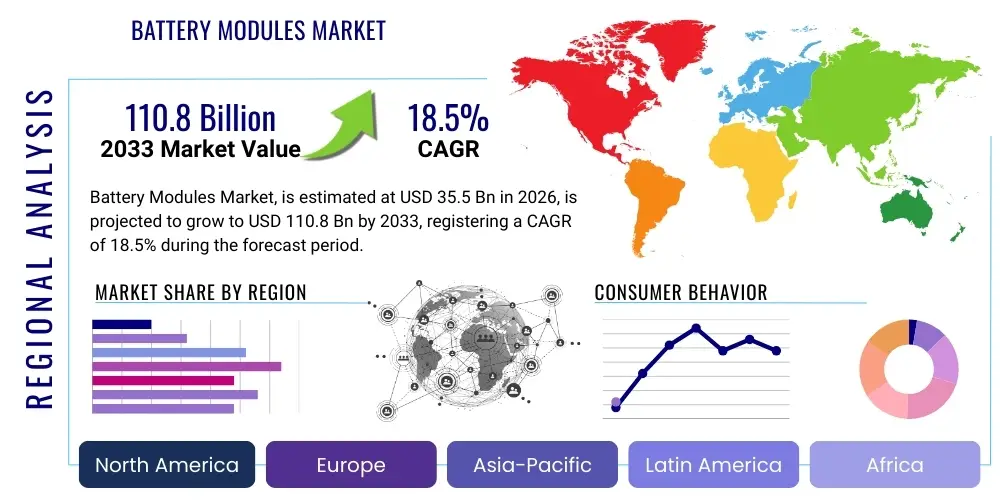

Battery Modules Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436065 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Battery Modules Market Size

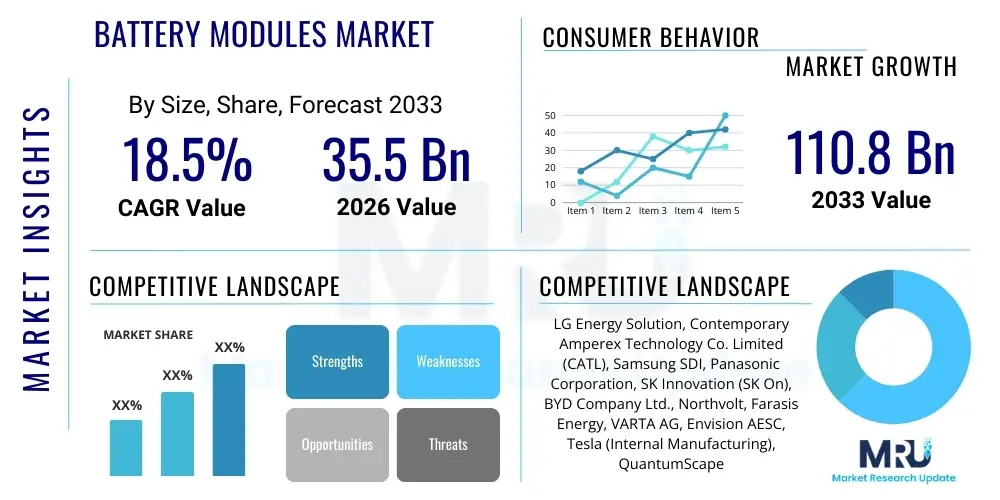

The Battery Modules Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 110.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerated global adoption of electric vehicles (EVs) and the critical need for robust, reliable energy storage systems (ESS) within utility and residential sectors. The modular design of these battery packs facilitates easier scalability, enhanced thermal management, and improved safety protocols, making them the preferred foundational component in high-voltage applications.

The valuation reflects ongoing technological advancements, particularly in energy density and charging speeds, which are making battery modules increasingly appealing across various industries. Furthermore, government mandates and incentives promoting zero-emission vehicles, coupled with supportive policies for renewable energy integration, significantly bolster market momentum. Investment influx into Gigafactories globally, especially across Asia Pacific and Europe, is expanding manufacturing capabilities, lowering production costs, and consequently making battery modules more accessible for large-scale deployment. Market growth is also influenced by the increasing demand for high-performance battery systems in specialized industrial applications, including aerospace and maritime transport, where energy efficiency and weight considerations are paramount.

Battery Modules Market introduction

The Battery Modules Market encompasses the production and integration of intermediate battery components, which typically consist of multiple interconnected battery cells (often lithium-ion based) packaged within a protective casing that includes thermal management systems, monitoring hardware (like passive cell balancing circuits), and electrical interconnections. A battery module serves as the fundamental building block of a larger battery pack, providing structural integrity and localized control over temperature and voltage stability before being assembled into the final system used in electric vehicles, grid storage, or complex industrial machinery. These modules are engineered to optimize performance, enhance safety through effective thermal runaway prevention, and simplify maintenance procedures by allowing replacement of smaller units rather than the entire battery system.

Major applications of battery modules span three primary domains: automotive, stationary storage, and portable electronics/industrial equipment. In the automotive sector, they are central to battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell vehicles (FCEVs), providing the necessary power and range. For stationary storage, battery modules are essential for grid stabilization, peak shaving, and integrating intermittent renewable sources like solar and wind power, enabling utility companies and commercial enterprises to manage energy supply efficiently. The benefits derived from utilizing modular battery architecture include superior scalability, allowing manufacturers to customize pack sizes for diverse vehicle platforms or energy needs; improved fault isolation, where failure in one module does not compromise the entire pack immediately; and enhanced thermal performance due to integrated cooling channels specifically designed at the module level.

The market is primarily driven by rigorous regulatory standards imposing stricter emissions controls globally, particularly in major automotive markets like the European Union and China, which directly incentivize the shift towards electrification. Additionally, declining lithium-ion cell costs, coupled with significant research and development focused on higher-density chemistries (e.g., NMC 811, NCA), are improving the cost-to-performance ratio of modules, making large-scale deployment economically viable. The increasing global energy transition, aimed at achieving carbon neutrality, further solidifies the demand for reliable and efficient energy storage systems, thereby acting as a powerful macro-environmental driving force for the Battery Modules Market.

Battery Modules Market Executive Summary

The global Battery Modules Market is characterized by robust business trends centered on vertical integration and standardization efforts, aimed at reducing manufacturing complexity and driving down costs per kilowatt-hour (kWh). Major automotive OEMs are increasingly collaborating directly with or acquiring battery cell manufacturers to secure supply chains and optimize module design specific to their platform requirements (e.g., cell-to-module architecture), bypassing traditional module assembly layers. Technology trends emphasize advanced thermal management systems, utilizing phase change materials and sophisticated liquid cooling loops, alongside the integration of wireless battery management system (BMS) functionalities within the module structure, enhancing data collection and reliability while reducing wire harness complexity.

Regionally, Asia Pacific maintains dominance due to the presence of leading cell manufacturers (especially in China, South Korea, and Japan) and significant domestic EV adoption in China, which represents the largest single consumer market. However, Europe is exhibiting the fastest growth rate, fueled by aggressive decarbonization targets, substantial investment in local Gigafactories (Battery Passports regulation further influences design), and strong consumer uptake of EVs spurred by stringent emission norms. North America is also scaling up its domestic module and pack manufacturing capacity, stimulated by supportive policies like the US Inflation Reduction Act (IRA), which aims to localize critical mineral processing and battery production, thereby shifting reliance away from Asian supply chains.

Segment trends reveal that the lithium iron phosphate (LFP) segment is gaining significant traction, particularly in entry-level and commercial vehicle applications, owing to its superior safety profile and lower cost, despite having lower energy density compared to nickel manganese cobalt (NMC) modules. Furthermore, within the application segments, the Electric Vehicle category remains the single largest consumer and primary growth engine, followed closely by grid-scale energy storage systems (ESS). The demand for high-voltage (800V and above) modules is rapidly increasing, driven by the requirement for ultra-fast charging capabilities in premium and high-performance EV models, pushing manufacturers to innovate in module connectivity and insulation materials.

AI Impact Analysis on Battery Modules Market

User queries regarding AI's influence on the Battery Modules Market frequently center on themes of predictive maintenance, optimization of manufacturing processes, and the acceleration of R&D for next-generation chemistries. Key concerns involve how AI algorithms can detect subtle degradation patterns within individual cells/modules far earlier than traditional BMS, thereby maximizing lifespan and reducing warranty costs. Users also express interest in AI’s role in optimizing the complex thermal and electrical balancing within a large battery pack composed of numerous modules, ensuring uniform performance under varying operational stresses. This analysis shows that users expect AI to transition battery management from a reactive state to a highly predictive, preventative system, particularly focusing on optimizing charging protocols and module longevity through real-time data analysis and machine learning models applied to vast operational data sets collected from vehicle fleets and grid deployments.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to forecast cell and module failures based on real-time voltage, temperature, and impedance data, extending module lifespan.

- Manufacturing Optimization: Implementing AI vision systems and robotics to enhance quality control during module assembly, reducing defects, and optimizing material usage (e.g., weld quality inspection).

- Thermal Management Optimization: AI algorithms continuously adjust cooling/heating strategies for individual modules based on predicted load cycles and ambient conditions, maximizing efficiency and safety.

- Accelerated R&D: Using generative AI and machine learning to screen vast material databases and simulate performance of novel battery chemistries and module layouts, significantly speeding up the development cycle.

- Optimized Charging Strategies: Dynamic charging profiles developed by AI that adapt based on the module's current state of health (SoH) and temperature, minimizing degradation during fast charging events.

- Supply Chain Management: AI analytics improving forecasting accuracy for raw material needs (lithium, nickel, cobalt) and optimizing logistics for high-volume module production.

DRO & Impact Forces Of Battery Modules Market

The Battery Modules Market is currently experiencing a powerful confluence of driving factors, primarily stemming from global decarbonization initiatives and the rapid commercialization of electric mobility across passenger, commercial, and even industrial segments. The supportive regulatory environment, characterized by tax credits, subsidies, and infrastructural development grants for EV charging networks and grid modernization, provides a robust foundation for market expansion. Simultaneously, ongoing breakthroughs in battery technology, such as improvements in energy density and the shift towards safer, cobalt-free chemistries, make modular battery solutions increasingly efficient and competitive against traditional fossil fuel technologies. These drivers are intrinsically linked to the macroeconomic objective of achieving energy independence and reducing reliance on volatile oil markets, positioning battery modules as critical strategic assets.

However, the market faces significant restraints, notably the persistent volatility in raw material prices (lithium, nickel, cobalt, manganese) and the complex, capital-intensive requirements for establishing localized, sustainable supply chains. Geographical concentration of critical mineral processing and cell manufacturing in a few regions creates supply vulnerability, exacerbated by geopolitical risks and trade tariffs. Furthermore, concerns regarding battery safety, particularly thermal runaway incidents, continue to pose a technical and reputational challenge, requiring substantial R&D investment in advanced thermal management and passive safety features within the module architecture. The slow pace of establishing comprehensive, global recycling infrastructure also presents a long-term economic and environmental constraint, limiting the circular economy potential of battery modules.

Opportunities for market growth are abundant, particularly in leveraging the inherent scalability of modular designs to penetrate niche markets such as marine electrification, aviation ground support equipment, and large-scale uninterrupted power supply (UPS) systems for data centers. The development of solid-state battery technology, while still maturing, promises a transformative shift by offering potentially higher energy density and improved safety, necessitating a complete redesign and optimization of current module structures. The overarching impact forces—such as increasing consumer awareness regarding climate change, rapid urbanization necessitating cleaner transport solutions, and the critical need for grid resilience against extreme weather events—are acting as accelerators, ensuring that the demand for high-performance, standardized, and easily serviceable battery modules continues to grow exponentially across the forecast period.

Segmentation Analysis

The Battery Modules Market is intricately segmented based on core variables including cell chemistry, capacity range, application type, and regional utilization. Understanding these segmentations is crucial for manufacturers and investors to tailor production strategies and identify high-growth sub-markets. The market is witnessing a diversification in chemistry segmentation, moving beyond the traditional reliance on high-nickel NMCs towards LFP, particularly for cost-sensitive and longevity-focused applications like commercial fleets and stationary storage. Capacity segmentation dictates suitability, with modules below 10 kWh typically servicing smaller industrial vehicles or hybrid ESS, while high-capacity modules (above 50 kWh) are standard for high-performance EVs and utility-scale grid projects.

Application segmentation remains the most influential factor driving volume, with Electric Vehicles demanding stringent requirements on energy density and power output, forcing module manufacturers to innovate rapidly in thermal management and weight reduction. Conversely, the stationary storage segment prioritizes cycle life, safety, and cost efficiency, often accommodating physically larger modules with less emphasis on gravimetric energy density. The increasing maturity of the market means that module designs are becoming more platform-specific, allowing major Tier 1 suppliers to offer highly customized solutions that integrate seamlessly with specific BMS architectures and vehicle chassis designs.

- By Cell Chemistry:

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

- Others (e.g., Solid-state, Lithium Sulfur)

- By Capacity:

- Below 10 kWh

- 10 kWh to 50 kWh

- Above 50 kWh

- By Application:

- Electric Vehicles (BEV, PHEV, Commercial Vehicles, E-Buses)

- Energy Storage Systems (Grid-scale, Commercial & Industrial, Residential)

- Consumer Electronics and Portable Devices

- Industrial and Special Purpose (e.g., Marine, Aerospace, Forklifts)

- By Form Factor:

- Cylindrical Modules

- Prismatic Modules

- Pouch Modules

Value Chain Analysis For Battery Modules Market

The value chain for battery modules is intricate, commencing with upstream activities focused on the extraction and processing of critical raw materials such as lithium, nickel, cobalt, and graphite. This raw material stage is followed by cell manufacturing, which is highly capital-intensive and technologically demanding, dominated by a few global players in Asia. The intermediate step involves module assembly, where cells are interconnected, and integrated with thermal management hardware (cooling plates, manifolds), structural components (housings, frames), and essential electronics (cell monitoring units). This modularization phase adds significant value by ensuring safety, structural integrity, and standardized connectivity crucial for large battery packs.

Downstream activities involve the final integration of these modules into a complete battery pack, often customized for specific OEM requirements (e.g., chassis integration, specific voltage requirements). This final pack is then distributed to the end-user markets. The distribution channel is segmented into direct sales to major automotive OEMs and energy storage integrators (Tier 1 suppliers often serve as middlemen) and indirect sales through specialized distributors focusing on aftermarket or smaller industrial applications. Direct channels emphasize deep technical collaboration and long-term supply agreements, necessary due to the high-value, highly customized nature of EV battery packs.

A critical trend shaping the value chain is the increasing involvement of OEMs (e.g., Tesla, Volkswagen) in both the module design and, occasionally, cell production, moving towards a more vertically integrated structure to optimize costs and secure supply. Furthermore, the downstream segment is rapidly evolving to include robust reverse logistics and recycling infrastructure development, aimed at recovering high-value materials from end-of-life modules. This closed-loop system is essential not only for sustainability mandates but also for mitigating future raw material supply risks, establishing module recyclers as an increasingly important part of the extended value chain.

Battery Modules Market Potential Customers

The primary consumers of battery modules are large-scale integrators and original equipment manufacturers (OEMs) operating across various sectors, requiring stable, high-performance, and scalable power sources. In the automotive industry, major global electric vehicle manufacturers constitute the largest customer base, demanding specialized modules optimized for high energy density, fast charging, and durability to meet passenger and commercial transportation requirements. These customers typically engage in long-term procurement contracts, often co-designing the module with suppliers to fit proprietary vehicle platforms and battery management systems.

The second major customer group consists of utilities and energy project developers seeking grid-scale energy storage solutions (G-ESS). These customers prioritize cycle life, safety certifications, and low capital expenditure per kilowatt-hour, utilizing modules designed for stationary, sustained operation to manage renewable intermittency and ensure grid stability. Commercial and industrial (C&I) facility owners form another growing segment, deploying battery modules for demand charge reduction, backup power, and microgrid applications, favoring easily scalable and durable module designs.

Beyond these large consumers, specialized manufacturers of industrial equipment, such as material handling systems (forklifts, AGVs), construction machinery, and specialized marine vessels, are increasingly electrifying their fleets and require robust, shock-resistant battery modules. Finally, the developers of advanced consumer electronics, particularly high-end power tools and specialized medical equipment, also represent potential customers for high-quality, compact battery modules, focusing on safety and reliability in confined spaces.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 110.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LG Energy Solution, Contemporary Amperex Technology Co. Limited (CATL), Samsung SDI, Panasonic Corporation, SK Innovation (SK On), BYD Company Ltd., Northvolt, Farasis Energy, VARTA AG, Envision AESC, Tesla (Internal Manufacturing), QuantumScape, Svolt Energy Technology, Clarios, Johnson Controls, EVE Energy Co., Ltd., Automotive Energy Supply Corporation (AESC), Freudenberg Sealing Technologies, Toshiba Corporation, Microvast. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Battery Modules Market Key Technology Landscape

The Battery Modules Market is undergoing a rapid technological evolution focused on enhancing safety, increasing energy density, and optimizing thermal management to improve overall system efficiency. A critical technological trend is the shift towards Cell-to-Module (CTM) and Cell-to-Pack (CTP) architectures, pioneered by players like BYD and CATL. These designs eliminate intermediate structural components or entire module housings, allowing more active cell material to be packed into a given volume, thereby significantly boosting volumetric energy density and reducing system weight and complexity. This architectural innovation directly addresses the primary demand of the EV sector for longer driving ranges without increasing vehicle footprint.

Another pivotal development is the refinement of thermal management systems within the module itself. Manufacturers are moving beyond simple air cooling to highly efficient liquid cooling systems, incorporating complex flow channels and advanced cooling plates integrated directly adjacent to the cells, often utilizing dielectric fluids for superior heat dissipation. This focus is crucial, especially with the introduction of high-voltage (800V+) systems and ultra-fast charging capabilities (350 kW and above), where rapid heat generation must be precisely controlled to prevent premature degradation and ensure safety. Furthermore, passive safety features, such as fire suppression materials, pressure release vents, and enhanced structural barriers against external impact, are being systematically integrated at the module level to comply with increasingly strict global crash and fire safety standards.

In terms of component technology, the adoption of wireless Battery Management Systems (BMS) within modules is gaining traction. This technology replaces traditional bulky and complex wire harnesses used for cell monitoring with high-reliability wireless communication protocols (e.g., Bluetooth, proprietary RF). Wireless BMS reduces weight, simplifies assembly, improves reliability by eliminating common points of failure related to wiring, and facilitates easier integration of diagnostic and machine learning capabilities for predictive health monitoring. Simultaneously, research into anode and cathode materials, aiming for high-nickel cathodes (NMC 811, 9½½) and silicon-enhanced anodes, necessitates corresponding adjustments in module packaging and pressure management to accommodate the higher energy density and associated expansion characteristics of these advanced chemistries.

Regional Highlights

The regional analysis of the Battery Modules Market reveals distinct dynamics across major geographical areas, primarily driven by differing regulatory landscapes, consumer adoption rates, and local manufacturing capabilities. Asia Pacific (APAC) currently dominates the market both in terms of production volume and installed capacity. This dominance is attributed largely to the extensive manufacturing ecosystem in China, Japan, and South Korea, which host the world’s largest cell manufacturers and a high volume of EV production. China’s aggressive subsidies for NEVs (New Energy Vehicles) and its vast stationary storage projects ensure that APAC remains the center of gravity for demand and technological leadership, particularly in LFP chemistry adoption.

Europe stands out as the fastest-growing market, experiencing explosive growth stimulated by ambitious regulatory targets like the EU Green Deal and national bans on internal combustion engines. This has spurred massive investment in local 'Gigafactories' across Germany, Poland, Hungary, and Scandinavia, aiming to localize the entire battery value chain (from raw materials to recycling). The region’s focus is heavily concentrated on high-performance passenger EVs and developing specialized modules that comply with forthcoming EU Battery Passport regulations, emphasizing traceability and sustainable sourcing.

North America is emerging as a critical growth region, driven by legislative support such as the U.S. Inflation Reduction Act (IRA), which provides significant financial incentives for battery and EV manufacturing localized within the region. This policy shift is leading to substantial capacity expansions by both Asian incumbents and domestic newcomers, especially in the US South and Midwest, transforming the regional supply chain and prioritizing modules that qualify for tax credits through domestic content requirements. Latin America and the Middle East & Africa (MEA) currently represent smaller but rapidly growing markets, with initial demand focused primarily on ESS for grid reliability and localized adoption of electric buses and commercial fleet vehicles.

- Asia Pacific (APAC): Market leader in manufacturing and consumption; strong governmental support for EVs (especially China); concentration of global cell giants (CATL, LGES, Panasonic).

- Europe: Fastest growth trajectory; driven by strict CO2 emission standards and Gigafactory localization efforts (e.g., Northvolt, ACC); high focus on premium EV modules and circular economy mandates.

- North America: Accelerating production localization due to the Inflation Reduction Act (IRA); major OEM investments in dedicated EV platforms; significant demand for large modules in pickup trucks and commercial EVs.

- Latin America & MEA: Nascent but growing markets; primary demand driver is energy storage systems (ESS) for renewable integration and electrification of public transport fleets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Battery Modules Market.- LG Energy Solution

- Contemporary Amperex Technology Co. Limited (CATL)

- Samsung SDI

- Panasonic Corporation

- SK Innovation (SK On)

- BYD Company Ltd.

- Northvolt

- Farasis Energy

- VARTA AG

- Envision AESC

- Tesla (Internal Manufacturing)

- QuantumScape

- Svolt Energy Technology

- Clarios

- Johnson Controls

- EVE Energy Co., Ltd.

- Automotive Energy Supply Corporation (AESC)

- Freudenberg Sealing Technologies

- Toshiba Corporation

- Microvast

- A123 Systems LLC

- GS Yuasa Corporation

- Kokam Co., Ltd.

- Exide Industries Limited

- Saft Groupe S.A.

Frequently Asked Questions

Analyze common user questions about the Battery Modules market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Battery Modules Market?

The predominant driver is the exponential increase in global Electric Vehicle (EV) adoption, spurred by stringent governmental emission regulations and significant consumer demand for sustainable transportation solutions, necessitating scalable and high-performance battery components.

How do cell-to-module (CTM) architectures affect module manufacturing and performance?

CTM architectures reduce the need for intermediate structural components, increasing the volumetric energy density of the module and lowering material costs. This simplification leads to higher efficiency, lighter weight, and improved manufacturing throughput for high-capacity battery packs.

What are the key differences in module requirements between EV and Energy Storage System (ESS) applications?

EV applications prioritize high power density and light weight for maximizing range and acceleration, demanding sophisticated thermal management. ESS applications prioritize long cycle life, low cost per kWh, and superior long-term safety, often favoring LFP chemistry over high-nickel variants.

Which geographical region dominates the production and supply chain for battery modules?

Asia Pacific (APAC), particularly China, South Korea, and Japan, currently dominates the global supply chain, housing the world's largest manufacturers of lithium-ion cells and sophisticated module assembly operations, benefiting from established infrastructure and substantial government support.

What technological advancements are crucial for enhancing battery module safety and longevity?

Crucial advancements include enhanced liquid cooling systems, integrated fire suppression materials, robust pressure venting mechanisms, and the deployment of AI-powered Battery Management Systems (BMS) for real-time predictive failure analysis and precise thermal control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager