Battery Electrode Cutting Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435552 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Battery Electrode Cutting Machine Market Size

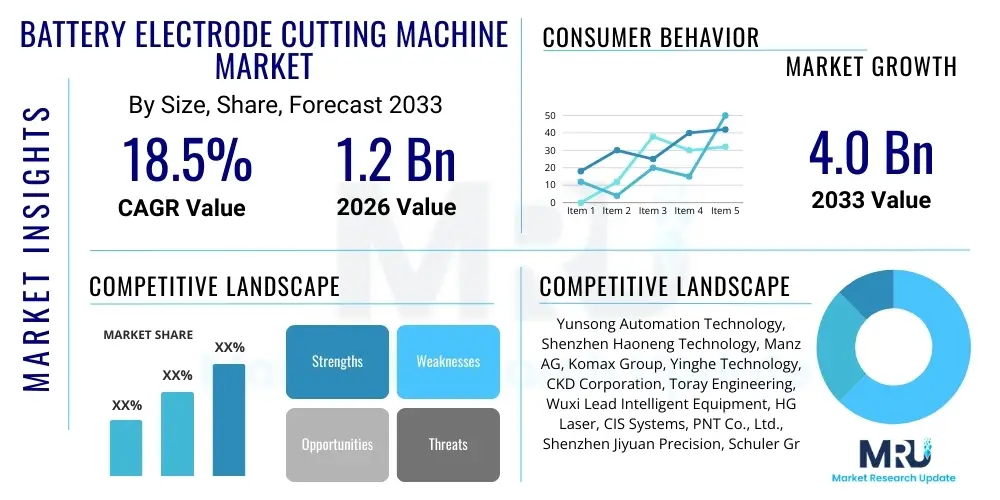

The Battery Electrode Cutting Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 4.0 Billion by the end of the forecast period in 2033.

Battery Electrode Cutting Machine Market introduction

The Battery Electrode Cutting Machine Market encompasses specialized industrial equipment designed for precisely processing coated battery electrodes (anodes and cathodes) into specific shapes and sizes required for battery cell assembly. These machines are critical components in the manufacturing flow of lithium-ion, solid-state, and other advanced battery types, ensuring dimensional accuracy and structural integrity necessary for optimal cell performance and safety. Product capabilities span from traditional mechanical cutting (slitting and punching) to high-precision laser cutting, catering to varying production volumes and material specifications, particularly those demanding minimal mechanical stress or contamination.

Major applications of these cutting machines are heavily concentrated in the rapidly expanding electric vehicle (EV) sector, where demand for high-capacity, durable batteries necessitates continuous scale-up of electrode manufacturing lines. Additionally, they serve the consumer electronics industry (smartphones, laptops) and stationary energy storage systems (ESS). The primary benefits derived from advanced cutting machines include enhanced manufacturing efficiency, reduced material waste through optimized cutting patterns, and stringent quality control, directly impacting the final battery’s energy density, longevity, and cost-effectiveness. Precision in cutting minimizes burr formation and particulate matter, which are detrimental to battery safety and performance.

The market growth is fundamentally driven by the global transition towards sustainable energy, characterized by robust governmental policies supporting EV adoption and massive investments in renewable energy infrastructure requiring large-scale battery storage solutions. Key drivers also include technological advancements in electrode materials (thicker coatings, novel chemistries) demanding more flexible and precise cutting technologies, coupled with increasing factory automation goals aimed at boosting throughput and reducing operational costs across major battery manufacturing hubs, predominantly located in Asia Pacific and increasingly in Europe and North America.

Battery Electrode Cutting Machine Market Executive Summary

The Battery Electrode Cutting Machine Market is experiencing unprecedented expansion, fundamentally underpinned by aggressive capacity expansion initiatives undertaken by major gigafactories globally. Key business trends show a significant shift towards fully automated, integrated manufacturing lines, demanding machines capable of high-speed, continuous operation with embedded quality inspection systems. Manufacturers are increasingly focusing on developing sophisticated laser cutting technologies that offer superior precision and adaptability for cutting fragile or advanced electrode chemistries, positioning these high-end systems as a critical competitive differentiator. Furthermore, the market structure is evolving as collaborations between machine builders and battery cell manufacturers intensify, driving customization and specialized solutions tailored to specific cell formats (e.g., prismatic, pouch, cylindrical).

Regional trends indicate that Asia Pacific, particularly China and South Korea, maintains dominance in terms of production volume and technological adoption, serving as the epicenter of global battery manufacturing. However, governmental incentives such as the Inflation Reduction Act (IRA) in North America and the European Green Deal are rapidly accelerating investment in localized battery supply chains, triggering substantial demand for electrode cutting equipment in these emerging regions. Europe is focusing heavily on sustainable manufacturing practices, favoring suppliers who can demonstrate energy efficiency and minimal waste generation. This localization trend is redefining supply chain logistics and fostering regional competition among equipment providers previously dominated by Asian market leaders.

Segment trends highlight the dominance of automatic operation mode machines due to their necessity in high-volume gigafactories, emphasizing efficiency and repeatability. By application, the Electric Vehicle (EV) battery segment remains the largest and fastest-growing category, commanding the majority of advanced cutting machine procurement budgets. Within technology types, while mechanical slitting remains critical for cost-effective, high-throughput processes, the Laser Cutting segment is projected to register the highest CAGR, driven by its unparalleled precision required for next-generation electrodes and increased adoption in high-value, quality-sensitive battery applications. Segment growth is characterized by a push toward integrated solutions that combine cutting, stacking, and defect detection capabilities.

AI Impact Analysis on Battery Electrode Cutting Machine Market

User inquiries regarding the influence of Artificial Intelligence (AI) in the Battery Electrode Cutting Machine Market commonly center on improving yield rates, enhancing quality control capabilities, and enabling predictive maintenance. Users frequently ask how AI can minimize electrode defects, particularly micro-cracks or burrs, which are often invisible to traditional vision systems. Another major concern involves optimizing cutting parameters dynamically based on material variability and wear, thereby reducing downtime and maximizing material utilization. Expectations are high that AI will transform these machines from simple processing tools into smart, self-optimizing manufacturing assets capable of achieving "zero-defect" production targets necessary for future battery technology generations.

The integration of AI, particularly machine learning and deep learning algorithms, into electrode cutting systems is rapidly becoming standard practice, moving beyond simple automation. AI-driven vision systems are significantly improving defect detection by analyzing high-resolution images of cut edges in real-time, identifying subtle anomalies that indicate potential future performance issues in the battery cell. Furthermore, AI models are being deployed for predictive maintenance, analyzing sensor data from motors, blades, and laser systems to anticipate component failure, thereby minimizing unplanned stoppages and optimizing scheduled maintenance cycles, crucial for maintaining the stringent uptime requirements of gigafactories.

This technological evolution enables complex parameter optimization. AI algorithms can instantaneously adjust cutting speed, tension, alignment, or laser power based on live feedback regarding material properties (e.g., variations in coating thickness or density) and machine performance. This dynamic adjustment capability ensures consistent output quality even when facing minor feedstock inconsistencies, leading to substantial improvements in manufacturing yield and material cost savings. The long-term impact of AI is expected to facilitate the creation of fully autonomous production lines where human intervention is primarily limited to system oversight and high-level strategic adjustments.

- AI-powered Vision Systems: Real-time, ultra-high-precision defect detection (burrs, micro-cracks, alignment errors).

- Predictive Maintenance: Minimizing unplanned downtime by forecasting equipment failure based on operational data analysis.

- Dynamic Parameter Optimization: Automated adjustments of cutting parameters (speed, tension, laser power) based on material input variability.

- Yield Rate Enhancement: Utilization of machine learning to identify and mitigate root causes of process inefficiencies.

- Optimized Material Utilization: Intelligent nesting and layout algorithms to reduce scrap material during cutting processes.

- Autonomous Quality Reporting: Generation of comprehensive, automated quality compliance documentation for regulatory adherence.

DRO & Impact Forces Of Battery Electrode Cutting Machine Market

The Battery Electrode Cutting Machine Market is primarily driven by exponential global demand for lithium-ion batteries, fueled by electrification mandates and the expansion of the EV sector, coupled with massive capital investments in global battery production capacity (gigafactories). However, growth is constrained by the complexity and high initial capital expenditure associated with high-precision cutting equipment, alongside intense competition and technological demands that necessitate continuous research and development. Opportunities arise from the transition to next-generation battery architectures, suchally solid-state batteries, which require new, highly precise cutting solutions, and the emerging market for recycling spent electrodes, creating demand for specialized processing tools. These forces collectively shape the market's trajectory, mandating manufacturers to balance high investment costs against the imperative for speed, precision, and automation.

Drivers: The most significant driver is the rapid scale-up of battery manufacturing capacity, particularly in APAC and newly established hubs in Europe and North America, necessitating the procurement of thousands of cutting machines. Technological drivers include the relentless push for higher energy density batteries, which require extremely precise electrode processing to prevent internal shorts or degradation, making the quality provided by advanced cutting machines indispensable. Furthermore, governmental incentives and subsidies aimed at boosting domestic battery production actively lower the investment risk for new manufacturing facilities, thereby accelerating equipment procurement cycles. The rising adoption of large-format batteries for grid storage also adds sustainable, long-term demand.

Restraints: High initial investment costs for advanced machinery, particularly laser cutting systems and fully automated lines, present a significant restraint, especially for smaller or new market entrants. Technical restraints include the complexity of handling certain advanced electrode materials (e.g., highly abrasive or sticky chemistries) and the challenge of maintaining zero-defect production at extremely high speeds. Furthermore, the market is characterized by a limited pool of highly specialized technical expertise required for operation, maintenance, and software integration of these complex machines, leading to operational bottlenecks in some regions.

Opportunity: Significant opportunities lie in developing highly flexible, modular cutting platforms that can rapidly adapt to evolving battery chemistries and form factors, such as those used in solid-state and sodium-ion batteries, which often require different handling or cutting tolerances. The burgeoning recycling sector presents an emerging opportunity for machines capable of safely and cleanly separating active electrode materials from current collectors. Geographically, underserved emerging markets in Southeast Asia and Latin America, planning their own EV transitions and battery production facilities, offer untapped potential for equipment suppliers.

- Drivers:

- Explosive growth in global EV production volumes.

- Establishment and expansion of large-scale battery gigafactories worldwide.

- Technological advancements demanding higher precision and quality in electrode processing.

- Favorable government policies and subsidies promoting localized battery manufacturing.

- Restraints:

- High capital expenditure required for automated, high-precision cutting lines.

- Technical challenges associated with processing novel and sensitive electrode materials.

- Scarcity of specialized technical expertise for maintenance and operation.

- Strict regulatory requirements concerning safety and environmental impact of manufacturing.

- Opportunity:

- Demand creation from the shift towards next-generation battery technologies (e.g., solid-state).

- Development of specialized cutting solutions for the emerging battery recycling industry.

- Expansion into new geographical markets outside traditional APAC manufacturing centers.

- Integration of IIoT, AI, and Big Data analytics for enhanced process control and system optimization.

- Impact Forces:

- High impact from EV adoption rates (Primary market pull).

- Medium impact from material science evolution (Technology shift forcing equipment upgrades).

- High impact from global geopolitical trends (Localization strategies influencing procurement decisions).

Segmentation Analysis

The Battery Electrode Cutting Machine Market is segmented based on Type, Application, and Operation Mode, providing granular insights into varying technological adoption patterns and end-user requirements. This segmentation highlights the diverse needs across the battery manufacturing landscape, ranging from high-volume standardized consumer cells to highly specialized, large-format EV cells. The market analysis across these segments reveals a clear bifurcation between mature, cost-efficient mechanical cutting technologies and nascent, high-precision laser-based systems, with end-user requirements dictating the choice between them based on required throughput, material type, and acceptable tolerance levels.

By Type, the division focuses on the mechanism used for cutting: Slitting Cutters (roll-to-roll mechanical cutting, high speed), Punching Cutters (die-cutting for specific geometries, high repeatability), and Laser Cutters (non-contact cutting, highest precision). The application segmentation illustrates the market's reliance on the Electric Vehicle sector, which mandates stringent quality and large-format capabilities, contrasting with the smaller scale and diverse needs of the Consumer Electronics and Industrial/Grid Storage segments. These distinctions inform R&D strategies and pricing structures among equipment suppliers.

The segmentation by Operation Mode—Automatic versus Semi-Automatic—is crucial for understanding the market's operational maturity. Automatic machines dominate new factory installations due to labor cost efficiencies and reliability at scale, aligning with the industry trend toward fully integrated, "lights-out" manufacturing. Semi-automatic machines, while diminishing in market share, maintain relevance in pilot lines, R&D facilities, or smaller specialized production environments where flexibility is prioritized over sheer volume.

- By Type:

- Slitting Cutters

- Punching Cutters

- Laser Cutters

- By Application:

- Electric Vehicle (EV) Batteries

- Consumer Electronics Batteries

- Industrial and Grid Storage (ESS) Batteries

- Specialty Batteries

- By Operation Mode:

- Automatic

- Semi-Automatic

Value Chain Analysis For Battery Electrode Cutting Machine Market

The value chain for the Battery Electrode Cutting Machine Market is intricate, starting upstream with key component suppliers and extending downstream through complex distribution channels to end-user battery manufacturers. Upstream analysis involves providers of high-precision components such as advanced motion control systems (servomotors, linear guides), industrial laser sources, specialized material handling components, and sophisticated computer vision systems. The performance and reliability of the final cutting machine are heavily dependent on the quality and integration of these specialized inputs. Key suppliers often operate in highly specialized global niches, necessitating robust and secure supply chain logistics for machine builders.

The core manufacturing stage is dominated by specialized equipment builders who integrate these components, along with proprietary software and mechanical designs, to produce the final cutting machinery. This phase involves extensive engineering to ensure precision, safety, and compatibility with various electrode materials. Distribution channels are typically direct, reflecting the high-value and customized nature of the equipment. Direct sales facilitate deep technical consultation and integration support, which are essential when deploying machines in sensitive battery manufacturing environments. Indirect channels, involving local agents or distributors, are sometimes utilized in emerging markets to manage installation and initial maintenance services, though the primary relationship often remains between the OEM and the Giga-factory operator.

Downstream analysis focuses on the end-users: large-scale battery cell producers (e.g., CATL, LG Energy Solution, Tesla, Samsung SDI). These downstream players drive demand based on their projected capacity expansion plans and technological requirements. The influence of these end-users is significant, as their strict specifications regarding throughput, tolerance, and safety often dictate technology development trends. The lifecycle support—including installation, commissioning, software updates, and predictive maintenance services—forms a crucial and high-value part of the downstream relationship, ensuring the machine's longevity and maximizing the return on investment for the battery manufacturer.

Battery Electrode Cutting Machine Market Potential Customers

The primary customers for Battery Electrode Cutting Machines are the major global manufacturers of lithium-ion and other advanced energy storage cells. This customer base is characterized by high capital investment capacity, an acute focus on mass production efficiency, and stringent quality control standards. The predominant buyers fall into the category of Giga-factory operators, including dedicated battery manufacturers and vertically integrated automotive OEMs who have insourced cell production. These clients typically procure equipment in large batches to outfit multi-gigawatt-hour production lines, making scale and reliability paramount purchasing criteria.

A secondary, yet rapidly expanding, customer segment includes emerging battery startups focused on novel chemistries like solid-state or sodium-ion batteries, as well as specialized producers catering to niche markets such as medical devices or aerospace. Although their volume requirements are smaller, these clients often demand the highest level of technological precision and flexibility, often favoring advanced laser cutting technologies suitable for R&D and pilot production lines. Furthermore, academic research institutions and national laboratories engaged in materials science and battery innovation also represent a continuous, albeit smaller, market for cutting machines used in prototyping and testing phases.

The third significant group comprises providers of Energy Storage Systems (ESS) and electric utility companies who are increasingly partnering with specialized manufacturers to develop large, customized battery packs for grid stabilization and renewable energy integration projects. While they may not directly purchase the cutting machines, their demand dictates the production volume and specifications required by the primary cell manufacturers. Therefore, the purchasing decisions of the ultimate end-users (EV manufacturers and ESS integrators) profoundly influence the procurement strategies of the immediate buyers (cell producers), favoring suppliers who can demonstrate proven track records in high-volume, continuous operation environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Yunsong Automation Technology, Shenzhen Haoneng Technology, Manz AG, Komax Group, Yinghe Technology, CKD Corporation, Toray Engineering, Wuxi Lead Intelligent Equipment, HG Laser, CIS Systems, PNT Co., Ltd., Shenzhen Jiyuan Precision, Schuler Group, WENZHOU SINOYUE MACHINERY, Dalian R&D New Energy Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Battery Electrode Cutting Machine Market Key Technology Landscape

The technological landscape of the Battery Electrode Cutting Machine Market is dominated by three principal cutting methods—slitting, punching, and laser cutting—each offering distinct advantages tailored to specific production requirements. Slitting technology, typically using rotating circular blades, is favored for high-throughput, continuous roll-to-roll processing of wide webs into narrow strips, serving as the backbone of high-volume manufacturing lines due to its speed and cost-efficiency. Punching, conversely, uses precision dies to cut specific shapes (e.g., tabs, pouches) with high repeatability, although it is limited by the fixed geometry of the dies and can introduce minor mechanical stress to the electrode material. The trend here is towards multi-cavity, high-speed punching and optimization of die materials for extended lifespan.

Laser cutting represents the highest-growth technology segment, driven by the demand for non-contact, high-precision processing required for advanced electrodes, particularly those with thicker coatings or complex chemistries sensitive to mechanical stress. Fiber lasers and ultrafast pulsed lasers (pico- or femtosecond lasers) are increasingly deployed as they minimize the Heat Affected Zone (HAZ), reducing the risk of contamination or degradation of the active material near the cut edge. This technology is critical for next-generation solid-state batteries and high-performance EV batteries where dimensional accuracy and material purity are paramount for safety and energy density performance.

Beyond the core cutting mechanism, the key technological focus is on full system integration and process control. This includes advanced web handling systems to manage fragile electrodes without damage, inline high-resolution vision systems (often AI-enhanced) for real-time defect detection and quality assurance, and sophisticated vacuum or dust management systems crucial for mitigating particulate contamination which can cause cell failure. The overall trend is towards closed-loop control systems, leveraging Industrial Internet of Things (IIoT) connectivity to monitor performance parameters and facilitate remote diagnostics, ensuring maximum uptime and efficiency in fully automated manufacturing environments.

Regional Highlights

- Asia Pacific (APAC): APAC is the unquestioned global leader in the Battery Electrode Cutting Machine Market, commanding the largest market share due to its dominance in global lithium-ion battery production. Countries like China, South Korea, and Japan house the world’s largest battery cell manufacturers (CATL, LG Energy Solution, Samsung SDI, Panasonic), which operate numerous gigafactories. China, in particular, drives massive volume demand, characterized by heavy investment in domestic automation solutions and continuous capacity expansion to meet global EV demand. South Korea and Japan, while focusing on premium, high-tech batteries, lead the adoption of advanced laser cutting and fully integrated, high-precision manufacturing lines. The regional market growth is sustained by strong governmental support for the entire battery value chain and a highly developed industrial ecosystem for machinery manufacturing.

- North America: North America represents the fastest-growing market region, largely propelled by the ambitious electrification goals of major US automakers and supportive legislative measures like the Inflation Reduction Act (IRA). The IRA has incentivized significant localization of battery production, leading to a surge in gigafactory construction across the US and Canada by both foreign and domestic entities. This greenfield development creates substantial, immediate demand for all types of electrode cutting equipment, with a strong preference for highly automated, technologically advanced systems compliant with stringent safety and quality standards. The market here is characterized by new entrant suppliers competing against established APAC firms seeking to build localized manufacturing and servicing capabilities.

- Europe: Europe is rapidly catching up, driven by the European Green Deal and the desire for strategic autonomy in the battery supply chain (Battery Passport initiative). Central and Northern Europe (Germany, France, Sweden, Hungary) are major investment hubs for battery manufacturing (e.g., Northvolt, Automotive OEMs). European demand emphasizes sustainable manufacturing practices, high energy efficiency, and stringent compliance with environmental regulations. The market favors suppliers offering customized, flexible solutions capable of handling diverse cell chemistries, reflecting Europe's focus on innovative battery technology development alongside high-volume production scale-up. The demand profile is highly biased toward fully automated, quality-assured production lines.

- Latin America (LATAM): LATAM is an emerging market for electrode cutting machines, driven primarily by the region’s vast reserves of lithium and the nascent development of local processing and cell manufacturing capabilities, particularly in Chile and Argentina. While the market size remains smaller compared to APAC or Europe, automotive assembly operations and regional initiatives to establish local EV supply chains signal future growth potential. Current demand is concentrated in pilot plants and specialized R&D facilities, predominantly procuring semi-automatic or smaller-scale equipment, but large-scale foreign investment is expected to catalyze exponential growth later in the forecast period.

- Middle East and Africa (MEA): The MEA market for electrode cutting machines is currently focused on captive industrial applications and grid-scale ESS deployment, often serving renewable energy projects backed by sovereign wealth funds, particularly in the UAE and Saudi Arabia. Battery production facilities are sparse, but strategic investments in clean energy infrastructure are stimulating demand for manufacturing equipment. The market relies heavily on imports, and procurement decisions prioritize robustness and ease of maintenance in challenging operating environments, often sourced through international turnkey solution providers. Future growth is contingent upon sustained diversification away from hydrocarbon economies and successful industrialization initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Battery Electrode Cutting Machine Market.- Wuxi Lead Intelligent Equipment Co., Ltd.

- Shenzhen Haoneng Technology Co., Ltd.

- Yunsong Automation Technology Co., Ltd.

- Manz AG

- Komax Group

- Toray Engineering Co., Ltd.

- CKD Corporation

- PNT Co., Ltd.

- CIS Systems Co., Ltd.

- HG Laser Engineering Co., Ltd.

- Shenzhen Jiyuan Precision Equipment Manufacturing Co., Ltd.

- Schuler Group GmbH

- Yinghe Technology Co., Ltd.

- Dalian R&D New Energy Technology Co., Ltd.

- WENZHOU SINOYUE MACHINERY Co., Ltd.

- Jingwei Equipment Co., Ltd.

- Han's Laser Technology Industry Group Co., Ltd.

- Suzhou Lead New Energy Equipment Co., Ltd.

- Koem America

- Maccor Inc.

Frequently Asked Questions

Analyze common user questions about the Battery Electrode Cutting Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Battery Electrode Cutting Machines?

The primary driver is the explosive expansion of Electric Vehicle (EV) production globally, which necessitates a continuous increase in the manufacturing capacity of high-quality lithium-ion battery cells. This global gigafactory boom directly translates into massive procurement demand for automated, high-speed electrode processing equipment required for cell assembly.

How does laser cutting technology differ from traditional slitting in battery manufacturing?

Laser cutting is a non-contact method offering superior precision and minimal mechanical stress, making it ideal for cutting sensitive, advanced electrode materials and achieving complex geometries with a minimal Heat Affected Zone (HAZ). Traditional slitting is a mechanical, contact-based method primarily used for high-throughput, continuous processing of long electrode strips, valued for its speed and lower operational cost in high-volume, standardized manufacturing.

Which geographical region dominates the Battery Electrode Cutting Machine Market?

The Asia Pacific (APAC) region, specifically China, South Korea, and Japan, dominates the market due to its established leadership in global battery cell manufacturing. This dominance is sustained by extensive governmental support, robust supply chains, and continuous investment in gigafactories to meet international and domestic demand for EVs and consumer electronics.

What impact does AI have on the performance of modern cutting machines?

AI significantly enhances cutting machine performance by integrating intelligent vision systems for real-time, ultra-high-precision defect detection (e.g., burrs and micro-cracks). Furthermore, AI enables dynamic parameter optimization based on material variability and facilitates predictive maintenance, drastically reducing downtime and improving overall manufacturing yield rates.

What are the key challenges facing equipment manufacturers in this market?

Key challenges include managing the extremely high capital expenditure required for advanced, automated production lines and the technical complexity of adapting machinery to handle next-generation electrode chemistries, such as those used in solid-state batteries. Equipment manufacturers also face intense pressure to localize production and service capabilities in North America and Europe to meet new regional supply chain requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager