcing and scaling up charging infrastructure deployment to keep pace with accelerating vehicle sales, ensuring a seamless user experience that fosters sustained consumer trust and loyalty.

Regional trends are bifurcated: Asia Pacific, led by China, dominates both manufacturing capacity and consumer adoption due to aggressive domestic policy support and a mature local supply chain, setting global benchmarks for speed and scale. Europe is defined by proactive regulatory deadlines, such as outright bans on new ICE vehicle sales, translating into consistent, high-growth demand for premium and smaller urban BEVs. Segment trends show a clear preference shift toward battery electric SUVs and crossovers, aligning with broader automotive consumer preferences, although the entry-level BEV segment is gaining traction as battery costs fall, crucial for penetration into emerging markets. Furthermore, the integration of advanced driver assistance systems (ADAS) and sophisticated in-car connectivity is standardizing across all segments, turning BEVs into intelligent, data-generating platforms.

AI Impact Analysis on Battery Electric Car Market

User queries regarding the intersection of Artificial Intelligence and the Battery Electric Car market primarily revolve around three critical areas: enhanced battery performance and longevity, the development of safe and reliable autonomous driving capabilities, and optimization of the charging ecosystem. Users seek assurance that AI can overcome current limitations like battery degradation, range uncertainty, and infrastructure bottlenecks. Concerns often focus on the cybersecurity implications of highly connected, AI-driven vehicles and the complex regulatory framework required for widespread autonomous vehicle deployment. Expectations are high regarding predictive maintenance powered by machine learning, personalized in-car experiences, and smart energy management systems that optimize vehicle-to-grid (V2G) interactions, fundamentally changing how cars interact with the electrical grid and their occupants.

The application of AI is instrumental in unlocking the next generation of BEV efficiency and safety. Machine learning algorithms are vital for simulating complex electrochemical processes, enabling the design of safer, higher-density battery chemistries and sophisticated Battery Management Systems (BMS) that can accurately predict state-of-charge and state-of-health, mitigating range anxiety and extending battery life cycles. In manufacturing, AI-powered quality control and robotic automation reduce defects and increase throughput, essential for meeting the massive global demand ramp-up. Furthermore, the future differentiation of BEVs will increasingly rely on proprietary AI stacks that deliver superior autonomous driving capabilities and deeply integrated user experience features, turning the vehicle into a personalized, constantly learning device on wheels, thereby elevating the competitive landscape beyond just battery capacity metrics.

- AI-driven Battery Management Systems (BMS) for enhanced thermal regulation and lifespan prediction.

- Optimization of charging infrastructure through predictive analytics for grid load balancing and station availability.

- Accelerated autonomous driving (AD) feature development and over-the-air (OTA) software updates.

- Machine learning models used in manufacturing to identify defects and optimize assembly line efficiency.

- Personalized in-car user experience and infotainment systems based on driver behavior modeling.

DRO & Impact Forces Of Battery Electric Car Market

The Battery Electric Car market is simultaneously propelled by aggressive regulatory frameworks and consumer demand for sustainable mobility solutions, yet constrained by infrastructure limitations and critical resource dependencies. Key drivers include national zero-emission vehicle (ZEV) mandates and substantial government subsidies that significantly reduce the total cost of ownership (TCO) for consumers. Opportunities abound in developing vehicle-to-everything (V2X) technology, particularly Vehicle-to-Grid (V2G), positioning BEVs as mobile energy assets that stabilize power grids. However, the market faces significant restraints, including the slow pace of charging network expansion outside metropolitan areas, high upfront vehicle purchase prices relative to equivalent ICE vehicles in certain segments, and supply chain volatility concerning lithium, cobalt, and nickel, which impacts production scaling and material costs.

The impact forces influencing the market's trajectory are largely external and systemic. Regulatory pressure acts as the primary acceleration force, forcing rapid compliance and innovation from OEMs globally. Market pull is generated by increasingly environmentally conscious consumers, particularly Millennials and Gen Z, who prioritize sustainability in purchasing decisions. Conversely, the inertial force of established ICE infrastructure, coupled with the capital intensity required for battery gigafactory construction and supply chain localization, creates significant friction. The long-term success of the BEV market hinges on the ability of governments and private entities to collaboratively address the infrastructure deficit and stabilize critical mineral procurement, thereby transitioning the BEV from a subsidized product to a cost-competitive necessity. Geopolitical tensions surrounding resource control pose a continuous threat to sustained supply chain stability.

Segmentation Analysis

The Battery Electric Car market is strategically segmented to reflect the diverse operational needs and consumer preferences across the global landscape. Segmentation is primarily conducted based on Vehicle Type, covering Sedans, SUVs/Crossovers, and Hatchbacks, with SUVs dominating recent sales volume due to consumer preference for larger vehicles and their utility. Further breakdown occurs by Battery Capacity (e.g., up to 50 kWh, 51 kWh to 75 kWh, and above 75 kWh), directly correlating with vehicle range and price point, where higher capacity batteries are critical for premium long-range models. The market is also segmented by Charging Type (AC and DC Fast Charging), indicating the technological infrastructure readiness and usage patterns. This granular segmentation allows manufacturers to tailor product offerings—from affordable urban commuters to high-performance luxury vehicles—and enables policymakers to target incentives effectively.

- By Vehicle Type:

- Sedan

- SUV/Crossover

- Hatchback

- Trucks/Pickups (Emerging Segment)

- By Battery Capacity:

- Up to 50 kWh

- 51 kWh to 75 kWh

- Above 75 kWh

- By Component:

- Battery Pack (Highest Revenue Contributor)

- Motor

- Power Electronics

- Chassis and Body

- By Charging Type:

- AC Charging

- DC Fast Charging

- By End-Use:

- Personal Use

- Commercial Fleet (Taxis, Ride-Sharing)

Value Chain Analysis For Battery Electric Car Market

The value chain of the Battery Electric Car market is complex and highly concentrated at the upstream manufacturing stage, particularly concerning battery components. Upstream analysis focuses heavily on the extraction and refining of critical raw materials—lithium, cobalt, nickel, and manganese—often sourced from a limited number of geographical regions, creating supply risks and requiring sophisticated resource management. This is followed by the cell manufacturing phase, dominated by a few major Asian players (CATL, LG Energy Solution, Panasonic), who then supply the integrated battery packs to OEMs. Controlling the upstream raw material costs and technological advancements in cell chemistry is the primary leverage point in the entire BEC value chain, determining final vehicle profitability and market competitiveness.

The midstream involves the core manufacturing and assembly of the vehicle, where traditional OEMs leverage their expertise in chassis design and safety systems, but face significant capital expenditure challenges in retooling plants for EV production and establishing dedicated gigafactories. Downstream activities encompass vehicle distribution, sales (increasingly shifting toward direct-to-consumer models), and the crucial after-sales service, which involves software updates, battery health monitoring, and specialized maintenance often requiring new skill sets from dealership technicians. Distribution channels are rapidly diversifying, moving beyond the traditional dealer franchise model towards online ordering and proprietary brand stores, especially for new EV entrants aiming to minimize overhead and enhance customer relationship management.

Direct distribution, utilized heavily by market disruptors, provides OEMs with full control over pricing, inventory, and customer data, allowing for swift adjustments to market dynamics and enhanced personalization. Indirect distribution, though undergoing transformation, still plays a vital role, particularly in established markets where dealer networks provide essential local service and trade-in mechanisms. The profitability focus is shifting downstream toward software and services, as the vehicle platform itself becomes a commodity. Companies that can successfully monetize data, offer subscription services, and manage the lifecycle of the battery pack (including second-life applications) are positioned for long-term value capture, emphasizing the importance of digital integration throughout the value chain.

Battery Electric Car Market Potential Customers

The potential customer base for Battery Electric Cars is rapidly broadening, transitioning from early adopters and environmentally conscious affluent individuals to mass-market consumers seeking lower running costs and technological novelty. Current primary end-users fall into three distinct categories: urban commuters who benefit significantly from charging accessibility and local incentives; higher-income households purchasing BEVs as primary or secondary family vehicles, often opting for premium long-range SUVs; and increasingly, commercial fleet operators (ride-sharing services, corporate fleets, and logistics companies) driven by total cost of ownership reductions and corporate sustainability mandates. Fleet operators are crucial buyers, as the predictable routes and high mileage accumulation maximize the financial benefits of electric propulsion.

Future growth will be fueled by the entry of price-sensitive buyers in emerging economies and those seeking affordable BEV options, supported by the expected introduction of smaller, lower-cost BEVs and improved public financing options. The rise of Vehicle-as-a-Service (VaaS) models and subscription services also attracts customers who prefer flexibility over outright ownership. Furthermore, specialized market niches are emerging, such as governmental and municipal fleets prioritizing zero emissions for public transport and service vehicles. Ultimately, the largest cohort of potential customers consists of mainstream car buyers who will transition to BEVs once purchase price parity is achieved and charging infrastructure availability becomes indistinguishable from traditional gasoline station access, making convenience the ultimate determining factor for mass adoption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Billion |

| Market Forecast in 2033 | USD 1,145.2 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tesla Inc., BYD Company Limited, Volkswagen Group, SAIC Motor Corporation Limited, BMW AG, Ford Motor Company, General Motors Company, Hyundai Motor Company, Kia Corporation, Stellantis N.V., Nissan Motor Co., Ltd., Mercedes-Benz Group AG, XPeng Inc., NIO Inc., Li Auto Inc., Polestar, Lucid Group, Rivian Automotive, Inc., Honda Motor Co., Ltd., and Volvo Car Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Battery Electric Car Market Key Technology Landscape

The Battery Electric Car market is fundamentally defined by continuous innovation in energy storage and propulsion systems, moving rapidly toward higher voltage architectures and next-generation battery chemistries. A significant focus is placed on 800-volt architectures, which allow for substantially faster DC charging rates and improved efficiency of the overall electric powertrain compared to the conventional 400-volt systems. This transition requires advancements in power electronics, including silicon carbide (SiC) inverters, which are critical for minimizing energy loss and managing the high currents involved. Concurrently, thermal management systems have become highly sophisticated, utilizing integrated liquid cooling loops and advanced heat pump technology to maintain optimal operating temperatures for both the battery and the cabin, directly impacting range and charging speed, especially in extreme climates.

Looking ahead, the development of solid-state batteries represents the single most disruptive technological pivot. Solid-state technology promises significantly higher energy density, increased safety (by eliminating flammable liquid electrolytes), and faster charging times, potentially solving the long-standing issues of range anxiety and battery degradation. Although still largely in the research and pilot phase, major OEMs are partnering with specialized battery developers to commercialize this technology within the forecast period. Beyond batteries, improvements in motor design—specifically the shift toward more efficient, power-dense permanent magnet synchronous motors (PMSMs) and flux-weakening control strategies—contribute to extending driving range without increasing battery size. Furthermore, advanced lightweight material usage, such as aluminum and carbon fiber composites, is essential for offsetting the weight of large battery packs, maintaining vehicle efficiency and dynamic performance.

Software and connectivity technologies form another crucial pillar of the landscape, encompassing vehicle operating systems, over-the-air (OTA) update capabilities, and sophisticated predictive maintenance platforms. These systems enhance vehicle functionality long after purchase, enabling feature upgrades and proactive identification of potential failures, thus improving reliability and customer satisfaction. The integration of Vehicle-to-Grid (V2G) technology, supported by smart charging protocols and standardized communication (like ISO 15118), is transforming the BEV from a consumer product into a vital component of the future smart grid infrastructure. This holistic technological approach—from materials and chemistry to power electronics and connectivity—is collectively accelerating the BEV market towards full maturity and sustainability.

Regional Highlights

The global Battery Electric Car market exhibits strong regional variances driven by policy heterogeneity, economic maturity, and infrastructure development pace. Asia Pacific (APAC) stands as the dominant market, primarily spearheaded by China, which accounts for the largest share of global BEV production and consumption. China’s success is attributable to aggressive national planning, generous local subsidies, a highly competitive domestic OEM landscape (e.g., BYD, Nio, Xpeng), and a robust, localized battery supply chain that effectively controls costs. India and Southeast Asian countries are emerging as high-growth potential regions, spurred by urbanization, pollution concerns, and government initiatives promoting two- and three-wheeler electrification, which is expected to gradually translate into four-wheeler adoption as infrastructure improves.

Europe represents the second most significant region, characterized by strong regulatory enforcement, particularly the mandates set by the European Union aiming for carbon neutrality. Countries like Norway, Germany, and the Netherlands lead in adoption rates, supported by attractive purchasing incentives and rapid expansion of cross-border charging networks. European consumers often prioritize premium, technologically advanced BEVs. North America, dominated by the United States, is experiencing accelerated growth following the introduction of supportive federal legislation like the Inflation Reduction Act (IRA), which provides substantial tax credits linked to domestic manufacturing and sourcing. This policy environment is driving massive investment in US-based battery and vehicle manufacturing capacity, aiming to localize the supply chain and reduce dependency on overseas imports, establishing a foundation for sustained, long-term market growth within the continent.

- Asia Pacific (APAC): Dominates global volume; China is the manufacturing and sales hub due to policy support and domestic supply chain strength.

- Europe: High adoption rates driven by stringent EU emission standards and national incentives; rapid transition to electric fleets and premium segment growth.

- North America: Experiencing explosive growth fueled by the U.S. Inflation Reduction Act (IRA), focusing on domestic supply chain localization and manufacturing expansion.

- Latin America & MEA: Nascent markets with potential; growth constrained by higher import costs and underdeveloped charging infrastructure, focusing initially on commercial vehicle electrification in metropolitan areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Battery Electric Car Market.- Tesla Inc.

- BYD Company Limited

- Volkswagen Group

- SAIC Motor Corporation Limited

- BMW AG

- Ford Motor Company

- General Motors Company

- Hyundai Motor Company

- Kia Corporation

- Stellantis N.V.

- Nissan Motor Co., Ltd.

- Mercedes-Benz Group AG

- XPeng Inc.

- NIO Inc.

- Li Auto Inc.

- Polestar

- Lucid Group

- Rivian Automotive, Inc.

- Honda Motor Co., Ltd.

- Volvo Car Corporation

Frequently Asked Questions

Analyze common user questions about the Battery Electric Car market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the main driver behind the rapid expansion of the Battery Electric Car market?

The rapid expansion is primarily driven by stringent global government regulations and zero-emission vehicle (ZEV) mandates, coupled with significant technological advancements in battery energy density and declining production costs, making BEVs increasingly competitive with traditional internal combustion engine vehicles.

What major challenges constrain the mass adoption of BEVs globally?

Key constraints include widespread range anxiety due to limited public charging infrastructure, particularly DC fast charging outside major cities, high upfront purchase prices compared to gasoline equivalents in some segments, and supply chain fragility concerning critical battery minerals like lithium and cobalt.

How will solid-state battery technology impact the future of the BEV market?

Solid-state batteries are anticipated to be a major technological breakthrough, offering higher energy density, improved safety by eliminating liquid electrolytes, and dramatically faster charging times. Commercialization is expected to significantly reduce vehicle weight and eliminate current range limitations, accelerating mass adoption post-2030.

Which region currently dominates the global Battery Electric Car production and sales?

Asia Pacific, specifically China, dominates the global Battery Electric Car market. China leads both in vehicle manufacturing volume and domestic sales, supported by robust state policies, comprehensive supply chain integration, and intense competition among local OEMs.

How does AI influence the operational efficiency of Battery Electric Cars?

AI significantly enhances operational efficiency through advanced Battery Management Systems (BMS) that optimize charging cycles and thermal management, extending battery life and range accuracy. AI also enables predictive maintenance and optimizes energy consumption based on driving patterns and route conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager